Let's consider solving the problem of returning personal income tax based on an employee's application.

After studying the material you will learn:

- how to register a personal income tax return to an employee upon his application in the 1C: ZUP 3 program;

- what amount of personal income tax should be transferred to the budget after the tax is refunded to the employee and how to reflect this in the 1C: ZUP 3 program;

- How the amount of personal income tax refund is reflected in the reports: 2-NDFL, 6-NDFL, Tax Registration Register for Personal Income Tax.

Employee Returned I.P. in January and February, wages of 10,000 rubles were accrued. and personal income tax is calculated - 1,300 rubles. Salaries for January and February have been fully paid, personal income tax has been withheld and transferred to the budget. In March, an employee brought a notice of property deduction from the tax office and asked to return personal income tax for the previous two months.

It is necessary to register the personal income tax return in the 1C:ZUP 8 program.

Regulatory regulation and stages of personal income tax return

To solve the problem, you first need to consider the regulatory regulation of personal income tax returns. The procedure for returning personal income tax to the taxpayer is described in Art. 231 Tax Code of the Russian Federation.

Stages of personal income tax return:

- excessively withheld personal income tax was detected;

- inform the employee about this within 10 working days;

- the employee must write a statement;

- within 3 months the organization must return personal income tax;

- Personal income tax refunds are made strictly to the employee’s bank account, i.e. You cannot return personal income tax through the cash desk.

Registration of property deduction and recalculation of personal income tax

A property deduction for an employee is registered in the program with the document Notification of a non-profit organization on the right to deduction (Taxes and contributions - Application for deductions - Notification of a non-profit organization on the right to deductions) .

It states:

- number and date of notification from the tax authority;

- application of property deduction from January 2022;

- amount of property deduction.

When calculating wages for March 2022, in the document Calculation of wages and contributions, personal income tax is recalculated from the beginning of the year.

The personal income tax tab reflects the amount of the actual property deduction provided, 10,000 rubles each. for 3 months and personal income tax for January and February 2022 is recalculated at -1,300 rubles:

The Payment Adjustment tab displays the personal income tax amounts to be refunded:

Using the amounts on this tab, you can track the occurrence of excessively withheld personal income tax, which must be reported to the employee.

Property deduction for an employee

Content:

1. Providing a property deduction by the employer

2. The taxpayer’s right to a property tax deduction

3. Calculation of personal income tax for property deduction in 1C

Providing a property deduction by the employer

Hello colleagues! In this article, I will talk in detail about how property tax deductions are provided to an employee from an employer in the Salary and Personnel Management 3.1 program. Everything that has been said will be illustrated with a real example, so after reading the article you can easily provide a property deduction to an employee yourself!

So, an example: let an employee of a company in March 2022 apply for a property deduction by the employer in the current year due to the acquisition of part of the share in the apartment. Also attached to the application was notification No. 7712-1235 dated March 05, 2018, which was issued by Federal Tax Service Inspectorate No. 14 for the city of Moscow. This application confirms the possibility of deducting 150,000 rubles according to the expenses that went towards purchasing part of the apartment, as well as in the amount of 20,000 rubles to pay off the loan that was taken out to purchase part of the apartment. This employee works with a salary once a month, the salary is 50,000 rubles. Therefore, it follows that you need to enter information on the taxpayer’s right to a property tax deduction based on the receipt of property, as well as calculate the personal income tax on the property deduction.

Taxpayer's right to property tax deduction

First, you need to register the right to a property deduction so that all subsequent actions are legitimate. All property deductions that are based on income from the sale of property will be given to taxpayers from the tax office, so this operation is not subject to registration in the system.

Let's consider property deductions in 1C, which relate to the costs of purchasing a home. In this case, deductions may be provided by the employer. We need a list of possible deductions. According to Chapter 23 of the Tax Code of the Russian Federation, they are returned to individuals from the tax agent during the determination of the general income that will be subject to taxes. This list is located in 1C 8 ZUP 3.1 in the directory “Types of personal income tax deductions” on the “Taxes and Contributions” tab, as shown in the screenshot below:

Rice. 1 Types of personal income tax deductions in 1C 8 ZUP 3.1

All the necessary data on the amount of deductions for personal income tax are located within the above information register. If legislation changes, the data in this register will change automatically.

