Responsibility of the financially responsible person for shortages

According to the provisions of Art.

242 of the Labor Code, the employee is liable to the employer for damages caused in full. When registering a cashier as an employee of an enterprise, in addition to an employment contract, a financial liability agreement is also concluded with him (Article 244 of the Labor Code), on the basis of which, and taking into account legal requirements, damages can be recovered from the guilty official. If a shortage is detected at the cash register, the cashier's liability arises regardless of whether his actions are accidental or intentional. How is the deficiency reimbursed by the financially responsible person? First of all, it is necessary to document the results of the inventory and record the results of the inspection in the prescribed manner. The extent and cause of the damage are then identified. For this purpose, the employer's administration has the right to create special commissions. The employee is required to provide written explanations of what is happening, and if the cashier refuses to provide explanations, a report should be drawn up (Article 247 of the Labor Code).

What you need to know if you are accused of a shortage

As a rule, an employee working with money or goods is a financially responsible person. When you are hired, you must sign the appropriate contract.

If a shortage does occur at your enterprise, then by law the employer has every right to recover material damages from its employees, but in amounts not exceeding the average wage. The procedure for involving an employee in compensation for material damage caused is established in the legislation by Articles No. 247, 248.

Article No. 247. The employer is obliged to establish the amount of damage and the reasons why this fact occurred. In turn, management is obliged to conduct an inspection and establish the circumstances of the shortage.

The employer has the right to convene a commission of relevant specialists. You must write a statement in which you describe in detail the situation and your involvement in it.

If you refuse to write such a paper, an act will be drawn up regarding this. But this is not in your interests, especially if you are confident in your innocence. You can resort to the services of a lawyer and, together with him, monitor the progress of the inspection and get acquainted with the relevant documents for its implementation.

Article No. 248 of the Labor Code. By order of your immediate superiors, you have the right to withdraw the resulting shortfall in an amount not exceeding your average monthly salary. Such an order, in accordance with the law, can be announced no later than the first month after an inspection has been carried out at the enterprise and all the facts and extent of the shortage have been established. The amount of the allowable amount that can be collected from you is calculated after full deduction of personal income tax from your salary.

Writing off the shortage to the guilty party - postings

Example 1

The discovered lack of funds is fully covered by the guilty official:

- D 94 K 50 – the identified damage is reflected in the company’s accounting.

- D 73.2 K 94 - the shortage is attributed to the guilty person of the enterprise.

- D 70 K 73.2 – the amount of established damage was withheld from the employee’s earnings.

- D 50 K 73.2 - or it is possible to deposit the shortage of funds directly into the organization’s cash desk.

Example 2

The discovered shortage of cash resulted from a natural disaster (or other emergency), and this is not the cashier’s fault:

- D 94 K 50 – a shortage of funds in the cash register was identified, the posting was made on the basis of the commission’s act and documents confirming the emergency.

- D 91.2 K 94 - the detected damage is included in other expenses of the enterprise. For the purpose of calculating profit tax, such amounts are written off as non-operating expenses and taken into account when determining profit tax (subclause 6, clause 2, Article 265 of the Tax Code).

Example 3

The discovered shortage of money was due to the fault of the responsible employee, but by the decision of the manager, the cashier was allowed to partially compensate for the damage:

- D 94 K 50 – reflects the identification of a shortage in the company’s cash register.

- D 73.2 K 94 – the recognized amount of the shortfall is written off to the guilty person, the posting was made on the basis of the relevant order of the director.

- D 91.2 K 94 – the balance of the unreimbursed shortfall is attributed to other expenses.

Accordingly, if the shortage is attributed to the financially responsible person, the posting is carried out using the account. 73 or 76. In the absence of those responsible for the damage, the account is applied. 91. Postings are made according to the norms of Order No. 94n.

Conditions for employee liability for cash shortages

When signing an employment contract with a cashier (senior cashier, controller), an agreement on full financial responsibility must be concluded. The employees with whom this agreement can be concluded, as well as the positions, are recorded in Resolution of the Ministry of Labor of the Russian Federation No. 85.

