Limits on most tax deductions (for education, for treatment, etc.) are established only within one calendar year: each calendar year the “limit” is reset, and the deduction can be received again. In contrast, the property deduction when buying a home contains more serious restrictions: both the maximum amount of the deduction and the number of times it can be used during one’s lifetime are legally limited.

Until 2014, there were restrictions according to which tax deductions for housing purchase expenses and loan interest could be obtained only once in a lifetime and only for one housing property. Since 2014, the deduction was allowed to be received for several residential properties, but the new rules were allowed to be applied only to new transactions (concluded after the entry into force of the new law). In this regard, many questions arose: in what cases what deduction restrictions apply? If you used the deduction earlier, in what cases can you “receive” it when purchasing a new home? Is it possible to get a deduction for credit interest if you previously only used the deduction for the purchase of housing?

In this article we will try to answer all these questions.

Please note: The key factor on which the property deduction limits depend is the date of purchase of the home for which you receive (or want to receive) the deduction. The “date of purchase of housing” for the purposes of this article should be considered: - the date of registration of ownership of housing according to an extract from the Unified State Register of Real Estate when purchasing under a sales contract; — the date of the transfer deed when purchasing housing under an agreement of shared participation in construction.

Deduction limits for housing purchased before January 1, 2014

If you purchased housing before 2014 and received (or plan to receive) a property deduction for it, then the “old” rules apply to you, according to which the deduction can be obtained strictly only for one property (paragraph 27, paragraph 2, paragraph 1, art. 220 of the Tax Code of the Russian Federation as amended, valid until 01/01/2014) and in an amount of no more than 2 million rubles. (260 thousand rubles to be returned). Moreover, even if you received a deduction less than the maximum amount, you will not be able to receive it additionally when purchasing another home.

Example: In 2008, Levashov I.I. bought an apartment for 500 thousand rubles. and received a tax deduction for it (returned 65 thousand rubles of taxes paid). When purchasing an apartment in 2016, Levashov I.I. will not be able to use the deduction again, since until 2014 the property deduction was provided only once for one housing property

The credit interest deduction for housing purchased before January 1, 2014 had no restrictions on the amount (you could return 13% of all mortgage interest paid), but it could only be received on the same property for which you received the principal deduction (deduction for purchase expenses). This is due to the fact that until 2014, the main property deduction and the interest deduction were not separated and constituted a single type of deduction (Article 220 of the Tax Code of the Russian Federation, as amended, valid until 01/01/2014).

Example: In 2012, Ivanchenko A.A. I bought an apartment and received a tax deduction for it. In 2013, Ivanchenko bought another apartment with a mortgage and wanted to get a deduction on loan interest. The tax office legally denied him the deduction, since for housing purchased before January 1, 2014, the main deduction and interest deduction could only be received for a single housing property.

However, it is worth noting that if you purchased a home before January 1, 2014 and only took advantage of the deduction for purchase expenses, then you can receive a deduction for credit interest on other housing, but only if it was purchased after January 1, 2014. We will look at this situation in detail below in the section - Is it possible to get a deduction for credit interest if you previously only used a deduction for purchase expenses?

Who can return the tax deduction

According to the law, in 2022, all taxpayers will be given a second chance to take advantage of the property deduction. According to Article 19 of the Tax Code, these can be legal entities and individuals paying taxes.

In addition, such citizens must reside permanently in Russia for one year (clause 1 of Article 207 of the Tax Code).

This justification does not apply to certain categories:

- military personnel forced to serve outside the country;

- employees of government agencies sent abroad.

These citizens are considered residents, regardless of their location throughout the year.

To return the tax deduction, you must have a stable income subject to personal income tax.

. If you don't have one, you won't be able to get compensation.

Deduction limits for housing purchased after 2014

Since January 1, 2014, significant changes have been made to the Tax Code of the Russian Federation, according to which, if the tax deduction for the purchase of an apartment/house is not received in the maximum amount (i.e. from an amount less than 2 million rubles), then the remainder can be received when purchasing other housing properties (paragraph 2, paragraph 1, paragraph 3, article 220 of the Tax Code of the Russian Federation).

