Time is a very important resource that is always in short supply. There's never enough of it. You always want there to be more of it.

People who know how to properly distribute this resource achieve a lot in their lives. Those who do not value time and waste it rarely achieve serious success. In order to complete any task on time, you need to assign a certain period of time during which it can actually be completed, and adhere to the established deadlines. Only by setting specific goals for yourself can you achieve your goals. What could be the time period? It can be different: a week, a month, a half-year, a year, etc. In this article we will talk about such a period as a quarter.

What is a quarter? How many months are there in each quarter?

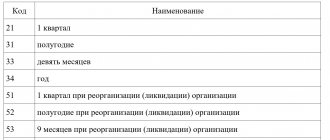

Translated from Latin, this word means “quarter”. Accordingly, a quarter is ¼ of a year. Thus, it becomes clear that we have only four quarters in a year. Knowing that a year consists of twelve months, you can calculate the number of months in one quarter. How many months are there in each quarter of the year? Through simple mathematical calculations we arrive at the following: 12 / 4 = 3. In total, we have 4 quarters in a year, each of which has three months. Quarters are numbered with Latin numerals. In English-speaking countries, this time period is indicated by Arabic numerals. Each of them is preceded by the letter Q.

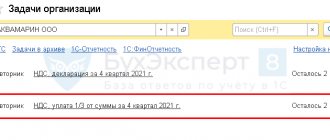

List of reports in the 3rd quarter

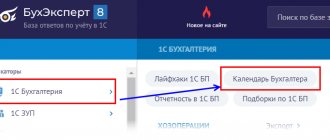

We recommend creating a personal tax calendar for the 3rd quarter of 2022, since each company and individual entrepreneur has its own list of reports to the Federal Tax Service, Social Insurance Fund, Pension Fund of the Russian Federation, Rosstat and other authorities. But regardless of what the taxpayer submits, the deadlines for submission are the same for everyone and are established by law.

Our calendar, which contains not only the main quarterly and monthly forms, but also the deadlines for mandatory payments, will help you find out what dates to submit the forms and how to fill them out. Below is a schedule of reports for the 3rd quarter of 2022, which will allow you not to miss anything.

| Report submission date for the 3rd quarter of 2022 | Report name (payment type), reporting period | Who is obliged to report, pay | To which authority should I submit and pay? |

| 01.07.2022 | Pay contributions for 2022 for compulsory pension insurance with an income of more than 300,000 rubles. | Individual entrepreneurs, lawyers, notaries, arbitration managers, appraisers, mediators, patent attorneys and other persons engaged in private practice. | Inspectorate of the Federal Tax Service |

| Provide an application for refusal of VAT exemption or suspension of the use of the exemption, starting from the 3rd quarter. Instructions for filling out from ConsultantPlus. | Taxpayers selling goods (work, services) provided for in clause 3 of Art. 149 of the Tax Code of the Russian Federation. | Federal Tax Service | |

| 14.07.2022 | Provide a register of workers entitled to payments for working with patients with COVID-19 for June 2022. | Medical and other organizations (their structural divisions). | IFSS |

| Pay tax on income on state and municipal securities for June or for the first half of 2022. | For the past month - taxpayers calculating monthly advance payments based on the actual profit received. For half a year - taxpayers for whom the reporting periods are the first quarter, half a year and nine months. | Federal Tax Service | |

| 15.07.2022 | Pay contributions for compulsory health insurance, compulsory health insurance, VNIM for June. Instructions for calculating and paying contributions from ConsultantPlus. | Payers of insurance premiums who make payments and other benefits to individuals. | Inspectorate of the Federal Tax Service |

| Transfer contributions for injuries for June 2022. Instructions for calculating and paying premiums for accident insurance from ConsultantPlus. | Policyholders. | FSS | |

| Make a payment for additional contributions to the funded pension and employer contributions for June 2022. Instructions for calculating and paying pension contributions from ConsultantPlus. | Employers. | Pension Fund | |