Systematic checks will allow you to identify shortages of funds in the cash register. The audit is carried out by a commission. Its composition is approved by order of the head of the organization.

Members of the commission, in the presence of the person bearing financial responsibility (cashier, controller), must count the funds available in the cash register. Next, a comparison is made of the balance available in the cash register with the balance of money indicated in the cash book. The commission confirms the fact of the shortage. Based on the results of the audit, a cash inventory report is drawn up in the INV-15 form. It should indicate:

- financially responsible person;

- composition of the commission;

- the amount of funds in the cash register, as well as funds according to accounting documents;

- inventory results;

- explanation of the reasons for the shortage;

- decision of the head of the organization.

The employee is required to provide a written explanation. If he refuses to give such an explanation, a statement of refusal is drawn up.

Thus, a shortage was identified at the cash register. What should the management of the organization do in this case?

Safety measures when working with material assets

Before you begin your direct duties at the workplace, familiarize yourself in detail with the enterprise’s security system, which can subsequently save your reputation.

Be sure to check whether the business is operating in accordance with the law. Whether there is a cash register or funds are not officially taken into account anywhere. Try to protect yourself as much as possible from possible unpleasant circumstances.

Neglecting the most basic safety rules and precautions will not lead to anything good. First of all, you yourself should protect yourself from various kinds of troubles associated with financial liability. Therefore, first you need to be honest with yourself, and this kind of problem will not affect you.

| Precautionary measures | Details |

| CCTV | Pay attention to whether your workplace is visible to CCTV cameras. If problems arise, you have the right to raise the entries they made. |

| Cash machine | Try to carry out transactions with funds that come to you only through a cash register. Cash tapes can also serve as proof of your innocence if necessary. |

| Written proof of cash acceptance | If there is no cash register at your workplace, then take a receipt from the person who gives you the money. It indicates the amount and details of the person transferring funds to you. At the end, sign your receipt. |

| Documentation | Never sign questionable documents. Before signing any papers, study them in detail. |

How to document a shortage at the cash register?

Hello! Please help me figure it out.

Extract from the household journal. transactions 01/08/2013 As a result of the audit of the cash register, a shortage was revealed, the guilty person was the cashier 450 rubles. The cashier contributed the shortfall in the amount of 450 rubles.

When taking inventory of the cash register, INV-15 is drawn up; can this document be indicated in the cash book?

Hello. The Ministry of Finance provides an answer to this question:

How to reflect the lack of money in the cash book

Elena Popova, State Advisor to the Tax Service of the Russian Federation, 1st rank

Record the lack of money in column 5 “Expense” of the cash book based on the inventory report.

The procedure for reflecting the shortage of money in the cash book is not considered in regulatory documents.

If you issue a cash receipt for the shortage, it will turn out that the financially responsible employee (cashier) received the money with the permission of the manager and chief accountant. But that's not true.

Therefore, based on the inventory act in the cash book, indicate:

the number of the inventory report and its date - in column 1;

“Shortage” - in column 2;

score 94 – in column 3;

the amount of the shortage is in column 5.

Thus, the balance at the end of the day in the cash book will correspond to the cash balance in the cash register.

If the guilty person subsequently makes a shortfall in the cash register, document this with a cash receipt order and make an entry in the cash book about the receipt of money.

This conclusion can be drawn from the provisions of paragraph 3 of paragraph 4.6 and paragraphs 5, 6 of the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U and the Instructions for the chart of accounts (account 94).

Prove innocence of shortage

What you should pay attention to first:

- You should know that if a month has already passed since the inspection, and you do not agree that you have been charged with a shortfall, and its amount significantly exceeds your average monthly salary, then the company management has the right to file a lawsuit, and this issue will be resolved there .

- If the above measures to establish the facts of the shortage on the part of management are not observed, then you have the right to appeal these actions in court.

If you agree with the results of the inspection, then the damage can be partially compensated voluntarily, while deferment of payment is allowed under the agreement that you draw up with the company management.

In the event that you are going to be fired after what happened, and you have already signed a document confirming your involvement in the shortage, but refuse to compensate for it, the employer has the right to sue you.

