In trading, it is important not only to sell and buy goods, but also to store them in the process between these operations. In theory, the owner of the goods must provide storage. But in practice, the service of storing cargo, goods, equipment, etc. is often in demand. In addition, there are situations when the buyer refuses the delivered goods and must save them until they are returned to the seller.

Let's consider all the nuances of the term “secure storage” and the features of this procedure.

obligations for responsible storage of goods arise and are fulfilled ?

Storage agreement

The storage agreement is concluded in writing (subclause 1, clause 1, article 161, clause 1, article 887 of the Civil Code of the Russian Federation). Organizations for which storage is a business activity (commodity warehouses), instead of concluding an agreement, can issue a simple (double) warehouse certificate, which indicates the conditions and storage period of goods and materials (Articles 887, 913, 917 of the Civil Code of the Russian Federation). If, within the period established by the agreement, the depositor does not pick up the goods and materials transferred for storage, the custodian has the right to sell them, having warned their owner about this (clause 2 of Article 899 of the Civil Code of the Russian Federation).

Receipt of inventory items for storage

Documentation of acceptance of inventory items for safekeeping depends on whether they were accepted under a storage agreement or not.

Under a storage agreement, the receipt of goods and materials from organizations and entrepreneurs must be formalized with a transfer and acceptance certificate in form No. MX-1. When returning inventory items to the depositor, a report is drawn up in form No. MX-3. In addition to the list of returned goods and materials, this act indicates the volume and cost of services provided by the custodian. Therefore, there is no need to prepare additional documents on the provision of storage-related services.

After receiving the goods and materials deposited for storage, the depositor must confirm the absence of claims against the custodian organization by signing the journal in Form No. MX-2.

This procedure is established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 9, 1999 No. 66.

There is no unified form of document used to formalize the acceptance of goods and materials for storage from the public. Therefore, when providing storage services to the population, an organization can use standard forms No. MX-1, No. MX-2, No. MX-3 or similar documents developed independently: receipts, receipts, numbered tokens, etc. The issuance of any of these documents will be mean that the storage agreement is concluded in writing (clause 2 of article 887 of the Civil Code of the Russian Federation).

For other agreements (for example, sales and purchases with transfer of ownership after payment), the acceptance of inventory items for safekeeping is documented with invoices (for example, according to forms No. TORG-12, No. 1-T, No. M-15).

Warehousing: accounting and taxation

A. Vagapova, auditor

Almost any organization is faced with the problem of storing inventory items (hereinafter referred to as goods and materials). There are different types of storage: in a pawn shop, in a bank, in a hotel, etc. The most common of them is storage in a warehouse.

According to Art. 907 of the Civil Code of the Russian Federation, under a warehousing agreement, a commodity warehouse (custodian) undertakes, for a fee, to store goods transferred to it by the goods owner (depositor) and to return these goods safely. Goods storage is a service for maintaining the safety of property transferred for a certain period or upon demand. The legal regulation of the storage agreement is determined by Chapter 47 of the Civil Code of the Russian Federation.

A goods warehouse is an organization that carries out the storage of goods as a business activity and provides storage-related services. The obligations of the warehouse in accordance with Art. 909 of the Civil Code of the Russian Federation are the inspection of goods upon acceptance for storage, determination of their quantity and external condition. The storage agreement must be concluded in writing. The written form is considered to be complied with if the conclusion of the contract and acceptance of the goods for storage are certified:

safety receipt, receipt, certificate or other document signed by the custodian;

a numbered token (number), other sign certifying the acceptance of things for storage, if such a form of confirmation of acceptance of things for storage is provided for by law or other legal act or is customary for this type of storage by a warehouse document.

An important feature of storage in a warehouse is that, on the basis of Art. 909, 911 of the Civil Code of the Russian Federation, when depositing and returning goods, they must be checked for quantity and quality.

Valuables transferred for storage remain the property of the depositor and are reflected on his balance sheet. The custodian, accepting things for storage, takes them into account as a debit to off-balance sheet account 002 “Inventory assets accepted for safekeeping.”

The general rules of the Civil Code of the Russian Federation regarding the storage agreement also contain strict rules on the possibility of transferring a thing for storage to a third party. According to Art. 895 of the Civil Code of the Russian Federation, unless otherwise provided by the storage agreement, the bailee does not have the right, without the consent of the bailor (the owner of the thing), to transfer the thing for storage to a third party, except in cases where he is forced to do so by force of circumstances in the interests of the bailor and is deprived of the opportunity to obtain his consent. The custodian is obliged to immediately notify the bailor of the transfer of a thing for storage to a third party.

Accordingly, in the case of transfer of property received by the custodian to a third party, the value of the property is written off from account 002. Moreover, the fact that there is responsibility for the safety of this property should be reflected in off-balance sheet account 009 “Securities for obligations and payments issued.”

The transfer of property to the custodian is formalized by an act on the acceptance and transfer of inventory items for storage (form No. MX-1), and when they are returned to the depositor - by an act on the return of inventory items deposited for storage (form No. MX-3), the unified forms of which were approved by Decree of the State Statistics Committee of Russia dated August 9, 1999 No. 66.

