The cost of transporting goods is calculated taking into account the provisions stated in the instructions on the composition, accounting and calculation of costs, approved by the Ministry of Transport on August 29, 1995. The legislator in the instructions determined the list of transportation costs taken into account in accounting. These include labor and material expenses, expenses for ensuring the reproduction of fixed assets, protection of the environment and property assets, payment of mandatory payments and invoices of counterparties.

How to draw up a contract for the carriage of goods by road?

What applies to transport costs?

The range of potential options is quite wide - in this case, the specifics, as a rule, are determined by the profile of the enterprise.

For example, an organization conducts production activities, producing various types of equipment, raw materials or products for subsequent sale to wholesale and retail customers. This means that when concluding a contract, one of the issues discussed is the delivery of goods, the costs of which may fall on both the seller and the buyer. The conditions depend on the agreements between the parties, the financial aspects of the transaction, the availability of the necessary logistics capacities and other factors. The main thing is that each unit produced must go through a full product distribution cycle, ultimately reaching the end consumer - either directly or through a retailer.

In addition, production requires certain resources supplied by third parties - in which case the costs of transporting the products must also be reflected in official accounts. If you ask the question: the costs of transportation costs - what are these costs, then we can say that they include all procurement operations for the movement of sold and purchased goods, equipment or raw materials, and are supplemented by items directly related to the provision of these processes.

The more significant the amount spent during the reporting period, the more attention is paid to it by both the organization’s management and the inspection services. In this regard, correct accounting, which reflects all related activities, is of particular importance. It is worth noting that it is a fairly common practice when the costs of transport services for the delivery of goods from the supplier to the buyer (essentially paid at his expense) are included in the price - this is important to take into account when making decisions on providing client discounts, since without optimizing the cost in First of all, margins suffer, to compensate for which a significant increase in quantitative sales volume is required. A comprehensive analysis allows you to identify sources of unnecessary expenses and reduce them without compromising operational activities. So, for example, if an organization owns its own fleet of vehicles, but the vehicles on its balance sheet are used quite rarely - which does not eliminate the need for their periodic maintenance - it is recommended to disband the division and hire a third-party company to perform irregular logistics tasks.

Accounting and tax accounting of transportation costs

Costs for the delivery of material assets can be taken into account according to two schemes:

- transportation was carried out using our own resources;

- the service was provided by third parties on a contractual basis for a fixed fee.

If the company has its own vehicles that can be used in the transportation of goods, the organization takes them into account using one of the methods:

- in the case of a large vehicle fleet, a separate division is created;

- in situations with a small number of vehicles, a separate service is not allocated in the structure of the enterprise; records are kept for each vehicle.

In the first option, in accounting, costs will be charged to account 23, intended for expenses of auxiliary production. In the absence of a separate transport department, the accounting department applies account 26, adding a subaccount for vehicles to it. In the latter case, the costs will be of a general business type.

Expenses for:

- fuel, oils;

- depreciation deductions;

- passing a technical inspection;

- carrying out repairs;

- wages paid to drivers with contributions accrued on it;

- remuneration of personnel involved in vehicle maintenance (mechanics, diagnostics, electricians, accountant, economist).

NOTE! Transportation costs should be allocated in accounting as a separate cost item and accumulated separately from other expense turnover. Such a rule is necessary to compare accounting and tax accounting data and create a basis for management accounting.

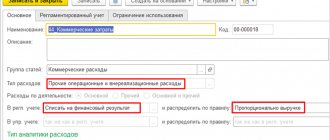

The account used in accounting for accumulating transportation costs must be approved in the local act of the enterprise - the accounting policy. Such expenses are in the nature of indirect costs. They are distributed according to the types of products manufactured or directly reduce sales revenue in the current period by their amount.

The procedure for recognizing and reflecting transport costs in tax accounting is regulated by the provisions of Art. 254 Tax Code of the Russian Federation. Expenses are taken into account in the current period. For material assets that are transported within the enterprise and were purchased from third parties, delivery costs are included in the cost of inventory.

Requirements for documentary evidence of cargo delivery operations are specified in clause 1 of Art. 9 of Law No. 129-FZ of November 21, 1996 and the Tax Code of the Russian Federation in paragraph 1 of Art. 252. To record the level of fuel costs for vehicles involved in transportation, a waybill form is used. When transporting valuables, a TTN is drawn up or a consignment note is filled out.

To what account should transport costs and costs associated with the movement of fixed assets be attributed?

In accordance with the provisions established within the eighth paragraph of the Rules defining the accounting procedure, this category of expenses is equated to the acquisition or creation of products by the enterprise. This approach applies to the following types of OS:

- Created directly by the organization.