Example: In 2016, Ukladova T.I. I bought a room for 500 thousand rubles. and received a property deduction (returned 65 thousand rubles). In 2022, she bought an apartment for 3 million rubles. Ukladova T.I. will be able to receive an additional property deduction for the purchase of an apartment in the amount of 1.5 million rubles. (to be returned 195 thousand rubles).

New rules also began to apply to the deduction for credit interest on housing purchased after January 1, 2014:

- the deduction for credit interest is not related to the deduction for expenses for the purchase of housing and can be obtained for a separate object;

- The maximum deduction for credit interest is 3 million rubles. (to be returned 390 thousand rubles);

- unlike the deduction for expenses for the purchase of housing, the deduction for credit interest can be received only once in a lifetime for one property;

Example: In 2016, Panyukov E.I. bought an apartment worth 8 million rubles. To buy an apartment, he took out a mortgage in the amount of 6 million rubles. (on which he will pay interest in the amount of 3.5 million rubles) Panyukov E.I. will be able to receive a basic property deduction in the amount of 2 million rubles. (to be returned 260 thousand rubles), as well as an interest deduction in the amount of 3 million rubles. (to be returned - 390 thousand rubles).

Example: In 2014, Epifanova T.K. I bought an apartment and received a property deduction for purchase costs. In 2017, she bought a new apartment with a mortgage and will be able to receive a deduction for the loan interest paid.

Example: In 2014, A.A. Cherezov I bought an apartment worth 1 million rubles with a mortgage. Cherezov A.A. received a deduction for purchase expenses and a deduction for credit interest. In 2022, he purchased another apartment worth 3 million rubles. (also using credit funds). Cherezov A.A. will be able to receive an additional deduction for purchase expenses (since he did not use it in full), but will not be able to receive an additional deduction for credit interest, since it is provided only for one property.

Mortgage borrowers file two separate deductions

If a citizen buys an apartment with personal funds, he receives the right to receive 13% of the cost of housing, but not more than 260,000 rubles. And the mortgage borrower immediately after the completion of the purchase and sale transaction receives this right.

But according to the law, he can separately return tax on mortgage interest. This is also 13%, but with interest paid by the bank. The maximum amount is 390,000 rubles for the entire period of repayment of the mortgage loan.

What we end up with:

- Already in the next tax year, the borrower can apply for a standard deduction for the purchase of real estate up to 260,000 rubles. For example, if the purchase of an apartment was made in September 2021, in 2022 you can return the personal income tax for September-December 2022.

- As you pay off the loan to the bank, you can apply for a second deduction - a property deduction for mortgage interest. You can submit an application for it at least every year, or even after 5 years you can receive it all at once - there are no time limits.

The law does not limit the deadline for filing applications for a tax refund on a mortgage; it is not necessary to file a return for the next year after the purchase. You can send a request even after 10 years, but personal income tax is returned only for the last 3 years.

That is, if you bought an apartment on credit in September 2022, it is better to apply for the deduction in 2023, then you will get back both the full 2022 deduction and the last months of 2022. And some wait 3 years to receive everything at once in a large amount.

Receipt of deductions before January 1, 2001 is not taken into account

In conclusion of the article, we note that until 2001, the property deduction was provided on the basis of the Law of the Russian Federation of December 7, 1991 N 1998-1 “On personal income tax.” This law became invalid on January 1, 2001. Therefore, if you claimed a property deduction and all payments on it were made before January 1, 2001, then you can assume that you did not use the deduction . When purchasing another home (after January 1, 2001), you can again receive a property deduction (Letters of the Ministry of Finance of Russia dated February 13, 2014 N 03-04-05/5889, dated July 24, 2013 N 03-04-05/29229).

Example: In 1998, Klestova Y.F. I bought an apartment. In 1999 and 2000, she submitted 3-NDFL returns to the tax office and received a full property deduction. In 2013, Klestova Ya.F. I bought an apartment again. Since she received the full deduction before January 1, 2001, when purchasing an apartment in 2013, she will be able to take advantage of the property deduction again (according to the rules of Article 220 of the Tax Code of the Russian Federation).

Example: In 1999, Ezhov N.N. bought an apartment. In 2000, 2001, 2002 and 2003, he applied to the tax office to receive a property deduction. In 2022 Ezhov N.N. bought a second apartment. Since part of the deduction payments was made after January 1, 2001, N.N. Ezhov can receive a property deduction for an apartment purchased in 2022. can not.