All rights of an employee regarding property deductions are subject to registration in the 1C: ZUP 3.1 program using the document “Notification of the NO on the right to deductions.” All information in this document must be filled out according to data from the tax office, which the employee provides himself. The above document is located on the “Taxes and Contributions” tab under the “Application for Deductions” link. Let's look at how to fill out the document “Notification of a legal entity on the right to deductions” when working in 1C ZUP 3.1:

· In the “Organization” field, you must indicate the company from which the property tax deduction will be provided. Typically, this field should be filled in automatically and the information in it cannot be changed, since the data is taken from the employee’s card.

· In the “Date” field you need to indicate the date on which this document will be registered in the information database.

· In the “Employee” field, you must indicate the employee for whom the right to provide a property deduction will be registered by the employer. If filling is done from an employee’s card, the field will be filled in automatically.

· In the “Tax period” field, be sure to indicate the tax period in which the property deduction was paid; according to the standard settings, “current year” is indicated;

· In the “Apply deductions from” field, you must select the month from which this property deduction will be issued. Similar to the year, the default is “current month”.

· In the “Notification of the right to deduction” section, in the “Number”, “Date” and “IFTS” fields, you need to enter the number, date and code of the notification from the tax office that issued this notification.

· On the “Property deductions” tab you need to indicate:

1. in the field “Construction/purchase expenses” - the total amount that was spent by the taxpayer on the construction or purchase of housing, the code for this deduction amount is 311;

2. in the “Interest on loans” field, you must indicate the total amount that was spent on repaying the interest rate on loans for the construction/purchase of residential premises, the code for this deduction is 312;

3. in the “Interest on refinancing” field, indicate the amount that was spent on paying interest on loans received in the form of refinancing loans for new construction or the purchase of residential property, the code for this deduction is 312;

· Next, you need to click on “Post and close”, after which the calculation of the property tax deduction will occur automatically and will be reflected every month in the tax period until the registered amounts are fully paid out.

The general view and design of the document “Notification of a non-commercial organization on the right to deductions” in 1C: Salaries and personnel management 3.1 is shown in the screenshot below:

Rice. 2 Notification of non-commercial organizations about the right to deductions in 1C 8 ZUP 3.1

Calculation of personal income tax for property deduction in 1C

The boss is obliged to issue the employee a personal income tax deduction for the entire year, if the employee applied for this deduction. The total amount of tax and deductions from the beginning of the tax period until the current month inclusive must be returned to the tax office in accordance with Article 231 of the Tax Code of the Russian Federation. In cases where the tax inspector decided to return personal income tax that was unduly withheld before filing an application for a property deduction, in the document “Notification of the Taxpayer on the right to deductions” in the field “Apply deductions from” January must be indicated, which is the month from which Tax season begins.

In our example, the tax deduction application was written in March 2022. In January, a salary in the amount of 50,000 rubles was accrued, and personal income tax was withheld in the form of 6,500 rubles, in February - similarly.

In this case, the employee must be provided with a property tax deduction in the amount of 170,000 rubles in accordance with the points described above. During the calculations of personal income tax for March, it was found that the total amount of property deduction is 50,000 rubles.

Rice. 3 The amount of property deduction provided in 1C 8 ZUP 3.1

As a result, personal income tax calculations do not provide any results. You also need to recalculate all previous months; for example, these are February and January. The amount of personal income tax that was withheld in excess of the norm in the example will be 13,000 rubles, as shown in the screenshot below:

Rice. 4 Amount of personal income tax in excess of the norm in 1C 8 ZUP 3.1

Personal income tax that was withheld above the norm is withdrawn as a debt from the company, but the amount for payments will not be increased. To return the personal income tax that was withheld, you need to register the “Personal Tax Return” document in 1C 8 ZUP 3.1, which is located in the “Taxes and Contributions” tab, as shown in the screenshot below:

Rice. 5 Return of personal income tax in 1C 8 ZUP 3.1

The balance of the property deduction that was not used will be transferred to the next month and will be, according to the example, 20,000 rubles, according to code 311. The total amount of income in April will be 50,000 rubles, and the personal income tax itself will be 3,900 rubles, as shown in the screenshot below :

Rice. 6 Personal income tax amount in 1C 8 ZUP 3.1

Starting from May, the property deduction will no longer be provided:

Rice. 7 Termination of property deduction in 1C 8 ZUP 3.1

Specialist

Aidar Farkhutdinov

Personal income tax refund

You can check the amount to be refunded using the service Analysis of personal income tax for refund (Salary – Service – Analysis of personal income tax for refund):

To register the personal income tax refund amount, the employee must create a personal income tax return (Taxes and contributions - personal income tax return).

