Everyone has heard about VAT. Even if you don’t run a business and don’t keep accounting records. The treasured abbreviation can be found in any store receipt. That is, perhaps without knowing it, you always pay value added tax.

For most people, the term “value added tax” will mean nothing. Well, tax and tax, we are used to this. Meanwhile, you need to know. After all, it concerns everyone, whether you are a simple manager in an office, a worker in a factory, or a director of a franchise.

First of all, you need to understand that VAT is imposed on any product and any service that you buy. If the price is higher than cost. And she is always taller. The amount of tax in this case will be calculated based on the difference between the cost of the product and its selling price.

Where does VAT come from?

More than a century ago, in the twenties of the twentieth century, VAT came into the world to replace the sales tax. Before this, the “tax” was taken from all the proceeds that the entrepreneur received. It’s difficult and partly unfair, because actual income was not taken into account. They took it for the bare proceeds, and not for the businessman’s profit.

But VAT was introduced on the territory of the Russian Federation only in 1992. And until recently, it was 18% - a figure to which everyone got used to and paid the tax calmly until 2022 came.

Then the government raised the rate to 20%, and the public began to be outraged. Well, how can you be outraged... political scientists and economists started a debate, criticized the innovation, the other side defended the necessity, declaring that 2% of the weather will not work. And people believed. Well, what is 2%? A trifle. But it’s actually not a small thing at all. Because the tax is taken from everything.

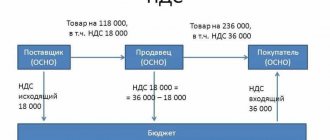

One produces wood and sells it to a kitchen store franchise, which turns it into a product and sells it to the end consumer (and this is the most primitive chain). And the tax accumulates progressively at each price of all participants in this chain. After all, no one wants to pay extra. And prices need to include coverage for this tax.

However, from January 1, 2022, VAT in Russia officially became 20%.

This rate applies, with some exceptions, to most goods and services. But there are other options. Thus, a rate of 10 percent, for example, is levied on medical drugs, which is used by pharmacy franchises, children's products and some food products, which is also actively used by brands and food franchises. But products for export (export) are not subject to this tax at all. There the VAT rate is zero. But perhaps this won't last long. And most still pay 20%

Rates are regulated by Article 164 of the Tax Code of the Russian Federation.

How to calculate VAT to be charged

In order to correctly calculate VAT for accrual, you need to decide on such concepts as the object of taxation, the tax base and the tax rate.

VAT section of our website will help you with this :

- "VAT: object of taxation" . This section contains articles that will help you understand which business transactions are subject to VAT. Art. is discussed in detail here. 146 and 148 of the Tax Code of the Russian Federation, and there is also a complete list of what is subject to taxation by the specified tax.

- "Tax base (VAT)" . After determining the object of taxation, you need to calculate its value in monetary terms - this will be the taxable base. In this matter, you also need to pay attention to the moment of determining the tax base.

- "VAT rate)" . The articles in this section contain a lot of useful information that will help you choose the right VAT rate depending on the type of material assets, works, and services being sold. Here you can also find materials about rates 0%, 10%, 18% and settlement rates.

- "VAT benefits" . Art. 149 of the Tax Code of the Russian Federation allows certain business transactions to be exempt from VAT. And don’t even issue an invoice for such transactions. The articles in this section will help you understand how to get VAT benefits, whether you need to use them or whether it is better to refuse to use them.

Who pays VAT

A scheme may be born in the mind of the average person, suggesting that this tax does not concern him at all. Well, the entrepreneur pays himself, and let him pay. But this is a mistaken opinion. Because in reality, the entire amount of this tax is ultimately paid by the buyer himself. To understand why this happens, let’s look at a simple example and see what stages the emerging value added tax goes through.

- One company orders material from another company to make its product from it. She pays for this material. VAT will be applied to this amount of the cost of the material that the company paid.

- Next, this company produces its product from the purchased material, and then decides what the cost of the finished product will be? So that you yourself don’t end up at a loss, and your clients don’t run away from inflated prices? First of all, take the amount of money that was spent on the production of a unit of a new product. The tax amount is also calculated, but is recorded as a “tax credit”.

- Next, the company needs to decide how much the product will cost the end customer. Here the cost of the goods is added up, excise taxes are calculated, the share that after the sale will go to profit is entered, and VAT is added. That is, it will already be included in the price of the product that the consumer will pay upon purchase.