| Provide SZV-M for June. The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Instructions for filling out SZV-M from ConsultantPlus. | Policyholders. | Pension Fund | |

| Submit SZV-TD for June (if necessary). Instructions for filling out SZV-TD from ConsultantPlus. | Policyholders. | Pension Fund | |

| Pay personal income tax for 2022. |

| Inspectorate of the Federal Tax Service | |

| Notify about refusal to use or loss of the right to use the simplified tax system. Instructions for filling out when canceling ConsultantPlus. Instructions for filling out and submitting in case of loss from ConsultantPlus. | Payers of the simplified tax system. | Federal Tax Service | |

| Make an advance payment of excise tax on alcohol and (or) alcohol-containing products for July 2022. How to pay an advance payment on excise taxes: consultation with an expert ConsultantPlus. | Manufacturers. | Inspectorate of the Federal Tax Service | |

| Provide a declaration and pay the excise tax on petroleum raw materials for June 2022. | Taxpayers are refiners of petroleum raw materials. | Federal Tax Service | |

| 18.07.2022 | Provide notice of advance payment of excise duty on alcohol and (or) alcohol-containing products. | Manufacturers of alcoholic and (or) alcohol-containing products. | Inspectorate of the Federal Tax Service |

| 20.07.2022 | Provide EUD for the 1st half of the year. The form was approved by Order of the Ministry of Finance No. 62n dated July 10, 2007. Instructions for filling out from ConsultantPlus. | Taxpayers. | Federal Tax Service |

| Submit Form 4-FSS and a report on the use of insurance premiums for financial support of preventive measures to reduce occupational injuries for the 1st half of 2022 on paper. Form 4-FSS was approved by FSS Order No. 381 dated September 26, 2016. The report form is given in the letter of the Federal Social Insurance Fund of the Russian Federation dated September 17, 2021 No. 02-09-05/06-10-24447. Instructions for filling out 4-FSS from ConsultantPlus. | Policyholders with less than 10 employees. | IFSS | |

| Register of insured persons for whom additional insurance contributions for funded pension have been transferred and employer contributions have been paid for the 2nd quarter of 2022. Instructions for filling out the DSV-3 form from ConsultantPlus. | Employers. | Pension Fund | |

| Send a copy of the document confirming the payment of additional insurance contributions for the funded pension for the 2nd quarter of 2022. | Individuals who independently pay contributions to a funded pension. | Pension Fund | |

| Pay quarterly advance payments for negative environmental impact for the 2nd quarter of 2022. | Persons obligated to pay fees for the NVOS. | Rosprirodnadzor | |

| Submit the invoice journal for the 2nd quarter of 2022 in electronic form. Instructions for working with the magazine from ConsultantPlus. | Tax agents for VAT. | Inspectorate of the Federal Tax Service | |

| Provide notice of the use of the right to VAT exemption or the extension of the use of such a right, starting from July 2022. | Taxpayers listed in paragraph 1 of Art. 145 Tax Code of the Russian Federation. | Federal Tax Service | |

| Provide a tax return for indirect taxes and pay the taxes themselves (for June 2022). The declaration form was approved by Order of the Ministry of Finance No. SA-7-3 / [email protected] dated September 27, 2017. Instructions for filling out a declaration from ConsultantPlus. | Taxpayers when importing goods into the territory of the Russian Federation from the territory of the EAEU. | Inspectorate of the Federal Tax Service | |

| Submit a water tax return for the 2nd quarter of 2022 and pay the tax itself. The declaration form was approved by Order of the Ministry of Finance No. ММВ-7-3/ [email protected] dated 09.11.2015. Instructions for filling out a declaration from ConsultantPlus. Instructions for paying water tax from ConsultantPlus. | Users of water bodies. | Inspectorate of the Federal Tax Service | |

| Provide alcohol declarations for the 2nd quarter of 2022 and corrective declarations for the 1st quarter of 2022. | Manufacturers and wholesalers. | Rosalkogolregulirovanie | |