For storage in a commodity warehouse, special forms of warehouse documents are provided, which the warehouse must issue (Article 12 of the Civil Code of the Russian Federation):

- double warehouse receipt;

- simple warehouse receipt;

- warehouse receipt.

Mandatory details of a simple and double warehouse receipt are specified in Art.

913 and 917 of the Civil Code of the Russian Federation. Both of these documents are securities. When transferring these documents, it is necessary to draw up acceptance certificates. Let's look at examples of accounting options when using a simple and double warehouse receipt.

If a warehouse, when accepting goods for storage, issues a simple warehouse certificate to the owner of the goods, then the conclusion of a separate storage agreement is not required, since a simple warehouse certificate is a form of a warehouse storage agreement. The owner of the goods, when concluding a supply agreement with the buyer, fulfills his obligations to transfer the goods by providing a simple warehouse receipt. This should be a mandatory condition of the contract. The transfer of a simple warehouse receipt is carried out according to the acceptance certificate. In this regard, the act of acceptance and transfer of a simple warehouse receipt (which is the primary accounting document) is the basis for reflecting the transaction for the sale of goods in the accounting records of the supplier and for the receipt of goods from the buyer. This is also indicated by Art. 224 of the Civil Code of the Russian Federation, which equates the transfer of a shipping document to the transfer of a thing. An exception is the pledge of goods by pledge of a simple warehouse receipt. In this case, the transfer of a simple warehouse receipt as collateral means the transfer of the goods themselves as collateral. Since the pledgor does not lose ownership of the goods pledged, there is no sale of this goods. Consequently, the transfer of a simple warehouse receipt (respectively goods) as collateral can only be reflected in off-balance sheet accounts (Table 1).

Table 1

Accounting records from the owner of the goods for transactions with a simple warehouse receipt

| Contents of a business transaction | Account correspondence | |

| debit | credit | |

| Goods are delivered from the supplier to the custodian's warehouse | 41 | 60 |

| VAT is reflected on the cost of goods | 19 | 60 |

| A simple warehouse receipt was received confirming acceptance of the goods for storage | 008 | |

| Paid for goods | 60 | 51 |

| Accepted for VAT deduction | 68 | 19 |

| Paid custodian services | 60 | 51 |

| The cost of custodian services is reflected as part of sales expenses | 44 | 60 |

| VAT is reflected on the cost of custodian services | 19 | 60 |

| Accepted for VAT deduction | 68 | 19 |

| A simple warehouse receipt was handed over to the buyer | 62 | 90 |

| VAT charged on revenue | 90 | 68 |

| The cost of the goods is written off | 90 | 41 |

| The simple warehouse receipt received from the custodian was transferred to the buyer of the goods | 008 | |

The buyer purchasing the goods accepts it for accounting by debiting account 41 at the time of receipt of a simple warehouse receipt.

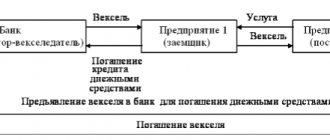

According to Art. 912 of the Civil Code of the Russian Federation, a double warehouse receipt consists of two parts that can be separated from one another. Each of the two parts is a security. One part of the double warehouse receipt is the actual warehouse receipt. The second part of the double warehouse receipt is the warrant (or pledge certificate). Both parts of the warehouse receipt must have the mandatory details listed in Art. 913 of the Civil Code of the Russian Federation, identical signatures of the authorized person and the seal of the warehouse. A document that does not meet these requirements is not a double warehouse receipt, but is converted from a security document into written evidence of storage of goods in a warehouse.

Let's define the difference between a warehouse receipt and a warrant. A warrant gives its holder the right to pledge the goods in the amount of the loan issued under the warrant, but does not give the right to dispose of the goods stored in the warehouse. Thus, when transferring a warrant, in contrast to transferring a simple warehouse receipt, the transfer of ownership of the goods does not occur. At the same time, the holder of the warehouse certificate has the right to dispose of the goods, but cannot take it from the warehouse until the loan issued under the pledge certificate is repaid. Only the holder of the warehouse and pledge certificate has, on the basis of clause 1 of Art. 914 of the Civil Code of the Russian Federation the right to dispose of goods stored in a warehouse in full.

Storing products and goods in warehouses with the issuance of a double warehouse certificate may be accompanied by their issuance to the depositor in parts. To do this, new certificates are issued for the goods remaining in the warehouse.

The procedure for accounting transactions when using double warehouse receipts is shown in table. 2.

table 2

Accounting records from the owner of the goods for transactions with a double warehouse receipt

| Contents of a business transaction | Account correspondence | |

| debit | credit | |

| Goods are delivered from the supplier to the custodian's warehouse | 41 | 60 |

| VAT reflected | 19 | 60 |

| A double warehouse receipt was received confirming acceptance of the goods for storage | 008 | |

| Paid for goods | 60 | 51 |

| Accepted for VAT deduction | 68 | 19 |

| The cost of custodian services is reflected as part of sales expenses | 60 | 51 |

| Custodian services charged | 44 | 60 |

| VAT is reflected on the cost of custodian services | 19 | 60 |

| Accepted for VAT deduction | 68 | 19 |

| Received a bank loan secured by goods located in a warehouse | 51 | 66 |

| A warrant received from the custodian was issued to the bank to ensure repayment of the loan | 008 | |

| The amount of the pledge certificate transferred to the bank is reflected (upon issuance of the warrant) | 009 | |

| An invoice was presented to the buyer for the goods | 62 | 90 |

| VAT charged | 90 | 68 |

| The cost of the goods is written off | 90 | 41 |

| A debt obligation secured by a certificate of pledge was transferred by reducing the amount payable for the goods | 66 | 62 |

| Transfer of the warehouse receipt to the buyer is reflected | 009 | |

An organization purchasing a warrant from a bank records it as a security in the debit of account 58 “Financial investments”.

