Basis and legal basis

The gambling tax is a regional direct tax.

It is regulated by Chapter 29 of the Tax Code of the Russian Federation, in force since January 1, 2004. For the purposes of determining this tax, it is established that the gambling business is an entrepreneurial activity in the organization and conduct of gambling, associated with the extraction of income by organizations in the form of winnings and (or) fees for gambling. Regional authorities have the right, by appropriate regional law, to introduce a tax on the gambling business and set its rate (taking into account the limits established by the Tax Code of the Russian Federation). However, if a regional law is not adopted, then the tax is still considered introduced and is fully regulated by the Tax Code of the Russian Federation. Unlike other regional taxes, the object of taxation, base, period and terms of payment of the tax on gambling business are fully regulated by the Tax Code of the Russian Federation and cannot be changed by the regional legislator.

Legal regulation of gambling business

The Law “On State Regulation of Activities for the Organization and Conduct of Gambling” (Federal Law No. 244, which entered into force in January 2007) is the main legal document relating to the organization of the gambling business and profit from this activity.

Gaming activities mean gambling in special institutions equipped with gaming tables and/or machines (only in specially designated gambling zones), as well as in bookmakers’ offices and sweepstakes (if licensed).

The tax on gambling business is regulated by Ch. 29 of the Tax Code of Russia, which has been in force since January 1, 2004. In accordance with the text of the Tax Code, such a business is regulated by regional legal acts, that is, local authorities have the prerogative to set the tax rate (the Tax Code of the Russian Federation does not allow benefits for this type of tax). If such a document is not adopted at the regional level, the tax will be levied according to the general requirements specified in the Tax Code.

SO! The gambling tax is a direct regional payment that goes to the budget of the territorial subject of the Russian Federation where it is introduced.

Objects of taxation

The list of what is subject to taxation by the gambling business tax is established by Article 366 of the Tax Code of the Russian Federation. This:

- gaming table;

- slot machine;

- betting processing center;

- bookmaker's processing center;

- totalizator betting point;

- bet acceptance point of a bookmaker's office.

Each taxable object must be registered in the manner prescribed by law with the tax authority at the place of installation or location no later than two days before the date of its installation (opening). The taxpayer is also required to register any change in the number of taxable items within the same period.

The application form for registration of taxable objects was approved by Order of the Ministry of Finance of the Russian Federation dated December 22, 2011 N 184n.

Registration (submission of an application by the taxpayer) can be carried out in person, through a representative or by mail.

Tax authorities, within 5 working days from the date of receipt of the application, must issue a certificate of registration or make changes related to changes in the number of taxable objects to the previously issued certificate.

The procedure for registering gambling tax payers was approved by Order of the Ministry of Finance of the Russian Federation dated 04/08/2005 N 55n.

Gambling tax. Objects of taxation and the procedure for their registration

The objects of taxation, according to Article 366 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), are:

- gaming table;

- slot machine;

- betting cash desk (betting is a game in which the participant makes a forecast (bet on a possible variant of a gaming, sports or other socially significant situation, the winnings in which depend on the partial or complete coincidence of the forecast with the documented facts that have occurred);

- bookmaker's office cash desk.

Here is an excerpt from the Letter of the Ministry of Taxation of the Russian Federation dated August 27, 2004 No. 22-1-14 / [email protected] “On the tax on gambling business”, regarding the registration of slot machines with the tax authorities: “Slot machines can be combined into a gaming entertainment complex.

In this case, the gaming machine included in this complex may have all the main blocks of the gaming machine, or some of the above blocks may be common to the entire complex. When playing on a slot machine included in the gaming complex, the gaming situation of one player does not depend on the gaming situations of other players; each slot machine is completely autonomous in realizing the random occurrence of the game result after a bet is made.

Taking into account the above, if the equipment of each of several gaming places of the Stolbik slot machine falls under the above concepts of a slot machine, then the Stolbik slot machine will be a gaming complex consisting of several slot machines combined into one building. In this regard, each slot machine included in the Stolbik gaming entertainment complex is subject to registration in the prescribed manner with the tax authorities.