In the Month , select the month in which the personal income tax refund will be reflected. Update refund amounts button, the amount is automatically loaded - 2,600 rubles. with the date of receipt of income – 02/28/2017:

Payment of the refund may be made along with the payment of wages.

The amount to be paid will be: 10,000 (salary) + 2,600 (personal income tax refund) = 12,600 rubles:

Please note that payment of personal income tax refund must be made only through a bank (according to Article 231 of the Tax Code of the Russian Federation). If an employee’s salary is paid through a cash register, then to return personal income tax in the program, you must enter a separate statement - the document Statement of Accounts (Payments - Statement of Accounts). In the Pay , in this case, you must specify the value Personal Tax Return and select the previously entered document Personal Tax Return .

Transfer of personal income tax to the budget in the month of tax refund

In the month when the tax refund occurred, the amount of personal income tax transferred by the organization to the budget is reduced by the amount of the returned personal income tax.

To do this, in the document Statement to the Bank, you need to uncheck the Tax is listed along with the salary :

As a result, when conducting the Statement , information on amounts paid to the employee and personal income tax withheld will be recorded.

In order to reflect the fact of tax transfer in the program, you need to create a document Transfer of personal income tax to the budget (Taxes and contributions - Transfers of personal income tax to the budget).

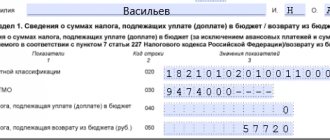

Amount to be transferred: 7,800 (total personal income tax withheld) – 2,600 (personal income tax refund) = 5,200 rubles:

When posting the document Transfer of personal income tax to the budget in the accumulation register Calculations of tax agents with the budget for personal income tax, a negative transfer will be written off for the employee for whom the return was made, and for other employees the amounts deducted from them will be registered as transferred:

Please note that starting from ZUP 3.1.10.135, ZUP 3.1.11, the movements when transferring personal income tax in case of its return have changed - CHANGES IN ACCOUNTING OF TRANSFERRED NDFL IN THE CASE OF TAX REFUND (ZUP 3.1.10.135, ZUP 3.1.11)

Clarification of the date of receipt of income in the document “Personal Tax Return”

Starting from ZUP 3.1.8 releases, the actions described in this section SHOULD NOT be performed, otherwise this will lead to errors during subsequent personal income tax deductions.

To check the correctness of the reflection of information on the return of personal income tax and its transfer, you can generate a report Analysis of personal income tax by month (Taxes and contributions - Reports on taxes and contributions - Analysis of personal income tax by month) grouped by Employee and Month of the tax period.

In general, the amount of personal income tax paid by the employee is returned by I.P. – zero, but there is a positive and negative amount for January and February, respectively:

It turns out that in the program:

- for January 2022: personal income tax withheld but not returned was recorded. The amount of tax paid remains;

- for February 2022: personal income tax withheld and over-returned was recorded. A negative amount of tax paid appeared.

If necessary to:

- the amount of personal income tax returned corresponded to the amount of tax withheld not only for the period as a whole, but also for each month;

- the amount of personal income tax paid became zero not only for the period as a whole, but also for each month,

then you need to manually correct the information in the Personal Income Tax Return , breaking down the total amount to 2,600 rubles. (automatically falling in February) for two periods: January and February for 1,300 rubles:

After this, you need to update the tax information in the Statement to the Bank by clicking the corresponding Update Tax .

Next, repost the document Transfer of personal income tax to the budget .

As a result, in the accumulation register Calculations of tax agents with the personal income tax budget, the negative transfer for the employee will be divided into 2 lines - for January and February:

In the report Analysis of Personal Income Tax by Month, the listed personal income tax for the entire period and for each month will become zero. The amounts of returned and transferred personal income tax will coincide not only for the period as a whole, but also for each month:

Accounting for the return of overpayments of income tax for previous years

For an organization, the discovered and returned amount of income tax overpaid for previous years is an unexpected gift, but for an accountant it is an unpleasant surprise if this overpayment was not taken into account at the end of the tax period. Olga Podvolokina and Svetlana Myagkova, experts from the Legal Consulting Service GARANT, talk about accounting and tax accounting, as well as how to correct a mistake in this situation.

In 2012, according to a reconciliation with the tax office, an overpayment of income tax for previous years was revealed. At the same time, in accounting there is no difference between the debit and credit balances in account 68, the subaccount “Income Tax Calculations”. The organization submitted an application for a refund of the amount of overpaid tax to the tax office. In 2012, the tax inspectorate refunded her the amount of overpaid income tax. The organization applies PBU 18/02. How to reflect this situation in accounting and tax accounting?

