Budget income classification codes are divided not only by type of payment, but also by purpose. The payment of funds ordered by a court verdict is called payment under a writ of execution. In order to pay a particular debt according to a court decision, you need to indicate in the payment order the details of the KBK according to the writ of execution of the bailiffs of 2022. In 2022, the ciphers of the corresponding year were used. This article presents codes and a sample for filling out a payment order to bailiffs, since the preparation of this documentation has nuances.

Individuals and legal entities that owe money to organizations or third parties are more likely to pay their debts after a court decision. Such debts include: alimony, unpaid loans, loans from friends, relatives, banking organizations or damage. But some citizens sometimes do not pay fines assessed by the court. Then Art. 122 Federal Law No. 229 of October 2, 2007 (as amended on December 27, 2018). The article states that in such a situation, the citizen is obliged to pay the enforcement fee of the bailiffs in 2018, the BCC of which is entered in field 104 of the payment order. The budget classification code for paying fees assigned by bailiffs is in this article.

Payment order to bailiffs

After the court renders a verdict on the guilt of a citizen or company and imposes a fine, the bailiff service begins to work. The latter generate payment orders and send them by Russian post:

- for individuals: at the registration address or to the organization in which the citizen works;

- for legal entities: to an organization in the name of the owner of the company;

- Individual entrepreneur: at the entrepreneur’s registered address.

The receipt form, encrypted under number 0401060, is regulated by Appendix No. 2 of Bank of Russia Regulation No. 383-P dated 06/19/2012 (as amended 10/11/2018), by following the link, download the payment order.

The payment is needed by FSSS employees to confirm the payment of debt money under the writ of execution. The contents of the receipt have two types: for withholding tax and non-tax arrears. The latter include alimony, credit loans, etc. The budget classification code in the Purpose of payment field of the receipt is indicated only when paying tax debts. Extra-budgetary arrears are characterized by the corresponding word or code, which is provided by clause 7

Appendix No. 2 according to Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017). Having received a payment slip, a citizen does not need to pay the debt on his own, since FSSS employees often write off money from the debtor’s salary or from the company’s current account. If an individual does not work anywhere, then the citizen’s property is confiscated for the amount owed. In such a situation, no payment orders will be received.

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment. The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

Rules for filling out a payment order

Since the receipt form is regulated at the legislative level, the rules for filling it out are also regulated by law. A receipt is drawn up in accordance with Appendix No. 2 of Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017). The Regulations of the Bank of the Russian Federation provide information about each payment cell. The encrypted instructions are in Appendix 3, and their decryption is in Appendix 1. Thus, before transferring the employee’s debt money to the budget, the accountant of the company in which the debtor citizen works will draw up the payment as follows:

- Fill in the employee’s TIN, indicate 0 in the checkpoint field, and the organization will be the payer.

- The debtor's position is 19. This means that the company calculates the amount accrued for debt repayment from the salary of the individual debtor. All statuses are indicated in Appendix 5 of Order No. 107n of the Ministry of Finance of Russia.

- To confirm your identity, in field 108, indicate a passport coded with the number 01. After entering the number 01, the accountant writes information about the passport from the second page, separated by a semicolon.

- The bailiff service - FSSP - is indicated as the recipient: they write the corresponding OKTMO number, and the UIN - 0.

After this procedure, the funds calculated for payment are debited from the employee’s salary and transferred to the budget.

Another example of calculations for a writ of execution is offered by Letter of the Ministry of Taxes of the Russian Federation No. BG-6-10/253 dated 03/05/2002 under number 10. The letter provides examples of filling out payment orders for different situations. Number 10 shows an example of a receipt filled out by an organization that reimburses a tax debt.

KBK bailiffs

Bailiffs order various types of payments: alimony, arrears on loans or taxes. But there are fixed types of payments to the federal budget, which correspond to a code that classifies payments. At the legislative level, budget classification codes are established for payment:

- state fees entered into the Unified State Register of Legal Entities of a company that deals with the return of enforcement fees and works with overdue debts;

- compensation for funds spent on criminal proceedings;

- penalties and fines that are imposed on individuals and legal entities for violating judicial legislation;

- performance fee.

| Operation name | KBK |

| State duty for entering information about a legal entity into the state register of legal entities engaged in the collection of overdue debts as the main activity | 322 1 0800 110 |

| Income received as compensation to the federal budget for expenses aimed at covering procedural costs | 322 1 1300 130 |

| Performance fee | 322 1 1500 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on the court and judicial system, on enforcement proceedings and court fines | 322 1 1600 140 |

Kbk Federal Bailiff Service for Moscow

Hello, in this article we will try to answer the question “Kbk of the Federal Bailiff Service in Moscow.” You can also consult with lawyers online for free directly on the website.