If at least one of the above conditions is absent, for example, the gaming situation of one player will depend on the gaming situations of other players and each slot machine included in the gaming complex will not be autonomous in realizing the random occurrence of the game result after a bet is made, registration in accordance with the established procedure, one slot machine is subject to the tax authorities, regardless of the number of players.

The “Romashka” slot machines should be considered in a similar manner.

Many taxpayers ask whether slot machines with winnings in the form of a soft toy will be subject to gambling tax. The Letter of the Ministry of Taxes and Taxes of the Russian Federation dated March 12, 2004 No. 22-1-14/413 “On the tax on gambling business” states that the game is one of the ways of entertainment and the characteristic focus of some games on developing a reaction or the ability to analyze does not deprive them presence of excitement. Based on this, slot machines with winnings in the form of a soft toy are subject to Chapter 29 of the Tax Code of the Russian Federation.

Each taxable object must be registered with the tax authority at the place of installation of this object no later than two working days before the installation of each object. If taxable objects are planned to be installed on the territory of a constituent entity of the Russian Federation where the taxpayer is not registered, he is obliged to register with the tax authorities at the place of installation of such objects also no later than two working days before the date of installation of each taxable object.

In accordance with paragraph 1 of Article 83 of the Tax Code of the Russian Federation, taxpayers are subject to registration with the tax authorities at the location of the organization, the location of its separate divisions, the place of residence of an individual, as well as at the location of the real estate and vehicles owned by them and on other grounds, provided for by the Tax Code of the Russian Federation. A separate division of an organization, in accordance with paragraph 2 of Article 11 of the Tax Code of the Russian Federation, is any division territorially isolated from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

From the Letter of the Ministry of Taxation of the Russian Federation dated March 15, 2004 No. 22-0-10 / [email protected] “On registration with the tax authority of objects of taxation for the gambling business tax” it follows that if an organization carrying out entrepreneurial activities in the field of gambling business, equips stationary workplaces outside its location, this is the creation of a separate unit. Consequently, the organization is obliged to register with the tax authority at the location of the separate division. Thus, the object of taxation must be registered with the tax authority at the location of the separate division of the organization (when using the object of taxation at the location of the separate division of the organization).

Entrepreneurial activity in the field of gambling in terms of organizing betting also has its own characteristics. An organization carrying out such activities can create a network of points united into a single system that accept bets on the outcome of an event and also pay out the corresponding winnings. The total amount of bets made can be taken into account both at the head office of the organization organizing the betting and at the betting points themselves.

The Letter of the Ministry of Taxes and Taxes of the Russian Federation dated January 16, 2004 No. 22-1-15/47-B583 “On the tax on gambling business” states that when determining the number of objects of taxation for a betting shop that has a network of points united into a single system, one should also have keeping in mind that the specifics of this type of business activity require a specially equipped place for accepting bets and paying out the corresponding amounts of winnings.

Therefore, if the organization of the betting allows taking into account the total amount of bets and the amount of winnings to be paid in each territorially separate division, then the object of taxation subject to registration will be each territorial separate structural subdivision of the betting.

If the betting organization does not allow taking into account the total amount of bets and the amount of winnings to be paid in each territorially separate division, then the object of taxation, subject to registration with the tax authorities, will be the head division of the organization.

With regard to slot machines, the following should be kept in mind: if the slot machine is located outside the location of the organization (the location of a separate division of the organization), registration of this taxable object is carried out with the tax authority at the location of the organization.

An individual entrepreneur carrying out entrepreneurial activities in the field of gambling business on the territory of a constituent entity of the Russian Federation at his place of residence, as well as on the territory of other constituent entities of the Russian Federation, is obliged to register all existing objects of taxation with tax on gambling business with the tax authority at his place of residence. To register an object or objects of taxation, the taxpayer must submit a registration application to the tax authority. The application form for registration of an object (objects) of taxation with the gambling business tax was approved by Order of the Ministry of Finance of the Russian Federation dated January 24, 2005 No. 8n “On approval of the application form for registration of the object (objects) of taxation with the gambling business tax.”

It is the responsibility of the taxpayer to register with the tax authorities at the place of registration of taxable objects and to register any change in the number of taxable objects. Such registration is carried out no later than two business days before the date of installation or disposal of each object.

