Purpose, definition

Before creating any document, it is worth understanding the terminology. The technical condition report with a conclusion represents a form with a detailed description of the operating condition of the equipment. It indicates possible shortcomings and breakdowns of equipment. The document can be used to justify equipping an enterprise with new equipment and writing off obsolete models.

Inspection of the technical base on a regular basis requires documentation. An inspection report is drawn up.

The form is filled out by members of the commission from competent employees. If we consider the required columns in the form, experts highlight the need to indicate the serial number, year of manufacture and article number of the equipment undergoing diagnostics. Additionally, an authorized member of the commission must note the number of the technical unit received at the time of the inventory.

The document must be accompanied by the results of measurements and examinations that were assigned to assess performance. The section indicates the degree of suitability for use at the time of inspection. If obvious defects are identified, a representative of the commission indicates this with clarification of the possibility of repair and the required time to return to its former performance. Papers will be needed to evaluate non-working devices and determine the extent of defects. Experienced managers also schedule scheduled inspections of enterprise equipment to identify problems at the initial stage of their occurrence, which can significantly reduce the cost of equipment restoration.

This type of act allows you to perform several tasks:

- reflect the actual state of the equipment;

- identify deficiencies that need to be corrected;

- confirm the fact of verification;

- protect interests at court hearings;

- make a claim regarding the quality of services provided;

- resolve controversial issues.

Regulatory regulation

The required technical condition of various equipment is provided for by the standards. There is a specialized collection of standard formats for various acts - “Album of unified forms of primary documentation.” When drawing up documents of this type, they are guided by it. There are various sections included.

The technical condition report is drawn up according to precisely regulated rules. Deviation from them may be grounds for declaring the document invalid. As you can see, it is required not only to know, but also to follow the correct order. The sample act has the following positions in the order of writing:

- Contact the manager. The text of the appeal should be located in the upper right corner. Be sure to indicate the position, name of the organization and the initials of the manager in the genitive case.

- Title columns. In the center of the page indicate the name of the form (Act), the essence of the problem (technical condition of the equipment). All words are written in one line. The use of abbreviations and additions is prohibited.

Next, indicate the serial number of the document and the date the form was filled out. The date form is day, month and year. The day of the month and year are written only in Arabic numerals, and the name of the month is written in words.

- Reasons for drawing up the document. List all the reasons for passing the inspection, indicating the name and number of the document being drawn up. Next, the composition of the commission and the competent persons who will carry out diagnostics of the equipment are prescribed.

- Justification for the commission's actions. This part briefly describes equipment problems, indicating the article and inventory number of the equipment being tested at the time the paper was compiled.

- Expert opinion. The block must contain the conclusions of the commission based on the results of the inspection. Here it is permissible to express a personal opinion on the problem and indicate recommendations for eliminating the identified shortcomings.

- List of applications. Members of the commission list supporting documents that can confirm the reality of the audit and its results. Only original forms are used. If equipment breaks down, the form is supplemented with a conclusion about the fact that the equipment has been written off.

- Witnessing. The form must be signed by all members of the commission. Positions held are indicated next to each name. The document will be valid only after being affixed with the organization's seal.

This is an approximate procedure for filling out and appearance of the technical report form. During the inspection, those present have the right to express a personal opinion about the causes of malfunctions and how to eliminate them, and also determine the decommissioning of equipment.

The act is drawn up in one copy, but if necessary, it is allowed to use copies.

Diagnostic procedure and principles

Since the form is standard and the filling procedure is approved as a model in GOST, certain rules for writing the act are provided.

It should contain the following items:

- name of the area where the audit takes place;

- date of inspection;

- personal data of commission members;

- specialization of audit participants;

- the name of the object in question, its model, type, article number;

- equipment location at the time of inspection;

- reason for the control inspection (failure, scheduled inspection);

- information from technical documentation, information about the operation of equipment;

- diagnostic details: circumstances, testing period, tools and materials used;

- the opinion of the commission members;

- conclusions, expert opinion;

- recommendations on the use of equipment;

- additions and attached papers;

- signatures of each member of the audit committee.

In conclusions and recommendations for eliminating shortcomings, inspectors have the right to indicate the persons responsible for the quality of repairs and write-off of equipment. The name and position of the employee are specified. In some cases, the timing of the prescribed instructions is indicated.

Carrying out an inspection

The verification algorithm may consist of various actions. The exact order will determine the type of equipment and its characteristics.

As a rule, conducting an audit involves:

- equipment inspection;

- analysis of design documentation and technical passport;

- carrying out technical tests, checking performance characteristics, etc.

