Who is required to submit a declaration

The list of payers is defined in the Tax Code. The size and rules are regulated by regional authorities. Here is who pays the water tax and who submits the declaration:

- legal entities and individuals in the status of individual entrepreneurs who have licenses for water use and actively exploit water resources;

- legal entities and individuals - individual entrepreneurs who use groundwater (subsoil) under appropriate licensing.

Organizations and entrepreneurs that have entered into water use agreements do not report to regulatory authorities and do not pay.

Example of a water tax declaration

The total amount of water tax for Hydrant LLC will be 47,461 + 23,820 = 71,281 rubles. and will be reflected in line 030 of section 1 of the declaration, which will take the form:

When is it due?

The reporting dates are the same for everyone. The declaration is submitted upon the fact - after the end of the reporting period. The Tax Code of the Russian Federation stipulates when to submit the 2022 water tax return - no later than the 20th day of the month that follows the reporting period (Articles 333.14, 333.15 of the Tax Code of the Russian Federation). See the table for dates for 2022.

| Reporting period | Deadline for submitting a water tax return | Code in the declaration |

| 4th quarter 2022 | 20.01.2021 | 24 |

| 1st quarter 2022 | 20.04.2021 | 21 |

| 2nd quarter 2022 | 20.07.2021 | 22 |

| 3rd quarter 2022 | 20.10.2021 | 23 |

| 4th quarter 2022 | 20.01.2022 | 24 |

When the reporting deadline falls on a weekend, the due date is moved to the next working day.

IMPORTANT!

The return for the 4th quarter of 2022 must be submitted by 01/20/2022.

Common mistakes when filling out a declaration

Many beginners often make mistakes when filling out a declaration, after which problems arise and the document has to be rewritten and submitted to the Federal Tax Service again. Among the most common mistakes are:

- When filling out, indicate not the full, but the abbreviated name of the organization. For example, instead of Limited Liability Company they write LLC.

- The documentation must indicate the details of the persons, that is, last name, first name and patronymic. Sometimes this data is indicated in abbreviations, however, it is recommended to enter full names, without abbreviations.

- When filling out the TIN, you should remember that if the field consists of 12 cells, and you need to enter 10 digits, then the remaining 2 cells must be filled with zeros.

- Some taxpayers believe that it is enough to indicate the TIN and the name of the organization on the title page. This approach is fundamentally wrong - you need to fill in all the necessary data.

It is recommended to submit the return for the first time as early as possible, so that in case of any errors when filling it out, the taxpayer can rewrite the documents and have time to resubmit them within the prescribed period.

How to calculate tax

All contributions are calculated as follows: the tax base is multiplied by the rate. In some cases, a correction (increasing) factor is added.

The object of taxation is water use. Natural water is used in various ways:

- fence from specific objects;

- development of water area;

- resource consumption for hydropower processes;

- exploitation of water for wood rafting.

The calculation depends on the volume of water consumed, that is, the tax base is the amount of water used under the license. In the procedure for generating reporting information, it is reported whether the daily or annual limit should be indicated when filling out a water tax declaration - the water use limit that is established in the license for a specific water body and the purpose of use (clause 5.1.9 of Section V of the procedure for filling out from Order No. MMV-7- 3/ [email protected] ).

Measurement is carried out in thousands of cubic meters. Each consumer of resources must install water measuring devices. If measuring equipment is not installed, then the calculation is carried out according to consumer standards in force in the region. In this case, the calculated value is indexed: a coefficient of 1.1 is applied to the contribution amount. The tax base is calculated separately for each operated facility and for each rate.

There is no single rate for this tax; indices vary geographically. All rates are set out in Art. 333.12 Tax Code of the Russian Federation.

For the water area:

For hydropower purposes:

For alloy wood:

The formula for calculating water tax is:

VN = base × rate (for the region according to the table) × coefficient.

Increasing coefficients are growing every year.

| Year | Coefficient |

| 2020 | 2,31 |

| 2021 | 2,66 |

| 2022 | 3,06 |

| 2023 | 3,52 |

| 2024 | 4,05 |

| 2025 | 4,65 |

Tariffs for water supply to the population are also increasing every year. The increasing factor does not apply to settlements with citizens under water supply contracts.

| Year | Tariff, rubles per 1000 cubic meters |

| 2020 | 162 |

| 2021 | 186 |

| 2022 | 214 |

| 2023 | 246 |

| 2024 | 283 |

| 2025 | 326 |

Let's look at an example of calculating water tax for organizations:

The budgetary institution SDUSSHOR "ALLUR" takes water from an artesian well for its own purposes - for non-commercial use (purpose code - 3). ALLURE is located in the Northern Economic Region and uses water resources from the Neva River. The tax rate is 264 per 1000 cubic meters used (clause 1, part 1, article 333.12 of the Tax Code of the Russian Federation).