The recommended form of application for registration of changes in the number of objects of taxation with tax on the gambling business is approved by Order of the Ministry of Taxation of the Russian Federation dated January 8, 2004 No. VG-3-22 / [email protected] “On approval of the recommended form of application for registration of changes in the number of objects of taxation with tax on gambling business " In this case, in the application the taxpayer must indicate only those taxable objects that are subject to installation (disposal).

The registration application can be submitted by the taxpayer to the tax authority in person or through a representative, or it can be sent by mail with a list of the contents.

Note!

The object of taxation is considered registered from the date the taxpayer submits to the tax authority an application for registration of the object (objects) of taxation with tax on the gambling business.

A taxable object is considered retired from the date the taxpayer submits an application for registration of changes (reductions) in the number of taxable objects.

The fact of registration is confirmed by the mandatory issuance of a registration certificate to the taxpayer. The recommended form of the certificate of registration of the object (objects) of taxation with the tax on the gambling business is approved by Order of the Ministry of Finance of the Russian Federation dated January 24, 2005 No. 7n “On approval of the form of the certificate of registration of the object (objects) of taxation with the tax on the gambling business and attachments to the certificate of registration of the object ( objects) taxation with tax on gambling business.”

A registration certificate must be issued to the taxpayer within five working days from the date of receipt of an application from the taxpayer to register taxable objects.

Amendments to a previously issued certificate related to a change in the number of taxable objects, or the issuance of a new certificate, are also carried out within five working days from the date of receipt of the application for a change in the number of taxable objects. According to the Letter of the Ministry of Taxation of the Russian Federation dated July 30, 2004 “22-1-14/ [email protected] “On the gambling business tax,” the fact of receiving a new certificate of registration of taxable objects or the fact of making changes to a previously issued certificate is determined by the taxpayer in the application. The number of changes made to the certificate by Chapter 29 of the Tax Code of the Russian Federation has not been established. If a taxpayer is issued a new certificate of registration of objects of taxation with the gambling tax, the previously issued certificate is withdrawn by the tax authority, and the newly issued certificate is assigned a new number.

For violation of the terms of registration of taxable objects, changes in their quantity, Chapter 29 of the Tax Code of the Russian Federation provides for a fine, which is levied at three times the tax rate established for the corresponding gambling business object.

If the taxpayer commits a violation a second time, the fine will double and be six times the tax rate.

I would like to remind readers that, according to Article 107 of the Tax Code of the Russian Federation, organizations and individuals bear responsibility for committing tax offenses in cases provided for by Chapter 16 of the Tax Code of the Russian Federation “Types of tax offenses and responsibility for their commission.” The establishment of additional penalties by Article 366 of the Tax Code of the Russian Federation contradicts Article 107 of the Tax Code of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

The tax base

The tax base for the tax on gambling business is determined for each object of taxation separately, based on their total number. The tax amount is calculated by the taxpayer independently as the product of the tax base for each object and the corresponding tax rate.

The tax is payable from the moment of carrying out licensed activities in the field of gambling business.

The procedure for calculating tax is explained in the Letter of the Federal Tax Service of the Russian Federation dated May 18, 2006 N GV-6-02/ [email protected]

Gambling tax rates

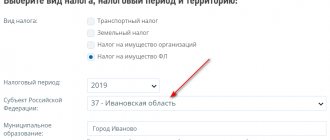

Tax rates are set by regional authorities of Russia. However, they must not exceed the limits established in Article 369 of the Tax Code of the Russian Federation. These marginal rates are:

- for one gaming table - from 25,000 to 125,000 rubles;

- for one slot machine - from 1500 to 7500 rubles;

- for one betting processing center - from 25,000 to 125,000 rubles;

- for one processing center of a bookmaker’s office - from 25,000 to 125,000 rubles;

- for one betting point - from 5,000 to 7,000 rubles;

- for one betting point of a bookmaker's office - from 5,000 to 7,000 rubles.

Subjects of the Russian Federation determine specific tax rates for the gambling business. In the absence of relevant laws of regional authorities, the lower limit established by Article 369 of the Tax Code of the Russian Federation is applied.

The procedure for filling out a declaration for a gambling business

The gambling declaration includes a title page and five sections.

