What documents are approved by KBK-2020

The BCC applicable in 2022 is covered by two current regulatory legal acts:

- Order of the Ministry of Finance dated November 29, 2019 No. 207n “On approval of codes (lists of codes) of the budget classification of the Russian Federation related to the federal budget and budgets of state extra-budgetary funds of the Russian Federation” (hereinafter referred to as Order No. 207n). This document replaced the order of the Ministry of Finance of the same name dated 06.06.19 No. 86n, which became invalid as of January 21, 2022.

- Order of the Ministry of Finance dated 06.06.19 No. 85n “On the procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of purpose.”

The codes that were used in 2022 were regulated by Order of the Ministry of Finance dated 06/08/18 No. 132n.

Codes for paying traffic fines have changed

Traffic police officers inform you that in accordance with the Federal Law of April 15, 2019 No. 62-FZ “On Amendments to the Budget Code of the Russian Federation,” a new principle for crediting income from the payment of fines will be introduced from January 1, 2022.

The budget classification codes for road traffic revenues have also been changed.

18811601111019000140 — administrative fines established by Chapter 11 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in transport, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines).

18811601121010001140 — administrative fines established by Chapter 12 of the Code of the Russian Federation on Administrative Offences, for administrative offenses in the field of road traffic, imposed by judges of federal courts, officials of federal government bodies, institutions (fines for violations of traffic rules, vehicle operating rules).

18811601191010005140 - administrative fines established by Chapter 19 of the Code of the Russian Federation on Administrative Offenses, for administrative offenses, against the order of management, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (fines for failure to comply with legal orders (decrees, submissions, decisions) of the body (official) exercising state supervision (control), organizations authorized in accordance with federal laws to carry out state supervision (official), body (official) exercising municipal control).

18811601191019000140 — administrative fines established by Chapter 19 of the Code of the Russian Federation on Administrative Offences, for administrative offenses against the management order, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines).

18811601201019000140 — administrative fines established by Chapter 20 of the Code of the Russian Federation on Administrative Offences, for administrative offenses encroaching on public order and public safety, imposed by judges of federal courts, officials of federal government bodies, institutions, the Central Bank of the Russian Federation (other fines).

OGIBDD of the Ministry of Internal Affairs of Russia "Irbitsky"

BCC for other tax sanctions

The changes affected the codes that are used to pay fines imposed under Chapter 16 of the Tax Code of the Russian Federation.

In 2022, there was one common code for all sanctions. And in 2020, different BCCs are provided for different sanctions (see Table 1).

Table 1

KBK for payment of tax sanctions for certain types of violations

| Type of tax sanction | 2020 | 2019 |

| For the submission of documents by the tax agent, containing false information (Article 126.1 of the Tax Code of the Russian Federation) | 182 1 1608 140 | 182 1 1600 140 |

| For failure to provide the information required for tax control (Article 126 of the Tax Code of the Russian Federation) | 182 1 1607 14 | |

| For gross violation of the rules for accounting for income and expenses and objects of taxation, bases for calculating insurance premiums (Article 120 of the Tax Code of the Russian Federation) | 182 1 1605 140 | |

| For violation of the established method submission of a tax return, calculation (Article 119.1 of the Tax Code of the Russian Federation) | 182 1 1603 140 | |

| For failure to submit a tax return, calculation of insurance premiums (Article 119 of the Tax Code of the Russian Federation) | 182 1 1602 140 |

Violation of legislation on taxes and fees

Sometimes citizens and legal entities evade paying fees, do not deposit tax funds on time, or violate other laws of the tax legislation of the Russian Federation. For these actions, Federal Tax Service employees impose penalties on the culprit, which are paid indicating the corresponding codes classifying the payment in the receipt.

| Payment | KBK |

| Violation of legislation on taxes and fees | 182 1 1600 140 |

| Violation of the legislation on taxes and fees, provided for in Articles 116, 1191, 1192, clauses 1 and 2 of Art. 120, art. 125. 126, 1261, 128. 129, 1291, 1294, 132, 133, 134. 135, 1351, 1352 Tax Code of the Russian Federation | 182 1 1600 140 |

| Evasion of taxes and/or fees, concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and/or fees should be collected, for failure to fulfill the duty of a tax agent (federal government bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

| Violation of the legislation on taxes and fees provided for in Art. 129.6 of the Tax Code of the Russian Federation (federal state bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation) | 182 1 1600 140 |

Codes for administrative fines

There are also innovations under the Code of Criminal Procedure for administrative fines, which are imposed under Chapter 15 of the Code of Administrative Offenses of the Russian Federation for tax-related violations.

In 2022, separate codes should be used for some fines, but in 2022 one general BCC was used (see Table 2).