Tax accounting

According to paragraphs. 5 p. 1 art. 21 of the Tax Code of the Russian Federation, taxpayers have the right to a timely offset or refund of amounts of overpaid or overcharged taxes, penalties, and fines.

The procedure for offset or refund of amounts of overpaid taxes, fees, penalties, fines is carried out in the manner prescribed by Art. 78 Tax Code of the Russian Federation.

Amounts of overpaid (collected) taxes returned (credited) to taxpayers from the budget are not taken into account when determining the object of taxation in the form of income, since these amounts are not economic benefits determined in accordance with Art. 41 of the Tax Code of the Russian Federation (letters of the Ministry of Finance of Russia dated June 24, 2009 N 03-11-06/2/106, dated September 21, 2009 N 03-11-06/3/237).

Despite the fact that the above letters from the Ministry of Finance of Russia provide explanations for taxpayers using the simplified tax system, they are also applicable for organizations that use the general taxation system and pay income tax, since the provisions of Art. 41 of the Tax Code of the Russian Federation are applied to both of these categories of taxpayers.

Thus, returned funds in the form of excessively transferred tax are not taken into account as part of income when determining the tax base for corporate income tax.

Accounting

According to clause 2 of PBU 9/99 “Income of the organization” (hereinafter referred to as PBU 9/99), the income of an organization is an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization , with the exception of contributions from participants (property owners).

In the situation under consideration, based on the taxpayer’s application, the tax inspectorate returned the overpaid amount of income tax to the organization; therefore, the organization, on the basis of clause 2 of PBU 9/99, also does not have income in its accounting.

According to the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions for the application of the Chart of Accounts), it is intended to summarize information on settlements with budgets for taxes and fees paid by the organization account 68 “Calculations for taxes and fees.” In this case, account 68 is credited for the tax amounts due on tax returns (calculations) for contributions to budgets, in correspondence with account 99 “Profits and losses”, and the debit of account 68 reflects the amounts actually transferred to the budget.

Thus, since in accounting the accrual of income tax is carried out based on the results of reporting periods, then, accordingly, the organization, based on the tax return data, makes a calculation of the amounts subject to accrual in accounting and reflects the accrual (additional accrual) of tax for the 1st quarter, 1st half of the year , nine months on the debit of account 99 “Profits and losses” in correspondence with the credit of account 68 “Calculations for taxes and fees”. Payment of advance payments for income tax is reflected in the generally established procedure - by the debit of account 68 in correspondence with the credit of account 51 “Current accounts”.

It should be noted that the amount of income tax calculated for the tax period is not reflected separately in accounting. In accounting, the organization shows only the amount of additional payment or the amount to be reduced at the end of the tax period, which is reflected by the entry:

Debit 99 Credit 68, subaccount “Calculations for income tax”

- reflects the amount of income tax to be paid additionally (or “reversed” - to be reduced).

If, at the end of the tax period, an organization has an overpayment of income tax, then no additional accounting entries are made in connection with its reflection. The amount of overpayment is reflected as a receivable (debit balance on account 68).

If for a tax period the amount of calculated advance payments exceeds the amount of accrued tax for the year, then the organization at the end of the tax period must reduce the amount of accrued tax, which, in our opinion, can be reflected by a reverse entry (or entry using the reversal method) in accounts 99 and 68 ( Instructions for using the Chart of Accounts).

If the amount of calculated advance payments exceeds the amount of accrued tax for the year, the organization must make the following entries (in general):

Debit 99 Credit 68, subaccount “Calculations for income tax”

— advance payments for the corresponding reporting periods have been accrued;

Debit 68, subaccount “Calculations for income tax” Credit 51

— advance payments for the relevant reporting periods are listed;

Debit 68, subaccount “Calculations for income tax” Credit 99

— profit tax was adjusted based on the results of the tax period.

In the situation under consideration, in 2012, based on the results of a reconciliation with the tax office, an overpayment of income tax for previous tax periods was revealed. At the same time, in accounting there is no difference between the debit and credit balances of account 68, the subaccount “Calculations for income tax”, which apparently indicates that in case of overpayment of income tax based on the results of tax periods, there were no entries were made to adjust the income tax (Debit 68, subaccount “Calculations for income tax” Credit 99).

The rules for correcting errors and the procedure for disclosing information about errors in accounting and reporting are established by PBU 22/2010 “Correcting errors in accounting and reporting” (hereinafter referred to as PBU 22/2010).

