INN/KPP

The rules for filling out invoices, approved by Government Resolution No. 1137 of December 26, 2011, do not determine which checkpoint should be indicated in the invoice issued to a separate unit: the parent organization or a separate unit.

In this case, in line 6b “TIN/KPP” the Ministry of Finance of the Russian Federation recommends indicating the KPP of a separate unit (see letters of the Ministry of Finance of Russia dated 05/04/2016 No. 03-07-09/25719, dated 02/26/2016 No. 03-07-09/11029, dated 09/05/2014 No. 03-07-09/44671).

From 07/01/2021 a new invoice form is in effect, incl. adjustment, as amended by the Decree of the Government of the Russian Federation dated 04/02/2021 No. 534. The update of the form was caused by the introduction of a goods traceability system. All taxpayers are required to use the new form, even if the goods are not included in the traceability system. We provide more information about changes to the invoice here.

You can download the new invoice form by clicking on the image below:

ConsultantPlus experts have prepared step-by-step instructions for preparing each line of the updated invoice. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The procedure for numbering invoices by separate divisions has been clarified

According to paragraphs. 1 clause 5 and pp. 1 clause 5.1 art. 169 of the Tax Code of the Russian Federation, invoices must indicate the serial number and date of the invoice.

In a letter dated March 27, 2012 No. 03-07-09/30, the Ministry of Finance of Russia explained that if an organization sells goods (work, services), property rights through separate divisions, including branches, then when these divisions draw up invoices, the serial number invoices are supplemented through a dividing line with a digital index of a separate division. This digital index must be established by the organization in the order on accounting policies for tax purposes. This procedure is provided for in paragraphs. "a" clause 1 section. II Rules for filling out an invoice used in calculations for value added tax, which were approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

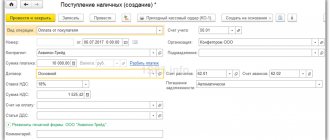

For accounting of organizations that have separate divisions, the software product “1C: Accounting 8 KORP” is intended, which provides end-to-end accounting in the context of organizational divisions, both allocated and not allocated to a separate balance sheet. This is precisely the accounting procedure implemented in it.

The news was prepared by ITS specialists

| Other site materials on the topic: “Separate divisions” | ||

| Articles | ||

| 04.08.2010 | Commentary on the Federal Law of July 27, 2010 No. 229-FZ (the document introduced changes to a significant number of articles of Parts I and II of the Tax Code of the Russian Federation) | |

| Software product "1C: Accounting 8 KORP" for accounting in organizations with separate divisions | ||

| News | ||

| 17.02.2012 | The Russian Ministry of Finance explained how to fill out individual lines and columns in the new invoice | letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-07-09/06 |

| 26.12.2011 | Information on the income of employees of a separate division is presented at the location of this division | letter of the Ministry of Finance of Russia dated December 16, 2011 No. 03-04-06/3-348 |

| 05.12.2011 | If a separate division and the head office are located in the same subject of the Russian Federation, the income tax return is submitted to the inspectorate at the place of registration of the latter | letter of the Ministry of Finance of Russia dated November 25, 2011 No. 03-03-06/1/781 |

| 03.10.2011 | The Russian Ministry of Finance explained how to pay personal income tax if an employee works part of the time in the parent organization and part in a separate division | letter of the Ministry of Finance of Russia dated September 21, 2011 No. 03-04-06/3-231 |

| 12.09.2011 | It is necessary to inform the inspectorate about the creation of each separate unit, regardless of its location | letter of the Ministry of Finance of Russia dated 02.09.2011 No. 03-02-07/1-314 |

| 18.08.2011 | A copy of the tax payment request may be sent to the inspectorate at the place of registration of the separate division | letter of the Federal Tax Service of Russia dated 07/05/2011 No. YAK-4-8/ [email protected] |

| Answers on questions | ||

| 16.06.2011 | Mismatch of legal and actual addresses: what problems may arise for a taxpayer? | |

| 14.12.2010 | Opening of a new cafe (UTII) | |

| 03.08.2010 | Business trip for a part-time worker living in another city | |

| 25.05.2010 | Issuance of salaries to employees of a separate department | |

| Other site materials on Separate divisions | ||

| See all information about VAT invoices on the ITS website | ||

Buyer's name

The buyer of goods (work, services) purchased by an organization for its branches and other separate divisions (or through them) is a legal entity represented by the parent organization. Therefore, the invoice is issued to the parent organization, and in line 6 “Buyer” its details are indicated (see letters of the Ministry of Finance of Russia dated May 4, 2016 No. 03-07-09/25719, dated May 15, 2012 No. 03-07-09/55 , Federal Tax Service of Russia for Moscow dated October 23, 2009 No. 16-15/1099)9, FAS North Caucasus District dated April 1, 2009 in case No. A63-675/2008-C4-17).

The nuances of issuing an invoice through a separate division are discussed in detail in ConsultantPlus. Get expert opinion by getting free trial access to the K+ legal reference system.

