Why reconcile with the tax office?

All business entities know that it is necessary to make mandatory payments on time. However, practice shows that this rule is often violated, and sometimes unintentionally. The taxpayer believes that he has paid everything, but in reality the amount never reached the addressee. As a result, after some time, the Federal Tax Service Inspectorate comes with a demand to make an additional payment, and at the same time also a penalty.

How to figure out who is right? The only option is to reconcile calculations with the budget for taxes, fees, insurance premiums and other payments.

But even if no questions arise, it is worth checking the tax calculations from time to time. This will help to find out whether all payments have been made and whether the taxpayer has any debts. Sometimes, during the reconciliation of taxes and contributions, it turns out that the funds were credited to the wrong bank account or there are amounts hanging that the Federal Tax Service could not identify.

When to reconcile

There are several situations when reconciliation of settlements with the Federal Tax Service must be carried out (clause 3 of the Regulations, approved by tax order of September 9, 2005 No. SAE-3-01/ [email protected] ):

- when a company or individual entrepreneur changes the Federal Tax Service;

- when a taxpayer is deregistered with the Federal Tax Service due to liquidation and reorganization;

- every quarter if the company is large;

- if tax officers discover overpayments or arrears (clause 3 of Article 78 of the Tax Code of the Russian Federation);

- at the request of the company or entrepreneur (clause 5.1, clause 1, article 21, clause 11, clause 1, article 32 of the Tax Code of the Russian Federation).

As a result of the procedure, Federal Tax Service employees draw up a reconciliation report and send or transfer it personally to the taxpayer.

How to request a tax reconciliation

Reconciliation with the Federal Tax Service is carried out in accordance with the procedure given in the letter of the Federal Tax Service dated March 9, 2022 No. AB-4-19/2990. This procedure is temporary, it replaced the old regulations from the order of the Federal Tax Service No. 09.09.2005 No. SAE-03-1 / [email protected] The new permanent regulations have not yet been approved.

Typically, the process of reconciliation for taxes and fees is initiated by the taxpayer, although the Federal Tax Service also has this right. The key point when applying is not so much the method of sending the application, but its form. It can be paper or electronic. In the second case, the application is submitted through the individual entrepreneur’s personal account on the Federal Tax Service website or through the reporting program/service (according to TKS).

Personal appeal

The classic way to receive a reconciliation report is to write an application and submit it to the tax office. You can do this yourself, through an intermediary or by mail. For some time now, a request for reconciliation can be submitted through the MFC.

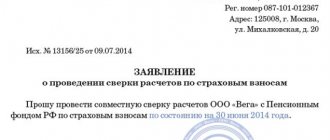

An application is drawn up on paper in free form. You must specify:

- your data – name, main codes, contacts;

- the period for which the reconciliation of calculations for taxes and fees is made. If it is not specified, then the act will be drawn up for the period from the beginning of the current year to the date of registration of the application. You can check for the previous 3 years;

- types of payments for which data needs to be compared (listed by KBK). If they are not listed, then a reconciliation will be carried out for all taxes and other payments that the taxpayer makes to the inspectorate where he applied. These are not only taxes, fees and contributions, but also penalties, fines and interest;

- method of obtaining the act. If you do not want to visit the tax office again, you can specify that it be sent by mail.

The same rules apply when applying for a reconciliation report by mail or through the MFC. The only difference is in the methods of presenting the document.

Having received a paper request, the Federal Tax Service Inspectorate prepares a reconciliation report within 5 working days. If the applicant has indicated that he will receive it in person, he must come for it at the appointed time and present documents certifying his authority. Otherwise, as well as in case of failure to appear for the act, it will be sent by mail.

Electronic request through the taxpayer’s personal account

If a taxpayer is registered on the Federal Tax Service website and has a personal account, then he can receive a reconciliation report with the tax office there. We tell you how to request it:

- select the section “Request certificates and other documents”;

- select “Act of joint reconciliation of calculations...”;

- indicate the date on which the data is compared;

- indicate the tax authority (or the option “in general for the taxpayer”), as well as, if necessary, the necessary BCCs;

- indicate the response format;

- we check the data and order a reconciliation with the budget for taxes and fees, not forgetting to connect the electronic signature medium.

The result must be no later than three working days from the date of registration of the electronic application. Its receipt can be tracked in the “Events” section of the Personal Account.

Electronic request through the reporting system

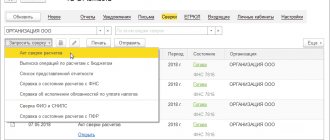

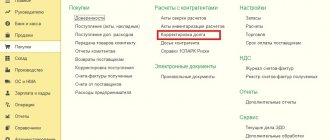

The submission of a joint reconciliation report for the TKS is regulated by Order of the Federal Tax Service of Russia dated June 13, 2013 No. ММВ-7-6/ [email protected] The nuances of drawing up a request in this case depend on what program or service is used. However, the principle is the same as when forming an application in the LC. For example, in the 1C:Reporting system you need:

- go to the “Reconciliations” section;

- select “Request reconciliation”;

- select “Calculation reconciliation report”;

- fill out the reconciliation request form according to the rules specified above.

