Tax control measures include conducting tax audits, requesting explanations and documents, inspecting premises, and so on. They are mentioned in Article 82 of the Tax Code of the Russian Federation. One of the special forms of tax control is additional measures , which can be assigned at the discretion of the management of the tax authority. Their goal is to confirm and consolidate the conclusions of the Federal Tax Service employees who conducted the inspection. As part of such activities, inspectors seek to collect facts that will confirm the commission of an offense.

We invite you to get acquainted with the answers of Tax Service specialists to 4 important questions related to additional control measures. They are given in the letter of the Federal Tax Service dated October 19, 2022 No. ED-4-2 / [email protected]

What are additional activities and when are they assigned?

Additional tax control measures are discussed in paragraph 6 of Article 101 of the Tax Code of the Russian Federation. This includes requesting documents, questioning witnesses and conducting an examination . Such measures are appointed by decision of the head of the tax authority or his deputy. The basis for making a decision is the need to obtain additional evidence that would confirm or refute the fact that the taxpayer committed a violation.

The period for carrying out such activities is a month for a regular audit, and 2 months for an audit of a consolidated group of taxpayers.

The aforementioned activities are scheduled before the tax audit is completed and a report is drawn up and handed over to the taxpayer. And also before its materials are reviewed by the management of the Federal Tax Service.

Forms of additional control

Additional tax control activities are carried out in the form of certain actions, a closed list of which is enshrined in the Tax Code of the Russian Federation (clause 6 of Article 101 of the Tax Code of the Russian Federation):

- Request for documents;

- Interrogation of witnesses;

- Expertise.

The choice of action depends on the specific circumstances of the case, including within the framework of one additional inspection, several similar activities can be carried out, for example, several interrogations or examinations, as well as a combination of different actions.

Read also: How to certify copies of documents for the tax authorities

It should be taken into account that if the taxpayer refuses to provide documents, including by evading such actions, the tax authorities have the right to seize the requested documents. This is possible provided that the materials provided are not sufficient to identify all the circumstances of the violation, or there is reason to believe that the original documents may be destroyed or reduced to a condition that does not allow establishing important circumstances. To carry out a seizure, a separate decision is made with a mandatory indication of the reasons for such an action. In all other situations, the inspector does not have the right to change the list of measures indicated in the decision to conduct additional control.

Read also: Penalty for failure to provide documents when requested by the tax authorities

What document is used to document the results?

The results of additional measures must be documented in a special document - an addition to the tax audit report . This is stated in paragraph 6.1 of Article 101 of the Tax Code of the Russian Federation. This rule, like several others, came into force on August 3 and applies to inspections that were completed after September 3, 2018.

The document is generated within 15 working days after the end of the additional event. It needs to reflect the following parameters:

- start and end date of the event;

- its description;

- evidence that was obtained during its course.

Order of conduct

Additional tax control measures during an on-site audit and similar control actions during a desk audit are carried out taking into account the requirements of the legislation on control actions by tax authorities and are recorded in the addition to the audit report, taking into account the provisions of clause 6.1. Art. 101 Tax Code of the Russian Federation.

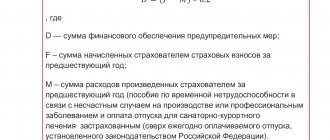

Additional fiscal supervision measures are carried out within a period not exceeding one month from the date of the decision to carry them out (two months for co-consolidated groups and foreign companies). Upon completion of the procedure, within 15 days, an addition to the inspection report is issued containing the following information:

- period of additional control procedures;

- list of completed activities;

- evidence of violation identified or lack thereof;

- conclusions and recommendations based on the results of the audit.

This document is sent within 5 days to the taxpayer, who can, within 15 days after receiving it, submit his objections to the conclusions made by the inspector.

As with a regular inspection, additional control provides for the right of the person being inspected to familiarize himself with the materials of the inspection activities. To do this, a written application is submitted to the Federal Tax Service, and no later than two working days after its submission, the applicant must be familiar with all the documents.

Could an additional activity reveal new violations?

No, he can not. The point of additional activities is to find facts confirming already identified offenses . In clause 6.1. Article 101 of the Tax Code of the Russian Federation states that additional evidence should be indicated in the addition to the inspection report. This implies evidence in relation to those offenses that are indicated in the tax audit report itself.

