What is a vehicle code and why is it needed?

The vehicle type code consists of 5 digits; for each group of vehicles (sea vessels, aircraft, cars, etc.) the law establishes a separate code. It is necessary to determine the transport tax rate to be transferred to the state budget. If this detail is incorrectly indicated in the declaration, the tax amount will be calculated incorrectly (overestimated or underestimated). Taxpayers should carefully ensure that the codes they use are up to date as they may change from time to time.

When specifying the vehicle code, you must do the following:

- clarify the characteristics of transport;

- find the corresponding value in a special table;

- enter the code in the declaration.

Vehicle type code for tax purposes

→ → Current as of: June 6, 2022

Organizations that have registered vehicles (vehicles) recognized as subject to transport tax must submit a tax return (,) at the end of the year to the tax office at the location of the vehicles. When calculating the tax for each vehicle, it is necessary to indicate the type code of this vehicle.

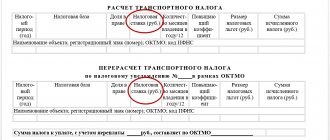

The transport tax return form and the procedure for filling it out have been approved. Section 2

“Calculation of the tax amount for each vehicle”

is filled out by organizations for each vehicle registered to it (approved.

By Order of the Federal Tax Service dated 05.12.2016 No. In line 030 of Section 2, it is necessary to indicate the code of the type of vehicle for which this section is filled out (approved by Order of the Federal Tax Service dated 05.12.2016 No. Codes of types of vehicles for filling out line 030 of Section 2 of the “transport” declaration are given in to the Procedure for filling out a tax return (approved.

By order of the Federal Tax Service dated December 5, 2016 No. Let us present some basic codes of types of vehicles in the table: Name of vehicle 42032 Sports, tourist and pleasure craft, self-propelled (except those included under codes 422 00, 423 00 - 426 00) 42033 Sports, tourist and pleasure vessels, non-self-propelled 42200 Yachts 42300 Boats 42400 Jet skis 42500 Motor boats 42600 Motor sailing vessels 51004 Other passenger cars (except those included under codes 56600, 56700)

Where can I find the code value?

In order to correctly determine the vehicle type code, the taxpayer will need:

- vehicle passport (PTS);

- Appendix No. 5 to the Procedure for filling out the transport tax declaration (approved by order of the Federal Tax Service of the Russian Federation dated December 5, 2016 No. ММВ-7-21/668).

First of all, it is necessary to understand the characteristics of the existing transport. Tax legislation, in particular, provides for the following categories of vehicles:

- cars;

- motor vehicles;

- cargo equipment;

- water transport;

- sea transport;

- self-propelled vehicles with caterpillar or pneumatic drive, etc.

When determining the category, you should be guided by the information from the vehicle passport.

When the category of transport is precisely determined, you should proceed to Appendix No. 5 to the “Procedure for filling out the declaration.” It is a vehicle classifier table for transport tax; it lists all codes of vehicle types for tax purposes. When filling out a return, the taxpayer must select a code only from this list.

The classifier is very convenient to use, since all types of transport are divided into groups. For example, the section “Aircraft” consists of the following subsections: “Airplanes”, “Helicopters”, “Aircraft for which jet engine thrust is determined”. And each subsection, in turn, is divided into groups (passenger, cargo, fire, etc.).

Where to get it from

When accountants prepare a transport declaration, they often encounter difficulty in determining the code of the type of vehicle in the reporting year. There is always a fear of making a mistake.

First of all, it helps to set the transport code:

- passport for him;

- Appendix No. 5 to the order of the Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/668.

Please note: only from the specified Application you must select a code that belongs to any type of owner’s vehicle.

If the data from the registration certificate is not entirely sufficient to accurately determine the type of vehicle (for example: truck/tractor/truck crane), you should consult with the appropriate mechanical specialists. Their consultations will help highlight the technical features of the vehicle and clarify unclear points.

When the accountant has received more complete information about the transport unit on the balance sheet, its features and characteristics have become known, then he must again look at Appendix No. 5 and select the code for the type of this transport.

The table below shows all possible codes for types of vehicles in 2022, which, depending on the situation, must be reflected in the transport tax return for 2022.

| Codes of vehicle types for transport tax declaration | |

| Code for tax purposes | T/s category |

| Aircraft | |

| Aircraft | |

| 411 12 | passenger airplanes |

| 411 13 | cargo planes |

| 411 20 | Other aircraft |

| 411 21 | firefighting aircraft |

| 411 22 | emergency service aircraft |

| 411 24 | other aircraft |

| Helicopters | |

| 412 12 | passenger helicopters |

| 412 13 | cargo helicopters |

| 412 20 | Other helicopters |

| 412 21 | firefighting helicopters |

| 412 22 | emergency service helicopters |

| 412 24 | other helicopters |

| 413 00 | Aircraft without engines |

| Air vehicles for which jet engine thrust is determined | |

| 414 01 | jet powered aircraft |

| Other aircraft | |

| 419 01 | other aircraft with engines |

| Water vehicles | |

| Sea and inland navigation vessels | |

| 420 10 | Passenger and cargo sea and river self-propelled vessels (except those included under code 421 00) |

| 420 12 | passenger sea and river vessels (except those included under code 421 00) |

| 420 13 | sea and river self-propelled cargo vessels (except those included under code 421 00) |

| 420 30 | Sports, tourist and pleasure boats |

| 420 32 | self-propelled sports, tourist and pleasure craft (except those included under codes 422 00, 423 00 – 426 00) |

| 420 33 | non-propelled sports, tourist and pleasure boats |

| 421 00 | Motor ships |

| 422 00 | Yachts |

| 423 00 | Boats |

| 424 00 | Jet skis |

| 425 00 | Motor boats |

| 426 00 | Sail-motor vessels |

| 427 00 | Non-self-propelled (towed) vessels |

| 427 01 | non-propelled passenger and cargo sea and river vessels |

| 428 00 | Watercraft without engines (except rowing boats) |

| 429 10 | Other self-propelled water vehicles |

| 429 11 | fire ships |

| 429 12 | emergency service vessels |

| 429 13 | medical service court |

| 429 14 | other water vehicles |

| Other non-propelled water vehicles | |

| 429 21 | other non-propelled water vehicles for which the gross tonnage is determined |

| 429 22 | other non-propelled water vehicles |

| Ground vehicles | |

| 510 00 | Passenger cars |

| 510 03 | medical service cars |

| 510 04 | other passenger cars (except those included under codes 566 00, 567 00) |

| 520 01 | Trucks (except those included under code 570 00) |

| Tractor, combines and special vehicles | |

| 530 01 | agricultural tractors |

| 530 02 | other tractors |

| 530 03 | self-propelled combines |

| 530 04 | special vehicles (except those included under code 590 15) |

| 530 05 | other tractors, combines and special machines |

| Buses | |

| 540 01 | medical service buses |

| 540 02 | city and intercity buses |

| 540 03 | other buses |

| Motor vehicles | |

| 561 00 | Motorcycles |

| 562 00 | Motor scooters |

| 566 00 | Motor sleigh |

| 567 00 | Snowmobiles |

| 570 01 | Other self-propelled vehicles, machines and mechanisms on pneumatic and tracked tracks (except those included under codes 530 01 – 530 05) |

| Other vehicles | |

| 590 10 | Special vehicles |

| 590 11 | fire trucks |

| 590 12 | vehicles for cleaning and cleaning cities |

| 590 13 | emergency service vehicles |

| 590 14 | medical service vans |

| 590 15 | special vehicles (milk tankers, livestock tankers, special vehicles for transporting poultry, vehicles for transporting mineral fertilizers, veterinary care, maintenance) |

| 590 16 | other special vehicles on the chassis of which various equipment, units and installations are installed |

Please note: this is a completely new list of codes that is effective as of the 2022 report.

In practice, most often an accountant needs a vehicle type code for a passenger car. As can be seen from the table, its vehicle type code is 510 00.

Other passenger cars are shown with the vehicle type code 510 04 (except for motor sleighs and snowmobiles). That is, the choice of code must be made according to the principle of exclusion.

If your vehicle is not a motorcycle, not a motor scooter, not a motor sleigh, or a snowmobile, then the vehicle type code is 570 01. It is intended for other self-propelled vehicles, pneumatic and tracked machines and mechanisms.

Also, according to the exclusion principle, one must approach the vehicle type code 590 16. These are other special vehicles on the chassis of which various equipment and units are installed (see the last part of the table).

Apparently, from 2022 all general purpose trucks have the vehicle type code 520 01.

For a long time, it was not clearly clear what type of vehicle code a forklift had. There are no official explanations from officials on this matter yet. In our opinion, code 590 16 is most suitable for forklifts.

