The need for due diligence

Exercising due diligence when choosing a counterparty is a category that is primarily of interest to tax authorities, who identify situations that entail the taxpayer receiving an unjustified tax benefit.

These points have acquired particular significance in connection with monitoring the reality of transactions taken into account when calculating 2 main taxes: profit and VAT. Of lesser (but also growing) interest in due diligence are:

- banks that are not only obliged to control certain transactions of their clients (Law “On Combating the Legalization (Laundering) of Income..." dated August 7, 2001 No. 115-FZ), but also interested in at least a stable financial position of persons who received a loan from the bank;

- business owners who want to run it with minimal losses (risks of buying and selling low-quality goods, late deliveries, non-receipt of payments, impossibility of recovering damages).

Why is due diligence one of the key issues directly for the taxpayer himself? Because entrepreneurial activity is carried out at your own peril and risk. That is, the negative consequences arising from the wrong choice of counterparty also become a taxpayer’s risk. And if the tax authority proves that the transactions were not real (that is, the transaction was fictitious), then additional tax charges will be inevitable.

Allocation of the burden of proof of due diligence

Whether the taxpayer or the auditor has the burden of proving due diligence also depends on the circumstances of the case.

If the tax authority establishes that the economic source of VAT deduction (refund) has not been created, and the supplier (executor) during the period of interaction with the taxpayer-buyer did not have the economic resources (material, financial, labor, etc.) necessary to fulfill the contract with buyer of the contract, in connection with which the transaction was actually executed by other persons to whom the supplier could not transfer the obligation to perform it due to its nominal nature, these circumstances may indicate that the taxpayer did not exercise due diligence when choosing a counterparty , unless otherwise proven by the taxpayer.

On the contrary, entering into a relationship with a counterparty that has economic resources sufficient to execute the transaction independently or with the involvement of third parties, the presentation by such entity of accounting and tax reporting that reflects the presence of such resources, gives a reasonably acting taxpayer-buyer reason to expect that the transaction will be the counterparty will be executed properly, and taxes upon its execution will be paid to the budget. In such a situation, it is assumed that the choice of the counterparty met the conditions of business transactions until otherwise is proven by the tax authority.

When considering the case, the taxpayer argued that his counterparty was a real economic entity that owned a warehouse in Murmansk and incurred the costs of paying for transport services of various forwarding organizations and renting premises. The general director of the counterparty, when questioned as a witness, also confirmed that the activities of the organization he headed were carried out. The transaction with the taxpayer was executed by the supplier chosen by the company with the involvement of third parties (forwarders) on the basis of agreements concluded between them and the counterparty of the company.

The tax authority did not refute these arguments of the taxpayer, and the judges recognized them as justified, but did not take them into account when assessing whether it is permissible to impose on the taxpayer-buyer the negative consequences of possible violations committed by its counterparty.

Prudence: legal basis

The concept of due diligence is not legally defined anywhere.

Read more about the current regulation of the concept of “tax benefit” in this article.

However, there are criteria developed by the Federal Tax Service of Russia (order dated May 30, 2007 No. MM-3-06/333), according to which the most likely candidates for an on-site tax audit are selected from among taxpayers. Among these criteria there is also such as conducting activities with a high level of tax risk, the description of which (clause 12 of Appendix 2 to the Federal Tax Service order No. MM-3-06/333) contains a list of characteristics that form the basis for assessing counterparties in terms of possible risks working with them.

For a complete list of criteria for selecting taxpayers for audit, see here.

Additional information about the signs of dubious counterparties can be found in the letters:

- Ministry of Finance of Russia dated December 17, 2014 No. 03-02-07/1/65228 - regarding the characteristics of one-day companies;

- Federal Tax Service of Russia dated February 11, 2010 No. 3-7-07/84 - about information that a taxpayer can request from its counterparties, and measures taken by the tax service to inform about persons unreliable for interacting with them;

- Federal Tax Service of Russia dated October 17, 2012 No. AS-4-2/17710 and dated March 16, 2015 No. ED-4-2/4124 - on available official sources of data on legal entities and individual entrepreneurs, as well as on the qualitative assessment of information reflected in the Unified State Register of Legal Entities;

- Federal Tax Service of Russia dated May 12, 2017 No. AS-4-2/8872 - on the study of certain characteristics of a counterparty when assessing tax risks.