Thus, the transfer of warehouse receipts means not just the transfer of a security, but the transfer of goods, which entails reflecting the corresponding transaction not as a transaction with a security, but as a sale of goods. A warehouse certificate, as a security of title, certifies the ownership of goods stored in the warehouse that issued this security, and the right to demand the warehouse to release the specified goods within a specified period or at the time of demand.

The circulation of warehouse receipts for which pledge certificates are transferred has its own characteristics. In accordance with paragraph 2 of Art. 914 of the Civil Code of the Russian Federation, the holder of a warehouse certificate, separated from the pledge certificate, has the right to dispose of the goods, but cannot take it from the warehouse until the loan issued under the pledge certificate is repaid. Thus, the depositor can sell the goods before the loan is repaid, shifting the obligation to repay the loan to the new holder of the warehouse receipt. The reflection of these transactions in accounting is shown in table. 3.

Table 3

Accounting records of the owner of the goods for transactions with a certificate of pledge

| Contents of a business transaction | Account correspondence | |

| debit | credit | |

| Goods are delivered from the supplier to the custodian's warehouse | 41 | 60 |

| VAT reflected | 19 | 60 |

| A double warehouse receipt was received confirming acceptance of the goods for storage | 008 | |

| Paid for goods | 60 | 51 |

| Accepted for VAT deduction | 68 | 19 |

| The cost of custodian services is reflected as part of sales expenses | 60 | 51 |

| Custodian services charged | 44 | 60 |

| VAT is reflected on the cost of custodian services | 19 | 60 |

| Accepted for VAT deduction | 68 | 19 |

| Received a bank loan secured by goods located in a warehouse | 51 | 66 |

| A warrant received from the custodian was issued to the bank to ensure repayment of the loan | 008 | |

| The amount of the pledge certificate transferred to the bank is reflected (upon issuance of the warrant) | 009 | |

| An invoice was presented to the buyer for the goods | 62 | 90 |

| VAT charged | 90 | 68 |

| The cost of the goods is written off | 90 | 41 |

| A debt obligation secured by a certificate of pledge was transferred by reducing the amount payable for the goods | 66 | 62 |

| Transfer of the warehouse receipt to the buyer is reflected | 009 | |

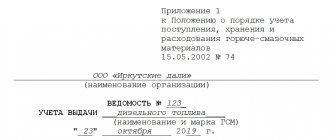

Warehouse receipt is a document certifying the transfer of materials, goods, finished products and other types of property of the depositor to a warehouse under the terms of a storage agreement.

This agreement provides for the return of goods by the custodian using a warehouse receipt within a specified period. The warehouse receipt is often used in the warehouses of suppliers and manufacturers of goods. A special feature of the design of a warehouse receipt is the possibility of issuing only one receipt for the entire quantity of goods accepted for storage. Therefore, if it is necessary to split the batch, it is necessary to draw up a new storage agreement and warehouse receipt, as well as draw up acts on the return of goods deposited in storage and on the acceptance and transfer of goods remaining in storage. A similar procedure for registering unsold goods is often used by wholesale trade organizations that do not have warehouse facilities.

Features of taxation when performing transactions with warehouse receipts are established in Art. 167 Tax Code of the Russian Federation. In accordance with paragraph 7 of this article, when a taxpayer sells goods transferred to him for storage under a warehousing agreement with the issuance of a warehouse certificate, the date of sale of these goods is determined as the day of sale of the warehouse certificate. This is explained by the fact that the transfer of a warehouse receipt or a double warehouse receipt means the transfer of ownership rights to the goods, as a result of which, on the basis of clause 1 of Art. 39 of the Tax Code of the Russian Federation, an object of VAT taxation arises.

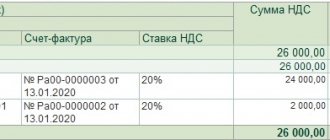

An invoice is issued in the generally established manner indicating the cost of the goods and is transferred along with the warehouse receipt.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Accounting with the custodian

Inventory and materials accepted for storage are not the property of the custodian, therefore they are accounted for separately from his own property in off-balance sheet account 002 “Materials accepted for safekeeping” (clause 10 of the Guidelines approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n ). Analytical accounting on this account is carried out by owners of inventory items, by grade and storage location (Instructions for the chart of accounts).

Receipt of inventory items for storage, as well as their return to the owner, is reflected with the following entries:

Debit 002

– goods and materials were received for safekeeping;

Credit 002

– goods and materials accepted for storage are returned.

Custodians (commodity warehouses) reflect income and expenses associated with the provision of storage services in accounting as income and expenses for ordinary activities (clause 5 of PBU 10/99, clause 5 of PBU 9/99).