- When a product is sold in a certain quantity, the company sits down to calculate profits. From the money received, 20 percent of the tax that the buyer has already paid is calculated. And this money is spent on tax obligations to pay VAT.

Here is a simple diagram that shows that the price of a product in a store already includes value added tax. And if it were not taken into account, the product would cost less. Even new franchises that want to enter the market with a new product produced personally include VAT in the price of the product, because they pay it when purchasing material for production.

VAT calculation

To understand the whole process, let's look at an example again.

We opened a clothing store franchise where we sell jeans. To sell something, you must first produce or buy it. In our case, we find a company that sells jeans wholesale. And we spend 100 thousand rubles on the purchase of a consignment of goods, where one pair of jeans costs 10 thousand rubles (the jeans turn out to be expensive, but for an example it will do). That is, we purchased 10 units of goods.

These 100 thousand rubles that were spent on goods already included 20 percent VAT. Since the jeans were sold to us by their supplier, who has already included this tax in the price, because he will have to pay it to the state for selling the product above cost. That is, we paid 20 percent of the tax. If it weren’t for him, the batch would cost not 100 thousand rubles, but 80 thousand rubles.

We calculate this amount as an incoming contribution or deduction. And we will need to have evidence that we paid for the jeans with VAT already included. Therefore, it is important to have one of the supporting documents - this is either an invoice, or a check, or an invoice, where the tax amount is indicated separately. That is why on all such documents we can find a line with VAT.

Further, when we ourselves set the price at which we will sell our jeans at retail, we remove this amount of VAT from the price for the product. And the next VAT, which will be levied on our sale, will be calculated from the amount received. That is, we add up our costs for the goods (this will include not only the cost price, but also our other expenses that we incur during the organization of the sale) without VAT and add 20 percent to this amount.

Input VAT accepted for deduction - what is it?

Art. 172 of the Tax Code of the Russian Federation requires compliance with several conditions:

- there is an invoice issued in accordance with current legislation;

- goods (works, services) are registered;

- in cases specified by law, VAT has been paid (tax agent, customs VAT);

- in the future it is assumed that the goods will be used in transactions subject to VAT.

Read more about the conditions for deducting VAT in this article.

If the specified conditions are met, the taxpayer has the right to deduct input VAT by posting D-t 68 K-t 19. After which this invoice will be registered in the purchase book, and the VAT amount will be included in section 3 of the VAT return.

ATTENTION! The Federal Tax Service has approved further changes to the VAT return form (order dated March 26, 2021 No. ED-7-3/ [email protected] ). The first time you will need to submit a report using this form is for the 3rd quarter of 2022. Find out what the changes are about here.

VAT calculation formulas

Let us first note that the formulas for calculating taxes are not so simple, especially for a person who is not used to dealing with mathematical equations. Therefore, there is more than one calculator that will calculate VAT or the amount excluding VAT for you. You can find them on the Internet, on specialized sites. You don’t need to learn how to use it, everything is extremely simple - there are a couple of fields for entering the amount and that’s it. For those who want to understand the algorithm for calculating the tax percentage, let’s look at the formulas in more detail.

VAT calculation formula

Let’s take the amount we know and denote it by the letter “X”. To understand how much VAT will be, we use a simple formula:

VAT=X*20/100

That is, if our amount of goods is equal to 100 thousand rubles, then the VAT on it will be equal, based on the formula, to 20,000 rubles. This is how much we paid when purchasing goods from a supplier in order to ensure that he paid his value added tax.

Once again, if we want to buy jeans worth 100,000 rubles, we will either pay 120,000 rubles, because we will also need to include VAT (this is done by the supplier), or we will pay 100,000 rubles with VAT already included, and in fact we will buy smaller quantity of goods.

Because in fact the price will be 83,333 rubles. 33 kopecks, and another 16,666 rubles. 67 kopecks is the VAT price for this amount, which is already included in the invoice for us by the supplier. You can open any VAT calculator on the Internet and check the calculation, but for now we’ll move on to the formula that will show us why it turns out to be 120 thousand.

Formula for calculating the amount including VAT

Amount - X. Amount with tax - Xn. Xn = X+X*20/100 Or Xn=X*(1+20/100)=X*1.20

That is, from our amount of 100,000 rubles, the amount including VAT will be equal to 120,000 rubles. We have already described this above, that is, if we want to buy 10 pairs of jeans, then we will actually have to pay 120 thousand, not 100, because the supplier will include VAT in the invoice.

