Definition of the concept

This is a separate personal account opened by the tax authority for each type of tax for all subjects, without exception, in order to control the receipt of funds.

Important: thanks to the presence of such an account, the tax office can control the receipt of funds from the taxpayer and their crediting.

The rules for maintaining and servicing such accounts are determined by the Recommendation on the procedure for maintaining accounts for various fees, duties, taxes and other payments.

The personal account stores information about the subject, which third parties do not have the right to request from the tax office in order to verify information about citizens; this register is internal and is used only by the Federal Tax Service.

The entire issue of using the account is regulated by Order of the Federal Tax Service of the Russian Federation No. YAK-7-1 / 9 @ of 2012.

Information reflected on the SLS

In the regulatory documents of the Federal Tax Service, this account is indicated as KRSB - a payment card with the budget, intended for:

- Individual entrepreneurs, companies and citizens who are charged with transferring payments;

- reflecting information on administrative fines.

At the same time, in relation to fines, data is entered by the department that accrued them, while there is absolutely no role regarding the place of registration of the subject.

The card contains information regarding:

- obligations of the person;

- amounts transferred by the person;

- indication of arrears based on the results of a tax audit;

- amount of accrued penalties.

How does the RSB card start up?

According to the law, a card for a taxpayer must be created after he is registered in the appropriate status, as well as from the moment:

- the occurrence of his obligations to pay tax payments on the basis of documents submitted to the tax department;

- receiving fiscal postings from citizens with different statuses.

Important: the card must be opened separately for each tax payment with the obligatory designation KBK.

For example, if one subject has two statuses - taxpayer and tax agent, then two cards are created at once.

What kind of data does the card carry?

The payment card has a unified form and consists of 2 parts intended for specific purposes and has an appropriate structure:

- Featured part:

- INN and KPP of the taxpayer. How to restore the TIN if lost - read the publication at the link;

- type of payment and its BCC;

- OKTMO. OKATO and OKTMO are the same thing or not, you will find out;

- activity code of the enterprise or entrepreneur;

- subject status.

In addition, this part may include information regarding:

- information about the person;

- budget commitment;

- necessary for the correct display of information.

- Balance of payments:

In this part there are 3 tables in each of which you need to enter the following data:

- date and due date of payment;

- the amount of funds received from the taxpayer;

- additional accrual or reduction of funds;

- balance paid by the taxpayer, what indicator it has - positive or negative;

- the amount of the penalty, if any;

- calculations of interest on account of penalties. You will find out what the fine is for failure to submit a declaration on time.

Important: these tables are the basis for further actions of the inspector, since from them you can see arrears in payments or their complete absence.

Extracting transactions for settlements with the budget.

How is the concept deciphered?

KRSB stands for budget settlement card and is a clearly grouped information resource that reflects information on accrued and paid tax payments. A taxpayer card is formed from tax reports submitted by a person to the Federal Tax Service. In controversial situations possible between the parties, this document allows you to identify discrepancies and control the payment of taxes.

In accordance with the uniform requirements of the Order of the Federal Tax Service of the Russian Federation dated January 18, 2012 No. YAK-7-1 / [email protected] , budget settlement cards are maintained for each taxpayer and for each individual type of tax. Each type of payment has its own code (KBK), and the code of the municipality where the tax revenues are received (OKTMO) is also taken into account. Different cards are provided for the taxpayer and the tax agent, so if the same person performs two tax functions at once, then two KRSB are issued for him, respectively.

Why do you need a budget card?

Often, entrepreneurs and the Federal Tax Service have inconsistencies when checking the status of tax payments. In such situations, the source of the necessary information is the KRSB database or the so-called personal account of the taxpayer.

Measures to account for funds received by the budget allow you to avoid overpayments or accumulation of debts on the part of the subject of taxation: a legal entity or an individual.

