Normative base

Decree of the Government of the Russian Federation No. 841 of July 18, 1996 “On the List of types of wages and other income from which alimony for minor children is withheld”

Federal Law No. 229-FZ of October 2, 2007 “On enforcement proceedings”

Directive of the Bank of Russia No. 5286-U dated October 14, 2019 “On the procedure for indicating the code of the type of income in orders for the transfer of funds”

Information letter of the Bank of Russia dated February 27, 2020 N IN-05-45/10 “On indicating the amount collected in the settlement document”

What has changed since June 1, 2022

From June 1, 2022, by the instruction of the Central Bank of Russia No. 5286-U, mandatory codes have been introduced that are indicated when issuing payment orders to individuals. The encoding is entered in field 20 “Name. pl.” and is intended to separate payments to citizens who can be levied under enforcement proceedings and who cannot.

There are only three codes:

1 - income that bailiffs have the right to seize, but subject to restrictions: wages, vacation pay, disability benefits;

2 - payments for which recovery is not applied: alimony, child benefits (Article 101 229-FZ of October 2, 2007);

3 – compensation for harm to health.

When transferring child support withheld from an employee, indicate the second income code in the payment order for alimony in field 20.

Withholding of alimony from earnings

After the employer has received a writ of execution from the claimant or a copy thereof from the bailiff, in which his employee is indicated as a debtor, the amounts specified in the writ of execution should be withheld from wages (including advance payments) and other income paid to the employee, regardless of his desire (Part 3 of Article 98 of the Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

The employer may receive a writ of execution from a bailiff or from the claimant himself (for example, from the employee’s ex-wife). It is imperative to inform the employee about the receipt of the writ of execution and obtain his signature stating that he knows about the receipt of such an order (letter of Rostrud dated December 19, 2007 No. 5204-6-0).

How deductions are made

Withholding of alimony from an employee is carried out either by writ of execution or by personal application of the employee.

If the organization receives a writ of execution, then child support is withheld regardless of the employee’s wishes. It specifies the amounts and procedure for withholding, and the details of the recipient.

If the transfer to the recipient is made by bank transfer, then it is necessary to fill out a payment order when transferring alimony, taking into account the latest changes in the processing of transfers to individuals.

Maintenance for a minor is ceased to be withheld according to a writ of execution only when the child reaches the age of majority or upon the dismissal of an employee.

How to transfer alimony by payment order

A payment order is a document on the basis of which funds are transferred from one current account to another. When transferring alimony funds, you must follow certain rules.

Required documents

As for the documents, you will only need those papers that contain the necessary information to fill out the payment order. It can be:

- Passport;

- TIN;

- A document serving as the basis for the legal collection of alimony;

- Recipient details.

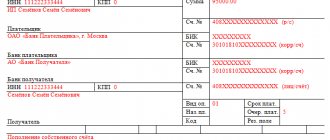

How to fill out a payment order

How should a document about the transfer of alimony funds be filled out, and what information must be contained in it:

- The payment order is assigned a number. It is indicated at the top and is created automatically after saving the typed payment;

- Date of the document;

- Document type: electronic;

- Information about the payer – full name, INN, account details, bank name, OKPO;

- Information about the recipient - full name, INN, account details, bank name, OKPO;

- The amount must be entered in numbers and words;

- Payment type. For alimony, select 01;

- The order of deduction (that is, in what sequence this document must be paid) – 1. Alimony payments are made first, in accordance with Article 855 of the Civil Code of the Russian Federation;

- Purpose of payment – child support, full name, date, month, grounds for collection;

- Payer's signature.

Remember that any bank document filled out incorrectly will not be processed, resulting in the money not being credited to the recipient's account. You will be notified of this, and you will have to correct errors in the order or refuse and create a new one.

Each of the listed items in the payment order has its own field, so it’s easy to figure out where and what information to enter. If you are worried that you will fill out the document incorrectly, you can ask an accountant at work or a bank employee for a sample.

Sample payment order for the transfer of alimony under a writ of execution

From what income is alimony withheld?

Maintenance for minors is paid from all employee income not only during work, but also during absence from work:

- wages;

- bonuses, allowances, and other remuneration for performing job duties;

- vacation pay;

- temporary disability benefits.

The full list is given in Government Decree No. 841 of July 18, 1996.

IMPORTANT!

The deduction should be made from the salary after personal income tax has been deducted.

The types of payments from which child support is not withheld include (Article 101 229-FZ):

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization. The government list clarifies that we are talking about the use of tools, transport, equipment, other technical means and materials, reimbursement of expenses associated with their use (RF Government Decree No. 388 of 04/01/2019);

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

Deduction amount

If the parents have not agreed on the amount of child support, then it is collected in court in the amount of:

- quarters of income - per child;

- thirds of income - for two children;

- half of earnings - on three or more.