This requires special equipment and tools. For example, to evaluate the performance of electrical equipment, load/measuring equipment is required. Often it is not possible to check on your own. The best solution would be to contact organizations that provide similar services. Their staff will be qualified specialists equipped with the required equipment. Responsibilities include drawing up a report on the technical condition of the inspected object.

However, before paying for the services of a third-party organization, you should find out more information about it and talk with former clients. There are many scammers and incompetent people in the market today.

Equipment decommissioning

It is recommended to carry out write-offs annually for proper control of production capacity. As described above, only a special commission, which will include a deputy manager, economist, accountant, and workers, has the right to write off equipment.

Material assets are written off for the following reasons:

- unfit for work;

- sale of an asset;

- liquidation after an emergency;

- do not exist at the time of inventory;

- morally or physically obsolete;

- complete wear and tear;

- damage beyond repair;

- transfer to another organization in the form of a capital contribution;

- partial liquidation after reconstruction.

Physical wear and tear results in loss of original value. Occurs during equipment operation or due to damage from fires, floods, etc.

Obsolescence – aging due to the release of improved analogues. Worn-out equipment must be written off, justified and supported by documents. To determine the possibility of further use of the equipment, another commission is appointed. For equipment that has become unusable, the OS-4 form is used.

It is important to indicate the date of preparation in the act and mention the past inventory.

Write-off rules:

- Determination of the technical condition of each object separately.

- Preparation of documentation indicating equipment that has failed.

- Drawing up an equipment write-off act.

- Permission from the director of the organization to write off objects.

- Dismantling, disposal.

- Deregistration of an object.

From the attached documents the general condition of the equipment, any deficiencies found and the likelihood of their elimination through repairs should be clear.

The write-off act consists of:

- Obtain prime costs for further formation of the price of the product.

- Justify the costs of taxation of the enterprise.

- Confirm the asset indicator when transferring it to the balance sheet of another organization.

As you can see, the technical condition of the equipment is important in many respects. It is permissible to write off only assets that are unsuitable for further use due to damage and loss of important qualities.

The equipment write-off act is drawn up in two copies: for the financially responsible person and the accountant. Be sure to indicate:

- Date of write-off (drawing up the act).

- Cost (must correspond to receipt documents).

- The document that serves as the basis for write-off.

Draw up an act in writing. The form is not regulated, they use TORG-16. The main part indicates the reasons for the write-off. At the end, the commission must make a final decision and sign the document.

To write off equipment, a previously drawn up technical condition report is required. It is filled out by a commission of competent specialists appointed by the director. The act is drawn up according to the approved model in a certain sequence. The people who signed it are responsible for the information provided. In case of deliberate distortion of data, the perpetrators fall under administrative or criminal liability.

The role and purpose of the equipment technical condition report

Most often, a certificate of technical condition of equipment is necessary when:

- acceptance of equipment for further use;

- renting it out;

- audit of enterprise property;

- its write-off.

The report contains information about the external and internal condition of the equipment, identified defects, breakdowns, defects, as well as information about the measures that need to be taken to eliminate them, and the time required for this. If the equipment cannot be repaired, this is also reflected in the report.

With the help of the act, several important issues are resolved at once:

- It shows the technical condition of the equipment and its suitability for use.

- Sometimes, on the basis of this document, claims are made against the supplier, lessee or owner of the equipment - especially in cases where malfunctions occur during its use, leading to material damage or industrial accidents.

Thus, the act is a very important document. You need to be careful when compiling it, describing in detail all the nuances of the condition of the equipment. In the future, this may allow you to avoid unfounded claims and, in the event of emergency situations, quickly identify the person at fault.

General points and features of drawing up the act

If you are tasked with inspecting equipment and drawing up a report on its technical condition, look at the recommendations below and familiarize yourself with a sample document.

Before moving on to the description of this particular act, we will provide some general information that is typical for all such papers. Today, standard forms of primary documents have been abolished, so company representatives can write them in any form - this also applies to the act on the technical condition of equipment. At the same time, if your organization has an approved template for such a document, it is better to follow it - this will save time and eliminate the need to rack your brains over its composition and text.

The act can be written on the company’s letterhead or on a blank sheet of any suitable format (usually A4), by hand or on a computer. When entering information, you must try to avoid inaccuracies, erasures and corrections - in the future they can play a negative role in establishing the legality of the document.

Another important requirement that must be taken into account is to have the form certified with the autographs of all members of the commission who were present when certifying the technical condition of the equipment.

A stamp should be placed on the form only when the clause on its use for such papers is enshrined in the accounting policy of the organization.

The act is written in several copies - one for each member of the commission. Information about the act must be included in a special accounting journal.