However, formal adherence to the provisions of these documents does not always guarantee the taxpayer the absence of claims from the tax authorities. They are increasingly successfully proving the unreality of dubious business transactions reflected in the accounting, including using arguments that complement the criteria developed by the Federal Tax Service of Russia. And increasingly, the point of view of the Federal Tax Service is supported by judges.

Judicial practice: signs of lack of diligence

The approach to assessing the due diligence of a taxpayer has been formulated by the Supreme Court. You can learn more about it from the Review from ConsultantPlus. Trial access to the system can be obtained for free.

As for district courts, the following arguments are based on the court’s recognition of the counterparty as not meeting the criteria of a person actually conducting business:

- Lack of the resources necessary for this (assets, personnel), payment of taxes in the minimum possible amount or in incomplete amount (resolutions of the Arbitration Courts of the Moscow District dated 05.30.2017 No. F05-7043/2017 in case No. A40-181608/2016, dated 30.05 .2017 No. F05-6970/2017 in case No. A40-208019/2016, dated 05.15.2017 No. F05-5962/2017 in case No. A40-74889/2016, Far Eastern District dated 08.14.2017 No. F03-2718/2017 in case No. A51-27634/2016).

To learn how the volume of the tax burden is determined and what its values are considered underestimated, read the article “Calculation of the tax burden in 2022 - 2021 (formula)” .

- The presence of a mass registration address, the absence of expenses characteristic of ongoing business activities, the disproportion of cash flows on accounts and the amount of taxes paid (resolution of the Arbitration Court of the Moscow District dated May 29, 2017 No. F05-6622/2017 in case No. A40-119724/2016).

- The presence of a predominantly transit nature of the movement of funds across accounts, nominal property status with a significant variety of activities declared for implementation, lack of consistency in receipts and expenditures of money (resolutions of the Arbitration Courts of the Moscow District dated May 25, 2017 No. F05-6702/2017 in case No. A40- 166522/2016, Volga-Vyatka District dated July 17, 2017 No. F01-2731/2017 in case No. A43-21051/2016).

- Lack of personnel, necessary assets (office, warehouses, equipment, transport, including leased ones) and documents confirming the provision of delivery services, presence of signs of one-day existence of counterparties, presence of a transit nature of cash flows, filing of tax reports indicating the minimum data in it, distortion of information when issuing permits to carry out activities (resolutions of the Arbitration Courts of the Moscow District dated 05.19.2017 No. F05-6215/2017 in case No. A41-66000/2016, Far Eastern District dated 08.09.2017 No. F03-2797/2017 on case No. A73-9509/2016, Northwestern District dated August 10, 2017 No. F07-5611/2017 in case No. A66-5287/2016).

- The presence of one-day companies among the counterparties, non-payment of taxes, lack of the necessary labor and property resources necessary to conduct business expenses, the presence of transactions with significant sums of money that are not confirmed by the counterparties (resolutions of the arbitration courts of the Moscow District dated 04.05.2017 No. F05-5426/2017 in the case No. A40-143250/2016, Central District dated 08/03/2017 No. F10-2817/2017 in case No. A09-9845/2016).

The arguments taken into account by the courts indicate that the justification for exercising due diligence should not be limited to asking the counterparty for constituent documents, a copy of the latest statements and an extract from the Unified State Register of Legal Entities. It is also necessary to collect other information about him. For example, check what his business reputation and solvency are, assess the presence of a risk of non-fulfillment of obligations, make sure that he has real resources to actually carry out the activities agreed upon in the relationship and has the right to conduct them.

Conclusions of the Judicial Collegium of the Armed Forces of the Russian Federation

The above arguments were heard: the Supreme Court of the Russian Federation, in its Ruling dated March 26, 2020 No. 307-ES19-27597, considered them sufficient grounds for transferring the cassation appeal for consideration by the Judicial Collegium for Economic Disputes.

Let us present the main conclusions of the Judicial Panel, voiced in the Determination dated May 14, 2020 No. 307-ES19-27597.

