The decision to liquidate the LLC

The LLC participants organize a meeting and, following the minutes, unanimously agree to close the company. If there is only one participant, instead of the protocol, he writes down the decision of the sole founder.

Participants choose a liquidation commission: it will manage the company during liquidation, represent its interests and bear responsibility. The commission may include one liquidator or several people, usually a director, chief accountant, lawyer, founders, and other important employees. The passport details of all commission members are included in the decision protocol.

The decision specifies the procedure and timing of liquidation. The period cannot exceed one year, and the procedure must comply with Art. 63 Civil Code of the Russian Federation.

LLC liquidation process

Liquidation of an LLC involves the use of a number of documents :

- certificate confirming the registration of the organization;

- extract from the Unified State Register of Individual Entrepreneurs/Unified State Register of Legal Entities;

- charter;

- constituent agreement;

- certificate of registration;

- information about the statistics codes used;

- notifications received from funds;

- stamp (seal);

- minutes of the meeting of participants;

- photocopied versions of passports and certificates of participants.

In 2022, the LLC liquidation procedure consists of the following stages .

- Making a general decision . Appointment of a liquidation commission with determination of procedures and deadlines for termination of activities. Notification of the decision to the tax office. Drawing up a notification in form P15001.

- Publication of relevant information in the media . Registration of balance. Identification of the existence of debt and written notification of the decision to creditors. Carrying out settlements on debt obligations. Providing a set of documents to the registration authority.

- Preparation of liquidation balance sheet . Transfer of property property to the founders. Preparation of the appropriate notification.

- Transfer of documents by the tax service for storage in the archive.

From this moment on, the LLC is considered liquidated and can no longer conduct activities.

Details on the preparation of interim liquidation reporting are presented in the video below.

Notification of the Federal Tax Service on liquidation

After the decision to liquidate is made, the company has three more working days to send a package of documents to the tax office on behalf of the head of the liquidation commission:

- notification P15016, certified by a notary or sent electronically with an enhanced qualified signature;

- minutes of the meeting or the founder’s decision on liquidation.

After 5 working days, an entry should appear in the Unified State Register of Legal Entities indicating that the company is in the process of liquidation.

There is no longer any need to notify the Pension Fund and Social Insurance Fund about the closure; the tax office will do it itself.

Notification of the fact of liquidation of the tax office and funds

The tax office must be notified of the liquidation of the LLC within three working days after the relevant decision is made using form P15016, certified by a notary. The decision on liquidation itself is also attached to the notice. Based on these documents, the tax office enters information into the Unified State Register of Legal Entities that the LLC is in the process of liquidation. It is no longer necessary to notify the funds (PFR and Social Insurance Fund) about this fact independently.

After receiving notice of the liquidation of an LLC, the tax inspectorate can begin an on-site audit, regardless of when and on what subject the previous audit was carried out. Funds – Pension and Social Insurance Fund – can also request documents related to the assignment, recalculation and payment of pensions, payment of contributions and benefits.

Notification in the State Registration Bulletin

You can’t just go ahead and liquidate a company. You will have to first warn all interested parties about this. The first step is to publish the decision on closure in the media - the journal “Bulletin of State Registration”. This is done through a form on the journal's website. Prepare for the “Herald”:

- cover letter and application form are generated automatically on the website;

- decision to initiate liquidation, appointment of a liquidator or commission;

- a sheet of entry from the Unified State Register of Legal Entities on the decision to liquidate or an extract stating that the LLC is in the process of liquidation.

- receipt for payment for publication.

Instructions for filling out the interim liquidation balance sheet

The execution of a document in form P15001 is carried out in the same way as a notice of the commencement of liquidation. However, certain nuances should be taken into account.

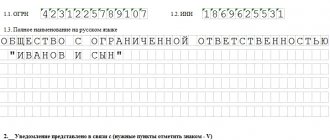

Title page

It includes 2 sections. The first section contains basic information about the company, including OGRN, TIN, name. The second contains several points - the reasons for providing the notification. Among them you need to select one and put a tick in front of it . The following sheets are completed in the same way as the notice of appointment of a liquidator.

Sheet A

It includes 2 pages. The purpose of its execution is to indicate the composition formed by the liquidation commission, or to appoint the person carrying out the closure of the organization.

- In section 1, one number is given based on who is carrying out the liquidation. If this is a commission, “1” is indicated, and if it is a specific person, “2”.

