A courier by car delivers pizza faster, a repairman travels to more clients, and a sales manager returns from a business trip sooner. Therefore, companies pay extra to employees for the use of personal cars and gasoline.

But the director wants to pay less taxes and not waste time on paperwork. Accountant - control the consumption of fuel and lubricants. A lawyer with a personnel officer - to eliminate disputes with the employee in the event of an accident.

In the article we look at how not to waste time, money and comply with the law.

Costs for different schemes

The use of a personal car for business purposes by an employee can be compensated under Art. 188 of the Labor Code of the Russian Federation. Compensation is not subject to personal income tax or insurance premiums. But only 1,200 rubles can be accepted as expenses for income tax or the simplified tax system.

Some accountants draw up a car rental agreement between the employer and employee. And then the cost of gasoline for the rented car is fully included in income tax expenses. But if the car is stolen, the employer will reimburse its cost.

You can rent a car with a crew. Then the employee is responsible for the machine. But there are tax risks. Rent payments may be reclassified as compensation under Art. 188 of the Labor Code of the Russian Federation and additionally charge income tax.

“Black cash” may be more convenient for payments, but it must be taken somewhere and taxes cannot be reduced on it.

Let's estimate the tax savings per person with different registration schemes. In all cases, the employee receives 3,000 rubles to pay for gasoline and 500 rubles. When renting with a crew, we will divide 500 rubles in half for rent and crew services.

| Cash from dividends | Compensation | Rent | Charter with crew | |

| Employee payments | 0 | 500 | 500 | 500 |

| Insurance premiums for crew services | 0 | 0 | 0 | 86 |

| Personal income tax | 0 | 0 | 75 | 75 |

| Fuel and lubricants (employee compensation by checks) | 3 500 | 3 000 | 3 000 | 3 000 |

| We'll take it into account | 0 | 1 200 | 3 575 | 3 661 |

| Income tax savings | -240 | -715 | -732 | |

| Paid taxes and SV to the state | -240 | -640 | -657 | |

| Total costs* | 3 500 | 3 260 | 2 935 | 3 004 |

*here we consider personal income tax as expenses of the employer, because the employee must receive an amount of 3,500 regardless of the chosen scheme.

How to properly document compensation payments

Cash reimbursement for employee business trips in a personal vehicle is not taxable. But in order to prove that the amount paid is not wages, it is necessary to complete the documentation correctly:

A written agreement must be drawn up between the employee and the employer, which is drawn up as an addition to the employment contract. If the use of a personal car to perform official tasks is discussed at the interview when enrolling an employee on the staff, the conditions for compensation of expenses and for depreciation of the car are prescribed in a separate clause in the employment contract.

A copy of the car registration certificate is attached to the agreement. After all, financial compensation is provided only if the employee uses his property for the company’s purposes. The issue of compensation is controversial if the employee does not use personal transport, but one that he uses by proxy.

It is necessary to have documents confirming the fact of a business trip. You can issue waybills (this is permitted by the Decree of the State Statistics Committee of Russia, which came into force on November 28, 1997). You can take into account the “service” mileage recorded by various devices, including a navigator. If mileage indicators are not taken into account when calculating the amount of payment, you can keep any documents for record keeping (route sheet, business trip log, etc.). But if you plan to keep documents of your own form in the documentation for recording the official use of personal transport, they must indicate the details of the primary official papers. In addition, they must be approved in accordance with the accounting policy of the enterprise (this is provided for in Article 6, paragraph 3 and Article 9, paragraph 2 of the Law “On Accounting”).

If the agreement provides for reimbursement of expenses for the purchase of fuel or lubricants, all receipts confirming the purchases made must be attached to the main documentation. Scheme for calculating the amount of payments. Since there is no specific guidance in this regard in the legislation, management can independently determine the scheme for determining the amount of compensation. For example, it could be a fixed monthly payment.

Drawing up an agreement between the manager and the employee is an important stage. After all, typos or inaccuracies present in the document may entail additional expenses for the company to pay taxes or insurance premiums.

Method 1. Black cash

You can also compensate an employee for expenses in an envelope. This is still popular in organizations, but it is risky.

What taxes? The company does not pay personal income tax or insurance premiums on payments to employees. Payments cannot be taken into account as income tax expenses. But to obtain cash, the company takes risks and incurs expenses. Someone gets cash from dividend payments, and that's an additional 13 or 15% tax. Someone cooperates with fly-by-night companies, which is fraught with tax claims and blocking of the current account by the bank service under 115-FZ “On combating the legalization (laundering) of income...”

With this work scheme, documents are often not drawn up with the employee. And if they do, they do not mention in the company’s official documents the traveling nature of the employee’s work and his car. So that the employee, having received the cash, does not then go to court demanding payment of official compensation for the use of his personal car.