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

Who will not be able to receive a tax deduction on a mortgage in 2022

A citizen of the Russian Federation who pays personal income tax can receive money from the state. That is, this is an employed person. He has an official place of work and can order a 2-NDFL certificate, where the Federal Tax Service will see the amount of tax paid, from which the calculation is made.

But if the mortgage borrower does not have an official job, then he does not pay personal income tax, and therefore cannot return it. This is a very real situation: for example, when applying for a loan, a person was working officially, but soon quit

If the borrower is an individual entrepreneur on a simplified taxation system, he will also not be able to apply for a mortgage deduction. The fact is that such individual entrepreneurs do not pay personal income tax, but only this tax can be returned by law.

How to get a tax deduction on a mortgage

There are two options - submit an application to the employer’s accounting department or to the Federal Tax Service. But in the first case, within the prescribed amount, the tax will simply be removed from your salary, and you will receive more. To get a large amount in your hands, you need to contact the Federal Tax Service.

Documents for a tax deduction for a mortgage (for the apartment itself):

- an extract from the Unified State Register of Real Estate, which confirms ownership;

- documentary evidence of payment for the purchase, for example, a receipt from the seller;

- certificate 2-NDFL for the period for which you want to receive a deduction;

- if we are talking about spouse-owners who want to distribute the deduction among themselves, their application is required;

- marriage certificate if the applicant is married.

In the application, the citizen indicates the details of the account to which the money needs to be transferred.

The procedure for returning personal income tax for a mortgage:

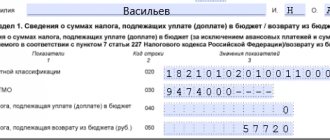

- Fill out the 3-NDFL declaration (a separate document is created for each year). To do this, you can contact the company or fill it out yourself. Here are instructions on how to draw up a 3-NDFL through State Services.

- Calculate the required deduction. Federal Tax Service employees will then double-check (the amount will be taken into account by you when submitting your application).

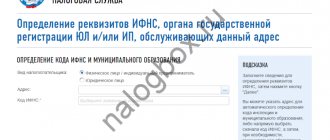

- You submit the package of documents along with 3-NDFL to the Federal Tax Service at your place of residence.

- The Federal Tax Service checks the declaration for 3 months. If everything is in order, the money is transferred to the account specified by the citizen within 30 days.

If we are talking about obtaining a deduction for mortgage interest, then a certificate from the bank about the amount of interest paid for the stated period is added to the above documents.

5 / 5 ( 1 voice )

Mortgage interest deduction - consider the second deduction

Refunds of mortgage interest are processed separately by the tax office. Typically, borrowers first receive what they are entitled to for the very fact of purchasing real estate, and only then return personal income tax on the interest paid. This is more convenient - a more interesting amount of interest will have time to calculate the deduction.

So, our potential borrower first applied for a deduction for the purchase of an apartment and received 260,000 rubles from the state over 2 years. Next year, he applies to the Federal Tax Service to begin receiving the 280,800 rubles due to him from the example above.

But there is an important point here - the calculation of the deduction base is formed on the basis of interest already paid to the bank. That is, you will not receive the entire amount at once. The last money is after the mortgage is completely closed.

Our potential borrower received a deduction for the apartment in 2022 and 2023. In 2024, he can get a tax deduction for mortgage interest for the first time. The interest he paid to the bank in 2022, 2022 and 2022 will be taken into account.

You can calculate these percentages yourself in the payment schedule, if you have followed it. In our case, the schedule for 2020-2022 looks like this:

The “Accrued Interest” column is the base from which the calculation will be made. You need to sum up the interest for the entire allotted period. But in any case, the applicant will receive from the bank a certificate of interest paid for the reporting period.

When you first start paying off your mortgage, your monthly payments mostly consist of interest. Therefore, the deduction for the first years will be higher, and as the payments end, it will be significantly reduced, so the percentage of interest in payments will decrease.

For example, our borrower paid the bank 750,000 rubles in interest for the period from October 2022 to December 2023. 13% of this amount is 97,500 rubles. This is exactly how much a citizen will receive in 2024.

But here we need to remember that our potential borrower received a tax refund for the purchase of an apartment in 2022 and 2023, that is, personal income tax for these years was returned. In 2024, the amount of the tax deduction also cannot exceed the amount of taxes paid for that year. If the full 97,500 is not due, the balance is carried forward to subsequent periods.

Applying for interest deduction every year is not entirely justified. The amounts will be small. Therefore, many borrowers make a personal income tax return of this type once every 3 years, each time requesting a certificate from the bank indicating the amount of interest for this period.

As a result, the borrower receives a tax deduction for the apartment under the mortgage throughout the entire loan repayment period. The final deduction for interest is issued upon full repayment of the mortgage.

FAQ

How many times can you receive a property deduction when purchasing an apartment with a mortgage?

The right to receive a tax deduction for the purchase of real estate and for mortgage interest arises multiple times, but within the limits of 260,000 and 390,000, respectively. If the limits are not exhausted within one transaction, they can be received on subsequent transactions.

Can both spouses return the tax at once when purchasing an apartment with a mortgage?

The property belongs to them together, and they are both legally entitled to receive tax deductions up to the limits established by law. As a result, they can simultaneously submit applications to the Federal Tax Service, payments will go to both, but within the amount stipulated in the transaction.

Is it possible to apply for two deductions at once: both for the purchase and for the interest?

You can, if the personal income tax you paid for the stated period allows you to do this. You can receive both deductions at once in full or one in full and one in part.

How can I get my mortgage interest back through a deduction?

You need to fill out a 3-NDFL declaration, get a 2-NDFL certificate at work, get a certificate from the bank about interest paid for a given period and contact the Federal Tax Service with an application to receive a deduction for mortgage interest.

Is it possible to repay mortgage interest in one amount?

Receiving interest deductions usually goes hand in hand with paying off your mortgage. The refund is made for the amount of interest that you have already paid to the bank. You will not receive a deduction immediately for the entire overpayment according to the schedule. You can submit an application after paying off the loan in full, but personal income tax for the last 3 years will be taken into account, or send applications to the Federal Tax Service every 3 years and receive the money in installments.

Sources:

- Government services: Property tax deduction.

- Federal Tax Service: Property deduction when purchasing property.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

We consider the first deduction - for the purchase of an apartment

We will consider the same situation with our potential borrower, which is described above. According to the law, for the very fact of purchasing an apartment for 3 million, he can return personal income tax in the amount of 260,000 rubles.

Advice for mortgage borrowers. It is better to first receive the required deduction for the purchase of housing. Once this deduction has exhausted itself, apply for a second one - for interest on a mortgage loan. During this period, a larger base of interest paid to the bank will already accumulate.

The law does not establish time limits; you can submit a declaration to the Federal Tax Service at least the next year after purchase, at least after 3-4 years. The main condition is that the personal income tax paid is considered for the last 3 years. For example, if you submitted a request in 2024, income from 2022, 2022 and 2023 will be taken into account.

Initial data of our borrower:

- he is entitled to a deduction for the purchase of an apartment in the maximum amount of 260,000 rubles;

- he bought an apartment with a mortgage in September 2022;

- technically, he can submit an application on any day of 2022 and return the personal income tax paid for September-December 2022. But the amount there will be small, so let’s take another period;

- A citizen applies for a personal income tax refund in 2022, that is, he has 12 months from 2022 and 4 from 2022.

The citizen orders a 2-NDFL certificate from the employer for this period, where the amount of taxes paid by the employer is displayed. For example, with a salary of 70,000 per month, the total income for 16 reporting months is 1,120,000. A 13% tax on this amount is 145,600 rubles.

In 2022, our potential borrower can receive from the state 145,600 rubles out of the required 260,000.

But a citizen has the right to receive exactly 260,000, and he is not deprived of this right. The remaining 114,400 rubles are carried over to the next period. That is, a citizen can apply again in 2023 and receive the money again. And if the amount is not exhausted again - in 2024.

Some mortgage borrowers make a tax refund on the mortgage for the apartment itself every year, others - once every 2 or 3 years in order to immediately receive a more significant amount. Here, as you wish, there are no legal restrictions. You can apply at least after 10 years.