- Section 2 must display the date of appointment of the commission group or liquidator.

- Full information about it is contained in the third section. You must include your full name.

- Data on the taxpayer identification number must be present in section 4. It is indicated in any case, otherwise the Federal Tax Service may refuse to carry out this procedure.

- Section 5 states the liquidator's date of birth and place.

- Section 6 fully displays the data from the passport.

- Section 7 contains the address and place of residence of the chairman of the formed commission group, according to information from KLADR.

- Section 8 indicates a contact telephone number with which you can contact the main member of the commission. When filling out this field, the numbers are indicated without dashes or spaces.

Landline telephone number is displayed with area code. In this case, each bracket has an individual familiarity. The issue related to the need to indicate this number is controversial.

The fact is that each individual tax authority has its own requirements. But if we talk about judicial practice, then frequent refusals are caused precisely by the absence of this parameter.

Sheet B

This sheet includes 3 pages that display complete information about the applicant.

- If the number “1” was entered in the first section, the founder is an individual, so you need to fill out sections 5 and 6.

- If the number 2 was indicated, the participant is a legal entity. Therefore, it is necessary to enter information in sections 2, 3, 5, 6.

- If the applicant is the body that made the decision to carry out the registration procedure, enter the number 3, and also fill out sections 4-6.

- If the responsibility for preparing the documentation has been assumed by the chairman, as well as the liquidator (solely), the number 4 is entered, and sections 5 and 6 must be completed.

In accordance with Order of the Federal Tax Service of Russia No. ММВ-7-6/25 dated January 25, 2012, when providing documentation, the liquidator only needs to fill out section 6 .

Form P15001

Completed sample P15001

Instructions for filling out P15001

Notification of creditors

Publication in the Bulletin is not enough: your creditors must know about the liquidation. Compose a notice to them in free form, tell them about the procedure in which they can make claims against you, and give a period of at least two months for these actions. It is recommended to include in the notification the text received when filling out the application in the “Vestnik”

Send notices to creditors and be sure to receive confirmation of delivery of the letter. This can be done, for example, by registered letter with return receipt requested or by courier service.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Notice of liquidation to the EFRSFYUL

Within three working days from the date of the decision on liquidation, the LLC must submit a notice of liquidation to the Unified Federal Register of Information on the Facts of the Activities of Legal Entities (EFRSFYUL). It contains information about the decision, the liquidation commission, the procedure, terms and conditions for creditors’ claims and other information.

You can enter information into the register directly through the website - https://www.fedresurs.ru. Notaries also provide such services for a fee.

For being late in entering information, you face a fine of 5,000 rubles (Part 6, Article 14.25 of the Code of Administrative Offenses of the Russian Federation). If information is not entered or false information is provided, the fine will be from 5,000 to 10,000 rubles for the first violation and from 10,000 to 50,000 for a repeated violation within a year (Parts 7, 8 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

We provide the interim liquidation balance to the tax office on time.

The purpose of drawing up an interim liquidation balance sheet is to clarify the real financial condition of the liquidated organization.

The balance sheet is drawn up at the end of the period established by the liquidation commission so that creditors can present their claims to the liquidated company.

Please note: the deadline for submitting claims by creditors is two months from the date of publication in the media about the liquidation of the company (Article 63 of the Civil Code of the Russian Federation). However, creditors may present their claims later than this period. But in this case, they will be repaid at the expense of the property that remains after satisfying the claims of creditors who applied on time.

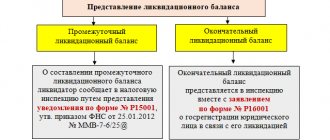

Interim liquidation balance sheet

When drawing up an interim liquidation balance sheet, you should be guided by the accounting regulations “Accounting statements of an organization” PBU 4/99.

The interim liquidation balance sheet contains:

- complete information about the composition of the organization’s assets and liabilities;

- the value of all property that the organization has;

- complete information about accounts payable and receivable.

Despite the fact that the interim balance sheet is drawn up before the creditors' claims are satisfied, it is necessary to indicate information about the composition of the property of the liquidated legal entity, the list of claims presented by creditors, the results of their consideration, as well as the list of claims satisfied by a court decision that has entered into legal force, regardless of whether such requirements were accepted by the liquidation commission (clause 2 of article 63 of the Civil Code of the Russian Federation).

