How are the criteria applied?

The status of the largest taxpayers at the federal level, which are subject to tax administration in the interregional inspectorates of the Federal Tax Service of Russia for the largest taxpayers, is assigned to organizations whose total income received for the year (for any year of the previous three years, not counting the last reporting year) exceeded 35 billion rubles (clauses 1, 8 Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ). The amount of income is determined according to the Statement of Financial Results by summing the indicators of the following lines (Order of the Ministry of Finance dated July 2, 2010 No. 66n):

- 2110 “Revenue”;

- 2310 “Income from participation in other organizations”;

- 2320 “Interest receivable”;

- 2340 “Other income”.

The largest taxpayers, regardless of income, may include a credit organization, an insurance, reinsurance organization, a mutual insurance company, an insurance broker, a professional participant in the securities market, a non-state pension fund that have the appropriate licenses (clause 4 of the Criteria, approved by Order of the Federal Tax Service dated 16.05 .2007 No. MM-3-06/ [email protected] ).

If certain conditions are met, the organization that submitted an application for tax monitoring may be classified as the largest taxpayer (clause 5 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ).

If the amount of income an organization receives in a year is in the range from 10 to 35 billion rubles, then it belongs to the largest taxpayers at the regional level, i.e., it is subject to tax administration in the interdistrict inspectorate of the Federal Tax Service of Russia for the largest taxpayers (clause 6 of the Criteria, approved. By Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ).

It is important to consider that organizations that apply special tax regimes are not recognized as major taxpayers.

Please also note that even those organizations that do not meet the criteria of the largest taxpayers can be recognized as such based on a decision of the Federal Tax Service (clauses 5.1, 6.1 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [ email protected] ).

Organizations (with the exception of credit institutions), in respect of which an arbitration court decided to declare the debtor bankrupt and a bankruptcy procedure was introduced, cease to belong to the category of the largest taxpayers (clause 9 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06 / [email protected] ). It is also important to take into account that an interdependent entity of the largest taxpayer can also be classified as the largest and be subject to tax administration in the interregional (interdistrict) inspectorates of the Federal Tax Service of Russia for the largest taxpayers. At the same time, the own indicators of such an interdependent person no longer matter.

The criteria by which an organization is classified as a major taxpayer are approved by the Order of the Federal Tax Service. This:

- Indicators of financial and economic activity for the reporting year;

- Signs of interdependence of organizations, their impact on the economic results of the activities of interdependent persons;

- Availability of a license to carry out certain types of activities.

The most important things about the largest taxpayers in 2022

An organization will be classified as a major taxpayer in the following cases (Federal Tax Service Criteria).

- Annual income from 10 billion rubles. The tax authorities add up four lines on the income statement: 2110, 2310, 2320 and 2340.

- Interdependence with the largest taxpayer.

- The organization submitted an application for tax monitoring.

- By decision of the Federal Tax Service.

The largest taxpayers are registered without any statements. A notification will come from the interdistrict or interregional Federal Tax Service with a new checkpoint (5th and 6th digits - 50). The largest taxpayers submit all tax reporting, except for the calculation of insurance premiums, 6-NDFL and 2-NDFL, to the interregional or interdistrict Federal Tax Service (Clause 3 of Article 80 of the Tax Code of the Russian Federation).

Federal level organizations

An organization will be considered the largest taxpayer if it satisfies at least one of the indicators of economic activity for the reporting year:

- the total volume of federal tax accruals according to tax reporting data exceeds 1 billion rubles. For organizations in the field of provision of communication services, in the field of sales or provision for use of technical means that ensure the provision of communication services, in the field of transport services - the amount of accrued taxes must be over 300 million rubles. (clause 1.1 of the Criteria);

- the total volume of income received (according to Form No. 2 “Profit and Loss Statement” of the annual financial statements, indicator codes 2110, 2310, 2320, 2340) exceeds 20 billion rubles. (clause 1.2 of the Criteria);

- The organization's assets exceed 20 billion rubles. (clause 1.3 of the Criteria).

