Basic definitions and order of interaction between the parties

An advance report is a document that confirms and explains the expenditure of the Organization's funds issued to an employee, in this case, an accountable person.

The accountable person is the employee of the Organization who is entrusted with the task and given the money for it.

The list of people who can act as an accountable person, the amount of the advance amount and the deadline for submitting the report are determined by the head of the Organization.

Accountable amounts must be spent only for the intended purpose specified when issuing financial resources, and cannot be transferred by one accountable person to another.

Before the expiration of the deadline, the employee must report for the spent funds and bring properly executed primary documents to the accounting department, and return those not spent to the cash register or to the current account; the overexpenditure is paid by the Organization.

Three days are given for the preparation of reporting documents from the date of expiration of the period for which the money was issued. If during this time the primary documents never made it into the accounting department and the funds never arrived back at the cash desk or to the Organization’s current account, then the employee is recognized as indebted. It is important not to be confused; this amount does not apply to taxable income.

The appropriate actions of the accountant in this case:

1. Write a letter to the employee politely reminding him of his debt.

2. Draw up a reconciliation report with the employee.

3. Most likely, what will follow:

3.1 report from the employee;

3.2 an application from an employee with a request to withhold arrears from wages;

3.3 return of the debt amount from other sources of income.

4. If nothing happened from point 3, then the Organization has the right to sue the employee.

Accounting for fuel and lubricants using coupons

Fuels and lubricants include fuels (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas), lubricants (motor, transmission and special oils, greases), as well as special fluids (brake, coolant). An organization can purchase fuel and lubricants for cash and in non-cash form.

If the organization has chosen a non-cash form, then a supply agreement is concluded with the fuel supplier, according to which the organization transfers funds to the supplier’s bank account, and in return receives coupons or fuel cards, with which drivers refuel cars at gas stations (gas stations).

| 1C:ITS For more information on accounting for fuel and lubricants using fuel cards, see the “Directory of Business Operations. 1C: Accounting 8" section "Accounting and tax accounting". |

The use of coupons as a form of payment for fuel and lubricants has become widespread. To account for such transactions, it matters what type of coupons the organization uses and at what point ownership of the fuel and lubricants is transferred to the organization.

There are two types of coupons:

- liter (quantitative), which indicate the quantity and brand of fuel without specifying the amount (the price of fuel and lubricants is fixed on the date of payment of coupons; it is usually not indicated on coupons);

- sum or cost (monetary), which indicate only the amount for which you can refuel (the price of fuel and lubricants is determined on the date of refueling; coupons do not indicate either the price or quantity, but the brand of fuel may be indicated).

Depending on the terms of the agreement for the supply of petroleum products, ownership of fuel and lubricants may pass to the organization either at the time of receipt of coupons or at the time of refueling the car at a gas station. When refueling, the driver gives a coupon, and in return receives a tear-off coupon with a stamp of the redeemed coupon and a cash receipt. Coupons have a validity period established in the agreement with the seller of fuel and lubricants.

Fuel and lubricants are included in inventories (MPI) and are accepted for accounting at actual cost in accordance with the Accounting Regulations “Accounting for inventories” (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, hereinafter referred to as PBU 5 /01). According to the Chart of Accounts, the program uses subaccount 10.03 “Fuel” to account for fuel and lubricants.

If, under an agreement with the supplier, ownership of fuels and lubricants passes to the organization at the time of refueling the car at a gas station, then coupons for fuels and lubricants can be taken into account:

- as part of monetary documents on account 50.03 (as a rule, for sum coupons, but also acceptable for quantitative coupons);

- on off-balance sheet account 006 “Strict reporting forms” (usually for quantitative coupons).

A document that confirms fuel consumption, data on actual mileage and the production nature of the vehicle’s route is a waybill (approved by Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78). This form of document is mandatory only for motor transport organizations. Other organizations can develop their own document form, which must contain the mandatory details provided for in Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” and Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 “On approval of the mandatory details and procedure for filling waybills."

If the organization's cars are equipped with an electronic mileage monitoring system (or mileage and fuel), then fuel consumption can be confirmed based on a printed system report signed by the responsible person.