After drawing up, the act should be placed in a separate folder along with other similar documents, and after the expiration of the storage period, it should be disposed of, following the algorithm established by law.

An example of an equipment technical condition report

When formulating the text of the act, keep in mind that it must meet certain rules of business documentation. At the very beginning of the act there is a so-called “cap” - this includes:

- the name of the organization that conducts the equipment inspection;

- Title of the document;

- date and place (locality) of its compilation;

- composition of the commission, i.e. the positions, surnames, first names and patronymics of the company representatives participating in this procedure are written.

Next comes the main part, which includes:

- identification parameters of the equipment (brand, model, series, year of manufacture, manufacturer and inventory number, address of installation site, etc.);

- measures taken to check the technical condition of the equipment;

- information about identified malfunctions, defects, breakdowns, as well as the possibility, timing and options for their repair;

- information about tests (if they were carried out).

If necessary, this part of the form can be expanded (depending on the needs of the commission members and the individual characteristics of the object). All additional papers attached to it (for example, a technical passport) must be included in the act.

At the end, the commission members draw a conclusion about the technical condition of the equipment and sign the report.

How is the equipment write-off report filled out?

Write-off of fixed assets.

Regardless of how the equipment decommissioning act is drawn up, the following is indicated in its upper right corner:

- The word in quotation marks “I approve”, and on a new line the full name of the enterprise, information about the manager - position, last name, first name and patronymic. After this, the line below remains empty for the manager’s signature;

- Below in the middle is the name of the document, for example, an act on the write-off of accounting computer equipment;

- The line below leaves space for the date - as a rule, the commission secretary indicates it in advance. The date and year are indicated in numbers, and the month in words;

- All members of the commission are listed, indicating their position and last name, first name, patronymic;

- The fact and reasons for decommissioning the equipment are recorded - information is taken from the certificate of its technical condition;

- A table that lists all equipment subject to write-off, indicating its name, quantity, cost for each unit and total price;

- Below after the table is the total cost of the equipment being written off. Numerical designations are duplicated in words in brackets.

Write-off acts are prepared in advance by lawyers and financiers. If necessary, you can hire a third-party consulting organization that will develop a package of sample documents for the enterprise.

After entering all this information, each member of the commission must sign. Therefore, at the end of the document they are all listed with the surname, initials and place for signature. Then the document is transferred to the manager, who checks and approves the act.

In what cases is an act of write-off of fixed assets necessary?

This document is usually used if it is necessary to deregister fixed assets, which include:

- Sale of enterprise assets.

- Impossibility of further use due to physical or moral wear and tear of the OS.

- After the liquidation of the company due to accidents or emergencies.

- When investing OS in the authorized capital of other organizations.

- When damage or shortage of certain objects is detected.

- The company transferred fixed assets for use to another company.

Most often, assets are written off due to their unsuitability, if the property cannot be repaired or restored. In such cases, it is necessary to draw up an act of write-off of fixed assets (form OS-4, 2 copies). All members of the commission, who are appointed by the head of the company, take part in the preparation of the document. One copy of the document is transferred to the accounting department for write-off, the second copy is transferred to the financially responsible person.

If there are spare parts or mechanisms left from the fixed assets that are suitable for use, then the responsible persons can also draw up a special act for their transfer to the warehouse for subsequent use at the enterprise.

How to correctly draw up an act of write-off of fixed assets

Since sooner or later an enterprise has to make a write-off, every accountant must be able to correctly formalize this procedure. This allows the company to always display the real situation with the property on the company’s balance sheet.

Various objects are subject to write-off:

- faulty transport;

- dilapidated buildings;

- outdated equipment;

- other property.

The main reason for write-off is the unsuitability of the property. The main condition is that it cannot be repaired or restored. This is determined by a specially created commission. However, if we are talking about technically complex property, it is unlikely that it will be possible to do without an expert opinion. For example, the air conditioner broke down. Company employees visually see only non-working equipment. An opinion on its malfunction can only be given by a specialist provided by the relevant company.

Even if the faulty equipment can be repaired, the service company must provide a full estimate to fix the problem. This will allow you to determine the economic benefit of the repair. If repair is not practical, the equipment is subject to write-off. Thus, it is the expert’s opinion that allows you to determine whether faulty OS can be written off.

What forms of document exist?

Let's look at some of the most common cases when you can't do without drawing up an act.

For example, the property became unusable before its expiration date. This usually happens when the rules for using equipment, which are prescribed in the instructions and manual, are violated. The commission appointed by the director of the company must first identify the perpetrators by drawing up a document on the inspection of the OS with a conclusion. Then a unified form for write-off of fixed assets is filled out in the OS-4 form. It should contain information such as:

- Because of this, the equipment was liquidated.