In accordance with clause 2 of PBU 22/2010, incorrect reflection (non-reflection) of facts of economic activity in the accounting and (or) financial statements of an organization is recognized as an error.

In the situation under consideration, the organization made an error in accounting by not reflecting the fact of overpayment of income tax at the end of the tax period (without adjusting the amount of income tax in the accounting at the end of the tax period).

Identified errors and their consequences are subject to mandatory correction (clause 4 of PBU 22/2010).

An error in the reporting year identified before the end of that year is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified (clause 5 of PBU 22/2010).

An error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, is corrected by entries in the relevant accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared) (clause 6 of PBU 22/2010) .

PBU 22/2010 establishes a different procedure for correcting an error of the previous reporting year, identified after the date of signing the financial statements for this year, which is significant and which is not material.

Paragraph 3 of PBU 22/2010 determines that an error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period.

The organization determines the materiality of the error independently based on both the size and nature of the relevant item(s) of the financial statements.

Based on the provisions of paragraph 3 of PBU 22/2010, the criteria for the materiality of an error must be specified in the accounting policies of the organization.

An error of the previous reporting year, which is not significant, discovered after the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts in the month of the reporting year in which the error was identified. Profit or loss arising as a result of correcting this error is reflected as part of other income or expenses of the current reporting period (clause 14 of PBU 22/2010).

The procedure for correcting a significant error is established in paragraphs. 7-13 PBU 22/2010.

Thus, in accordance with paragraph 9 of PBU 22/2010, a significant error of the previous reporting year, identified after the approval of the financial statements for this year, is corrected:

1) entries on the relevant accounting accounts in the current reporting period. In this case, the corresponding account in the records is the account for retained earnings (uncovered loss);

2) by recalculating the comparative indicators of the financial statements for the reporting periods reflected in the financial statements of the organization for the current reporting year, except in cases where it is impossible to establish the connection of this error with a specific period or it is impossible to determine the impact of this error on a cumulative basis in relation to all previous reporting periods.

Small businesses, with the exception of issuers of publicly placed securities, have the right to correct a significant error of the previous reporting year, identified after the approval of the financial statements for this year, in the manner established by clause 14 of PBU 22/2010 (clause 9 of PBU 22/2010).

We remind you that if the identified error is significant, then in the explanatory note to the annual financial statements it is necessary to reflect information regarding significant errors of previous reporting periods corrected in the reporting period (clause 15 of PBU 22/2010).

Thus, if an error made in accounting in previous reporting periods associated with the failure to reflect the fact of overpayment of income tax is recognized by the organization as significant (in accordance with its accounting policies), then it is corrected by an entry in account 68, subaccount “Calculations for income tax.” profit" in correspondence with account 84 "Retained earnings (uncovered loss)" (clause 9 of PBU 22/2010):

Debit 68, subaccount Income tax calculations Credit 84

— overpayment of income tax for previous tax periods is reflected.

The return of income tax to the organization's current account is reflected by the following posting:

Debit 51 “Current account” Credit 68 “Calculations for taxes and fees.”

If the error is not significant for the organization, then in this case, when reflecting the overpayment, the corresponding account 68 will be account 91 “Other income and expenses”) (clause 14 of PBU 22/2010, Instructions for using the Chart of Accounts):

Debit 68, subaccount “Calculations for income tax” Credit 91, subaccount “Other income”.

At the same time, since no income arises in tax accounting upon the return of overpaid tax, a constant difference arises between the accounting profit (loss) and the taxable profit (loss) of the reporting period, leading to the formation of a permanent tax asset (clauses 3, 4, 7 PBU 18/02 “Accounting for calculations of corporate income tax” (hereinafter referred to as PBU 18/02)), which is reflected in accounting by the entry:

Debit 68, subaccount “Calculations for income tax” Credit 99, subaccount “Permanent tax asset”

— the PNA is reflected (the product of the amount of the returned overpayment by the profit tax rate in effect on the reporting date - paragraph 3 of clause 7 of PBU 18/02).

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Reflection of personal income tax returns in reports: 2-NDFL, 6-NDFL, Tax accounting registers for personal income tax

In the 2-NDFL certificate for transfer to the Federal Tax Service (Taxes and contributions - 2-NDFL for transfer to the Federal Tax Service), the personal income tax refund is not reflected separately; the refund amount reduces the amount of tax withheld. Due to the reduction in the amount of tax transferred to the budget by the amount of personal income tax returned to the employee, the tax transferred before this operation is also reduced.