In section 1, taxpayers enter the tax amount (line 030).

In line 010 you need to indicate KBK. In 2022, the code has the value 18210605000021000110.

The main sections with tax calculation are sections 2 and 2.1.

Section 2

Line 020 of the second section indicates the total number of game objects by type. The species are listed in columns 3-8.

Line 020 of column 3 is equal to the sum of the values in line 040 of all completed sections 2.1 of the declaration.

Line 020 (columns 4-8) = line 010 of section 3 + line 020 of section 3 + line 040 of section 3.

Line 030 (columns 4-8) = line 020 of section 2 - (line 040 of section 3 + line 050 of section 3).

Line 030 of column 3 is equal to the sum of the values in line 050 of all completed sections 2.1.

Line 040 (columns 4-8) is equal to the sum of the values in lines 040 and 050 of section 3.

Line 040 of column 3 is equal to the sum of the values in lines 060 of all completed sections 2.1.

Line 050 is equal to the sum of the values on line 070 of all completed sections 2.1 of the declaration.

Line 060 is equal to the sum of the values on line 080 of all completed sections 2.1 of the declaration.

In lines 080-120, column 3 indicates the corresponding tax rate in rubles. In the same lines, column 4 indicates the amount of calculated tax.

The amount of tax reflected in line 070 of column 4 is equal to the sum of lines 090 of all completed sections 2.1.

The amount of tax reflected in line 080 of column 4 is equal to the sum of two products: line 080 of column 3 multiplied by line 030 of column 4 and 1/2 of line 080 of column 3 multiplied by line 040 of column 4.

The amount of tax reflected in line 090 of column 4 is equal to the sum of two products: line 090 of column 3 multiplied by line 030 of column 5 and 1/2 of line 090 of column 3 multiplied by line 040 of column 5.

The amount of tax reflected in line 100 of column 4 is equal to the sum of two products: line 100 of column 3 multiplied by line 030 of column 6 and 1/2 of line 100 of column 3 multiplied by line 040 of column 6.

The amount of tax reflected in line 110 of column 4 is equal to the sum of two products: line 110 of column 3 multiplied by line 030 of column 7 and 1/2 of line 110 of column 3 multiplied by line 040 of column 7.

The amount of tax reflected in line 120 of column 4 is equal to the sum of two products: line 120 of column 3 multiplied by line 030 of column 8 and 1/2 of line 120 of column 3 multiplied by line 040 of column 8.

Section 2.1

This section can be compiled several times. The number of pages in section 2.1 depends on variations in the number of playing fields on the tables.

In line 010 you need to reflect the number of playing fields on the gaming table.

Line 020 records the tax rate in accordance with paragraph 1 of Art. 369 Tax Code of the Russian Federation.

Line 030 records the tax rate in accordance with clause 1 of Art. 369 of the Tax Code of the Russian Federation, taking into account paragraph 2, paragraph 1, art. 370 Tax Code of the Russian Federation.

Line 030 = line 020 gr. 3 x page 010 gr. 3.

The value of line 040 corresponds to the number of gaming tables with the number of fields indicated in line 010 of column 3.

Line 040 of section 2.1 = page 020 of section 3.1 + page 030 of section 3.1 + page 050 of section 3.1.

Line 050 records the number of gaming tables with one playing field. Here there are only objects taxed in accordance with paragraph 1 of Art. 369 Tax Code of the Russian Federation.

Line 050 is equal to the difference between the values in line 040 of section 2.1 and lines 050 and 060 of section 3.1.

In line 060, record the number of gaming tables with one playing field, subject to taxation at 1/2 the tax rate (clauses 3, 4 of Article 370 of the Tax Code of the Russian Federation).

Line 060 is equal to the sum of the values in lines 050 and 060 of section 3.1 of the declaration.

In line 070, write down the number of gaming tables that have more than one playing field (clause 1, article 369, paragraph 2, clause 1, article 370 of the Tax Code of the Russian Federation).

Line 070 is equal to the difference between the values in lines 040 of section 2.1 and lines 050 and 060 of section 3.1.

Line 080 records the number of gaming tables that have more than one playing field. These objects are subject to 1/2 of the tax rate established taking into account paragraph. 2 clause 1, clause 3 and clause 4 art. 370 Tax Code of the Russian Federation.