Notification on the preparation of an interim liquidation balance sheet

The interim liquidation balance sheet must be approved by the founders (participants) of the organization or the authorized body that made the decision on liquidation.

Then it must be agreed upon with the registration department (tax office). To do this you need to submit there:

- notification of the preparation of an interim liquidation balance sheet;

- interim liquidation balance sheet (according to the standard balance sheet form);

- power of attorney (for someone who acts on behalf of an organization for the purpose of its liquidation, but does not have the right to do this without a power of attorney).

Thus, in accordance with paragraph 3 of Article 20 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, the head of the liquidation commission (liquidator) must notify the registration authority about the preparation of the interim liquidation balance sheet.

The notification about the preparation of the interim liquidation balance sheet is filled out according to form No. P15001, approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ76/ [email protected]

Submission deadlines

A notification about the preparation of an interim liquidation balance sheet cannot be submitted to the registering authority earlier than the deadline (Clause 4, Article 20 of Federal Law No. 129-FZ):

a) established for the presentation of claims by creditors;

b) the entry into force of a decision of a court or arbitration court in a case (another judicial act that ends the proceedings in the case), in which the court or arbitration court accepted for proceedings a statement of claim containing claims presented to a legal entity in the process of liquidation ;

c) completion of an on-site tax audit, registration of its results (including consideration of its materials) and entry into force of the final document based on the results of this audit in accordance with the legislation of the Russian Federation on taxes and fees in the case of a legal entity in the process of liquidation , on-site tax audit;

d) completion of an on-site customs inspection in relation to a legal entity that is in the process of liquidation, drawing up an on-site customs inspection report and making a decision (the last of the decisions) in the field of customs based on the results of this inspection (if the adoption of the corresponding decision is provided for by international treaties of the Russian Federation) Federation and the law of the Eurasian Economic Union and (or) the legislation of the Russian Federation on customs).

The Ministry of Finance of Russia in letter dated October 17, 2018 No. 03-12-13/74446 noted that there are no exceptions to the rule contained in subparagraph “b” of paragraph 4 of Article 20 of Federal Law No. 129-FZ. Thus, compliance with this norm is mandatory in all cases when presenting an interim liquidation balance sheet.

Notifying employees and employment services

Employees must be notified of future dismissal no later than two months before the expected date of dismissal. This is done under the signature of the employee. The notice notes that the dismissal occurs at the initiative of the employer due to termination of activity. You will also have to send a notice to the employment service two months before terminating the contract. If there is a trade union, notice is sent to it three months before dismissal.

When dismissed due to liquidation, employees must be paid severance pay in the amount of average monthly earnings (Article 178 of the Labor Code of the Russian Federation). If an employee does not find a job within a month and applies, the employer is obliged to pay him the average monthly salary for the next month or part thereof. In exceptional cases, payment for the third month is also due, but in this case the employee must present the decision of the employment service. These payments can be replaced with a one-time compensation in the amount of twice the average monthly earnings.

Dismissal is documented using standard documents. The employer issues a dismissal order, and the personnel officer makes an entry in the work book and hands it over to the employee. If the work is carried out electronically, the employee is given the STD-R form “Information on work activity provided to the employee by the employer.” Additionally, on the next working day after the order is issued, you must submit the SZV-TD to the Pension Fund upon dismissal.

Interim liquidation balance sheet

When the period within which creditors can present their claims expires, an interim balance sheet can be prepared. You will need to wait at least two months from the date of publication in the Bulletin, unless you have set a longer period. If there is a debt settlement trial, you must wait for it to end, as well as for the end of the tax audit.

The interim liquidation balance sheet is prepared on the basis of the current balance sheet, adding the necessary details, and then it is approved at the meeting of the founders. It should include:

- information on the composition of the LLC’s property;

- a list of claims submitted by creditors, with the results of consideration;

- a list of demands that have been satisfied by the court.

Before submitting the balance sheet to the tax office, a notification is submitted in form P15016. It is certified by a notary on the basis of the minutes of the meeting of participants on the approval of the interim balance sheet or the decision of the sole founder.

Within 5 working days, the tax office will make changes to the Unified State Register of Legal Entities.

Deadlines for preparation and approval

A financial report should be drawn up after the end of the period allotted for the presentation of property or monetary claims by creditors, in accordance with clause 1 of Art. 63 of the Civil Code of the Russian Federation, that is, 60 days from the date of official publication of a message in the media about the beginning of the liquidation procedure. The two-month period may be extended by decision of a special commission.