I just went to the bailiffs website, found our employee’s file, and there on the website you can generate a receipt using his sheet (the service fills it out itself). OKTMO, UIN are filled out. But the KBK field is empty.

As a result, the Ministry of Telecom and Mass Communications of Russia, without analyzing the results achieved within the framework of informatization activities for 2022, the indicated government bodies agreed on informatization plans for 2022 and the planning period of 2021 and 2022 in the total amount of 1,496,054.3 thousand rubles.

Payment order to bailiffs - sample 2021-2021

When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code.

Lawyer Vologda Regional Court. Lawyer Leningrad Regional Court. Lawyer Leningrad Regional Court. Lawyer St. Petersburg City Court. Lawyer St. Petersburg City Court. Lawyer Moscow Regional Court. Lawyer Moscow Regional Court. Lawyer Moscow City Court.

Lawyer Moscow City Court. Renovation Moscow. Renovation in Moscow. Lawyer renovation Moscow.

Analysis of regulatory legal acts, other documents regulating the implementation of projects (events) aimed at establishing the information society in the constituent entities of the Russian Federation, and the timing of their implementation.

The program includes 5 basic directions for the development of the digital economy in the Russian Federation for the period until 2024, containing a set of indicators and indicators characterizing the implementation of these directions: regulatory regulation; personnel and education; formation of research competencies and technical groundwork; information infrastructure and information security.

A wide range of additional services at no extra charge, or on preferential terms for the company’s accompanying clients.

Financial support for the implementation of projects (events) aimed at establishing an information society in the constituent entities was carried out by providing subsidies from the federal budget to the budgets of the constituent entities, provided for in the federal laws on the federal budget for the corresponding financial year and planning period (hereinafter referred to as subsidies).

Alimony in favor of bailiffs Usually, alimony is transferred in favor of the claimant - ex-wife (husband), parents, etc.

Is it necessary to submit information to the waste cadastre of the Moscow region if the activity is carried out in a rented office? Should this be done in Moscow?

news about changes in legislation, recordings of the most useful professional events, a video course of mini-lectures on the most popular topics.

Interdistrict department of bailiffs for the collection of alimony payments No. 1: Bailiff Service (UFSSP): District Central Administrative District 109044, Moscow, st. Krutitsky Val, 18, bldg.

Achieving the indicator “The share of citizens using the mechanism for receiving state and municipal services in electronic form” by 2022 to a value of at least 70% is provided for by Decree of the President of the Russian Federation of May 7, 2012 No. 601 “On the main directions for improving the public administration system” (hereinafter referred to as the Decree No. 601).

Executive documents issued by the competent authorities of the Russian Federation do not have the force of an executive document on the territory of a foreign state.

An effective tool and reliable assistant for various specialists, helping to make the right decisions.

Executive documents issued by the competent authorities of the Russian Federation do not have the force of an executive document on the territory of a foreign state.

An effective tool and reliable assistant for various specialists, helping to make the right decisions.

Failure to comply with the order of a judge or bailiff to ensure the established procedure for the activities of courts.

Perovsky district department of bailiffs of the city of Moscow

The budget classification code (BCC) you need will depend on the type of payment made using the details of the Federal Bailiff Service (FSSP). That is, his groups. For example, this could be transport tax, debts to the Federal Tax Service, etc.

Assessment of prospects for appealing to the European Court of Human Rights. Preparation of complaints to the European Court of Human Rights. ECtHR. Assessment of prospects for appealing to the ECHR. Preparation of complaints to the ECHR. ECtHR complaint. Complaint to the ECHR. ECHR lawyer. ECHR lawyer. Lawyer European Court of Human Rights. Lawyer European Court of Human Rights. UN Human Rights Committee.

A sample payment order for bailiffs in 2022 may be required by an organization that makes deductions from an employee’s salary according to a writ of execution and transfers this money to bailiffs. In this article we will tell you how this payment card differs from others and provide a sample of how to fill it out.