Your employer can file a claim against you in court within a year from the first day when they discovered a shortage at the enterprise.

- In the case where you are not involved in the shortage, but management blackmails you and forces you to pay for the damage caused to the organization, go to the police and write a statement about the employer’s abuse of its powers and fraud.

It would be advisable if you monitor the progress of the inspection yourself. Failure to comply with the conditions will only benefit you.

- The check should be carried out according to instruction No. 69.

- A commission of specially trained people is created.

- A specific document is drawn up upon the fact of the audit, in which the cashier or the person responsible for the goods must put a note that he agrees with the results of the audit.

The answer to the question: “how can one prove innocence of a shortage” is not easy. In any case, if you think that you are not guilty, write a statement to the police, they are obliged to look into this matter.

You have the right to prove your innocence in court, and you can even win the trial - for this you need to draw up a statement using the services of your lawyer.

Types of liability for shortages

- Full financial responsibility. This implies reimbursement of the entire missing amount at the expense of the cashier. If the amount that needs to be reimbursed is no more than the average monthly salary of the culprit, then he must reimburse it by order of management, issued no later than a month from the date of discovery of the shortage. Large sums can only be recovered through judicial proceedings. The employer has a year to go to court on this matter.

ATTENTION! You will have to file a claim in court if the cashier does not agree to voluntarily pay the funds, as well as after the expiration of the established month.

- Administrative penalty. The cashier, through his action, inaction or negligence, violated the procedure for handling cash, which means he may be subject to administrative liability. Officials can pay 4–5 thousand rubles, and legal entities – 40–50 thousand rubles. - this is in addition to compensation for the amount of the shortfall itself.

- Disciplinary action. May also be imposed by the employer, in addition to damages. A careless cashier can be reprimanded, reprimanded, and in some cases fired without mercy.

- Criminal liability. Threatens those officials in respect of whom the intent of their actions has been proven. Such guilty actions are recognized as: theft - secret appropriation of someone else's property;

- fraud - the acquisition of rights to someone else's funds due to abuse of trust or deception;

- embezzlement – theft of entrusted property or funds and subsequent sale, use, transfer to third parties;

- misappropriation – unlawful retention of entrusted assets for one’s use.

These actions are punished, depending on the severity, the possibility of relapse and the category of the guilty employee, either by a fine, or by compulsory or correctional labor, or by restriction of freedom, arrest or prison. The specific time limits depend on the type of criminal act.

What should an employer do if a lack of funds is identified?

In most cases, cash shortages are identified during an inventory count. This procedure is an integral part of the work of almost every organization.

What to do if there is a shortage of inventory items identified during inventory?

In the process of its implementation, the recalculation and assessment of material assets and money related to the company’s property is carried out.

In addition, shortages are identified as a result of unplanned inspections. The need for them is due to the following factors:

- change of financially responsible person;

- natural disaster, emergency;

- change of owner of the enterprise;

- the likelihood of theft of company property.

If, during an audit of the cashier’s work, the employer identified a shortage, he needs to take a number of actions. The first thing to do is demand an explanation from the cashier.

He is given 2 days to provide an explanation of the situation. The employer's request can be documented or expressed orally. An employee’s refusal to testify must be documented in a document.

Subsequently, the employer conducts an investigation. Based on its results, the culprit is determined, as a result of whose action or inattention the shortage arose. If a penalty is imposed on him, an order is drawn up.

What to do if you find a shortage in the store?

Possible reasons for lack of cash

The shortage is not always associated with the dishonest attitude of responsible employees to their work.

Other factors may be responsible for this phenomenon.

The main reasons for the lack of money in the cash register:

- theft. The most common circumstance. Any person who has access to the cash register can commit theft;

- unforeseen circumstances. For example, a natural disaster. As a result of this phenomenon, material assets can be lost or damaged without human participation;

- re-grade Selling an item at an invalid or lower price. Often this error occurs if a company sells several types of one product;

- production costs. Products can be damaged without anyone's fault.

It is important to take into account that for each type of shortage there is a certain limit, so minor shortages of funds in the cash register are normal.

Is the cashier required to refund the money?