Situation: is it necessary to reflect monthly revenue from the sale of storage services in the accounting of a custodian (warehouse). Is the storage agreement concluded for a period exceeding one month?

Answer: yes, it is necessary.

For custodians (commodity warehouses), revenue from the sale of storage services is income from ordinary activities (clause 5 of PBU 9/99). Revenue is taken into account in an amount equal to the amount of cash receipts and (or) the amount of accounts receivable (clause 6 of PBU 9/99).

Revenue is reflected in accounting if the following conditions are met:

– the organization has the right to receive it;

– the amount of revenue can be determined;

– the service is actually provided to the customer;

– the costs associated with the operation can be determined.

Such rules are established by paragraph 12 of PBU 9/99.

When providing storage services, all of the above conditions can be considered fulfilled on the last day of each month during the contract period. Moreover, the custodian has the right to receive remuneration, even if the storage agreement is terminated early (clause 3 of Article 896 of the Civil Code of the Russian Federation). Remuneration will also be received if the owner refuses the goods and materials transferred for storage. The custodian can sell such property (with notification to the owner) (clause 2 of article 899 of the Civil Code of the Russian Federation). Consequently, the custodian should reflect the revenue from the provision of services under a storage agreement in accounting based on the results of each reporting period, that is, monthly (clause 29 of the Regulations on Accounting and Reporting).

For organizations that have the right to conduct accounting in a simplified form, a special procedure for recording income and expenses is provided (Parts 4, 5, Article 6 of the Law of December 6, 2011 No. 402-FZ).

TRANSFER OF GOODS FOR STORAGE

As a result, we need the goods to continue to be listed in account 41 and be on the balance sheet. But at the same time, so that we can see that these goods are not physically present, and which of our counterparties has them.

We transfer goods for safekeeping using the “Transfer of Goods” document. Let's find it through the "Operations" menu - documents. And in the list that opens, select the document “Transfer of goods”. We will create, fill out and post.

When creating a document, select the “Transfer of materials to processor” operation. In this document, we transferred our goods to the counterparty “Counterparty-Custodian”.

Let's look at the entries made by the document Transfer of goods: transfer of materials to the processor.

We see that the goods continue to be listed on account 41, but the “Warehouse” subaccount is already empty. That is, the goods are listed on our balance sheet, but are physically located with the custodian counterparty.

Let's look at reports for accounting and management accounting.

Balance sheet for account 41. (Report - accounting and tax accounting - balance sheet for account).

The turnover balance sheet showed us that the goods are listed on our balance sheet, but are not physically located in our warehouses. The accounting issue in this situation can be completely resolved.

But we still need to know who has our goods in storage. Let’s use the universal report “Balances and Turnovers”

In the report form that opens, set the period and select the accounting section “Goods transferred.” If any special settings are required, you can set them using the “Settings” button. Let's look at the result.

From the report Goods transferred: balances and turnover, you can see who has and which of our goods are under storage agreements, in quantitative and amount terms.

Let's now see what management reports tell us about the availability of goods in warehouses. We will generate a report “Goods in warehouses”. Reports - inventories - goods in warehouses.

Let's look at the settings. There is no need to configure anything specially.

Result:

The 1C:UPP program shows us that we actually do not have this product in stock, which is true.

And then the day comes when we take our goods back. To do this, based on the previously entered document “Transfer of goods”, we will enter the document “Return of transferred goods”.

And let's look at the postings that the document Return of transferred goods: materials from recycling made to us.

We see that the goods have returned to our main warehouse. If we create a balance sheet for account 41, we will also see this.

We have the goods in our main warehouse; our goods are not available in foreign territories.

All that remains is to reflect the debt for storage services. We will do this using the usual document Receipt of goods and services.

To separately account for storage costs, you can create a special cost item, for example “Storage of goods”:

By clicking the “Go” button, you need to configure “Methods of distribution of cost items” and “Methods of distribution of organization items”. You need to configure how you need to distribute these expenses for a specific organization. At the close of the month, these expenses will be allocated accordingly.

Unfortunately, in the standard configuration it is not possible to establish a direct relationship between the consignment of goods transferred for storage and the costs of storage services. If such a function is necessary, then a corresponding modification of the 1C:UPP program will be required.

Buyer's accounting

On off-balance sheet account 002, purchasing organizations reflect inventory items that were received:

- from the supplier and for which the buyer refused payment on a legal basis (inconsistency of the assortment, quantity or quality specified in the contract);

- under contracts providing for the transfer of ownership to the buyer only after payment (or other events).

In accounting, the movement of such inventory items is reflected by postings:

Debit 002

– goods and materials that are not subject to payment due to violation of the terms of the supply agreement are accepted for safekeeping;

Credit 002

– inventory items that are not payable and returned to the supplier are written off off-balance sheet;

Debit 002

– goods and materials that are not subject to expenditure (use) before payment are accepted for safekeeping (under an agreement with special conditions for the transfer of ownership);

Credit 002

– written off from off-balance sheet accounting due to the transfer of ownership to the buyer;

Debit 10 (08, 41…) Credit 60

– accepted on the balance sheet of goods and materials, the ownership of which has passed to the buyer.