Formula for calculating the amount excluding VAT

Amount including VAT = HN. You need to understand what the amount X will be equal to - the amount excluding VAT. To understand the formula, let’s remember the second formula, which calculated the amount including tax. And we enter the designation of the tax itself - it will be Y. Y, if the VAT is 20 percent = 20/100. Then the formulas will look like this:

Xn = X+Y*X Or Xn = X*(1+Y) From here we get that X = Xn/ (1+Y) = Xn / (1+0.20) = Xn / 1.20

We want to buy goods worth 100,000 rubles, but so that this figure already includes VAT, and at the same time understand how much the true amount we pay for the goods, and not for the tax, will be. We use the calculation:

Amount without VAT (X in this case) = 100,000 rubles (Xn) / 1.20 = 83,333 rubles with kopecks.

That is, if indeed one pair of jeans costs us 10 thousand rubles without VAT, then by paying only 100,000 rubles we will be able to purchase no more than 8 pairs from the supplier (there will be a little money left). Or, if we nevertheless spent 100,000 rubles and bought exactly 10 pairs, and VAT was already taken into account in this amount, then a pair of jeans costs 10,000 rubles with VAT already included in it. And we still paid it for the supplier (who, in turn, also paid VAT for the supplier of the materials from which these jeans are made).

VAT payers

The main thing to start studying VAT is to understand whether the organization is a tax payer. The list of payers and those who VAT is specified in Art. 143 Tax Code of the Russian Federation. “Payers (VAT)” will help you understand the legal intricacies . Some business entities are generally exempt from paying VAT (Article 145 of the Tax Code of the Russian Federation). You can find a list of them and other useful information regarding this situation in the section “VAT Exemption” .

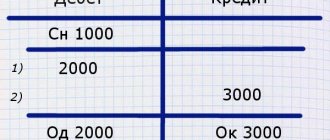

Tax credit and tax liability

We looked at the formulas, but how much should we pay to the budget for this tax, you ask. Let's finish off the topic with jeans and resolve this issue, and at the same time we will understand such components of the concepts of value added tax as credit and liability.

We still bought jeans for 120,000 rubles. Of which 20 thousand were paid as VAT for the supplier. We have an invoice from this supplier for our batch of jeans, where it is written in black and white that the price of the goods without VAT is 100,000 rubles, the amount of VAT is 20,000 rubles, and the total cost is 120,000 rubles.

Next, we set aside the VAT figure during calculations and remembered it as a tax credit.

A tax credit is the amount by which at the end of the reporting period it will be possible to make a tax deduction from the tax liability - that is, to reduce the amount of tax we pay to the budget. And what we will have to pay to the budget is a tax obligation.

Let's look further at the jeans.

In reality, we will subtract the VAT we have already paid from the amount of 120,000 rubles to form our price. That is, the amount will be the same 100 thousand rubles.

Let's say, having included all other cost and expense factors, and adding the percentage of the desired profit, we received a price of 200,000 rubles. This is exactly how much our jeans will be sold for in our store to the end consumer. And it is from this amount that our tax liability will be deducted - that is, the tax that we must pay to the budget.

From 200 thousand rubles, according to the formula or calculator, it turns out that VAT is equal to 33,333 rubles. This is our tax liability. But! After all, we also have documents that confirm our tax credit of 20,000 rubles (that is, the fact that we have already paid 20 thousand in the form of value added tax). This means that we can subtract 20 thousand already paid from 33 thousand. In total, we will get 13 thousand rubles, which we will pay after selling all 10 pairs of jeans (let’s say this happened in one reporting period).

From 200 thousand rubles, 13,000 went to the budget from us in the form of tax. But we must not forget that our supplier also paid his 13 thousand into the budget, which he received from us when purchasing the jeans initially.

Why is VAT the biggest problem for taxpayers?

Over the course of the 30-year existence of VAT, the rules of the game have changed several times. Taxpayers have more than once had to overcome the difficulties of the so-called “transition” period associated with the new tax calculation procedure.

For example, starting in 2006, a completely new procedure for calculating VAT when performing construction and installation work was introduced.

Legislators often change the form of the tax return, as well as the books of purchases and sales, and invoices.

Ambiguous interpretation of legislation constantly causes tax disputes. Therefore, taxpayers should know the judicial practice on issues of interest to them.