Certain categories of taxpayers have their own criteria values. For example, for organizations of the military-industrial complex and companies included in the list of strategic enterprises, one of the following conditions must be met (clauses 2-3 of the Criteria):

- the amount under concluded contracts for the export of strategic products should be more than 27 million rubles. in year;

- the amount of revenue from export deliveries of strategic products is more than 20% of the total revenue;

- average number of employees over 100 people;

- the share of the founder's contribution (state) is over 50%.

Definition of a large enterprise

There are several definitions of a large enterprise. There cannot be just one, since the country’s economy is large and diverse. A large firm is one that produces a significant and significant portion of the total volume of the industry. You can also rely on the following indicators:

- Volume of sales.

- Number of employees.

- Asset size.

A large enterprise means any of the following:

- A company is a legal entity in the authorized capital of which the state participates in more than a quarter of a percent.

- Subsidiaries with state participation in the capital of 50% or more.

- Companies with more than 250 employees last year and sales income of over 2,000 million rubles.

- State and municipal authorities, subjects of natural monopolies.

Criteria for a large enterprise in some industries

To call an enterprise large, it is necessary to take into account the specifics of the industry to which it belongs and the territory where it is located. The table shows the distinctive features for some sectors of the economy:

| Industry | Criteria for a large enterprise |

| Mechanical engineering |

|

| Agro-industrial complex |

|

New criteria for the largest taxpayers

By Order of the Federal Tax Service of the Russian Federation dated September 19, 2014 No. ММВ-7-2/483, the criteria for classifying taxpayers as the largest were adjusted. Let's analyze the positive and negative aspects of the changes made.

The Fiscal Department (Letter of the Federal Tax Service of the Russian Federation dated August 23, 2012 No. AS-4-2/13912) noted that the established “largest” criteria are subject to regular clarification depending on the economic situation. And by Order of the Federal Tax Service of the Russian Federation dated September 19, 2014 No. ММВ-7-2/483 (hereinafter referred to as the Order of the Federal Tax Service of the Russian Federation), such changes were made to two documents at once:

1) in the order of the Ministry of Taxes of the Russian Federation dated April 16, 2004 No. SAE-3-30 / [email protected] “On organizing work on tax administration of the largest taxpayers and approving criteria for classifying Russian organizations - legal entities as the largest taxpayers subject to tax administration at the federal and regional levels";

2) in the criteria for classifying organizations - legal entities as the largest taxpayers subject to tax administration at the federal and regional levels, approved by order of the Federal Tax Service of the Russian Federation dated May 16, 2007 No. ММВ-3-06/ [email protected] “On amendments to the order of the Ministry of Taxes RF dated April 16, 2004 No. SAE-3-30/ [email protected] "(hereinafter referred to as the Criteria).

CHOOSING A “SIMPLIED” OBJECT: 6 OR 15%?

"Federal" changes

The order of the Federal Tax Service of the Russian Federation preserved a special category of taxpayers (organizations of the military-industrial complex) with criteria for financial and economic activity that differ from the generally established ones. However, to recognize strategic enterprises as the largest taxpayers, the enterprise must meet all established criteria. As noted in the Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 27, 2012 No. Ф03-3038/2012. “... when resolving the issue of classifying an organization as a major taxpayer, the tax authority must proceed from an assessment of the totality of circumstances characterizing the activities of a particular taxpayer and influencing the possible classification of an organization as a major taxpayer.” That is, if the taxpayer did not have export supplies while meeting other criteria, then the enterprise of the military-industrial complex cannot be assigned the status of the largest taxpayer.

LEGAL SERVICES

- the total amount of federal taxes and fees accrued according to tax reporting data is over 300 million rubles;

- the volume of net assets at the end of the year is at least 25 million rubles;

- the amount of insurance premiums for the reporting period is at least 2 billion rubles.

Now this category of taxpayers has been expanded and restrictions regarding financial and economic indicators have been lifted. In addition, to classify taxpayers as the largest taxpayers at the federal level, another criterion was added for financial sector organizations - the presence of a license to carry out a specific type of activity:

| List of organizations engaged in financial activities | License name |

| Credit organisation. | To carry out banking operations |

| Insurance organization. | For insurance, reinsurance, mutual insurance, intermediary activities as a broker |

| Reinsurance organization. | |

| Mutual Insurance Society. | |

| Insurance broker. | |

| Professional participant in the securities market. | To carry out activities as a professional participant in the securities market and maintain the register |

| Non-state pension fund. | To carry out activities related to pension provision and pension insurance |

What consequences will the transfer of this group of taxpayers to the status of the largest?

