Business entities are required to report to the state not only for taxes, insurance premiums and other payments paid, but also must submit reports on cash flows within the company. Organizations and individual entrepreneurs are required to submit to the Federal Tax Service (for posting on the open information resource of the BFO) a balance sheet and other financial statements at the end of the year. What balance sheet supplements must be submitted as part of the accounting “package”? Details in our article.

You can often come across the statement that it has become easier for companies to report to the state for accounting. Indeed, now there is no need to submit accounting reports to several structures - the obligation to send accounting reports to Rosstat has been abolished. However, now it is necessary to remember two new important conditions for submitting accounting reports: the mandatory transfer of them to electronic rails and the openness of the company’s accounting data to any interested party.

- From January 1, 2022, the “Procedure for the submission of complete annual accounting (financial) statements and the auditor’s report thereto” established by Order of the Federal Tax Service of the Russian Federation dated November 13, 2019 N ММВ-7-1/ [ email protected] Now you only need to submit your financial statements to the tax authorities in electronic form via TCS channels through an electronic document management operator. In 2022, everyone without exception is required to do this, including small businesses that were given a one-year deferment.

- VLSI Electronic reporting will send your reporting to regulatory authorities via TCS channels. VLSI users always have up-to-date reporting forms at hand, as well as confidence in the successful submission of reports - due to easy completion, checking for errors, and monitoring the deadlines for submitting reports.

- Now all accounting records are posted on an open information resource called the State Information Resource of Accounting (Financial) Reporting (BFO resource). The BFO Internet service is available to all users and allows you to obtain free information about the accounting (financial) statements of any company. The openness of data, as well as the close “look” of the Federal Tax Service, require careful attention to the preparation of submitted accounting reports.

What balance sheet annexes are required for reporting purposes?

Order of the Federal Tax Service of the Russian Federation dated November 13, 2019 N ММВ-7-1/ [email protected] approved formats for presenting full and simplified annual financial statements in electronic form, including the auditor’s report.

The full composition of financial statements in the Federal Tax Service:

- balance sheet (form 1);

- statement of financial results (form 2);

- applications:

— statement of changes in capital (form 3); — cash flow statement (form 4); — report on the intended use of funds (only for non-profit organizations); — explanations to the balance sheet, financial results statement (formerly called Form 5).

- audit report.

However, not all enterprises must submit reports “in full”. Organizations that submit simplified financial statements have the right not to prepare appendices of reports to the balance sheet in forms 2.4 and explanations. This right is granted to small and micro-enterprises, residents of Skolkovo, the criteria of which are established in Article 4 of Law No. 209-FZ of July 24, 2007. Such companies can only submit simplified forms of balance sheet and income statement. They can also submit applications and explanations, but only if they themselves consider it necessary. The state does not require additional reporting from them.

Reporting changes in capital

IMPORTANT!

The unified form was approved by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010, and has an assigned number according to the All-Russian Classifier of Management Documentation (OKUD) 0710004. Form No. 3 is no longer used.

According to the norms of Order No. 66n, the statement of changes in capital is a report on the value of the company for the founders and its operating ability. Form 0710004 is included in the list of final accounting reports. If the organization carried out operations on such indicators as equity and authorized capital (AC), profits and losses, revaluation of property and others in the reporting period, this is shown in f. 0710004.

The amounts of taxes and contributions are not taken into account in the form. By analyzing the document, they determine how the movement of capital property and assets of the enterprise was carried out in the context of types (own, authorized, reserve, additional, etc.) or specific periods of time.

When and in what forms should reports be submitted?

Tax accounting reports must be submitted within three months from the end of the reporting year. For example, reporting for 2021, including appendices to the balance sheet, must be submitted in one package to the Federal Tax Service no later than March 31, 2022.

All reports must be in electronic form; paper will not be accepted from anyone (according to the legislative situation as of November 2021 - the time of writing).

The forms of reports and annexes are in force, the content of which is set out in the Order of the Ministry of Finance “On approval of forms of financial statements” dated 07/02/2010 No. 66n. The requirements for the format of electronic documents are established in the Order of the Federal Tax Service dated November 13, 2019 No. ММВ-7-1/570.