| 21.07.2022 | Report the loss of the right to use the Unified Agricultural Tax. | Users of the Unified Agricultural Tax. | Federal Tax Service |

| Provide copies of declarations in electronic form on the volume of retail sales of alcohol and alcohol-containing products for the 2nd quarter of 2022. | Organizations and individual entrepreneurs selling alcohol and alcohol-containing products. | Rosalkogolregulirovanie | |

| 25.07.2022 | Submit Form 4-FSS and a report on the use of insurance premiums for financial support of preventive measures to reduce industrial injuries for the 1st half of 2022 in electronic form. Form 4-FSS was approved by FSS Order No. 381 dated September 26, 2016. The report form is given in the letter of the Federal Social Insurance Fund of the Russian Federation dated September 17, 2021 No. 02-09-05/06-10-24447. Instructions for filling out 4-FSS from ConsultantPlus. | Insureds employing more than 10 people. | FSS |

| Pay personal income tax for the 1st half of 2022. |

| Inspectorate of the Federal Tax Service | |

| Report on transactions with goods subject to traceability completed in the 2nd quarter of 2022. The report form and procedure for filling out were approved by Order of the Federal Tax Service of Russia dated July 8, 2021 No. ED-7-15/ [email protected] The list of goods subject to traceability was approved by Decree of the Government of the Russian Federation dated July 1, 2021 No. 1110. | Individual entrepreneurs and legal entities are participants in the circulation of goods. | Federal Tax Service | |

| Provide a VAT return for the 2nd quarter of 2022. Instructions for filling out a VAT return from ConsultantPlus. | Taxpayers and tax agents. | Federal Tax Service | |

| Pay VAT (1/3 part or full amount) for the 2nd quarter of 2022. Instructions for calculating and paying VAT from ConsultantPlus. | Taxpayers and tax agents, including foreign organizations. | Inspectorate of the Federal Tax Service | |

| Make an advance payment under the simplified tax system for the 1st half of 2022. | Payers of the simplified tax system. | Federal Tax Service | |

| Submit a declaration in connection with the termination of business activities using the simplified tax system and pay tax for June 2022 or the 2nd quarter of 2022. The declaration form was approved by Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 02/26/2016. Instructions for filling out a declaration under the simplified tax system from ConsultantPlus. | Payers of the simplified tax system. | Inspectorate of the Federal Tax Service | |

| Pay the advance payment under the Unified Agricultural Tax for the 1st half of 2022. | Payers of Unified Agricultural Tax. | Federal Tax Service | |

| Submit a declaration in connection with the termination of business activities on the Unified Agricultural Tax and pay tax for June 2022. The declaration form was approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] dated July 28, 2014. Instructions for filling out a declaration from ConsultantPlus. | Payers of Unified Agricultural Tax. | Inspectorate of the Federal Tax Service | |

| Pay professional income tax (PIT) for June 2022. | NAP payers. | Federal Tax Service | |

| Pay the mineral extraction tax for June 2022. | Subsoil users | Inspectorate of the Federal Tax Service | |

| Pay the trading fee for the 2nd quarter of 2022. | Payers of the fee. | Moscow budget | |

Submit declarations and pay excise taxes for June, April, January 2022 on:

The forms are approved by Orders of the Federal Tax Service dated October 13, 2020 No. ED-7-3/ [email protected] , dated August 27, 2020 No. ED-7-3/ [email protected] , dated February 15, 2018 No. ММВ-7-3/ [email protected] ] | Excise tax payers. | Federal Tax Service | |

| Provide a bank guarantee for exemption from excise duty. | Excise tax payers. | Inspectorate of the Federal Tax Service | |

| 28.07.2022 | Submit a declaration (calculation) and pay income tax. Depending on the situation, you should report and pay for:

Instructions for calculating and paying income tax from ConsultantPlus. | Taxpayers. | Federal Tax Service |

| 29.07.2022 | Submit the calculation of regular payments for the use of subsoil and pay 1/4 of the amount calculated for the year for the 2nd quarter of 2022. Instructions from ConsultantPlus. | Subsoil users | Inspectorate of the Federal Tax Service |

| Submit an application for financial support for preventive measures for 2022. The application form was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated May 7, 2019 No. 237. | Policyholders. | IFSS | |

| Provide a report on the flow of funds on accounts (deposits) in foreign banks for the 2nd quarter of 2022. The form was approved by Government Decree No. 819 of December 28, 2005. Instructions for filling out a report from ConsultantPlus. | Legal entities and individual entrepreneurs. | Federal Tax Service | |

| 01.08.2022 | Provide a calculation of insurance premiums for compulsory pension, social, and medical insurance, including information on the average number of employees for the 1st half of 2022. The calculation form, filling procedure, electronic format are approved by Order of the Federal Tax Service of Russia dated October 6, 2021 No. ED-7-11/ [email protected] | Policyholders. | Federal Tax Service |

| Pay personal income tax for July 2022. Instructions for calculating and paying personal income tax from ConsultantPlus. | Tax agents. | Federal Tax Service | |

| Provide calculation of 6-NDFL for the 1st half of 2022. Calculation according to Form 6-NDFL, the procedure for filling out and submitting, the format for submitting in electronic form are approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] | Tax agents in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation. | Inspectorate of the Federal Tax Service | |

| Prepare a tax return for mineral extraction tax for June 2022. The declaration form was approved by Order of the Federal Tax Service of Russia dated December 8, 2020 No. KCh-7-3/ [email protected] Instructions for filling out the mineral extraction tax declaration from ConsultantPlus. | Subsoil users | Federal Tax Service | |

| 01.08.2022 | Pay an advance on transport tax for the 2nd quarter of 2022. Instructions for transport tax from ConsultantPlus. | Taxpayer organizations. | Inspectorate of the Federal Tax Service |

| Pay an advance on land tax for the 2nd quarter of 2022. Instructions for land tax from ConsultantPlus. | Taxpayer organizations. | Federal Tax Service | |

| Make an advance payment for the property tax of organizations in the constituent entities of the Russian Federation (clause 1 of Article 372 of the Tax Code of the Russian Federation) for the 2nd quarter of 2022. | Taxpayer organizations. | Inspectorate of the Federal Tax Service | |

| 12.08.2022 | Provide a register of workers entitled to payments for working with patients with COVID-19 for July 2022. | Medical and other organizations (their structural divisions). | FSS |

| Pay tax on income on state and municipal securities for July 2022. | For the past month - taxpayers calculating monthly advance payments based on the actual profit received. | Inspectorate of the Federal Tax Service | |

| 15.08.2022 | Pay contributions for compulsory medical insurance, compulsory medical insurance, VNIM for July. Instructions for calculating and paying contributions from ConsultantPlus. | Payers of insurance premiums who make payments and other benefits to individuals. | Federal Tax Service |

| Transfer contributions for injuries for July 2022. Instructions for calculating and paying premiums for accident insurance from ConsultantPlus. | Policyholders. | FSS | |

| Make a payment for additional contributions to the funded pension and employer contributions for July 2022. Instructions for calculating and paying pension contributions from ConsultantPlus. | Employers. | Pension Fund | |

| Provide SZV-M for July. The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Instructions for filling out SZV-M from ConsultantPlus. | Policyholders. | Pension Fund | |

| Submit SZV-TD for July (if necessary). Instructions for filling out SZV-TD from ConsultantPlus. | Policyholders. | Pension Fund | |

| Make an advance payment of excise tax on alcohol and (or) alcohol-containing products for August 2022. How to pay an advance payment on excise taxes: consultation with an expert ConsultantPlus. | Manufacturers. | Inspectorate of the Federal Tax Service | |

| Provide a declaration and pay the excise tax on crude oil for July 2022. | Taxpayers are refiners of petroleum raw materials. | Federal Tax Service | |

