Legislative basis for charitable assistance

Charitable activities in our country are regulated by the Law “On Charitable Activities and Charitable Organizations” dated August 11, 1995 No. 135-FZ. It must be voluntary and can be carried out by all persons, both legal entities and individuals, to any person in the form of:

- transfer of property and funds;

- performing work or services free of charge;

- other support.

Charitable activities must comply with the goals listed in Art. 2 of Law 135-FZ. The law ensures the unimpeded conduct of charitable operations based on the free choice of the benefactor. An individual or legal entity can also create charitable organizations, one type of which is a charitable foundation. The charitable foundation is a non-profit organization (NPO) and operates in accordance with the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ.

All NPOs must maintain accounting and prepare reports in accordance with Art. 32 of Law 7-FZ. Accounting statements are provided to the founders, tax authorities, state statistics authorities, and are also published annually (for those performing the functions of a foreign agent - once every six months) on the Internet or in the media.

Procedure for donating to a non-profit organization

To carry out a transaction to donate certain resources to a non-profit organization, it is necessary to draw up an agreement. In the agreement, the donor indicates for what purposes the property benefits are transferred in favor of the NPO. The goals specified in the contractual documentation must be consistent with the specialization of the non-profit organization. The recipient undertakes to use the received assets only for the prescribed purpose.

Civil law (Article 582 of the Civil Code of the Russian Federation) allows the following resources to be transferred to NPOs as a donation:

- tangible assets (movable and immovable property, securities, monetary resources);

- property rights.

When deciding to make a donation to an NPO, it is not necessary to obtain consent or permits from third parties or government agencies.

NOTE! The consent of third parties to transfer and receive a donation is not required, but it is necessary to ensure the willingness of the NPO itself to accept the gift. A non-profit organization has the right to refuse a donation if, in order to use it for its intended purpose, the institution will have to face a number of intractable problems.

The agreement for the transfer of a donation can be drawn up orally or in writing. A written version of the donation transaction is required for the following situations:

- if the subject of the donation is a real estate object, the registration of rights to which requires documentary grounds;

- if it is not the donation itself that is being made, but only a promise to implement it in the near future, then the agreement of intent specifies the object to be transferred;

- in transactions involving donations certified by notaries.

If in one of the listed situations a written agreement is not drawn up, the contract will be declared invalid by the regulatory authorities. All essential conditions must be specified in the contract; additionally, you can add conditions specifying the transaction, any elements that do not contradict current legislative norms.

FOR REFERENCE! Transactions related to donations to NPOs may be subject to double control: on the one hand, the operation of receiving the gift and its subsequent use will be verified by the tax authorities, on the other hand, the donor may request a report on the actual use of the subject of the agreement.

The donation agreement is signed by both parties to the transaction. The non-profit organization must certify the agreement with its seal.

How to use a charitable donation ?

Funds used as a donation can be given in different forms:

- In cash. In this situation, the money can be transferred at the time of signing the agreement or within the period specified in the agreement.

- By bank transfer. The money is transferred to a separate bank account of the non-profit structure. This option does not require official confirmation of the transaction by contractual documentation. The donor can act as an anonymous donor.

If the subject of the donation is monetary resources, the agreement between the parties must indicate the purposes for which the transferred funds can be spent and the amount of the transaction. An NPO can publish reporting information on its official Internet resource or send it separately to each donor.

Charitable foundation reporting

Accounting for charitable assistance in accounting entries and reporting in charitable foundations is organized on the basis of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Composition of accounting records for a charitable foundation (clause 2 of article 14 of law 402-FZ):

- balance sheet,

- report on the intended use of funds,

- applications to them.

Law 402-FZ gives NPOs a relaxation in the form of the right to use simplified methods of accounting and reporting (subclause 2, clause 4, article 6), while we must not forget about the exceptions given in clause 5 of art. 6, which an organization may fall under. Full and simplified reporting forms can be found in the order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n.

