Who is entitled to social benefits for education?

When receiving income, any individual is obliged to pay tax on this income to the state budget. For individuals, this is the personal income tax – personal income tax. The state provides its citizens with various tax benefits. One of these personal income tax benefits is the right to receive a social deduction for training (Article 219 of the Tax Code of the Russian Federation).

It is worth considering that personal income tax rates are not the same for every type of income. The basic personal income tax rate is 13%. But there are others:

- 30% – for non-residents;

- 15% – for income over 5 million rubles;

- 35% – for income in the form of winnings, etc.

IMPORTANT!

A tax deduction for education can only be obtained if you have income taxed at a rate of 13% personal income tax.

Thus, if in one tax period (calendar year) you received income taxed at a rate of 13% and studied for a fee, then you have the right to receive a deduction for education.

You also have the right to a deduction if you child (ward), brother or sister was trained . At the same time, you also paid for the training.

Let us summarize in the diagram who is entitled to a social deduction for education and who is not.

Who is eligible for a refund?

A deduction for training can only be claimed if you have income subject to personal income tax at a rate of 13%. After all, you can return from the budget the tax that was previously paid there (in particular, personal income tax, which was withheld by the employer from your salary and transferred to the budget).

If you do not have such income, then you will not be able to receive a deduction. For example, non-working pensioners, students without income, and mothers on maternity leave will not be able to receive a refund.

A deduction for training can be received by individuals who have paid for:

- your training;

- training your children and wards;

- education of their brothers and sisters (including half-siblings).

That is, the deduction is not due to a grandfather/grandmother who paid for the education of a grandson/granddaughter, a stepfather/stepmother who paid for the education of a stepson/stepdaughter, an aunt/uncle who paid for the education of nephews, a husband who paid for the education of his wife (and vice versa). But when a husband pays for his wife’s tuition (and vice versa), the deduction can be received by the one who studies

The essence of the personal income tax deduction

What is the meaning of the personal income tax deduction? There are several types of personal income tax deductions, but the essence of their application is the same.

Personal income tax is calculated as a percentage of the tax base. A deduction is an amount by which the tax base can be reduced.

IMPORTANT!

A deduction is not an amount that can be returned, but an amount by which the tax base is reduced.

Let's look at an example. The income for the year amounted to 100,000 rubles. Deduction – 20,000 rubles. What will be the tax without applying the deduction and with applying the deduction?

Thus, when applying the personal income tax deduction, it becomes less. If the tax base for the year was calculated without taking into account the deduction, then personal income tax was overpaid, and the overpayment can be returned.

The next question is what amount of tax deduction can be applied.

Spouse tuition deduction

The officials in the letter in question noted that, according to paragraph 1 of Article 256 of the Civil Code of the Russian Federation, property acquired by spouses during marriage is their joint property, unless an agreement between them establishes a different regime for this property.

A spouse who is studying in an organization engaged in educational activities, subject to the established conditions, has the right to apply for a social tax deduction, regardless of which spouse contributed the funds and which spouse received documents confirming actual expenses.

A spouse who is not studying in an organization engaged in educational activities is not provided with a social tax deduction. For example, my wife studies at a driving school. Her husband paid for her studies. The spouse cannot receive a deduction, since he was not the one who studied. The spouse whose education is paid for has the right to receive a deduction for herself, regardless of who is indicated on the receipt. Previously, the Russian Ministry of Finance took a different point of view, citing the fact that Article 219 of the Tax Code of the Russian Federation does not provide for a social tax deduction for the education of a spouse.

Limit on the amount of social deduction for training

The deduction is equal to the amount actually incurred (subclause 2, clause 1, article 219 of the Tax Code of the Russian Federation). This amount must be paid during the tax period (calendar year). However, there is a limit for it. Moreover, there are 2 types of limits:

Thus, the maximum possible return from the use of a social deduction is the overpayment of personal income tax in the amount of: 120,000 × 13% = 15,600 rubles.

Let us repeat that in addition to the deduction for training, there is also a deduction for treatment, pension contributions and other types of social deductions. The limit of 120,000 rubles applies in total to all social deductions (except for expensive treatment and education of children).

If suddenly the tax base for personal income tax for the year is less than the deduction amount, then the tax payable for the year is 0, and the balance is not carried over to the next tax period (calendar year).

How can you return overpaid personal income tax taking into account the deduction for training?

Tax deduction for sibling's education

An individual, as already noted, can take advantage of a tax deduction for education on amounts allocated for the education of a brother/sister.