The taxpayer is not responsible for the actions of the counterparty...

On the one hand, the Constitutional Court indicated back in 2004 that denial of the right to a tax deduction may occur if the process of selling goods (work, services) is not accompanied by compliance with the obligation corresponding to this right to pay VAT to the budget in cash (Definition from 04.11.2004 No. 324-O).

However, the same court has repeatedly emphasized: the taxpayer should not be responsible for the actions of all participants in the process of transferring taxes to the budget. The taxpayer’s right to a tax deduction cannot be conditioned by the fulfillment by direct counterparties (sellers, suppliers) and their predecessors of their obligation to pay VAT, as well as the financial and economic situation and behavior of third parties (Resolution dated December 19, 2019 No. 41-P, definitions dated 16.10.2003 No. 329-O, dated 10.11.2016 No. 2561-O, dated 26.11.2018 No. 3054-O, etc.).

Consequently, if the taxpayer did not pursue the goal of evading taxes by coordinating his actions with others, and also did not know and should not have known about the violations of the counterparty, he cannot be deprived of the right to deduction. Otherwise, this becomes the responsibility of the taxpayer for non-payment of taxes, committed not by him, but by other persons, including when those persons distort the facts of their economic activities.

How to exercise due diligence when choosing a counterparty in 2020-2021

A taxpayer entering into a relationship with another counterparty should check it:

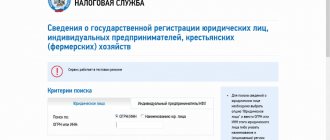

- for legitimacy (presence in the Unified State Register of Legal Entities (USRIP), absence of a mass registration address and a disqualified manager, availability of permits necessary to conduct the relevant activities);

- the reality of the activity being carried out (actual location at the place of registration, the presence of a manager with the necessary powers, physically existing offices and warehouses at the specified addresses, necessary equipment and transport, personnel, a valid current account, the presence of information in the media and the Internet);

- reliability (absence of non-filers, tax evaders, bankrupts, persons involved in legal proceedings in connection with their non-payments or work with one-day companies, availability of recommendations from business partners, duration of activity and maintaining relationships with the same partners ).

When checking, use the services from the Federal Tax Service.

However, you should not be limited to the above, since any additional information (including, for example, correspondence preceding the conclusion of the contract or conducted during its execution, or minutes of a meeting of managers) will serve as confirmation of the reality of the existence of the counterparty and the actual conduct of those activities, the results which the taxpayer will take into account.

It is preferable to have all data received about the counterparty in the form of documents (originals, copies, printouts from websites, screenshots of Internet pages, photographs, emails, advertising materials, audio and video recordings) and store them formed into a file (dossier).

You will find more practical advice on due diligence and verification of counterparties in the Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Other free ways to check counterparties

On the Internet, you can obtain information about the activities of a business partner through search engines (mentions about the company in the media), in online map services (check the availability and photos of the company’s office) and directly on the counterparty’s website (large clients, completed projects, reviews).

Services provide additional information:

- Checking against the list of invalid Russian passports. Information service of the Ministry of Internal Affairs, which will help you check the passport of the head of the counterparty company.

- Decisions of registration authorities on the upcoming exclusion of inactive legal entities from the Unified State Register of Legal Entities.

- File of arbitration cases. Contains information on 26 million cases.

- Data bank of enforcement proceedings.

- Registers of unscrupulous suppliers: Unified information system in the field of procurement.

- Availability of government contracts. Like a positive sign.

- Unified register of inspections. Data on inspections of legal entities and individual entrepreneurs on the portal of the Prosecutor General's Office.

Justification for choosing a counterparty to the Federal Tax Service: sample

The presence of such a dossier will help you easily justify the choice of a specific counterparty to the Federal Tax Service. The documents present in it will not only make it possible to correctly formulate all the grounds necessary for the argument, but will also serve as an appendix (in copies) to the text of such an explanation.