There is no legal regulation of costs for fuels and lubricants, but the organization can itself establish fuel consumption standards by order of the manager.

In this case, you can be guided by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r or the standards specified in the vehicle operating instructions.

If standards are not established, then actual fuel consumption based on waybills is written off as expenses for ordinary activities. If the accounting policy of an organization provides for the use of fuel consumption standards, then the amount of fuel consumed within the standards is included in the organization’s expenses for ordinary activities, and in excess of the standards is included in other expenses.

In tax accounting, expenses for the purchase of fuel and lubricants can be taken into account in one of the following ways:

- as part of material expenses (based on clause 5, clause 1, article 254 of the Tax Code of the Russian Federation);

- as part of other expenses associated with production and (or) sales, such as the cost of maintaining official transport (clause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

For profit tax purposes, expenses for fuel and lubricants are not standardized and are taken into account in full if they are economically justified, documented and incurred for the purpose of carrying out activities aimed at generating income (clause 1 of Article 252 of the Tax Code of the Russian Federation).

VAT on purchased fuels and lubricants is accepted for deduction in the general manner on the basis of an invoice presented by the supplier (clause 2 of Article 171 of the Tax Code of the Russian Federation, clause 1 of Article 172 of the Tax Code of the Russian Federation). As a rule, the supplier provides a set of documents (waybill, invoice) at the end of the month for the total amount of fuel sold during the month. The amount of fuel according to the supplier's invoice and according to the drivers' advance reports (according to tear-off coupons and cash receipts) must match.

Example 1

| Sewing Factory LLC (OSNO, VAT payer, applies PBU 18/02) purchases gasoline coupons in the amount of 30 pcs. from the organization Etalon-Kart LLC for a total amount of 58,500 rubles. (the numbers in the examples are conditional). The denomination of one coupon is 50 l. According to the terms of the agreement, ownership of the fuel and lubricants passes to the buyer at the time the vehicle is refueled at the gas station. Drivers receive gasoline using coupons received for reporting and draw up an advance report. The supplier provides documents for the fuel selected during the month (waybill, invoice) on the last day of each month. The cost of consumed gasoline is included in expenses at the end of the month according to travel sheets. Coupons for fuel and lubricants are recorded in account 50.03. |

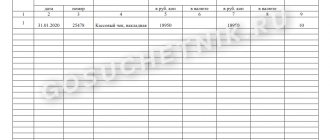

Payment to the supplier for coupons is registered in the program by the document Write-off from current account with the transaction type Other settlements with counterparties, where account 76.05 should be specified as the settlement account.

As a result of posting the document, an accounting entry is generated:

Debit 76.05 Credit 51 - for the amount of the prepayment (RUB 58,500).

Please note that for those accounts where tax accounting is supported, the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes. In the examples discussed in this article, there are no differences between accounting and tax accounting.

The receipt of monetary documents is reflected by a document of the same name with the transaction type Receipt from supplier (Fig. 2).

Rice. 2. Receipt of monetary documents

In the header of the document you should indicate the details of the primary document: date and number. The From tab is filled in by the user as follows:

| Field | Data |

| "Counterparty" and "Accepted from" | The supplier of fuels and lubricants from which the monetary documents were received is indicated (selected from the “Counterparties” directory) |

| "Treaty" | An agreement with a supplier is selected from the directory of the same name, and the type of agreement must have the value “Other” |

| "Settlement account" | The score is indicated as 76.05 |

On the Cash Documents tab, click the Add button to select incoming cash documents from the Nomenclature of Cash Documents directory. In Example 1, the monetary document has the form Coupons for fuel and lubricants (Fig. 3). The number and amount of received monetary documents is indicated.

Rice. 3. Nomenclature of monetary documents

When posting a document, the following entries are entered into the accounting register:

Debit 76.05 Credit 76.05 - for the amount of the offset advance (RUB 58,500). The offset is carried out between documents of settlements with counterparties Receipt of monetary documents and Write-off from the current account; Debit 50.03 Credit 76.05 - for the amount of gasoline coupons received (RUB 58,500) in the amount of 30 pcs.