So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee.

This fact is due to the fact that the current Procedure for authorizing expenses does not provide for the Federal Treasury authorities to check, when authorizing payment as part of the execution of a state contract, the presence of informatization measures in the approved informatization plan.

If alimony was collected by court, then you should have received a writ of execution or a court order and sent it to the bailiff to the executor, write a statement in which you should indicate your details for the transfer. Send the application to the bailiff at the place of registration of your ex. Indicate everything you know about him, and also write that you do not receive alimony.

As a result, failure to pay alimony payments for more than 2 months led to the drawing up of a protocol against the man under Part 1 of Art. 5.35.1 Code of Administrative Offenses of the Russian Federation. Having considered the case materials, the court found the defaulter guilty and imposed a sentence of 40 hours of compulsory labor.

Tender for the provision of cleaning services for administrative buildings and premises of the central office of the Federal Bailiff Service in Moscow. Price: 6,731,890 rubles.

The basis for this is the writ of execution. Funds from such documents are always transferred to bailiffs.

The lack of interconnection of indicators (indicators) of the List of priority areas with indicators (indicators) and basic directions of the strategic planning document - the “Digital Economy of the Russian Federation” program does not allow us to assess the contribution of the implementation of priority informatization measures to achieving the directions of development of the digital economy in the Russian Federation.

On the one hand, it shouldn't. On the other hand... the employee will then try to return the excess payment. The chance is small, of course, but suddenly.

Kbk for payments for enforcement proceedings

Bailiff of the Office of the Federal Bailiff Service for the Lipetsk Region MRO SP for special important enforcement proceedings Tatarinova N.

Until he was returned, there is no period of at least 10 years. ——————————————————————— Lawyer’s answer to the question: cbk on the writ of execution 2015 Time limit for collection on the writ of execution, presented in a timely manner never expires.

Subsidies provided for 2013 in the amount of 670,000.0 thousand rubles were redistributed to 2014.

Despite the fact that the “payment purpose” field of the payment order is formed in a fairly free format, the required list of data for it must be clarified with the bailiffs, because

KBK (field 104). Here they put 0, since BCCs are not provided for such transfers. 7. OKTMO is brought to the location of the bailiff service. 8. Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual.

Let’s say that ICS LLC, on the basis of writ of execution dated January 18, 2021 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

Payer's name (field 8). The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given.

2. Results of automatic checks

On November 24, 2012, the Government Decree on the abolition of automobile powers of attorney will come into force.

The organization will fill out the payment order as follows:

- will indicate the employee’s tax identification number, enter 0 in the checkpoint, and designate himself as the payer;

- will indicate 19 as the payer status;

- the individual’s identifier will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

- the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

- instead of UIN will put 0;

- payment order 4th;

- OKTMO - the one that is installed at the location of the FSSP management;

- fields 104, 106, 107 and 109 will contain 0.

The STAR information system does not provide financial services and does not provide financial products.

Source: https://shadowgunlegends.ru/subsidii/11875-kbk-federalnoy-sluzhby-sudebnykh-pristavov-po-moskve.html

KBK 3220000000000000180

Often citizens receive payment orders in which bailiffs indicate the details. KBK 3220000000000000180, the decoding of which is incomprehensible to most citizens, means that the citizen missed a payment under the writ of execution. Missing payments ordered by a court hearing will result in a fine, which is coded by this number. A receipt with this code must be paid within five working days, otherwise a further fine will be assessed.

According to the Civil Code, they must necessarily include:

- Budget Classification Code (BCC).

- Nuances for LLC.

Rules for filling out a payment order

Persons who are faced with the need to deposit funds in favor of bailiffs should be aware that the procedure for filling out payment slips is different. It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of the employee (for example, alimony or traffic police fines) it does not match.

If the document is necessary for non-budgetary collections, then there are no official rules for processing payments. He does not need to fill out tax fields, indicating the payer status, KBK, etc.

Kbk 3220000000000000 bailiffs 2022

Subsequently, they are transferred to the persons to whom the debt arose.

The main functions of a payment document include the following:

- They confirm the legal validity of the deductions made from wages.

- Help maintain order in financial statements.

- Simplify the financial reporting process.

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address. And this, in turn, will lead to penalties from the Federal Tax Service.

Issues related to the formation of payment documents are considered by the Civil Code of the Russian Federation.