As a result, in the example under consideration, after registering the tax refund in the 2-NDFL certificate, the tax calculated, withheld and transferred will be equal to zero:

In the calculation of 6-NDFL for the 1st quarter of 2022, the amount of personal income tax returned will be reflected in line 090 of Section 1. In Section 2, the amount of personal income tax refund is not reflected.

In the Tax Accounting Register for Personal Income Tax (Taxes and Contributions - Reports on Taxes and Contributions - Tax Accounting Register for Personal Income Tax), the personal income tax refund operation is reflected as follows:

- in Section 4 – the table “Returned of overly withheld tax” shows the amounts of returned personal income tax:

- in Section 4 - the table “Tax Transferred” reflects the initially transferred personal income tax amounts to the budget and the same negative figures due to a decrease in the amount of tax transferred to the budget at the expense of the taxpayer to whom the personal income tax refund was made:

Please note that starting from ZUP 3.1.10.135, ZUP 3.1.11, the entries in the “Tax Transferred” section will look different - CHANGES IN ACCOUNTING FOR TRANSFERRED PIT IN CASE OF TAX REFUND (ZUP 3.1.10.135, ZUP 3.1.11)

- in Section 6 for the example under consideration, zero amounts of calculated, withheld and transferred personal income tax are reflected:

In release 3.1.2.213, in the Tax Accounting Register for Personal Income Tax, Amount of tax not withheld by the tax agent erroneously filled in .

This registered error in the 1C:ZUP 3 program was corrected in ZUP versions 3.1.2.316 and 3.1.3.136.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Possible options for returning to an employee the personal income tax that was excessively withheld from him

The most common situation when an employee may overpay personal income tax during the year is when he submits to the employer, along with a notice <1> issued by the tax office, an application for the return of withheld personal income tax in connection with the provision of a property deduction for purchased housing (apartment, room , residential building or share in them) <2>. After all, many people want not to pay personal income tax immediately after purchasing an apartment.

This is more profitable and easier than waiting until the end of the year and submitting a declaration in form 3-NDFL and an application for a tax refund to the tax office at your place of residence. At the same time, the organization’s accountant has a question: what is the procedure for returning tax already withheld during the year and how can this be done? Well, let's figure it out.

We recalculate the tax

STEP 1. Make sure that the notification of confirmation by the tax authority of the employee’s right to a property tax deduction correctly indicates all the details of your organization (name, INN, KPP), as well as the last name, first name, patronymic and passport details of your employee. If there are any errors in the data, ask the employee to bring the correct notice.

STEP 2. Transfer the amount of property deduction specified in the notification to the 1-NDFL tax card <3> registered for this employee. If you use the standard form 1-NDFL, then you need to add a new line “Property tax deduction” to section 3 of the employee’s card immediately after the line “Standard tax deductions”. The notification indicates on separate lines the amount of deduction attributable to the cost of housing and the amount of deduction attributable to interest on targeted loans (credits) taken for the purchase of housing. If your employee brought a notice in which two amounts are indicated, then by adding them up, you will receive the total deduction amount, which must be transferred to the 1-NDFL card.

Note. If an employee is just starting to use a property deduction, then the notification may indicate the maximum amount of the deduction (excluding interest on targeted loans (credits)) of 1 million rubles. or 2 million rubles. - depends on when the right to deduction arose <4>. And if the employee has already claimed a deduction in one of the previous years, then the notification will indicate the amount of the remaining unused deduction transferred to 2009. In any case, you have no control over the correctness of the amounts indicated in the notification.

STEP 3. Receive a free-form application from the employee to provide him with a property deduction and to return the excessively withheld personal income tax <5>.

STEP 4. In the month in which the employee brought the notice and application, recalculate the tax from the beginning of the calendar year <6>. At the same time, in the month of granting the property deduction, in section 3 of the standard 1-NDFL card, in the line “Tax debt due to the tax agent,” you must indicate the amount of excess personal income tax withheld. From this month forward, do not withhold personal income tax from the employee’s income. If the amount of the property deduction exceeds the employee’s annual income, then the tax will not have to be withheld until the end of the year.

If the amount of the deduction does not exceed the employee’s annual income, then from the month in which the amount of income calculated from the beginning of the year exceeds the amount of the deduction, personal income tax will have to be calculated and withheld (provided that all excessively withheld personal income tax was returned to the employee - see below) .

STEP 5. In accounting, reverse the amount of personal income tax previously withheld from the employee <7>: Dt 70 “Settlements with personnel for wages” - Kt 68 “Calculations for taxes and fees”, subaccount “Settlements for personal income tax at the rate of 13%”.

