Export to Belarus: customs clearance, documents, VAT refund, transaction control

Are you planning to organize the export of your goods to Belarus (Belarus), but don’t know where to start?

We will help you organize the entire process of processing and sending your cargo to Belarus from any city in Russia. We will advise on issues of customs clearance and statistical accounting of goods. The Republic of Belarus is a member of the EAEU (formerly the Customs Union). In addition to the Russian Federation and Belarus, this association also includes (Armenia, Kyrgyzstan, Kazakhstan).

The Eurasian Economic Union is an international organization for regional economic integration, established by the Treaty on the Eurasian Economic Union. The EAEU ensures freedom of movement of goods, as well as services, capital and labor, and the implementation of a coordinated, coordinated or unified policy in sectors of the economy.

The EAEU was created for the purpose of comprehensive modernization, cooperation and increasing the competitiveness of national economies and creating conditions for stable development in the interests of improving the living standards of the population of the member states.

Between the countries of the Eurasian Economic Union, has been abolished and there is no need for customs clearance for exports to Belarus, however, there are several nuances related to accounting for imports/exports between member states of the EAEU. Therefore, consultations and participation of a qualified customs broker when carrying out export transactions with Belarus may be necessary at the initial stage.

included in the register of customs representatives

We bear full responsibility to customs and the client for the quality of services provided

What is a statistical declaration

If a Russian person moves cargo across the border of the Russian Federation, he is obliged to take into account the rules established by Russian customs legislation. These rules vary and depend, in particular, on which country the person is trading with; customs statistical reporting is mandatory when trading with states that are members of the Eurasian Economic Union:

- Republic of Belarus;

- Armenia;

- Kazakhstan;

- Kyrgyzstan.

Statistical reporting is a document that the Federal Customs Service will require when moving items within the EAEU; the form for this reporting and the procedure for filling it out are approved by Government Decree No. 1329 of December 7, 2015.

Registration of Value Added Tax offset when exporting to Belarus

Starting from 07/01/2016, the right to offset input VAT, in other words, to refund Value Added Tax on the transaction amount when making export supplies, arises for the taxpayer at the time of issuing the incoming invoice, and not after providing the required set of accounting documents. Confirmation of the 0% Value Added Tax rate for export to Belarus must be completed within six months from the date of shipment of the products.

In order to prove a 0% rate, the following set of documents is required:

- Foreign economic agreement (copy);

- Contact account number (formerly Transaction Passport);

- Shipping documents (copies) (invoices, waybills in the TORG-12 form, waybills or CMR);

- Application (original) for payment of taxes from the importer, or notification from the tax office of the importer's state about acceptance and payment of taxes in their country.

When do you need to submit statistical reports to the Federal Customs Service?

The changes affected not only participants in foreign economic activity, but also the deadlines for submitting static reporting. Before the above-mentioned Decree of the Government of the Russian Federation came into force, eight working days were allotted for submitting the report. Now organizations are given ten working days.

The government gave more time for sending reports so that participants could be more careful in their preparation and subsequent verification. There are serious fines for submitting distorted data, which we will discuss in the appropriate section.

Below is a table with the deadlines for submitting statistical reports to the Federal Customs Service in 2022.

| The reporting month | Deadline |

| December 2022 | January 22 |

| January 2022 | 12th of February |

| February 2022 | March 15th |

| March 2022 | 14th of April |

| April 2022 | May 18 |

| May 2022 | June 15 |

| June 2022 | the 14 th of July |

| July 2022 | August 13 |

| August 2022 | September 14 |

| September 2022 | October 14 |

| October 2022 | November 16 |

| November 2022 | December 14 |

Customs clearance of goods transported between members of the EAEU

Filling out declarations for goods in the usual manner for goods transported between the states of the EAEU has been abolished; accounting is carried out through the submission of a statistical declaration form (statistical form) to the customs office of the state of export. Submission of statistical forms is carried out in order to record the movement of goods during Russia’s foreign trade with member countries of the Eurasian Economic Union. The statistical form is drawn up by the person who made the transaction, or on whose instructions this transaction was made, or who is vested with the right to own and dispose of goods.

The statistical form is submitted to customs no later than the eighth working day of the month following the month in which the goods were shipped.

Important! For violation of the deadlines for submitting a statistical form for recording exports to Belarus, a fine may be imposed on officials in the amount of ten thousand to fifteen thousand rubles under Article 19.7.13 of the Code of Administrative Offenses of the Russian Federation; for legal entities - from twenty thousand to fifty thousand rubles.

The statistical accounting form in the form of a paper document can be sent through the Personal Account of a participant in foreign trade activities on the website of the Customs Service in the following order:

- It is necessary to fill out the statistical form electronically;

- Make sure that the form is filled out correctly and completely;

- Request a system number and save the form;

- Certify the received document with the signature and seal of the applicant;

- Send the received document in paper form in person or by post with acknowledgment of receipt to the customs office at the place of registration of the applicant;

- The customs inspector, having received the statistical form in paper form, will download it from the customs system using the system number, verify the information and register it, assigning an official registration number;

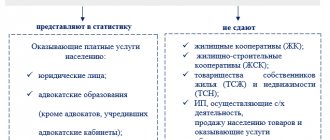

Who fills out the declaration

The circle of persons required to submit a report to customs statistics is outlined in Art. 278 of Federal Law No. 289-FZ of August 3, 2018. This is a Russian person (organization or individual entrepreneur) who has entered into a transaction, in pursuance of which an item is moved across the state border of Russia within the EAEU.

If there was no such transaction, but the movement of the object took place, the statistical form for recording the movement of goods of the customs union is submitted by the person who has the rights to use, own or dispose of the moved object.