Types of VAT

- 0%

- 10%

- 20% (replaced the rate of 18%)

As mentioned above, there are a number of goods and services that are not subject to this tax. Therefore, we can talk about the existence of a zero rate. These are exports of goods, products of the space niche, niches of gas and oil transportation and some other types of goods. The list of such positions is regulated by Article 164 of the Tax Code of the Russian Federation.

There is also a list of trade names that are subject to a ten percent tax. These are mainly food products - meat, vegetables, dairy products. It also includes children's clothing, children's furniture and more. Again, the list is quite large; it is better to familiarize yourself with it in person in the tax code if this issue interests you.

Well, the rate of 20 percent is the most popular. You can meet her almost everywhere.

Note: since changes in legislation occurred relatively recently (01/01/2019), you can still find outdated data on the Internet, which describes a rate of 18%.

Transactions subject to VAT

- Import of any product

- Any work on the construction of buildings without concluding a contract

- Transfer of services and goods for personal use, the costs of which are not taken into account when calculating tax.

Which processes are not subject to VAT?

- The work of government bodies, which relates to its direct responsibilities.

- The process of purchase and privatization of municipal and state-owned enterprises.

- Investment.

- Sale of land plots.

- Transfer of money to enterprises operating on a non-profit basis.

VAT calculation methods

- Subtraction. In this option, the tax is imposed on the full amount of revenue, and from this amount the VAT payable for the purchase of materials for the product or service is calculated.

- Addition. In this case, VAT is imposed at a fixed rate according to the tax base. It is made up of the added value of each type of product sold.

So, while the second option is difficult to implement, because there are often very many such individual items, the first option is used much more often.

What are the VAT rates?

The price of the goods also depends on the applicable VAT rates. There are three direct VAT rates: 0, 10 and 20%. In some cases, VAT is calculated by calculation.

- A 0% rate applies to export goods.

- VAT 10% rate is used for socially significant goods, such as bread, milk, eggs, sugar, salt, cereals, meat, baby food, medical products, etc.;

- 20% rate for other goods.

It is clear that the lower the VAT rate, the cheaper the product should be. Although in practice this does not always work, and the policies pursued by retailers play a big role here.

VAT reporting

It seems that it has become a little clearer what value added tax is, where it comes from, how it is calculated and who pays it. However, you still need to report to the FSN authorities for it. Let's figure out how this is done.

The first thing you need to know is that you need to report quarterly. Moreover, the deadline is until the 25th of the post-reporting month. Otherwise, ugly fines await.

Important! If you send a VAT report by mail, then take into account the filing date - this is the date that will be stamped on the letter.

Example: It took 10 days from the post office where you sent a registered letter with your declaration to the tax office itself. Sent on the 18th, arrived on the 28th. Will it be considered that you submitted the report late? The answer is no. After all, the 18th number will appear on the stamp of the letter.

Tax deductions

In the case of value added tax, deductions are considered to be the amount of tax that is presented for payment by the supplier of the goods. The tax that will go to the budget from you will be reduced by this figure.

But there are some nuances that you need to know and understand. This concerns the conditions for the tax authorities to accept these deductions. Three rules must be followed:

- The product itself, which you purchased for the purpose of subsequent sale, is subject to VAT.

- The company has all supporting documents, including a correctly executed invoice.

- The goods that were purchased went through the accounting procedure.

And only after these conditions are met, the company will be able to accept the entire amount of payments as a deduction at the end of the tax period. Naturally, if all procedures were taxable.

Invoice

This document will reflect several amounts. Firstly, the cost of the goods without VAT. Secondly, the final amount includes VAT.

An invoice is provided for the goods sold to the client. This must be done within 5 days. All documentation is filed and noted in the sales book.

It happens that the audit makes a decision to cross out all calculated deductions and charge unpaid VAT. This can happen if there are errors on the invoice. And it’s not so difficult to allow them, because the invoice is issued by the counterparty, not the taxpayer.

What transactions are subject to VAT: analysis of controversial situations

Compensation for early termination of a lease agreement

Let's consider this situation.