According to the Civil Code, they must necessarily include:

- Budget Classification Code (BCC).

- Nuances for LLC.

Rules for filling out a payment order

Persons who are faced with the need to deposit funds in favor of bailiffs should be aware that the procedure for filling out payment slips is different. It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of the employee (for example, alimony or traffic police fines) it does not match.

If the document is necessary for non-budgetary collections, then there are no official rules for processing payments.

He does not need to fill out tax fields, indicating the payer status, BCC, etc.

Such an order must include the following information:

- Nature of payments (for example, alimony deductions).

- Details of the writ of execution according to which deductions are collected.

- Enforcement case number.

- Information about the person in whose favor payments are made.

Additional information that should be included in the payment can always be clarified with the employees of the Federal Bailiff Service.

When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.)

This will avoid various difficulties.

Many people may be faced with a situation where they need to make a payment to the state budget, but they have no idea about it, or, on the contrary, they deliberately do not make this payment, delaying it in all possible ways. Such situations occur mainly when some administrative offense has been committed, but the offender does not want to pay the fine for it. How is KBK 3220000000000000180 used in such situations according to the writ of execution, and also where does this document come from? Let's look at it in this article.

Bailiffs are needed to monitor the implementation of decisions made by the court during legal proceedings.

Moreover, they control not only the implementation of decisions made by the court in material terms. They are also responsible for collecting fines.

That is, they perform the following actions:

• Find a person who owes money to the state budget; • Notify him of debts and the consequences of non-payment; • Find legal ways to collect from this person the amounts of his debts.

A fine will have to deal with bailiffs if he avoids fulfilling his court obligations in every possible way. In this case, he avoids paying the fine to which he is obliged to spend the funds.

In this case, all information identifying the payment is provided in the “Purpose of payment” field.

So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee.

How do bailiffs work?

The main task of bailiffs is to monitor the implementation of decisions made in court. They not only ensure the implementation of court decisions in material terms, but also collect fines from individuals and legal entities that do not repay their existing debt on a timely basis. Bailiffs search for debtors and find legal ways to collect existing debts from them. The most common debt collection mechanism is to send a payment order to the organization where the debtor works.

Budget classification codes according to the writ of execution of the joint venture in 2018

The specific composition of the information can be clarified with the bailiffs.

If, according to a writ of execution, you transfer an employee’s personal taxes to the account of the FSSP department, the payment order is issued according to the rules provided for payments to the budget.

The features of this payment are as follows:

1. Payer’s TIN (field 60). The TIN of the individual whose tax obligation is being fulfilled is indicated. If he does not have a TIN, “0” is entered.

2. Payer’s checkpoint (field 102). Set to "0".

3. Name of the payer (field 8). The short name of the organization that transfers the withheld amounts to the budget, i.e. yours, is given.

4. Payer status (field 101). For these payments, Appendix No. 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n provides the status “19”.

Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, “0” is entered.

6. KBK (field 104). Here they put 0, since BCCs are not provided for such transfers.

OKTMO is brought to the location of the bailiff service.

8. Document number (field 108).

In such a situation, no payment orders will be received.

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment. The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

Why are budget classification codes changing?

In July 1998, the Budget Code of the Russian Federation in Federal Law No. 145 first introduced the term “KBK”, used as a means of grouping the budget.

There are 4 types of KBK:

- relating to government revenues;

- related to expenses;

- indicating the sources from which the budget deficit is financed;

- reflecting government operations.

- organize financial reporting;

- provide a unified form of budget financial information;

- help regulate financial flows at the state level;

- with their help, the municipal and federal budget is drawn up and implemented;

- allow you to compare the dynamics of income and expenses in the desired period;

- inform about the current situation in the state treasury.

INFORMATION FOR ENTREPRENEURS! KBK is an internal coding necessary, first of all, for the state treasury, where the distribution of incoming funds takes place. Entrepreneurs need these codes insofar as they are interested in complying with the requirements for processing government payments, especially taxes and contributions to extra-budgetary funds. Therefore, do not forget to indicate the correct and current KBK code in field 104 of the payment receipt.

This is the cry from the heart of the vast majority of entrepreneurs: how much easier it would be if these codes were uniform and established once and for all. But the Ministry of Finance makes certain changes to the BCC almost every year. Entrepreneurs and accountants do not always have the opportunity to timely monitor innovations and correct the specified BACs, this is especially evident during reporting periods.