A cashier is an employee whose professional activity involves working with cash. He has a huge responsibility.

The Labor Code of the Russian Federation and the Resolution of the Ministry of Labor reflect a list of positions in relation to which the full type of financial liability must be established. This means that if violations are detected, employees are obliged to fully compensate the employer for all damages.

The position of cashier is included in the specified list.

The amount of the shortage can be attributed to the cashier in full, since responsibility for the lack of cash in the cash register rests with this employee.

This rule is regulated by Article 242 of the Labor Code of the Russian Federation.

The cashier is not obliged to pay compensation to the employer if the shortage was caused by factors beyond his control. These are:

- a disaster or other similar event during which the cash register was damaged;

- force majeure - robbery, theft, etc.

When an employee cannot be blamed for a shortage

You should also know that there are certain situations when an employee cannot be blamed for the damage caused:

- when exposed to force majeure;

- in case of emergency;

- if the damage was caused in case of self-defense;

- failure to comply with proper rules for the storage of material assets by immediate management.

If you find yourself in an unpleasant situation, do not panic under any circumstances. Every effort must be made to resolve this issue.

At any time, you can seek help from law enforcement agencies or hire a lawyer who will competently help you solve the problem that has arisen.

There can be no unsolvable situations; if you are completely confident that you are not involved in the shortage, be sure to try to prove that you are right and do not succumb to blackmail and threats from superior employees and management. No matter how hopeless the situation may seem to you, you always need to go to the end, defending your honor and rights.

Refund Methods

The technology for returning missing funds to the cash desk depends on the amount of the shortage and other related factors.

If the cashier has the appropriate ability, he must pay off the debt one time.

In case of significant shortage, payment by installments is possible.

It is important that in this way the collection of funds is carried out only with the consent of both parties to the employment relationship.

A certain amount may also be set that will be withheld from the employee’s salary until the full amount lost is returned.

If there are disagreements or the cashier refuses to compensate for losses, the employer has the right to go to court.

How to write off the identified lack of money?

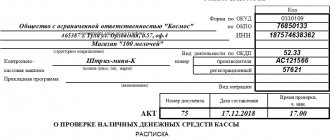

In order for the shortage identified as a result of checking the cashier’s work to be written off or attributed to the cashier’s account, it is necessary to ensure that the following documents are available:

- A report on the correctness of the inspection, during which the deficiency was identified.

- Collation statement.

- Inventory result record sheet

- Explanatory note from the cashier.

- Order from the manager to impose a penalty.

- Decision of the judicial authority (if any).

- Resolution to suspend the investigation of the situation (if the culprit is not found).

Also, some changes are reflected in accounting. All shortages must be written off to the debit of account 94, which has the appropriate name - “Shortages and losses from damage to valuables.”

Documenting

The lack of money in the cash register is classified as an expense. To establish it, an inventory is carried out, the results of which reveal the reasons for the lack of funds in the cash register.

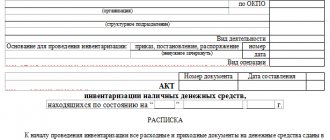

At the end of the procedure, the responsible employees draw up a report drawn up according to the unified form INV-15.

The report is prepared in several copies. One is transferred to the accounting department, the other remains with the cashier.

The head of the organization draws up an act with the help of which he notifies the employee about the misunderstanding that has occurred.

Within a few days, employees who, according to preliminary data, are guilty of identifying the deficiency must provide written explanations.

If at the end of the specified period the explanatory note is not provided to the manager, a statement of refusal is drawn up.

The fact that a shortage is identified is also reflected in accounting. For this purpose, a special account 94 has been created, which has the appropriate name - “Shortages and losses from damage to valuables”. Also, shortages may be reflected in account 50 - “Cash”.

After receiving/not receiving the cashier’s explanations, the employer conducts an investigation into the situation.

Based on its results, the fact that the cashier is guilty is confirmed or refuted.

If an employee is found guilty, he is subject to a financial penalty.

For this purpose, the manager issues an appropriate order.

A document of this type reflects information about the violator, the date the deficiency was discovered and the conditions under which it was discovered. The amount of the shortage and the method of compensation are indicated.

