The difference between receipts and payments in the DDS report and income and expenses

There are many differences, so receipts and incomes should not be confused. Firstly, these two concepts are most often separated in time, for example, due to a deferred payment. Secondly, not every receipt is income, and not every payment is an expense.

Example . My Defense LLC sells tea. In June, the company sold tea for 300 thousand rubles. But in fact I received the money only in August. To produce this tea, 100 thousand rubles were spent on craft bags. But the director agreed with the package manufacturer on a deferment and will pay only in July. In addition, the company took out a loan of 50 thousand rubles in July. In the table we have broken down income, expenses, receipts and payments by month.

June, rub. July, rub. August, rub. Income 300 000 Consumption 100 000 Receipt/influx 50 000 300 000 Payment/outflow 100 000

As you can see, income in the example was recognized before the money actually arrived. The same goes for expenses. But a loan is not income at all, since the money must be returned. But the loan receipt appears in the DDS report. If My Defense LLC issued a loan to someone, we would count the amount as an outflow, but not as an expense.

With barter, there will be no cash flows in principle, since money does not move. But there will be income and expenses. Income is the value of the property received, expense is the value of the property transferred.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What is ODDS

The cash flow statement shows information about all sources of cash flow and how they are used during the reporting period. Also, based on the report data, you can determine revenues using an indirect or direct method. Incoming amounts will be classified by type of source and shown for a given period.

The main purpose of the report is to provide an overview of the organization's overall operating results, short-term liquidity and long-term lending opportunities. General financial analysis of a company's activities is no longer difficult.

The report is used not only by business owners and managers. ODDS is also necessary for managers and other users who want to track their income and expenses.

ODDS allows you to control:

- Where and in what volume the funds come from and where they are then used.

- Is the company able to ensure an increase in revenues?

- Is the company capable of fulfilling the necessary obligations?

- Are there enough funds in the account for successful development in the future?

- If there is a discrepancy between profit and total cash, the report allows you to understand the reasons.

- Is the company able to meet investment needs from its sources?

Methodology for working with ODDS

To correctly generate data in the ODDS report, it is necessary to divide the inflow and outflow of cash into three types of activities:

- Current (operational). The type of activity that is the main one in the company. This type may also include activities that generate income and expenditure of money.

- Investment – directly related to the purchase, production or sale of assets that are not in circulation. For example, fixed assets or intangible assets. It can also be different types of investments that are not included in the general list of funds.

- Financial activities. With this type of activity, the ODDS reflects changes depending on the size and composition of the company’s total capital. Most often, this type of activity is used when attracting creditors.

There are two main methods for generating a cash flow statement: indirect and direct. Let's look at each of them in more detail.

Cash flow structure

The structure of the report is usually the same. It doesn’t matter whether the report is intended for internal use or for submission to the Federal Tax Service, there are three groups of cash flows.

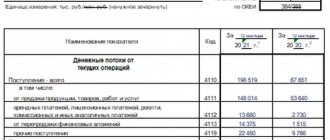

Cash flows from current operations or operating activities

These are all cash movements related to the company's main activities and are usually the largest section of the report. Recorded here:

- proceeds from the sale of goods and services;

- payments to suppliers and contractors;

- rent, license payments, royalties;

- transfers for remuneration of employees and so on.

Cash flows from investment operations

This section includes all payments and receipts from the company's investment activities. It can be:

- proceeds from the sale of equipment, machinery, buildings;

- inflows from the sale of shares of other companies;

- receipts in the form of dividends on shares held by the organization;

- payments for the purchase of new equipment and other fixed assets;

- payments for the purchase of shares and securities, and so on.

Cash flows from financial transactions

All cash movements associated with loans and borrowings are reflected here. For example:

- receipts in the form of credit or borrowed funds;

- owner deposits;

- inflows from the issue of shares;

- payments to owners upon repurchase of shares from them;

- dividend payments.

For each group of flows, the balance is calculated - the difference between receipts and payments. Within one group, the value can have a “+” sign or a “-” sign. Then the balances for all groups are summed up and added to the cash balance at the beginning of the period.

The total amount cannot be less than 0! Otherwise, it turns out that you spent more money than you had, and this is impossible. This is the main rule that must be followed when drawing up a report.

What are cash flows and their balances

Cash Flow is the receipt and payment of cash and cash equivalents. Cash flow is not considered to be any change in the form of money: the exchange of cash for cash equivalents and vice versa, the purchase or sale of currency, the transfer of money from one account to another, the withdrawal or deposit of cash. But only the change in form itself: if the amount of money changes, the difference forms a separate cash flow.

Cash Flow Balance is the difference between receipts and payments. If there were more receipts during the reporting period, the balance is positive. If there were more payments, the balance is negative.

Example 3.

Yesterday the seller sold the product for $100 and received payment. The rate was 69 rubles. for a dollar. Today he exchanged dollars for rubles. The course is already 70 rubles. for a dollar. Cash flow (receipt) yesterday amounted to 6,900 rubles. Today there was no cash flow due to currency conversion, but due to the difference in exchange rates, an additional flow of 100 rubles arose. The total positive balance of cash flows amounted to 7,000 rubles.

In some months the cash flow balance may be negative. If the business has fat in the form of account balances and other types of money, this can be survived. Especially if profit is fixed at the same time. But a persistently negative cash flow balance is a warning sign. It means that debtors live at your expense. If possible, this should be avoided.

Methods for preparing a DDS report

There are two methods for compiling DDS: direct and indirect. In domestic practice, only the direct method is used. Indirect is more common abroad.

Direct method

When constructing a DDS report, the accountant uses all transactions corresponding to accounts 50-55. That is, it distributes all payments and receipts across the cash register and accounts by type of cash flow. This is the only method that is legally permitted in Russia.

The disadvantage of the direct method is that it does not correlate in any way with profit from the income statement.

Indirect method

Not used in Russia. In this way, the report is collected when applying IFRS. This method is closely related to the income statement and balance sheet. When compiling, the accountant uses the profit figure from the income statement and adjusts it for non-cash items, such as depreciation and exchange rate differences.

The adjustment occurs as follows: non-monetary items with a “+” sign are subtracted from profit, and those with a “-” sign are added. For example, accounts receivable is a non-cash item with a “+” sign that is deducted from profit because it is money not received.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

ODDS

Cash flow statement (CFS) is a mandatory type of reporting under IFRS. It shows the company's cash flow generation capabilities, as well as key financial expenditure items. This data is extremely important for users of reporting when making economic decisions.

According to the requirements of IAS 7 “Statement of Cash Flows”, all organizations must prepare a report and provide it as part of the financial statements for each period in which they are formed.

According to IFRS (IAS) 7, information on financial flows is provided for the following activities:

- operating room

- Financial

- Investment

IFRS (IAS) 7 “Report on DDS” suggests two ways to generate this report: direct and indirect.

It is important to remember that DDS in accounting has its own characteristics. The indirect method is provided exclusively for analyzing the flow of operating cash. To represent the movement of money from activities related to financial circulation and investment, an exclusively direct method is used.

IAS 7 gives preference to the direct method of reporting. However, a fairly large number of companies now use an indirect method of generating reports. Firstly, because this method is simpler. Secondly, because it demonstrates how cash flows are related to the financial performance of the company. This is extremely significant information for the owner and management of the organization.

In this material, we will look at both options for generating a cash flow report according to IFRS standards and see how you can set up the automatic creation of this report in BIT.FINANCE.

Working with Operations

The flow of funds from operating activities shows the income and expenditure of funds from the leading activities of the organization (see examples in Table 1). This section is key, since it makes it clear how the company’s key activities contribute to the receipt of funds that are required to pay obligations and maintain its own operating capabilities.

Direct method

The direct method is based on the presentation of the main sources of income and expenditure. Information about finances is provided here in terms of income and expenditure items.

| Operating activities | Change (+/-) |

| Revenue from buyers, customers | XX |

| Other income | XX |

| Purchase of goods, works and services | XX |

| Salary | (XX) |

| Payment of interest on loans and credits | (XX) |

| Calculations for taxes and fees | (XX) |

| Income tax payments | (XX) |

| Other expenses | (XX) |

| Net change from operating activities | XX/(XX) |

Table 1: Example of the content of operating report items (direct method)

Indirect method

Displaying a company's cash flows using an indirect method demonstrates to those who work with financial statements how certain business transactions affect the flow of finances.

With the indirect method of reporting generation, it is assumed that the income (loss) of the reporting period is estimated adjusted for non-monetary transactions.

An example of articles from the section of the report on operating activities generated indirectly is shown in Table 2.

| Operating activities | Change (+/-) |

| Net income (loss) | XX/(XX) |

| Amendments for non-cash transactions: | |

| Depreciation of fixed assets and intangible assets | (XX) |

| Loss from the withdrawal of fixed assets and intangible assets | (XX) |

| Interest expenses | (XX) |

| Interest income | XX |

| Profit from exiting investments | XX |

| Income tax expenses | (XX) |

| Profit (loss) from currency revaluation | XX/(XX) |

| Writing off bad debts | (XX) |

| Dividend income | XX |

| Changes in reserves | XX/(XX) |

| Changes in stocks | XX/(XX) |

| Changes in accounts receivable | XX/(XX) |

| Changes in accounts payable | XX/(XX) |

| Cash flow from operating activities before taxes and interest | XX/(XX) |

| % paid | (XX) |

| Income tax paid | (XX) |

| Cash flows from operating activities | XX/(XX) |

Table 2: Example of the composition of items in the statement of cash flows for operating activities (indirect method)

With the help of BIT.FINANCE you can easily set up ODDS according to IFRS standards

Try the program for FREE

Investment activities

In terms of inflow/outflow of money from investment activities, data is displayed on the financial mass that the company invests in resources that are able to generate cash flows in the future.

Transactions related to the purchase/exit of non-current assets and other investments are often displayed here.

An example of items from the section in the statement of cash flows for investing activities is shown in Table 3.

| Investment activities | Change (+/-) |

| Proceeds from the sale of fixed assets and other non-current assets | XX |

| % received | XX |

| Proceeds from loan repayments | XX |

| Other income from investment activities | XX |

| Purchase of fixed assets, intangible assets | (XX) |

| Loans to other organizations | (XX) |

| Other cash outflows from investing activities | (XX) |

| Net change in finances from investing activities | XX/(XX) |

Table 3: Example of the composition of articles in a report on investment activities

Financial activities

It mostly includes financial flows that change the composition of capital and borrowed funds.

This data enables reporting professionals to predict future creditor claims.

An example of items from the financial activities section of the report is shown in Table 4.

| Financial activities | Change (+/-) |

| Loans and credits received | XX |

| Other inflows from financing activities | XX |

| Dividend payment | (XX) |

| Dividends received | XX |

| Repayment of loans and credits | (XX) |

| Repayment of finance lease obligations | (XX) |

| Other payments for financial activities | (XX) |

| Net change in financing activities | XX/(XX) |

Table 4: Example of the composition of items in a report on financial activities

DDS REPORT BUILDING MODEL

Let's consider the main stages of constructing a Cash Flow Report in BIT.FINANCE.

For these purposes, the BIT.FINANCE software product has a mechanism called “Custom Report”.

“Custom report” allows you to:

- Customize reports in custom mode with any fixed layout. This is especially important for the preparation of IFRS reporting, since the standards do not imply a single fixed form of reports, and different companies have different presentations;

- Set a custom report design;

- Automatically calculate report indicators based on accounting system data;

- Generate both individual and consolidated reporting;

- Create layouts in different languages;

- Generate reports in multiple currencies. When setting up a report, it is possible to set currency conversion algorithms for each indicator;

- Receive transcripts of report data to primary documents;

- Generate disclosure of required report indicators in the form of separate reporting forms.

The “Custom Report” report is located in the “Receiving Data” section:

First of all, you need to create an element in the “Custom Report Settings” directory:

Customizing the Report Layout

In the directory element “Custom Report Settings” you can configure the layout of the future report:

If the DDS report layout already exists in Excel, then you can simply copy and paste it into the layout area.

If necessary, you can set the report design by selecting “Properties” from the context menu:

In the report design form, you can set the font size and type, text color, background color, and border format.

If you need to generate a report in several languages, then for these purposes you can use the parameter mechanisms. On the “Parameters” tab, for each line of the DDS report, you can set the presentation in an unlimited number of languages.

For example, defining a parameter and specifying Russian and English spelling for the line “Revenue from buyers and customers” will look like this:

In order to bind this parameter to the layout, you need to select “Layout Actions” - “Set Parameter” - “Text in different languages”:

Parameters appear in the report layout as square brackets, for example [Revenue From Customers]

When generating a report, the generation language is specified in the “Language” parameter:

Also, using parameters, you can set parameters such as “Start date”, “End date”, a sign of a consolidated report, etc.

These parameters will change their meaning when the report is generated, depending on the selected report settings.

Try the program for FREE

Setting up calculated indicators

BIT.FINANCE, as a rule, is integrated into the accounting solution in which primary accounting is maintained. And the generation of transactions according to IFRS is performed:

- When posting a primary document in accounting from the RAS chart of accounts to the IFRS chart of accounts according to a given correspondence of accounts (mapping);

- Documents of parallel accounting of IFRS for fixed assets, intangible assets, financial leases, financial instruments, etc.

Thus, all transactions according to IFRS are already in BIT.FINANCE and setting up the receipt of data in the “Custom Report” comes down to indicating from which IFRS accounts and for which analytics the data should be received.

This is done as follows. In the directory element “Custom Report Settings” in the “Composition Method” attribute, the method of composing the data is determined, in which the methods of obtaining data are determined:

The appearance of the directory element “Methods of layout of data sources” is shown in the screenshot:

In the tabular part, data elements are configured, which determine the list of IFRS accounts from which data must be obtained, and, if necessary, filters are set by the value of the analyst:

If it is assumed that the DDS report will be generated in several currencies, then on the “Conversion at rates” tab, you can set the method for converting numerical indicators into the reporting currency:

The choice of report presentation currency is performed in the “Currency” attribute:

Binding of a data element to the report layout is performed using the commands “Layout Action” - “Set Area Filling Rule”:

You can also set arbitrary formulas for any cell in the report layout. The formula editor opens with the command “Layout Action” - “Set Formula”:

This way you can configure:

- An arbitrary layout of the “Cash Flow Statement” report, generated in a direct way;

- An arbitrary layout of the “DDS Report” report, generated indirectly;

- Arbitrary algorithms for sampling data from the accounting system;

- Set algorithms for converting report indicators into any report presentation currency;

- Multilingual report presentation form.

Rules for drawing up a DDS report

Remember that a DDS report is essentially an analogue of a bank statement, which reveals information about the movement of all the company’s money. You also need to understand that the DDS report reveals line 1250 of the balance sheet.

When drawing up a DDS, follow the following rules:

- in the report, do not take into account cash flows that change the composition, but not the amount of funds: for example, do not record the transfer of money from an account to an organization’s account in the DDS report;

- reflect receipts and payments without VAT;

- Indicate VAT and excise taxes separately as part of current cash flows: we count all submitted VAT and compare it with incoming; if the tax presented is greater than the input tax, then the difference is entered in “Other receipts”, otherwise - in “Other payments”;

- employee salaries are taken into account with personal income tax and insurance contributions;

- income tax is shown separately in flows from current activities.

BDDS is

BDDS is one of three financial budgets. Besides this there is also:

- budget of income and expenses (BDR). Read more about him in the article “BDR”

- balance budget.

The BDDS reflects planned receipts and payments, and also calculates net cash flow (NCF). Together with money balances, the latter shows either a surplus or deficit in the money supply.

The main purpose of compiling a BDDS is to manage the solvency of the company. Particular tasks follow from it:

- justification of the need to attract and calculation of the amount of additional financial resources (borrowed funds);

- awareness of the irrationality of the current conditions of settlements with counterparties and their subsequent adjustment;

- creating an information basis for plan-fact analysis of cash flows and searching for reasons for the discrepancy between the forecast and reality.

How to Use a Cash Flow Statement

To answer this question, you need to understand who is using the report. And there are two user groups.

External users are the Federal Tax Service. It is not for nothing that the DDS report is included in the group of financial statements. However, not everyone submits the DDS: small businesses are exempt from submitting it if they believe that it does not contain important information. Such a report is made once a year along with the balance sheet.

Internal users are top managers and owners of the company who want to understand the state of the main asset - money. For them, the DDS report is often even more interesting than the financial results report. The reason is that the DDS is based on actual data, that is, it allows you to really judge how much money came and went from the company.

But the financial results report is based on accounting data, which largely depends on the accounting methods.

Example . The head of My Defense LLC makes a decision to open a new business line. In the financial result report, he sees a profit of 300 million rubles. The number is not small. But then he looks at the DDS report and sees that the balance of money is three times less - 100 million rubles. The reasons are different, for example, the remaining 200 million rubles are receivables that are unknown when they will return. Since the business actually only has 100 million, the manager is holding back the opening of a new direction.

For internal use, the report is prepared at different intervals. Some once a month, some once a quarter.