There are various versions put forward by entrepreneurs and the Ministry of Finance and the Ministry of Justice do not comment in any way.

- The more receipts passed through incorrect BCCs, the more funds will be “suspended” for some time as unknown. Until errors are corrected, they can be used for unseemly purposes, and on a national scale this is a huge amount.

- Additional filling of the budget by charging fines and penalties for “overdue” payments that were made through the already inactive BCC. Proving timely payment is quite troublesome.

- Inconsistency between the actions of the Ministry of Finance, which assigns codes, and the Ministry of Justice, which approves them.

- Since the KBK is directly “tied” to the public sector, any changes within the relevant structures, the receipt of new directives, etc. lead to a change in coding.

FOR YOUR INFORMATION! There are opinions that since this coding is an internal matter of the Treasury, it should be done by them, and not by taxpayers. The KBK code can be assigned by bank employees based on the specified data about the recipient and purpose of the payment, or by treasury employees upon receipt of it.

Rules for filling out a payment order

Since the receipt form is regulated at the legislative level, the rules for filling it out are also regulated by law. A receipt is drawn up in accordance with Appendix No. 2 of Order of the Ministry of Finance of Russia No. 107n dated November 12, 2013 (as amended on April 5, 2017).

The Regulations of the Bank of the Russian Federation provide information about each payment cell. The encrypted instructions are in Appendix 3, and their decryption is in Appendix 1. Thus, before transferring the employee’s debt money to the budget, the accountant of the company in which the debtor citizen works will draw up the payment as follows:

- Fill in the employee’s TIN, indicate 0 in the checkpoint field, and the organization will be the payer.

- The debtor's position is 19.

This means that the company calculates from the salary of the individual debtor the amount accrued for debt repayment. All statuses are indicated in Appendix 5 of Order No. 107n of the Ministry of Finance of Russia.

- To confirm your identity, in field 108, indicate your passport coded with the number 01.

It is this executive body that must ensure that the calculated fine and penalties are transferred to the state budget.

How to force someone to pay a fine

In this case, naturally, no violent measures will be used. If a person has a debt to the state budget or to another individual and the court has decided to collect the amount of the fine from him, then the bailiffs will search for a method of implementing the court order legally.

One of these is the obligation of the debtor’s employer to transfer the amount of the fine calculated for payment to the state budget by withdrawing it from the wages accrued to the debtor. In this case, of course, all calculations must have a justification and confirm their legality with documents. Bailiffs, obliging the employer to collect money from the state budget, will provide him with the necessary documents to validate the procedure in accounting.

This document substantiating the legality of the deductions made from wages is a writ of execution. It is there that the necessary details for payment are indicated, as well as the legal grounds for withdrawing the required amount, which will then be used by accountants when conducting accounting and reporting.

If he does not have a TIN, 0 is entered.

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

Kbk when transferring to bailiffs

In field No. 4 “Date of payment order” the day, month, year are indicated.

In fields 106 “Base of document”, 107 “Tax period” and 109 “Date of document” enter 0.

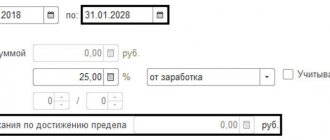

For clarity, let’s look at filling out a payment slip to the FSSP using a conditional example.

Let’s say that IKS LLC, on the basis of writ of execution dated January 18, 2018 No. 1234/56789, withholds from its employee amounts to pay off his transport tax debt.

The organization will fill out the payment order as follows:

• will indicate the employee’s TIN, enter 0 in the checkpoint, and designate himself as the payer;

• indicate 19 as the payer status;

• the identifier of an individual will be a passport, so in field 108 the organization will enter code 01 and, separated by a semicolon, the series and number of the employee’s passport;

• the recipient of the payment will be the department of the Federal Bailiff Service for Moscow;

• instead of UIN will put 0;

• priority of payment is 4th;

• OKTMO - the one that is installed at the location of the FSSP management;

• fields 104, 106, 107 and 109 will contain 0.

You can view and download a completed sample payment order to bailiffs on our website.

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way.

Such an order must include the following information:

- Nature of payments (for example, alimony deductions).

- Details of the writ of execution according to which deductions are collected.

- Enforcement case number.

- Information about the person in whose favor payments are made.

