Tax agents annually fill out 2-NDFL certificates for each individual who received income from them. The tax is levied on both Russian citizens and foreigners, and at different rates. In order to correctly apply the tax rate for personal income tax, you need to accurately determine the status of an individual and indicate it in section 2 of the 2-NDFL certificate. We will tell you how to choose a taxpayer status in this article.

Value in payment

For correct crediting to the budget, you must correctly indicate the value in the appropriate field. If a specialist or accountant makes mistakes, the Treasury will designate the payment as “unclarified,” which will not contribute to the timely fulfillment of the monetary obligation, since it will take time to clarify the payment details.

The total values, in accordance with regulatory documentation, are 28. The main ones are:

- 01 - the organization transfers mandatory fees;

- 02 - companies and individual entrepreneurs pay as agents;

- 08 - contributions for injuries;

- 09 — individual entrepreneur performs duties to the supervisory authority;

- 10 - engaged in private practice;

- 11 - lawyers;

- 12 - heads of peasant farms;

- 13 - individual.

Point 14 is currently excluded.

Where can I get the data to accurately fill out the payment order in field 101? All values are indicated in Appendix No. 5 to Order of the Ministry of the Russian Federation dated November 12, 2013 No. 107n. The last changes to it were made on 04/05/2017, some of which came into force on 10/02/2017. This document should be used as a guide when filling out the payment order form. Below are examples of the most common values in practice.

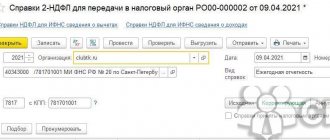

Deadlines for submitting a certificate

It is necessary to submit reports on 2-NDFL certificates indicating the new status codes in order to avoid claims from regulatory tax authorities. If for some reason the organization did not withhold income tax by the end of the year, it is necessary to notify the tax authorities about this before March 1 of the following year in order to avoid penalties.

If an employee was dismissed for any reason during the year, then the certificate must indicate the code of his status at the time of dismissal. If a foreign citizen was employed, but by the end of the year he acquired resident status, then the certificate for him must indicate the number 1 in the status column. This rule does not apply to those who originally came from abroad and work under a patent. The status “6” remains for them.

The updated classification has simplified the determination of the status of specialists coming to work in Russia on patents, as well as on invitations from large companies. However, when filling out documentation, difficulties periodically arise that require detailed explanations.

Rules for specifying information

Let us dwell in more detail on the content of two-digit codes, which are most often used by payers. The table will help you figure out how to determine your taxpayer status.

| Index | Meaning |

| Taxpayer status 1 | This designates the payer - a legal entity in terms of payment of fees, taxes, insurance premiums and other payments administered by the tax inspectorate. Note: in other words, this means the execution of monetary duties in the form of fees, insurance premiums by a legal entity - a company or organization. |

| Taxpayer status 02 | Based on these figures, the Treasury determines tax agents (which can be organizations, companies, and individual entrepreneurs). Note: for example, this code is used when transferring personal income tax for employees. The agent should pay attention to the specifics of paying such fees. |

| Taxpayer status 08 | This code is used when transferring contributions for injuries that are not transferred to the administration of the Federal Tax Service of the Russian Federation, unlike all other insurance contributions. |

| Taxpayer status 09 | Fulfillment of the individual entrepreneur’s obligation to transfer payments administered by the Federal Tax Service of the Russian Federation. |

Clarification of the data in the payment slip, if necessary, is carried out in accordance with the provisions of Art. 45 of the Tax Code of the Russian Federation.

Taxpayer status 1 in 2-NDFL

For individuals who are residents of the Russian Federation, indicate the taxpayer status code “1” in the 2-NDFL certificate. Resident income is generally taxed at a rate of 13%.

Who tax residents are is explained in paragraph 2 of Art. 207 of the Tax Code of the Russian Federation: these are individuals who stay in Russia for at least 183 days, taking into account the days of arrival and departure, for 12 consecutive months. At the same time, short-term (up to six months) trips abroad for treatment or training, as well as work in offshore hydrocarbon fields do not interrupt this period.

During the calendar year, an individual's tax status may change. It must be finally installed at the end of the calendar year. Moreover, if the status is determined not at the end of the tax period, but earlier, on the date of receipt of income, then the period of 12 months will begin not in the reporting calendar year, but in the previous one.