Difficulties that may arise for exporters:

Despite the simplified procedure for processing export-import transactions in the EAEU states, there are many peculiarities. For example:

- In the absence of confirmation of the 0% rate of Value Added Tax, within a certain period of time, the exporter may be additionally charged Tax at the internal rate on the amount of goods released for export;

- Tax inspection - you need to prepare for a serious desk audit of the exporting company and its counterparties;

- Some products are on control lists and require permits or licenses from various government agencies to export them. Only an experienced customs representative can determine whether a product belongs to the control lists;

Our company guarantees the fulfillment of its promises regarding the organization of foreign trade activities. With our help, customs clearance for the export of your products to Belarus from Russia will be easy and transparent, and will also significantly expand the number of potential partners in both countries.

Service consultation

When to fill out the declaration

It is necessary to fill out a statistical report to the customs office of the customs union whenever objects are moved across the state border of the Russian Federation within the union, including:

- temporarily for a period of more than 1 year;

- imported as contributions to authorized funds;

- as part of the provision of humanitarian or technical assistance;

- under barter or consignment agreements;

- for processing;

- under a leasing agreement for more than 1 year.

In some cases, the customs statistical form is not filled out, for example, if the goods:

- moving in transit;

- moved by individuals for personal needs;

- are moved to or removed from the Baikonur complex;

- are imported or exported for a period of less than 1 year;

- are exhibition pieces.

A complete list of cases when a customs report for export or import is not required is indicated in clause 3 of the rules for maintaining statistics, approved by Government Decree No. 1329 of 12/07/2015.

OUR ADVANTAGES

COMFORTABLE

Your personal account allows you to carry out the vast majority of procedures electronically, from uploading documents and information to monitoring the progress of customs clearance. The declaration for goods is submitted to the customs authority through a secure channel using Electronic Declaration technology (ED-2).

FAST

Thanks to our long-term experience of working with the customs service, we have created a clear procedure for interaction, allowing us to complete the customs clearance procedure quickly enough.

PROFITABLE

Our clients receive a Declaration of Goods (DT) and a set of documents for crossing the border at a single price specified in the Agreement, without additional costs.

Algorithm for filling out the declaration

The algorithm for filling out a statistical declaration is described in detail in Appendix No. 2 to the rules for maintaining statistics. The declaration consists of the following columns:

- registration number - filled in automatically upon registration;

- number of the canceled statistical form - filled in by the applicant if the report is submitted again to replace the previously submitted one;

- system number - assigned to a form submitted on paper automatically after passing format and logical control;

- 20 semantic graphs; if reporting is completed for several types of objects, columns 1 to 10 inclusive are general, and columns 11 to 20 inclusive are filled out separately for each object; in one report it is allowed to declare no more than 999 transportation objects;

- summary columns: document date, reporting period and information about the applicant.

The procedure for filling out reports in customs statistics for foreign trade transactions

| Column number | Name | Content |

| 1 | Salesman | Information about the person indicated as the seller in the contract and shipping documents:

After the “N” sign, the TIN is indicated, and after the separator sign “/” - the OGRN and KPP (if available). |

| 2 | Buyer | Information about the person indicated as the buyer in the contract and shipping documents. The rules for presenting information are similar to column 1. |

| 3 | Person responsible for financial settlement | Information about the person carrying out tax transactions in the territory of the Russian Federation in relation to the declared objects. The rules for presenting information are similar to columns 1 and 2. |

| 4 | Direction of movement |

|

| 5 | Trading country | The first subsection contains the name of the country in which the counterparty of the person responsible for the financial settlement is registered. The second contains the code of this country. |

| 6 | Destination country | The first subsection contains the name of the country to which the objects are transported. The second contains the code of this country. Filled in only when exporting. |

| 7 | Currency code and total cost of goods | The first subsection contains the letter code of the value currency. The second subsection shows the total cost of all transported objects. |

| 8 | Departure country | The first subsection contains the name of the country of departure. The second contains its code. Filled in only upon import. |

| 9 | Type of transport at the border | The first subsection shows the type of vehicle. The second contains his code. |

| 10 | Documentation | It is necessary to indicate the details of the contract, the relevant invoices for payment and delivery, the shipping document, the transaction passport (if any), a document confirming compliance with the restrictions imposed by technical regulation and export control measures (if any). |

| 11 | Product code | The first subsection contains the serial number of the object, starting from one. The second contains its classification code. |

| 12 | Product description | Name of the object in accordance with the transport documents, information about the manufacturer, additional information that allows you to identify the cargo. |

| 13 | Cost of goods | The actual price paid in the currency indicated in column 7 of the statistical form. If the transaction is free of charge, the estimated value is indicated. |

| 14 | Statistical cost of goods (in US dollars) | The cost of the object together with the costs of delivery to the border of the country, converted into US dollars. |

| 15 | Country of origin | The first subsection contains the name of the country of origin. The second contains its code. |

| 16 | Product net weight (kg) | The net weight is indicated taking into account only the primary packaging or excluding any packaging. For cargo transported without packaging - total weight. |

| 17 | Statistical cost of goods (in rubles) | Cost together with delivery costs, converted into Russian rubles. |

| 18 | Additional units | The first subsection shows the quantity of goods. The second contains the code for the additional unit of measurement. |

| 19 | additional information | A mark is placed in the declaration if the following types of transactions are present:

|

| 20 | Declaration of goods | The first subsection contains the number of the declaration according to which the cargo was released in the customs territory of the EAEU. The second contains the serial number of the goods in the declaration. The column is filled in if the objects were imported into the territory of the EAEU. |

Filling out the declaration form is completed by indicating the date of completion, indicating the reporting period (month and year of shipment of the goods) and information about the applicant.