The issuance of coupons to the driver is reflected in the document Issuance of monetary documents with the transaction type Issuance to an accountable person. On the To tab, the accountable person is indicated, which is selected from the Individuals directory.

On the Cash Documents tab, indicate the name of the coupon (selected from the Nomenclature of Cash Documents directory) and quantity, for example, 10 pcs. The cost of coupons is calculated automatically.

As a result of posting the document, the following posting is generated:

Debit 71.01 Credit 50.03 - for the amount of monetary documents issued to the accountable person (RUB 19,500) in the amount of 10 pieces.

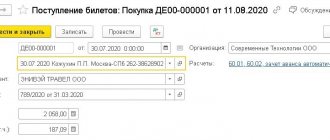

The posting of gasoline purchased by the driver using coupons and the accounting of input VAT on the gasoline received is reflected in the Advance report document (Bank and cash desk section). Let's say the driver has reported for all the tickets issued to him.

In the header of the document it is necessary to indicate the reporting accountable entity and the date of preparation of the advance report. If your organization keeps inventory records by warehouse, then you should fill in the Warehouse field.

On the Advances tab, use the Add button to select the document Issuance of monetary documents, according to which the accountable person received coupons.

Since the accountable person purchased inventory items, the Goods tab should be filled out in the Advance Report document. On this tab, click the Add button to fill in the table part (Fig. 4):

Rice. 4. Tabular part on the “Products” tab of the “Advance report” document

- in the Document (expense) field, the details of the primary documents received from the supplier are indicated;

- indicate the nomenclature, quantity and price of purchased gasoline in the appropriate fields, and the Amount field is calculated automatically;

- the supplier of fuels and lubricants is indicated;

- To register an invoice, you should set the checkbox in the Invoice field, and in the Invoice Details field, enter the date and number of the invoice received from the supplier. After executing the Write command, a link to the created document Invoice received for receipt is automatically added to the Invoice Details field of the Advance Report document;

- in the Accounting account and VAT account fields, fuel and lubricants accounting accounts and a VAT accounting account are indicated.

When posting the Advance Report document, the following transactions are generated:

Debit 10.03 Credit 71.01 - for the cost of gasoline received without VAT (RUB 16,525) in the amount of 500 liters; Debit 19.03 Credit 71.01 - for the amount of VAT (2,975 rubles).

The deduction of VAT on purchased gasoline will be reflected by the date of receipt of the invoice if the Reflect the deduction of VAT in the purchase book by the date of receipt in the form of the document Invoice received for receipt is checked.

By default, the date of receipt of the invoice corresponds to the date of the expense report, but if necessary, the date of receipt can be changed. If the flag is cleared, then the deduction can be reflected in the document Formation of purchase book entries (section Operations - Regular VAT operations) within 3 years after registration of fuel and lubricants.

To include the cost of gasoline in expenses, you need to create a Request-invoice document (Production section).

Let's say that the gasoline purchased with coupons was completely used up in accordance with the waybill. In the header of the document, the date of write-off of fuel and lubricants is indicated (the last day of the month) and the Warehouse field is filled in.

On the Materials tab, the name and quantity (500 l) of gasoline are indicated. If the item settings have been previously configured, the accounting account is filled in automatically. On the Cost Account tab, select the cost account to which materials are written off, for example, account 26 “General expenses”.

When posting a document, a posting is generated:

Debit 26 Credit 10.03 - for the cost of gasoline included in expenses (RUB 16,525).

| 1C:ITS How to account for monetary documents in the form of coupons, see the “Directory of Business Transactions. 1C:Accounting 8" section "Accounting and tax accounting": — accounting of fuels and lubricants; — accounting for services for removal and disposal of solid waste. |

Issuance of accountable amounts in 1C 8.3 Accounting step by step.

The basis for issuing an advance may be an order or instruction from the head of the Organization, or an application from an employee. Since 2018, writing an application from an employee is not mandatory. The application is written in any form, indicating the amount and what the funds are needed for. In this case, the next step will be the signing of this document by the Director of the Organization.

If you are creating an expense report for the first time, we recommend leaving a free request for 1C support through the Bit.Personal Account service. A 1C consultant will call you back and help.

Issuing an advance amount through the cash desk in the 1C 8.3 Accounting program.