Tax authorities resort to the use of this payment accounting tool, since Article 32 of the Tax Code of the Russian Federation imposes on the Federal Tax Service the duties of reconciling the amounts of paid taxes, penalties, fines, generating certificates and statements about the status of the taxpayer’s personal account, and so on. During desk audits, the tax service will refer to the CRSB, however, starting in 2010, this document has lost its legal force and since then has been of reference nature only. Consequently, the card is an additional tool for an organization or entrepreneur, allowing the taxpayer to control the status of his personal account.

Who maintains the document

The CRSB database is maintained directly by the Federal Tax Service on the basis of information submitted by the taxpayer. To do this, tax returns are submitted to the tax office in forms 2-NDFL (at the end of the reporting year) and 6-NDFL (quarterly). The use of RSB cards is a procedure within the jurisdiction of the tax authorities, carried out both at the initiative of the taxpayer and the Federal Tax Service.

Closing the card is also carried out through the Federal Tax Service, in particular for registering the taxpayer in a new place. Then the person is deregistered with one tax authority and transferred to another territorial department of the Federal Tax Service in the prescribed manner. As for fines for late tax payments and administrative offenses, the KRSB with these data is not transferred to a new place of registration, but is opened at the location of the authorities that made the decision on sanctions against the taxpayer. That is, information that does not reflect the activities of the organization/individual entrepreneur cannot be transferred to another Federal Tax Service.

Obtaining information regarding an account

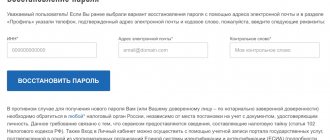

To find out your own account, you can use 2 options:

- Contact the tax authority in person with your passport and receive the necessary information exclusively about your account.

- Use the State Services portal if you have an account there. In this case, the number will not be displayed anywhere; to receive it, you should open the “ and “Receive” tab, after which after a while you will receive a file containing information on the operations and the corresponding numbers.

Receiving an extract

To check your payments and data recorded in the tax office, the user can order an extract from the Federal Tax Service in a convenient option:

- On the website nalog.ru you can order an extract for both an enterprise and an entrepreneur. To do this, go to your personal account and get the following information:

- certificate of account status;

- extract;

- receive a reconciliation report;

- a certificate about the quality of fulfillment of obligations by the taxpayer;

- reports provided in the reporting period.

- Use the ION-offline service through the Kontur Extra system.

If you use Balance-2 software in the process of obtaining data, then you can import the information into the required electronic document management system.

A taxpayer’s personal account is a card in which the Federal Tax Service contains basic information regarding the subject’s payments to the budget. At the same time, it can be used to check or obtain an extract for personal purposes.

You can see what a taxpayer identification number is and where it is used in this video:

The taxpayer's KRSB is a personal account card that reflects the tax agent's budget. It is conducted by Federal Tax Service employees based on the reporting documentation of a legal entity or individual. In practice, the form is drawn up in accordance with the recommendations of Federal Tax Service Order No. MM-3-10/ [email protected]

The conditions for opening a card are the deadline for paying fees or taxes, submitting a declaration or other reporting, obtaining a license or registration document. The form is also created in case of unclear payments discovered during the audit. A payment card is not a basis for the reliability of personal income tax information, since it relates to internal forms of control by the tax service.

What is CRSB in tax practice will help clarify its content. The document includes:

- data on the amounts of duties, fines and penalties. This information is entered by Federal Tax Service employees based on the declarations provided by the legal entity or individual entrepreneur, as well as on the basis of an audit or a court decision;

- information about the fact of transfer of tax, penalty or fine;

- balance – the difference between accruals and transfers. A negative value reflects the debt of the tax agent, and a positive value indicates the presence of an overpayment.

A prerequisite for a payment card is that the amounts entered into it correspond to the current budget of the enterprise or individual.