The license limit for using a well is 30,000 cubic meters. ALLURE used 35,000 cubic meters in the 4th quarter of 2022, the limit was exceeded by 5,000 cubic meters. For exceeding the limit, the rate is multiplied by 5 and is 1320. The coefficient in 2022 is 2.66.

The tax will be:

- contribution within the limit: 30 × 264 × 2.66 = 21,067.20 rubles;

- contribution over the limit: 5 × 1320 × 2.66 = 17,556.00 rubles.

Total water tax to be transferred to the budget: 21,067.20 + 17,556.00 = 38,623.20 rubles. We round to the whole value (everything less than 50 kopecks is reset to zero, 50 kopecks and more are equal to a whole ruble) and we get 38,623 rubles. Such a contribution must be paid by SDUSSHOR "ALLUR" for the 4th quarter of 2022.

How to calculate

The objects of taxation are various ways of using resources (Article 333.19 of the Tax Code of the Russian Federation):

- water intake;

- use of the water area;

- use of water for hydropower;

- rafting of wood on water.

The standard technology for calculating and preparing a tax return for water tax is as follows: the contribution is calculated as the product of three indicators: the tax base, the current rate and the increasing coefficient. The tax base is the amount of water consumed during the reporting period. Rate - tariff for a specific region. The coefficient is an adjustment index that changes every year.

The quarterly contribution to the budget is calculated using the formula: tax = tax base × current rate × adjustment factor.

Let's present a table with coefficients and tariffs for water supply. These tariffs are applied only for commercial purposes; for consumer services, a different tariff scale is used for citizens.

| Year | Increasing factor | Tariff per 1000 m³, rub. |

| 2020 | 2,31 | 162 |

| 2021 | 2,66 | 186 |

| 2022 | 3,06 | 214 |

| 2023 | 3,52 | 246 |

| 2024 | 4,05 | 283 |

| 2025 | 4,65 | 326 |

To determine the amount of water used under the license, it is necessary to install water measuring instruments. If there are no such devices, then the calculation is carried out according to basic regional standards. In the procedure for filling out the reporting form, it is explained whether to indicate a daily or annual limit when filling out a water tax declaration - we indicate the water use limit, which is specified in the license for a given type of facility and the established purpose of use (clause 5.1.9 of Procedure No. ММВ-7-3/ [email protected] ).

There is no general rate for calculating the water tax. The coefficients differ according to the type of use and geographical location of water bodies (Article 333.12 of the Tax Code of the Russian Federation).

Water intake from the surface of objects and groundwater within the limits:

Withdrawal from the territorial sea and internal sea waters within the limits:

Using the surface water area of objects:

Use of the waters of the territorial sea of the Russian Federation:

Use for hydropower purposes without water intake:

Current example of calculating water tax in 2022 for enterprises:

PPT LLC takes water from an artesian well for its own needs - for the purpose of non-commercial use (purpose code - 3). The company operates in the Northern Economic Region and uses the water basin of the Neva River. The tax rate for users of surface water is 264 per 1000 cubic meters (clause 1, part 1, article 333.12 of the Tax Code of the Russian Federation).

The license limit for using a well is 25,000 cubic meters. PPT LLC for the 3rd quarter of 2022 exceeded the limit and took 27,000 cubic meters from the well. The excess was 2000 cubic meters. According to the standards of the Tax Code of the Russian Federation, the rate for exceeded limits is multiplied by 5, i.e. 264 × 5 = 1320. In 2022, the coefficient is 2.66.

- Within the limit: 25 × 264 × 2.66 = 17,556 rubles.

- Excess: 2 × 1320 × 2.66 = 7022.40 rubles.

The contribution for the 3rd quarter will be: 17,556.00 + 7,022.40 = 24,578.40 rubles. The tax for declaration and transfer is rounded to the nearest whole: if it is less than 50 kopecks, it is discarded, if it is 50 kopecks or more, it is increased to the ruble. PPT LLC transfers 24,578 rubles to the budget.

How to fill out the declaration correctly

The following procedure for filling out a water tax return in 2022 applies to all taxpayers:

- Fill out in strict order - do not go beyond the edges of the cells, fill out with dark ink, a ballpoint or fountain pen (for paper forms).

- Do not correct errors with a proofreader.