- Purchased on the basis of an appropriate agreement (including in relation to barter-type agreements, when mutual settlements do not involve the transfer of funds).

- Received free of charge.

All of the above options for transportation costs in the accounting policy are considered as capital investments, which actually increase the base cost of commodity units. For reflection, the corresponding debit accounts are used, and within the framework of correspondence, expense accounts are used.

It is important to consider that this procedure is not relevant for all situations. Thus, expenses associated with the movement of objects within the territory of an enterprise that do not require installation work for subsequent operation are classified as production. This is true not only for vehicles, but also for various types of equipment, including large equipment used in construction work - from excavators and bulldozers to concrete mixers and rollers for laying asphalt. In the case of transportation of equipment that involves installation and dismantling, the costs incurred are considered as operating costs.

Where and when will the experiment take place?

The experiment will last one month - from October 1 to October 30, 2020.

The pilot project will unfold in six regions: the Republic of Tatarstan, Krasnodar Territory, Moscow, Moscow, Ryazan and Kaluga regions. The Ministry of Transport intends to attract the largest regional carriers to it. Participation in the pilot project is voluntary. During the experiment, companies will continue to issue paper transport documents simultaneously with electronic ones.

Fill out the waybill with all the necessary details in a special service

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Re-setting the TR

In this case, we consider the features of accounting in situations where transport costs for the delivery and transportation of goods (products) to the buyer are associated with the services of third-party organizations - these are the so-called logistics intermediaries. After all planned work has been fully implemented, an invoice for payment is issued to the client. The procedure is associated with tax risks, which makes it important to correctly reflect it in the financial statements. If necessary, the conditions for compensation for emerging expenses can be fixed within the framework of an agreement defining the main provisions of cooperation between companies.

What is the point of the experiment

As part of the pilot project, road transport participants will generate the necessary documents electronically and transfer them to each other and to the Ministry of Transport using the information system “Paperless transportation of passengers and cargo” (“Superservice 22”).

It is currently under development. Part of the system will be launched by October 31, after which feedback collection, analysis and refinement will begin. The Ministry of Transport plans that the transfer of transport documents into digital format will make document flow transparent for senders and recipients of goods, carrier companies and regulatory authorities, including the Federal Tax Service, the Ministry of Internal Affairs, etc. Transportation participants will save time and money on initial clearance.

Posting examples

Let's consider the possible options in more detail.

Transport costs are included in the product price

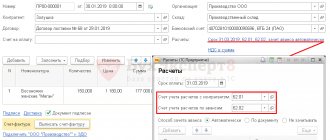

The enterprise CJSC Amethyst purchased equipment with a total cost of 531 thousand rubles, including VAT in the amount of 81 thousand. The amount of logistics costs amounted to 29.5 thousand, respectively, VAT - 4500. Based on the accounting policy of the organization, these expenses are attributed to the cost of goods units, which necessitates the use of count 15.

In accordance with the provisions of paragraph 6 of the Accounting Rules (PBU 5/01), transportation costs can be taken into account within the actual cost value written off through account 41. It is carried out as follows:

| Debit | Credit | Amount, thousand rubles | Document | Description |

| 15 | 60 | 450 | TORG-12, entrance. s/f | Purchase price |

| 19 | 60 | 81 | VAT | |

| 15 | 60 | 25 | Shipping | |

| 19 | 60 | 4,5 | Per. VAT | |

| 41 | 15 | 475 | Fact. price |

Transport costs for delivery of goods are considered costs associated with sales.

Izumrud LLC made a purchase for 413 thousand rubles, including VAT 63,000. Transportation cost 20 thousand 60 rubles, including tax 3,060, and, in accordance with the company’s policy, as well as paragraph 13 of PBU 5/01, was categorized as selling expenses. To form the cost price, 41 invoices must be used, as well as basic entries for calculating the tax levy.

Products are shipped through a freight forwarding company.