- Technical condition of the property after inspection.

- Is it possible to carry out repairs to restore characteristics.

- A list of those responsible for causing the equipment to fail.

- Is it possible to remove working mechanisms for their further operation?

It is important to note that the act must clearly state all the arguments for the need to write off property and equipment.

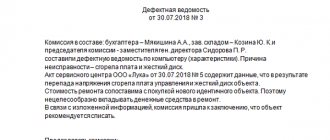

If fixed assets have become unusable not due to the guilt of persons, then a defect report must be drawn up to confirm the impossibility of further operation of the equipment. The document must contain a list of detected defects - their number, size, characteristics. Subsequently, based on this document, recommendations should be developed, which will indicate certain mechanisms and details that can be used. All products that have become unusable are written off according to the OS-4 form.

If an organization’s property has become unnecessary and obsolete, it is written off by order of the company’s management. In this case, an act on the write-off of fixed assets is also drawn up, but the object should not be inspected. The main thing is to justify your position in the document, for example, by writing that the period for using the property has expired, etc.

Results

It is important to properly document the disposal of fixed assets. In particular, it is worth paying attention to the preparation of the manager’s order to write off the fixed assets, which is the basis for drawing up the act. You can use the sample order for write-off of fixed assets posted on our website as a basis, or create your own template. An order may also be required to confirm the corresponding costs associated with the procedure for writing off an object.

If you have any unresolved questions, you can find answers to them in ConsultantPlus. Full and free access to the system for 2 days.

The act of write-off of fixed assets is filled out on the basis of information from the manager’s order and primary documents for accounting for fixed assets. A sign of a correctly completed act is the ability, based on the information displayed in it, to track in detail the entire process of disposal of fixed assets from the organization’s records.

General recommendations for drawing up the act

The form must be completed by an employee who is a member of the commission and is responsible for accounting for all fixed assets in the company. You need to fill out two copies in total. At the same time, each organization has the opportunity to supplement the adopted template with additional columns, the main thing is not to delete or adjust those details that are approved by the State Statistics Committee. Before editing the form, the head of the company must write a corresponding order, otherwise the document will lose its legal force.

This act consists of three tables that need to be filled out - each table is designed to describe in detail specific actions and information that are related to the use of the OS. In the columns of the first plate you need to transfer data from the acceptance certificate for the transfer of fixed assets, according to which the fixed assets were transferred to production. This also includes general data about objects, terms of use, and depreciation charges.

In this article you will learn in detail about the straight-line depreciation method.

What is the book value of fixed assets? Read more about this.

We will look at a sample of drawing up an order to write off fixed assets.

In the form of the second table you need to enter information about the property that is subject to write-off, information about the presence of precious metals in the fixed assets is also entered here. Important data from OS-1 acts is also transferred here.

Information in the third table is entered based on data on the liquidation of objects, since this process is always associated with the costs of dismantling equipment and disassembling it. This also includes the cost of inventory items, which the commission also found unsuitable for use at the enterprise.

One of the copies is sent to the accounting department, and the second must be kept by the employee who is responsible for the safety of fixed assets. Also, according to this document, usable mechanisms and parts obtained during equipment dismantling are transferred to him. If we are talking about a report on motor vehicles, then in addition to this document you must additionally provide a certificate of deregistration with the traffic police.

Instructions for filling out an act for write-off of fixed assets

The form has three sections. Each of them is designed to display specific information. An accounting employee is responsible for filling out the document. This can also be done by an employee who is responsible for the safety of fixed assets. In addition, a special commission is created that is directly involved in drawing up the act. Filling is carried out in four stages:

- Title page . Designed to indicate the company name. If the property belongs to a specific department or division, it is also indicated. The write-off is carried out on the basis of an order, therefore the date of its preparation and number are indicated on the title page. The date of direct write-off of the property is also indicated. Here you can see a column intended to indicate the reason for the write-off. This may be wear and tear, inappropriate repair, or physical aging.

- First table . Information and characteristics of the OS are entered here. The name of the product being written off, its serial and inventory numbers, the date of issue and registration with the organization must be indicated here. The relevant columns indicate the actual service life of the object, its initial cost and wear and tear costs.

- Second table . Additional data about the means is indicated here, for example, the materials that make up the OS. This table is filled out by members of the commission, confirming that the property is truly unsuitable for further use. The commission also gives its conclusion and detailed reason for the write-off. Each participant signs the document.