Pros and cons of an additional agreement

Compensation of employee expenses under an employment contract is primarily beneficial to the employer. After all, you can always limit it to the amount provided for by Government Decree No. 92 of 02/08/2002: 1200 rubles - for cars with an engine capacity of less than 2000 cm3 and 1500 rubles - for cars with an engine capacity of more than 2000 cm3.

However, such compensation is unlikely to satisfy the employee - at current gasoline prices it is almost impossible to meet it. Accordingly, the employer has to compromise and enter into a lease agreement or an agreement for the provision of transport services, or pay out of his own pocket - it will not be possible to offset compensation by reducing taxes.

Method 2. Compensation

This method of reimbursing expenses to employees is recognized by the tax and social insurance funds. It is expressly provided for in Art. 188 Labor Code of the Russian Federation.

What taxes? You can take no more than 1,200 rubles as income tax expenses. There is no need to withhold personal income tax and pay insurance premiums from the compensation amount. This is directly permitted by paragraph 3 of Art. 217 of the Tax Code of the Russian Federation and confirmed by government agencies: letters of the Ministry of Finance dated August 27, 2013 No. 03-04-06/35076, Ministry of Labor dated February 26, 2014 No. 17-3/B-92, FSS of the Russian Federation dated November 17, 2011 No. 14-03-11/08 -13985, Pension Fund of the Russian Federation dated September 29, 2010 No. 30-21/10260.

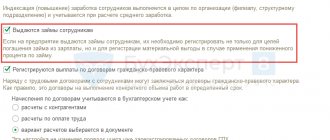

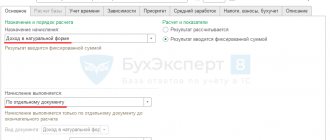

How to apply. Documents required:

1. Agreement with the employee.

According to Art. 188 of the Labor Code of the Russian Federation requires a written agreement with the employee. But the procedure for compensation is not a mandatory condition of the employment contract under Art. 57 Labor Code of the Russian Federation. Therefore, it can be drawn up not only in the form of an Agreement to the Employment Contract, but also in the format of a Manager’s Order.

The Ministry of Finance recognizes the format of the order: “the basis for making compensation payments is an order from the head of the enterprise, which indicates the amount of compensation (depending on the intensity of use), as well as documents confirming that the employee has a personal car, in particular a copy of the technical passport of the personal car (if the employee manages by power of attorney - relevant documents). Letter of the Ministry of Finance of the Russian Federation dated May 16, 2005 No. 03-03-01-02/140.

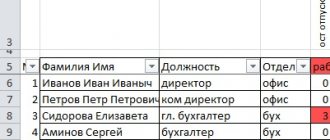

2. Local regulations on the traveling nature of work.

This may also be a clause in the collective agreement. Usually they indicate lists of positions that are of a traveling nature and their right to receive compensation.

3. Order on approval of fuel consumption standards.

to confirm the amount of payments. Set for each car brand or average for all cars.

4. Monthly reports on car use.

Needed to confirm the amount of fuel expenses and distance traveled. Usually these are Waybills, but in order not to waste time on their preparation, Electronic System Reports are used. The Ministry of Finance recognizes such reports in letter dated 06.16.11 No. 03-03-06/1/354: “In the opinion of the Department, when compiling such documents, data from metering and control devices for the movement of vehicles using the GLONASS satellite navigation system or other systems can be used , allowing to reliably determine the distance traveled by a vehicle.”

How to check whether an employee went to the right address? How far did you travel and did you really use that much gas? Automate it. You write the client’s address and time, the employee turns on the SBIS Courier mobile application and goes to the client. The system will check the route using GPS and generate a report for the manager.

On the road - with a waybill?

Do you need waybills when using a personal car for business purposes? As practice shows, this issue is one of the most controversial.

On the one hand, such sheets are intended to record the work of an enterprise’s transport, and not the personal cars of its employees. Therefore, you can do without them, especially if the specialist is not a company driver (resolutions of the Federal Antimonopoly Service of the Central District dated May 25, 2009 No. A62-5333/2008, dated April 10, 2006 No. A48-6436/05-8, Moscow District dated December 19. 2011 No. A40-152815/10-116-694).

Some officials in private consultations expressed the opinion that in order to write off auto compensation for tax expenses, an order from the manager with its amount, as well as a job description indicating the traveling nature of the employee’s work, is sufficient. But on the other hand, how exactly to confirm the actual use of an individual’s property in the interests of the company? Just with the help of a waybill containing the date, purpose of the trip, specific route, kilometers traveled, fuel consumption, etc. After all, for example, a gas station receipt indicates that the fuel was purchased, but for whose needs - the company or the employee himself - unclear. Therefore, there is no way without a waybill (see letters from the Federal Tax Service of Russia dated November 13, 2018 No. BS-3-11/ [email protected] , the Ministry of Finance of Russia dated June 27, 2013 No. 03-04-05/24421, etc.). It is separately noted that the memo does not confirm the use of a personal car for the benefit of the company (letter from the financial department dated April 20, 2015 No. 03-03-06/22368).