JSC Diamant enters into a deal for the supply of a batch of manufactured products, assuming delivery obligations. The contract is valued at 885 thousand rubles, including value added tax in the amount of 135 thousand. To organize transportation, a logistics intermediary is involved, who undertakes to fulfill the order within the appointed time frame. In accordance with the terms of the agreement, the sender must pay the carrier 35.4 thousand, including VAT 5.4 thousand rubles. How to include transport costs in the cost of goods and register a write-off in tax accounting? The algorithm looks like this:

| Debit | Credit | Amount, thousand rubles | The document that serves as the basis | Description |

| 62 | 90.01 | 885 | TORG-12, outcome. s/f, TTN 1-T | Receipt of working capital |

| 90.03 | 68.02 | 135 | VAT on sales price | |

| 90.02 | 41 | 885 | Write-off of commercial products | |

| 44.01 | 60 | 30 | Agreement for the provision of logistics services, Certificate of completion of work, TN, TTN, TORG-12 | Shipping costs |

| 19.04 | 60 | 5,4 | Received invoice | Input VAT issued by the logistician |

| 51 | 62 | 885 | Extract | Payment, shipment |

| 60 | 51 | 35,4 | Payment, transportation | |

| 90.07.01 | 44.01 | 30 | Buh. reference | Write-off of transportation expenses |

| 68 | 19 | 5,4 | Book of purchases | VAT for deduction |

Transport expedition: documentation, accounting and taxation

Currently, activities related to the provision of transport and forwarding services are quite common. As practice shows, when concluding contracts related to the transportation of goods and placing transportation orders, many violations and inaccuracies arise. From this article you will learn about the documents used to document these transactions and how to avoid errors when recording transactions in accounting and taxation.

Legal basis

Transport and forwarding activities are regulated by Chapter 41 of the Civil Code of the Russian Federation, as well as Federal Law No. 87-FZ dated June 30, 2003 “On transport and forwarding activities” (hereinafter referred to as Law No. 87-FZ).

Services provided by a freight forwarder can be divided into basic (related to the transportation of goods) and additional, which may or may not be contained in the contract.

The main services include: conclusion, on the client’s instructions, of contracts for the organization of transportation by appropriate mode of transport or intermodal transport; registration of orders and applications for the provision of vehicles for loading; payment of freight charges; concluding transportation contracts, charter agreements, ensuring the dispatch and receipt of cargo, etc.

As additional services, the forwarder can undertake the receipt of documents required for export and import, customs clearance of cargo, and can also check the quantity and condition of cargo, its loading and unloading, storage of cargo, its receipt at the destination, labeling and packaging of cargo, inspection state of packaging, warehousing, as well as performing other operations with cargo (clause 1 of Article 801 of the Civil Code of the Russian Federation).

The client may grant the forwarder the right to enter into contracts both on his own behalf and on behalf of the client. The latter must issue a power of attorney to the forwarder if it is necessary to fulfill his duties (Clause 2 of Article 802 of the Civil Code of the Russian Federation).

The client is obliged to provide the forwarder with complete, accurate and reliable information about the characteristics of the cargo, the conditions of its transportation, other information, as well as documents necessary for the implementation of customs, sanitary and other types of state control (Article 804 of the Civil Code of the Russian Federation, Article 5 of Law No. 87 -FZ).

In turn, the forwarder is obliged to inform the client about any deficiencies found in the information received, and if the information is incomplete, request additional data from the client. It is better to provide information in writing (clause 2 of Article 804 of the Civil Code of the Russian Federation).

The client, in the manner prescribed by the transport expedition agreement, is obliged to pay the remuneration due to the forwarder, as well as reimburse the expenses incurred by him in the interests of the client (clause 2 of article 5 of Law No. 87-FZ).

Documenting

Documentation confirming the execution of the transport expedition agreement depends on the type of services provided.

In accordance with clause 5 of the Rules of transport and forwarding activities, approved by Decree of the Government of the Russian Federation of September 8, 2006 No. 554, forwarding documents are:

- instructions to the freight forwarder (determines the list and conditions for the freight forwarder to provide freight forwarding services to the client under the freight forwarding agreement);

- forwarding receipt (confirms the fact that the forwarding agent has received cargo for transportation from the client or from the shipper indicated by him);

- warehouse receipt (confirms the fact that the freight forwarder has accepted the cargo from the client for warehousing).

Forwarding documents are an integral part of the transport expedition agreement.

Depending on the nature of freight forwarding services, including when transporting cargo internationally, the parties to the freight forwarding agreement may determine the possibility of using forwarding documents not specified in clause 5 of the Rules for freight forwarding activities.

It would also be useful to draw up a document such as a forwarder’s report. In it, the forwarder can indicate: the amounts transferred on account of the transportation contract concluded on behalf of the client; documents confirming transportation to the destination; the amount of your remuneration.

The report must be accompanied by primary transportation documents or copies thereof.

If the forwarder provides transportation services personally, then he is obliged to provide the client with transportation documents (waybills, air waybills, bills of lading, etc.) confirming the provision of these services. The parties sign the acceptance certificate.