We return the tax to the employee

The Tax Code of the Russian Federation does not define how much personal income tax must be returned to an employee if he has submitted an application to the employer for the return of excessively withheld personal income tax. Let's consider the possible options.

OPTION 1. We return the tax at the expense of current personal income tax payments for other employees

Since the tax withheld from the employee has already been transferred to the budget, you can return the tax to him using the amounts of personal income tax withheld in the current month from the income of other employees of the organization. That is, you reduce the personal income tax for the current month, subject to payment to the budget, by the amount of the employee’s overpayment. This way, you are essentially doing the credit yourself. In this case, the amount of the refunded tax is reflected in section 3 of the standard 1-NDFL card on the line “Excessively withheld tax amount was returned by the tax agent” in the month in which the tax was returned to the employee (issued from the cash register, transferred to the salary card). And in accounting the following entries are made: Dt 70 - Kt 50 “Cashier”, 51 “Settlement accounts”.

Organizations use this option, justifying it by the fact that the payment of personal income tax is not personalized. After all, you transfer personal income tax to the budget in one payment for all employees. The amount of the transferred tax attributable to each employee is not reflected either in the 1-NDFL card, or in the 2-NDFL certificate <8>, which is annually submitted to the tax authority <9>, or in the card for settlements with the personal income tax budget, filled out by the Federal Tax Service your organization as a tax agent. Please note that this card indicates only the total amount of personal income tax transferred by you for all employees. Moreover, this personal income tax amount is always listed as an overpayment. Charges of tax and penalties can appear only after the tax inspectorate conducts an on-site audit based on decision <10>. So even if you do not pay personal income tax for the current month, the arrears will not appear on the card. Specialists from the Moscow Federal Tax Service have nothing against such a return <11>.

You will not be able to return to the employee in the current month the entire amount of excess tax withheld from personal income tax amounts withheld in the current month from the income of other employees of the organization, only if they do not cover the amount of debt to the employee. In this case, you can return the tax using your own funds. After all, there is no responsibility for this. But since this is not profitable for the organization, it is better to return the remaining amount of over-withheld tax to the employee in the following months. So, let's summarize the pros and cons of the first option. (+) With this option, the employee immediately receives the over-withheld personal income tax. You do not need to contact the tax authority with a tax refund application.

(?) The Ministry of Finance is against the return to an employee of excessively withheld tax at the expense of the current personal income tax withheld from other employees <12> (for more details, see below), and it is possible that some tax inspectorates will take the position of a financial authority. But even if this happens, the tax inspectorate will not be able to make any claims against you, since: - firstly, you returned to the employee the tax withheld in excess from him in connection with the provision of a property deduction to him on the basis of a notice issued by the tax office; — secondly, there will be no arrears in personal income tax in the budget.

OPTION 2. We return the tax from the budget

The Ministry of Finance believes that it is impossible to return excessively withheld tax to an employee at the expense of the current personal income tax withheld from other employees. Moreover, the financial department indicated that since Art. 231 of the Tax Code of the Russian Federation, a special procedure for offset or refund by a tax agent of amounts of excessively withheld tax is not defined, then the general procedure for refund or offset established by Art. 78 Tax Code of the Russian Federation <12>. Let's imagine what this procedure will look like in practice <13>. STEP 1. Having received an application for a tax refund from an employee from whom personal income tax was excessively withheld, you do not return the tax to him. You submit an application to your tax office for a refund from the budget of the personal income tax that was excessively withheld from the employee <14>. Attached to this application are copies of documents: the employee’s application for a tax refund, notices of granting him a property deduction, 1-NDFL card, which indicates the amount of debt attributed to the tax agent <15>. STEP 2. You still continue to pay personal income tax withheld from other employees to the budget. STEP 3. After receiving money from the budget into your current account, you will return the tax to the employee. This tax refund procedure has both advantages and disadvantages.

(+) In this case, you will definitely not face any claims from the tax authorities. (-) It is unknown how long an employee will wait for a personal income tax refund, since tax refunds from the budget to the organization’s current account can take a long time. At the same time, an organization can return excessively withheld personal income tax to an employee without waiting for the tax inspectorate to transfer the money to its current account, since the Tax Code of the Russian Federation allows this <16>. That is, the organization will return personal income tax to the employee at its own expense. But then the tax refund procedure will be slightly different.