| 18.08.2022 | Provide notice of advance payment of excise duty on alcohol and (or) alcohol-containing products. | Manufacturers of alcoholic and (or) alcohol-containing products. | Federal Tax Service |

| 22.08.2022 | Provide notice of the use of the right to VAT exemption or the extension of the use of such a right, starting from August 2022. | Taxpayers listed in paragraph 1 of Art. 145 Tax Code of the Russian Federation. | Inspectorate of the Federal Tax Service |

| Provide a tax return for indirect taxes and pay the taxes themselves (for July 2022). The declaration form was approved by Order of the Ministry of Finance No. SA-7-3 / [email protected] dated September 27, 2017. Instructions for filling out a declaration from ConsultantPlus. | Taxpayers when importing goods into the territory of the Russian Federation from the territory of the EAEU. | Federal Tax Service | |

| Application for reimbursement (offset, return) of tax indicating bank account details for transferring funds and providing a bank guarantee for July 2022. Instructions for filling out from ConsultantPlus. | EGAIS participants and other excise tax payers. | Inspectorate of the Federal Tax Service | |

| 25.08.2022 | Pay VAT (1/3 part or full amount) for the 2nd quarter of 2022. Instructions for calculating and paying VAT from ConsultantPlus. | Taxpayers and tax agents, including foreign organizations. | Federal Tax Service |

| Submit a declaration in connection with the termination of business activities using the simplified tax system and pay tax for July 2022. The declaration form was approved by Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 02/26/2016. Instructions for filling out a declaration under the simplified tax system from ConsultantPlus. | Payers of the simplified tax system. | Inspectorate of the Federal Tax Service | |

| Submit a declaration in connection with the termination of business activities on the Unified Agricultural Tax and pay tax for July 2022. The declaration form was approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] dated July 28, 2014. Instructions for filling out a declaration from ConsultantPlus. | Payers of Unified Agricultural Tax. | Federal Tax Service | |

| Pay professional income tax (PIT) for July 2022. | NAP payers. | Inspectorate of the Federal Tax Service | |

| Pay the mineral extraction tax for July 2022. | Subsoil users | Federal Tax Service | |

Submit declarations and pay excise taxes for July, May, February 2022 on:

The forms are approved by Orders of the Federal Tax Service dated October 13, 2020 No. ED-7-3/ [email protected] , dated August 27, 2020 No. ED-7-3/ [email protected] , dated February 15, 2018 No. ММВ-7-3/ [email protected] ] | Excise tax payers. | Inspectorate of the Federal Tax Service | |

| 29.08.2022 | Submit a declaration (calculation) and pay income tax. Depending on the situation, you should report and pay for:

Instructions for calculating and paying income tax from ConsultantPlus. | Taxpayers. | Federal Tax Service |

| 31.08.2022 | Pay personal income tax for August 2022. Instructions for calculating and paying personal income tax from ConsultantPlus. | Tax agents. | Inspectorate of the Federal Tax Service |

| Provide a mineral extraction tax declaration for July 2022. | Subsoil users | Federal Tax Service | |

| 01.09.2022 | Provide an application and documents for tax monitoring in 2023. The application form was approved by Order of the Federal Tax Service of Russia dated May 11, 2021 No. ED-7-23/ [email protected] | Organizations that are not subject to tax monitoring in 2022 | Federal Tax Service |

| 14.09.2022 | Provide a register of workers entitled to payments for working with patients with COVID-19 for August 2022. | Medical and other organizations (their structural divisions). | FSS |

| Pay tax on income on state and municipal securities for August 2022. | For the past month - taxpayers calculating monthly advance payments based on the actual profit received. | Federal Tax Service | |

| 15.09.2022 | Pay contributions for compulsory health insurance, compulsory health insurance, VNIM for August. Instructions for calculating and paying contributions from ConsultantPlus. | Payers of insurance premiums who make payments and other benefits to individuals. | Inspectorate of the Federal Tax Service |