The tenant and the landlord entered into a lease agreement for three years. After six months, the tenant wanted to terminate the lease agreement early and offered the landlord compensation in the amount of one million rubles as compensation. Should the landlord pay VAT to the budget on the compensation amount? The Ministry of Finance of the Russian Federation, in letter No. 03-07-11/41194 dated August 18, 2014, takes the position that the amounts of compensation received by the landlord from the tenant in the event of the tenant’s refusal to lease retail space are not subject to VAT. Since the VAT tax base includes funds received as payment for goods, works and services sold by the taxpayer (clause 2, clause 1, article 162 of the Tax Code of the Russian Federation). Accordingly, funds not related to the sale of goods (work, services) are not included in the VAT tax base.

Various situations for calculating VAT on rentals are discussed in the course “VAT for Practitioners”

To learn more

Transfer of inseparable improvements to the leased property

The courts believe that the transfer of inseparable improvements from the tenant to the landlord is certainly subject to VAT. They treat inseparable improvements as part of the lessor's indivisible property and not as part of the tenant's property. In particular, if, under the terms of the property lease agreement, the cost of the inseparable improvements made upon the expiration of the lease term or after the termination of the contracts is not reimbursed (Determination of the Supreme Arbitration Court of the Russian Federation dated 05.08.2013 No. VAS-10058/13).

The Presidium of the Supreme Arbitration Court of the Russian Federation in paragraph 26 of Resolution No. 33 dated May 30, 2014 indicated: if the lessor compensated the lessee for the cost of inseparable improvements, the latter presents the tax amounts previously accepted by him for deduction to the lessor and has the right to claim VAT for deduction (Article 171 of the Tax Code of the Russian Federation).

Based on the materials of one of the cases, the company rented a premises in which, with the consent of the landlord, it installed partitions, floors, a suspended ceiling, plumbing work, installed a ceiling, windows, installed a fire alarm system, and reconstructed the ventilation system. At the end of the lease period, the parties estimated the improvements made at more than 9 million rubles. Of these, more than 6 million rubles are the costs of inseparable improvements. However, under the terms of the termination agreement, the landlord undertakes to compensate the tenant for the full cost of the improvements.

The courts of first and appellate instances did not agree with the inspectors’ conclusions about the need to charge VAT. However, the Supreme Arbitration Court of the Russian Federation noted that the tenant actually transfers inseparable improvements into the ownership of the lessor and has the right to compensation for the cost of these improvements if such compensation is provided for in the lease agreement.

The transferred inseparable improvements have cost and physical characteristics. The parties determined their residual value, which the lessor transferred to the lessee. Consequently, their transfer is a sale and is subject to VAT. Thus, the courts come to the conclusion that when returning leased property, VAT is charged as in the case of a normal sale. See, for example, the resolution of the Federal Antimonopoly Service of West Siberia dated May 30, 2014 in case No. A45-12766/2013; Povolzhsky dated June 26, 2012 in case No. A65-12909/2011 and Moscow dated June 25, 2009 in case No. KA-A40/4798-09 districts.

Providing food for employees

When providing employees with free meals is the employer’s obligation under labor law, for example, in the presence of harmful or dangerous working conditions, VAT is not charged.

When food for employees is provided for by a collective agreement, and its cost is deducted from wages, such an operation is subject to VAT in the general manner. In this case, the amounts of VAT presented by suppliers to the employer when purchasing these food products are subject to deduction in the manner prescribed by Art. 171 and 172 of the Tax Code of the Russian Federation (letter of the Ministry of Finance dated October 16, 2014 No. 03-07-15/52270).

When selling goods on credit, the amount of interest that the seller receives for providing a deferred payment to the buyer is not subject to VAT. For example, a unit of goods costs 1,000 rubles, the buyer will pay 1,100 rubles, where 100 rubles is the loan fee, on which the seller does not pay VAT.

Sale of goods in installments on commercial credit terms

According to Art. 823 of the Civil Code of the Russian Federation, a commercial loan includes civil obligations providing for deferment or installment payment for goods, work or services, as well as the provision of funds in the form of an advance or prepayment. When selling goods in installments on commercial credit terms, the amounts of interest received by the seller from the buyer are not included in the VAT tax base.

Let's look at this situation with an example. The seller ships the goods in February 2016, and the buyer will pay for it only in December 2016. This procedure is recognized as a commercial loan. Let’s say a unit of goods costs 1,000 rubles. As a result, the buyer will pay not 1,000, but 1,100 rubles: 1,000 for the goods, 100 for the loan. The seller must pay VAT on 1,000 rubles, but not on 100 rubles.