Buyer's location

In line 6a of the invoice you need to write: “The address indicated in the Unified State Register of Legal Entities, within the location of the legal entity” (subparagraph “k” of paragraph 1 of the Rules for filling out invoices as amended by the resolution of the Government of the Russian Federation dated 19.08. 2017 No. 981).

Until 10/01/2017, officials recommended that when preparing invoices, indicate in line 6a “Address” the address of the buyer - a legal entity represented by the parent organization (see letters of the Ministry of Finance of Russia dated 02/26/2016 No. 03-07-09/11029, Ministry of Finance of Russia dated 26.02 .2016 No. 03-07-09/11029).

There are currently no official clarifications on the procedure for indicating the address when issuing an invoice to a separate division using the new form. But analyzing in totality clause 3 of Art. 55 of the Civil Code of the Russian Federation and the Rules for filling out invoices, it can be assumed that in the situation under consideration, in line 6a “Address” of the invoice, the address should be given:

- a separate division that is not a representative office or branch must indicate the address of the parent organization entered in the Unified State Register of Legal Entities;

- branch or representative office specified in the Unified State Register of Legal Entities.

Read about the consequences of an error in specifying address data in the material “ Address on the invoice: what is not an error.”

Separate division - shipper

When issuing an invoice on behalf of the parent company, a separate division must adhere to a certain procedure.

On line 2 of the invoice you must indicate the name of the parent company in accordance with the constituent documents (full or abbreviated).

In line 2a - the address of the legal entity, which is indicated in the Unified State Register of Legal Entities.

In line 2b write the TIN of the organization and the checkpoint of the separate unit.

Line 3 of the invoice “Consignor and his address” is intended to indicate the name of the consignor in accordance with the constituent documents (full or abbreviated).

So, if the shipper is a separate division, in line 3 of the invoice you need to write exactly its address - that is, the address of the real shipper.

Name and address of the consignee

If the consignee of the goods is a separate division of the organization (for example, a branch), line 4 “Consignee and his address” of the invoice indicates the details of this division (see letters of the Ministry of Finance of the Russian Federation dated May 4, 2016 No. 03-07-09/25719, dated April 13 .2012 No. 03-07-09/35). A similar point of view was expressed by officials earlier, regarding invoices issued according to the rules of Decree of the Government of the Russian Federation dated December 2, 2000 No. 914 (letters of the Federal Tax Service of Russia for Moscow dated March 24, 2009 No. 16-15/028080, dated March 20, 2008 No. 19-11/026593, Ministry of Finance of Russia dated 02.11.2011 No. 03-07-09/36).

For a sample of filling out an invoice addressed to a branch, see below

The procedure for filling out an invoice for services is different. You can familiarize yourself with a sample of filling out an invoice for the purchase of services by a branch of an organization from an individual entrepreneur in the material prepared by ConsultantPlus experts. Get trial access to the system and study the information for free.

Operating principles of a separate division ↑

A separate division is understood as any branch of a legal entity that meets the requirements specified in paragraph 2 of Article No. 11 of the Tax Code of the Russian Federation.

The list of requirements themselves is as follows:

| Isolation | Territorial nature |

| Presence of appropriately equipped workplaces | Which will be valid for more than one month and located outside the place of state registration |

| Activities are underway | Some kind |

| The employer himself carries out constant supervision | Behind the workplace itself |

To recognize a unit as separate, it must comply with all the points indicated above.

The process of registering organizations that have any separate divisions is announced in paragraph 1 of Article No. 83 of the Tax Code of the Russian Federation.

In this case, the checkpoint of a separate division in the invoice is an individual code assigned to a specific branch. Do not confuse the registration code of the main organization and its branch.

Legal grounds

The basis for generating an invoice is the following regulatory framework (Letters of the Ministry of Finance of the Russian Federation):

| No. 03-07-09/18318 dated 04/02/15 | When you make a mistake |

| No. 03-07-11/16655 dated 03/26/15 | Deadlines for issuing invoices |

| №03-07-14/18223 | About keeping a log book |

In addition to the letters indicated above, it is necessary not to forget about the relevant articles of the Tax Code of the Russian Federation:

| Article No. 169 of the Tax Code of the Russian Federation | The most important points regarding the invoice are highlighted |

| Article No. 84 of the Tax Code of the Russian Federation | Regulates the procedure for registration at the place of territorial location and assignment of checkpoints |

Some letters and articles of the Tax Code do not specifically say anything directly about the issuance of an invoice by a separate division, but it is imperative to know their content.

For a sample of filling out an invoice without VAT, see the article: sample of filling out an invoice. Read how to create an invoice electronically here.

Since they indirectly affect the order of filling out this document, as well as the data entered into it. In particular, this applies to checkpoints.

It is worth paying attention to the study of federal legislation and its following sections:

- Law No. 185-FZ of December 23, 2003;

- Law No. 229-FZ of July 27, 2010;

- Law No. 347-FZ of 04.11.14;

- Law No. 248-FZ of July 23, 2013

All the federal laws mentioned above cover various nuances that relate to the procedure for filling out a document of the type in question.

Moreover, they concern the most complex and intractable situations (designation of checkpoints after liquidation and other similar things).