| List injury contributions for August 2022. Instructions for calculating and paying premiums for accident insurance from ConsultantPlus. | Policyholders. | FSS | |

| Make a payment for additional contributions to the funded pension and employer contributions for August 2022. Instructions for calculating and paying pension contributions from ConsultantPlus. | Employers. | Pension Fund | |

| Provide SZV-M for August. The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Instructions for filling out SZV-M from ConsultantPlus. | Policyholders. | Pension Fund | |

| Submit SZV-TD for August (if necessary). Instructions for filling out SZV-TD from ConsultantPlus. | Policyholders. | Pension Fund | |

| Make an advance payment of excise tax on alcohol and (or) alcohol-containing products for September 2022. How to pay an advance payment on excise taxes: consultation with an expert ConsultantPlus. | Manufacturers. | Inspectorate of the Federal Tax Service | |

| Provide a declaration and pay the excise tax on crude oil for August 2022. | Taxpayers are refiners of petroleum raw materials. | Federal Tax Service | |

| 19.09.2022 | Provide notice of advance payment of excise duty on alcohol and (or) alcohol-containing products. | Manufacturers of alcoholic and (or) alcohol-containing products. | Inspectorate of the Federal Tax Service |

| 20.09.2022 | Provide notification of the use of the right to VAT exemption or the extension of the use of such a right, starting from September 2022. | Taxpayers listed in paragraph 1 of Art. 145 Tax Code of the Russian Federation. | Federal Tax Service |

| Provide a tax return for indirect taxes and pay the taxes themselves (for August 2022) The declaration form was approved by Order of the Ministry of Finance No. SA-7-3 / [email protected] dated September 27, 2017. Instructions for filling out a declaration from ConsultantPlus. | Taxpayers when importing goods into the territory of the Russian Federation from the territory of the EAEU. | Inspectorate of the Federal Tax Service | |

| 26.09.2022 | Pay VAT (1/3 part) for the 2nd quarter of 2022. Instructions for calculating and paying VAT from ConsultantPlus. | Taxpayers and tax agents, including foreign organizations. | Federal Tax Service |

| Submit a declaration in connection with the termination of business activities using the simplified tax system and pay tax for August 2022. The declaration form was approved by Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 02/26/2016. Instructions for filling out a declaration under the simplified tax system from ConsultantPlus. | Payers of the simplified tax system. | Federal Tax Service | |

| Submit a declaration in connection with the termination of business activities at the Unified Agricultural Tax and pay tax for August 2022. The declaration form was approved by Order of the Federal Tax Service No. MMV-7-3 / [email protected] dated July 28, 2014. Instructions for filling out a declaration from ConsultantPlus. | Payers of Unified Agricultural Tax. | Federal Tax Service | |

| Pay professional income tax (PIT) for August 2022. | NAP payers. | Federal Tax Service | |

| Pay the mineral extraction tax for August 2022. | Subsoil users | Federal Tax Service | |

Submit declarations and pay excise taxes for August, June, March 2022 on:

The forms are approved by Orders of the Federal Tax Service dated October 13, 2020 No. ED-7-3/ [email protected] , dated August 27, 2020 No. ED-7-3/ [email protected] , dated February 15, 2018 No. ММВ-7-3/ [email protected] ] | Excise tax payers. | Federal Tax Service | |

| Provide a bank guarantee for exemption from excise duty. | Excise tax payers. | Federal Tax Service | |

| 28.09.2022 | Submit a declaration (calculation) and pay income tax. Depending on the situation, you should report and pay for:

Instructions for calculating and paying income tax from ConsultantPlus. | Taxpayers. | Federal Tax Service |

| 30.09.2022 | Provide a mineral extraction tax declaration for August 2022. | Subsoil users | Federal Tax Service |

| Pay personal income tax for September 2022. Instructions for calculating and paying personal income tax from ConsultantPlus. | Tax agents. |

We emphasize that all third quarter dates presented are the last dates when completed forms must be submitted or mandatory amounts must be paid. But we do not recommend leaving everything until the last day, otherwise there is a high risk of a fine for failure to submit the required forms.

