Legal representative

The legal representative of an organization is a person authorized to express its interests on the basis of the law or constituent documents (that is, without a power of attorney). The basis is paragraph 1 of Article 27 of the Tax Code of the Russian Federation. For example, such an intermediary is:

- for a limited liability company and a joint stock company - their sole executive body. This is the general director, president or other person (Article 40 of the Federal Law of February 8, 1998 No. 14-FZ, Article 69 of the Federal Law of December 26, 1995 No. 208-FZ);

- for a production cooperative - its chairman (Article 17 of the Federal Law of May 8, 1996 No. 41-FZ);

- for a general partnership - its participant, unless the constituent agreement stipulates that all its participants conduct business jointly, or the conduct of business is entrusted to individual participants (Article 72 of the Civil Code of the Russian Federation).

The powers of the legal representative of the organization are confirmed by documents certifying his official position, including copies of constituent documents.

Let us note that the heads of representative offices and branches of the organization are its authorized representatives, and not legal representatives. After all, they act on the basis of the organization’s power of attorney (clause 3 of Article 55 of the Civil Code of the Russian Federation).

Important point

The taxpayer’s personal participation in tax legal relations does not deprive him of the right to have representatives. And vice versa, if a business entity acts in tax legal relations through intermediaries, this does not mean that it is deprived of the right to participate in these legal relations personally (Clause 2 of Article 26 of the Tax Code of the Russian Federation).

Authorised representative

Other individuals and legal entities can also express the interests of the organization in relations with the tax authorities. They have the right to exercise their powers only on the basis of a power of attorney issued in the manner established by the Civil Code (Article 29 of the Tax Code of the Russian Federation). Employees of the organization (chief accountant, financial director, deputy general director and other heads of various services of the organization), private auditors or specialized firms can act as authorized representatives.

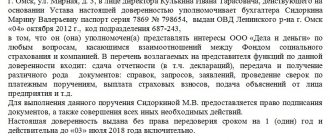

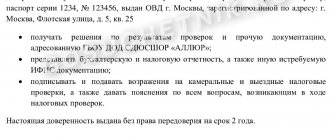

An organization may have several authorized representatives to represent its interests before the tax authorities. She must give each of them a power of attorney. This paper must contain (Articles 185-187 of the Civil Code of the Russian Federation):

- date and indication of place of compilation. A power of attorney that does not indicate the date of its execution is void (Clause 1 of Article 186 of the Civil Code of the Russian Federation);

- organization data: its full name, TIN, location;

- position, full name, passport details, address of the representative - employee of the organization (full name, location of the representative - legal entity, full name, passport details, address - representative - third-party individual);

- a message about the intermediary representing the interests of the organization in relations with the tax authorities;

- rights of an authorized person;

- validity period of the power of attorney. It cannot exceed three years. If this period is not specified, the power of attorney remains valid for a year from the date of its signing (Part 1 of Article 186 of the Civil Code of the Russian Federation);

- signature of the representative;

- signature of the head of the organization that issued the power of attorney, or another person authorized to do so by its constituent documents;

- imprint of the principal's seal.

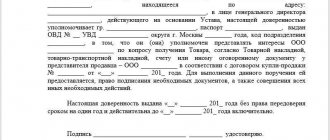

Sample power of attorney for representation by an authorized representative of the interests of the organization in relations with tax authorities, including for filing tax returns

| Power of attorney No. 22 to represent the interests of the organization in relations with tax authorities Moscow First of October two thousand and eleven Limited Liability Company "Orbita" represented by General Director L.E. Stupin, acting on the basis of the Charter, in accordance with Article 29 of the Tax Code, entrusts auditor Albert Mikhailovich Remezov with a passport series 97 03 N 864256, issued by the Ramenskoye Department of Internal Affairs of Moscow September 29, 2002, residing at the address: 111141, Moscow, st. Kuskovskaya, 32, apt. 54, to represent his interests in relations with the tax authorities. In order to fulfill this order, Remezov A.M. the following rights are granted: — represent the interests of Orbita LLC in the tax authorities on all issues related to this assignment; — submit declarations of Orbita LLC to the tax authorities; — receive and transmit documents; — conduct correspondence in pursuance of this instruction; — sign and perform other legal actions related to the execution of this order. The powers under this power of attorney cannot be transferred to other persons. This power of attorney is valid until October 1, 2012. Sample of Remezov's signature A. M. I certify Remezov. General Director of Orbita LLC Stupin /Stupin L.E./ |

Attention

Officials of tax, customs authorities, internal affairs bodies, judges, investigators and prosecutors cannot be authorized representatives of the taxpayer (Clause 2 of Article 29 of the Tax Code of the Russian Federation).