How can you confirm the time of an individual’s actual presence on the territory of Russia in order to indicate taxpayer status “1” in the 2-NDFL certificate? The law does not contain a list of such documents, but the Federal Tax Service in its letter dated 03/05/2013 No. ED-3-3/743 indicates that these can be copies of a passport with marks of crossing the border of the Russian Federation, certificates from places of work drawn up on the basis of these report cards working hours, as well as a certificate of temporary registration at the place of stay.

Status "6"

If a foreigner is engaged in labor activity under a patent, paying fixed advance payments, then the tax agent-employer paying him income indicates taxpayer status “6” in certificate 2-NDFL. A patent for employment is issued to citizens of countries that apply a visa-free regime in relations with Russia (Uzbekistan, Ukraine, Azerbaijan, Abkhazia, etc.).

Read also: Fixed advance payments in the 2-NDFL certificate

When should the norms of the Treaty on the EAEU, and not the Tax Code of the Russian Federation, be applied?

Part 4 of Article 15 of the Constitution of the Russian Federation establishes the unconditional priority of international norms over the norms of the national legislation of our country. This applies to both tax legal relations and social insurance. For example, if the international norm of Article 73 of the Treaty on the EAEU contradicts the internal law of the Russian Federation - Article 207 of the Tax Code of the Russian Federation, then it is the international rules that should be applied. The personal income tax rate of 13% should be applied to the income of EAEU residents received from the first day of employment in the Russian Federation. Work under employment and civil law contracts can be classified as employment work in accordance with Article 96 of the Treaty on the EAEU and Article 13.3 of the Federal Law of July 25, 2002 No. 115-FZ “On the legal status of foreign citizens in the Russian Federation.”

The concept of “income in connection with employment” includes any income provided for in an employment or civil law contract. Moreover, the activities are carried out directly on the territory of the Russian Federation. This is a mandatory condition for applying the personal income tax rate of 13% (see letters from the Ministry of Finance of Russia dated June 10, 2016 No. 03-04-06/34256, dated July 17, 2015 No. 03-08-05/41341). In a letter dated 06/10/2015 No. OA-3-17/ [email protected] the Federal Tax Service of Russia clarifies that the fact that an employee is located and working in Russia is confirmed by copies of passport pages with marks from border control authorities about crossing the border, information from the work time sheet, data migration cards, registration documents at the place of residence (stay).

Please note that this taxation procedure does not apply to EAEU residents working under an agreement with a Russian employer in another state (for example, remotely in Belarus). In this case, the general rules apply: the employer must not withhold personal income tax from the remuneration of a non-resident employee of the Russian Federation received outside the Russian Federation (clause 6, clause 3, article 208, clause 2, article 209 of the Tax Code of the Russian Federation).

Section 2. Calculation of calculated, withheld and transferred personal income tax amounts

Section 2 indicates, generalized for all individuals, the amounts of accrued and actually received income, calculated and withheld tax on an accrual basis from the beginning of the tax period at the appropriate rate.

If the tax agent paid income to individuals taxed at different tax rates, section 2 is completed separately for each tax rate.

“Rate” field indicates the corresponding tax rate.

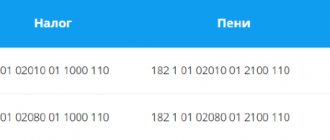

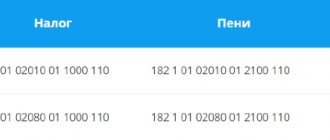

Line 105 indicates the BCC of the tax.

From 01/01/2021, in addition to the main BCC used by tax agents, a new BCC 18210102080011000110 is used for taxes calculated from a tax base exceeding 5 million rubles.

Line 110 reflects the total amount of income accrued for all individuals on an accrual basis from the beginning of the tax period.

Lines 111-115 provide a breakdown of accrued income by type of payment:

- income accrued to individuals in the form of dividends is indicated on line 111 ;

- income accrued under employment contracts - on line 112 ;

- income accrued under civil law contracts (GPA) - on line 113 ;

- income accrued to highly qualified specialists (HQS) under employment contracts and GPA - on line 115 (from lines 112 and 113 ).

Line 120 reflects the number of individuals to whom taxable income was accrued during the corresponding reporting period.