Specifics of filling out the payment card

Information received from payers and agents is entered into a special accounting card. What CRSB is in tax practice has already been established. This is an internal departmental form that is needed to collect data from individuals and legal entities. Entering information into the document involves a number of nuances:

- Data on personal income tax of organizations and individual entrepreneurs with the status of a tax agent are entered only on the basis of an audit in accordance with clause 1 of section. 10 Order of the Federal Tax Service No. YAK-7-1/ [email protected]

- Amounts of personal income tax that were accrued but not paid are not indicated in the CRSB. If there is no duty withholding, the tax authorities, on the basis of the Supreme Arbitration Court Resolution No. 57, charge a penalty.

- The information on the RSB card is not the basis for accruing arrears. Their fact must be confirmed by other sources.

Information from the CRSB under Art. 32 Tax Codes can be transferred to taxpayers or agents in the form of a certificate. In paragraph 10 of Art. 32 noted the need to submit a request within 5 working days. Information that taxes, interest, penalties or fines need to be paid is transmitted by Federal Tax Service employees 10 days after receiving the notice.

What is a budget card?

Important! Budget settlement card (CRSB) is a concept directly related to the payment of taxes. The card is a database of individuals or legal entities registered with the tax authority.

The card is an information resource containing information on accrued and paid taxes. Its formation occurs on the basis of tax reports submitted to the tax authority by taxpayers. If disputes arise between the taxpayer and the tax authority, this document helps to identify discrepancies and also monitor the payment of taxes.

According to the requirements of Order of the Federal Tax Service of the Russian Federation No. YAK-7-1/ [email protected] dated January 18, 2012, a card is created for each taxpayer and for all types of tax. Each tax payment has its own code KBK and OKTMO (municipal entity code). Different records are maintained for taxpayers and tax agents. Thus, if one person is both a tax agent and a taxpayer, then two cards are created for him (

How to obtain KRSB data for a company

Taxpayers do not have direct access to the budget settlement card itself. The data in this register is an official and tax secret and public access to it is not provided. But you can request an extract from the Federal Tax Service for settlements with the budget. It will contain basic information from the Federal Tax Service register by types of taxes:

- balance at the beginning and end of the period;

- amounts to be accrued;

- taxpayer payments;

- amounts of credited and written off fiscal payments.

To receive an extract, you must send a request to the Federal Tax Service at the payer’s place of registration via TKS. The extract will be provided within five days from the date of the request.

Who maintains the budget cards?

The database of budget settlement cards is maintained by the tax office based on the data submitted by individual taxpayers or tax agents. The tax office enters the information received on the basis of forms such as 2-NDFL and 6-NDFL, which taxpayers submit at the end of the reporting year and at the end of the quarter. The procedure for using cards is under the jurisdiction of the Federal Tax Service and is carried out on the initiative of either the taxpayer himself or the tax office.

The card is closed through the tax office. This is necessary, for example, so that the taxpayer can register for tax purposes in a new location. In this case, the taxpayer is deregistered with one tax authority, after which he is transferred to another at a new location. The translation is carried out in a certain order. Along with the card, data on late tax payments, as well as data on administrative offenses, are not transferred to another tax office. A database for them is opened at the location of the body that made the decision on penalties and interest on the taxpayer. Thus, all information that does not reflect the activities of an individual entrepreneur or organization is not transferred to another tax office (

The procedure for opening, maintaining and closing KRSB

The card is opened by the Federal Tax Service after the taxpayer is registered with the tax authority from the moment:

- the occurrence of circumstances requiring the payment of a certain tax, fee, or insurance premium;

- payment by the payer of the fiscal payment.

For companies that have separate divisions registered with different Federal Tax Service Inspectors, RSB cards will be opened for one tax for each checkpoint in each inspection at the place of registration.

As the obligation to pay a tax or fee arises, transfer payments to the budget, or other tax payment transactions, responsible inspectorate employees must promptly enter information into the CRSB. At the end of each year, the balance at the end of the tax period is formed on the card.

The document is closed when the grounds for accounting for tax and fee payments are terminated. It could be:

- liquidation of the organization;

- transfer of the payer to another Federal Tax Service (in this case, the balance of payments is transferred to the inspectorate at the new place of registration);

- termination of the obligation to pay tax with the simultaneous absence of debt (for example, the transition from the OSNO to the simplified tax system will lead to the closure of the taxpayer’s VAT control system).

