Learn more about off-balance sheet accounts

In accountant accounting, along with balance sheet accounts, 11 off-balance sheet accounts are used, including 007.

In general, the purpose of any off-balance sheet account is to store records of assets that do not belong to a particular enterprise, but are temporarily available to it.

The presence of such entries in the balance sheet is due to Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n “On approval of the Chart of Accounts”.

The peculiarity of this data is that the summaries on it are not indicated in cross order, but are indicated only by debit or credit.

Registers for reports and accounting policies are also simplified for recording; they indicate only receipts.

Almost every institution opens an off-balance sheet account for entering data on certain records (receipts, fuel coupons, tickets, diplomas, etc.), as well as any information indicating the possibility of receiving payment.

The amount intended to be indicated on the off-balance sheet account must be stored there for a period of 5 years after its transfer from the accounting balance.

What are accounts receivable?

Accounts receivable are funds owed to a legal entity or entrepreneur by counterparties.

Below are the main cases of occurrence of receivables and accounts for their accounting according to the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2001 No. 94n):

| Situation | Accounting account |

| The supplier received an advance payment, but did not ship goods and materials or did not perform the agreed services | 76, 60 |

| The buyer did not pay for the valuables supplied or services received | 76, 62 |

| The borrower did not repay the loan received | 73, 76, 58 |

| The employee did not report on accountable amounts | 71 |

NOTE! We consider the nuances of accounting and writing off receivables from legal entities. Entrepreneurs are not required to keep accounting on the basis of Art. 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, but they can, at their own discretion, reflect receivables according to accounting rules.

The legislative framework for accounting for accounts receivable is represented by the following standards:

- Civil Code of the Russian Federation;

- Tax Code of the Russian Federation;

- regulations on accounting and accounting in the Russian Federation (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, hereinafter referred to as Regulation No. 34n);

Unfortunately, counterparties are not always in a hurry to pay off their debts. Therefore, in a number of situations, accounts receivable are considered uncollectible and are written off.

If you doubt the return of receivables, you must create a reserve for doubtful debts in your accounting. In tax accounting, such a reserve is not created in all cases.

ConsultantPlus experts explained how to properly form a reserve for doubtful debts. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Legal regulation

According to clause 77 of the “Regulations on Accounting and Reporting in the Russian Federation”, all bad debts of an enterprise must be written off at a loss.

Debt obligations are written off after the expiration of the limitation period (see Article 196 of the Civil Code of the Russian Federation), that is, after 3 years.

However, this rule applies only to a claim for which the creditor has done everything possible to return the asset.

In other cases, receivables are considered unclaimed and are taken into account on the enterprise’s balance sheet in accordance with legal requirements after 4 months from the date the debtor receives the loan and there is no payment at all.

Write-off of accounts receivable. Accounting workshop

Accounts receivable

it is customary to call the debt of any legal or natural persons (debtors) to a given organization.

Thus, accounts receivable may include

debts of buyers for purchased goods (works, services), debt of the supplier resulting from the transfer of advance amounts to the supplier, etc.

According to clause 77 of the Regulations on accounting and financial reporting in the Russian Federation

, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, receivables for which the statute of limitations has expired, other debts that are unrealistic for collection

are written off for each obligation based on the inventory data, written justification and order (instruction) of the head of

the organization and are respectively credited to the reserve for doubtful debts or to the financial results of a commercial organization.

Art. 196 Civil Code of the Russian Federation

It is established that the general limitation period is

three years

.

It should be borne in mind that in cases where a claim is brought against the debtor or the debtor has admitted his debt, the limitation period is interrupted

.

After the break, the limitation period begins anew; the time elapsed before the break is not counted towards the new term ( Article 203 of the Civil Code of the Russian Federation

).

Therefore, if the receivables were formed, for example, 5 years ago, but the debtor two and a half years ago took actions indicating recognition of the debt

(for example, asked for a deferred payment, paid off part of the debt, etc.), then the creditor cannot write off such debt - the limitation period begins

anew

from the date of signing the debt reconciliation act or acceptance of the statement of claim by the court.