Supplier organizations reflect on account 002 inventory items that became the property of the buyer, but were not removed from the supplier’s warehouse:

Debit 002

– goods and materials not removed by the buyer are accepted for safekeeping;

Credit 002

– inventory items left by the buyer for safekeeping are written off from off-balance sheet accounting.

This procedure follows from the provisions of the Instructions for the chart of accounts.

Inventory and materials recorded on account 002 in the listed cases are not received under a storage agreement. Consequently, it is not necessary to draw up documents on the acceptance and transfer of goods and materials according to forms No. MX-1, No. MX-2 and No. MX-3. This is explained by the fact that these documents are intended to formalize the transfer of inventory items under a storage agreement. And suppliers and buyers act within the framework of purchase and sale (supply) agreements. Therefore, in this case, when receiving and transferring goods and materials, fill out invoices (for example, according to forms No. TORG-12, No. 1-T, No. M-15).

An example of reflecting in accounting the acquisition of materials under a purchase and sale agreement with a special procedure for the transfer of ownership. Ownership of the shipped materials passes from the seller to the buyer only after payment.

Alpha LLC purchased materials worth RUB 118,000. (including VAT – 18,000 rubles). According to the terms of the agreement, ownership of the materials passes to Alpha only after payment. The materials were transferred to the buyer on October 18, and paid for on November 15. The materials are intended for conducting activities subject to VAT.

The following entries were made in Alpha's accounting:

October 18:

Debit 002 – 118,000 rub. – materials that are not subject to consumption before payment are accepted for safekeeping (at the cost indicated in the accompanying documents, including VAT).

15th of November:

Debit 60 Credit 51 – 118,000 rub. – money was transferred for materials received;

Loan 002 – 118,000 rub. – materials were written off from off-balance sheet accounting due to the transfer of ownership;

Debit 10 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – materials are taken into account as part of own working capital;

Debit 19 Credit 60 – 18,000 rub. – VAT on capitalized materials is allocated;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of VAT on capitalized materials (based on the supplier’s invoice).

Attention: if the buyer stores inventory items for a long time, the ownership of which has not been transferred to him, the tax office may consider that he is providing storage services to the seller free of charge. A similar situation may arise during long-term storage in the seller’s warehouse of goods and materials that have not been removed by the buyer. In both cases, organizations may be subject to additional taxes.

If the tax inspectorate proves that a hidden form of storage agreement has arisen in relations between organizations, then the organization that stores the goods of its counterparty will be accrued non-operating income in the amount of the market value of the free service provided for the storage of inventory items (clause 8 of Article 250 of the Tax Code of the Russian Federation). In addition, organizations can charge VAT on the market value of services provided free of charge (clause 1, article 39, clause 1, article 146 of the Tax Code of the Russian Federation). An increase in the tax base for VAT and income tax will lead to the formation of arrears, and, as a result, to the accrual of penalties and fines (Articles 75, 120, 122 of the Tax Code of the Russian Federation).

Advice: Claims from the tax inspectorate in connection with the storage of inventory items that are not the property of the buyer before payment, as well as inventory items that have not been removed from the seller’s warehouse, can be avoided. To do this, additional conditions should be included in the purchase and sale (supply) agreement.

Both the seller and the buyer need to prove that the storage of the counterparty’s goods is carried out within the framework of the purchase and sale (supply) agreement. Evidence can be provided by the provisions of the contract, according to which the buyer:

– a certain period is given to remove the goods from the supplier’s warehouse;

– a deadline for payment for goods is established (under contracts with a special procedure for transferring ownership);

– the right is granted not to pay for the goods until the end of checking its quality and completeness (indicating the timing of this check).

ACCEPTANCE OF GOODS FOR STORAGE

Let’s assume that our organization decides to provide someone with storage services for someone else’s goods. In this situation, we are required to reflect such goods on off-balance sheet account 002. You can use manual transaction entry. Or you can use the document “Receipt of goods and services” with the type of operation “for processing”, and then, based on it, enter the document “Return of goods to the supplier”.

We set the account “002” manually in the document. Let's see the result.

Introducing a refund based on this document will give us a movement on the credit of account “002”.

If necessary, you can create a special warehouse in the 1C:UPP program, to which we will receive goods for storage.

You can see how much of someone else’s goods we have in storage and whose it is, using the same universal report “Remains and Turnovers”. Section "Goods received".

If you use a manual transaction to register the receipt of goods for safekeeping, the information will not be displayed in this report. It will be possible to use only accounting reports for account “002”

Afterwards, we will formalize our services with the usual document for the sale of goods and services.

You can also accept goods for storage in the 1C:Enterprise 8. Manufacturing Enterprise Management 1.3 program using a commission agreement (with the principal). In this case, we will also manually change account 004 to 002 in the document of receipt of goods and services under the commission agreement, and then, based on this receipt, we will enter a refund. But to implement our storage services, we will need to enter another agreement with the type “With the buyer”.

BASIC: income tax

The custodian should not take into account inventory items accepted for storage, either as part of income or as part of expenses. When goods and materials are received for storage, the ownership of them does not pass to the custodian, therefore he does not have objects of taxation either for VAT, or for profit tax, or for property tax (Clause 1, Article 886 of the Civil Code of the Russian Federation, Article 39, 146, 247, paragraph 1 of Article 374 of the Tax Code of the Russian Federation).