- Do not staple, staple, or use any other method that would damage the integrity of the paper.

- Do not print the form on both sides.

- Number the pages in order, starting from 001.

- Assign the number “0- -” to the primary declaration. Adjustments are assigned numbers in order - “1- -”, “2- -”.

- Provide actual data for the reporting period. Information is submitted separately for each quarter.

Now let's look at the instructions for filling out the water tax return for each section:

| Section number | Section title | Filling procedure |

| — | Title page | All information about the accountable person - an organization or an individual entrepreneur - must be indicated. The TIN and KPP, the name or full name of the taxpayer, the main type of economic activity (OKVED code), contacts and the responsible person are entered. The details of the report are written down: period and year, controlling inspection, correction number and coding at the place of registration |

| — | Information about an individual who is not an individual entrepreneur | To be completed for accountable individuals operating for non-commercial purposes |

| 1 | Amount of tax to be paid to the budget | In this block, the tax is identified: all contributions, KBK and OKTMO are registered for payment to the budget |

| 2 | Calculation of tax base and amount | This is where the tax amount is calculated. The block is differentiated into two subsections according to the type of water resource use |

| 2.1 | Calculation of the tax base and amount when withdrawing water from a water body | A contribution is calculated in case of withdrawal of water resources. The object data is indicated: name of the well and license number, water use code (checked in the order of filling out the form, Appendix No. 4), amount of withdrawn water in thousands of cubic meters, license limit and excess limit. A calculation is made - the limit and excess volume are multiplied by the corresponding rates and by a multiplying factor. In the last cell, enter the calculated amount of tax to be paid. Section 2.1 is completed separately for each object and for each bet |

| 2.2 | Calculation of the tax base and amount when using a water body, with the exception of water intake | The data is generated similarly to section 2.1. This block takes into account all other methods of using water resources, except for abstraction |

Here's how to file a water return for a taxpayer:

Filling procedure

Title page

On the title page the taxpayer indicates:

- TIN . 10 digits for legal entities, 12 for individuals and individual entrepreneurs.

- Checkpoint . Code assigned by the tax authority where the declaration is submitted.

- Correction number . If the declaration for the specified quarter is submitted for the first time, “0—” is entered. When submitting an updated declaration, the correction number is entered: “1—”, “2—” and so on.

- Tax period (code). Filled out in accordance with Appendix No. 1 to the Procedure. The taxpayer must select one of the codes:

- 21 - first quarter;

- 22 - second quarter;

- 23 - third quarter;

- 24 - fourth quarter;

- for reorganized or liquidated organizations: 51 - first quarter;

- 54 - second quarter;

- 55 - third quarter;

- 56 - fourth quarter.

- Reporting year. The year to which the reporting quarter relates is indicated.

- Tax authority code. It is necessary to indicate the code of the authority to which the declaration is submitted. For example, code 7722 is deciphered as follows: 77 is the region, that is, the city of Moscow, 22 is the number of the tax authority. That is, code 7722 corresponds to Federal Tax Service Inspectorate No. 22 for the city of Moscow.

- By location (registration) (code). The code from Appendix No. 1 to the Procedure is indicated:

- 213 - at the place of registration of the largest taxpayer;

- 255 - at the location of the water body;

- 250 - at the place of registration of taxpayers when executing production sharing agreements.

- Taxpayer. The full name of the organization, including its legal form, or the last name, first name and patronymic of an individual entrepreneur shall be indicated.

- Code of the type of economic activity. The code is indicated in accordance with OKVED.

- Block for reorganized companies. It indicates the TIN/KPP of the organization, the code of the reorganization form from Appendix No. 1 to the Procedure.

- contact telephone number . Indicated together with the code without spaces or other symbols between the numbers.

Upper part of the title page

At the bottom of the title page, the taxpayer must confirm the accuracy and completeness of the data specified in the report. The part is filled in as follows:

- Code 1 is indicated if the taxpayer signs the declaration, code 2 if the report is signed by his representative.

- In the following lines, the last name, first name and patronymic of the head of the taxpayer organization are indicated line by line. If the declaration is submitted by an individual entrepreneur, there is no need to duplicate his full name.

- If the declaration is signed by a representative of the taxpayer , then his last name, first name and patronymic are indicated. If such a representative is an organization, then the full name of its head is indicated, and the name of the representative organization is indicated in the following lines.

- If the declaration is signed by a representative, an individual or a legal entity, the last two lines indicate information about the document confirming his authority .