Additional information that should be included in the payment can always be clarified with the employees of the Federal Bailiff Service.

When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.)

The concept was put into effect by the Budget Code of Russia (Federal Law No. 14).

The procedure and principle of deduction from wages under writs of execution are prescribed in the regulations of the Labor and Family Codes, Federal Laws and Resolutions approved by the Government of the Russian Federation.

According to the letter of Federal Law No. 229 “On Enforcement Proceedings”, in cases where the debt does not exceed 25,000 rubles, the claimant has the right to send a document on its retention to the debtor directly, without resorting to the services of bailiffs. In addition to the writ of execution, the debtor is sent an application indicating the account and details of the claimant, where payment under the writ of execution will be received.

In accordance with Art. 242.1 of the BC RF, a copy of the arbitration court decision on the basis of which the corresponding writ of execution was issued must be attached to the writ of execution.

Payment must be made within five working days after receiving the writ of execution. The period for voluntary repayment of the debt amount is established by the bailiff service at the time of initiation of enforcement proceedings.

- 01 — passport of a Russian citizen;

- 04 - military personnel identification card;

- 14 — SNILS;

- 22 - driver's license;

- 24 - vehicle registration certificate.

This cipher is separated from the identifier by a semicolon. The signs “No” and “–” are not indicated in field 108.

— violation of the prohibition to perform certain actions imposed as part of measures to secure a claim (Part 2 of Article 140 of the Code of Civil Procedure);

What is judicial debt and why does it arise?

Legal debt of a legal entity is a debt of an organization to an individual, legal entity or state, which was transferred for collection to the Federal Bailiff Service (FSSP).

One of the most common causes of legal debt is unpaid traffic fines. Bailiffs can also transfer overdue taxes or debts of an organization to other legal entities or individuals.

The organization is given 5 days to voluntarily pay the debt from the date of receipt of the decision to initiate enforcement proceedings. You can also notify about the debt by SMS or through State Services, and then the period for voluntary payment is counted from the moment the notification is delivered. If you do not repay the debt on time, the bailiffs will forcefully collect it.

The statute of limitations for collecting money from traffic police fines is 2 years. If the period has expired and the fine has not been collected, then the enforcement proceedings end (Article 47 of the Federal Law “On Enforcement Proceedings”).

What is a payment order to bailiffs

To implement court decisions in the Russian Federation, the Office of the Bailiff Service was created. Its employees are required to perform the following tasks:

- Find people who have debts (for example, on loans).

- In various ways, notify debtors about existing arrears and about options for repaying them.

- Seek legal opportunities to pay existing debts.

These measures, naturally, become relevant if the citizen himself evades his obligation to comply with court decisions.

One of the ways to pay debts is the sums of money that the defaulter’s employer transfers from his official income from production activities. The bailiffs, in turn, are obliged to submit to the accounting department of the enterprise where the debtor works, all documents that may serve as the basis for the implementation of court orders. These include a writ of execution. They must indicate all the necessary details for cash payments. A sample payment order for a writ of execution to bailiffs can be viewed on the Internet.

In practice, there are several forms of such receipts:

- To make payments to cover tax debts.

- For non-tax deductions.

The purpose of the payment document is to justify the deductions that are made from the employee’s income. These amounts of money are first credited to the SSP account. Subsequently, they are transferred to the persons to whom the debt arose.

The main functions of a payment document include the following:

- They confirm the legal validity of the deductions made from wages.

- Help maintain order in financial statements.

- Simplify the financial reporting process.

Persons responsible for sending payment documents should always remember the need to be scrupulous in filling them out. Errors in this case may result in money being sent to the wrong address. And this, in turn, will lead to penalties from the Federal Tax Service.

Issues related to the formation of payment documents are considered by the Civil Code of the Russian Federation. According to the Civil Code, they must necessarily include:

- Budget Classification Code (BCC).

- Nuances for LLC.

Fee amount

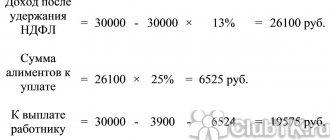

The bailiff cannot arbitrarily determine the amount of the fee. In paragraph 3 of Art. 112 of Law No. 229-FZ provides for all possible options for calculation:

- if a certain amount is recovered by a court decision, the fee will be 7%;

- if the subject of recovery is property or rights to it, the fee is fixed at 7% of its value;

- the size of the sanction cannot be less than 1 thousand rubles. (for collection from citizens and individual entrepreneurs) or 10 thousand rubles. (when recovering from legal entities);

- if the performance is of a non-property nature, the fee is collected in a fixed amount of 5 thousand rubles. (from citizens and individual entrepreneurs) or 50 thousand rubles. (from legal entities).