When calculating income tax, the custodian must take into account:

- in income - the amount of services sold (remuneration for storage) (Article 249 of the Tax Code of the Russian Federation);

- in expenses - expenses associated with the provision of storage services (clause 1 of Article 252 of the Tax Code of the Russian Federation).

The procedure for recognizing income by a custodian who uses the accrual method depends on the duration of the storage agreement. If storage services are provided for less than one income tax reporting period, then recognize income from the sale of such services at the time of return of inventory items to their owner (clause 3 of Article 271 of the Tax Code of the Russian Federation). If storage services are provided for more than one income tax reporting period, the custodian must distribute the income from their sale taking into account the principle of uniformity (clause 2 of Article 271 of the Tax Code of the Russian Federation). For more information about this, see How to take into account income taxes relating to several reporting periods.

Custodians (commodity warehouses) have the right to recognize all expenses (both direct and indirect) in the current reporting (tax) period (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

If an organization uses the cash method, then recognize income and expenses only after they have been paid (clauses 2 and 3 of Article 273 of the Tax Code of the Russian Federation).

An example of reflection in accounting and taxation of income and expenses associated with the provision of services under a materials storage agreement

Alpha LLC (commodity warehouse) accepted for safekeeping from Proizvodstvennaya LLC a batch of cement worth 500,000 rubles. The storage agreement is valid for 6 months (from February 1 to July 29). The cost of storage services for the entire period of validity of the contract is RUB 35,400. (including VAT – 5400 rubles). In addition, when receiving and returning cement, Alpha provides the Master with services for unloading (in February) and loading (in July). The cost of unloading is 6018 rubles. (including VAT - 918 rubles), and the cost of loading - 7080 rubles. (including VAT - 1080 rubles). According to the agreement, “Master” pays for all services of the warehouse at a time at the end of the storage period. In fact, the money for the services provided was credited to Alpha’s bank account on July 29 in the amount of 48,498 rubles. (RUB 35,400 + RUB 6,018 + RUB 7,080).

Cost in accounting and tax accounting is:

– storage of cement – 3000 rub. per month; – unloading – 3700 rub.; – loading – 4400 rub.

"Alpha" applies a general taxation system, income and expenses are determined by the accrual method.

According to the accounting policy, in accounting and tax accounting, income from the provision of services under contracts whose validity period exceeds one month is recognized evenly on the last day of each month. Expenses associated with the provision of services are taken into account in the reporting period in which they were incurred (without distribution to work in progress balances).

Monthly revenue from the sale of storage services excluding VAT is: (RUB 35,400 – RUB 5,400): 6 months. = 5000 rub.

The amount of VAT on revenue from the sale of storage services for the month is equal to: 5,000 rubles. × 18% = 900 rub.

The following entries were made in Alpha's accounting.

In February:

Debit 002 – 500,000 rub. – cement from “Master” was accepted for responsible storage;

Debit 20 Credit 02, 10, 25, 26, 68, 69, 70 – 6700 rub. (RUB 3,000 + RUB 3,700) – costs for storage and unloading of cement are taken into account;

Debit 62 Credit 90-1 – 11,918 rubles. (RUB 5,900 + RUB 6,018) – revenue from the provision of services for storing and unloading cement is reflected;

Debit 90-2 Credit 20 – 6700 rub. (RUR 3,000 + RUR 3,700) – the cost of services provided has been formed;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 1818 rubles. (918 rubles + 900 rubles) – VAT is charged on services provided.

From March to June inclusive:

Debit 20 Credit 02, 10, 25, 26, 68, 69, 70 – 3000 rub. – the costs of cement storage are taken into account;

Debit 62 Credit 90-1 – 5900 rub. – revenue from the provision of cement storage services is reflected;

Debit 90-2 Credit 20 – 3000 rub. – the cost of services provided is formed;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 900 rubles. – VAT is charged on services provided.

In July:

Loan 002 – 500,000 rub. – the cement is returned to the depositor;

Debit 20 Credit 02, 10, 25, 26, 68, 69, 70 – 7400 rub. (RUB 3,000 + RUB 4,400) – expenses for storage and loading of cement are taken into account;

Debit 62 Credit 90-1 – 12,980 rub. (RUB 5,900 + RUB 7,080) – income from the provision of services for storing and loading cement is recognized;

Debit 90-2 Credit 20 – 7400 rub. (RUR 3,000 + RUR 4,400) – the cost of services provided has been formed;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 1980 rubles. (900 rubles + 1080 rubles) – VAT is charged on services provided;

Debit 51 Credit 62 – 48,498 rub. – money received from the depositor.

Data on the tax base for VAT and income tax for the period of validity of the storage agreement are given in the table:

| Month (period) | Type of services provided | Revenue subject to VAT and income tax | Expenses that reduce the tax base for income tax |

| February | Unloading of cement and its storage during February | 10,100 rub. (5100 rub. + 5000 rub.) | 6700 rub. (3700 rub. + 3000 rub.) |

| March–June | Cement storage | 20,000 rub. (5000 rub. × 4 months) | 12,000 rub. (3000 rubles × 4 months) |

| July | Cement storage and loading in July | 11,000 rub. (6000 rub. + 5000 rub.) | 7400 rub. (4400 rub. + 3000 rub.) |

| Total | RUB 41,100 | RUB 26,100 | |

Situation: can a custodian organization (commodity warehouse) take into account the costs of insuring property accepted for safekeeping when calculating income tax?