If a citizen does not comply with the court’s demand voluntarily, then the writ of execution is sent to his place of work. The employer is obliged to fulfill it unconditionally. How to draw up a payment order for alimony under a writ of execution and avoid mistakes?

According to the writ of execution, in addition to current payments for children, the resulting debt is collected. The maximum total percentage of such deduction is 70% of the employee's earnings.

Example

Semenov Andrey Petrovich pays, according to the writ of execution for his son, to his ex-wife, Semenova Inna Leonidovna, a payment in the amount of 25% of the income. In May 2022, he received a salary of 30,000 rubles. He did not submit an application for personal income tax deductions. Let's calculate the amount of deduction:

Features of filling out a payment document

The employer is obliged to transfer the amounts withheld from the employee's salary to the recipient of the minor's support within three days from the date of payment of the employee's salary (Part 3 of Article 98 of Law No. 229-FZ).

When issuing a payment order, you must indicate the recipient's full name and bank details. They are either indicated in the writ of execution, or the employee indicates them in the application (when paying maintenance for minors by agreement).

Payment of child support is debited from the account on a priority basis (Article 855 of the Civil Code of the Russian Federation), therefore, in field 21 of the payment order, indicate “1”.

When transferring by agreement between the child’s parents, the details of this document should be indicated in the purpose of payment.

Example of alimony payment from June 1, 2020

If maintenance is paid for a minor by court decision, then in the purpose of payment, be sure to indicate the number and date of the writ of execution.

Sample - how to fill out a payment order for alimony from 06/01/2020

After June 1, 2022, the amounts withheld under enforcement documents should be indicated in the order on the transfer of income from which the withholding was made. Such clarifications are given by the Bank of Russia in letter No. IN-05-45/10 dated February 27, 2020. When filling out a payment order for your salary, enter in field 24 “Purpose of payment” the amount of funds withheld.

Briefly about the procedure for calculating alimony

Alimony is transferred by the employer within 3 days from the date of payment of income to the employee on the basis of a writ of execution or an agreement of the parties on the payment of alimony (Article 109 of the RF IC).

From 06/01/2020, in field “24” of a payment slip for the payment of income to an individual debtor, information about the amount of the collected amount is indicated. For example, the entry “Payment of wages for June 2022 to Ivan Ivanovich Ivanov //VZS//5000-00//” means that the employer withheld 5,000 rubles from the amount of payment to the employee according to the writ of execution. This is how withheld alimony is now indicated in payment slips for the transfer of wages (or other income) to the debtor.

When calculating alimony for minor children, it is not allowed to recover more than 70% of the employee’s income after withholding personal income tax, in other cases - no more than 50% (Article 138 of the Labor Code of the Russian Federation, Article 99 of Law No. 229-FZ dated 02.10.2007).

Transfer to the account of bailiffs

Sometimes the decree on the execution of a court decision does not indicate the second parent as the recipient, but the Office of the Federal Bailiff Service. This situation arises, for example, when collecting a debt, in the absence of the ability for the applicant or the child to receive funds either in cash or in non-cash form (no bank card or account), and if the children are supported by the state. In this case, the recipient of the payment is the Federal Bailiff Service. But despite the fact that the funds are transferred to a government agency, the payment order for alimony should not be filled out in the fields intended for payments to the budget. This is explained by the fact that such a payment is not a transfer to the budget (tax, fee), but is simply accumulated by the bailiff service in a special account for further payment to the recipient.

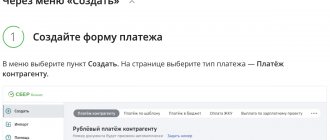

How to fill out a payment form when transferring alimony to the FSPP deposit

When transferring to bailiffs, in field 60, provide the tax identification number of the employee from whom you are withholding alimony, checkpoint - 0.

Details of the payee, take the order of the bailiff, on the basis of which you transfer alimony. In this case, the recipient can be either an individual in whose favor alimony is paid or a territorial branch of the FSSP.

In fields 6 and 7, enter the amount of alimony withheld.

In field 21 “Essay. payment." When transferring alimony according to a writ of execution, indicate the order of payment – “1”.

In field 24 “Purpose of payment”, briefly indicate the document on the basis of which you are transferring alimony, and other information about the payment that will help identify it. For example, “Alimony under writ of execution No. 22/6 dated 09/29/2021 for October 2022, OSP for the Central JSC No. 3 of the Federal Bailiff Service of Russia for the city of Moscow. Case 12345/alim/12. Without VAT".

Fields 101, 104 - 110 in the payment order for the payment of alimony do not need to be filled out.

Also on topic:

How payment orders have changed in the fall of 2022: explanations from berator experts