The main disadvantage of having the status of the largest taxpayer is the close attention of the tax authorities. The frequency of on-site tax audits is usually once every 2 years.

In addition to on-site tax audits (usually lasting six months, and in the case of several separate divisions - more than six months), tax inspectorates require additional information about the upcoming amount of tax revenues to the budget, planned revenue indicators and other indicators (for forecasting budget revenues).

In relation to the largest taxpayers, so-called “in-depth” desk tax audits are carried out, requiring additional information and documents.

That is, such organizations will be given special attention in terms of tax control measures.

According to clause 6 of the Order of the Ministry of Taxes of the Russian Federation No. SAE-3-30 / [email protected], tax administration of organizations in the financial and credit sector will be carried out by the Interregional Inspectorate of the Federal Tax Service of the Russian Federation for the largest taxpayers No. 9.

Thus, if an organization carries out financial activities, for example, in the Ural region and receives the status of the largest taxpayer, then it will be registered with MI Federal Tax Service of the Russian Federation No. 9 in Moscow and, accordingly, will submit reports to the inspection for registration of major taxpayers ( regional and local taxes are paid at the location of the organization). In practice, this leads to an increase in the organization’s costs for sending documentation from the region to Moscow, for telephone conversations and travel expenses. It is impossible not to take into account possible problems associated with the transfer of personal accounts from one inspection (with which the taxpayer was registered) to another for the registration of major taxpayers (with which the taxpayer will be registered).

RESTORATION OF TAX ACCOUNTING

Tax benefits for enterprises

There are several types of tax benefits:

- Tax discounts. The paying company is given the right to reduce the amount of profit that is taxed. The amount of the discount corresponds to that spent on purposes encouraged by the state, for example:

- primary vocational education (PPE);

- advanced training and retraining of enterprise personnel.

- Exemption – provides for a reduction in the tax rate. For large enterprises, incentives are provided for the installation of energy-efficient equipment. Companies can be exempt from taxation when commissioning new facilities that have high energy efficiency. Their list is determined by the Government of the Russian Federation.

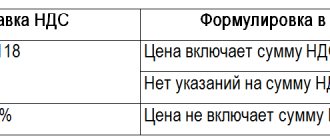

Local authorities have the right to reduce the company's income tax rate. This applies to the part that goes to their budget. The maximum rate of 18% can be reduced to 13% and 10% by decision of local authorities and from a position of expediency.

Investment tax credit

This loan means a deferment of the deadlines for paying income taxes (up to five years). It can be used for municipal taxes. Conditions:

- Repayment of the loan provided within the agreed time frame.

- Payment of interest. The rate is no more than ¾ of the refinancing rate of the Central Bank of the Russian Federation.

This type of tax credit is provided to large enterprises that are engaged in:

- innovative activities;

- technical re-equipment and modernization of production.

"Regional" changes

The order of the Federal Tax Service of the Russian Federation clarified financial and economic indicators at the regional level:

| Indicator name | Regional level | |

| It was (as amended by Order of the Federal Tax Service of the Russian Federation dated June 27, 2012 No. ММВ-7-2/ [email protected] ) | Became (as amended by Order of the Federal Tax Service of the Russian Federation dated September 19, 2014 No. ММВ-7-2/483) | |

| The total amount of federal taxes and fees accrued according to tax reporting data. | Over 75 million rubles to 1 billion rubles | |

| The total amount of income received (form “Profit and Loss Statement”, line codes 2110 “Revenue”, 2310 “Income from participation in other organizations”, 2320 “Interest receivable”, 2340 “Other income”). | From 1 billion rubles to 20 billion rubles | From 2 billion rubles to 20 billion rubles |

| The total amount of non-current and current assets (form “Balance Sheet”). | Over 100 million rubles to 20 billion rubles | |

| Average number of employees. | There was no criterion | Exceeds 50 people |

Thus, for the largest regional taxpayers, the lower threshold of the total amount of income received has been increased and an additional criterion has been introduced - the average number of employees.