According to the latest clarifications of the Russian Ministry of Finance, it is impossible. The Tax Department believes that the expenses can be taken into account.

In a letter dated April 28, 2009 No. 03-03-06/1/285, the Russian Ministry of Finance indicated that insurance of property accepted for storage does not belong to the types of voluntary insurance, the costs of which can be taken into account when calculating income tax. It is explained this way.

In accordance with subparagraph 10 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation, when calculating income tax, you can take into account the costs of all types of voluntary insurance, which are a condition for conducting the organization’s activities by virtue of the legislation of the Russian Federation. Insurance of property accepted for safekeeping may be a condition of the contract concluded by the parties. By virtue of the legislation of the Russian Federation, such insurance is not a condition for the custodian to conduct its activities. This conclusion follows from paragraph 4 of Article 935 and Article 891 of the Civil Code of the Russian Federation. Consequently, the costs of this type of voluntary insurance cannot be taken into account when calculating income tax under subparagraph 10 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation.

Advice: there are arguments that allow organizations to take into account, when calculating income tax, the costs of voluntary insurance of property accepted for safekeeping, as expenses that are a condition of the custodian’s activities. They are as follows.

Organizations have the right to take into account the costs of all types of voluntary insurance, which are a condition for conducting their activities by virtue of the legislation of the Russian Federation (subclause 10, clause 1, article 263 of the Tax Code of the Russian Federation). At the same time, the concept of “condition for conducting activities” is not explained in the legislation of the Russian Federation. However, it is incorrect to interpret this term as “a mandatory requirement of the legislation of the Russian Federation.” All mandatory requirements form the compulsory insurance system. The voluntary insurance system gives the organization the right to insure its activities against possible losses, but does not oblige it to do so. This conclusion follows from the provisions of Articles 927, 935 of the Civil Code of the Russian Federation and paragraphs 3 and 4 of Article 3 of Law No. 4015-1 of November 27, 1992.

In accordance with the requirements of the Civil Code of the Russian Federation, the custodian is obliged to ensure the safety of the property entrusted to him (Article 891 of the Civil Code of the Russian Federation). Otherwise, he compensates for damage to it (Article 902 of the Civil Code of the Russian Federation). In this regard, the organization’s expenses for insuring property accepted for safekeeping can be considered as a condition for the custodian to conduct business. Moreover, if such a condition is specified in the storage agreement with the customer of services (Article 930, paragraph 4 of Article 421 of the Civil Code of the Russian Federation).

In letters dated April 17, 2007 No. 03-03-06/1/246, dated March 11, 2003 No. 04-02-05/2/13, the Russian Ministry of Finance expressed a different point of view. In them, the financial department classified the costs of voluntary insurance of property accepted for safekeeping according to subparagraph 7 of paragraph 1 of Article 263 of the Tax Code of the Russian Federation. This subclause allows you to take into account, when calculating income tax, the costs of voluntary insurance of property that the organization uses for income-generating activities. Property accepted for safekeeping satisfies the specified condition, therefore the custodian can include the costs of its insurance in reducing the tax base. This point of view is also shared by the tax service (see, for example, letter of the Federal Tax Service of Russia for Moscow dated June 16, 2006 No. 20-12/53511).

In the current situation, the organization must make the final decision on the issue of accounting for the cost of insuring property accepted for safekeeping when calculating income tax. Arbitration practice on this issue has not yet developed.

Advice: to avoid disagreements with inspectors, to take into account insurance costs when calculating income tax, economically justify and document them (clause 1 of Article 252 of the Tax Code of the Russian Federation).

In the situation under consideration, it would be reasonable to insure property in case of damage, theft, fire, etc. In this case, indicate in the storage agreement that property accepted for safekeeping must be insured at the expense of the custodian (Article 930, paragraph 4 of Art. 421 of the Civil Code of the Russian Federation).

In addition, during the inspection, the tax inspectorate can check whether the property transferred for safekeeping is not insured by the owner on the same grounds. If it is established that it is insured, the custodian’s expenses may be considered economically unjustified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

OTHER SITUATIONS

In the economic life of any organization, one-time situations may arise when it becomes necessary to take into account other people’s material assets, ensure their safety and reflect them in accounting in a way that does not contradict the law. There are at least three situations in which an organization may need to accept inventory items for safekeeping, and, as a result, provide accounting for off-balance sheet account 002. Let’s briefly consider them.

1. If for us, as a buyer, according to the terms of the contract, the transfer of ownership is provided only after payment of goods and materials to the supplier, but physically these goods and materials are already located on our territory.

2. We have received goods of inadequate quality, which will subsequently be returned to the supplier. But until this moment it is necessary to take it into account in account 002.

3. We sold the goods and materials, and the transfer of ownership has passed, but physically they are still on our territory.

If the situation arises is one-time in nature, then manual operations can be used.

Consider a situation in which we already physically have the goods, but since we have not paid for them, we cannot yet capitalize them and take them into account on account 41 “Goods”.