- Third table . Filled out by an accounting employee who calculates finances associated with the property being written off. If dismantling the OS required monetary costs, this must also be indicated in the document.

The document is completed in two copies. One of them remains with the employee who was financially responsible for this object. The second copy is transferred to the accounting department, where the official write-off is carried out.

Read further:

Fill out the invoice TORG-12 - form 2021

Certificate of write-off of fixed assets - sample filling

Let's take a step-by-step look at how to fill out this form:

Title page

Here you should indicate the name of the company, department where the property is registered. In addition, the date of write-off of fixed assets is indicated. Then the number and date of the order, on the basis of which the write-off occurs, is recorded.

In the field where you need to describe the reason, you need to clearly and clearly explain why the write-off occurred and its reasons. For example, this could be information about wear and tear - moral or physical.

First table

Then fill out the first plate. All data on fixed assets must indicate the date of their write-off - all data must be taken from the inventory card of this fixed asset. If any property has been revalued, then the seventh column reflects its value based on the results of the last inspection. For funds that have not been revalued, you must indicate their original cost on the date of delivery of the property for accounting in the accounting department.

The data in column nine reflects the residual value of the property, which is expressed by the difference between their original cost and the value on the date of write-off by depreciation.

Second table

In the second plate you should fill in the information about the OS being liquidated and the metals they contain. This part must be completed by the members of the commission. After completion, the commission members write their conclusion, which describes in detail the reasons for writing off the objects. Each representative must also sign the document.

Third table

This plate must be filled out by an accountant who calculates the financial results from the write-off of property. This amount should also include the costs that went into dismantling the products.

Finally, the act of write-off of fixed assets is signed by the head of the enterprise after familiarizing himself with the information presented in it.

Write-off of fixed assets: documentation

Writing off fixed assets seems common and simple, but in reality the company needs to draw up a number of papers that would confirm the legality of disposal of fixed assets.

The disposal is preceded by the execution of an order to create a special commission, which is tasked with writing off fixed assets (documentary registration of the formation of such a commission is strictly necessary). It includes the following persons:

- chief accountant of the company;

- technical specialists;

- MOLs to which fixed assets subject to disposal are assigned.

Responsibilities and functions of the commission for writing off fixed assets

During the creation of the commission, their powers are determined. The guidelines provide for the inclusion of the following functionality in this list:

- The commission is inspecting the decommissioned facility. She is also responsible for drawing up all documentation related to write-offs. This includes not only technical and commercial documents, but also accounting documents.

- The reason for write-off is established, as well as the impossibility of using the OS object for subsequent use, restoration or sale.

- The circle of culprits is determined if the OS has become unusable before the established service life, was damaged or partially damaged. During the proceedings, the Commission develops proposals to involve these workers in compensation for damages.

- If some parts of a fixed asset can be used in further work (for example, as a spare part for other equipment), then a list of these parts is compiled and their cost assessment is carried out. In the future, it is the commission that is responsible for the dismantling of all the listed parts.

- Filling out write-off acts, signing all necessary documentation.

Upon completion of the inspection of the object, a special commission draws up a decommissioning act. The form of this document is approved by the head of the organization. If desired, you can also use unified acts approved on January 21, 2003 after the release of Resolution No. 7 of the State Statistics Committee of the Russian Federation. If an enterprise independently develops forms of acts, then they must comply with the requirements reflected in Federal Law No. 402-FZ of December 6, 2011.

Forms of acts for write-off of fixed assets

During the work of the commission, acts of the following forms can be drawn up:

- OS-4 is used to write off one object that is not a vehicle;

- OS-4a - to be filled in in case of disposal of vehicles;

- OS-4b - it is necessary for writing off several fixed assets not related to motor vehicles at once.

When transferring fixed assets to other organizations, an acceptance certificate is used. This is the justification for the write-off in this case.

Mandatory details of write-off acts

The main document confirming the work of the commission is the write-off act. It must indicate the following information about the written-off fixed asset item:

- when it was produced or erected;

- when and at what cost it was accepted onto the balance sheet of the enterprise;

- lifetime;

- the total amount of accrued depreciation;

- why is it written off?

- its quality characteristics.

Features of drawing up a write-off act

After drawing up, the act is signed by all members of the commission and approved by the head of the organization. Only after this, information about its disposal is entered into the inventory card of the object. This is done by the chief or other authorized accountant. The inventory card must be kept at the enterprise after disposal of the object for another 5 years.

All accounting entries are made on the basis of the write-off act. The document must be drawn up in two copies. They are handed over to the following persons:

- responsible accountant;

- MOL of this object (only with the presence of an act is it possible to deliver the object’s spare parts to the warehouse).