STEP 1. Having received an application for a tax refund from an employee from whom personal income tax was overdeducted, you return the tax to him at your own expense. STEP 2. You still continue to pay personal income tax withheld from other employees to the budget. STEP 3. Submit to your tax office an application for a refund from the budget of the personal income tax that was excessively withheld from the employee, attaching all documents <17> to it. STEP 4. After receiving money from the budget into your current account, close the overpayment of tax listed in account 68. Now let’s see what are the pros and cons of such a refund procedure.

(+) There will be no claims from the tax office. The employee quickly receives over-withheld personal income tax. (-) You are diverting the organization’s money from circulation. However, when applying option 2, it is not clear why the organization should continue to transfer personal income tax to the budget in anticipation of the return of money from the budget that needs to be returned to the employee.

OPTION 3. We offset the tax against the upcoming personal income tax payment by this employee

The Russian Ministry of Finance believes that excessively withheld tax can not only be returned directly to the employee, but also offset against upcoming personal income tax payments in accordance with Art. 78 Tax Code of the Russian Federation <18>. Although clause 1 of Art. 231 of the Tax Code of the Russian Federation speaks specifically about tax refund to the employee. However, in practice, this option will only work if: - the amount of property deduction does not exceed the amount of the employee’s annual income; - the employee brought a notice from the tax office at the beginning of the year, that is, a small amount of personal income tax was withheld from his income, for example, for 1 or 2 months. Let's see if option 3 is good. (+) In this case, there will be no disputes with the tax office. (-) The period for an employee to receive a deduction extends over several months throughout the year. In addition, option 3 cannot always be applied.

* * * Taking into account the pros and cons we have given, choose the most convenient option for you to return personal income tax to an employee. The easiest option for you is to get your tax back using taxes from other employees for the current month. And the most “conflict-free” option is to offset the tax against upcoming payments for this employee.

——————————— <1> appendix to the Order of the Federal Tax Service of Russia dated December 7, 2004 N SAE-3-04/ [email protected] <2> sub. 2 clause 1, clause 3 art. 220 Tax Code of the Russian Federation <3> approved. By order of the Ministry of Taxes and Taxes of Russia dated October 31, 2003 N BG-3-04/583; clause 1 art. 230 Tax Code of the Russian Federation <4> subp. 2 p. 1 art. 220 Tax Code of the Russian Federation <5> clause 1 art. 231 Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia dated 09/03/2008 N 3-5-04/ [email protected] ; Letters of the Ministry of Finance of Russia dated 04/02/2007 N 03-04-06-01/103, dated 02/13/2007 N 03-04-06-01/35, dated 06/26/2006 N 03-05-01-04/188; Information messages of the Federal Tax Service of Russia from 04/06/2005, from 03/18/2005 <6> clause 3 of Art. 210, paragraph 1, art. 224, paragraph 3 of Art. 226 Tax Code of the Russian Federation; Letters of the Ministry of Finance of Russia dated 04/02/2007 N 03-04-06-01/103, dated 02/13/2007 N 03-04-06-01/35, dated 06/26/2006 N 03-05-01-04/188; Information messages of the Federal Tax Service of Russia from 04/06/2005, from 03/18/2005 <7> Chart of accounts and Instructions for its use, approved. By Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n <8> approved. By Order of the Federal Tax Service of Russia dated October 13, 2006 N SAE-3-04/ [email protected] <9> clause 2 of Art. 230 Tax Code of the Russian Federation <10> clause 4 section. VII, paragraph 1 section. IX Recommendations on the procedure for maintaining the “Settlements with the Budget” database in tax authorities, approved. By order of the Federal Tax Service of Russia dated March 16, 2007 N MM-3-10/ [email protected] (as amended on January 11, 2008) <11> Letter from the Federal Tax Service of Russia for Moscow dated November 29, 2007 N 28-11/113476 <12> Letter Ministry of Finance of Russia dated January 19, 2009 N 03-04-06-01/3 <13> clause 1 art. 231, art. 78 Tax Code of the Russian Federation <14> paragraphs. 6, 14 art. 78 Tax Code of the Russian Federation <15> Resolution of the Federal Antimonopoly Service of the Ural District dated July 22, 2008 N F09-5055/08-S2 <16> Letter of the Ministry of Finance of Russia dated April 3, 2009 N 03-04-06-01/76 <17> paragraphs. 6, 14 art. 78 Tax Code of the Russian Federation <18> Letter of the Ministry of Finance of Russia dated January 19, 2009 N 03-04-06-01/3

Read the full text of the article in the journal “Glavnaya Ledger” N 09, 2009

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up