The same conclusion was made in the resolution of the Constitutional Court of July 14, 2005 No. 9-P and the resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57. They indicate that additional measures are aimed at collecting evidence on those violations that have already been discovered.

Even if during additional measures some other violations are revealed, inspectors should not include them in addition to the report.

Why are additional events scheduled?

Nowadays, a situation often arises when the supervisory authority, during the inspection process, was unable to obtain the necessary information to make a decision. But this does not mean that inspectors can no longer obtain information about this enterprise, and after the investigation everything will end. For these purposes, additional tax control measures are used.

The main objective of these procedures is to confirm or refute the commission of an offense. Inspectors can collect missing information only within the framework of the taxpayer’s activities that were considered during the main audit. It is important to note that these activities are not aimed at detecting new violations, but at thoroughly investigating existing ones.

The payer learns about the appointment of such events during the review of the audit results or a few days after them. The implementation of additional procedures is an intermediate result of the investigation, during which it is necessary to find out whether an offense has been committed.

Does the Federal Tax Service have the right to assess additional taxes after additional measures have been taken?

There is a resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, which states: after a decision has been made based on the results of an inspection, the Federal Tax Service cannot change it in such a way that it worsens the position of the company or individual entrepreneur being inspected . In other words, additional taxes cannot be assessed.

However, this is a general case, and there are exceptions to it in judicial practice. An example is the resolution of the AS of the Ural District dated April 23, 2015 No. F09-1929/15. When filing an objection to the act, the taxpayer submitted documents that were not available to the inspectors during the on-site inspection. The study of these documents led to an increase in additional charges.

The taxpayer went to court, but it was supported by the tax authority. The judges indicated that the documents presented were related to violations that were identified during the inspection. And additional charges made on their basis are legal , since otherwise the taxpayer would have avoided paying tax on the taxable item that he had hidden. The Supreme Court, by its ruling of August 20, 2015 No. 309-KG15-9617, upheld the said decision.

Interrogation of witnesses

In Art. 90 of the Tax Code of the Russian Federation states that one of the additional measures of tax control is the interrogation of witnesses. It should be noted that any person who has information relevant to this case can be called to testify. There are some restrictions on calling witnesses; they cannot be:

- persons who, due to age or physical and mental disabilities, are not able to correctly perceive information;

- persons who received the necessary information in the course of their professional activities, for example, a lawyer.

A person has the right to refuse to testify only on the grounds provided for by the legislation of the Russian Federation. The most common excuse for refusal is Art. 51 of the Constitution: no one should testify against themselves, their spouse or close relatives.

Taxpayers often ask: Can people be called to testify while a field audit is suspended? Moreover, most of them believe that the tax authorities do not have the right to do this. However, they are wrong.

During tax control activities, there are a huge number of reasons to suspend an audit. But there is no clause in the legislation of the Russian Federation that prohibits interrogating witnesses at this time. Controlling authorities have the right to call to testify people who have information necessary to make a decision on a specific case. Thus, even during the period of suspension of the inspection, interrogation of witnesses can be carried out.

Types of checks

According to the legislation, secondary measures can only be carried out in certain forms:

- interrogation of witnesses on the basis of Art. 90 Tax Code of the Russian Federation;

- examination – Art. 95 Tax Code of the Russian Federation;

- requesting documentation on the basis of Art. 93, 93.1 of the Tax Code of the Russian Federation - this option is possible only in the process of exercising control over the taxpayer himself, his subordinates or close associates. This means that it is possible to request documentation only during the periods indicated by Art. 88, 89, 101 Tax Code of the Russian Federation.

Important: in fact, this opportunity ensures that tax inspectors study the entrepreneur’s documentation outside the periods of the main stage of control, and at the same time, the deadlines will not be legally violated.

In addition, based on Federal Law No. 302 of 2022, there are changes regarding the conduct of inspections, namely:

- an additional on-site tax audit can now only occur on the basis of a received updated declaration with a reduction in the amount of tax without any supporting or justified documents;

- The repeated request by tax authorities for documents is limited for any type of documentation, including holding an event on the basis of Art. 93.1 Tax Code of the Russian Federation;

- the deadline for submitting documents has been increased to 10 working days;

- Formation of an addition to the act based on the results of the inspection.

Dates and procedure

Legislation - Art. 101 of the Tax Code of the Russian Federation, only a month is defined for the period of the inspection; 2 months are allowed only in the case of an inspection of a consolidated group of entrepreneurs.