Example of an act for writing off an asset

Thus, this act represents a kind of conclusion of the commission on the possibility of writing off the enterprise’s facilities. Let's take a closer look at how to format it correctly.

As a result of an inspection of the inventory warehouse, which belongs to , and the OS listed on its register, the unsuitability of some objects was revealed due to their physical wear and tear, and a write-off act was drawn up under number 3 dated 04/23/2017. By order of director A.V. Maslakov dated April 24, 2017, number 23, a decision was made to dismantle the structure.

Information from the inventory card:

- The employee responsible for security is engineer A.P. Ivanovsky (account number – 000162).

- Inventory number – 0002316SK.

- Date of construction – 04/24/2006

- Useful life – 154 months.

- The actual period of use is 104 months.

- The operating period was 132 months.

- The initial cost of the property is 500,740 rubles.

- The amount of depreciation written off is 450,000 rubles

The dismantling of the structure was carried out by the company's employees, whose work was paid in accordance with the additional agreement to the employment contract dated April 24, 2017. The cost of paying specialists amounted to 12 thousand rubles (including insurance payments). The structure was dismantled within 24 hours.

Still have questions? Find out how to solve exactly your problem - call right now:

+7 (Moscow)

+7 (St. Petersburg)

8 For all regions!

It's fast and free!

After dismantling, boards remained (100 pieces, market price - 150 rubles per piece), which were transferred for the economic needs of the enterprise. Materials for strengthening the structure (warehouse) were left for subsequent sale - 10 pieces for 1500 rubles per copy.

Based on the results of the dismantling, an act for write-off of fixed assets was drawn up under number 4 dated 04/25/2017 (approved by director A.V. Maslakov on 04/27/2017).

Sample act for writing off illiquid goods

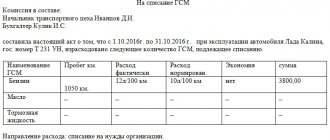

act on write-off of inventory items Act on write-off of materials for production In organizations engaged in production activities, often with the help of a write-off act, the consumption of materials and raw materials for production needs, to perform work and provide services is drawn up. Such an act is usually drawn up at the end of the month, and it indicates:

- price;

- in some cases - the quantity of products or the amount of work performed.

- quantity;

- in case of overspending, the reasons for exceeding the limits;

- name of the material;

- assignment (information about the order for which materials were used);

It should be noted that in this case the reason for the write-off of materials is not indicated in the act of write-off for production.

When and what to write off and how to formalize it?

The standard process of writing off materials is carried out once a month.

Act of write-off of material assets

0 organizations that have a material form are often called material assets.

These include, in particular, fixed assets, materials, goods, and finished products.

Those material assets that cannot be used for their intended purpose, are not capable of generating income for the organization in the future, or are disposed of, are subject to write-off.

Write-off of material assets occurs in cases of their sale, transfer as a contribution to the authorized capital of another organization, identification of shortages or damage during inventory, etc.

Interesting How and with what to collect mercury from a broken thermometer?

Operations to write off material assets involve crediting the accounts of the corresponding assets.

In particular, accounts 01 “Fixed assets”, 10 “Materials”, 41 “Goods”, 43 “Finished products”, etc.

(). The basis for reflecting accounting entries for the write-off of material assets are primary accounting documents (). We will tell you how to draw up an act for writing off material assets in our consultation.

Form TORG-16. Certificate of write-off of goods

Author of the article Olga Lazareva 2 minutes to read 4 The act of writing off goods (form TORG-16) is issued to write off damaged, defective or expired goods. Such a need may arise, for example, due to improper storage.

Or the product has a fairly short shelf life, during which it did not have time to be sold.

If, after accepting the valuables for accounting, a defect was discovered, the validity period of the product has expired, or it has lost its consumer properties, then it can be written off by drawing up an act in the TORG-16 form.

In order to write off damaged or defective goods, the manager appoints a commission,

How to take into account the write-off of illiquid inventory items in accounting, for income tax, VAT, and what documents should be used?

Depending on the circumstances surrounding the write-off, the cost of illiquid inventory items can be attributed: to production expenses or selling expenses; on account of other settlements with personnel; on account of other expenses, if the perpetrators have not been identified; to the profit and loss account.

For the purpose of calculating income tax, costs associated with shortages or damage to inventory items can be taken into account as non-operating or other expenses. The question of the need to restore VAT on illiquid inventory items written off from the balance sheet remains controversial.

The procedure for documenting the write-off of inventory items is set out in the justification.