For example, on what date is the interim liquidation balance sheet drawn up?

The date of the decision to terminate activities is 08/10/2017.

Publication in the media - 08/30/2017.

The balance was drawn up on October 31, that is, 2 months from the date of publication in the media.

After drawing up the balance sheet, it is approved by a specially created liquidation commission. Three working days are given to make a decision on approving the interim liquidation balance sheet. According to the conditions of our example, the PLB must be approved before November 3, 2017.

IMPORTANT!

The approved interim liquidation balance sheet must be submitted to the Federal Tax Service no later than 3 business days from the date of its approval. Moreover, the day of the meeting of the liquidation commission and the day of approval are not counted. For example, the deadline for submission to the tax office will be November 6, 2017.

The LLP can be drawn up several times; this may be caused by the length of the liquidation procedure, significant changes in the claims of creditors, or the need to update information for the participants in the process.

We pay off debts

The law requires that debts be repaid in the following order:

- citizens for causing harm to life and health;

- employees;

- mandatory payments of taxes, contributions, fines to the budget and funds;

- other creditors.

If the company does not have enough money to cover all debts, it will have to put the property up for auction. Funds from the sale of property may not be enough to pay off debts, then the liquidation commission must begin bankruptcy proceedings for the legal entity. So if you know in advance, even before the decision to liquidate, that there is not enough money and property to cover your debts, it is better to go bankrupt right away.

The property remaining after the distribution of debts can be transferred to the participants of the company.

Who approves the document?

During the liquidation procedure of an organization, each founder and liquidator performs their functions. Thus, the liquidator identifies the current state of the property, determines the amount of debts, and interacts with creditors.

From the moment the corresponding decision was made, he acts on behalf of the LLC and manages it. The founders, in turn, make decisions on liquidation, appointment of a liquidator, and approval of the balance sheet. They are the ones responsible for approving the P15001 form.

An educational program on the liquidation balance sheet is presented below.

Liquidation balance

Once all debts have been paid off, prepare a final liquidation balance sheet. If you have already distributed property between the participants, but the balance sheet will not have assets and liabilities. If you haven't done this, include information about your remaining assets. Be careful: if the amount of assets in the final balance sheet is greater than in the interim balance sheet, the tax authorities will become interested in the company and may stop the liquidation. This is how the Federal Tax Service fights unscrupulous liquidators who temporarily withdraw assets from business in order not to pay debts.

Approve the final balance at the meeting of participants, draw up a protocol of approval.

Who should be responsible for preparing the interim balance sheet?

As a rule, organizations do this:

- employees of accounting, financial and economic departments;

- directly the head of the enterprise if the necessary skills are available;

- liquidator;

- other authorized persons.

If the interim liquidation balance sheet is drawn up during the bankruptcy procedure of a legal entity, then it must be approved by the bankruptcy trustee. In cases of ordinary closure of an enterprise, the liquidation commission must approve it.

After the interim balance sheet has been drawn up and approved, that is, all the assets and liabilities of the closing enterprise have been taken into account, it is necessary to finally pay off the existing debt obligations. Then, the property and finances that remain with the company can be calmly distributed among the founders of the legal entity, in accordance with their equity participation or in another way prescribed by law or the organization’s Charter.

Final closure

The liquidation procedure will be completed when a record of this appears in the Unified State Register of Legal Entities. To do this, the liquidator must prepare and send a package of documents to the tax office and pay a fee.

Submit the final package of documents to the Federal Tax Service:

- application P15016, signed by the chairman of the liquidation commission (liquidator) and certified by a notary;

- final liquidation balance sheet;

- protocol on approval of the final balance;

- receipt of payment of state duty 800 rubles;

- confirmation that information about the insured persons has been submitted to the Pension Fund (the tax office can receive it through interdepartmental cooperation, but we recommend submitting it so as not to delay the deadlines).

5 days - and the tax office will liquidate the LLC, enter the data into the Unified State Register of Legal Entities, and give you a copy of the confirmation of the entry in the state register. Now all that remains is to close the current account, destroy the seal and hand over the documents to the archives.

While you have not yet closed the company, keep records, pay salaries and submit reports in the online service Kontur.Accounting. The first 14 days of work are free for everyone!