We create an expense cash order in the 1C 8.3 Accounting program: 1. Sequentially open the tabs: “Bank and cash desk” - “Cash desk” – “Cash documents” – “Cash withdrawal (creation)”

2. We indicate (fill out the document):

2.1 Type of transaction: “issuance to an accountable person.”

2.2 The number and date are assigned automatically by the program.

2.3 Recipient: select from the list of employees.

2.4 Amount: indicate the required amount, starting from the basis (order or application).

2.5 Cash flow item: “issuance of accountable amounts.”

2.6 Comment: it is convenient to indicate what served as the basis for issuing an advance, for example, “order No. 124A dated July 11, 2019” or “application from an employee dated July 11, 2019.”

2.7 Account: “50.01” (automatic)

2.8 Organization: select and list if the program maintains reports on several enterprises. If there is only one Organization, it will be automatically selected.

2.9 Open the “Details of the printed form” - fill out the “ground”: write the number and date of the order from the director or the date of the application from the employee.

3. Next, click “conduct”.

4. Check the wiring generated by the program. To do this, press the “Dt/Kt” button. Postings: debit 71.01, credit 50.01.

Check: if we open the balance sheet for 71 accounts, we will see that the employee has an advance amount.

5. Go to the newly created cash receipt order and send it for printing (icon with a picture of a printer).

6. Sign the accountable person, accountant and manager.

7. The next step is to issue money to the employee.

Transfer of funds in the 1C 8.3 Accounting program from the Organization’s account to the employee’s personal account.

We create a document in 1C Accounting 8.3, issuing funds by transferring non-cash funds to the employee’s personal account.

1. Sequentially open the tabs: “Bank and cash desk” - “Bank” - “Bank statements” - “Debit from current account (creation)”. We create a new document (payment order).

2. We indicate:

2.1 Type of transaction: “transfer to an accountable person”

2.2 The date and document number are assigned automatically.

2.3 Recipient: select from the list of employees.

2.4 Amount: we deposit the required amount specified in the basis for issuing the advance.

2.5 Purpose of payment: “issuance of funds on account for the purchase of office supplies based on order No. 1020A dated July 11, 2019.”

3. Write down the document and close.

4. Next, you will need to upload a file to send to the bank, or generate a payment order directly in the online bank (in organizations, communication with the bank is configured differently).

5. After a bank statement is received from the bank with the actual debit from the Organization’s current account, the accountant posts it in the program and again goes into the document created when transferring funds, ticks “confirmed by bank statement” and attaches the payment order. Post the document.

6. The program generates transactions: debit 71.01, credit 51.

Organization of accounting of monetary documents

Monetary documents are documents certifying the fact of payment and the right to subsequent receipt of work or services. As a rule, such documents are drawn up on strict reporting forms (SSR).

| 1C:ITS For more information about strict reporting forms of the old and new sample (taking into account the current version of the Federal Law of May 22, 2003 No. 54-FZ), see the “Online cash desks” directory in the “Legal Support” section. |

According to the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, hereinafter referred to as the Chart of Accounts), monetary documents located at the organization’s cash desk (paid air and railway tickets, coupons for the disposal of solid household waste (MSW), postage stamps, etc.) are taken into account in subaccount 50-3 “Cash documents” in the amount of actual purchase costs. To account for monetary documents, the value of which is expressed in foreign currency, in “1C: Accounting 8” there is a separate subaccount 50.23 “Cash documents (in foreign currency)”.

On accounts 50.03 and 50.23, the program keeps records both in total and in quantitative terms. Analytical accounting is organized in the context of monetary documents (for this, the reference book Nomenclature of monetary documents is used). For each monetary document its type is indicated:

- Tickets;

- Vouchers;

- Stamps;

- Coupons for fuel and lubricants;

- Other.

When entering information in the card of a monetary document, you can indicate its value, then it will be automatically entered when registering the receipt or issue of the corresponding document.

In order for operations with monetary documents to be available to the user, it is necessary to enable the appropriate functionality of the program (section Main - Functionality). On the Bank and cash desk tab, set the Cash Documents flag (Fig. 1).