How to compose?

To carry out an inventory of goods and funds, a commission is appointed, which consists of the head of the organization, an accountant and a lawyer.

The form must be completed in two copies.

It is important that all copies contain the signatures of the financially responsible person, accountant and manager. Their absence will result in the document being declared invalid.

When a shortage of goods is detected during inventory

To prepare a statement of shortage of goods, you must attach documents confirming the costs.

These can be receipts for the purchase of goods, supply agreements. It is legally permitted to use the standard INV-3 form, or you can fill out a form developed by the organization. But at the same time, it must reflect mandatory items.

When a shortage of goods is identified, the report is filled out as follows:

- The header of the document indicates the full and abbreviated name of the organization. The contact telephone number and name of the department are indicated.

- Next, fill out the plate located on the right. It indicates the OKPO and OKVED code. Next, the date the document was compiled is indicated.

- The main field indicates the location where the inventory was taken. For example, this could be a store warehouse. The act can be drawn up only after the commission has carried out a full inspection.

- If the inventory reveals a defect or shortage of cargo, the sender must be called. The letter is sent by mail or fax. Information about the sender's notification must be indicated in the act.

- The text indicates the details of the cargo, as well as the number of the insurance contract. All numbers of accompanying papers must also be entered.

- It is necessary to indicate the date of arrival of goods and unloading. This information can be obtained from the invoice.

- Next, fill in information about the delivery of goods. The table should contain information about packaging and cargo weight.

- The following table lists the actual data and lists any discrepancies.

The following describes the defects and the reasons why they could occur.

filling

standard form of inventory list of goods INV-3 - excel

filling in a free form report on the shortage of goods discovered during the audit - word.

If there is a shortage of funds at the cash desk

Upon verification of funds at the cash desk, an act is always drawn up in the INV-15 form.

Features of filling out the form when identifying a shortage at the cash register are as follows:

- When filling out the INV-15 form, the details of the enterprise, the KVED code, the date and number of the order on the basis of which the inventory is carried out must be indicated. The number and date of the report, as well as the date when the inspection was carried out, are indicated. It is important to take into account that the document must be drawn up on the day of the audit of funds at the cash desk.

- The main part of the document must indicate the actual amount of funds and the accounting amount. All indicators must be specified taking into account the types of cash and documentation. All amounts are written both in numbers and in words.

- Based on the results of the inspection, the report should reflect information about any surplus or shortage found. If the accounting amount corresponds to the actual amount, then a dash is entered in the “Surplus” and “Shortage” columns.

- On the reverse side of the INV-15 form, information about the giving of explanations by the financially responsible person should be displayed. The decision of the head of the organization is also indicated here. This could be a reprimand or dismissal.

Design example

act when a shortage of funds in the cash register is identified during the inventory - word.

Posting surplus

Unlike a shortage, where suspicions of theft or embezzlement immediately arise, a case of a surplus can have two interpretations.

If there is unaccounted money in the cash register, then perhaps some product was sold at an incorrectly indicated price or there was an underweight. In principle, with modern systems of fixation and operations, such cases should not occur by chance. It often happens that cashiers in small stores, in the absence of a sufficient number of necessary change notes, report them to the cash register from their wallet. Later, due to forgetfulness or busyness, you may not remove the change notes in time, which will lead to the appearance of surpluses and subsequent problems when they are detected.

The actual market value of identified surpluses requires confirmation. This is done in one of the following two ways:

- An independent appraiser determines the price of non-income assets. This is a simpler and more transparent method.

- The trade organization conducts a comparative analysis of market prices for similar property and draws up a certificate. The following information documents are taken into account:

- advertisements with prices for similar properties in the media;

- invoices from suppliers;

- certificates from statistical agencies, etc.

Surplus valuables found during inventory are correlated with their market value and posted to other income: debit 10 (or 01, 41, 50), credit 91-1.

How to write an explanatory note

Within the framework of current legislation, when surpluses are discovered during inventory, the employer is obliged to require an explanatory note from the cashier.

Important! The employee does not have the right to refuse and must provide the required document within two working days.