The entire event is closed, during which inspectors have the right to perform an unlimited number of designated types of checks.

Important: if the taxpayer interferes with an additional audit, specialists have the right to act on the basis of Art. 94 of the Tax Code of the Russian Federation and seize materials.

At the stage of interviewing witnesses, according to the law, the citizen being interviewed can be any person who, in the opinion of tax specialists, has valuable information.

But there are also restrictions; witnesses cannot be:

- persons with mental and physical illnesses, elderly citizens who, due to their thinking, are unable to adequately perceive information and reality;

- citizens who have received the necessary information as a result of their professional activities - lawyers, advocates and others.

Important: in this case, the witness may refuse to testify on the basis of legislative acts, for example, on the basis of Art. 51 of the Constitution, when he cannot testify against himself, relatives or spouses.

How are additional tax control measures carried out?

Expertise is used in the process of researching a specific area of the production process, when the tax authorities themselves are not able to check the legal basis of the activity.

In this case, an expert is engaged on the basis of an agreement and a notification from the taxpayer about conducting an examination as part of the control measure. Such an action, as already indicated, can be carried out repeatedly until specific issues are resolved.

In order for a tax audit to take place in an additional format, the head of the department must initially issue an order. Next, the taxpayer gets acquainted with it, and an audit is carried out within the specified period from the date specified in the notification.

How is the decision on additional verification made?

Initially, a decision is made based on the results of a scheduled tax audit; if no violations were identified during the audit, then such a document is not generated at all.

The decision must indicate:

- the period for making a decision is no more than 10 days from the end of the inspection, in some cases a month;

- information regarding the participation of the taxpayer himself in the decision-making process - he has the right to give explanations for each case;

- request for additional materials - explanations, documents, if unresolved issues arise during the consideration of the case;

- decision - based on the results of the inspection, the manager indicates his decision, for example, the presence of such and such shortcomings, what is the responsibility and whether additional verification is needed. At the same time, it must set out everything in detail and indicate the articles on the basis of which liability arises.

Here you will learn what a taxpayer’s personal account is and what data it contains.

The decision regarding an additional inspection is handed to the businessman within 5 days from the date of its adoption, and it comes into force a month after delivery.

Important: if during this month the organization appeals the decision in the court of appeal, then its legal force will take place in accordance with the court decision.

In addition, the taxpayer has the right to know where and when the materials will be studied and a decision will be made on them. That is, at each stage of their actions, tax authorities are required to notify the taxpayer.

Otherwise, he will have grounds to go to court to declare the actions of the tax authorities illegal.

What materials for conducting an inspection?

After an additional tax audit and during its course, materials are generated that are added to the general materials for a specific case. The taxpayer has the right to familiarize himself with them on the basis of an official request to the authorities.

Important: the taxpayer has the right to access information and take part in consideration of the issue after 2 days from the date of application. At the same time, the results of control actions can be the most unpredictable - from the recognition of an error on the part of the taxpayer to the closure of the enterprise.

Based on all the materials received and the results of the audit, tax specialists draw up a protocol on the outcome of the case, which should indicate:

- document's name;

- date, time and place of events;

- Full name of the compiler;

- a list of all persons who took part in the action;

- the results of the audit, in full, must contain detailed descriptions of each stage.

Important: such a protocol must be signed by both parties regarding their agreement with the information specified in it, so it is important to pay the utmost attention to its study.

What to do if the results of the previous check are not yet available

Based on the results of the inspection, a report is drawn up. It takes some time to compile it. Is a repeat event held if the results of the previous one are not yet available? Paragraph 10 of Article 89 of the Tax Code of the Russian Federation states that a re-inspection is carried out with the aim of analyzing the productivity, legality and validity of decisions of a lower structure. This approach is confirmed, among other things, by paragraph 5 of Resolution No. 5-P of the Constitutional Court Resolution.

That is, the higher authority does not check the results, but the process of the control event. Therefore, the presence or absence of an act does not matter. Even if the test results are not ready, the subject of the repeated event is present. In addition, the article of the Tax Code of the Russian Federation does not indicate that the second inspection should be carried out based on the results of the first.

What types of tax audits are there?

Usually they are afraid - and this is logical - of on-site inspections. Many people know that there are also office ones. Some people are familiar with the word “counter”. Let us add that inspections can also be scheduled and unscheduled. Now that everything is completely confused, let's figure it out