Bottom of title page

Information about an individual who is not an individual entrepreneur

This section is filled out only by individuals who are not entrepreneurs recognized as water tax payers in accordance with Article 333.8 of the Tax Code of the Russian Federation.

Such persons indicate their full name, date of birth, code of country of citizenship, information about the identity document (type of document, its series and number, information about issue), taxpayer status, address of residence in the Russian Federation.

Filling out this part of the declaration is not difficult. Let's mention just a few details:

- The code of the country of citizenship is indicated in accordance with the all-Russian classifier of countries of the world. For Russia this is code 643.

- The document type code is taken from Appendix No. 2 to the Procedure. The passport of a citizen of the Russian Federation corresponds to code 21.

- Taxpayer status . Residents indicate code 1, non-residents - 2.

- The region code must be taken from Appendix No. 3 to the Procedure.

This sheet is filled out by individuals (not individual entrepreneurs)

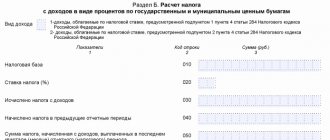

Section 2

Section 2 calculates the water tax base and its amount. This section should be completed before Section 1, since the latter contains the results of the calculations that are carried out in Section 2.

Subsection 2.1

Subsection 2.1 serves to calculate the base and amount of tax for those taxpayers who withdraw water from a water body. Line by line this section is filled out like this:

- Line 010. The budget classification code is indicated, according to which the tax will be credited to the budget.

- Line 020. OKTMO code at the location of the water use facility.

- Line 030. Name of the water body. If this object belongs to groundwater, the number of the artesian well is indicated.

- Line 040. Information about the taxpayer’s licenses is reflected. You must indicate the series, number and type of license, separating them with the sign “;”.

- Line 060. The water use code from the range 11011–13140 is indicated, which must be taken from Appendix No. 4 to the Procedure. The exception is the water bodies of Crimea and Sevastopol - codes 50091 and 50092 are intended for them.

- Line 060. The total volume of water in thousand cubic meters that was taken from this facility for the tax period for a specific water use code. The indicator is calculated as follows: Line 70 + Line 100.

- Line 070. Reflects the actual volume of water taken for purposes not recognized as an object of taxation under paragraph 2 of Article 3.9 of the Tax Code of the Russian Federation.

- Line 080. Water intake purpose code. Taken from Appendix No. 5 to the Order.

- Line 090. The limit value of the water use indicator in thousand cubic meters, which is indicated in the license for a given facility and the purpose of water use.

- Line 100. The total volume of water that was taken from this facility during the quarter for a specific water use code and purpose of withdrawal, subject to tax. The indicator for this line is calculated as follows: Line 101 + Line 102.

- Line 101. The volume of water withdrawn from sources within the established limit.

- Line 102. The volume of water taken from the source in excess of the limit.

- Line 110. The rate established for calculating the tax for the volume of water withdrawn within the limit (subclause 1 of clause 1 of Article 333.12 of the Tax Code of the Russian Federation).

- Line 120. The rate established for calculating tax above the limit (clause 2 of Article 333.12 of the Tax Code of the Russian Federation).

Note! If the declaration is filled out by an individual who is not an individual entrepreneur, lines 110 and 120 indicate the rates from paragraph 3 of Article 333.12 of the Tax Code of the Russian Federation.

- Line 130. Coefficient from clause 1.1 of Article 333.12 of the Tax Code of the Russian Federation. In 2022 it is 1.75.

- Line 140. Coefficient 1.1 (clause 4 of Article 333.12 of the Tax Code of the Russian Federation). The coefficient is applied if the water source does not have a means of measuring the volume of water taken.

- Line 150. Coefficient 10 (clause 5 of Article 333.12 of the Tax Code of the Russian Federation). Indicated if groundwater is extracted for the purpose of selling it after processing and packaging. Please note! If the coefficients mentioned in lines 130–150 are not applied by the taxpayer, dashes are placed instead.

- Line 160. Indicate the amount of tax payable to the budget, calculated using the formula: Line 101 × Line 110 × Line 130 × Line 140 × Line 150 + Line 102 × Line 110 × Line 130 × Line 140 × Line 150 .

Section 2.1 form

Subsection 2.2

Subsection 2.2 calculates the tax base and amount if the user does not withdraw water. This part of the declaration is filled out by taxpayers who:

- use the water areas of water bodies;

- use water bodies without water intake for hydropower;

- use objects for wood rafting.

Subsection 2.2 should be completed separately for each type of use, water body and license. If different tax rates are applied, then the section for each rate is also filled out separately.

Next, let's look at filling out this section line by line:

- Line 010. Reflects the BCC, according to which the tax should be credited to the budget.

- Line 020. OKTMO code at the location of the water use facility.

- Line 030. Name of the object - lake, river, etc.

- Line 040. Information about licenses. Through the sign ";" the series, number and type of license are indicated.

- Line 050. Information about the agreement for the use of the water body is reflected.

- Line 060. Water use code from Appendix No. 4 to the Procedure.

- Line 070. Filled in if Line 060 contains a code in the range 21010–22140. The tax base is reflected, defined as the area of water in square kilometers. The area is taken from the license, and if it is missing, from the technical and design documentation.

- Line 080. Filled in if Line 060 contains a code in the range 30100–32100. The amount of electricity produced is indicated in thousand kilowatt-hours.

- Line 090. Filled in when reflected on Line 060 of the code in the range 40100–41200. The volume of wood rafted during the tax period is reflected in thousand cubic meters.

- Line 100. Filled in when reflected on Line 060 of the code in the range 40100–41200. The distance of timber rafting is reflected in kilometers.

- Line 110. The tax rate from paragraph 1 of Article 333.12 of the Tax Code of the Russian Federation is indicated.

- Line 120. The coefficient established in paragraph 1.1 of Article 333.12 of the Tax Code of the Russian Federation. In 2022, the coefficient is 1.75.

- Line 130. The amount of tax on a water body or license subject to payment to the budget. It is calculated as follows: If line 060 contains a code in the range 21010–22140 - Line 070 × Line 110 × Line 120 / 4.

- If line 060 contains a code in the range 30100–32100 - Line 080 × Line 110 × Line 120.

- If line 060 contains a code in the range 40100–41200 - Line 090 × Line 100 × Line 110 × Line 120 / 100.

Examples of filling lines 60–100:

- The taxpayer uses the water area of the water body . In line 060 it should reflect the water use code in the range 21010–22140. In lines 080–100 of section 2.2, this taxpayer will put a dash.

- The taxpayer uses water bodies for hydroelectric power . According to Line 060, it should reflect the water use code in the range 30100–32100. In lines 070, 090 and 100 of section 2.2, he must put a dash.

- The taxpayer uses water bodies for timber rafting . In line 060 it reflects the code in the range 40100–41200, in lines 070 and 080 dashes are placed.

Section 2.2 form

Section 1

This section reflects the amount of tax that must be paid to the budget. The section is filled in according to the location of the taxable object.

Line 010 indicates the budget classification code by which the tax is credited to the budget. Next in the section there are blocks from lines 020–030, which indicate:

- In line 020 - the code of the municipality where the water intake item for which the tax is paid is located.

- In line 030 - the amount of tax for all types of water use according to the specified OKTMO. To determine it, you need to add up the tax amounts reflected for all types of water use in subsections of the declaration 2.1 and 2.2 with the corresponding OKTMO and KBK codes.

The correctness of filling out the declaration can be checked using the control ratios from the letter of the Federal Tax Service dated September 7, 2016 No. SD-4-3/16671.

Section 1 form

How and where to submit

Reporting is controlled by the Federal Tax Service. The inspectorate where to submit the water tax declaration is determined by the place of registration of the reporting person (code on the title page of the declaration - 214) or by the place of registration of the largest taxpayers (code 215). If the objects used are located within the same region, but are specifically assigned to different districts, then a consolidated report is submitted to any Federal Tax Service Inspectorate by agreement with all authorities. But you will have to pay the tax to several inspectorates - separately for each OKTMO. In the declaration, such payments are divided according to the location of the objects.

The form of delivery depends on the number of personnel. If the number of employees is less than 100 people, then payers choose the delivery format independently: paper or electronic. For enterprises with a large number of employees (over 100 people), there is only one option for filing a declaration - only in electronic form through telecommunication channels.

In what form and where to report?

KND form 1151072 has not been updated. The form of the declaration and the procedure for filling it out are set out in the Order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated 09.11.2015.

The delivery format is determined by the number of employees of the organization or individual entrepreneur. If, judging by the tax report on the average headcount for last year, the organization employs 100 people, submit the declaration electronically (clause 3 of Article 80 of the Tax Code of the Russian Federation). If the institution employs less than 100 people, it is possible to choose the delivery method - on paper or electronically.

In Art. 333.15 of the Tax Code of the Russian Federation indicates where water tax declarations are submitted: to the territorial tax inspectorate at the location of the water use facility. The largest taxpayers report to the Federal Tax Service at the place of registration as the largest.