If the same individual is fired and hired during the same tax period, he is counted only once.

On line 121 of the total number of persons reflected on line 120 , the number of HQS who received income under employment contracts and GPA is indicated.

Line 130 , on an accrual basis, the total amount of tax deductions that reduce the taxable income indicated in line 110 . The amount of tax deductions also indicates other amounts that reduce the tax base, and non-taxable amounts if income is exempt from tax within certain limits (for example, financial assistance in the amount of 4,000 rubles).

If the amount of the deduction is greater than the amount of income, then the deduction is indicated in an amount not exceeding the income.

Line 140 reflects the amount of calculated tax generalized for all individuals on an accrual basis from the beginning of the year.

Line 141 reflects the amount of calculated tax on dividends paid for all individuals from the beginning of the year. In this case, the tax amount for each taxpayer is calculated separately for each income payment.

Line 142 reflects the amount of calculated tax generalized for all VKS on an accrual basis from the beginning of the year.

Line 150 indicates the amount of fixed advance payments that the foreigner paid when obtaining a patent. By this amount, the tax agent can reduce the amount of calculated tax if the appropriate documents are available (application from an employee, notification from the Federal Tax Service, receipts for payment of fixed payments).

Line 155 reflects the amount of income tax withheld in respect of dividends received by a Russian organization and subject to offset when determining the amount of tax on income from equity participation in this organization.

Line 160 indicates the amount of tax withheld, calculated on an accrual basis from the beginning of the tax period.

If line 110 indicates the amount of income, but its actual payment has not yet been made in the reporting period, then line 160 does not reflect tax on such income, since it will be withheld in another reporting period.

Line 170 reflects the amount of tax that cannot be withheld by the tax agent (for example, in case of payment in kind in the absence of cash payments). This amount does not include tax on wages, which will be paid in the next reporting period.

Line 180 reflects the amount of tax over-withheld by the tax agent.

Line 190 indicates the amount of tax returned by the tax agent (for example, in the case of excessive tax withholding from the employee’s income).

What is “Taxpayer Status”

Clause 3.5 of Part III of the Filling Out Procedure states that the field “Taxpayer Status” in the 2-NDFL certificate for 2018-2019. can take six different values. An incorrect choice may lead to a discrepancy between the data within the document: the personal income tax rate, and therefore the amount of tax withheld, may vary depending on the status of the taxpayer in 2-personal income tax 2019. Status is a category of individuals to which a particular person can be classified. In other words, who is a person for tax purposes? What exact status a tax agent will assign to a citizen does not depend solely on the taxpayer’s citizenship. Below we will describe in more detail what you need to follow when choosing specific taxpayer statuses in 2-NDFL.

Read also: Citizenship (country code) in 2-NDFL

Status "2"

Taxpayer status in the 2-NDFL certificate is set to “2” if a company or individual entrepreneur paid income to a person who is not a resident of the country. Usually these are foreign persons or Russian citizens who frequently stay abroad. Their income is taxed at a rate of 30%. Also, status “2” is assigned to citizens of the EAEU countries (Kazakhstan, Kyrgyzstan, Belarus and Armenia) who have received income. But for persons arriving from EAEU member countries, the tax rate does not differ from the rate of residents, amounting to 13% (Article of the Treaty on the EAEU dated May 29, 2014). For example, the taxpayer status in 2-NDFL for a Belarusian is “2”, but only 13% of the tax is withheld from his earnings.

Persons who can be classified as status “3” or “6” are not included in the specified composition.

Change of status

During the tax period, the status of an individual may change. To reflect the income statement filed in 2022 for the previous year, the period of 2022 is checked. The final status is assigned on the last day of the year. If the income was paid in the middle of the period, then the status can be determined on the day of payment. Then the certificate will indicate the status code for that day.

The tax authority has the right to recalculate a person’s tax obligations based on the results of the entire year. And he, and not the tax agent, will return the excess withheld amount if, for example, the taxpayer ends up being a resident.

When filling out, you need to check that the code is entered correctly. For the Federal Tax Service, the status of a taxpayer in certificate 2-NDFL 2022 is important, since the amount of tax payable is calculated on the basis of this information. If the agent who paid the income makes a mistake in the code, the certificate may be recognized as containing false information.

Read also: Income codes in the 2-NDFL certificate in 2019

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.