Sample filling

How to fill out the KRSB

The card is filled out according to the following criteria:

- tax payment deadline (KRSB is formed based on taxes paid currently, as well as quarterly);

- KBK of the taxpayer;

- OKTMO;

- status of a taxpayer or tax agent.

There are also some rules for filling out the card:

- personal income tax information is entered only after the appropriate check has been carried out;

- personal income tax amounts that were not withheld by the tax agent are not entered into the card;

- Tax arrears are calculated not only on the basis of the card data, but also on the basis of other documents containing the amounts paid.

To monitor the status of his personal account, the taxpayer should contact the tax office and submit a certificate based on the data from the card, an extract and a reconciliation report. You can find out information about whether a taxpayer has a debt as follows:

- on the tax website ru, through the taxpayer’s “Personal Account” (since 2015, verification is available for both organizations and individual entrepreneurs);

- through the Kontur-extern system using the ION-offline service, where reconciliation can also be carried out.

When accessing the taxpayer information service, the following documents can be generated:

- certificate of personal account status;

- Act of reconciliation;

- issuing settlements with the budget;

- certificate of fulfillment of tax obligations by the taxpayer;

- report on the submitted tax and accounting reports for the reporting period.

To automatically obtain data from ION, Balance-2 software can be used, which allows you to import data into the desired electronic document management system. On the tax website, information is provided in PDF format, which is not very convenient for large companies. It will be convenient for them to carry out automatic reconciliation of calculations.

The card is an important and informative document. But it’s not worth saying that the card contains comprehensive information. If the tax authority, when conducting an audit, refers to the card information, then this is considered unlawful for the taxpayer, and the results can be challenged in court. Thus, the card should not be considered an independent document against which reconciliation of accrued and paid taxes cannot be carried out.

Reconciliation with the tax office: how to understand the statement ٩(͡๏̯͡๏)۶ — Elba

To reconcile with the tax office, you will need two documents:

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

You can order them through Elba - no need to go to the tax office.

Try Elba - 30 days free

Information about the status of settlements

Using the certificate of payment status, you will check whether there is any debt or overpayment at all.

The first column shows the name of the tax you are reconciling against. Information on debts and overpayments is contained in columns 4 - for taxes, 6 - for penalties, 8 - for fines:

- 0 - no one owes anyone, you can breathe easy.

- A plus amount means you have overpaid.

- The amount with a minus - you owe the tax authorities.

Why does the certificate include an overpayment?

- You really overpaid and now you can return this money from the tax office or count it as future payments.

- You ordered a certificate before submitting your annual report under the simplified tax system. At this moment, the tax office does not yet know how much you have to pay. She will understand this from the annual declaration. Before submitting the declaration, quarterly advances under the simplified tax system are listed as an overpayment, and then the tax office charges tax and the overpayment disappears. Therefore, overpayment in the amount of advances under the simplified tax system during the year is not yet a reason to run to the tax office for a refund.

If you see incomprehensible debts or overpayments in the certificate, you will need an extract of transactions with the budget to find out the reason for their occurrence.

Answers to common questions

Question: The tax office identified discrepancies between the calculation of 6-personal income tax provided by the company and the card calculations with the budget. At the same time, a fine was immediately imposed on the company, without asking for clarification on 6-NDFL. Are the tax authorities’ actions legal?

Answer: If in the 6-NDFL calculation provided by the company, the indicated amount is greater than the amount reflected in the budget settlement card, then the tax authority may not request an explanation for the calculation and impose a fine on the company. Explanations are requested only if errors and contradictions are found in the calculation during verification. Otherwise, the tax office should not demand an explanation, but may immediately impose a fine. Thus, the tax authorities’ actions are indeed legal.