Rice. 1. Setting up functionality

After setting the flag in the Bank and Cash Department section of the program, the documents Receipt of monetary documents and Issue of monetary documents, as well as the Cash Documents journal, become available. From the journal you can generate a Report on the movement of monetary documents, which is intended to control received and issued monetary documents. To control the safety and analyze the movement of monetary documents, you can also use standard accounting reports.

The document Receipt of monetary documents is intended to reflect the fact of receipt of a monetary document at the organization's cash desk. In the header of the document you need to indicate the account for accounting of monetary documents (50.03 or 50.23). If you select account 50.23, then you must specify the currency for recording monetary documents. Depending on the method of receipt of the monetary document, the type of operation is selected:

- Receipt from the supplier;

- Receipt from an accountable person;

- Other receipts.

If a Receipt from a supplier is registered, then in the Settlement Account field you must specify the account for settlements with the counterparty.

At the same time, the document Receipt of monetary documents does not provide for simultaneous indication of both the account for accounting of settlements with the counterparty and the account for accounting for settlements for advances. Therefore, it is convenient to use account 76.05 “Settlements with other suppliers and contractors” as a settlement account. The same account should be indicated when reflecting payment to the supplier, then there will be no difficulties with offsetting advances.

For each nomenclature of received monetary documents, their quantity and amount (including taxes) are indicated. VAT is not allocated in the amount of the document, since the fact of receipt of a monetary document is not the fact of acceptance for accounting of goods or services, the right to which the document provides. Goods (work, services) can be taken into account later (for example, when registering an employee’s advance report on a business trip or on the purchase of fuel and lubricants using a coupon), then, as a general rule, VAT is taken into account.

The document Issuance of monetary documents reflects the following types of business transactions:

- Issuance to an accountable person;

- Return to supplier. When making a return, it is necessary to indicate the amount of the return, as well as the account of income or expenses, since the amount of the return may differ from the value of the monetary document;

- Other issue.

Advance report in 1C 8.3 Accounting.

Primary documents accepted for the report. With updates as of July 1, 2022.

What documents can be used for the report?

1. Cash receipts. From July 1, 2022, all sellers, including individual entrepreneurs, are required to issue checks or send them via email. Therefore, an online receipt or a receipt printed at the register must be requested for any purchase. An electronic check is just as suitable and legally binding as a printed one. In this case, it is important to indicate “electronic check” in the expense report. If an advance was issued for fuel, then a waybill must be attached to the receipt.

2. Payment receipts, if for some reason the seller does not issue checks, indicating the details and signature of the seller.

3. Travel documents.

3.1 It is important to include a boarding pass with your plane ticket, otherwise the Organization may lose expenses, and the employee’s personal income tax will be withheld.

3.2 If the employee traveled by train, the ticket issued at the ticket office must be attached to the report. If the ticket is electronic, then it must have a mark indicating that registration has been completed. Without a mark, the electronic receipt is not valid.

3.3 If an employee used taxi services and ordered through the application, then you must request an electronic receipt there and ask the driver for a receipt with his signature. Sometimes a Taxi Service Organization may offer to deliver a signed receipt to your Organization's address. To confirm the purpose of the trip, you need to ask the employee from the application to print out the same route that the ordered car followed.

4. Accommodation bills (on a business trip).

5. Invoices, delivery notes.

Without the presentation of such documents, the report is not valid.

Step-by-step creation of a report in the 1C 8.3 Accounting program.

Upon expiration of the stipulated period, the employee prepares the documents for the report and draws up the report independently in Form AO-1 within three days. The accountant checks the documents and, if everything is in order, starts processing the documents in the 1C program.

In some Organizations, it is customary for an employee to bring only primary documents to the accounting department and not worry about drawing up the report itself. And the accountant generates the report itself in the 1C program, based on primary documents from the employee, prints it out from the 1C program and the finished document is signed by the accountable person, the accountant and, then, the manager.