To become the largest taxpayer, the above conditions must be met at the same time. The changes introduced by the Order of the Federal Tax Service of the Russian Federation will lead to a reduction in the number of largest taxpayers at the regional level.

Thus, when summing up the results of the administration of the largest taxpayers in one of the regions (Chelyabinsk region), it was noted that as of July 1, 2014, the number of largest taxpayers was 264 organizations, which is 12 less than in 2013.

That is, the number of largest taxpayers in the region is already decreasing, and taking into account the new criteria in an unstable economic situation, their number will be even smaller. And given that payments from the largest taxpayers make up a large share of the region’s budget (up to 80-90%), the “loss” of budget revenues will also affect the region’s social programs.

In addition, clause 5 of the Order of the Federal Tax Service of the Russian Federation directly stipulates that the largest regional taxpayers in terms of financial and economic activity do not include organizations under special regimes.

But already now, restrictive barriers have been established in the relevant chapters of the Tax Code of the Russian Federation devoted to the application of special tax regimes. So, for example, organizations classified as the largest taxpayers do not have the right to apply UTII (clause 2.1 of Article 346.26 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 05.08.2009 No. 03-11-06/3/204).

Organizations using the simplified tax system do not meet the criteria established for major taxpayers based on financial and economic indicators. The introduction of a special tax regime in the form of the simplified tax system already implies restrictions on the amount of revenue, the number of employees, and the cost of fixed assets (Article 346.12 of the Tax Code of the Russian Federation).

AUDIT OF ENTERPRISE REPORTING

And only when the fact of interdependence and the ability to influence the economic results of another largest organization is established (section II of the Criteria, first introduced by Order of the Federal Tax Service of the Russian Federation dated April 24, 2012 No. ММВ-7-2 / [email protected] ), such taxpayers can be classified as categories of largest taxpayers. Interdependence between organizations is determined in accordance with the rules of Article 105.1 of the Tax Code of the Russian Federation. Let us recall that since January 1, 2012, Article 105.1 of the Tax Code of the Russian Federation established 11 grounds for recognizing organizations as interdependent.

The most difficult thing seems to be the calculation of the direct and (or) indirect participation of an organization in another organization (clause 1, clause 3, clause 2, article 105.1 of the Tax Code of the Russian Federation). Let us illustrate the calculation with a specific example.

Interdependence of companies and availability of licenses for activities

An enterprise can be included among the largest taxpayers in a situation where the relationship with it is reflected in the functioning of a law firm whose performance indicators meet the criteria of the Tax Code. Contacts of this kind represent the interdependence of companies (Article 105 of the Tax Code of the Russian Federation).

The administration of tax amounts of an interdependent enterprise is carried out at the level (regional, federal), at which the control of the entity is carried out, whose functioning is characterized by the corresponding criterion indicators.

Business entities that have received state permission, i.e. licenses to engage in certain types of activities are subject to federal control. In this case, compliance/non-compliance with the assessed parameters of the tax code (the amount of tax payment or revenue received, the size of existing assets or staff, the fact of interdependence) is not taken into account.

These types of activities include (Order of the Federal Tax Service of the Russian Federation No. ММВ-7-2/274, 04/24/2012):

- Bank operations;

- pension provision (NPF);

- pension insurance and some other types of it, as well as reinsurance;

- intermediary brokerage services;

- activities at a professional level in the operation of the stock market.

The criteria for determining the largest taxpayer have changed

The Federal Tax Service of Russia has developed criteria for determining whether an organization is the largest or not (Criteria for classifying organizations - legal entities as the largest taxpayers subject to tax administration at the federal and regional levels, approved by order of the Federal Tax Service of Russia dated May 16, 2007 No. MM-3-06 / [email protected] , hereinafter – Criteria). Until recently there were only two of them:

- indicators of financial and economic activity for the reporting year, which are taken from the accounting and tax reporting of the organization;

- signs of interdependence.

But on September 19, 2014, an order of the Federal Tax Service of Russia came into force, which expands the above list (Order of the Federal Tax Service of Russia dated September 19, 2014 No. ММВ-7-2/483, hereinafter referred to as the Order). Now the second criterion has added signs of the taxpayer’s influence on the economic results of the activities of interdependent entities. They also introduced a new criterion - the presence of a special permit (license) for the right of a legal entity to carry out a specific type of activity.