What does the report consist of?

Order No. 66n specifies what information is reflected in the statement of changes in capital; the reporting includes 3 sections:

- Capital movements reflect changes in the structure of resources and the operating ability of the company.

- Adjustments due to accounting policy updates and error corrections.

- Net assets indicate the position at the beginning and end of the year.

All final information about the financial and economic activities of the organization is distributed according to the following main parameters:

- types of capital, ways of changing it;

- reporting periods (years).

When preparing reports, a period of 3 years is taken (the reporting year and the two previous ones). In the 2022 reporting, we fill in information for 2021-2019.

Appendix to financial statements: explanation, ex-form 5.

Explanations to financial statements detail the balance sheet and allow information about individual types of assets and liabilities to be presented in a simple and understandable form. Not all tables recommended in this reporting form can be used, but only those that are necessary to disclose the indicators indicated in the balance sheet.

What are the differences between the explanations and the application on Form 5?

The name “fifth form or form No. 5,” familiar to many accountants with experience, is not used in the currently used composition of accounting reporting forms. This form was previously in force in accordance with Order of the Ministry of Finance dated July 22, 2003 No. 67n, which has now lost force. Form No. 5 was called “Appendix to the Balance Sheet” and consisted of the following sections:

- intangible assets;

- fixed assets;

- profitable investments in material assets;

- expenses for research, development and technological work;

- expenses for the development of natural resources;

- financial investments;

- accounts receivable and accounts payable;

- expenses for ordinary activities (by cost elements);

- provision;

- government assistance.

Currently, the Appendix to the Balance Sheet is not used as an independent approved form of reporting. The Explanation to the Balance Sheet and Income Statement is currently used. The composition of these explanations is in many ways the same form No. 5 that was previously used. Explanations to the balance sheet and profit and loss account now contain the following sections:

- intangible assets and expenses for research, development and technological work (R&D):

- fixed assets;

- financial investments;

- stocks;

- accounts receivable and accounts payable;

- production costs;

- estimated liabilities;

- securing obligations;

- government assistance.

The organization itself has the right to determine which items should be indicated in the explanatory note in order to most accurately detail the financial position at the end of the reporting year.

How to write a report

The OKUD form 0710004 is formed strictly in accordance with the requirements established by the Ministry of Finance of the Russian Federation. The report is compiled in several stages.

First of all, you need to fill out the title part of the document. To do this, information about the name of the enterprise, form of ownership, INN, KPP, codes according to all-Russian classifiers, type of activity and unit of measurement used in the register are entered in the appropriate lines.

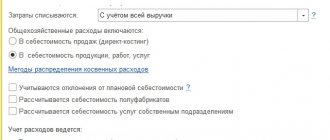

Next, fill out the sections of the tabular part of form 0710004. The procedure for filling out reporting items in relation to net assets is provided for by Order of the Ministry of Finance No. 84n dated August 28, 2014. The annual report on changes in capital contains information about transactions with the organization’s capital - its decrease, increase and other changes for the reporting and previous years. Here are instructions on how to fill it out:

- in the 1st section, data on net profit and losses, changes (increase or decrease) in the insurance system, profit and loss items, income and expense values in monetary terms, etc. are indicated. The table shows that the movement of capital in section 1 of the report form on changes in capital is presented by the following indicators: increase, decrease in capital property, change in additional and reserve capital, balances at the end of the reporting year;

- Section 2 is intended to reflect adjustments and amendments to accounting policies. Corrections are made here to previously made errors in calculations (it is necessary to note the indicators before and after the amendments). The adjustment is made in accordance with International Financial Reporting Standards (IFRS);

- in section 3 - “Net assets” - it is necessary to determine the real value of the enterprise’s operating capacity (the difference between assets and resulting liabilities), the current value and status as of the reporting date.

A sample of how to fill out a line-by-line example of a statement of changes in capital for 2022:

What balance indicators are deciphered by other applications?

Not all balance sheet indicators are specified in the explanation. The balance sheet supplements also include:

- Cash and cash equivalents are deciphered in the DDS report - the cash flow statement. This report should reflect all cash inflows and outflows for 2022, including those not classified as income and expenses. For example, taking out a loan or paying out of net profit. The DDS does not need to reflect the movement of money within the company.

- The size of the authorized capital and retained earnings by period are specified in the OIC - the report on changes in capital. This reporting form shows how the authorized capital changed during the reporting year, from what sources, and shows the structure of these funds.

- Report on the intended use of funds. Applies to the expenditure of funds allocated to non-profit organizations from the budget.

Document structure

Form 3 of financial statements, which can be found at the end of the article, consists of 3 sections:

1. "Movement of capital."

2. “Adjustments due to changes in accounting policies and correction of errors.”

3. “Net assets.”

The first section reflects the movement of capital (its increase or decrease in monetary terms) for the reporting year in comparison with the previous one. The changes in capital that have occurred are indicated with a distinction between its types - authorized (AC), additional (AC), reserve (RK), retained earnings or uncovered loss (NP) and the company’s own shares (SA) purchased from shareholders, i.e. balance sheet items contained in the third section of the balance sheet. The table clearly shows from what sources the transformation of capital took place.

The data in the first section is filled in line by line, each value corresponds to a line under a specific code, and the indicator in it must be linked to accounting registers and balance:

| Line code | What does it mean | What does it correspond to? |

| 3100 | Amount of capital in thousand rubles. as of the end of the year preceding the previous period. For example, when reporting for 2020, data for 2022 is recorded in this line | The sum of credit balances of accounts 80, 82, 83, 84 at the end of 2018 (i.e. balance sheet data on line 1300) |

| 3210 | Increase in capital for the previous reporting year. In the 2020 report, data for 2022 is indicated here | Amount of increase in credit turnover of accounts 80,82,83,84 |

| 3211-3216 | Breakdown of the amounts of increase by type of capital, i.e. according to the corresponding columns | |

| 3220 | Decrease in capital for the previous year | The amount of decrease in turnover on debit accounts 80,82,83,84 for 2019 |

| 3221-3240 | Reflection of debit turnover by type of source | |

| 3200 | Capital amount as of 12/31/2019 | page 3100 + page 3210 – page 3220 The total should be equal to the amount on line 1300 of the balance sheet |

| 3310 | Increase in capital for the reporting year (2020) | Total increase in credit accounts 80,82,83,84 for 2020 |

| 3311-3316 | Decoding by type of sources | |

| 3320 | Decrease in capital for the reporting year | |

| 3321-3340 | Explanation of capital reduction by type | |

| 3330 | Amount of capital in thousand rubles. as of 12/31/2020 | page 3200 + page 3310 – page 3320 and the result page 1300 on the balance sheet |

Filling out the section is not a difficult task - data is entered into the document sequentially:

- capital balance at the end of the year preceding the previous period,

- indicators of capital transformations for the previous reporting year - general and with a breakdown by type, balance at the end of the period,

- capital flow indicators for the reporting year and its balance.

The second section is devoted to adjustments to the capital structure that occurred due to changes in accounting policies (AP) or corrections of errors made in previous periods (IA). In the table of this section, information is also entered in the corresponding rows and columns:

| Code | What does it mean |

| 3400 | Unadjusted equity: |

| 3401-3402 | including for uncovered losses/retained earnings and other types of capital |

| 3410-3412 | Adjustments caused by changes in the CP |

| 3420-3422 | Adjustments related to AI |

| 3500 | Adjusted capital amount: |

| 3501-3502 | including for profit/loss and other types of capital |

If there are such changes, it is more advisable to start generating the report from the 2nd section, since these transformations will certainly be reflected in the stock accounts (80, 82, 83, 84), and therefore will affect the results of the first section.

The third section of the OIC contains information about the amount of the company’s net assets for three years (the reporting year and the two previous ones). To reflect them, line 3600 is allocated; the size of net assets is calculated as the difference between the sum of all the company’s assets and all its liabilities.