Step-by-step creation of a report in the 1C Accounting 8.3 program:

1. Sequentially open the tabs: “Bank and cash desk” - “Advance reports” - “Create”

2. We indicate (fill out the document):

2.1 Number and date: filled in automatically. You can also change it.

2.2 Organization: the field is filled in automatically or selected if the program contains data for several enterprises.

2.3 Accountable person: select and list.

2.4 Warehouse: indicate if goods and materials were purchased. You can specify "main"

3. “Advances” tab. Click “add” and select “cash withdrawal” or “debit from current account” in the window that appears (depending on how the employee received the advance money), then select the required document from the list for which the report is provided.

4. “Products” tab. We fill in if the employee acquired any material assets or provided services for the benefit of the Organization, to do this, click “add” and proceed to filling out the table

4.1 Document: write the name of the document, for example: “Sales receipt No. 2551265 dated 07/11/2019”

4.2 Nomenclature: for example, “office supplies”, select a list or create the desired group of goods or services.

4.3 Quantity: 1.

4.4 “Amount”: indicate the amount in this check.

4.5 “VAT”: select “with VAT” or “without VAT” (look at the receipt)

4.6 If there is an invoice for purchased goods and materials, then you need to scroll through the table further and fill out the “supplier” tab, select and list or create based on the full details specified in the invoice. Next, put a tick in the column named “Invoice” (invoice) and in the next column indicate the date and invoice number.

4.7 “Accounting account”: 10.09 (when purchasing materials) or 41 (goods), is generated automatically based on the selected or created group of goods or services in the nomenclature (filled in at the beginning of the table).

4.8 “VAT invoice”: 19.03, is also generated automatically (it is better to immediately check the correctness of the postings)

5. We post the document and see what transactions have been generated. When registering, for example, the purchase of inventory items, the following posting is generated: Debit 10.09, Credit 71.01.

6. We print the document and collect signatures.

In order to check the correctness of the documents created in 1C, we create a revolving balance sheet for account 71.01 for the required period and look at the reflected amounts opposite the full names of the employees. Through this statement, it is convenient to control accountable persons and promptly remind them of debt or the need to report.

We store the signed advance report with neatly pinned checks, receipts, travel documents, invoices, invoices in the folder with reports, as a rule, for at least four years.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

How to prepare an advance report

Since DS are issued on the basis of an employee’s application, we can conclude that the organization has the right not to accept an advance report from an employee who has not previously been given funds on account (or was issued, but for other purposes). In this case, information about the costs incurred by the employee is not reflected in the system.

You can create a new document “Advance report” from the “Bank and cash desk” subsystem, then the “Advance reports” command.

The header of the document must indicate to whom and from which company the funds for which the employee is reporting were issued.

Fig. 3 Preparation of an employee’s advance report

The document also contains a number of optional fields used to print advance reports by the employee (printed form AO-1) or, if the advance report contains goods purchased by the employee, to print a receipt order (printed form M-4).

If you need to change or supplement printed forms, contact our specialists; we will provide 1C modification services as soon as possible.

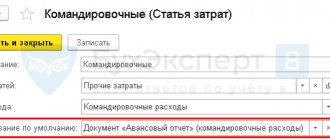

Using an expense report, you can reflect a whole range of employee expenses:

- Acquisition of inventory items (tabular section “Goods”). In this part, the functionality of the Advance Report duplicates the capabilities of the “Receipt of Goods and Services” document;

- Register the receipt of returnable packaging (tab “Returnable packaging”);

- Reflect the payment of DS to the supplier against future receipts or for previously delivered goods/rendered). The key difference between this operation and the operation of reflecting the purchase of goods and materials is that when displaying the operation on the “Goods” tab, the accountant must indicate specific values purchased by the employee by selecting them from the “Nomenclature” directory, whereas when reflecting the expenditure of funds on the “Payment” tab It is enough to indicate the amount and recipient of the funds. You can also indicate in free form the details of the incoming document and the content of the transaction. This data will be used when filling out the printed form of the Advance Report (AO-1).

- Reflect other expenses (tab “Other”). On the tab, you can reflect other expenses by specifying expense accounts manually.

The “Advances” tab stands out, where it is necessary to list the documents with which funds were issued to the employee for reporting.

According to current legislation, an employee who has received funds on account is required to report on the use of these funds no later than 3 business days from the end of the period for issuing these funds. If the deadline for the issuance of funds is not clearly defined (it can be indicated either in an order for the organization (common to all employees) or specified by the manager in an application for the issuance of funds), then three days are counted from the moment the funds are issued.