Fill out payments in the web service for individual entrepreneurs for free

table 2

KBC for payment of administrative fines for tax-related violations

| Type of administrative fine | 2020 | 2019 |

| For violation of deadlines for submitting a tax return, calculation of insurance premiums (Article 15.5 of the Code of Administrative Offenses of the Russian Federation) | 182 1 1605 140 | 182 1 1600 140 |

| For failure to provide (failure to report) information, necessary for tax control (Article 15.6 of the Code of Administrative Offenses of the Russian Federation) | 182 1 1606 140 | |

| For violation of the registration deadline in the tax authority (Article 15.3 of the Code of Administrative Offenses of the Russian Federation) | 182 1 1603 140 |

Administrative offenses

Administrative violations are illegal actions in relation to laws and the charter of the Code of Administrative Offenses of the Russian Federation Federal Law No. 195 of December 30, 2001 (as amended on December 27, 2018). According to ch. 2 of the Code of Administrative Offenses of the Russian Federation, both individuals and legal entities, including foreigners, are held administratively liable.

The legislation of the Russian Federation provides a list of illegal acts for which citizens and legal entities are held accountable before the law and pay penalties. A complete list is provided in section II of the Code of Administrative Offenses of the Russian Federation. The amounts of fines are approved in Art. 3.5 Ch. 3 Code of Administrative Offenses of the Russian Federation.

If it so happens that an individual entrepreneur, an organization or a citizen committed any of the listed acts and were subject to sanctions, then when paying penalties in the payment order, you must indicate to the KBC the administrative fine.

Payment

KBK

Violations of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation (federal government agencies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

Violation of the legislation of the Russian Federation on administrative offenses provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation (federal bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

What codes to use in 2022 when paying fines for past periods

Since budget classification codes approved by Order No. 207n are in effect from January 21, 2022, the previous values do not apply from that date. This means that, regardless of the period to which the payment relates, it is no longer possible to use outdated BCCs.

EXAMPLE. Let’s say that in January 2022 the company pays a fine for a gross violation of the rules for accounting for income and expenses committed in 2022. The amount of the fine is reflected in the decision made following the tax audit in December 2022. In the payment order, the accountant must reflect the BCC in force in 2020, namely 182 1 1605 140.

Please note: errors when filling out payment slips can be eliminated if payment documents are generated automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in 1 click based on data from the declaration (calculation) or the request for payment of tax (contribution) sent by the inspectorates. All necessary data (recipient details, current BCC, account numbers of Federal Treasury departments, codes for payer status) are promptly updated in the service without user participation. When filling out a payment slip, all current values are entered automatically.

Structure of payment details of the Federal Criminal Code of the Russian Federation

The details of the recipient of payments for fines consist of several values, each of which carries important information. An error will lead to the payer’s money not reaching its intended destination.

Recipient

When filling out the receipt yourself, you must correctly indicate the name of the recipient of the funds. As mentioned above, it is the regional Department of the Federal Treasury of the Russian Federation. However, you do not need to write its name in full.

The name of the recipient should be indicated in an abbreviated form in the same form in which it appears in the details received on the official website of the traffic police.

For example, UFK for the Ulyanovsk region (Ministry of Internal Affairs of Russia for the Ulyanovsk region). It should be remembered that the name of the organization is not the purpose of payment to pay the fine.

Recipient's TIN

The receipt must indicate the recipient's TIN, which consists of 10 digits and is assigned by the tax authority at the place of registration of the legal entity. Each division of the Federal Tax Service has its own unique taxpayer identification number entered in the Unified Register of the Federal Tax Service of the Russian Federation.

checkpoint of the organization

If the TIN is assigned to both individuals and legal entities, then the KPP (reason code for registration) is only available to organizations and enterprises. It is assigned by the Federal Tax Service at the place of registration of the legal entity and consists of 9 digits. The checkpoint contains information about the region where the organization is located, the Federal Tax Service inspection that issued the code, the reason for registration and its serial number. This value in the details is used to record incoming payments. The average payer is only required to correctly indicate the checkpoint combination.

OKTMO value

OKTMO (All-Russian Classifier of Territories and Municipalities) can have up to 8 digits in its combination. It is intended to identify the location of the organization that is the recipient of the payment - in a certain region, city, district, rural settlement, etc.

Checking account

The recipient's current account opened in a particular bank is very important. This is where the funds transferred as payment of traffic police fines go. The current account consists of 20 digits, and all of them must be entered correctly by the payer. If you enter at least one digit incorrectly, the transaction will not go through and the debt will not be repaid.

Bank identification code

When making any payments, you must indicate your bank identification code (BIC). It is assigned by the Bank of Russia and no longer belongs to the UFC, but to a specific financial institution that is engaged in servicing the organization’s current account.

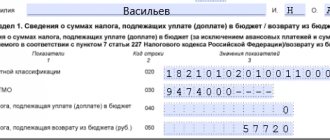

Budget classification code

It is necessary to add a budget classification code (BCC) to the payment details, which serves to identify the type of payment to the state budget - traffic police fines. You will find out which BCC to indicate right now. All fines for violations of the Traffic Rules, regardless of the region, have a single BCC value - 18811630020016000140.

Is it necessary to indicate the name of the traffic police inspection?

When filling out a receipt or a universal online form for paying fines for non-compliance with traffic rules, you do not need to indicate the full name of the State Traffic Inspectorate, since it is not the direct recipient of the payment. In addition to the details of the Federal Criminal Code in your region, you must indicate the number of the resolution on the administrative offense, your personal data, registration address and the name of the payment - “Fine for violating traffic rules”.