The justification for choosing a counterparty does not have a specific form. It will need to be drawn up in the form of a regular letter addressed to the Federal Tax Service, on the form used by the taxpayer for such documents. The main text part of it will be devoted to the argument itself. For example, it might look like this:

“Variant LLC showed due diligence when choosing Soyuz LLC as a counterparty, taking actions to obtain:

- copies of the counterparty's constituent documents, its accounting records for the year preceding the year of conclusion of the agreement, tax returns for profit, VAT, property tax for the last 4 reporting periods;

- originals of certificates issued by Soyuz LLC from the Federal Tax Service on the absence of tax arrears and from the bank on the flow of funds on accounts for the last six months;

- copies of documents confirming the authority of the manager and chief accountant;

- extracts from the Unified State Register of Legal Entities, information from the Federal Tax Service website about the absence of disqualified persons in the management of the counterparty and the non-classification of the registration address as a mass one;

- screenshots of Soyuz LLC website pages with a description of the types of work it performs, the technologies used and the personnel involved in them;

- reviews from representatives of Mir LLC and Grad LLC about the quality of work performed for their Soyuz LLC and the fulfillment of warranty obligations;

- protocols of negotiations between the heads of Variant LLC and Soyuz LLC that preceded the conclusion of the agreement;

- photographs of the counterparty’s office, production and warehouse premises taken at the place of its registration.”

Enclosures to such a letter will be copies of the documents listed in it.

About the obligations of the counterparty

The Supreme Court of the Russian Federation noted: the reliability of tax reporting submitted by the company's counterparty cannot be refuted only by the insignificance of the final amount of VAT calculated for payment to the budget and the large share of tax deductions declared by the supplier.

The courts had to find out why the tax liability was small. In addition, it was necessary to understand whether there were signs of withdrawal of funds by the supplier using fictitious documents in favor of third parties, including signs of cashing out, transfer of funds to low-tax foreign jurisdictions, and other similar circumstances discrediting the reliability of the supplier’s tax reporting and the completeness of its tax payment during the period of sale of goods to the public.

The judges accepted the inspector's evidence that the counterparty did not submit a sales book to the tax authority at its place of registration, but did not consider extracts from it submitted by the taxpayer. On appeal, these statements did not confirm that the counterparty declared income from the transactions. The Supreme Court considered this approach unlawful.

Answer for the bank about the reasons for choosing a counterparty

The response to a bank requesting information within the framework of the requirements of Law No. 115-FZ will also be similar in content. In addition to justifying the choice of a specific counterparty, it may also be necessary to justify the conditions for concluding a specific transaction.

Since banks face quite serious liability for failure to take measures to combat money laundering, they can rely on any (not just those listed as mandatory) signs that make a transaction suspicious (Methodological recommendations attached to the letter of the Bank of Russia dated July 13, 2005 No. 99-T). For this reason, a request from the bank may be received in relation to any transaction with any of the counterparties and require the most complete documentary justification.

You should not ignore a credit institution’s request for documents. This may become a reason for the bank not to carry out the transaction that has raised doubts (Clause 11, Article 7 of Law No. 115-FZ).

Results

Exercising due diligence is becoming increasingly important for the taxpayer when choosing a counterparty.

He will need to explain his actions, supporting them with documentary justification, not only to the Federal Tax Service, which detects the receipt of an unjustified tax benefit, but also to the bank, which controls the process of legalizing illegally obtained income. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Invoices: the compliance violation has been corrected

Doubts regarding the signing of the original invoices by authorized persons had no legal significance for the resolution of the present dispute.

In addition, as the company indicated, the supplier eliminated the formal violation of the requirements of Art. 169 of the Tax Code of the Russian Federation, transferring to the taxpayer invoices signed by the general director. However, the judge did not take these arguments into account. What's the result?

As a result, the Judicial Collegium of the Armed Forces of the Russian Federation canceled the acts of the arbitration courts of the first, appellate and cassation instances regarding the disputed episode of additional VAT assessment, and the case in this part (in order to assess the arguments of the tax authorities and the taxpayer’s objections regarding the presence (absence) of an economic source of deduction (reimbursement) VAT on the relationship with the counterparty, the reality of the execution of the supply contract by this supplier and (if necessary) the taxpayer’s exercise of due diligence when choosing a counterparty) was sent for a new consideration to the court of first instance.