Line 080 is equal to the sum of lines 050 and 060 of section 3.1.

Line 090 records the amount of calculated tax on gaming tables.

Section 3

The third section contains information about the balances and movement of game objects (points).

Line 010 will tell you about the number of registered objects at the beginning of the month.

Line 020 will show the number of new objects registered before the 15th of the reporting month.

Line 030 should take into account the number of objects deregistered after the 15th of the reporting month.

Line 040 should take into account the number of new objects registered after the 15th of the reporting month.

Line 050 should take into account the number of objects deregistered before the 15th of the reporting month.

Line 060 indicates the number of objects registered with the Federal Tax Service at the end of the reporting month.

Line 060 = page 010 + page 020 - page 030 + page 040 - page 050.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Procedure for paying tax and submitting a declaration

The gambling business tax is paid to the budget at the place of registration of the objects with the tax authority no later than the deadline for filing the declaration (20th day of the next calendar month). The tax amount is calculated by the taxpayer independently as the product of the tax base established for each taxable object and the tax rate provided for these objects.

Payment of tax if the organization has a separate division - at its location.

The gambling business tax declaration is also submitted monthly - no later than the 20th day of the month following the tax period. The declaration must take into account the change in the number of taxable objects in the expired tax period (month).

The declaration must be submitted to the tax authority at the place of registration of taxable objects. The largest taxpayers submit it to the tax authority at the place of registration as the largest taxpayers.

The tax return form and instructions for filling it out were approved by Order of the Federal Tax Service of the Russian Federation dated December 28, 2011 N ММВ-7-3/ [email protected] The declaration can be submitted by the taxpayer personally or through his representative, sent by mail with a list of attachments, or transmitted electronically form via telecommunication channels.

Please pay attention!

Taxpayers whose average number of employees for the previous calendar year exceeds 25 people, as well as newly created organizations whose number of employees exceeds the specified limit, submit tax returns and calculations in electronic form. The same rule applies to the largest taxpayers.

More information about submitting electronic reporting can be found here.

Gambling tax. Tax reporting. Payment of tax.

DEADLINES AND METHODS FOR SUBMISSION OF THE DECLARATION

According to paragraph 2 of Article 370 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the tax return for the expired tax period is submitted by the taxpayer to the tax authority at the place of registration of taxable objects no later than the 20th day of the month following the expired tax period.

Since the tax period for gambling business tax is a calendar month, the taxpayer is obliged to submit a tax return to the tax office no later than the 20th day of the month following the expired month. Thus, the declaration for January must be submitted no later than February 20, for February - no later than March 20, and so on.

We remind readers that according to Article 6.1. In the Tax Code of the Russian Federation, the period established by the legislation on taxes and fees is determined by a calendar date or the expiration of a period of time.

If the last day of the term falls on a non-working day, the end of the term is considered to be the next working day following it.

An action for which a deadline has been established can be performed before twenty-four hours of the last day of the deadline. If documents or sums of money were submitted by post or telegraph before twenty-four hours of the last day of the deadline, then the deadline is not considered missed.

A tax return, in accordance with Article 80 of the Tax Code of the Russian Federation, is submitted to the tax authority at the place of registration of the taxpayer in the prescribed form on paper or electronically in accordance with the legislation of the Russian Federation, and tax return forms must be provided by tax authorities free of charge.

A tax return can be submitted by a taxpayer to the tax authority in the following ways:

- personally or through his representative;

- sent in the form of a postal item with a list of attachments;

- transmitted via telecommunication channels.

When submitting a tax return in person or through a representative, the tax authority does not have the right to refuse to accept the tax return and is obliged, at the request of the taxpayer, to put a mark on the copy of the tax return regarding acceptance and the date of its submission.

When sending a tax return by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting a tax return via telecommunication channels, the day of its submission is considered the date of its dispatch. When receiving a tax return in this way, the tax authority is obliged to provide the taxpayer with an acceptance receipt in electronic form. The procedure for submitting a tax return in electronic form via telecommunication channels was approved by Order of the Ministry of Taxes of the Russian Federation dated April 2, 2002 No. BG-3-32/169 “On approval of the procedure for submitting a tax return in electronic form via telecommunication channels.”