In the absence of a waybill, the auditors will probably consider that the employee received an economic benefit (to the extent that it can be assessed), and the expenses are not economically justified. As a result, additional personal income tax, insurance premiums and income taxes, fines and penalties are charged.

Many judges agree that the use of a personal car for the benefit of the company is confirmed by waybills (see decisions of the Arbitration Court of the Ural District dated October 18, 2018 No. A71-312/2018 and dated May 16, 2016 No. F09-4056/16, Arbitration Court of the North- Western District dated 03/16/2015 No. A05-6484/2008 and FAS of the same district dated 02/17/2006 No. A66-7112/2005).

Hence the conclusion - it is better not to ignore such documents, but to draw them up clearly and carefully. Of course, this is a certain hassle, but it's worth it. Otherwise, claims from auditors most likely cannot be avoided. In principle, the company has a chance to defend its position in court, but wasting time, energy and tempting fate is not an activity suitable for everyone.

In addition, some will likely escape with little blood. According to financiers, waybills should be drawn up at a frequency that allows one to judge the reasonableness of expenses. Let’s say this can be done once a month, if the accounting of time worked and fuel consumption does not suffer (letter dated February 20, 2006 No. 03-03-04/1/129). This means that in some cases the additional burden on employees and accounting can be reduced to a minimum.

And further. Keep in mind that the waybill is not recognized as a primary document, which in itself certifies a business operation (Resolution of the Federal Antimonopoly Service of the Ural District dated March 12, 2014 No. A07-11574/2013). So you can’t do without checks, receipts, acts and other papers indicating expenses incurred.

To complete the picture, we recommend keeping a log of business trips.

Method 3. Renting a car

This method is suitable for small companies when the employer completely trusts the employee.

The employer leases the employee's car under a lease agreement. Such an agreement is provided for in Art. 642 of the Civil Code of the Russian Federation. To start the rental, he and the employee sign an acceptance certificate for the car for rent. After completion - a certificate of return of the car from rental. This is difficult when the car is not actually transferred to the company and the employee drives the car either to clients, then home, or to kindergarten to pick up the child. In the event of an accident, theft or breakdown of a car, the employer compensates for the damage. Therefore, you will have to either trust the employee or sign 2 acceptance certificates per day. Some simply do not give the employee his copy of the contract.

What taxes? Income tax expenses can include: rent, gasoline costs, current and major repairs of cars (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation). Personal income tax must be withheld from the rent amount.

How to apply. Documents required:

1. Car rental agreement.

2. Certificate of acceptance and transfer of the car.

3. Order on approval of fuel consumption standards.

Needed to confirm the amount of payments. Set for each car brand or average for all cars. Not required, this information can be specified in the rental agreement.

4. Monthly reports on car use.

Needed to confirm the amount of fuel costs and distance traveled.

Method 4. Renting a car with crew

This method is used as an alternative to compensation. Under a crewed car rental agreement, the employer pays for the rental car and driver services. This type of contract is provided for in Art. 632 of the Civil Code of the Russian Federation.

What taxes? Personal income tax on rental amounts and driver services. Insurance premiums from the amount of driver services. Income tax expenses can include: rent and driver services, insurance premiums, and gasoline costs.

How to apply. Documents required:

1. Car rental agreement with crew.

2. Order on approval of fuel consumption standards.

Needed to confirm the amount of payments. Set for each car brand or average for all cars. Not required, this information can be specified in the rental agreement.

3. Monthly certificate of services rendered.

Needed to confirm the cost of services provided, the amount of fuel expenses and the distance traveled.

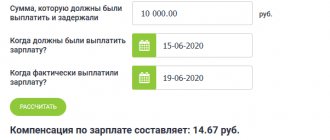

What is the amount of compensation for an employee?

The amount of compensation to an employee for a personal car is not regulated at the legislative level. Article 188 of the Labor Code of the Russian Federation indicates that the terms of compensation for the use of transport are agreed upon by the parties to the employment contract independently. You should agree:

- on payments for operating transport for official purposes;

- obligation to pay for vehicle depreciation;

- costs of purchasing fuel and other materials;

- amounts of compensation for repairs that were required as a result of the use of personal property during working hours.

For the first and second positions, it is advisable to establish payments in a fixed amount, but the legislation does not stipulate such an obligation of the parties.

Expenses for fuel and lubricants and repairs should be compensated in the amounts actually incurred. Additionally, it is worth indicating how the employee can confirm the costs of fuel and car repairs, what supporting documents to provide, in which cases fuel compensation is not calculated and compensation is not due.