The table of most commonly used codes includes the following:

| Code | Transport name |

| 51000 | Passenger cars |

| 52001 | Trucks |

| 53001 | Agricultural tractors |

| 53003 | Self-propelled harvesters |

| 56100 | Motorcycles |

| 54002 | Buses of city and intercity transport |

| 41112 | Passenger aircraft |

| 41113 | Cargo aircraft |

The full version of the vehicle code table can be downloaded at the end of this article.

Second section

The second section must be completed for each of the available vehicles. Please note that there is a new entry in this order. If an organization has changed its location (this also applies to representative offices of foreign organizations), and the vehicle was deregistered during a given tax period, the tax return is sent to the tax inspectorate at the new location where the organization registered its vehicle.

The vehicle type code must be entered in line 030. It must be borne in mind that the type of vehicle is of fundamental importance. For example, trucks and cars of the same capacity will have different tax rates.

Features of defining codes

In some situations, it can be difficult to correctly determine the vehicle code using the classifier. For example, passenger cars are shown under group codes 51000. If the taxpayer owns a vehicle that does not fit into any of the passenger vehicle categories listed in the table, he should select the item “Other passenger cars (except for vehicles included under codes 56600, 56700)” , code ˗ 51004. Here you need to use the elimination method.

Using the same principle, code 59016 is indicated for other special vehicles. If the vehicle, according to its technical characteristics, does not fit paragraphs 59010-59015, it is shown in the declaration under code 59016. Another controversial point is the code for forklifts, since it is difficult to determine whether it is a vehicle or refers to machinery and equipment. After the approval of a new code table in 2016, forklifts are shown in tax returns under code 59016.

The vehicle type code for a cargo van also often raises questions. When determining the code of such a vehicle, you should look at the direct indication in the PTS that it is a “cargo van”, or at the permitted weight - more than 3500 kg. Taking this into account, code 52001 “Trucks (except code 57000)” is indicated in the transport tax declaration.

Track loaders will be included in another group.

They belong to the section that lists other vehicles (self-propelled, tracked and pneumatic vehicles). Code – 57001. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Vehicle type code 51000 or 51004

" Administrative law

Free legal advice: 1. Codes of types of vehicles for filling out the form for advance payments for transport tax, dated March 23, 2006 N 48n Free legal advice: CODES OF TYPES OF VEHICLES (Vehicles) Code of type of vehicle for tax purposes Name of vehicles Air vehicles Airplanes passenger and cargo Free legal advice: Passenger and cargo aircraft - emergency service aircraft - air ambulance and medical service aircraft Passenger and cargo helicopters - passenger and cargo helicopters Free legal advice: - emergency service helicopters - air ambulance and medical service helicopters Air vehicles that do not have engines Air vehicles for which the thrust of a jet engine is determined Other air vehicles - other aircraft with engines Free legal advice: Water vehicles Sea and inland navigation vessels Passenger and cargo sea and river self-propelled vessels - vessels passenger and cargo sea and river self-propelled (except those included by code) Sea and river fishing vessels Free legal advice: - sea and river self-propelled fishing vessels - non-self-propelled sea and river fishing vessels Sports, tourist and pleasure vessels

Categories of self-propelled vehicles

Self-propelled vehicles

are divided into categories according to the “Rules for admission to driving self-propelled machines and issuing tractor driver (tractor operator) licenses”, approved by Decree of the Government of the Russian Federation of July 12, 1999 N 796:

- Category “A” : Motorized vehicles not intended for driving on public roads;

- Category “B” : Tracked and wheeled vehicles with an engine power of less than 25.7 kW;

- Category “C” : Wheeled vehicles with engines with power from 25.7 to 77.2 kW;

- Category “D” : Wheeled vehicles with engines with a power of more than 77.2 kW;

- Category “E” : Tracked vehicles with engines with a power of more than 25.7 kW;

- category "F" : Self-propelled agricultural machines.

Categories B and C usually include forklifts.

Gostekhnadzor has adopted the division of self-propelled vehicles into both categories and types of equipment. In this regard, in the License for a loader with approved categories, in the section “Special notes” the type of machine is indicated. For example: E-tractor, C-loader or B-tractor.

If you want to operate the most common types of equipment, then you need training in the following courses:

- P 03. 6 Forklift driver with the right to work on battery and diesel forklifts of category B (retraining) with electrical safety certification for group II.

- P 03. 23 Forklift driver of additional category C.

- R 30. 2 Retraining to become a category C tractor driver.