Please note that the authority of the representative is confirmed by the original power of attorney or its certified copy. This follows from the decisions of the Federal Antimonopoly Service of the Far Eastern District dated December 28, 2009 No. F03-7808/2009 in case No. A51-2623/2009, dated December 24, 2009 No. F03-7569/2009 in case No. A51-7172/2009, dated December 23, 2009 No. F03-7520/2009 in case No. A51-2622/2009 and December 21, 2009 No. F03-7420/2009 in case No. A51-4697/2009. In addition, the presence of a power of attorney is a mandatory condition even if interests in the field of taxation are represented under an agency agreement (see resolutions of the Federal Antimonopoly Service of the North Caucasus District dated December 25, 2009 in case No. A32-16230/2007-66/102-2008-3 /385-2009-29/188, FAS North Caucasus District dated May 29, 2009 in case No. A32-16233/2007-66/100-2008-3/384).

Transfer of powers

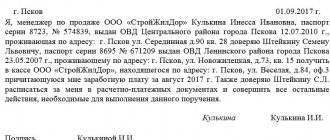

The authorized representative must personally perform those actions that are indicated in the power of attorney issued to him. He can entrust their implementation to another citizen or organization. To do this, the document must indicate that he is allowed to do this. Reassignment without such an indication is possible only due to circumstances to protect the interests of the person whose interests are expressed.

Let’s say a company has issued a power of attorney to a third-party company with the right to delegate powers to its employee. Then in this paper she should indicate such a right.

The authorized representative who transferred the authority must notify the principal about this and provide him with the necessary information about the new holder of the authority. Failure to fulfill this obligation makes the transferor responsible for the actions of the person to whom he delegated authority, as if for his own.

A power of attorney issued by way of delegation must be notarized. The period of its validity cannot exceed the validity period of the power of attorney on the basis of which it was issued (Article 187 of the Civil Code of the Russian Federation).

Attention

The fact that an organization can present financial statements to a user through a representative is stated in paragraph 5 of Article 15 of Federal Law No. 129-FZ of November 21, 1996.

Suppose the company has transferred accounting maintenance to a specialized organization. At the same time, the head of the latter entrusted his authority to sign tax and accounting reports to his employee. In this situation, when submitting the company’s declarations to the tax authority, a third-party organization must attach to the reporting:

- a document confirming the authority of your manager to sign the declaration;

- a document that confirms the authority of the individual who signed the declaration to take such actions.

In addition, it is necessary to follow the established procedure for filling out tax return forms for a specific tax, including provisions for confirming the accuracy and completeness of information in the tax return by an authorized representative of the taxpayer (see letters of the Ministry of Finance of Russia dated January 31, 2011 No. 03-02-07 /1-28 and dated November 27, 2009 No. 03-02-07/1-523).

Grounds for termination of the power of attorney

Article 187 of the Civil Code of the Russian Federation contains grounds for termination of a power of attorney:

- if the power of attorney has expired;

- if the power of attorney is canceled by the principal;

- if the trustee himself renounced his authority;

- if the legal entity has ceased its activities as a result of liquidation or reorganization;

- if the principal and the trustee are declared incompetent or missing;

- upon the death of the principal or trustee;

- if a bankruptcy procedure has been introduced in relation to the organization, in which the principal loses the right to issue powers of attorney.

There are no deadlines for revocation of a power of attorney for either the principal or the authorized person. If the principal changes or cancels the power of attorney, he is obliged to notify the authorized person and the tax authorities about this.

The taxpayer's legal successors retain their rights and obligations that arose as a result of their actions after it became known about the termination of the power of attorney. However, the rule is not valid if the tax authorities were aware of the termination of the document.

After the power of attorney has expired, the authorized person or legal successor is obliged to return the document to the taxpayer immediately.

This obligation is two-sided.