Rate the quality of the article. We want to become better for you: Tags: Budget settlement card

One of the frequently asked questions from entrepreneurs is: what is the CRSB in the tax office? This abbreviation stands for budget settlement card. Tax officials compile them and track the movement of payments, relying on an information base that combines the flow of information about the accrual and receipt of tax payments. All settlements with the budget, as the main component of the activities of the Federal Tax Service, are accumulated in this general information resource, and the requirements for its formation are approved by Order of the Federal Tax Service dated January 18, 2012 No. YAK-7-1/ [email protected] and are uniform when carrying out tax transactions .

The taxpayer's KRSB is a grouped resource where information about the status of tax payments is entered for each payer.

What does the taxpayer's CRSB mean?

Every working citizen and every organization registered on the territory of the Russian Federation is responsible for paying taxes and other payments to the budget of the Russian Federation. To organize data on settlements with taxpayers in favor of the state, tax authorities are responsible for maintaining a special card for settlements with the budget, abbreviated as KRSB.

This is a special register that takes into account insurance premiums, taxes and other fees payable to the budget.

What is indicated in the CRSB

The regulations for the preparation of KRSB are established in the text of the Order issued by the Federal Tax Service of Russia on January 18, 2012 under the number YAK-7-1 / [email protected] “On approval of the Unified Requirements for the procedure for creating the information resource “Settlements with the Budget.”

It specifies the requirements for registration and maintenance of RSB cards for all categories of payers.

The algorithm for maintaining and entering information into the KRSB is regulated by numerous letters and resolutions of the Federal Tax Service of the Russian Federation. One of the innovations was the mandatory use of data entry automation processes. In accordance with the Order of the Federal Tax Service of the Russian Federation dated 02/07/20 No. ED-7-12 / [email protected], data must be entered using the AIS “Tax-3” application software, developed to automate the entry of data into the KRSB.

In accordance with the obligation to pay certain budget payments, the taxpayer may have many RSB cards opened at once.

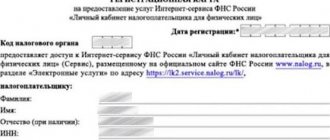

Information in the created KRSB is necessarily formed in two sections:

- the first section, which is intended for entering information identifying the tax payer, and along with it the type of budget payment;

- The second section is aimed at informing about the state of settlements with the budget.

The second section contains separate subsections:

- budget accruals;

- cash inflow;

- settlement balance.

The RSB card must also certainly show:

- information about the calculated tax amount;

- information about calculated penalties and fines;

- information about calculated fees;

- information about the amount of taxes, contributions and fees contributed by the taxpayer;

- information about fines and penalties paid by the taxpayer.

Responsibility for entering, storing and working with information rests with employees of the division of the Federal Tax Service to which the person or organization responsible for paying taxes is attached.

How to open, maintain and close a CRSB

In the process of tax registration with a certain Federal Tax Service, the tax payer (organization, as well as an individual) does not automatically have a KRSB.

The RSB card must be opened by the Federal Tax Service when the following circumstances occur:

- obligation to make a certain budget payment, insurance or other contribution or tax;

- obligation to make customs or fiscal payments.

Important! If an organization has branches or separate (separate) divisions that are registered with the Federal Tax Service inspection at different addresses, then different RSB cards are created that correspond to the checkpoint of the branch or separate divisions in the corresponding Federal Tax Service Inspectorate.

Inspectorate employees are required to enter information on payment of budget payments or fees, as well as other payments provided for by the legislation of the Russian Federation as soon as possible. At the end of the calendar year, a balance should be formed with the amounts recorded at the beginning and end of the tax period in the RSB card.

If the balance is negative, it is obvious that the taxpayer has arrears in payments to the state, but if the balance is positive, it means that an overpayment has been recorded. A legal entity or individual has the right to recover the overpayment by submitting an application to the relevant Federal Tax Service inspectorate in their personal account.

The RSB card is closed if the obligation to keep records of payments for insurance premiums, taxes and fees is terminated.