The tax return form and instructions on the procedure for filling it out were approved by Order of the Ministry of Finance of the Russian Federation dated November 1, 2004 No. 97n “On approval of the tax return form for the gambling tax and instructions on the procedure for filling it out.”

The tax return is filled out by the taxpayer for each tax period, that is, monthly, taking into account changes in the number of taxable objects for the past tax period. In each line of the declaration and the corresponding column, only one indicator should be indicated. In the event that any indicator provided for in the declaration is missing, a dash is placed in the corresponding line and column.

If a mistake is made when filling out the declaration, the incorrect value of the indicator must be crossed out and the correct value entered. The correction is certified by the signatures of the organization's officials, as well as its seal, or the signature of an individual entrepreneur indicating the date of the correction. Please note that correction of errors by correction or other similar means is not permitted.

All pages of the tax return must be numbered, on each of them the taxpayer identification number (hereinafter TIN) and the reason for registration code (hereinafter KPP) of the organization or TIN of the individual entrepreneur should be indicated.

TAX PAYMENT PROCEDURE

According to Article 12 of the Tax Code of the Russian Federation, federal, regional and local taxes and fees are established in the Russian Federation. Regional taxes are those that are established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation on taxes and are obligatory for payment in the territories of the corresponding constituent entities of the Russian Federation. The gambling tax is classified as a regional tax in Article 14 of the Tax Code of the Russian Federation. According to Article 371 of the Tax Code of the Russian Federation, the amount of tax payable at the end of the tax period is paid by the taxpayer at the place of registration of taxable items with the tax authority no later than the deadline established for filing a tax return for the corresponding tax period, that is, no later than the 20th day of the month following the reporting period. month.

From the Letter of the Ministry of Taxes and Taxes of the Russian Federation dated March 15, 2004 No. 22-0-10/ [email protected] “On registration with the tax authority of objects of taxation for the gambling business tax” it follows that payment of the gambling business tax if the organization has a separate division both having a separate balance and settlement (current) account, and not having them, must be made at the location of a separate division of the organization, at the rate established in accordance with Article 369 of the Tax Code of the Russian Federation on the territory of the subject of the Russian Federation at the place where the organization carries out activities in the field of gambling business through a separate division.

An individual entrepreneur carrying out entrepreneurial activities in the field of gambling business on the territory of a constituent entity of the Russian Federation at his place of residence, as well as on the territory of other constituent entities of the Russian Federation, is obliged to register all existing objects of taxation with tax on gambling business with the tax authority at his place of residence. At the same time, payment of the gambling business tax in the above cases must be made by the individual entrepreneur at the place of residence of the individual entrepreneur at the rate established by the legislative bodies of the given subject of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Gambling tax in St. Petersburg

In St. Petersburg, the tax on gambling business is regulated by the Law of St. Petersburg dated July 3, 2012 N 395-66 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one betting processing center - 125,000 rubles;

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

Gambling tax in Moscow

In Moscow, the tax on gambling business is regulated by the Moscow Law of December 21, 2011 N 69 - this document sets the tax rates. According to the Tax Code of the Russian Federation, only rates can be set at the regional level; all other aspects of the gambling tax are regulated by the Tax Code of the Russian Federation.

The rates are as follows:

- for one processing center of a bookmaker’s office - 125,000 rubles;

- for one betting processing center - 125,000 rubles;

- for one betting point - 7,000 rubles;

- for one betting point of a bookmaker's office - 7,000 rubles.

Rates and amounts

The Tax Code sets the minimum and maximum bet sizes for each type of gaming object. Regional authorities have the right to choose any figure within these boundaries. If a given subject of the Russian Federation has not adopted a law regulating the tax rate for the gambling business, then the minimum rate specified in the Tax Code of the Russian Federation is applied. Here are the amounts an entrepreneur should expect:

- for a gambling table - from 25 thousand to 125 thousand rubles;

- for a slot machine – from 1.5 thousand to 2.5 thousand rubles;

- for a processing betting or bookmaker center - from 25 thousand to 125 thousand rubles;

- for a betting point - from 5 thousand to 7 thousand rubles.