Let's look at examples:

If the subject of collection is financial in nature, it is not difficult to calculate the amount of the fee. For example, if the amount of 100 thousand rubles is fixed in the writ of execution, and the debtor does not transfer it within the appointed time, the amount of the sanction will be 7 thousand rubles. The amount recovered by the court may include not only the satisfaction of the claimant's claims, but also court costs, legal costs and other financial obligations. For all amounts confirmed by the writ of execution, the fee will be calculated at a rate of 7%. If only part of the debt is paid within the period specified in the resolution, the fee will be calculated on the remaining amount.

Difficulties may arise when determining the value of property assets or rights. The bailiff cannot independently assess the value of the property. For this, the rules set out in the Letter of the FSSP dated 07/08/2014 No. 0001/16 apply:

- when collecting property from the defendant, the court is obliged to indicate its value in the decision and writ of execution;

- in the absence of such information in the writ of execution, the bailiff is obliged to send to the court a request for clarification of the act regarding the value of the property;

- if the court indicates that the property is not subject to assessment or refuses to provide an explanation, the enforcement fee is assigned in a fixed amount of 5 thousand rubles. (from citizens and individual entrepreneurs) or 50 thousand rubles. (from legal entities).

The bailiff does not have the right to involve appraisers in calculating the value, or to determine it based on information and documents provided by the claimant or debtor. Therefore, all controversial issues related to the valuation of property will have to be resolved by the parties in court.

Special rules are also provided for calculating the fee for periodic (regular) obligations. A typical example is the withholding of alimony from a debtor in favor of a child. The bailiff is given the right to collect a fee of 7% for each late periodic payment. Therefore, during ongoing proceedings, several decisions may be made against the debtor if he systematically violates payment deadlines.

Rules for filling out a payment order

Persons who are faced with the need to deposit funds in favor of bailiffs should be aware that the procedure for filling out payment slips is different. It depends on the nature of the cash withholdings. This means that for taxes and for non-tax payments of the employee (for example, alimony or traffic police fines) it does not match.

If the document is necessary for non-budgetary collections, then there are no official rules for processing payments. He does not need to fill out tax fields, indicating the payer status, BCC, etc.

Such an order must include the following information:

- Nature of payments (for example, alimony deductions).

- Details of the writ of execution according to which deductions are collected.

- Enforcement case number.

- Information about the person in whose favor payments are made.

Additional information that should be included in the payment can always be clarified with the employees of the Federal Bailiff Service.

When transferring taxes, the payment document must include the following information:

- TIN of the person who is the payer.

- Checkpoint of the citizen from whom deductions are made.

- The name of the payer is the organization that transfers the amounts of money collected from the individual.

- Payer status. In this case it will be 19.

- Code. If the payer has an identifier, then this should be entered.

- KBK. Such documents are marked with 0.

- The classification according to OKTMO is the one that relates to the location of the bailiff’s office to whose account the payment is made.

- A unique number of a document that can act as an identifier of an individual (for example, a civil passport number, SNILS, etc.).

You can see how payment orders are filled out for bailiffs in 2022 and download the corresponding form on various legal sites on the Internet.

What is an enforcement fee from bailiffs?

Let's understand the basic terms and concepts that you will encounter in this article, so:

An enforcement fee is a monetary penalty imposed by bailiffs. The fee is analogous to a fine, which is imposed only for the debtor’s failure to comply with the deadline for the voluntary execution of a court decision.

Enforcement proceedings are the process of forced execution of judicial acts carried out by bailiffs. During this process, the bailiff can seize bank accounts and property, seize wages and other income, put the debtor on the wanted list, and take other enforcement measures. Proceedings begin after the bailiff receives the application and enforcement documents, and terminates after the debt is repaid or other court orders are fulfilled.

A writ of execution is a document confirming the list of obligations and amounts specified in the court decision. The claimant may receive a writ of execution after the decision enters into force. The document is signed by the judge and the seal of the court, and it is drawn up on a strict reporting form.