To do this you need to:

- the specified training was also carried out with a license;

- brother/sister's age was under 24 years;

- training took place full-time.

To find out whether a deduction is possible for part-time education, read the material “A parent is not entitled to a personal income tax deduction for part-time education of a child.”.

It should be noted that a brother/sister can be considered as such if there is at least one common parent.

The deduction is received provided that the taxpayer himself appears in the agreement with the educational institution and payment documents. To confirm the degree of relationship, photocopies of the birth certificates of the applicant and the student are provided.

Methods for returning personal income tax - applying deductions

So, without applying the deduction, the result is an overpayment of personal income tax to the budget. How can I return this overpayment? There are 2 ways to receive a deduction:

- through the employer - tax agent,

- on one's own.

The employer pays wages and withholds personal income tax from it monthly and transfers it to the budget. If you receive a deduction through your employer, he will reduce the tax base by the deduction every month. Accordingly, reduce personal income tax payable to the budget. And in fact, you will receive a larger amount in your hands.

In the second case, the employer calculates personal income tax without taking into account the deduction, which results in an overpayment of personal income tax. At the end of the tax period, you independently contact the tax office, confirm your right to deduction, and the tax office returns the amount of overpayment for personal income tax.

Thus, you can receive a personal income tax deduction gradually throughout the year through your employer or all at once in the next tax period.

Remember

- Only those who work “in white” can count on a tax deduction for education.

- You can receive a deduction for yourself for any form of training. An important condition is that the educational organization has a license.

- You can receive a deduction not only for yourself, but also for the education of children, wards, brothers and sisters under the age of 24, but only in full-time education.

- The statute of limitations for receiving a deduction is three years from the date of payment for tuition.

- The maximum amount from which personal income tax is returned is 120,000 rubles. and 50,000 rub. when teaching children. That is, you can get 15,600 rubles for your training. per year, and for a child - 6,500 rubles.

- You can submit an application for a deduction to the Federal Tax Service at your place of residence or through your employer. There are three options for submitting to the Federal Tax Service: online (the most convenient), in person and by mail. When submitting an application through your employer, you will still have to go to the Federal Tax Service to request a notification of your right to a deduction, and then to pick up this notification.

- The set of documents for receiving a deduction for yourself includes: a tax return in form 3-NDFL (not needed if you receive a deduction through an employer), a copy of the training agreement, a copy of the license of the educational organization, copies of payment documents, an application for a personal income tax refund, a copy of the passport. Keep originals of all documents

See also: Advantages of the Russian School of Management

Ivan Ilyin Chief Editor of the Russian School of Management

Necessary conditions for the return of personal income tax for training

We have already given some important conditions. Let’s add a few more and summarize all the important nuances of receiving a deduction for education.

One of the main conditions for obtaining a tax deduction for education is the presence of an appropriate license from an educational organization or an entry in the Unified State Register of Entrepreneurs stating that an individual entrepreneur is engaged in educational activities (since individual entrepreneurs engaged in education without the involvement of third parties have the right not to obtain a license) .

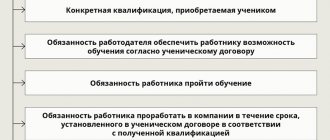

Let’s put the main conditions for receiving a deduction for education on the diagram:

The year 2020 was marked by the coronavirus pandemic, due to which all educational institutions switched to distance learning. Is it possible to consider distance learning full-time and receive a deduction for such education for a child? Yes, it is possible, since full-time and correspondence forms of education differ in the format of student-teacher communication. During distance learning, the face-to-face format did not stop, it only moved into another form – online.

Tax deduction for a child’s education at a university and other institutions in 2022

There are some features of the emergence of the right to apply a tax deduction for education when children receive education:

- daughter/son must be no older than 24 years old;

- form of education - full-time only;

- An educational institution must have a license that confirms its educational status.

Read about the possibility of a stepfather receiving a deduction in the material “The stepfather will not be given a deduction for a child’s education.”

If these requirements are collectively met, then by collecting the necessary package of documents and filling out the 3-NDFL declaration, an individual can count on a tax deduction for education.

In this case, full-time education can be provided by the following institutions:

- private educational school;

- kindergarten;

- child development center;

- music school, art studio, sports club;

- university, school, college;

- other educational institutions.

Example

The citizen has two children under the age of 24. One child is engaged in painting, the other is studying at the evening department of the university.

During the year, the citizen incurred the following expenses:

- for painting - 60,000 rubles;

- for higher education - 150,000 rubles.

A citizen can take advantage of a deduction of 50,000 rubles. only from the funds spent on drawing, because The form of education for the 2nd child is evening and no refund is provided in this case.

The tax deduction for education is applied on the basis of the above-mentioned package of documents, and the degree of relationship in this case will be confirmed by the child’s birth certificate.

IMPORTANT! If an individual paid for the education of children from maternity capital funds, it will not be possible to return personal income tax.

For other deductions that a parent can take advantage of, see the article “Art. 218 of the Tax Code of the Russian Federation (2016-2017): questions and answers" .

Procedure for receiving a deduction

As already mentioned, there are 2 ways to apply the social tax deduction. Let's consider the procedure for obtaining it for each method.

DEDUCTION FROM EMPLOYER

To receive a deduction for training from an employer, you must confirm your right to it with the tax authority and only then contact the employer. Let's present the algorithm of actions in the table.

| ACTIONS | REQUIRED DOCUMENTS | RESULT |

| 1. Applying to the tax authority for confirmation of the right to receive a social tax deduction. This can be done either in person or through the taxpayer’s personal account. | 1. Application for confirmation of the right to deduction in the form recommended in the letter of the Federal Tax Service of Russia dated January 16, 2017 No. BS-4-11/500. 2. Agreement with an educational institution. 3. License. 4. Documents confirming payment in cash by the taxpayer. To receive a deduction for the education of children and a brother/sister, you additionally need:

| Receiving a notification from the tax office within 30 days confirming the right to deduction. The notification is drawn up on a specific form recommended in the letter of the Federal Tax Service of Russia dated January 16, 2017 No. BS-4-11/500. |

| 2. Contacting the employer | 1. Notification from the tax office. 2. Application in free form. | The employer, starting from the month of contacting him, begins to provide a social deduction. That is, he reduces the tax base, transfers personal income tax in a smaller amount, and the taxpayer receives a salary greater than before the deduction was issued. |

If the employer does not apply the deduction, he will have to recalculate the tax and return the excess withheld.

If the employer did not manage to include the entire required deduction amount in the calculation of the tax base (for example, the taxpayer contacted him at the end of the year), then the unused portion cannot be , but you can return the unused balance by independently contacting the tax office.

INDEPENDENT RECEIPT OF DEDUCTION

If the taxpayer did not apply to the employer to apply for a deduction for training, he can return the overpayment of taxes on his own. We present the action algorithm in the table.

| ACTIONS | REQUIRED DOCUMENTS | RESULT |

| Applying to the tax authority to receive a social deduction for education. You can provide documents either in person or through the State Services portal (you must have a verified account), as well as through the taxpayer’s personal account | 1. Declaration 3-NDFL. 2. Certificates of income of an individual (2-NDFL). 3. Agreement with an educational institution. 4. License. 5. Documents confirming payment in cash by the taxpayer. To receive a deduction for the education of children and a brother/sister, you additionally need:

| The desk audit of the declaration takes place within 3 months . Upon successful completion of the audit and confirmation of the right to deduction, the tax authority transfers funds to the payer’s account specified in the 3-NDFL declaration (application). |

If you missed the deadline for filing a 3-NDFL declaration to receive a deduction for education, you can do this for the previous 3 years. For example, if in 2022 you met all the conditions for receiving a deduction, but for some reason you did not use it, then in 2022 you can still do this. But it’s too late to receive a deduction for 2022.

IMPORTANT!

If in the year of study there was no income taxed at a rate of 13%, and later they appeared, this does not mean that you can reduce the tax for later periods by deducting training completed in previous tax periods. Income and training must be within the same tax period (calendar year).

Next, we will consider in more detail the procedure for filling out the 3-NDFL declaration to receive a social deduction for education in 2022.

Documents for tuition deduction

At the end of the calendar year in which a person spent on training, he has the right to apply for a deduction to his tax office. Here are the documents you will need:

- declaration in form 3-NDFL;

- training agreement with annexes and additional agreements thereto;

- payment documents;

- documents confirming the degree of relationship and age of the student;

- document confirming full-time attendance;

- application for personal income tax refund.

How to fill out and submit 3-NDFL for a refund of tuition fees

The most convenient and fastest way to tell the tax office about your right to deduction is to fill out a declaration online on the Federal Tax Service website:

- there is guaranteed to be the latest current declaration form (and they change annually);

- The data of 2-NDFL certificates is automatically pulled up (they do not need to be taken from the employer);

- the program displays only necessary to fill out (in the paper 3-NDFL declaration there are a lot of sections that are simply not needed to receive a deduction).

How to get a tax deduction for a student's education

If a citizen has rights to guardianship, he can take advantage of a tax deduction for the education of a legal ward.

Refunds are possible:

- if the educational institution has an educational license;

- the ward is no more than 18 years old;

- education is full-time.

IMPORTANT! After the ward turns 18 years old, the right to a tax deduction for education from the person paying for his education also remains until the student reaches 24 years of age.

To receive a deduction in this situation, a document confirming guardianship is added to the required documents sent to the Federal Tax Service.

FILLING 3-NDFL WITH DEDUCTION FOR TRAINING

If you still decide to fill out the form on paper, you can download the form used in 2022 for the 2020 report here:

Let us remind you: for 2022 and 2022, forms different from those presented were used. If you submit data for several years, for each year you need to use Form 3-NDFL, which is valid specifically for that year.

We have given the 3-NDFL declaration in full. We will consider below which sheets to use and how to fill them out to receive a deduction for education. Let’s assume that no other deductions or additional income are claimed.

Here are the sheets that must be filled out to receive a tuition deduction.

| SHEET | COMMENTS ON COMPLETION |

| Title page | Here you indicate information about the taxpayer: INN, full name, date and place of birth, telephone number and passport, code of the tax authority where you are filing the declaration (usually at the place of registration of the individual). The primary declaration is submitted with the adjustment number “0–”. All subsequent ones are adjustments. They are numbered in order: “1–”, “2–” and so on. Tax period – 34, reporting year – 2022, taxpayer category code – 760, taxpayer status code – 1. |

| In the header of each sheet indicate the TIN and full name. taxpayer | |

| Section 1 | Here you only need to fill out item 1, since you need a refund of the overpaid tax. Line 010 – “2 – return from the budget” Line 020 – KBK NDFL 182 1 01 02 010 01 1000 110 Line 030 - indicate the OKTMO according to which the excess personal income tax was paid (the tax agent's OKTMO can be found in the 2-NDFL certificate). If there are several of them, then fill in several blocks of lines 010 – 050 Line 040 – not filled in Line 050 = line 160 of section 2 (calculated amount to be returned from the budget) |

| Appendix to section 1 | This is an application for a refund of overpaid tax. It has been included in the 3-NDFL declaration since 2022. Previously, it had to be written separately. Here only the second part “about the return” is filled out. The first part “about the test” is left empty. Line 095 – serial number of the application data for lines 100 (return amount), 110 (KBK), 120 (OKTMO) - taken from the corresponding lines of section 1 Line 130 – GD.00.2020 Next, enter the details of the bank account to which the money should be transferred. Here it is important to enter the current account number, not the bank card number. |

| Section 2 | Here the total amount to be refunded is calculated. Line 002 – “3 – other” Line 010 – contains the total amount of income from all 2-NDFL certificates Line 020 – fill in if Appendix 4 is completed Line 030 = line 010 – line 020 Line 040 = sum of all deductions (page 200 of Appendix 5) Line 060 = line 030 – line 040 Line 070 = line 060 × 13% Line 080 = the amount of tax withheld by the employer (taken from 2-NDFL certificates) Line 160 = line 080 – line 070. This means that when calculating tax using a deduction, its amount is less than that withheld by the employer. Therefore, an overpayment occurs (indicated on page 160), and this amount must be returned from the budget. |

| Annex 1 | Here they enter data from income certificates (2-NDFL) issued by the employer. All fields specified in the application are in 2-NDFL. If there were several sources of income, fill out some application sections. Line 020 – “07” for income from employment contracts |

| Appendix 4 | Fill in only if there was non-taxable income specified in this application and a certificate from the employer (for example, financial assistance in the amount of 4,000 rubles) |

| Appendix 5 | This reflects the deductions to which the taxpayer is entitled. Since we are talking about the tuition deduction, let’s focus on it. Let's assume that there are no other deductions. Section 1. Employer tax agents usually provide standard child tax deductions. Data on standard deductions provided by the employer are indicated in the income certificate (2-NDFL). They should be transferred to line 070. If you do not add other standard deductions, then line 080 = line 070. Section 2. Line 100 reflects the costs of training children (wards), but not more than 50,000 rubles for each child (i.e., if there are two children studying, put no more than 100,000 rubles, etc.). It must be remembered that the deduction is total for both parents. Line 120 = line 100 Section 3. In line 130 enter the amount of payment for your education (brother, sister), but not more than 120,000 (we remind you that the limit of 120,000 rubles applies to the entire amount of social deductions specified in this section). Line 180 = line 130 (provided there are no other deductions) Line 181 indicates the social deductions provided by the tax agent (for example, if the declaration is filled out when additionally applying for a social deduction for training, when part of it was provided by the tax agent - the employer). If, after deduction, the employer was not contacted, this line is not filled out. Line 190 = line 181 + line 130 Line 200 = line 190 + line 120 + line 080 |

Now let’s look at a sample of filling out the 3-NDFL declaration using an example.

| EXAMPLE. Let Kazeeva A.A. paid for my education in the amount of 50,000 rubles and my daughter’s education in the amount of 10,000 rubles in 2020. Let’s assume that Kazeeva collected and provided all supporting documents (agreement, license, etc.). Kazeeva’s income in 2022 from her work at Spectr LLC amounted to 340,000 rubles. |

| 1. From her employer, Kazeeva received a standard tax deduction for a child of 1,400 rubles for each month. Thus, the deduction amount was 1,400 × 12 = 16,800 rubles. 340,000 – 16,800 = 323,200 × 13% = 42,016 – tax withheld by the employer in 2022. 2. In addition, Kazeeva has the right to receive a social deduction for the education of her child and her own education: 10,000 + 50,000 = 60,000. These deductions can be applied in complete size because they do not exceed established limits (Kazeeva has no rights to other deductions in this tax period). Kazeeva did not apply for social deductions for training from her employer, so she will receive them independently from the tax office in 2021. 3. Let's calculate the amount of tax overpayment for 2022. 340,000 – 16,800 – 50,000 – 10,000 = 263,200 rubles. (the tax base is calculated using all required deductions). Tax payable: 263,200 × 13% = 34,216. And the employer withheld 42,016 rubles from Kazeeva. Thus, the overpayment to be refunded is: 42,016 – 34,216 = 7800. This is the amount Kazeeva should receive from the tax office. |

For a sample of the 3-NDFL declaration for educational deductions in 2022, completed based on the example, see below:

SAMPLE DECLARATION 3-NDFL 2022 FOR DEDUCTION FOR TRAINING

We remind you that there is no need to print, number or provide blank declaration sheets.

If you fill out the paper form 3-NDFL by hand or use MS Office tools, you need to additionally observe some points. We talked about them in the article “How to fill out a declaration on paper: rules.”

Documentary justification for the right to a personal income tax refund: what to collect and what to fill out

All papers that need to be sent to tax authorities in the situation of a personal income tax refund from the cost of training can be divided into 3 groups:

- prepared by the taxpayer (application for tax refund, declaration 3-NDFL);

- available to the taxpayer (identity documents, proof of relationship, etc.);

- received (requested) from other persons (2-NDFL certificate from the employer, agreement with an educational institution, etc.);

The diagram below will help you familiarize yourself with the list of documents that a person applying for a personal income tax refund needs to collect:

For detailed information about the required documents, see the material “How to return personal income tax for education.”

Particular attention should be paid to the nuances of document preparation. For example:

- the presence in the training agreement of the details of a license for the right to carry out educational activities - in the absence of such information, a copy of such a license must be attached to the agreement;

- payment documents and a training agreement must be issued to the person applying for a personal income tax refund.

A video tutorial will help you fill out an application for an income tax refund, which is posted on our YouTube channel - “We are preparing an application for a personal income tax refund (sample, form) .

Find out about the nuances of filling out an application for a personal income tax refund from the articles:

- “In the application for personal income tax refund, bank details must be indicated in full”;

- “Account name in the application for personal income tax refund (nuances)”.

An equally important moment is filling out 3-NDFL. We'll tell you how to do this below.

Article 219 of the Tax Code of the Russian Federation. Social tax deductions (current version)

1. When determining the size of tax bases in accordance with paragraph 3 or 6 of Article 210 of this Code, the taxpayer has the right to receive the following social tax deductions:

1) in the amount of income transferred by the taxpayer in the form of donations:

charitable organizations;

socially oriented non-profit organizations to carry out activities provided for by the legislation of the Russian Federation on non-profit organizations;

non-profit organizations operating in the field of science, culture, physical culture and sports (except for professional sports), education, enlightenment, healthcare, protection of human and civil rights and freedoms, social and legal support and protection of citizens, assistance in protecting citizens from emergency situations , environmental protection and animal welfare;

religious organizations to carry out their statutory activities;

non-profit organizations for the formation or replenishment of endowment capital, which are carried out in the manner established by Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations”.

The deduction specified in this subparagraph is provided in the amount of expenses actually incurred, but not more than 25 percent of the amount of income received in the tax period and subject to taxation. If the recipients of donations are state and municipal institutions operating in the field of culture, as well as non-profit organizations (foundations) in the case of transferring donations to them for the formation of endowment capital in order to support these institutions, the maximum deduction amount established by this paragraph may be increased by the law of the subject Russian Federation up to 30 percent of the amount of income received in the tax period and subject to taxation. The said law of a constituent entity of the Russian Federation may also establish categories of state and municipal institutions operating in the field of culture, and non-profit organizations (foundations), donations to which may be accepted for deduction in an increased maximum amount.

When returning a donation to a taxpayer, in connection with the transfer of which he applied a social tax deduction in accordance with this subparagraph, including in the case of dissolution of the target capital of a non-profit organization, cancellation of a donation, or in another case, if the return of property transferred for the formation or replenishment of the target capital of a non-profit organization, provided for by a donation agreement and (or) Federal Law of December 30, 2006 N 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations”, the taxpayer is obliged to include in the tax base of the tax period in which the property or its cash equivalent were actually returned the amount of the social tax deduction provided in connection with the transfer of the corresponding donation to the non-profit organization;

2) in the amount paid by the taxpayer in the tax period for his training in organizations engaged in educational activities - in the amount of actually incurred training expenses, taking into account the limitation established by paragraph 2 of this article, as well as in the amount paid by the taxpayer-parent for training his children under the age of 24, by a taxpayer-guardian (taxpayer-trustee) for full-time education of their wards under the age of 18 in organizations engaged in educational activities - in the amount of actual expenses incurred for this education, but not more than 50,000 rubles for each child in the total amount for both parents (guardian or trustee).

The right to receive the specified social tax deduction applies to taxpayers who performed the duties of a guardian or trustee over citizens who were their former wards, after the termination of guardianship or trusteeship in cases where taxpayers paid for full-time education of these citizens under the age of 24 in organizations engaged in educational activities .

The specified social tax deduction is provided if an organization carrying out educational activities, an individual entrepreneur (except for cases where individual entrepreneurs carry out educational activities directly) has a license to carry out educational activities or if a foreign organization has a document confirming the status of an organization carrying out educational activities, or if provided that the unified state register of individual entrepreneurs contains information about the implementation of educational activities by an individual entrepreneur who carries out educational activities directly, as well as the submission by the taxpayer of documents confirming his actual expenses for training.

A social tax deduction is provided for the period of study of these persons in an organization carrying out educational activities, including academic leave issued in the prescribed manner during the training process.

The social tax deduction does not apply if the payment for educational expenses is made from maternal (family) capital funds allocated to ensure the implementation of additional measures of state support for families with children;

The right to receive the specified social tax deduction also applies to a taxpayer who is a brother (sister) of a student in cases where the taxpayer pays for full-time education of a brother (sister) under the age of 24 in organizations engaged in educational activities;

3) in the amount paid by the taxpayer in the tax period for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to him, his spouse, parents, children (including adopted children) under the age of 18, wards in under the age of 18 (in accordance with the list of medical services approved by the Government of the Russian Federation), as well as in the amount of the cost of medicines for medical use prescribed by their attending physician and purchased by the taxpayer at his own expense.

When applying the social tax deduction provided for by this subparagraph, the amounts of insurance premiums paid by the taxpayer in the tax period under voluntary personal insurance contracts, as well as under voluntary insurance contracts for their spouse, parents, children (including adopted children) under the age of 18 years old, wards under the age of 18, concluded by him with insurance organizations that have licenses to conduct the relevant type of activity, providing for payment by such insurance organizations exclusively for medical services.

The total amount of social tax deduction provided for in paragraphs one and two of this subclause is accepted in the amount of expenses actually incurred, but subject to the limitation established by paragraph 2 of this article.

For expensive types of treatment in medical organizations, for individual entrepreneurs carrying out medical activities, the amount of tax deduction is accepted in the amount of actual expenses incurred. The list of expensive types of treatment is approved by a decree of the Government of the Russian Federation.

A deduction for the payment of the cost of medical services and (or) payment of insurance premiums is provided to the taxpayer if medical services are provided in medical organizations, from individual entrepreneurs who have appropriate licenses to carry out medical activities, issued in accordance with the legislation of the Russian Federation, as well as when the taxpayer submits documents , confirming his actual expenses for medical services provided, the purchase of medicines for medical use or the payment of insurance premiums.

The specified social tax deduction is provided to the taxpayer if payment for the cost of medical services and purchased medications for medical use and (or) payment of insurance premiums were not made at the expense of employers;

4) in the amount of pension contributions paid by the taxpayer in the tax period under the agreement (agreements) of non-state pension provision, concluded by the taxpayer with a non-state pension fund in his favor and (or) in favor of family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters), disabled children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under a voluntary pension insurance agreement (agreements) concluded with an insurance organization in his own favor and (or) in favor of a spouse (including a widow, widower), parents (in including adoptive parents), disabled children (including adopted children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under the voluntary life insurance agreement (agreements), if such agreements are concluded for a period not less than five years, concluded (concluded) with an insurance organization in one’s own favor and (or) in favor of a spouse (including a widow, widower), parents (including adoptive parents), children (including adopted children under guardianship (trusteeship) ), - in the amount of expenses actually incurred, taking into account the limitation established by paragraph 2 of this article.

The social tax deduction specified in this subparagraph is provided upon submission by the taxpayer of documents confirming his actual expenses for non-state pension provision and (or) voluntary pension insurance and (or) voluntary life insurance;

5) in the amount of additional insurance contributions for a funded pension paid by the taxpayer during the tax period in accordance with the Federal Law “On additional insurance contributions for a funded pension and state support for the formation of pension savings” - in the amount of expenses actually incurred, taking into account the limitation established by paragraph 2 of this article .

The social tax deduction specified in this subclause is provided when the taxpayer submits documents confirming his actual expenses for paying additional insurance contributions for a funded pension in accordance with the Federal Law “On additional insurance contributions for a funded pension and state support for the formation of pension savings,” or when the taxpayer submits certificates from the tax agent about the amounts of additional insurance contributions paid by him for a funded pension, withheld and transferred by the tax agent on behalf of the taxpayer, in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees;

6) in the amount paid in the tax period by the taxpayer for undergoing an independent assessment of his qualifications for compliance with qualification requirements in organizations carrying out such activities in accordance with the legislation of the Russian Federation - in the amount of actual expenses incurred for undergoing an independent assessment of qualifications for compliance with qualification requirements taking into account the size limitation established by paragraph seven of paragraph 2 of this article;

7) in the amount paid by the taxpayer in the tax period at his own expense for physical education and health services provided to him, his children (including adopted children) under the age of 18, wards under the age of 18 by physical education and sports organizations, individual entrepreneurs those carrying out activities in the field of physical culture and sports as their main activity.

The amount of expenses specified in this subparagraph is taken into account for tax purposes, subject to the limitation established by paragraph 2 of this article.

The provisions of this subparagraph apply if, on the date of the expenses actually incurred by the taxpayer specified in this subparagraph:

the physical education and health services specified in this subclause are included in the list of types of physical education and health services approved by the Government of the Russian Federation;

a physical culture and sports organization, an individual entrepreneur, specified in this subparagraph, are included in the list of physical culture and sports organizations, individual entrepreneurs carrying out activities in the field of physical culture and sports as the main type of activity (hereinafter in this subparagraph - the list of physical culture and sports organizations, individual entrepreneurs) formed for the corresponding tax period.

The list of physical culture and sports organizations, individual entrepreneurs for the next tax period is formed by the federal executive body, which carries out the functions of developing and implementing state policy and legal regulation in the field of physical culture and sports, as well as providing public services (including the prevention of doping in sports and the fight against it) and management of state property in the field of physical culture and sports, on the basis of data provided by the executive authorities of the constituent entities of the Russian Federation in the field of physical culture and sports, and is sent to the federal executive authority authorized for control and supervision in the field of taxes and fees, no later than December 1 of the year preceding the next tax period.

The procedure for forming and maintaining a list of physical culture and sports organizations, individual entrepreneurs, including the criteria for including such organizations, individual entrepreneurs in the list of physical culture and sports organizations, individual entrepreneurs, deadlines and methods for submitting data by executive authorities of the constituent entities of the Russian Federation in the field of physical culture and sports, on the basis of which a list of physical culture and sports organizations and individual entrepreneurs is formed, is approved by the Government of the Russian Federation.