If this does not happen, and the organization is unable to return the document form, then it must submit an announcement within the established time frame that the power of attorney is considered invalid. This is necessary to prevent fraudulent activities, namely to ensure that no one else can use the company’s power of attorney.

After publication of the announcement, all actions under the power of attorney carried out within the period following publication are considered invalid.

Reporting is submitted according to TKS

When submitting reports electronically under the TCS, you must be guided by the Methodological Recommendations, which were approved by Order of the Federal Tax Service of Russia dated November 2, 2009 No. MM-7-6 / [email protected] According to them, a power of attorney (a copy thereof) certifying the right to confirm the accuracy and completeness The information specified in the declaration is sent by the taxpayer's representative to the inspectorate before submitting tax reports in electronic form. A copy of it is retained by the Federal Tax Service for three years after the expiration of the said document.

The software on the representative side sequentially performs the following actions:

- tax return in electronic form in accordance with the approved format and procedure for filling it out;

- an information message about the details of the power of attorney issued to this representative;

- a transport message containing a declaration encrypted for the tax authority and an information message about the details of the power of attorney.

The representative signs the generated reports, information and transport messages with his electronic digital signature.

The representative saves the declaration and information message about the details of the power of attorney signed with his electronic digital signature.

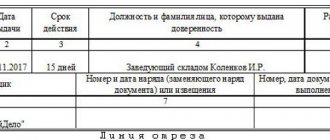

Notice of issued power of attorney

Form

information message about the power of attorney issued to the representative granting him the authority to perform duties in the tax authorities is established in Appendix No. 1 to the above Methodological Recommendations.

The message shall indicate the period for which the power of attorney was issued, its number, information about the person represented, the principal, the authorized representative, and the powers of the representative. Let us note that the document in question provides for 16 types of powers of a representative:

- sign a tax return and other reporting;

- submit a tax return and other reporting;

- receive documents from the Federal Tax Service of Russia;

- make changes to tax reporting documents;

- sign documents on registration and deregistration;

- submit documents on registration and deregistration;

- receive from the inspection of the Federal Tax Service of Russia documents for registration and deregistration, except for the certificate;

- sign documents for accounting of bank accounts;

- submit documents on accounting of bank accounts;

- submit documents on the application of special tax regimes and consolidation of accounting for separate divisions;

- receive documents from the Federal Tax Service of Russia inspectorate on the application of special tax regimes and consolidation of accounting for separate divisions;

- sign documents on consolidation of accounting for separate divisions;

- submit applications and requests for reconciliation of settlements with the budget, obtaining information on the status of settlements with the budget;

- receive reconciliation reports and certificates about the status of settlements with the budget from the Federal Tax Service of Russia inspection;

- sign an act of reconciliation of settlements with the budget;

- sign the tax audit report and decision.

Format

submission of information in an information message about a power of attorney issued to a representative granting him the authority to perform duties in the tax authorities in electronic form (version 5.03), part LXXXVI, established by Appendix No. 1 to the order of the Federal Tax Service of Russia dated November 9, 2010 No. ММВ-7-6 / [email protected]

Other requirements

Also, when generating an information message about a power of attorney issued to a representative, it is necessary to be guided by the Methodological Recommendations, which are approved by the Deputy Head of the Federal Tax Service of Russia A.S. Petrushin on November 21, 2011. They were brought to the attention of lower tax authorities by letter of the Federal Tax Service of Russia dated January 24, 2011 No. 6-8-04/ [email protected] According to these Methodological recommendations, the authorized representative sends an information message about the power of attorney to the Federal Tax Service only electronically form via TKS simultaneously with the electronic document. He must submit to the inspection a copy of the power of attorney on paper before he begins to carry out the actions entrusted to him.

This information message must indicate the details of the power of attorney and the powers of the person, the owner of the signature key certificate, who signs and submits the electronic document. In this case, the details of the signatory in the tax return (last name, first name, patronymic) must match the details (last name, first name, patronymic) of the owner of the signature key certificate.

Filling out the fields of the information message about the power of attorney in electronic form is essentially a reflection of the information located on paper - the original power of attorney issued by the taxpayer to the authorized representative.

