BSO – strict reporting forms. In some cases, they can be used instead of a check if a cash register is not used for payment. Persons and organizations providing services need to know who is allowed to replace BSO checks, how to draw them up, and what nuances there are when filling them out. We will also clarify in the article the issues of accounting and disposal of forms.

Question: Is it possible to deduct VAT on hotel services if the tax is not allocated in the strict reporting form issued to the posted worker (clause 7 of Article 171 of the Tax Code of the Russian Federation)? View answer

Working outside the cash register: who can?

Strict reporting forms are an alternative way to record payments in cash or by card when cash register is not used. Clause 3 Art. 2 of Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) payments using payment cards” allows such accounting for certain categories of individual entrepreneurs or organizations. Those engaged in certain activities have the right to use BSO instead of checks, namely:

- sells press and related products at kiosks (newspapers and magazines should make up more than half of the assortment);

- sells securities;

- sells lottery and city transport tickets;

- provides food to pupils and students, as well as employees of educational institutions;

- engages in trade in specially designated places, such as markets, fairs, exhibition complexes, etc. (separate pavilions, shops, tents, etc. inside such places are subject to other requirements);

- peddles or sells from carts (except for complex equipment and perishable food products);

- offers tea and similar products in train carriages;

- makes it possible to purchase medicines at paramedic stations in rural areas;

- sells ice cream from trays, soft drinks, beer, butter, etc. spilling from tanks, waddling live fish and vegetables;

- accepts glass containers and scrap (except metal);

- offers to buy religious products and literature in specially designated places (temples, church shops, etc.), provides services for worship;

- sells stamps at their face value.

Is it possible to use BSO instead of a cash register ?

What is the procedure for writing off strict reporting forms ?

ADDITIONALLY. It is allowed not to use cash registers, using BSO instead of checks, for those entrepreneurs who operate in hard-to-reach areas (their list is approved by regional legislation).

Accounting for expenses using strict reporting forms

Since BSO are taken into account off the balance sheet, the question arises where to allocate the costs of their acquisition. The procedure for applying the classification of operations of the public administration sector (KOSGU), approved by order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n, indicates that such expenses are taken into account according to the analytical code KOSGU 226 “Other work, services”, that is, the last 3 digits of the budget expense account will be 226. Let us list the following accounts:

- 0010960226 “Direct costs for the manufacture of finished products, performance of work, provision of services”;

- 0010970226 “Overhead costs for the production of finished products, performance of work, provision of services”;

- 0010980226 “General business expenses of the institution”;

Example:

The institution purchased 10 work books for 230 rubles. BSO are accounted for at the actual cost of the purchase. Of these, 4 were issued to employees serving in the management apparatus this month.

Expenses for the acquisition of BSO were taken into account in the amount of 2,300 rubles:

- Dt 0010980226 “General business expenses of the institution”;

- Kt 0030226730 “Increase in accounts payable for other works and services.”

BSO reflected on the balance sheet in the amount of RUB 2,300:

- Dt 03 “Strict reporting forms.”

The cost of 4 work books in the amount of 920 rubles was written off:

- Kt 03 “Strict reporting forms”.

Legislative regulation

Clause 2 Art. 2 of Federal Law No. 54 speaks of the possibility of using BSO instead of cash registers when providing services to the population included in the corresponding list of OKUN.

Federal Law No. 290-FZ of July 3, 2016 amended the above-mentioned Federal Law No. 54, making the list of services, payment for the provision of which can be registered using BSO, without cash register, exhaustive.

In 2008, the government of the Russian Federation updated the regulations on making payments without the use of cash registers (Resolution No. 359 of May 6, 2008). It covers in detail the requirements for this type of documentation, the procedure for settlements with their help, and the features of accounting and disposal. The main changes (compared to previous requirements) are as follows:

- old BSO forms are considered irrelevant and cannot be used;

- entrepreneurs must themselves develop new forms of SSB (except for certain types of activities for which standard ones have been approved);

- The BSO must contain certain details;

- You must indicate typographical information if the BSO was printed in this way.

How is it regulated?

The write-off of BSO is regulated by government decree No. 359 of 05/06/2008, which sets out the details of the procedure. Order of the Ministry of Finance No. 52n dated March 30, 2015 reflects recommendations for working with BSO. Regulatory acts establish a procedure for writing off damaged strict reporting forms, in accordance with which they are subsequently destroyed.