Enter a manual operation. Menu “Documents” - accounting and tax accounting - operation

We got the following result

07/01/2014 Dt 002 100 units of goods in the amount of 11,800 rubles

Let's assume that we paid for these goods on 07/07/2014

Dt60 Kt51 11800 rub.

Now on 07/07/2014 we can capitalize goods with the usual receipt of goods and services

Dt41 tKt60 10,000 rubles

Dt19 Kt60 1,800 rubles

We will not consider these documents, because... this is simple and not relevant to our topic.

And now we need to write off goods from account 002. We will also use manual operation.

07/07/2014 Kt002 100 units of goods in the amount of 11,800 rubles.

If necessary, you can create a virtual warehouse to reflect off-balance sheet inventory items on it.

In conclusion, we can say the following. If we have one or another situation related to responsible storage, then we can solve it using standard tools in 1C:UPP. But no special documents have been developed for such situations in standard configurations. And if accounting for safekeeping operations using standard means is not satisfactory for some reason, then the program will need to be modified in accordance with the wishes of a particular organization.

Thank you!

BASIS: VAT

Charge VAT on the entire amount of remuneration for services provided under the storage agreement (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

Situation: when should a storage organization (warehouse) charge VAT on revenue from the provision of storage services? The storage agreement was concluded for a period of more than one quarter. Payment for custodian services during the contract period is not provided.

On the last day of the tax period in which the services were provided.

From the literal interpretation of the provisions of subparagraph 1 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, it follows that VAT on the cost of services provided must be calculated after the storage agreement is completed. That is, when goods and materials accepted for storage will be returned to the owner on the basis of an act in form No. MX-3.

However, with regard to ongoing contracts, the terms of which do not provide for monthly payment for services provided, the financial department takes a different point of view. Letter No. 03-07-15/47 of the Ministry of Finance of Russia dated April 4, 2007 states that under such agreements the contractor must determine the tax base for VAT on the last day of the tax period in which the services are provided. Regardless of the frequency of payment for these services agreed upon by the parties. For more information about this, see How to calculate VAT on the sale of goods (work, services).

Situation: can the purchasing organization deduct “input” VAT on inventory items accepted for safekeeping before the transfer of ownership (inventory items are recorded in account 002)?

Answer: no, it cannot.

An organization has the right to submit “input” VAT for deduction if the following four conditions are simultaneously met:

- presentation of tax by suppliers;

- acquisition of property (work, services) for carrying out transactions subject to VAT, or acquisition of goods for resale;

- acceptance of acquired property (work, services) for registration;

- availability of an invoice.

This procedure is established by Article 171 of the Tax Code of the Russian Federation.

Despite the fact that inventory items have been accepted for accounting (recorded on account 002), until the transfer of ownership of them from the seller to the buyer, they are not recognized as acquired (Articles 223 and 491 of the Civil Code of the Russian Federation). Since one of the mandatory conditions for deducting VAT is not met in this case, the amount of “input” VAT cannot be deducted.

When it is not necessary to accept for safekeeping

Despite the fact that this operation is called mandatory in the law, there are a number of conditions under which the buyer may not accept the goods for safekeeping.

- The buyer selects a product and discovers that the assortment does not comply with the contract. He refuses to accept and pay for the goods (the basis is clause 1 of Article 468 of the Civil Code of the Russian Federation), and, naturally, does not take it to his warehouse for safekeeping.

- The supplier is present when accepting the goods. A quantity discrepancy is discovered, which the supplier agrees to. He immediately takes the unpaid goods back, a corresponding act is drawn up, there is no need for responsible storage.

- A product has been delivered that must be stored in a strictly defined manner. It was found that it did not meet the specifications specified in the contract. It makes sense to compare transport costs with the costs of the appropriate storage mode. If the first ones turn out to be lower, the goods should be returned immediately without being accepted for storage.

NOTE! When concluding a supply agreement, the parties can enter into it conditions according to which goods that do not comply with the parameters of the agreement can be returned without being accepted for safekeeping.

simplified tax system

When goods and materials are received for storage, ownership rights do not pass to the custodian organization (commodity warehouse) (clause 1 of Article 886 of the Civil Code of the Russian Federation). Therefore, when calculating the single tax, their cost is not reflected in either income or expenses (Articles 39, 346.15 and 346.16 of the Tax Code of the Russian Federation).

Regardless of the chosen object of taxation, include income from the provision of storage services in the calculation of the tax base after they are paid (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization applies a simplified tax system and pays a single tax on the difference between income and expenses, then take into account the costs associated with the provision of storage services after they have been paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Organizations that apply a simplified tax system with the object of taxation “income” do not take into account expenses when calculating the single tax (Article 346.14 of the Tax Code of the Russian Federation).

UTII

By decision of local authorities, activities related to the provision of services for storing cars in paid parking lots can be transferred to UTII (clause 1, subclause 4, clause 2, Article 346.26 of the Tax Code of the Russian Federation). The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the receipt and disposal of inventory items accepted for safekeeping does not affect the calculation of UTII. Since UTII payers are not exempt from accounting, they are required to maintain off-balance sheet accounting of inventory items accepted for safekeeping in the same manner as organizations applying the general taxation system.