Here are the recommended power of attorney details for correctly filling out the fields of the information message:

- power of attorney number;

- date of issue of the power of attorney;

- validity period of the power of attorney (no more than three years);

- reflection of the right to delegate powers, if any;

- details of the taxpayer organization on whose behalf (a direct power of attorney is issued) or for which (in case of delegation of powers) the authorized representative represents the interests;

- details of the principal (the person who issued and signed the power of attorney, if he is not the head of an organization or an individual entrepreneur, that is, in the case of sub-authorization);

- details of the authorized representative(s) (person) who is given the right to interact and sign reports;

- information about credentials.

The list of credentials is required to be completed. To submit declarations electronically under the TKS, an authorized representative must, at a minimum, indicate the code - “01” (sign the tax return). When granting full powers to an authorized representative, code “99” is indicated.

Important point

The current list of powers is posted in the form of a directory on the website of the Federal State Unitary Enterprise GNIVTs Federal Tax Service of Russia: www.gnivc.ru - Information support - Classifiers and reference books - "SPPR". Directory of powers, taxpayer representative.

Types of authorized representatives

Authorized representatives who sign a tax return, confirming the accuracy and completeness of the information specified in it, are divided into two types.

The first type occurs in the following situation. The tax return is submitted by the taxpayer himself, and the declaration is signed by an employee of the taxpayer organization who is not a manager. In this case, in the name of the files of the tax return and the information message on the power of attorney, the taxpayer’s INN and KPP are entered; in the tax return, in the block “I confirm the accuracy and completeness of the information specified in this declaration,” the code “02” (authorized representative) and the surname, first name are entered , patronymic name of an employee of the taxpayer organization;

The second type - the tax return is submitted by an authorized representative, who is an organization or an individual entrepreneur. Then, in the name of the files of the tax return and the information message about the power of attorney, the TIN and KPP of the representative are entered, in the tax return in the block “I confirm the accuracy and completeness of the information specified in this declaration” the following are entered: code “02” (authorized representative), last name, first name, patronymic of an employee of the authorized organization (last name, first name, patronymic of the authorized individual entrepreneur) and full name of the authorized representative.

Power of attorney information messages are generated in various situations, including when:

- the head of the organization has signed a power of attorney in which he authorizes his employees to perform actions on behalf of the organization when submitting tax reports to the tax authorities;

- the head of the organization signed a power of attorney for an authorized representative, which is a third-party company, represented by the director and employees of the latter;

- the head of the organization signed a power of attorney for an authorized representative represented by an individual entrepreneur;

- the legal representative of the organization signed a power of attorney for its employee (employees);

- the head of the organization signed a power of attorney for the authorized representative, which is the company, represented by the head of the latter. In turn, if he has the appropriate rights, this manager signed powers of attorney for his employees;

- the head of the organization signed a power of attorney in which he authorizes the director of its branch to perform actions on behalf of the organization only in relation to the branch in the Federal Tax Service of Russia at the location of such division.

Rights and obligations

Along with ordinary taxpayers, tax agents have similar rights and responsibilities. A comprehensive concept of who tax agents are, their rights and obligations are discussed in Article 24 of the Tax Code of the Russian Federation.

Key rights of tax agents:

- Receive free information and clarifications from representatives of the Federal Tax Service regarding the application of tax regimes, types and rules.

- Request unified forms and demand clarification on the rules for filling them out and submitting them to the Federal Tax Service.

- Take advantage of statutory deductions, benefits and concessions if you have legal rights to use them.

- Receive an installment plan, deferment or debt restructuring or an investment fiscal loan if there are good reasons.

- Claim for a timely return or credit of over-transferred funds to the budget.

- Initiate reconciliations of mutual settlements with government agencies, receive appropriate corrections, extracts and explanations.

- Refuse to carry out illegal or unlawful actions of Federal Tax Service inspectors and other officials.

The main responsibilities of tax agents: perform timely and reliable calculations, withholding and transfer of amounts of fiscal obligations to the budgets of the appropriate level. In addition to this obligation, the following are assigned to the NA:

- within a month, inform the Federal Tax Service about the impossibility of withholding fiscal debt from the taxpayer;

- keep reliable records of accrued and paid income, as well as withheld amounts of taxes and fees, separately for each taxpayer;

- promptly provide reports and documents confirming the accuracy and completeness of the calculations made;

- ensure the safety of documentation confirming the facts of transactions performed for 4 calendar years.

This list is not exhaustive. Thus, for a specific type of fiscal obligations (personal income tax, VAT and income tax), officials have provided additional obligations.