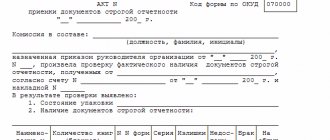

State and municipal enterprises use the OKUD form 0504816 for the procedure, which is approved by law as the only possible one. Commercial firms have the right to independently develop and secure the right to use other forms of the write-off act, which will require including it in the accounting policy.

Organizations often use document form 0504816, accepted by inspection authorities. The act is convenient and has fields for entering the necessary information.

Nuances of form design

The form for strict reporting must be produced exclusively in printing or generated by automated programs that meet certain requirements for the protection and recording of data (the second method is practically not used in practice due to the difficulty of meeting these requirements).

FOR YOUR INFORMATION! Forms printed using a regular printer are invalid.

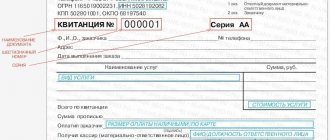

A number of fields must be required; the rest can be entered by the entrepreneur at his own discretion. The law requires that the form must contain the following information:

- name, a unique number of 6 characters and a series of two capital letters (assigned arbitrarily by the entrepreneur);

- name of the organization or name of the individual entrepreneur;

- for legal entities – address of the executive body;

- TIN;

- type and cost of the service provided (in money);

- amount to be paid;

- date of payment and completion;

- details of the person filling out the document, signature, seal (if applicable);

- additional service details.

IMPORTANT! External registration of your own form of the form is not required; it is enough to approve it in the internal accounting policy.

Admission

Strict reporting forms are printed or generated using automated systems (clause 4 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359).

Forms produced by printing must be recorded by name, series and numbers in the document form accounting book. The form of such a book for commercial organizations has not been approved. Therefore, the organization needs to develop it independently. You can take the following as a basis for developing your own document form:

- book form for recording documents of strict reporting OKUD 0504819;

- form of the book of accounting of strict reporting forms OKUD 0504045.

The sheets of the book of accounting forms must be numbered, laced, signed by the head and chief accountant of the organization, and also sealed.

This follows from paragraph 13 of the Regulations, approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359, and letter of the Ministry of Finance of Russia dated August 31, 2010 No. 03-01-15/7-198.

Accounting for forms produced using automated systems is carried out automatically using software that allows you to obtain information about issued strict reporting forms. In this regard, when generating strict reporting forms in an automated way, the organization must comply with the following requirements:

- the automated system must be protected from unauthorized access, identify, record and store all operations with the document form for at least five years;

- When filling out and issuing a document form, the automated system stores the unique number and series of its form.

This is stated in paragraph 11 of the Regulations, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Receive the BSO on the same day with an acceptance certificate. It can be drawn up, for example, according to the form approved by the GMEC protocol of June 29, 2001 No. 4/63-2001. The act must be approved by the head of the organization and signed by members of the commission for the acceptance of strict reporting forms. The composition of the BSO acceptance committee is fixed by order of the head of the organization. Such rules are provided for in paragraph 15 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

How to fill out the BSO

The regulations set out a number of requirements for filling out this document:

- clear, legible, without discrepancies;

- corrections are not allowed;

- at least in two copies.

What to do if the BSO is damaged

Made a mistake in a strict reporting document? This document cannot be thrown away because it is numbered. You are supposed to cross out the damaged form and hand it in at the end of the working day along with the proceeds and the current BSO (copies and counterfoils). They will be attached to the BSO Account Book.

Sometimes it happens that the form is filled out correctly, but the client refused the service at the last moment and therefore did not pay for it. With such a BSO you should do the same as with a damaged one: cross it out and hand it in at the end of the day in its entirety: 2 copies with the same number (or a copy and a spine).

NOTE! If the forms are not printed, but generated by an automated system, then opposite the damaged form should be written. Printed invalid BSOs are subject to recording and destruction in the usual manner.

Accounting for strict reporting forms

BSO turnover is recorded in off-balance sheet account 006, which is called “Strict Reporting Forms”. BSO accounting is carried out through entries reflecting the amount of costs for the production of forms (clause 22 of the minutes of the GMEC meeting No. 4/63-2001). As a rule, these are the postings:

- Dt account 26 “General business expenses”;

- Kt account 60 “Settlements with suppliers and contractors.”

In some cases, BSO accounting involves the creation of subaccounts for account 006. This is possible if the forms capitalized by the accounting department are subsequently issued to other employees who actually manage the BSO (we examined a similar scenario above). In this case, subaccount 006-1 “BSO in accounting”, as well as subaccount 006-2 “BSO from executors” can be formed.

How to correctly write off BSO in accounting and what documents to prepare? The answer to this question was given by 2nd class State Civil Service Advisor I. O. Gorchilina. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

How strict reporting forms are taken into account

A financially responsible person must be responsible for recording, storing and disposing of BSO (an appropriate agreement is concluded with the employee or management takes over this function). The receipt of forms from the printing house is reflected in the acceptance certificate signed by the commission.

Further dynamics are kept in the BSO Accounting Book.

BSO accounting book

The form of this mandatory accounting document has not been approved; an enterprise or individual entrepreneur can develop it independently. Primary requirements:

- the sheets should be numbered, stitched, and the firmware sealed;

- they must contain the signature of the manager or chief accountant;

- forms are counted by names, series, numbers.

The book is divided into several parts: the forms received and those transferred for use are separately reflected, the balance for each type of form is displayed (it must match the inventory data). The following columns are provided:

- date of receipt (transfer);

- number of forms;

- who transmitted;

- Based on what document?

Criteria for correct numbering of strict reporting forms

An important criterion characterizing the accounting and storage of BSO is the correct numbering of the relevant forms.

The main requirement for a BSO is the presence of a unique 6-digit serial number and a series consisting of 2 letters. At the level of federal legislation, the noted criteria are not fixed, but they are regularly found in departmental legal acts regulating the production of BSO (for example, in the letter of the Ministry of Culture of the Russian Federation No. 2344-01-39/03-E4 dated April 13, 2009). These provisions can be applied by subjects of legal relations in other industries on the principle of legal analogy.

The relevant details of the forms - series, number - will need to be recorded in the marked forms (BSO acceptance certificate, BSO accounting book).

As we noted at the beginning of the article, BSOs must be produced using the printing method or using automated systems. In the first case, the organization, as a rule, orders the production of forms from a third-party contractor who has the necessary printing equipment. If such an order is being made for the first time, then you can start producing BSO with series AA and number 000001. But in subsequent orders, printed forms must begin with the number following the one that was present on the last BSO of the previous edition.

The use of automated systems for issuing forms assumes that the correct numbering of the BSO (in correlation with entering the necessary information into the system registers) will be carried out automatically by the corresponding software.

BSO audit

It is necessary to carry out an inventory of forms from time to time. This is usually done simultaneously with cash reconciliation. The forms are checked by numbers and series, separately for each storage location and the persons responsible for them. The actual availability is verified with the records in the accounting documentation.

The results are reflected in the inventory list, the form of which (INV-16) was approved by Decree of the State Statistics Committee No. 88 of August 18, 1998. The inventory is drawn up in two copies, and if the financially responsible persons have changed, in three.

BSO storage

Forms must be stored in safes or specially equipped rooms where they cannot be stolen and where they will not be damaged. At the end of each working day, storage areas must be sealed or sealed.

Used documents confirming the acceptance of money (copies, counterfoils) must be saved for another 5 years. To do this, they should be placed in bags that are sealed.

After the expiration of the 5-year period, the BSO that has lost its relevance is destroyed according to a protocol similar to the destruction of documentation (based on the commission’s act).

Which printing houses have the right to print BSO

Currently, printing activities are not subject to licensing. The only exceptions are protected products, for the production of which special equipment, materials and technologies are used, for example, shares, bills, money, etc. When producing strict reporting forms, security methods are not used, so they can be produced in any printing house that has equipment for printing and consistent numbering.

Moreover, it is possible to produce a BSO using a computer and print it out on a printer, but for this it is necessary to use special programs that guarantee the uniqueness of the form being produced. This is mentioned in the law, but what specific programs need to be used is unknown. Therefore, to avoid misunderstandings on the part of the tax authorities, most entrepreneurs print forms using a typographic method.

This issue is discussed in more detail in a separate article.