An OS object has become unusable: how to account for write-off

An OS object may be so physically or mentally worn out that it can no longer be restored. This means that carrying out work to repair, modernize or reconstruct such a facility will not bring the desired result or is not economically feasible. Such circumstances can result from both normal long-term use of an OS object and the occurrence of force majeure circumstances (for example, a natural disaster). Therefore, such fixed assets are written off from accounting precisely because they have become unusable.

Income and expenses from writing off fixed assets from accounting are reflected in the reporting period in which they occurred. In this case, income and expenses arising from write-off are taken into account as part of others in account 91 “Other income and expenses” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

This means that when writing off an OS object that has become unusable, the following accounting entries are usually made:

| Operation | Account debit | Account credit |

| The original cost of a retiring fixed asset has been written off | 01 “Fixed assets”/B | 01 |

| Depreciation accrued on the fixed asset at the time of disposal is written off | 02 “Depreciation of fixed assets” | 01/B |

| The residual value of a retiring asset that has become unusable has been written off | 91, subaccount “Other expenses” | 01/B |

If materials suitable for further use remain from an asset (in particular, spare parts or scrap), then it is accepted for accounting at market value on the date of capitalization. The following accounting entry is made:

Debit of account 10 “Materials” - Credit of account 91, subaccount “Other income”

How to reflect the liquidation of a fixed asset in 1C: Accounting 8

Example

The company operates on OSNO and is a VAT payer. From 2022, it will switch to using FSBU 6/2020.

In February 2022, it writes off the OS due to ineffective use.

In accounting, the initial cost of the object is 1 million rubles, accumulated depreciation charges are 325 thousand rubles, the amount of monthly depreciation is 25 thousand rubles.

The dismantling of the OS was carried out by a third-party company, for which it was paid 120 thousand rubles. (including VAT 20%).

The estimated liability for dismantling, disposal and restoration of the environment was not previously recognized for the facility, and depreciation was not taken into account. During dismantling, inventory items were recovered, and the company decided to use them in its activities.

To reflect the costs of dismantling an object when engaging a third-party company, use the document “Receipt (act, invoice, UPD).” In this case, you need to set the type of operation to “indicate accounts for recording expenses for dismantling operations for accounting and tax accounting purposes.

In accounting, the costs of dismantling and disposal of fixed assets are included in the costs of the period of their implementation. These costs must also be taken into account when calculating:

- financial result from disposal of fixed assets;

- the cost of inventory items received upon write-off of fixed assets.

In this regard, it is recommended to display the costs of dismantling in accounting on the account. 01.09 “Disposal of fixed assets” with recording of the disposed object. When the disposal procedure is completed, the book value of the object, taking into account dismantling costs, indicated on the account. 01.09, will be written off to the account. 91 “Other income and expenses.” 1C will determine the financial result from the disposal of the object and take it into account when calculating the cost of extracted inventory and materials.

In tax accounting, the costs of liquidating a fixed asset must be included in non-operating expenses (Articles 265, 272 of the Tax Code). Accordingly, in 1C tax accounting, dismantling costs must be recorded on the account. 91.02 “Other expenses”.

Correspondence of accounts when carrying out this document:

The write-off of an object is reflected in a document of the same name, and income and expenses from it must be taken into account in the account. 91.01 and 91.02.

However, now the document makes it possible to take into account inventory items that remain after the liquidation of a fixed asset.

In the header of the document, check the box “Materials left after decommissioning of the OS.” And then the table will have a column “Remaining materials”.

It will contain a link through which the user can go to the form of the same name. It is needed in order to indicate for each written-off fixed asset the name of the extracted inventory items (selected from the “Nomenclature” directory), quantity, market value and accounting account. For example, the market price of the remaining inventory items is 50 thousand rubles.

In the document “Write-off of fixed assets”, when you click the “Print” button, you can now use a new form of help-calculation “Cost of remaining materials when writing off fixed assets”.

It contains the following information according to the example conditions:

- book value of the fixed asset (initial cost - accumulated depreciation and based on the results of the current month) - 650 thousand rubles;

- costs for the dismantling operation - 100 thousand rubles;

- the amount of costs for disposal of the object (book value + dismantling costs) - 750 thousand rubles;

- the market price of the remaining inventory items is 50 thousand rubles;

- the actual price of the remaining inventory items is 50 thousand rubles, because this amount does not exceed the cost of dismantling (50 thousand rubles less than 750 thousand rubles);

- the financial result from the liquidation of an object (expense) is determined by subtracting the actual (market) price of inventory items from the costs of disposal of the object - 700 thousand rubles.

Correspondence of accounts when carrying out this document:

In accounting, the benefit from the sale of such inventory items can be recognized as income upon their sale if the requirements of PBU 9/99 “Organizational Income” are met, but not upon their extraction.