The applicant will be able to receive the report within three working days from the date of the request.

Response time

Business correspondence is not regulated in any way by the laws of the Russian Federation. Whether a response to a request is sent or not depends on how well the recipient follows the rules of business ethics. Replying to a request is good form for a reputable company. You should also expect that you will receive a response to your request, but it will be negative. Thus, it is worth noting that all query letters are drawn up in accordance with the basic requirements for business correspondence: brevity and accuracy of the thoughts expressed, the absence of ambiguous phrases. In addition, letters are issued on company letterhead (if available).

Statement of reconciliation with the tax office - how to understand it

The form of the act of reconciliation of calculations regarding taxes and fees was approved by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-17/ [email protected] It contains a title page, section 1 and section 2.

At the first stage, the taxpayer must delve only into section 1. It is filled out by the Federal Tax Service for each type of payment separately. In the lines of the act, information is grouped by type of payment, that is, separately tax debt, penalties, fines, interest. Also indicated are funds written off from current accounts, but not reaching their intended destination, and unknown amounts.

For each type of payment, the debt (negative balance) or overpayment (positive balance), as well as data on deferred, suspended payments and restructured debt can be indicated. This information is reflected in column 3.

The taxpayer needs to check the information provided by the Federal Tax Service with his own data. If they coincide, it is enough to sign the reconciliation act on the last sheet of section 1 and indicate that it was agreed upon without disagreement. The completed act is returned to the tax authority.

Statement of reconciliation with the tax office, sample filling

Primary in the reconciliation report

What documents need to be referred to in the reconciliation report so that it can later be used in court?

The reconciliation act is a general register, a consolidated document. If it is impossible to establish on the basis of which primary document a particular item was entered into the reconciliation report, then the court will not recognize either the transfer of goods or monetary obligations.

If we are talking about the delivery of goods, the act must indicate a document that indicates the transfer of ownership (for example, a bill of lading). This is a general rule. But the parties can agree that ownership passes at a different time. Then the obligation to pay for the goods will arise at another moment, and in the reconciliation report it will be necessary to refer to another document.

Confusion often arises at the time of shipment of goods. One party indicates in the act a document that evidences the shipment of goods, the other party substantiates the amount of obligations of the invoice. This cannot be done: counterparties must refer to the same document and it must be a delivery note.

If the reconciliation act does not indicate the primary document on the basis of which this act was drawn up, the court does not recognize such obligations.

The same goes for loans. The act of reconciling them in itself does not confirm that borrowing relationships have arisen between the counterparties. The act must indicate on the basis of which document - payment order or agreement - these obligations arose.

How to draw up a statement of reconciliation of mutual settlements with the supplier if the supplier has sent the goods and we have not yet received it?

Indeed, such a situation may arise if the parties agreed to reconcile once a month and at the end of the month the goods were shipped, but are still in transit.

But I repeat: the reconciliation act must be based on primary documents. As a general rule, until the buyer has accepted the goods, they are the property of the supplier. The supplier is responsible for the safety of the goods. Accordingly, until the buyer has accepted the goods, he is not obliged to pay for it. Therefore, until ownership has passed to the buyer, it is premature to reflect such a delivery in the reconciliation report.

Alternatively, the buyer can take this delivery into account by drawing up a statement of disagreement and indicating in it that the obligation to pay for the goods has not yet arisen, because it has not yet been received. Also, the supplier and buyer can stipulate in the contract that ownership passes to the buyer at the time of shipment of the goods. Then the reconciliation report must include a document that confirms the shipment.

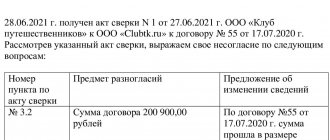

For a sample of filling out the reconciliation act for mutual settlements 2022 with expert comments, see the article “What is important to know about the reconciliation act for mutual settlements” (template can be downloaded).

If there is disagreement

In case of discrepancies, you need to fill out column 4 of section 1 according to the lines for which they exist, putting your data next to the figures of the Federal Tax Service. When signing the act, you must indicate “Agreed with disagreements.”

Having received such a document, the tax authority will conduct an audit. During the process, payment slips and other documents may be required from the taxpayer. In the end, it should become clear who made the mistake. If this is the Federal Tax Service, then corrections will be made based on the memo within 5 working days.

If it turns out that the taxpayer made a mistake, he will be notified of this. Everything needs to be fixed immediately. For example, if it turns out that the tax was not paid due to an error in the calculations, you need to recalculate it, pay the additional amount and submit an updated declaration.