Indicators of financial and economic activity

Indicators of financial and economic activity for classifying a taxpayer as the largest are taken for any of the three years preceding the current reporting year. If an organization in the reporting year ceases to meet the established criteria, then it retains its status as the largest for another two years (clause 2.4 of the Order).

Since the largest organizations are administered at the federal and regional levels, the criteria indicators will be different.

Federal level

For those organizations that fall into this category, at least one of the indicators of financial and economic activity for the reporting year must have the following values:

- the total volume of federal tax accruals according to tax reporting data exceeds 1 billion rubles. If an organization operates in the field of providing communication services, and also sells or provides for use technical means that ensure the provision of communication services, or provides transport services, then the amount of accrued taxes must be over 300 million rubles. (clause 1.1 of the Criteria);

- the total volume of income received (according to Form No. 2 “Profit and Loss Statement” of the annual financial statements, indicator codes 2110, 2310, 2320, 2340) exceeds 20 billion rubles. (clause 1.2 of the Criteria);

- The organization's assets exceed 20 billion rubles. (clause 1.3 of the Criteria).

FORM

Form No. 2 “Profit and Loss Statement”

Other forms: https://www.garant.ru/doc/forms/

There are also separate categories of taxpayers for which their own criteria are provided. So, for example, for organizations of the military-industrial complex and companies included in the list of strategic enterprises, one of the following conditions must be met (clauses 2-3 of the Criteria):

- the amount under concluded contracts for the export of strategic products should be more than 27 million rubles. in year;

- the amount of revenue from export deliveries of strategic products is more than 20% of the total revenue;

- average number of employees over 100 people;

- the share of the founder's contribution (state) is over 50%.

Regional level

With organizations administered at the regional level, everything is much simpler - indicators for them are not divided depending on the type of activity of the company. In addition, the Order also raised the threshold values of financial and economic indicators for the reporting year.

So, now, in order to become the largest regional taxpayer, all the following conditions must be met simultaneously:

- the total volume of income received (according to the data reflected in Form No. 2 “Profit and Loss Statement” of the annual financial statements in lines with indicator codes 2110, 2310, 2320, 2340) is in the range from 2 to 20 billion rubles. inclusive;

- the average number of employees exceeds 50 people;

- assets range from 100 million rubles. up to 20 billion rubles. inclusive, or the total amount of federal taxes and fees accrued according to tax reporting data is in the range of 75 million rubles. up to 1 billion rubles (clause 2.3 of the Order).

The legislators once again emphasized that if an organization applies special tax regimes in relation to relevant types of activities, then it does not belong to the largest ones (clause 2.3 of the Order).

Interdependence and licensed activities

The criterion of interdependence is applied when the taxpayer’s relations influence the conditions or economic results of the main activity of an organization recognized as the largest in terms of financial and economic indicators. Moreover, the taxpayer will be administered at the same level as the organization interdependent with it (Part 2 of the Criteria).

There is another special category of taxpayers engaged in financial activities, which are subject to federal tax administration, regardless of the volume of accrued taxes, net assets and revenue at the end of the reporting year, number of employees, interdependence with the largest company or other indicators. Initially, it included only credit and insurance organizations. But the Order expands this list. Now it includes a reinsurance organization, a mutual insurance company, an insurance broker, a professional participant in the securities market, a non-state pension fund that have licenses to carry out their activities (clause 2.2 of the Order).

HOW TO EVALUATE THE EFFICIENCY OF AN ENTERPRISE

Assessing the efficiency of an enterprise, due to its complexity, involves the use of partial and general indicators.

Based on specific indicators, you can determine:

- the efficiency of using each of the company's resources;

- the effectiveness of sales of each type of product/service of the company.

Based on general indicators, the following are determined:

- efficiency of all resources, products/services of the enterprise;

- the performance of the company as a whole.

The procedure for assessing the efficiency of an enterprise

The efficiency of an enterprise is assessed in several stages.