Such circumstances are:

- liquidation or termination of the activities of a legal entity;

- termination of an individual's employment, for example, in the event of job loss or retirement;

- change by an individual or organization of the Federal Tax Service, as a result of which a new KRSB is created in the new Federal Tax Service, which reflects the previous balance;

- termination of obligations to pay funds to the budget for a certain tax or fee, while there must be no debt on such payments. This situation arises, for example, if there is a change in the taxation regime, a transition from the basic to a simplified taxation system, or the dismissal of employees.

Can I see my RSB card?

You need to know that according to the law of the Russian Federation, the information contained in the KRSB is not subject to disclosure, therefore the card itself is not issued at the request of the taxpayer. Typically, legal entities and individuals can find the necessary data on budget payments in their personal account registered on the Federal Tax Service website. Organizations can use the services of their providers that provide access to electronic reporting, for example, VLSI. You can request a reconciliation of your calculations with the budget for the required period of time.

If necessary, the data of interest from the card should be requested from the Federal Tax Service inspection. The Tax Service will provide basic information from the KRSB data, including:

- calculated amounts of taxes;

- calculated penalties and fines;

- balance recorded at the beginning and at the end of the requested period;

- payments made by the taxpayer during the requested time.

A request for an extract can be sent through your personal account or TKS telecommunication channels. The deadline for providing an extract is five working days.

It should be noted that sometimes the information in the KRSB is not updated. In this case, the taxpayer must submit an application for correction of information through the TKS or in the personal account of the Federal Tax Service.

KRSB: features of compilation

The RSB card is created separately for each specific payer. At the same time, for the convenience of accounting, information is systematized, i.e., a separate form is maintained:

- For each tax that is paid or must be paid by the payer;

- For each BCC (budget classification code) used in the company;

- According to the OKTMO code of the territory in which the company is located and tax revenues are mobilized;

- By payer status. In cases where an enterprise or businessman, being a taxpayer, also acts as a tax agent, cards are generated for each existing status.

KRSB are usually created when registering companies, entrepreneurs or individuals with the Federal Tax Service, as well as when receiving information about them from another inspection, for example, when changing the location of an enterprise or place of residence of a businessman.

In connection with changes from the beginning of 2022 (letter of the Federal Tax Service dated December 30, 2016 No. PA-4-1/25563) regarding the transfer of the administration of insurance contributions to the jurisdiction of the Federal Tax Service, RSB cards for insurance premium payers are also opened by tax authorities, guided by the established rules, i.e. .with division according to BCC.

Contents of the KRSB

The following information is recorded in the CRSB:

- on the calculation of tax amounts, as well as the amount of fines and penalties accrued on it. This information is entered on the basis of declared data provided by payers, court decisions, decisions made to review the results of tax audits, etc.

- about the amounts of taxes/penalties/fines transferred by enterprises and individual entrepreneurs;

Based on this information, the balance between the accrual and payment of tax is determined. If the balance is negative, it means that on the day of calculation the taxpayer has a debt to the budget, while a positive balance indicates an overpayment of tax. Thus, ideally, a taxpayer’s KRSB is a document that records the state of tax calculations in a company at a certain moment.

It should be noted that the information in the KRSB does not always reflect the real state of payments. For example, bad tax liabilities with confirmation of this status by court decisions are often listed on the card for a long time, significantly distorting the result when calculating the final balance. The question of the legality of such actions by the Federal Tax Service remains extremely acute today, although Art. 59 of the Tax Code of the Russian Federation clearly defines the criteria for the hopelessness of debts and the loss of the possibility of collecting them.

KRSB

The information resource maintained by the Federal Tax Service for each taxpayer is usually called a settlement card or KRSB. Each payer has this card at the tax office. Moreover, there may be several such registers if more than one payment is made.

The register consists of two departments. The first contains information about the user. The second register records the receipt of funds and payment of tax duties. But it happens that the card is not readable.

This is possible if the information is out of date because it was not corrected in time. In this case, the register may not be reflected at all in the Federal Tax Service database, which will lead to problems with paying taxes.