Then everything is repeated - the Federal Tax Service will again send a reconciliation report. It’s good if all the inconsistencies were eliminated. In this case, when signing the act, indicate “Agreed without disagreement,” the document is sent to the Federal Tax Service, and the story ends. If discrepancies are again found, they should be reflected in section 2.

Request for a reconciliation report

The maximum reconciliation period is three calendar years preceding the current year, as defined in clause 5 of the Temporary Procedure sent by Federal Tax Service letter No. AB-4-19/2990 dated 03/09/2021.

The deadline for contacting the inspectorate with an application for offset or refund of the overpayment is three years from the date of payment of the tax. Accordingly, offset and refund of overpayments are possible only within this period. Reconciliation will not be carried out outside the specified period.

Having received your application, the Federal Tax Service Inspectorate, within up to five working days, is obliged to generate a reconciliation report with its data and invite a representative of the applicant organization to submit the report. She also has the right to send the act by mail.

After receiving the reconciliation report, if discrepancies between your data and tax data are identified, you must do the following:

1. In column 4 section. 1 act next to the data specified by the Federal Tax Service that you want to challenge, indicate your data. 2. Sign the act on the last page of section. 1, making the note “Agreed with disagreements.” 3. Submit the document to the Federal Tax Service. 4. Attach to the document certified copies of payment orders, data from which is not included in the reconciliation report received from the Federal Tax Service.

Having received an act with disagreements, the tax service must check its data using internal information resources. If a mistake was made by the tax authorities, then they must eliminate it (in accordance with clauses 3.1.5, 3.1.6 of the Federal Tax Service Regulations) within 5 days after receiving from you a reconciliation report agreed with the disagreements. If the reason for the discrepancies is your mistakes, made, for example, when filling out a declaration or payment order, then the Federal Tax Service will notify you of the exact error that led to the discrepancy in data (the inspector will call or send you a notification) (clause 3.4.6 of the Federal Tax Service Regulations) . You can eliminate the mistakes you made by submitting an updated declaration, clarifying tax payments, paying additional tax, etc.

After analyzing the discrepancies and eliminating them, the Federal Tax Service Inspectorate will prepare and send you a new reconciliation report and agree on the date for its signing (clauses 3.1.6, 3.1.7 of the Federal Tax Service Regulations).

Download the request for the reconciliation report

The article was edited in accordance with current legislation 01/05/2022

Extracting transactions for settlements with the budget - what is it?

The reconciliation report for taxes and fees shows only the total amounts of debt or overpayment on the day of the request. You can track the history of payments to the Federal Tax Service in the statement of transactions with the budget for a certain period. It reflects the balance at its beginning and end, as well as amounts accrued for the period and receipts from the taxpayer. The extract will help you understand where the debt or overpayment came from.

So, we told you how you can get a reconciliation report with the tax office and what to do with it. Often the reason that the money was not credited to the desired account is a simple error. And to prevent such missteps from being too costly, it is useful to check your budget from time to time.

How to write an application correctly

There is no approved form for such a statement, so we draw it up using the traditional structure of such a paper. The document must include the following information:

- to whom the application was sent: name of the Federal Tax Service;

- from whom the application is received: company name, details, legal address, contact person;

- Title of the document;

- reference to legislation, request to initiate a joint reconciliation of calculations for taxes and fees;

- a list of taxes and fees for which reconciliation is required, their KBK and OKTMO;

- an indication that the act must be handed over to a contact person (if necessary);

- signature of the head of the company, date of preparation of the document.

When submitting the application to the tax office in person, you need to have two copies. The first is handed over to the Federal Tax Service employee, and on the second he puts a mark of receipt. This copy must be kept by the taxpayer. It will be confirmation that his application has been accepted.

Expected response

In response to a written request, the organization can count on receiving a written response in the form of a reconciliation report, which can be received within 5 working days in person or by mail (clause 3.4 of Order No. SAE-3-01 / [email protected] dated 09.09.2005. ) Options for receiving the act are indicated in the text of the application when preparing it for transfer.

In response to an electronic request, the Federal Tax Service Inspectorate will respond with an electronic version of the reconciliation report , which is intended only to inform the taxpayer about the status of settlements (clause 2.22 of the Recommendations for organizing electronic document management, approved by Federal Tax Service Order No. ММВ-7-6 of June 13, 2013 / [email protected] , edition 4.04.2017).

Obviously, the electronic version does not involve comments about disagreement, and in the paper version the taxpayer has the right to mark the presence of discrepancies or confirm agreement with the specified amounts.

Read more about how to properly respond to a request for information here.

The current financial position of an organization is largely assessed by the state of its property (including accounts receivable) and financial liabilities (including accounts payable). A timely and competently completed reconciliation request will help avoid litigation.