To confirm the completion of other types of services (loading, packaging, labeling, etc.), the parties sign an act of provision of paid services indicating specific types of services and their cost.

Unified forms of the forwarder's report and the acceptance certificate for services provided have not been established. Therefore, the parties have the right to independently determine the form and content of these documents.

In accordance with paragraph 2 of Art. 9 of the Federal Law of November 21, 1996 No. 29-FZ “On Accounting”, documents for which a unified form is not provided must contain the following mandatory details:

- name and date of preparation of the document;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- business transaction indicators (in physical and monetary terms);

- names of positions of persons responsible for carrying out a business transaction and the correctness of its execution

- personal signatures and their transcripts.

Thus, in order to be accepted for accounting and tax accounting, the act must contain all the required details.

It is advisable to describe the content of a business transaction in more detail, and not limit yourself to the words “the work has been completed in full,” etc. In addition, in documents confirming the provision of transport and forwarding services, it is necessary to make a reference to the contract and application.

The package of documents for organizing transportation using the forwarder’s own vehicles includes:

- contract for transport and forwarding services;

- certificate of completion;

- tear-off coupon of the vehicle's waybill;

- the third copy of the consignment note (form No. 1-T) (hereinafter referred to as TTN);

- forwarder's invoice.

These documents must contain information about the route and distance of transportation, the name and quantity of cargo, the make and model of the vehicle.

If carriers are involved in transportation by road, then in addition to the contract for freight forwarding services, the forwarder's report and the forwarder's invoice, the package of documents includes: a copy of the agreement concluded by the forwarder with the carrier; copy of TTN; a copy of the carrier's invoice.

To organize rail transportation you need:

- a copy of the agreement concluded by the forwarder with JSC Russian Railways;

- a copy of the railway bill;

- a copy of the invoice of JSC Russian Railways;

- copies of railway receipts for various fees.

Transportation accounting

Funds received under a transport expedition agreement from a client to pay for transport services are not recognized as income of the forwarder (clause 3 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n).

Payments made by the organization to third parties involved in the execution of the transport expedition agreement, at the expense of the client, are not recognized as expenses of the organization on the basis of paragraphs 2, 3 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 06.05. 1999 No. 33n. At the time of provision of such services, their cost is included in settlements with the client under the transport forwarding agreement.

On the date of signing the document confirming the provision of forwarding services, the forwarder’s accounting records recognize the revenue from the provision of these services (remuneration for the provision of forwarding services), which is for him income from ordinary activities on the basis of clause 5 of PBU 9/99.

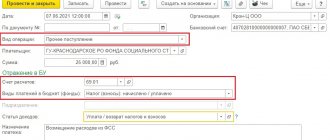

Funds received under a transport expedition agreement from a client as an advance payment for forwarding services are not recognized as income of the forwarder (clause 3 of PBU 9/99). By virtue of paragraph 14 of Art. 167, paragraph three, clause 1, art. 154 of the Tax Code of the Russian Federation, the forwarding organization is obliged to include the amount of the prepayment received in the VAT tax base, reflect the accrual of VAT in accounting and issue an invoice.

On the date of signing the document confirming the provision of forwarding services, the forwarder’s accounting records recognize the revenue from the provision of these services (remuneration for the provision of forwarding services), which is for him income from ordinary activities on the basis of clause 5 of PBU 9/99.

On the date of provision of forwarding services, the amount of VAT calculated and paid from the amount of prepayment received as compensation for the provision of forwarding services, the organization has the right to accept as a tax deduction (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

The following entries are reflected in the accounting records:

Debit 51 – Credit 76/“Settlements under the transport expedition agreement”

– the client’s funds have been received as payment for services under the transport expedition agreement (transport expedition agreement, bank account statement);

Debit 51 – Credit 62/Advances

– reflects the amount of remuneration received in advance for the provision of forwarding services (transport expedition agreement, bank account statement);

Debit 76/"VAT on advances" – Credit 68/"VAT"*

– VAT is charged on the amount of the received prepayment (invoice) in a single copy;

________________

* In case of provision of transport and forwarding services in relation to goods exported, VAT is not charged.