STEP 1. Calculate and evaluate overall profitability indicators , reflecting the efficiency of the company's production activities:

- business profitability - informs about the share of net profit in sales revenue:

Business profitability = Net profit / Sales revenue × 100%; (1)

- return on sales - gives an idea of the share of profit from sales in sales revenue:

Return on sales = Profit from sales / Revenue from sales × 100%; (2)

- profitability of products sold - shows the efficiency of product sales:

Return on products sold = Profit from sales / Cost of products sold × 100%. (3)

STEP 2. Calculate and evaluate overall profitability indicators , reflecting the efficiency of using enterprise resources:

- return on current assets —reflects the efficiency of using the organization’s working capital:

Return on current assets = Net profit / Average cost of current assets × 100%; (4)

- profitability of non-current assets - shows the efficiency of using the enterprise’s non-current assets:

Return on non-current assets = Net profit / Average cost of non-current assets × 100%; (5)

- return on equity - reflects the efficiency of the organization's use of equity capital:

Return on equity = Net profit / Average equity × 100%; (6)

- return on invested capital - characterizes the return on the amount of money invested in the business:

Return on invested capital = Net profit / (Average equity capital + Average long-term liabilities) × 100%; (7)

- return on borrowed capital - characterizes the efficiency of an organization's use of borrowed capital:

Return on debt capital = Net profit / Average debt capital × 100%. (8)

STAGE 3 . Conduct factor analysis of profitability indicators. The goal is to determine the reasons for deviations in the values of the reporting period in comparison with data from previous periods or plans for the reporting period.

STEP 4. Calculate and evaluate private performance indicators that reflect individual aspects of the enterprise. These may include the following indicators:

- cost intensity of production;

- production and wages per employee;

- the share of aggregated cost items in the cost of production, etc.

An example of assessing the effectiveness of a manufacturing company

Let's evaluate the efficiency of a manufacturing company for 2022. We will conduct the assessment in accordance with the above algorithm.

First of all, we will need data on the company’s performance for several reporting years (Table 3), which includes the following indicators:

- the company's revenue from product sales;

- cost of goods sold;

- costs of selling products;

- business management expenses.

We also need data on the structure of property, capital and liabilities of the company for the analyzed period (Table 4).

Based on the available data, we will calculate performance indicators.

Step 1. We calculate indicators of the overall efficiency of the enterprise.

We use formulas (1)–(3) and find the values of profitability of the business as a whole, profitability of sales and profitability of products sold.

Step 2. We calculate indicators of the overall efficiency of using enterprise resources.

We use formulas (4)–(8) and find the values of profitability of current and non-current assets, own, invested and borrowed capital. When calculating the return on borrowed capital using formula (8), data on short-term liabilities are used as the amount of borrowed capital, since data on long-term liabilities are involved in calculating the return on invested capital.

We reflect the results obtained in table. 5 and analyze their dynamics:

The efficiency indicators of the company’s economic activities at the end of 2022 improved compared to the data of 2022, but they are lower than the indicators of 2022. Overall efficiency improved slightly, which indicates an insufficient degree of control over management costs; Based on the data in Table. 5 the following conclusions :

- faster growth of profitability of sold products than growth of profitability of sales is a sign of good control over the cost of production;

- analysis of the efficiency of resource use shows that current assets can be used more efficiently. To do this, their size should be more carefully controlled;

- a decrease in the dynamics of return on equity indicates that the company needs to improve the efficiency of capital management.

Step 3. We carry out a factor analysis of the profitability indicators of the enterprise’s activities and resources.

Here you can calculate the influence of factors on the dynamics of profitability of sales in 2022 in relation to 2022. For this indicator, such factors are:

- revenue from product sales;

- revenue from sales.

To determine the influence of these factors, we use the method of chain substitutions and perform the following calculations sequentially:

1) calculate return on sales using 2022 revenue and 2019 profit amount:

20,000 thousand rubles. / 160,000 thousand rubles × 100% = 12,50 %;

2) determine the influence of the revenue factor by subtracting the calculated return on sales (item 1) from the actual return on sales in 2022:

12,50 % – 13,33 % = –0,83 %;

3) determine the influence of the sales profit factor by subtracting the value obtained in the first calculation from the actual return on sales for 2022:

14,38 % – 12,50 % = 1,88 %;

4) check the correctness of the calculations . To do this, we will find the sum of the influence of factors calculated in the two previous paragraphs (–0.83% + 1.88% = 1.05% ) and compare it with the difference between the actual profitability of 2022 and 2022 (14.38% – 13.33% = 1.05% ). Since these amounts are equal, the calculation of the influence of factors is carried out correctly.