The Ministry of Finance in its letter dated December 30, 2014 No. 03-07-05/68784 comments on this situation as follows. Interest charged for using a commercial loan, including advance amounts and prepayments, is a fee for the use of funds. Based on paragraphs. 15 clause 3 art. 149 of the Tax Code of the Russian Federation, interest on loans is exempt from VAT.

Therefore, the amounts of interest that the seller receives from the buyer for providing a deferred payment on the terms of a commercial loan are not included in the VAT tax base and are not subject to this tax. The same position was previously held by the Supreme and Supreme Arbitration Courts of the Russian Federation (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 13, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of October 8, 1998).

Distribution of advertising catalogs and brochures

In clause 3 pp. 25 Art. 149 of the Tax Code of the Russian Federation states that the transfer of goods (work, services) for advertising purposes, the cost of acquiring (creating) a unit of which does not exceed 100 rubles, is not subject to VAT. Will advertising products whose unit cost exceeds 100 rubles and amounts to, for example, 1,000 rubles, be subject to VAT?

The Ministry of Finance in its letter dated October 23, 2014 No. 03-07-11/53626 explained this situation as follows. Catalogs and advertising brochures do not correspond to the characteristics of the product, because they have no value for buyers. Therefore, they should not be subject to VAT, regardless of the amount of expenses for the acquisition (creation) of these catalogs and brochures.

Penalties for late obligations under the contract

Penalty amounts for late fulfillment of obligations that a company receives from its contractual counterparties are, as a rule, not subject to VAT. The Ministry of Finance in its letter dated October 30, 2014 No. 03-03-06/1/54946 explained that the obligation to take into account the amount of penalties as of the date the counterparty is recognized as a debtor arises for the organization only if the amount of these sanctions is established by the agreement (Article 331 Civil Code of the Russian Federation and Article 317 of the Tax Code of the Russian Federation). Otherwise, the organization has no such obligation.

The penalty can be recognized as income on the basis of a bilateral act signed by the parties (agreement on termination of the contract, reconciliation act, etc.), a letter from the debtor, as well as another document that confirms the fact of violation of the obligation and allows us to determine the amount of the amount recognized by the debtor.

In addition, the Ministry of Finance of Russia indicated that an independent basis that indicates the recognition by the debtor of the obligation to pay a penalty is full or partial actual payment of the corresponding amounts to the creditor. In this case, the organization must also include the amounts actually paid by the debtor as non-operating income. Non-operating income is all income not related to sales operations.

The procedure for recognizing non-operating income is discussed in the course “Income Tax for Accountants.”

To learn more

On the issue of paying VAT on amounts received by an organization from a counterparty for violating the terms of an agreement providing for the supply of goods (works, services), the financial department noted the following. If the penalty represents liability for delay in fulfilling obligations to pay for goods (work, services), then the amounts due are not related to payment for goods (work, services) within the meaning of Art. 162 of the Tax Code of the Russian Federation and, therefore, are not subject to VAT. This conclusion is confirmed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/05/2008 No. 11144/07.

At the same time, if the amounts received, provided for by the terms of the contracts in the form of a penalty, are not essentially a penalty that ensures the fulfillment of obligations, but in fact relate to the element of pricing that provides for payment for goods (work, services), then such amounts are included in the VAT tax base on the basis of Art. 162 of the Tax Code of the Russian Federation.

Bottom line

Knowing what VAT is is important for anyone. Knowing how to calculate it is important for those who are directly involved in filling out documents and submitting reports to the tax department. Being unaccustomed to doing this using formulas is difficult and tedious. Therefore, to check yourself and your counterparties, there are many electronic resources where you can find a VAT calculator that will calculate it for you in two clicks. The main thing is to remember that attentiveness is an important component in the matter of VAT, and you cannot be late in submitting your reports to the tax office.

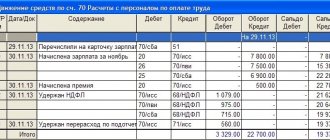

VAT included in taxpayer accounting

When purchasing goods (work, services), the taxpayer receives from the supplier primary documents and invoices, which reflect the input VAT.

When importing goods, input VAT is calculated on the value reflected in the customs declaration. After receiving the documents, incoming VAT is reflected in accounting by posting: D-t 19 K-t 60(76).

Thus, input VAT is the tax imposed on the taxpayer when purchasing goods and services. It is accumulated in the debit of account 19, and is subsequently accepted for deduction if the conditions provided for in Art. 172 of the Tax Code of the Russian Federation.

Read what VAT deductions are here.