Debit 002

– the cargo to be transported has been accepted for accounting (a transport expedition agreement, an order to the forwarder and a forwarding receipt);

Debit 76 / “Settlements with the carrier” * – Credit 51

– paid for the carrier’s services (contract of carriage, bank account statement);

Debit 76/“Settlements under the transport expedition agreement” – Credit 76/“Settlements with the carrier”

– the cost of transportation is written off at the expense of the client under the forwarding agreement (transport services delivery and acceptance certificate, consignment note);

Debit 62/“Settlements under the transport expedition agreement” – Credit 90/“Revenue”

– the remuneration under the transport expedition agreement is reflected (service acceptance certificate, forwarder’s report);

Debit 90/"VAT" – Credit 68/"VAT"**

– VAT is charged on the amount of remuneration under the transport expedition agreement (invoice);

____________________

* Transactions involving third parties by the freight forwarder to provide transport forwarding services are reflected in a similar manner. Such persons may be a customs broker, an organization providing temporary storage warehouse services, etc.

** In case of provision of transport and forwarding services in relation to goods exported, VAT is not charged.

Debit 90/“Cost of services” – Credit 20

– the cost of transport and forwarding services is written off (accounting certificate);

Credit 002

– the goods are delivered to the client or consignee (bill of lading);

Debit 62/“Advances” – Credit 62/“Settlements under the transport expedition agreement”

– the previously received advance payment is offset against the payment of the forwarding fee;

Debit 68/"VAT" – Credit 76/"VAT on advances"**

– VAT calculated from the amount of the prepayment received (invoice) is accepted for deduction.

Taxation of transportation

Let's consider two options for the relationship between the forwarder and the client.

1. The contract provides for compensation for the freight forwarder’s expenses incurred in the interests of the client.

income tax

When calculating income tax, expenses in the form of property (including cash) transferred by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement are not taken into account as expenses. Expenses made by the commission agent, agent and (or) other attorney for the principal, principal and (or) other principal are also not taken into account if they are not included in the expenses of the commission agent, agent and (or) other attorney in accordance with the concluded agreements. This procedure is provided for in paragraph 9 of Art. 270 Tax Code of the Russian Federation.

Based on the foregoing, we believe that the forwarder in this case does not have the right to include as expenses when calculating income tax the expenses compensated to him by the client.

Also in accordance with sub. 9 clause 1 art. 251 of the Tax Code of the Russian Federation, the forwarder does not include in income when calculating income tax income in the form of property (including cash) received by the commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement. This also applies to reimbursement of costs incurred by the commission agent, agent and (or) other attorney for the principal, principal and (or) other principal, if such costs are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the agreement contracts The indicated income does not include commission, agency or other similar remuneration.

The Ministry of Finance of Russia adheres to a similar opinion (letter dated March 30, 2005 No. 03-04-11/69).

Note! The above applies exclusively to services in the provision of which the forwarder is an intermediary.

If the forwarder provides services personally, then, in our opinion, there is no reason not to include them in income (to exclude expenses incurred to generate income from expenses) when calculating income tax for the forwarder.

In order to minimize tax risks, we recommend highlighting in the contract the amount of the forwarder’s remuneration for organizing transportation and the cost of services provided by the forwarder himself, as well as expenses subject to compensation.

Value added tax

Taxpayers, when carrying out business activities in the interests of another person on the basis of commission agreements, commissions or agency agreements, determine the tax base as the amount of income received by them in the form of remuneration (any other income) in the performance of any of these agreements (clause 1 of Article 156 of the Tax Code of the Russian Federation ).

The expedition agreement is not listed in this article, but given its similarity to an agency agreement, we believe that the provisions of Art. 156 of the Tax Code of the Russian Federation.

For forwarding agents-intermediaries, the tax base for VAT is determined in accordance with Art. 156 of the Tax Code of the Russian Federation as the amount of income received by the forwarder in the form of remuneration.

The procedure for issuing invoices for intermediary transactions is set out in paragraphs 3, 7, 11 and 24 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations, approved by the Decree of the Government of the Russian Federation dated 02.12.2000 No. 914.

According to the specified norms, the freight forwarder reissues invoices received from carriers and other counterparties under related agreements to the client on its own behalf. At the same time, it reflects the indicators indicated in the invoices of carriers and counterparties. The forwarder does not register received and issued invoices in the purchase book and sales book.

On his own behalf, he also draws up an invoice for the amount of the remuneration and calculates VAT on this amount. The invoice is issued within five days from the date of signing the act of provision of services and is registered by the forwarder in the sales book.

Thus, for forwarders, the tax base for VAT is determined as the amount of income received by him in the form of remuneration, without including the amount of compensation in it.

A similar position is set out in letters of the Ministry of Finance of Russia dated March 30, 2005 No. 03-04-11/69 and dated June 21, 2004 No. 03-03-11/103.

Note! The forwarder does not have the right to deduct VAT amounts on expenses that are subject to subsequent compensation by the client, since these expenses were incurred for transactions that are not subsequently recognized as subject to VAT.

