Who are considered tax agents for VAT in 2022

The Tax Code defines several cases when a company is considered a tax agent:

- if it purchases goods, works or services on the territory of the Russian Federation from a foreign company that is not registered for tax purposes in Russia (clauses 1, 2 of Article 161 of the Tax Code of the Russian Federation);

- if the company leases property from the authorities, and also if the company buys or receives from the authorities property that constitutes the state treasury (paragraph 1, paragraph 3, article 161 of the Tax Code of the Russian Federation);

- if, on behalf of the state, the company sells property by court decision, as well as confiscated, ownerless or purchased property (clause 15, clause 2, article 146, clause 4, article 161 of the Tax Code of the Russian Federation);

- if the company acts as an intermediary - commission agent or attorney, participates in settlements and sells goods, work, services or property rights to a foreign company not registered in Russia (clause 5 of Article 161 of the Tax Code of the Russian Federation);

- if the company owns the ship on the 46th calendar day after the transfer of ownership rights to it, if before this date the ship is not registered in the Russian International Register of Ships (clause 6 of Article 161 of the Tax Code of the Russian Federation);

- if the company buys raw animal skins, scrap and waste of ferrous and non-ferrous metals, secondary aluminum and its alloys, as well as waste paper (clause 8 of Article 161 of the Tax Code of the Russian Federation);

- if it provides railway rolling stock or containers on the territory of the Russian Federation on the basis of an intermediary agreement (with the exception of the international transportation of goods and transportation of exported (re-exported) goods, if the point of departure and destination are located on the territory of the Russian Federation) (clause 5.1 of Article 161 of the Tax Code of the Russian Federation).

Even if a company is not a VAT payer, it is not exempt from the duties of a tax agent. For example, “simplified people” or payers of UTII who perform the listed operations are recognized as tax agents.

Filling out the Declaration Cover Page

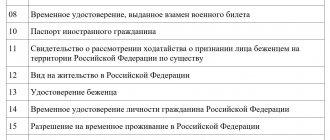

The TIN and KPP of the organization are filled out on the title page. The data can be found in the registration certificate received upon registration. You need to fill out the TIN from the first cell, if the organization's TIN has only 10 digits, the last two cells do not need to be filled in, dashes are placed in them.

The “adjustment number” depends on what kind of declaration the organization submits: primary or updated. When submitting an initial declaration, you need to enter “0–”, and when submitting an updated declaration, indicate the adjustment number, that is, “1–” for the first clarification and “2–” for the second.

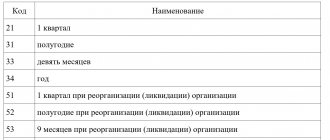

The “tax period” is set depending on the quarter for which the declaration is submitted, that is, 21 – the first quarter, 22 – the second quarter, 23 – the third quarter, 24 – the fourth quarter.

“Reporting year” – enter the year of the quarter for which the declaration is submitted. For the 3rd quarter of 2022 – “Reporting year” should be entered as 2022.

“Submitted to the tax authority” - enter the code of the Federal Tax Service that registered the tax agent. This code can be found in the same certificate as the TIN, or at the address of the Federal Tax Service on the official website.

“At the location (registration)” it is indicated that the declaration is submitted at the place of registration of the organization. For this, the code “214” is indicated.

“Taxpayer” – indicate the full name of the organization, or the full last name, first name and patronymic of the entrepreneur. It should be indicated in the same way as written in the registration certificate.

“Code of the type of economic activity according to the OKVED classifier” - it should be borne in mind that from 2022 the code is indicated in accordance with the OKVED2 classifier.

“Contact telephone number” – indicate a landline or cell phone number, including the area code.

What should a VAT tax agent do?

In simple terms, the VAT tax agent must pay the tax instead of an organization or individual entrepreneur who cannot do this. In this case, the tax agent’s action plan is as follows:

- calculate the amount of VAT;

- withhold tax from the taxpayer’s income, which the tax agent himself pays;

- transfer taxes to the budget.

Tax agents - VAT payers who withheld VAT and transferred it to the budget, can accept the tax as a deduction (clause 3 of Article 171 of the Tax Code of the Russian Federation). Tax agents who do not pay VAT cannot do this. The exception is if the company sells confiscated goods or acts as an intermediary, including providing railway rolling stock. In such situations, even the payers of this tax are not allowed to deduct the VAT paid.

How to pay VAT when purchasing goods from a foreign company

Read more…

Who fills out which sections?

The following table lists the sections of the VAT return, as well as the cases when entities must fill them out.

Table 2. Sections of the VAT return

| Chapter | Who fills in / What is reflected |

| Title page | All |

| Section 1 | All |

| Section 2 | Tax agents |

| Section 3 | Everyone who performed taxable transactions. The calculation of the amount of tax to be paid/refunded is reflected. |

| Section 4 | If the activity was carried out at a VAT rate of 0%, and there are documents to confirm its legality |

| Section 5 | If activities were carried out at a VAT rate of 0%, but there are no documents for confirmation |

| Section 6 | If the application of a 0% rate was previously announced, but the right to the benefit was received only in the current period |

| Section 7 | If there are transactions exempt from VAT |

| Section 8 | Everyone who performed taxable transactions. Purchase ledger data is displayed |

| Section 9 | Everyone who performed taxable transactions. Sales book data is reflected |

| Section 10 | Intermediaries reflect data on issued invoices |

| Section 11 | Intermediaries reflect data on received invoices |

| Section 12 | Non-payers of VAT when issuing invoices |

The table above shows that in most cases, organizations and individual entrepreneurs fill out the following sections of the declaration:

- Title page.

- Section 1, which indicates the amount of VAT payable.

- Section 3 in which this amount is calculated.

- Sections 8-9 containing purchase and sales ledger data.

Completing the remaining sections depends on the specifics of the activity.

Zero VAT return

VAT payers must submit reports even if there are no indicators . In particular, this is necessary if:

- in the reporting period there were no activities or were carried out only outside the Russian Federation;

- in the reporting period, only transactions not subject to VAT were carried out;

- the subject performed long-cycle operations (completion time was more than six months).

In this case, only the Title Page and Section 1 are completed. Dashes are placed in the lines intended to indicate tax amounts.

When do you need to pay agency VAT?

The tax agent must transfer the VAT withheld from the taxpayer's income to the budget at his location. The entire tax amount must be divided by three and each third transferred to the budget. This must be done no later than the 25th day of each of the three months following the quarter in which VAT was withheld (clause 1.3 of Article 174 of the Tax Code of the Russian Federation).

That is, when:

- payment was transferred to a foreign company for the purchased goods;

- money was transferred to a government agency under an agreement for the rental of premises;

- the intermediary received payment for goods, works, or services sold by a foreign person.

Another rule has been established for the transfer of VAT when purchasing works and services from a foreign organization that is not registered for tax purposes in Russia. In this case, VAT must be paid to the budget simultaneously with the transfer of money to the foreigner (clause 4 of Article 174 of the Tax Code of the Russian Federation).

Therefore, you will have to send two payments to the bank at once: one to pay for the work or services of a foreigner, the other to transfer taxes to the budget.

How to pay VAT when selling foreign goods by an intermediary

Read more…

Completing Section 7

In section 7 of the declaration, indicate:

- in column 1, the transaction codes given in Appendix No. 1 to the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558;

- in column 2, the cost of goods (work, services) sold according to the corresponding transaction codes;

- in column 3, the cost of purchased goods (work, services) according to the corresponding transaction codes;

- in column 4, the amount of VAT on purchased goods (works, services), which is not subject to deduction, according to the corresponding transaction codes.

This is provided for in Section XII of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

How to fill out a VAT return as a tax agent

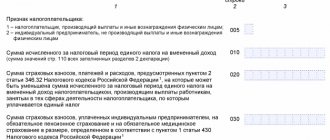

Tax agents do not fill out the entire declaration, but only section 2 “The amount of tax to be paid to the budget, according to the tax agent.”

This section is filled out separately for each foreign partner, lessor (government body), in relation to whom the company acts as a tax agent. A separate section must be completed for each seller according to the agreement for the sale (transfer) of state property, which constitutes the state treasury.

How to pay VAT when purchasing and leasing state property

Read more…

Tax agents - ship owners - fill out section 2 separately for each ship that is not registered in the Russian International Register of Ships within 45 calendar days after acquisition.

An exception to this procedure is provided for companies that sell property by court decision, as well as confiscated or ownerless property. Such companies fill out this section on one page.

How to pay VAT if a company sells property by court decision

Read more…

You also need to fill out Section 2 on one page if the company paid income to only one lessor (government agency), but under several contracts.

Other sections are included in the declaration if there is a need to reflect relevant data in them.

An example of filling out a tax agent declaration

Read more…

Rules for filling out the declaration

The established procedure for filling out the report depends on whether the organization is a VAT payer (Appendix 2 to Order No. ММВ-7-3/).

If the organization is a value added tax payer, then the tax agent is additionally required to fill out section 2 of the VAT return and transfer to section 9 the sales book data for agency transactions with code 06. The remaining sections are filled out in the standard manner. A taxpayer has the right to deduct paid agency tax if the following conditions are met:

- payment is transferred to the budget;

- goods (work, services) are accepted for accounting and purchased for taxable activities;

- an invoice has been issued in accordance with the established procedure.

Read more: “On the procedure for submitting a report on value added tax”

Example

Clubtk.ru LLC is a VAT payer. In the 4th quarter of 2022, in addition to normal operations, the company leased real estate from the local administration. The monthly rent was 30,000 rubles. The organization monthly calculated and paid tax to the budget in the amount of:

30,000 × 20 / 120% = 5,000 rub.

After payment, the tax is accepted for deduction. When filling out section 2, Clubtk.ru LLC indicated:

- in line 070 - transaction code 1011703, relating to the lease of state property;

- details of the government agency from which the property is leased;

- in line 060 - the amount of VAT payable to the tax agent in the declaration;

- KBK and OKTMO - are indicated similar to those filled in when calculating tax by the taxpayer.

ConsultantPlus experts have sorted out which type of transaction code to indicate to the seller of waste paper in the sales book and who submits the VAT return (seller and buyer on OSN), if the invoice contains a note that VAT is calculated by the tax agent. Use these instructions for free.

A sample of filling out a VAT return by a tax agent when renting municipal property in 2022 by a taxpayer

IMPORTANT!

The list of codes for all transactions classified as taxation in the agency procedure is given in Section V of Appendix 1 to the procedure for filling out the declaration, approved by Order of the Federal Tax Service No. ММВ-7-3/ dated 10/29/2014.

VAT evaders fill out the report in a special manner. Be sure to include the following sections in the VAT return of the tax agent on the simplified tax system (or other value added tax defaulter):

| Chapter | Filling Features |

| Title page | In the line “At location (accounting) (code)”, indicate the code of the tax agent in the VAT return 231 |

| Section 1 | Fill in only lines 010 and 020. Leave lines 030-095 blank |

| Section 2 | To be completed for each type of transaction related to fiscal agency |

| Section 9 | Transfer data from the sales book for agency transactions with code 06 |

A sample of filling out a VAT return when renting municipal property in 2022 for a defaulter

How to submit a VAT return to a tax agent

Tax agents must submit a VAT return to the Federal Tax Service with which they are registered. Some of them can choose for themselves whether to submit the declaration to them on paper or electronically. These are tax agents who simultaneously:

- are not intermediaries acting in the interests of another person;

- are not VAT payers or are such, but are exempt from the obligation to pay tax (clause 5 of Article 174 of the Tax Code of the Russian Federation);

- are not the largest taxpayers;

- have an average number of employees for the previous calendar year of no more than 100 people (clause 3 of Article 80). Newly created organizations should focus on the number of employees, which should not be more than 100 people.

Other tax agents must submit returns exclusively electronically. A declaration submitted on paper is not considered accepted (clause 1, clause 3, article 76, clause 5, article 174 of the Tax Code of the Russian Federation).

Value added tax reporting form

To provide information on the amounts of calculated and paid value added tax, you should use a unified reporting form. The form for the fiscal declaration for value added tax was approved by Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 10/29/2014 as amended by Order of the Federal Tax Service of Russia No. ED-7-3/ [email protected] dated 03/26/2021.

The document contains the electronic format of the report and the procedure for filling it out. IMPORTANT!

For value added tax reporting for the 4th quarter of 2021, a form is used that was updated in the 3rd quarter of 2022! And with reporting for the 1st quarter of 2022, the form will be updated again. The order has not yet been officially approved, but as soon as it comes into force, you will have to use a new VAT declaration form.

We remind you that tax agents can be both VAT payer organizations and non-payers. Let's focus on the latter. It is much easier for them to fill out a report than for payers. Mandatory for this category of business entities are:

- title page;

- first and second sections;

- section 9, if there is information about invoices recorded in the sales ledger.

We disclosed the basic procedure for entering information into the fiscal report in a separate material, “How to submit a VAT return electronically.” Now we will determine how to correctly fill out a VAT return to a tax agent, taking into account the new requirements.

ConsultantPlus experts analyzed how a tax agent fills out a VAT return. Use these instructions for free.