The amount of money issued and the amount spent by the accountable person may not match:

- In case of overexpenditure (if the overexpenditure is reflected in the Advance Report document, then the company has recognized the fact of overexpenditure), a credit balance is formed on account 71 for the amount of the overexpenditure, which can be closed by issuing funds to the employee.

- If the employee has a balance of funds, he can formalize their use with a new advance report or return the balance of unspent funds.

If working with expense reports raises any questions for you, please contact our 1C:Enterprise program support specialists. We will be happy to help you!

Exchange and return of travel documents

In practice, there are situations when a ticket has to be returned or exchanged. In this case, for the return or exchange of a travel document (including an electronic one), the carrier withholds a commission (fine). The transport agency may also charge an additional fee for its services.

If the exchange or return of a ticket is due to operational necessity, then the organization can include as expenses for profit tax purposes both the cost of the originally purchased (minus the amount returned by the airline) and the new ticket (letter of the Ministry of Finance of Russia dated May 2, 2007 No. 03-03-06/ 1/252). Expenses in the form of a fine for reissuing and returning tickets reduce the tax base for corporate income tax (letter of the Ministry of Finance of Russia dated September 8, 2017 No. 03-03-06/1/57890).

Example 3

Let's change the conditions of Example 2. Due to production needs, an organization, through a transport agency, exchanges an electronic air ticket on the route Moscow - Ufa - Moscow (let's say the departure time from Ufa changes). The organization pays an additional RUB 3,880 to the trans agency, including:

|

After posting the document Write-off from current account with the transaction type Payment to supplier, an accounting entry will be generated:

Debit 76.05 Credit 51 - for the cost of air tickets, taking into account commission and additional services (3,880 rubles).

The exchange of an air ticket through a transagency is reflected in the following documents:

- Receipt of monetary documents with the transaction type Receipt from an accountable person (if the accounting reflected the issue of a ticket to an accountable person);

- Issuance of monetary documents with the transaction type: Return to supplier;

- Receipt of cash documents with the transaction type Receipt from supplier.

Additionally, you should create a document Receipt (act, invoice) with the transaction type Services to reflect additional expenses for the services of the transagency (590 rubles). When filling out the document Receipt of monetary documents with the transaction type Receipt from an accountable person on the From tab, fill in the details Accountable person and Received from (full name of the employee for the printed form).

On the Cash Documents tab, the name of the cash document, quantity (1 pc.) are indicated, and its value is filled in automatically. After posting the document, the following posting is generated:

Debit 50.03 Credit 71.01 - for the amount of the ticket received (RUB 10,574) in the amount of 1 piece.

In the document Issuance of monetary documents with the transaction type Return to supplier, on the Cash documents tab, not only the name of the monetary document, its quantity (1 piece) and cost (RUB 10,574), but also the return amount (RUB 9,374) is indicated, since the carrier withholds a commission of RUB 1,200. (10,574 rubles - 1,200 rubles = 9,374 rubles) (Fig. 6).

Rice. 6. Return of the monetary document to the supplier

Additionally, you need to fill in the details on the Income and Expense Accounts tab to reflect the differences between the accounting value of monetary documents and the refund amount:

- Item of income and expenses - selected from the directory Other income and expenses;

- Income account - an account for income that arises when the return amount exceeds the accounting value of monetary documents;

- Expense account - an account for expenses that arise when the book value of monetary documents exceeds the return amount.

After posting the document, the following transactions will be generated:

Debit 76.05 Credit 50.03 - for the cost of a refundable air ticket (RUB 10,574); Debit 91.02 Credit 76.05 - for the amount of the withheld commission for the return (RUB 1,200).

Then you should create a new document Receipt of monetary documents with the transaction type Receipt from supplier, where the receipt of a new air ticket should be reflected. After posting the document, the following transactions will be generated:

Debit 50.03 Credit 76.05 - for the amount of the ticket received (RUB 12,664) in the amount of 1 piece.

Further actions with the electronic ticket are similar to those described in Example 2.