In addition, the contract can indicate that the remuneration is calculated and paid on the basis of the forwarder’s report. This will avoid the need to allocate the amount of the forwarder's remuneration from the amounts received from the client, and, accordingly, to pay VAT on advances.

2. The costs of providing services related to transportation include remuneration intended for the forwarder

In this case, the amount of remuneration is not separately allocated in the expedition agreement.

Income tax

In this case, there are no grounds for excluding expenses related to the fulfillment of obligations by the forwarder from expenses when calculating income tax.

The forwarder is also obliged to include these amounts in the income taken into account when calculating income tax. In other words, the forwarder must determine taxable income based on all receipts from the client related to payments for services sold.

Value added tax

With this scheme of work, the tax base should be determined taking into account the entire amount of remuneration without excluding from it the costs associated with the fulfillment of obligations.

At the same time, it is possible to take into account as part of tax deductions the amounts of VAT charged to the forwarder in connection with the performance of his duties in full.

In this case, the forwarder bears tax risks within the entire amount of the contract.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Calculation of TR in tax and accounting

Now let's look at the methods used for each type of cost.

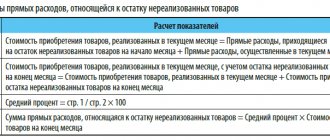

Property acquisition costs

In such situations, expenses are considered by the legislator as falling into the direct category, which necessitates distribution between already sold and other products - instead of including the full amount in the cost structure. The provisions enshrined within Art. 320 of the Tax Code, provide for the use of an average indicator determined for a specific period, and also indicate how to calculate the percentage, calculate and write off transportation costs for the delivery of goods.

For calculation you will need to perform the following steps:

- Clarify the amount of costs in relation to unsold balances as of the starting date of the calendar period, as well as the total amount of sales.

- Determine the purchase price of the goods sold and the inventories available to the company.

- Calculate the average percentage, which is the ratio of total direct expenses and commodity value.

- Find the amount of costs related to balances, equal to the product of two factors: the found percentage and the actual balances at the end of the reporting time period.

It is important to consider that transportation costs include all direct costs associated with inventory that is the property of the organization. This category includes, among other things, objects that at the time of settlement are in the process of being transported to the final recipient.

Delivery of goods to customers

The specifics are directly related to the core activities of the enterprise. Firms specializing in production classify logistics as indirect material costs, which are an integral part of the work cycle. In turn, for companies engaged in commercial transactions, shipping costs are indirect - and trade transactions are processed accordingly. Without exception, all organizations that ship products are required to ensure the availability of goods and waybills.

Costs associated with maintaining a vehicle fleet

This expense item combines such types of costs as:

- Purchase of fuels and lubricants.

- Purchase of components for repairs and scheduled maintenance.

- Vehicle insurance, as well as payment for parking spaces and fines for traffic violations.

Let's take a closer look at each of these points.

In the case of fuels and lubricants, as a rule, categories of technical regulations related to ensuring production or sales are applied. The exception is situations when costs are taken into account as direct - based on the corresponding letter from the Ministry of Finance of 2011. For example, accounting for transportation costs for delivery from a supplier using your own transport can be attributed to material costs - however, to write off fuel, you will also need to issue waybills.

The purchase of spare parts and the organization of repairs are operations related to indirect expenses and are subject to complete write-off within the reporting period during which they arose. Do not forget about the economic justification - maintenance designed to improve the performance of the car will be considered a reasonable necessity, while expensive, but useless from a functional point of view, tuning may give rise to questions from the tax authorities.

In the case of insurance, a mandatory condition is the presence of compulsory motor liability insurance. The costs associated with its execution are also considered indirect, and are included in equal shares in the structure of other technical regulations of the enterprise during the validity period of the concluded agreement. But the increase in transportation costs in connection with the acquisition of Casco, which is a voluntary option, will be considered within the category of other costs, and cannot be taken into account in situations where a simplified taxation system is applied.

Parking, cash and sales receipts are used as the basis for writing off expenses incurred when paying for a parking space - if it is not located on the territory owned by the organization. When registering a long-term lease, the basis document can also be an act on the provision of relevant services. In both cases, transportation costs are indirect, which under no circumstances can be considered administrative fines issued for violations of traffic rules. In case of non-compliance with the requirements of the traffic police, it is either collected from the entity guilty of committing the offense, or written off in a non-sales form - from the company’s own funds.

The procedure for calculating the costs of transporting goods

In the calculation, the costs of transporting goods are detailed in the following groups:

- Costs that are directly related to the transportation process: issuing an insurance policy, maintaining the technical condition of the vehicle, compliance with the approved level of service quality, costs of meeting the requirement for the safety of transported valuables and following the route in accordance with the approved schedule.