IMPORTANT!

If the company or individual entrepreneur has just opened, then the reporting period for the 3rd quarter of 2022 will begin in the next quarter.

Use free instructions from ConsultantPlus experts to pay taxes and contributions on time, as well as submit reports for the 3rd quarter. 2022.

What are the months in each quarter?

The year has a similar division into seasons. There are also four of them, each lasting three months. However, there are differences between quarters and seasons. Seasons represent the seasons of the year. There are four seasons in total: winter, spring, summer and autumn.

However, the winter season does not begin with the beginning of the year. The first month of winter is the last month of the year – December. The quarter is characterized by division from the beginning of the year. That is, the first quarter begins on January 1. Further, both in seasons and in quarters, the months are counted in order.

This way we can find out which months are in the first quarter. These are January, February and March. The total is 31 + 28 (29) + 31 = 90 (91) days in the first quarter of the year. The number of days can only change in the first quarter, because February does not have 28 days in a leap year, but once every 4 years it consists of 29 days.

Q2 – what months are these? The second quarter of the year includes the next three months - April, May and June. Total number of days: 30 + 31 + 30 = 91. This number of days is constant from year to year.

Q3 – what months are these? July, August, September - these are the three months that make up the third quarter of the year. Total number of days: 31 + 31 + 30 = 92.

And finally, the last quarter of the year consists of the following months: October, November and December. Total days: 31 + 30 + 31 = 92.

Reporting for the 2nd quarter of 2022 to extra-budgetary funds

Employers (individual entrepreneurs and organizations) are required to report not only to the tax office, but also to extra-budgetary funds.

For personalized accounting, information must be sent to the Pension Fund; these data will be compared with the information submitted to the Federal Tax Service as part of the DAM calculations.

Contributions for “injuries” are reported to the Social Insurance Fund. Additionally, before April 15, the main type of activity must be confirmed annually - the norm is relevant for employers with the status of a legal entity, as well as for individual entrepreneurs who have changed the type of activity in the Unified State Register of Individual Entrepreneurs.

The time frame for reporting to the relevant funds for the 2nd quarter of 2022 is shown in the table:

| Report name | When to take it | Note |

| SZV-M |

| Submitted monthly by policyholders (employers) to the territorial division of the Pension Fund |

| SZV-TD | If we are talking about the hiring or dismissal of employees, the deadline for submitting the report is the next business day after the date of issue of the order. If there are other personnel events, the report is submitted no later than the 15th day of the month following the month of personnel changes:

| Employers submit a report to the Pension Fund when the employee has had any personnel events reflected in the work book - hiring, dismissal, transfer to another position, assignment of qualifications, etc. If there are no personnel events, the report is not submitted. |

| DSV-3 |

| Employers report monthly to the Pension Fund, transferring additional insurance contributions for employees for pension insurance |

| 4-FSS | On paper – July 20, 2021 In electronic format – July 26, 2021 | Report for the first half of 2022. Submitted by the employer to the territorial office of the Social Insurance Fund. The choice of data presentation format depends on the average number of personnel - with a small number (up to 25 people), it is possible to prepare a report on paper. |

Why is this division of the year needed?

Typically, the “quarter” period is used in those institutions where it is necessary to prepare reports, for example in statistics or accounting.

This division allows you to bring documentation into the system, correctly draw up plans and monitor their implementation. The annual report, of course, is very important, but until the whole year has passed, quarterly reporting allows you to track how timely the assigned tasks are being accomplished. This makes it possible to adjust their implementation in time, if necessary, in order to reach the desired indicators at the end of the year. Reports are executed once a quarter. How many months it takes to complete a particular task determines the number of quarters allocated to each goal.