The results of these calculations are presented in table. 6.

Step 4. Let's calculate and evaluate private indicators of the enterprise's performance.

To carry out the final stage of efficiency assessment, we will take data on product output for 2018–2020. (Table 7).

Based on the data in table. 7 we calculate the following partial indicators of production efficiency :

- cost intensity of the main groups of production costs in the structure of the total cost of production;

- cost intensity of the main groups of production costs in thousands of rubles per 1 ton of products;

- production indicators of product output in terms of output in tons per person, wage fund in thousands of rubles per person and average monthly salary in thousands of rubles per person.

The calculation results are in table. 8.

The data obtained indicate that positive indicators of product output efficiency include a consistent reduction in the share of material and energy intensity in the overall cost structure.

Positive dynamics are also present in the total indicators of these expenses per 1 ton of product output. Such results indicate sufficient efficiency of production cost management.

The negative point is the constant decrease in production output in tons per person. This is evidence of insufficient efficiency of labor resource management.

Contents of the first criterion

The company will be administered directly by the Federal Tax Service if one of the indicators for the reporting year has the following meaning:

- the total amount of federal tax accruals according to reporting is from 1 billion rubles;

- for communications or transport organizations – from 300 million rubles;

- the total amount of income according to annual form No. 2 “Profit and Loss Statement” (indicator codes 2110, 2310, 2320, 2340) – from 20 billion rubles;

- assets – from 20 billion rubles.

Almost the same applies to defense enterprises (at least one of the criteria):

- the amount under export contracts for the supply of strategic products – from 27 million rubles per year;

- revenue from export deliveries of strategic products – from 20% of total revenue;

- average number of personnel – over 100 people;

- state share – from 50%.

The Federal Tax Service will also oversee organizations from the list of strategic enterprises for which one indicator is important:

- the amount under export contracts for the supply of strategic products – from 27,000,000 million rubles per year;

- revenue from similar transactions – from 20% of total revenue;

- average number of personnel – from 100 people;

- state share – from 50%.

Credit institution, insurance/reinsurance organization, mutual insurance company, insurance broker, professional participant in the securities market, non-state pension fund, if available:

- banking licenses;

- licenses for insurance, reinsurance, mutual insurance, intermediary activities as an insurance broker;

- license of a professional participant in the securities market and/or license to maintain a register;

- license for pension provision and insurance.

If the company has submitted a request for tax monitoring, subject to the following conditions:

- submission of all information in accordance with clause 2 of Art. 105.27 Tax Code of the Russian Federation;

- compliance with the criteria of paragraph 3 of Art. 105.26 Tax Code of the Russian Federation;

- compliance of the information interaction regulations with its form and requirements;

- compliance of the company's internal control system with Article 105.26 of the Tax Code of the Russian Federation.

At the level of the Federal Tax Service, administration will be subject to simultaneous compliance with the following conditions:

- The total amount of income according to the annual profit and loss report (codes 2110, 2310, 2320, 2340) is from 2 to 20 billion rubles inclusive.

- The average number of staff is from 50 people.

- Assets – from 100 million to 20 billion rubles inclusive, or the total amount of accruals of federal taxes and fees according to reporting – from 75 million to 1 billion rubles.

According to the law, special regimes cannot be classified as the largest taxpayers.

Features of taxation, accounting and reporting of large enterprises

Large enterprises are forced to use the regular tax payment system (OSN), which is the most cumbersome and inconvenient for an accountant. When working on OSN you cannot do without:

- payment of all major taxes;

- reporting on their payment;

- filling out numerous declarations;

- high accuracy, allowing to avoid errors in calculations.

Large enterprises pay:

- Income tax. This federal tax has a base rate of 20%. Two percent of the sum is transferred to the federal budget, and eighteen to the regional budget.