- Payment for the use of natural resources (if such a fact occurs).

- Expense operations associated with the commissioning of a new vehicle for transportation (registration, running-in, adjustment of vehicle systems).

- Modernization of vehicles, development of new cargo delivery routes. Costs for upgrading the class of transport and forwarding services are written off to the enterprise's profit and are not included in the cost of the service.

- Expenses aimed at servicing the process of delivering goods to their destination (fuel, lubricants, electricity, tools, examinations).

- Costs of maintaining vehicles in proper technical condition and compliance with sanitary and hygienic standards (diagnostics with technical inspection, washing, current and major repairs, creation of special temperature conditions for certain categories of cargo).

- The carrier's expenses related to the remuneration of workers involved in delivery.

- Payment for medical examinations and pre-trip briefings.

- Costs attributable to organizing the management of the transportation process.

- Personnel training and regular retraining and advanced training courses for employees employed at the enterprise.

- Payment of credit interest in favor of banking institutions for vehicles and equipment borrowed for the delivery of goods.

- Depreciation type deductions.

- Rental payments.

- Payment of taxes, fees and contributions to government bodies.

- Amounts of customs duties.

Question: How to reflect in the accounting of a forwarding organization the provision of services to a client for organizing the transportation of goods on the terms of 100% prepayment, if, according to the transport expedition agreement, the forwarding agent is obliged to conclude an agreement for the carriage of goods with the carrier on its own behalf at the expense of the client? The cost of transported cargo is 500,000 rubles. The forwarder's remuneration for organizing transportation is 18,000 rubles. (including VAT 3,000 rubles) and is transferred to the forwarder in advance along with funds for prepayment of cargo transportation services (after concluding an agreement with the carrier). Services for organizing cargo transportation were provided to the client in the reporting period following the period of receipt of the advance payment. The cost of carrier services (carriage fee) is 47,200 rubles. (including VAT). The freight forwarder provides the client with a report on actual expenses incurred. The fact of provision of expedition services is confirmed by the relevant act. Other expenses of the forwarder for organizing transportation are covered by remuneration and are not reimbursed separately by the client. The actual cost of services for organizing transportation (non-reimbursable costs associated with the provision of services: wages to staff, deductions for wages) amounted to 5,000 rubles. and is equal to the amount of expenses for the provision of services recognized in tax accounting at the time of signing the act. The forwarding organization uses the accrual method in tax accounting. View answer

IMPORTANT! If, during the preparation of the vehicle for commissioning, defects in factory assembly or processing of materials were identified, the defects are eliminated at the expense of the manufacturer.

Calculation of the price of services for the transportation of valuables should be based on the cost price. The calculation is made taking into account the operating characteristics of the vehicles available at the enterprise. Fuel prices are set at current prices and distances are calculated with maximum accuracy. The desired level of profitability is added to the resulting estimated cost indicator. This will be the price of transportation for contractors, calculated for each kilometer of movement.

What terms of the contract for the carriage of goods by road are essential?

Primary documents confirming TR

Within the framework of contracts drawn up between manufacturers and trading enterprises, on the one hand, and logistics intermediaries, on the other, the Consignment Note serves as documentary evidence of the actual provision of services. According to the current standards, enshrined within the framework of paragraph 2 of Art. 785 of the Civil Code of the Russian Federation, as well as the ninth rule of government decree No. 272 of April 15, 2011, in situations where the contract does not otherwise provide, responsibility for drawing up the technical specifications rests with the sender.

To indicate the price and value, the TORG-12 consignment note is filled out, and the accounting document confirming the movement of goods and serving as confirmation when issuing an invoice for delivery is the consignment note (1-T), which looks like this.

What is remarkable about transportation activities?

The transport company is distinguished by the following:

- In it, on any basis (owned, rented, leasing), there are vehicles with the help of which transportation services are provided.

- A significant part of the workforce consists of employees driving vehicles, and the conditions for their admission to work and its mode are subject to certain rules.

- The presence of a special set of costs necessary both for the emergence of the right to provide transportation services (registration of vehicles, their insurance, the presence of specially trained people to drive) and for ensuring the functioning of vehicles (special materials, regular maintenance).

- The need to accrue and pay a special transport tax, which is additional to other mandatory taxes, generally subject to the rules of the Tax Code of the Russian Federation (Chapter 28), but having specific features in each region.