Reports on the results of the year and the first quarter

The main block of reporting submitted in the second quarter by the organization’s accounting department depends on the chosen taxation system and type of activity. Typically, more data is submitted in April, since if you remember what month the 2nd quarter of 2022 begins, then it is from April, and this is the first month of the quarter, so some annual reports and reports on the results of the past three months fall on it.

Among the main forms that will have to be prepared and submitted during the 2nd quarter of 2022:

- VAT and income tax returns;

- personalized reporting to the Pension Fund;

- reports of tax agents on personal income tax;

- calculation of insurance contributions to the Federal Tax Service and form 4-FSS to the Social Insurance Fund.

Additionally, the accountant's calendar for the 2nd quarter of the year indicates the deadlines for paying taxes and fees. In addition to the basic reporting forms that are regulated at the federal level, some companies are required to report on regional and local tax obligations. The required second quarter dates for submitting reports in this case are set at the local or regional level.

Interesting Facts

In the word "quarter" the stress falls on the second syllable. However, many people pronounce this word incorrectly, emphasizing the first syllable. You need to remember how to pronounce it correctly so as not to look illiterate.

Previously, in Soviet times, the quarterly year began in October. This fact caused confusion in the documentation, so this practice was soon abandoned.

Since at the end of each quarter, as a rule, employees of accounting, statistics and other organizations have to make a report, this period of time is also called the reporting period, as well as the tax period.

The word "block" can refer not only to a period of time, but also to a row of houses between two intersections on a street.

Employer reporting

All employers submit to the Federal Tax Service, Pension Fund and Social Insurance Fund special reporting forms containing information on accruals and deductions of employees for the reporting period and other data necessary to confirm the insurance length of insured citizens. There are no significant changes in the reporting prepared in the 2nd quarter by the accounting department, no new forms have been introduced for employers, and the procedure for submitting existing ones has not changed.

The reporting forms are approved by the relevant regulations of regulatory government agencies. Most of the information must be submitted to the Federal Tax Service. Separately, provision is made for the submission of quarterly information on NS and PZ insurance contributions, which are transferred to the Social Insurance Fund, as well as monthly personalized reports for the 2nd quarter (other periods) to the Pension Fund.

Use free instructions from ConsultantPlus experts to submit all required reports on time.

Tax paid depending on the tax regime

In Russia, all commercial organizations pay their tax depending on the tax regime they choose. However, only OSN and UTII are paid by organizations once a quarter. There are four payments and four reporting dates in a year. Also, the income tax of an organization located on the OSN can be paid once a month.

Thus, reporting on UTII is submitted on the twentieth day of the month following the reporting period according to the tax return form approved by order of the Federal Tax Service of the Russian Federation. This form is filled out in accordance with the regulations and submitted to the tax authority to which the organization is attached. Failure to submit or late submission entails an administrative penalty in the form of a fine.

The tax for OSN is paid once a quarter. There are three months in a quarter, therefore, an enterprise can also submit three tax returns per quarter, since the reporting period for this tax is not precisely specified. Organizations determine it independently. This declaration is mandatory for use; Order of the Ministry of Finance No. 55n approved its form.

Other special regimes submit tax reports only once a year, although they pay advance payments every 3 months.

Norms for working hours according to labor legislation

- general norm - the law establishes a 40-hour work week

— for medical employees (doctors) — a 39-hour work week is provided

- for those who work in hazardous conditions - the working week does not exceed 36 hours

- for minors from 16 to 18 years old - our legislation proposes a 36-hour work week

— for teachers (teachers) — a 36-hour work week is provided

- for students and workers during school holidays, aged 14 to 15 years - a 24-hour work week is established by law

- for minors from 14 to 15 years old - our legislation proposes a 24-hour work week

- for students and workers throughout the year and in their free time, aged 14 to 16 years - a 12-hour work week is established by the standards

- for students and workers throughout the year and in their free time, aged 16 to 18 years - an 18-hour work week is established by the standards

According to the production calendar for the 2nd quarter of 2022, there will be non-working days, weekends and holidays in our country - see below: