Many have abandoned the use of PBU 18/02, but this does not eliminate the need to take into account the emerging differences between accounting and tax accounting. In order for our readers to apply PBU 18/02 without fear, we will analyze the key concepts, frequently occurring errors and show how to find them using the 1C: Accounting 8 program.

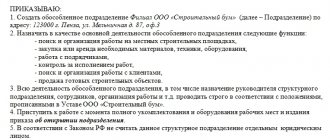

No time to read? Cheat sheet on the contents of the article:

- How to enable the use of PBU 18\02 in 1C

- What are “permanent differences” (DP) in income tax

- What are “temporary differences” (TD) in income tax

- Conditional income or expenses for income tax (IT)

- Accounting for differences in valuation of assets and liabilities

- Sales proceeds for tax accounting purposes

About PBU 18/02

The main purpose of Accounting Regulations 18/02 is to take into account the discrepancy between accounting profit (loss) and profit calculated in accordance with the requirements of Chapter. 25 of the Tax Code of the Russian Federation (approved by Order of the Ministry of Finance dated November 19, 2002 No. 114n).

PBU 18/02 was introduced in 2003. There are organizations that have the right to apply this provision at will: small businesses, non-profit organizations, organizations that have received the status of participants in the Skolkovo project. In this regard, many have abandoned the use of PBU 18/02, but this does not eliminate the need to take into account the emerging differences between accounting (AC) and tax accounting (TA). It is necessary to understand whether these differences arose as a result of objective circumstances or as a result of error.

Therefore, we recommend that you still not be afraid and apply PBU 18/02.

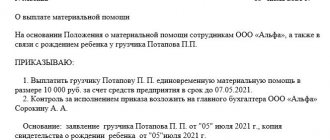

To enable the use of PBU 18/02 in the accounting program, you need to set the appropriate flag in the “Accounting Policy” register. It is recommended to perform this setting from the beginning of the tax period (Fig. 1).

Rice. 1

Key concepts:

PR - permanent differences BP - temporary differences PNA - permanent tax assets PNO - permanent tax liabilities ONA - deferred tax assets IT - deferred tax liabilities Current NP - current income tax Conditional expense for NP Conditional income for NP

Accounting for income tax calculations

The procedure for accounting for income tax calculations, as well as identifying the difference between the accounting profit tax recognized in accounting and the tax reflected in the income tax return, is established by the Accounting Regulations (PBU) 18/02, approved.

by order of the Ministry of Finance of the Russian Federation dated November 19, 2001 No. 114n. The Ministry of Finance has made a number of amendments to PBU 18/02, which must be applied starting with the reporting campaign for 2022. Find out exactly what amendments were made to the regulations and how to apply them in practice in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

PBU 18/02 introduced indicators into accounting practice, each of which increases or decreases taxable profit. Next we will look at these indicators.

Constant differences

Permanent differences (PD) are income (expenses) that affect the formation of accounting profit (loss), but are not taken into account when determining the tax base for income tax (PT) for both the reporting and subsequent reporting periods. This includes all kinds of voluntary contributions to various funds, donations, and gifts.

These are also income (expenses) that are taken into account when determining the tax base for IR of the reporting period, but are not recognized for accounting purposes as income (expenses) of both the reporting and subsequent reporting periods.

Example.

As part of transfer pricing, the taxpayer adds some income or expenses to market prices. His counterparty is an interdependent party, and everything remains in accounting without any adjustments based on primary documents.

In addition, PR are expenses that are taken into account when forming the financial result in accounting in full, and for NU purposes the following are normalized: advertising expenses, entertainment expenses, expenses for voluntary medical insurance.

In the reporting period when permanent differences arise, permanent tax assets (PNA) and permanent tax liabilities (PNO) are formed.

PNO and PNA are calculated as the product of permanent differences and the income tax rate in effect at the reporting date.

PNO is the amount of tax that leads to an increase in income tax payments in the reporting period. Posting that allows you to accrue PNO: D 99.02.3 K 68.04.2.

Reverse posting accrues PNA: D 68.04.2 K 99.02.3. This is the tax amount that reduces the income tax.

How is the current income tax formed?

Current income tax is the income tax payable to the budget in the reporting period. It is calculated based on the amount of conditional income (expense), adjusted for the amounts of deferred tax assets and liabilities, permanent tax assets and liabilities of the reporting period.

Using the indicators discussed in this article, introduced by PBU 18/02, we will draw up a rule for calculating the current income tax (current tax loss):

Tnnp (Tu) = UD (UR) + NONA – PONA – NONO + PONR + PNR – PND

Where:

Тнп (Ту) – current income tax (current tax loss).

UD (UR) – conditional income (expense) for income tax.

NONA – accrued NONA, which represent deferred tax assets that arose in a given tax period.

PONA – repaid ONA, which represent deferred tax assets generated when calculating income tax in previous tax periods, for which in a given tax period there is no longer a difference between accounting and tax accounting. For example, accounting and tax depreciation for some accounting object are equal.

NONO is the accrued deferred tax liability that arose in a given tax period.

PONR are repaid deferred tax expenses generated when calculating income tax in previous tax periods, for which in a given tax period there is no longer a difference between accounting and tax accounting. For example, customs duties were included in direct expenses for tax accounting purposes, and in accounting they were written off in proportion to the goods sold, and finally, in accounting they were completely written off, since all the goods were sold.

PPR is a constant tax expense, which leads to an increase in income tax in the reporting period.

IPA is a constant tax income, which leads to a reduction in income tax in the reporting period.

SHE and IT in the above formula for calculating the current income tax are deferred income taxes, formed on the basis of deductible and taxable temporary differences.

In the absence of permanent differences, deductible and taxable temporary differences that give rise to deferred tax liabilities and assets, the contingent income tax expense will be equal to the current income tax.

Temporary differences

Temporary differences (TD) are income and expenses that form accounting profit (loss) in one reporting period, and the tax base for TP in another or other reporting periods.

In the reporting period, when BP arises between accounting and accounting data, deferred tax assets (DTA) and deferred tax liabilities (DTL) are formed.

Temporary differences are divided into deductible (TVR) and taxable (TVR).

Deductible temporary differences are formed if any expenses in accounting reduce accounting profit in the reporting period, and will be accepted in accounting only in the following reporting (tax) periods.

Example.

Small enterprises have the right to depreciate a fixed asset (fixed asset) at a time, which relates to business inventory, and in NU, if such a fixed asset meets the conditions of depreciable property, it will be depreciated over its useful life. Thus, the VVR will be formed.

And in the reporting period when IRR arises, a deferred tax asset is formed, which is also calculated as the product of this difference by the current income tax rate.

ONA is accrued on the debit of account 09, and is repaid on the credit of account 09 in correspondence with account 68.04.2.

Taxable IR are formed if in the reporting period the tax base for IR is reduced, and accounting profit will be reduced by this amount in the following reporting (tax) periods.

Example.

If an asset is purchased, the cost of which is 60,000 rubles, then in the accounting book it will not be depreciated, and its cost will be immediately taken into account in the expenses of the current period, and in the accounting book the cost will be repaid through depreciation during its useful life.

In the reporting period when the non-current tax arises, deferred tax liabilities are recognized.

The change in the value of IT is calculated as the product of NVR and the income tax rate in effect at the reporting date. IT is accrued on the debit of account 77, and is repaid by a reverse entry to the credit of account 77 in correspondence with account 68.04.2.

Income tax and its calculation in 1C: Accounting 3.0

- What is income tax and according to what data is it collected in 1C.

This article is not about the intricacies of the code, but is more devoted to the 1C accounting program, so we will not give definitions from the tax code, but will limit ourselves to simple concepts that are sufficient to understand the organization of income tax accounting in 1C programs.

So, income tax is a direct tax levied on the profits of an organization (enterprise, bank, insurance company, etc.). Profit for the purposes of this tax is usually defined as income from the company's activities minus the amount of established deductions and discounts.

Let's look at the question being asked. The organization has not yet begun full operations and has only purchased goods. We make a declaration of profit, but there are no losses on direct expenses. How so!, the organization purchased, spent money, but no! the cost price will be formed ONLY WHEN THE GOODS are sold . You can look at the regulatory framework, but 1C works exactly like that and not any other way. If you don’t like it, go to the simplified tax system.

Profit in fact is accounts 90 and 91 of the balance sheet, but not according to accounting, but according to NU.

It is important not to be confused here - tax accounting is not accounting for all taxes, but just accounting for Income Tax. For other taxes, accounting is not carried out according to NU - for example, VAT - these are the accumulation registers “VAT of purchase” and “VAT of sale.” Property tax is generally the only tax known to me that is paid based on accounting data. But our topic today is profit.

You may say, why then Tax accounting for all other accounts, and you will be partially right, tax accounting for all accounts except 90 and 91 is not particularly needed, in any case, it will not affect the income tax return. It’s just that in order for Tax accounting to be reflected correctly in expense accounts, it must go through the process of becoming a material or other cost item and ultimately be written off to 90 or 91 accounts.

In the accounting policy there is a checkbox, PBU 18/02 “Accounting for calculations of corporate income tax” is applied, what does this checkbox actually mean for an accountant.

Installing or unchecking this box is, of course, carried out in accordance with the accounting policy, and what should we choose to make our lives easier?

First, checking or unchecking this box does not affect income tax in any way - this is generally clear for accountants, PBU is the same as the Accounting Regulations and should not affect taxes, because tax accounting is interpreted by the Tax Code.

In the help for this checkbox we will see the following explanation: “Keeping records of permanent and temporary differences in the valuation of assets and liabilities in order to comply with the requirements of PBU 18/02.”

It is impossible to give an unambiguous answer here, but you need to understand that if you do not check the box, then the accounting data for account 68.04 and the NU data on which the declaration will be generated, if, for example, you have at least one non-acceptable expense, they will diverge forever, and you will not be able to pay tax simply by generating a turnover - you will always have to look back at the declaration data and recalculate the balance of payments.

If you do not use PBU 18\02, and you always have the right to use it, then you can see the balance of the tax for its payment in the balance sheet according to 68.04. But then, when closing the month, you will have movements in account 77 “Deferred tax assets” and account 09 “Deferred tax liabilities”. As well as movements in account 99 for permanent tax assets and liabilities, but the income tax according to accounting data will be caught up with these operations to the NU data for turnover. By the way, for understanding, when we talk about movements on account 09, we exclude movements on the “Losses of the current period” subconto. I don’t even know why this was done, but apparently the accounting rules somehow interpret it. But turnover in subconto 09 “Losses of the current period” is not a “deferred tax asset” in the usual sense. In any case, this turnover is excluded from the report “Analysis of the state of tax accounting for income tax”. If, for example, you receive a loss in the 1st quarter of the current year, then on the 09th subconto “Losses of the current period” there will be a movement in the amount of the financial result multiplied by the income tax rate. And in the period when you make a profit, this type of asset will automatically close.

What problems await us if we still want to calculate permanent and temporary differences and how to check the correctness of accounting when.

Let's start with the principles of checking the correctness of profit accounting

When checking the correctness of income tax calculations, I recommend using the report “Analysis of the state of tax accounting for income tax.”

In this report, the “Income” and “Expenses” blocks are formed according to the accounting register and can be further deciphered, but the “Adjustment (PNO, PNA, ONO, ONA)” block is not decrypted. I have developed special reports that will help you decipher the differences that arise. Reports are available here

Here I would recommend two reports: Decoding IT and Decoding PR for self-supporting.

The report “Analysis of the state of tax accounting for income tax” without applying PBU 18/02 will not show anything at all. And the regulatory operation “Calculation of income tax” will make one entry, calculating the Conditional income or expense, as well as the “Loss of the current period” if you have a loss and not a profit:

Let's look at the most common errors that occur in the program and which 1c does not signal in any way.

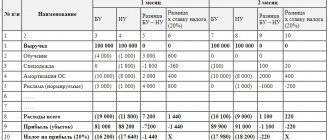

Let's look at an example. Let's see, the month of November is completely closed, all operations have been completed, Let's generate a report - Analysis of the status of income tax - everything is correct BU = NU + BP + PR.

This formula is ultimately converted into Analysis 68.04 = NU*0.2 + She - It + PNA - PNA.

I will create an Accounting Certificate,

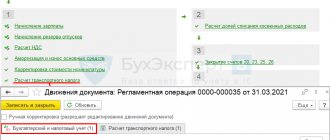

We cancel the last two operations in closing the month and close them again:

We see the result - we get a discrepancy in the report “Analysis of the income tax situation”:

What is our mistake? Let’s create a balance sheet for 91 accounts. And we will see that the sub-account “Other income and expenses” is not filled in.

At the same time, the 1C program does not signal this error there.

If you have discrepancies in this report, then first of all check the completeness of the “Other Income and Expenses” sub-account for 91 accounts - there should not be empty sub-accounts.

We will also try to reproduce the error with the calculation of IT, SHE.

For example, if you make a transaction on 91 accounts in the amount of PR,

You won't have any problems:

And if you perform the same operation using VR, you will most likely receive an error:

Temporary differences cannot arise just like that, but must arise on the accounts specified in the configurator. This is how this 1C works: Accounting 3.0)))

Here is a list of accounts for which temporary differences may occur, from the configurator. In the general module “Tax Accounting” there is a Function “Get Table of Types of Assets and Liabilities() Export”:

If you have questions about income taxes and you can’t figure it out, write to me in a personal message, maybe I can help you.

| Type of asset and liability | Accounting 1C | Accounts | Conducted in analytics |

| Fixed assets | Fixed Assets, Depreciation OS_01 | 01 02 | BasicMeans |

| Profitable Investments in_MC | Depreciation OS_03, Profitable Investments in_MC | BasicMeans | |

| Intangible assets | IntangibleAssets, Amortization of IntangibleAssets | Intangible assets | |

| Equipment | Equipment for installation | Warehouses, Nomenclature | |

| Non-current assets 08.01 | Acquisition of Land | ObjectsConstruction | |

| Non-current assets 08.02 | Acquisition of Natural Resources Management Facilities | ObjectsConstruction | |

| Non-current assets 08.03 | ConstructionObjectsFixed Assets | ObjectsConstruction | |

| Non-current assets 08.04 | Acquisition of Objects, Fixed Assets | Warehouses, Nomenclature | |

| Non-current assets 08.05 | Acquisition of Intangible Assets | Intangible assets | |

| Non-current assets 08.08 | Carrying out R&D | R&D Expenses | |

| Non-current assets 08.11 and 08.12 | IntangibleSearchAssets, TangibleSearchAssets | ||

| Materials | Materials news, with the exception of (10.MC, 10.11, 10.07) | Warehouses, Nomenclature | |

| Recycled materials | Materials Transferred for Recycling | Nomenclature, Contractors | |

| Materials in use | Working clothes for operation, special equipment for operation | Nomenclature, Lots of Materials in Operation | |

| Unfinished production | Main Production, Auxiliary Production, Defects in Production | 20.01 23 28 | NomenclatureGroups |

| IndirectProductionCosts | General production expenses, general business expenses | Expenditures | |

| Unfinished production | Production From Provided Raw Materials | 20.Feb | Nomenclature |

| Finished products | Finished products | Warehouses, Nomenclature | |

| Semi-finished products | Semi-finished products | Warehouses, Nomenclature | |

| Future expenses | Future expenses, | Future expenses | |

| Goods | Goods | Warehouses, Nomenclature | |

| Goods shipped | Goods shipped | Nomenclature | |

| Fixed assets shipped | TransferredObjectsReal Estate | Counterparties, Basic Assets | |

| Distribution costs | Selling Expenses | Expenditures | |

| Financial investments (accounts 58.01.1) | Shares | Counterparties | |

| Financial investments (accounts 58.01.2 and N58.02) | Shares, Debt Securities | Counterparties, Securities | |

| Financial investments (accounts 58.03, 58.04, 58.05) | Granted Loans, Deposits under the Simple Partnership Agreement, Acquired Rights | Contractors, Agreements | |

| revenue of the future periods | Revenue of the future periods | ||

| Accounts receivable | Settlements with Buyers, Settlements for Advances Received, Settlements with Retail Buyers, Settlements with Other Buyers and Customers | Contractors, Agreements | |

| Accounts receivable | Payments for Voluntary Insurance of Employees, Payments for Other Types of Insurance | Counterparties, Expenses of Future Periods | |

| Accounts payable | Settlements With Suppliers, Settlements For Advances Issued, Bills Issued, Settlements For Property AND Personal Insurance, Settlements For Claims, Settlements For Due Dividends, Settlements For Deposited Amounts, Settlements With Other Suppliers And Contractors, Other Settlements With Various Debtors And Creditors, Settlements For Executive Documents Workers | Contractors, Agreements | |

| Exchange differences when paying in rubles (passive accounts) | Calculations with UE suppliers, Calculations for Advances received by UE, | 60.31 62.32 | Contractors, Agreements |

| Exchange differences when paying in rubles (active accounts) | Settlements for Advances issued by UE, Settlements with Buyers UE, Settlements for Claims UE, Settlements with Other Suppliers and Contractors UE, Settlements with Other Buyers and Customers UE, Other Settlements with Various Debtors and Creditors of UE, | 60.32 62.31 76.32 76.35 76.36 76.39 | Contractors, Agreements |

| Exchange differences when paying in foreign currency (passive accounts) | Calculations With Suppliers Shaft, Calculations For Advances Received Shaft | Contractors, Agreements | |

| Exchange differences when paying in foreign currency (active accounts) | Calculations for Advances Issued by Val, Calculations with Buyers Val, Calculations for Property or Personal Insurance Val, Calculations for Claims Val, Calculations with Other Suppliers and Contractors Val, Calculations with Other Buyers and Customers Val, | Contractors, Agreements | |

| Current period losses | |||

| Shortages and losses from damage to valuables | Shortages and Losses from Damage to Valuables | ||

| Estimated liabilities | ReservesForthcomingExpenditures | ||

| Provisions for doubtful debts | Provisions for Doubtful Debts, |

Contingent income and expenses

Conditional expense (conditional income) for income tax (IT) is an amount calculated as the product of the financial result according to accounting data and the income tax rate. In fact, this is an income tax calculated based on accounting data.

D 99.02.1 K 68.04.2 – a conditional income tax expense has been accrued.

D 68.04.2 K 99.02.1 – conditional income for income tax was accrued.

Current income tax (CIT) is the amount of conditional income (expense) for income tax, adjusted to the amounts of PNO, PNA, ONO, ONA:

Npr = +/–UN + PNO – PNA +/– SHE +/– IT

According to clause 22 of PBU 18/02, an organization has the right to determine the amount of current income tax in one of two ways: either on the basis of data generated in the accounting system, in accordance with clause 20 and clause 21 of PBU 18/02, or on the basis of tax income tax returns.

But in any case, regardless of whether PBU 18/02 is applied, the rule must be observed:

The amount of current income tax must be equal to the amount of income tax calculated according to tax accounting data.

The same amount of current income tax is reflected directly in the income statement and in the tax return.

Example.

The Phoenix LLC organization applies the basic taxation system, pays quarterly advance payments for income tax, and applies PBU 18/02. Income in the first half of 2016 is 2,500,000 rubles, and expenses are 1,000,000 rubles. for normal activities. In addition, in the second quarter of 2016, Phoenix LLC received due dividends from a foreign company in the amount of RUB 2,000,000. Income tax on dividends is calculated at a rate of 13%.

In the program we will generate an income tax return. We will see that the amounts of income tax calculated at rates different from the 20% rate are reflected in sheet 04. At the same time, on page 010 Tax base - 2,000,000 rubles, tax rate 13%, on page 040 the amount is reflected income tax RUB 260,000.

Income and expenses from ordinary activities are indicated on sheet 02. Since dividend income is reflected in non-operating income, we exclude these dividends from profit on line 070 to avoid double taxation. Thus, the tax base cleared from dividends is multiplied by a rate of 20%, and a tax is calculated in the amount of 300,000 rubles.

In the accounting system, the program will show the calculated tax in the amount of 700,000 rubles.

While, based on the income tax return on page 040 of sheet 04, we have 260,000 rubles, and on page 180 of sheet 02 – 300,000 rubles.

It turns out that there is a discrepancy between the BU and NU data, which should not exist. Where is the mistake?

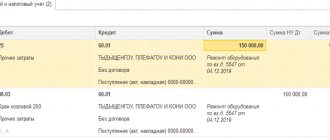

The fact is that the 1C program does not yet know how to calculate income tax at different rates, and in accounting the program calculates tax on dividends at a rate of 20%. Therefore, it is necessary to make corrective entries in order to align the control unit and control unit.

We recommend adjusting the calculation of UN, PNO, PNA, ONO, ONA in the accounting system if you have income that is taxed at a rate different from the rates specified in clause 1 of Art. 284 Tax Code of the Russian Federation.

Why is it conditional?

Conditional income tax expense (income) is the product of profit according to accounting data and the tax rate, the amount of tax calculated based on accounting profit. The calculation formula is as follows: Ur (Ud) = Pr (Ub) * StN. Here Ur and Ud are, respectively, conditional income and expense, Pr (Ub) is profit or loss, StN is the tax rate.

The calculation of the conditional expense is made from the profit. We are talking about conditional income if a loss is received. Profit tax expense (income), calculated according to accounting data, can be adjusted for permanent and temporary accounting differences between accounting and tax data. Obviously, it is inconclusive and conditional. If such differences do not arise, the indicators of conditional income (expense) and current income tax are equal.

The meaning of this indicator is to indicate the difference between accounting and tax profit in accounting.

Accounting for differences in valuation of assets and liabilities

In order to reflect PNO, PNA, ONO, ONA in accounting and reporting, and to calculate the current income tax in accordance with the norms of PBU 18/02, it is necessary to determine the value of PR and VR. We know that IR and IR can arise when recognizing income and expenses, but this is not always the case.

The reason for the formation of differences does not always arise directly when recognizing income and expenses (for example, if a difference arises in the assessment of the initial cost of fixed assets or intangible assets - “potential” PR and BP, since depreciation may already be accrued in the next reporting period)

Therefore, in “1C: Accounting 8” accounting is organized:

- PR and VR as interpreted by PBU 18/02

- “potential” PR and BP, which someday will lead to the calculation of PNO, PNA, ONO, SHE.

All differences between accounting and NU in 1C: Accounting 8 are called differences in the valuation of assets and liabilities.

You will not find what types of assets and liabilities are in PBU 18/02, but in terms of the program, each type of asset or liability corresponds to one or more accounts in the entries for which BP is reflected in the assessment of assets and liabilities. Moreover, there are types of assets and liabilities for which the total assessment is determined by several accounts, for example, fixed assets, intangible assets.

How are differences in the valuation of assets and liabilities recorded?

We know that we have an accounting ledger (“entry”). If we do not use NU, then in this register we only use Dt, Kt and amount. If we use NU, then the amount NU Dt, the amount NU Kt are added. And if we use PBU 18/02, then we add 4 resources: the sum of PR and VR for Dt and Kt, where we display the differences in the valuation of assets and liabilities.

Moreover, the double entry rule cannot always be followed for NU, since NU is not supported on all accounts. And total indicators can be determined either automatically when posting documents, or can be indicated in transactions entered manually.

Relationship between tax and accounting

The organization's tax payable to the budget (current income tax) PBU 18/02 proposes to determine either according to the tax return data or according to accounting data. As a rule, the accounting policy selects the option “according to accounting data”. It allows you to use a standard accounting chart of accounts to correctly account for the indicator and connects it with a conditional expense (income) for profit. The differences between BU and NU data involved in the calculations can be permanent or temporary:

- temporary – data is reflected according to accounting and accounting records in different periods;

- permanent - data is recognized either in accounting or in NU.

Temporary differences then appear in the form of deferred tax assets and liabilities (ONA and ONO). They are formed by subtracting at the end of the year the value of assets on the balance sheet and the value of assets for NU purposes; the value of liabilities on the balance sheet and the value of liabilities for NU purposes. If the balance sheet value of the assets is greater, a taxable difference arises. If, on the contrary, the value of the assets on the balance sheet is less, the difference will be deducted. Liabilities: their value on the balance sheet is greater - the difference is deductible; the balance sheet value is less – the taxable difference.

All differences at the end of the period are added up and reduced to one value. A similar algorithm is applied to differences at the beginning of the year. Next, the values of the beginning and end of the period are compared with each other. Deductible differences are added up (with a + sign), taxable differences are added up (with a - sign). The deductible difference at the beginning of the year will be offset by the taxable difference at the end of the year, resulting in the taxable amount. Conversely, the taxable difference at the beginning of the year is offset by the deductible difference at the end of the year.

SHE = deductible difference* StN. IT = taxable difference*StN.

Permanent differences manifest themselves in the form of permanent tax revenues and expenses (PND and PNR). They are calculated as follows:

- the current income tax and deferred income tax are summed up (the current income tax is taken with a minus sign);

- from the result you need to subtract the conditional expense or income tax income (expense is taken with a minus, income with a plus).

Let us recall that deferred income tax is the amount of tax obtained by multiplying the temporary difference by the tax rate. Depending on the result (+ or -), we have either PNR (with a - sign) or PND (with a + sign).

Thus, the relationship between the conditional income tax expense (income) and the profit tax according to NU data can be expressed by the scheme Nb * StN = UR (UD) + PNR – PND + ONA – ONO, where Nb is the income tax base according to WELL.

According to PBU 18/02, conditional expense (income) is reflected in accounting separately from the amount of taxable profit or loss. It is not reflected in the financial statements. To account for conditional income and expenses, a separate subaccount is used in account 99.

The main accrual transactions are as follows:

- Dt 99 Kt 68 – conditional expense if profit was made;

- Dt 68 Kt 99 – conditional income, reverse entry upon receipt of a loss.

The differences between the control unit and the control unit are reflected by the postings:

- Dt 09(68) Kt 68(09) – ONA is fixed (extinguished);

- Dt 68 (77) Kt 77 (68) – IT is recorded (extinguished);

- DEBIT 99 CREDIT 68 – PNR recorded;

- DEBIT 68 CREDIT 99 – PND is recorded.

Attention! Currently, the term “tax loss” is not used. According to the Tax Code of the Russian Federation, income tax cannot have a negative value. If for a period expenses exceed income, the tax base is zero and the profit tax is also zero (Article 274-8 of the Tax Code of the Russian Federation).

Example

The current general income tax rate is 20%. Let the profit according to accounting data be 400 thousand rubles. Conditional consumption, according to the formula: 400,000 * 20% = 80,000 rub. Dt 99 Kt 68 80000 rub.

Let the NU not take into account part of the depreciation expenses taken into account within the accounting system - due to the use of different accrual methods - 15,000 rubles. Current income tax = (400,000 - 15,000)*20% = 385,000*20% = 77,000 rubles. Dt 68 Kt 77 3000 rub. - IT is recorded. Let's check: 80,000 - 3,000 = 77,000 rubles.