The explanatory note is written on a computer or manually on the organization’s official letterhead. The signature and its transcript are written by hand. If a surplus is detected, a work completion report is drawn up, and a note from the responsible employee is attached to it.

The explanatory note contains two sections:

- The factual section describes the events and conditions that led to the situation described in the document. For example, this can be done like this: “Yesterday, March 20, an inventory was taken at the Ulybka cafe. As a result of the inspection, excess funds were discovered in the cash register.”

- The causal section indicates why extra funds appeared in the cash register. There are usually several reasons, and they need to be properly explained in order to reduce the degree of your guilt or future liability.

When writing an explanatory statement, the facts must be clearly indicated, but there is no place for speculation and reasoning in it. The document conveys to management only what the employee knows and has seen—data and facts.

The explanatory note must include the following details:

- name of company;

- Full name of the manager and his position;

- the title of the document is “Explanatory” (without a period at the end);

- the employee's position and full name;

- date of creation of the document and signature of the employee.

Considering that there is no established form for the note, it is written in any form, taking into account the requirements listed above. Here is an example of such a document:

After drafting and signing, the note (in two copies) is sent to the immediate superior, who signs it and puts a registration number. You need to keep a copy for yourself - this is proof of the existence of the document and its registration at the enterprise.

Did you know? Some managers may suspect that the surplus in the cash register is the result of incorrectly posting goods with the goal of future theft. While the shortage is most likely just a mistake.

Penalty for excess at the cash register

When a surplus is detected, suspicion naturally falls on the cashier, who, through his intentional or accidental actions, allowed such a situation to occur. Financial penalties are imposed on the head of the enterprise, and then he himself chooses the measure of disciplinary action against the offending cashier. Depending on the damage caused, this may be a reprimand, deprivation of a bonus or bonus, and in a serious case, dismissal.

Violations of cash discipline, which include non-receipt or under-receipt of cash, are punishable in accordance with Articles 14.5 and 15.1 of the Administrative Code of the Russian Federation. In most cases, a legal entity is fined, along with an official - the head of the organization. For a legal entity, the fine will be from 40 to 50 thousand rubles, and for a manager - from 4 to 5 thousand rubles.

Did you know? If violations are detected by an individual entrepreneur, he is equated to an official and pays a fine established for this category (4-5 thousand rubles).

In case of minor violations or cases with “mitigating circumstances,” a warning can be dispensed with. A decision based on the application can be made by the head of the interdistrict tax inspectorate. This takes into account the absence of detected violations during the last year. The petition is written in free form, where the manager indicates all the factors that, in his opinion, should influence the mitigation of the punishment - from the creation of a modern workplace for the cashier to the possibility of simple human error.

Modern cash registers virtually eliminate the possibility of unintentional errors. Although, in any case, we should not forget about the human factor - a surplus at the box office may not necessarily appear due to malicious intent. Perhaps the cashier’s qualifications were insufficient or some force majeure circumstances arose.

The procedure for carrying out inventory, accounting for surpluses and shortages: video

Is the cashier obligated to compensate for shortfalls in the cash register?

The position of a cashier involves enormous responsibility, but the responsibilities in this profession must be precisely correlated with the rights. Both excess and shortage are not always the fault of the cashier, since there are many situations that can lead to a difference between the amount at the cash register and the settlement amount.

In any case, the cashier, as a financially responsible person, is obliged to pay for his miscalculations from his own pocket. If there is a minus at the cash register, the cashier must fully reimburse the missing amount. These actions are regulated by articles 242 and 243 of the Labor Code of the Russian Federation. The reason for the shortage in the cash register is not important - whether the employee made a mistake accidentally or intentionally, he must compensate for the damage.

Did you know?

If the amount of the shortfall is less than the employee’s monthly salary, then the employer can recover it without the consent of the person who was at fault.

Financial penalties are not the only type of punishment for improper performance of work duties. In accordance with Articles 192 and 193 of the Labor Code, the employer has the right to take disciplinary action against a negligent employee. This could be a warning, a reprimand, and in extreme cases, dismissal. Of course, an adequate leader must weigh the pros and cons before making a fateful decision.