The social tax deduction provided for by this subclause is provided upon submission by the taxpayer of documents confirming his actual expenses for payment for physical education and health services, namely copies of the contract for the provision of physical education and health services and a cash receipt issued on paper or sent in electronic form in accordance with the requirements established by Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making payments in the Russian Federation.”

2. Social tax deductions provided for in paragraph 1 of this article are provided when a taxpayer submits a tax return to the tax authority at the end of the tax period, unless otherwise provided by this paragraph.

Social tax deductions provided for in subparagraphs 2, 3 and 7 of paragraph 1 of this article, and a social tax deduction in the amount of insurance premiums under a voluntary life insurance agreement (agreements), provided for in subparagraph 4 of paragraph 1 of this article, may be provided to the taxpayer before the end of the tax period for on the basis of his submission of a written application to the employer (hereinafter in this paragraph - the tax agent), subject to the tax authority submitting to the tax agent confirmation of the taxpayer’s right to receive social tax deductions.

The taxpayer sends to the tax authority an application to confirm the right to receive social tax deductions specified in paragraph two of this paragraph, and documents confirming the right to receive these social tax deductions. The application must be considered by the tax authority within a period not exceeding 30 calendar days from the date the taxpayer submitted the specified application and documents to the tax authority in writing, or electronically via telecommunication channels, or through the taxpayer’s personal account.

Within the period specified in paragraph three of this paragraph, the tax authority informs the taxpayer about the results of consideration of the application specified in paragraph three of this paragraph through the taxpayer’s personal account (in the absence (termination) of the taxpayer’s access to the taxpayer’s personal account - by registered mail), and also provides the tax agent with confirmation of the taxpayer’s right to receive social tax deductions specified in paragraph two of this paragraph, in the form and format approved by the federal executive body authorized for control and supervision in the field of taxes and fees, if, based on the results of the review the statement did not reveal the absence of the taxpayer’s right to such a tax deduction.

In the event that after the taxpayer applies in the prescribed manner to the tax agent to receive social tax deductions provided for in subparagraphs 2, 3 and 7 of paragraph 1 of this article, and a social tax deduction in the amount of insurance premiums under the voluntary life insurance agreement (agreements) provided for in subparagraph 4 of paragraph 1 of this article, the tax agent withheld the tax without taking into account social tax deductions, the amount of tax withheld in excess after receiving the taxpayer’s application is subject to return to the taxpayer in the manner established by Article 231 of this Code.

If during the tax period the social tax deductions provided for in subparagraphs 2, 3 and 7 of paragraph 1 of this article, and the social tax deduction in the amount of insurance contributions under the voluntary life insurance agreement (agreements), provided for in subparagraph 4 of paragraph 1 of this article, are provided taxpayer in a smaller amount than provided for in this article, the taxpayer has the right to receive them in the manner provided for in paragraph one of this paragraph.

Social tax deductions provided for in subparagraphs 4 and 5 of paragraph 1 of this article (with the exception of a social tax deduction in the amount of expenses for paying insurance premiums under a voluntary life insurance agreement (agreements)) may be provided to the taxpayer before the end of the tax period when he contacts a tax agent subject to documentary confirmation of the taxpayer's expenses in accordance with subparagraphs 4 and 5 of paragraph 1 of this article and provided that contributions under the agreement (agreements) of non-state pension provision, under the agreement (agreements) of voluntary pension insurance and (or) additional insurance contributions for a funded pension were withheld from payments in favor of the taxpayer and transferred to the appropriate funds and (or) insurance organizations by the employer.

Social tax deductions provided for in subparagraphs 2 - 7 of paragraph 1 of this article (with the exception of deductions in the amount of expenses for the education of the taxpayer’s children specified in subparagraph 2 of paragraph 1 of this article and expenses for expensive treatment specified in subparagraph 3 of paragraph 1 of this article), are provided in the amount of actual expenses incurred, but in total no more than 120,000 rubles for the tax period. If, during one tax period, a taxpayer has expenses for training, medical services, physical education and health services, expenses under a non-state pension agreement (agreements), under a voluntary pension insurance agreement (agreements), under a voluntary life insurance agreement (agreements) if such contracts are concluded for a period of at least five years) and (or) for the payment of additional insurance contributions for a funded pension in accordance with the Federal Law “On additional insurance contributions for a funded pension and state support for the formation of pension savings” or for payment for an independent assessment of one’s qualifications, the taxpayer independently, including when contacting a tax agent, chooses which types of expenses and in what amounts are taken into account within the maximum amount of the social tax deduction specified in this paragraph.