- The possibility of using UTII for taxation (clause 3 of Article 346.29 of the Tax Code of the Russian Federation) with a certain number of vehicles in the company (for the transportation of goods) or a certain number of seats (for the transportation of passengers). Specific criteria for using this opportunity are established by the regions of the Russian Federation.

IMPORTANT! From 01/01/2021, the UTII regime in Russia has been cancelled.

- It is mandatory to use a number of special documents in the work: waybill (for vehicles), waybill, railway or air waybill, bill of lading, documents on transshipment from one type of transport to another.

Read more about the preparation of waybills in the following materials:

- “Truck waybill in accounting (form)”;

- “A waybill for a passenger car according to Form 3 in accounting”;

- “Non-public bus waybill - Form 6”;

- “What are the features of a waybill for a passenger taxi?”;

- “Features of a monthly travel sheet - sample.”

ConsultantPlus experts in the Transaction Guide collected the main operations of a cargo carrier and explained how to properly set up accounting in such a company. If you do not have access to the K+ system, get trial online access for free.

Optimization of TR in accounting

Reducing cost items, which helps relieve a company of unnecessary financial burden, is usually the result of careful work by a qualified accountant. To achieve optimal performance, it is important not only to know in which account transport costs are taken into account and reflected, or how to calculate income tax, but also to correctly convey information about rising costs to the organization’s management. Unfortunately, as practice shows, the majority of ordinary accounting employees, even at large enterprises, do not have the appropriate skills or do not have the time, being forced to deal with everyday, although necessary, but monotonous tasks. As a result, mistakes are much more common than suggestions that improve business performance.

This situation can be avoided by automating routine processes, offered within the framework of solutions developed by Cleverence specialists.

The introduction of modern mobile technologies guarantees not only an increase in the accuracy of accounting, but also the provision of sufficient time necessary to find ways to optimize transportation costs and reduce costs. Number of impressions: 11357

Electronic waybill (EPL)

Waybill is an internal document of the carrier, which is needed to record the work of the driver and vehicle. In addition to information about the route, mileage, fuel consumption, the waybill must include notes on the driver’s pre-trip medical examination and monitoring the technical condition of the car (for more details, see: “How to draw up a waybill that the inspectors won’t have any complaints about”).

The scenario for working with electronic waybills involves the following steps:

- The carrier creates an EPL, indicates in it his registration data, as well as information about the vehicle, trailer, driver, and delivery addresses.

- The medical worker records the date and time of the driver’s pre-trip medical examination in the EPL, makes his comments about his suitability for the trip and certifies the document with an electronic signature.

- The mechanic records in the EPL the date and time of the vehicle’s pre-trip inspection, current odometer readings, remaining fuel, readiness for departure and certifies the records with an electronic signature.

- The carrier signs the waybill with an electronic signature and, through the EDF operator, sends the document to the IS “Superservice 22.

- The information system checks data on the carrier and driver with the Federal Tax Service, and on transport with the Ministry of Internal Affairs. If errors are detected, they are recorded in “Superservice 22” and transmitted to the carrier through the EDI operator. The latter eliminates the shortcomings and re-submits the EPL for consideration. If the EPL does not contain errors, the Superservice 22 system assigns it a unique identifier. The EDF operator sends a notification to the carrier that an identifier has been assigned to the electronic waybill.

- The mechanic records in the EPL the date and time of the post-trip vehicle inspection, current odometer readings, remaining fuel, comments on the condition of the vehicle and certifies the information with an electronic signature.

- The carrier enters data on the passage of checkpoints, delivery addresses and other information into the EPL, certifies them with an electronic signature and closes the EPL.

- Through the EDF operator, the carrier sends the closed EPL to the Superservice 22 system.

- Based on the received file, Superservice 22 makes changes to the register of carriers and opens access to the EPL to executive authorities.

- After the driver returns from the trip, the medical worker indicates in the EPL the date and time of the post-trip medical examination, makes comments about the driver’s condition following the trip and certifies the records with an electronic signature.

Please note that at each stage, employees who are involved in the registration of the EPL must certify the data with their electronic signature. However, the regulations on the experiment do not yet specify what type of signature is needed.

ATTENTION

During the pilot project, the traffic police officer will not be able to request information from the EPL about transport, cargo and driver. The electronic waybill cannot contain data on weight and dimensional control or mark checkpoints. There are no fields in the EPL where you can enter information about gas stations, mileage, etc. At this stage, the electronic waybill is not an operational document. The driver on the line will continue to use the paper option. The organizers of the experiment consider the EPL as a fiscal document, like a cash receipt, which is recorded in a unified database of regulatory authorities.