Since debts that are unrealistic to

, then, for example, if the debtor organization was liquidated, such debt must be written off

without waiting for the expiration of the statute of limitations

, if there are documents confirming the fact of liquidation of the debtor company.

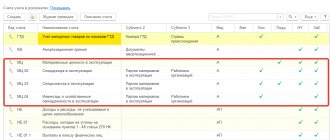

Used accounting

According to the Instructions for using the Chart of Accounts...

To summarize information about the state of receivables written off at a loss due to the insolvency of debtors,

account 007 “Debt of insolvent debtors written off at a loss”

.

Write-off receivables must be taken into account off the balance sheet for five years from the date of write-off

to monitor the possibility of its collection in the event of a change in the property status of the debtors.

Analytical accounting for account 007 “Debt of insolvent debtors written off at a loss” is maintained for each debtor

, whose debt is written off at a loss, and to each debt written off at a loss.

Provision for doubtful debts is not created

In accounting, amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection are recognized as non-operating expenses

(

clause 12 PBU 10/99 “Organization expenses”

).

Accounts receivable for which the statute of limitations has expired and other debts that are unrealistic for collection are included in the organization's expenses in the amount in which the debt was reflected in the organization's accounting records.

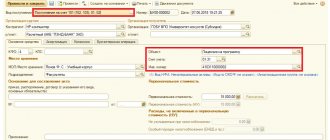

The write-off of accounts receivable is reflected in the accounting records by the following entries:

DEBIT 91 “Other income and expenses” CREDIT 62 “Settlements with buyers and customers”, 60 “Settlements with suppliers and contractors”, etc.

– the amount of receivables is written off as a non-operating expense.

DEBIT 007 “Debt of insolvent debtors written off at a loss”

– the written off debt is included in the balance sheet.

If the debtor has repaid a debt that was previously written off

, the following accounting entries must be made:

DEBIT 50 “Cash”, 51 “Current accounts” CREDIT 91

– a sum of money has been received to repay previously written off receivables

or

DEBIT 10, 41 CREDIT 91

– non-cash funds were received to repay previously written off receivables.

CREDIT 007

– the amount of repaid accounts payable is removed from off-balance sheet accounting.

Accounting for the creation of provisions for doubtful debts

According to clause 70 of the Regulations on accounting and financial reporting in the Russian Federation

An organization can create

reserves for doubtful debts

for settlements with other organizations and citizens for products, goods, works and services, attributing the amounts of reserves to the financial results of the organization.

A doubtful debt is considered

receivables of an organization that are not repaid within the terms established by the contract and are not secured by appropriate guarantees.

The reserve for doubtful debts is created based on the results of the inventory

receivables of the organization.

Reserve amount

is determined separately for each doubtful debt depending on the financial condition (solvency) of the debtor and the assessment of the likelihood of repaying the debt in whole or in part.

If by the end of the reporting year following the year in which the reserve for doubtful debts was created, this reserve is not used in any part, then the unspent amounts are added

when preparing the balance sheet at the end of the reporting year

to financial results

.

In accounting, provisions for doubtful debts are recognized as operating expenses

.

for doubtful debts ” is intended to summarize information on reserves for doubtful debts.

.

An accounting entry is made for the amount of reserves created:

DEBIT 91 CREDIT 63 “Provisions for doubtful debts”

– a reserve for doubtful debts has been created.

Write-off of accounts receivable from the reserve

for doubtful debts is reflected by the entry:

DEBIT 63 CREDIT 62

– uncollected receivables are written off against the reserve for doubtful debts.

The addition of unused amounts of reserves for doubtful debts to the profit of the reporting period following the period of their creation is reflected by the entry:

DEBIT 63 CREDIT 91

.

Note!

According to the Ministry of Finance of the Russian Federation, for a purchasing organization that has transferred an advance payment for goods in accordance with the contract, the supplier’s obligations to ship products cannot be considered as debt for which a reserve for doubtful debts is formed ( letter dated October 15, 2003 No. 16-00- 14/316

).

From a literal reading of clause 70 of the Regulations on accounting and financial reporting in the Russian Federation

such a conclusion does not follow, however, the Ministry of Finance of the Russian Federation believes that this norm refers to obligations

to pay

for products, goods, work, and services that were not fulfilled on time.

Tax on corporate profits

Provision for doubtful debts is not created

According to paragraphs 2 p. 2 art. 265 Tax Code of the Russian Federation

amounts of bad debts, and if the taxpayer has decided to create a reserve for doubtful debts, also amounts of bad debts not covered by the reserve funds are recognized for profit tax purposes as

non-operating expenses

.

Bad debts

(debts unrealistic for collection) are those debts to the taxpayer for which the established limitation period has expired, as well as those debts for which, in accordance with civil law, the obligation has been terminated due to the impossibility of its fulfillment, on the basis of an act of a state body or the liquidation of an organization (

p 2 Article 266 of the Tax Code of the Russian Federation

).

Thus, written off receivables are recognized as non-operating expenses

and reduces the tax base for corporate income tax.

At the same time, as the Ministry of Finance of the Russian Federation has repeatedly explained, for profit tax purposes, the taxpayer has the right to write off as expenses the entire amount of receivables , including VAT

(see, in particular,

letter of the Ministry of Finance of the Russian Federation dated October 7, 2004 No. 03-03-01-04/1/68

).

A reserve for doubtful debts is created

For profit tax purposes, doubtful debt is considered

any debt to the taxpayer if this debt is not repaid within the time limits established by the agreement and is not secured by a pledge, surety, or bank guarantee (

Article 266 of the Tax Code of the Russian Federation

).

Amounts of deductions to reserves for doubtful debts are included in non-operating expenses on the last day of the reporting (tax) period.

due to non-payment of interest are not included in non-operating expenses.

, with the exception of banks.

The amount of the reserve for doubtful debts is determined based on the results of the inventory of receivables carried out on the last day of the reporting (tax) period and is calculated as follows:

1) for doubtful debts with a period of occurrence exceeding 90 days

– the amount of the created reserve includes the full amount of debt identified on the basis of the inventory;

2) for doubtful debts with a period of occurrence from 45 to 90 days

(inclusive) – the amount of the reserve includes 50 percent of the amount of debt identified on the basis of the inventory;

3) for doubtful debts with a period of up to 45 days

– does not increase the amount of the created reserve.

At the same time, the amount of the created reserve for doubtful debts cannot exceed 10 percent of revenue

reporting (tax) period.

The reserve for doubtful debts can be used by an organization only to cover losses from bad debts.

The amount of the reserve for doubtful debts that was not fully used by the taxpayer in the reporting period to cover losses on bad debts may be transferred to the next reporting (tax) period.

.

In this case, the amount of the reserve newly created based on the results of the inventory must be adjusted

by the amount of the reserve balance of the previous reporting (tax) period.

If the taxpayer has decided to create a reserve for doubtful debts, bad debts are written off at the expense of the amount of the created reserve

.

If the amount of the created reserve is less

the amount of bad debts subject to write-off, the difference (loss) is subject to inclusion

in non-operating expenses

.

Obviously, only organizations that determine revenue for profit tax purposes using the accrual method

.

Since the organization makes the decision to form a reserve for doubtful debts voluntarily

(that is, the organization can, but is not obligated to, create a reserve), then

the decision to create such a reserve must be recorded in the organization’s accounting policies

.

When creating a reserve for doubtful debts, accounts receivable are taken into account in the amounts presented by the seller to the buyer, including taking into account value added tax

.

This opinion is shared by the Ministry of Finance of the Russian Federation and the Ministry of Taxes of the Russian Federation (FTS) ( letter of the Ministry of Finance of the Russian Federation dated July 09, 2004, Ministry of Taxes of the Russian Federation dated September 5, 2003.

).

Value added tax

According to Art. 167 Tax Code of the Russian Federation

taxpayers can determine the tax base when selling goods using one of two methods: “by shipment” or “by payment”.

When writing off accounts receivable, taxpayers determine the tax base for VAT at the time of shipment

goods, do not make any recalculations for VAT - they have already accrued and paid VAT in the period when the goods (work, services) were actually shipped (performed, provided).

Taxpayers determining the tax base for VAT at the time of payment for shipped goods

, must remember that if the buyer fails to fulfill the counter-obligation related to the delivery of goods (performance of work, provision of services) before the expiration of the limitation period, the

date of payment for goods (work, services) is recognized as

the earliest of the following dates:

1) the day of expiration of the specified limitation period;

2) the day the accounts receivable are written off ( clause 5 of Article 167 of the Tax Code of the Russian Federation

).

That is, at the moment the statute of limitations expires or accounts receivable are written off, the taxpayer has an obligation to pay VAT to the budget

from the amount of uncollected receivables.

In this case, the following accounting entry must be made:

DEBIT 76, subaccount “VAT” CREDIT 68 “Calculations for taxes and fees”, subaccount “Calculations for VAT”

– VAT payable to the budget has been accrued.

Note!

VAT to the budget when writing off receivables or expiration of the statute of limitations must be accrued only in relation to receivables resulting from transactions recognized as subject to VAT taxation

according to

paragraph 1 of Art.

146 Tax Code of the Russian Federation .

is not subject to VAT taxation

.

Therefore, when writing off receivables resulting from an advance payment to the supplier, there is no need

.

According to clause 39.6 of the Methodological Recommendations for the Application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation

, approved by order of the Ministry of Taxes of the Russian Federation dated December 20, 2000 No. BG-3-03/447, for goods (work, services) shipped (performed, provided)

before January 1, 2004

, subject to taxation at a tax rate of 20 percent, Tax calculation is carried out at a tax rate of 20%,

regardless of the moment of receipt of payment

for the specified goods (work, services).

That is, when writing off accounts receivable in 2005 for goods shipped, for example, in 2002, VAT must be charged at a rate of 20%

, regardless of the fact that at the time of write-off the tax rate is 18%.

Main purpose

Off-balance sheet account 007 contains information on bad debts of counterparties who received services or goods from the enterprise written off at a loss within 5 years after the expiration of the statute of limitations.

Analytics is systematically carried out for each case of debt write-off separately. It is necessary to monitor the state of the defaulter’s financial affairs: perhaps the debtor will still pay off his debt.

In order for debt obligations to be written off in full, an explanatory note to the accounting is required, which provides a detailed description of the ongoing collection of information about the possibility of repaying the debt to the enterprise.

The entire write-off process is carried out after the inventory count and on the basis of the manager’s order.

Accounts receivable fall off the balance sheet of the organization after it is identified during the inventory process, which is carried out every 3 months.

Then the company must take all legal measures to return the funds and only after that transfer the debt as an entry to 007.

Accounting Rules

Debts are written off for 007 after receiving an inventory report and issuing an order from the manager through the use of the reserve for doubtful debts and other expenses.

As a result, the following entries are made:

- Dt 63, 91 Kt 62, 60, 58, 76 – recognition of the liquidated debt as bad;

- Dt 007 – accounting for bad debt on the balance sheet of the enterprise.

In this case, data on debtors and their debts must be stored in full for 5 years (or until the financial situation of the debtor changes), which is what account 007 is intended for.

If the debtor makes a refund, the other income accounts are debited with the cash accounting entries.

In addition to the above, the following entries are also made:

- Dt 50 – 52 Kt 62, 58, 60, 76 – receipt of debt from the debtor;

- Dt 62, 60, 58, 76 Kt 91 – counting the amount of debt obligations into the profit of the enterprise;

- Kt 007 – deleting information about the debt amount from balance sheet 007.

The debt entry is excluded from loan 007 if the 5-year period has expired or the debtor has been liquidated.

It is worth noting that making entries in off-balance sheet accounts of organizations for bad debts of debtors occurs in almost every enterprise.

This information makes it possible to indicate any transactions related to the use of reserves and property not only by debtors, but also by employees of the organization.

Postings to account “07”

By debit

| Debit | Credit | Content | Document |

| 07 | 000 | Entering initial balances: equipment requiring installation | Entering balances |

| 07 | 19.01 | Inclusion in the price of equipment requiring installation of the amount of non-refundable VAT paid upon purchase | VAT write-off |

| 07 | 23 | Acceptance for accounting of equipment requiring installation, manufactured by auxiliary production | Operation |

| 07 | 23 | Inclusion in the price of equipment requiring installation and auxiliary production services | Operation |

| 07 | 60.01 | Acceptance for accounting of equipment requiring installation received from the supplier under a contract in rubles. | Receipts (acts, invoices) |

| 07 | 60.21 | Acceptance for accounting of equipment requiring installation received from the supplier under a contract in foreign currency | Receipts (acts, invoices) |

| 07 | 60.31 | Acceptance for accounting of equipment requiring installation received from the supplier under a contract in cu. | Receipts (acts, invoices) |

| 07 | 66.03 | Acceptance for accounting of equipment requiring installation received under a short-term loan agreement in rubles. | Operation |

| 07 | 66.04 | Reflection of debt for payment of interest under a loan agreement (short-term) in rubles. The interest amount is included in the cost of equipment requiring installation | Receipts (acts, invoices) |

| 07 | 66.04 | Accrual of interest on a short-term loan agreement in rubles. The interest amount is included in the cost of equipment requiring installation | Operation |

| 07 | 66.23 | Acceptance for accounting of equipment requiring installation received under a loan agreement (short-term) in foreign currency | Receipts (acts, invoices) |

| 07 | 66.24 | Reflection of debt for payment of interest under a loan agreement (short-term) in foreign currency. The interest amount is included in the cost of equipment requiring installation | Receipts (acts, invoices) |

| 07 | 67.03 | Acceptance for accounting of equipment requiring installation received under a long-term loan agreement in rubles. | Operation |

| 07 | 67.03 | Acceptance for accounting of equipment requiring installation received under a loan agreement (long-term) in rubles | Receipts (acts, invoices) |

| 07 | 67.04 | Accrual of debt for interest payments under a long-term loan agreement in rubles. The interest amount is included in the cost of equipment requiring installation | Operation |

| 07 | 67.04 | Reflection of debt for payment of interest under a loan agreement (long-term) in rubles. The interest amount is included in the cost of equipment requiring installation | Receipts (acts, invoices) |

| 07 | 71.01 | Inclusion in the cost of equipment requiring installation, expenses of the accountable person in rubles. | Advance report |

| 07 | 71.21 | Inclusion in the cost of equipment requiring installation of expenses of the accountable person in foreign currency | Advance report |

| 07 | 75.01 | Acceptance for accounting of equipment requiring installation received as a contribution to the authorized capital | Operation |

| 07 | 76.05 | Inclusion in the price of equipment that requires installation of additional services related to the purchase (transport services, intermediary fees, etc.) | Receipts (acts, invoices) |

| 07 | 98.02 | Acceptance for accounting of equipment requiring installation, received free of charge, including under a gift agreement | Operation |

By loan

| Debit | Credit | Content | Document |

| 08.03 | 07 | Inclusion in capital construction costs of the cost of equipment requiring installation (equipment transferred for installation) | Transfer of equipment for installation |

| 23 | 07 | Installation or large-scale assembly of equipment in an auxiliary production workshop | Operation |

| 76.02 | 07 | Return of equipment requiring installation to the supplier under a contract in rubles. | Returning goods to the supplier |

| 91.02 | 07 | Write-off of the cost of equipment requiring installation in connection with its sale or disposal under an exchange agreement | Operation |

| 91.02 | 07 | Decommissioning (liquidation) of equipment requiring installation as a result of natural disasters, fires and other emergency circumstances | Operation |

| 91.02 | 07 | Write-off of the cost of equipment requiring installation, transferred free of charge, including under donation agreements | Operation |

| 94 | 07 | Shortage or damage to equipment requiring installation | Write-off of goods |