What to do if the remaining inventory items have a high cost?

Let’s say, according to the conditions of the example, the market price of inventory and materials is 1 million rubles, i.e. it is more than the book value of the object and the costs of the installation operation (1 million rubles is more than 750 thousand rubles).

In such a situation, the actual cost of inventory items is equal to the book value of the object and dismantling costs, i.e. 750 thousand rubles. In this case, the 1C program will automatically determine the price of each individual material asset in proportion to the market price specified in the “Remaining Materials” document.

Expense in accounting is defined as subtracting the actual price of inventory items from disposal costs (book value and dismantling costs). In the example it would be 750 thousand rubles. — 750 thousand rubles.

Accordingly, when the document “Write-off of fixed assets” is carried out, the financial result in accounting will be equal to zero.

The program will proceed in a similar manner when business transactions are reflected in 2022.

Act in form No. OS-4

To register and record the write-off of fixed assets that have fallen into disrepair, Resolution of the State Statistics Committee dated January 21, 2003 No. 7 approved the following forms:

- for a separate OS object (except for a car) - form No. OS-4;

- for a motor vehicle - form No. OS-4a;

- for a group of OS objects - form No. OS-4b.

The use of these forms for an organization is not mandatory (Information of the Ministry of Finance No. PZ-10/2012). This means that to formalize the write-off of unusable operating systems, she can use any other primary accounting document. It is only necessary that the form used be approved in the accounting policy of the organization for accounting purposes.

Let's talk about some of the features of filling out form No. OS-4 “Act on write-off of fixed assets (except for vehicles)”, which are given in the Instructions approved by Resolution of the State Statistics Committee of January 21, 2003 No. 7.

Based on the order of the head of the organization, the Act in form No. OS-4 is drawn up in 2 copies, signed by the members of the commission and approved by the head. The first copy is transferred to the accounting department, and the second remains with the person who was responsible for the safety of the OS object. The second copy will also be the basis for putting into storage the materials remaining from the write-off of the asset. Information on the costs of decommissioning an asset, as well as the cost of materials remaining from disassembly, is reflected in Section 3 of the Act.

The result of the write-off of an asset is entered into the inventory accounting card, i.e., in the OS-6 form or another similar document with which the organization records the availability and movement within the organization for a specific asset.

Related documents

- Act on liquidation of fixed assets (in relation to standard form No. os-4)

- Certificate of acceptance and transfer of fixed assets. Form No. os-1

- Cash audit report (instruction of the Central Bank of the Russian Federation dated 10/04/93 No. 18 (as amended on 02/26/96)

- Act of markdown of goods

- Act-receipt for the performance of warranty and paid work on the repair of telephone sets. Form No. tf-2-22 (letter of the Ministry of Finance of the Russian Federation dated February 22, 1994 No. 16-36)

- Act-request for replacement (additional supply) of materials. Form No. m-10

- Analytical data on accounting for the costs of procuring and purchasing materials for journal order No. 6

- Analytical data on accounting for deviations in the cost of materials for journal order No. 6

- Certificate of assessment of the value of buildings and structures approved. Ministry of Agriculture of the Russian Federation on January 22, 1992 (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm)

- Certificate of assessment of the cost of machinery, equipment and transport (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Certificate of assessment of the cost of unfinished capital construction (appendix to the regulations on the commission for the privatization of land and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act on the assessment of the value of working capital (appendix to the regulations on the commission for the privatization of land and reorganization of a collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- Act of transfer (sale) of collective farm (state farm) property to the rural (settlement) council of people's deputies (appendix to the regulations on the commission for land privatization and reorganization of the collective farm (state farm), approved by the Ministry of Agriculture of the Russian Federation on January 22, 1992)

- An acceptance certificate

- Balance sheet of an insurance organization (quarterly). Form No. 1-insurer (Order of Rosstrakhnadzor dated April 16, 1996 No. 02-02/12)

- Balance sheet of the enterprise (Form No. 1 for capital) (approved by Letter of the Ministry of Finance of the Russian Federation dated October 13, 1993 No. 114 for annual reporting for 1993)

- Balance sheet of an insurance organization - form No. 1 - insurer. (approved by the Russian Federal Service for Supervision of Insurance Activities in agreement with the Ministry of Finance of the Russian Federation for quarterly reporting in 1993)

- Balance sheet of economic and financial activities of the enterprise

- Balance sheet of economic and financial activities of the enterprise form 1.

- Statement of uncollected overdue receivables and violations of settlement discipline on synthetic accounts