In addition, according to paragraph 3 of Art. 32 of Law 7-FZ, a charitable foundation is subject to the obligation to report to the Ministry of Justice. The report forms were approved by Order of the Ministry of Justice of the Russian Federation dated August 16, 2018 No. 170.

You can learn about simplified reporting that is relevant for charitable foundations from the article “Simplified accounting reporting for small businesses.”

The procedure and timing for publishing a report on the use of donations.

As mentioned earlier, donations transferred to NPOs are not included in the taxable base when calculating income tax. However, there are several important aspects to keep in mind when filing your financial returns.

Non-profit organizations that do not have obligations to pay income tax are required to submit a declaration only after the end of the year. At the same time, this declaration, according to the Order of the Federal Tax Service of Russia dated March 22, 2012, must include the following sheets:

- title page (sheet 01);

- sheet 02;

- sheet 07 (upon receipt of targeted financing, targeted revenues and other funds specified in paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation - including donations).

As part of the income tax return, the accountant of a non-profit organization for the tax period is presented with sheet 07 “Report on the intended use of property” . Such a report is required to be compiled and submitted by all non-profit organizations that received donations, money or services as part of charitable activities, as well as targeted revenues or targeted financing during the past tax period. This report does not include: funds received according to estimates of income and expenses from budgets of all levels and state extra-budgetary funds.

Moreover, let’s assume that an NPO received a certain amount of money as donations, and the nth part of this amount was spent within the framework of its statutory activities. However, the report must indicate all such receipts, their expenditures, and any unused balances. If, upon receipt of donations, a specific purpose and period were indicated, then despite this, in the report the accountant should transfer the data of the previous tax period for funds received but not used, the period of use of which has not expired, and also for which there is no period of use, while in Separate columns indicate the date of receipt of funds, as well as the amount of funds whose use period has not expired in the previous period. It is also important to realize that data for each donation is broken down by date and source of income.

If the NPO itself sends donations, how to reflect this fact in the accounting report?

Let's say your nonprofit sends a donation to another nonprofit. How to formalize and reflect this gratuitous transfer in accounting and taxation, and what transactions should be used to reflect this operation?

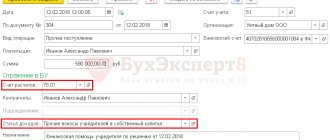

Thus, in accordance with current legislation, in accounting, transactions such as donations (charity) are usually recognized as “other” and, as a rule, are reflected in account 91 “Other income and expenses” (clause 11 of PBU 10/99). To record this transaction, your accountant should use the following combination of entries:

- “Debit 91-2” – “Credit 76” - reflects the amount of charitable (gratuitous) assistance to be transferred to another organization;

- “Debit 76” – “Credit 51” - the amount of charitable (free) assistance is transferred to the account of another organization;

The Ministry of Finance has repeatedly emphasized that expenses for charitable purposes are not related to the receipt of income, therefore taxable profit cannot be reduced on them. Due to the fact that charitable assistance in the form of a donation implies a gratuitous transfer of money or valuables, expenses in the form of the cost of the gratuitously transferred property plus expenses associated with the transfer procedure are also not taken into account when calculating income tax. By the way, VAT is not charged on expenses associated with the provision of charitable assistance in the form of donations provided by a non-profit organization; the only exception to this rule is excisable goods.

Accounting support

Zero 1500 rub. Activity 3500 rub. Activities + Salary 5000 rub.

• Personal accountant • Possibly remotely • 12 years of experience • 1000+ NGOs • All forms • Grants

Call your accountant right away

*The cost in Moscow and Moscow Region, St. Petersburg and Leningrad region is respectively: 2000, 5000, 7000 rubles

Call

How to register charitable assistance received from a legal entity or citizen?

A peculiarity of accounting in charitable foundations is that financial results accounts are not used to reflect non-profit charitable activities, but account 86 “Targeted financing” is used.

How to register charitable assistance from a legal entity? Income from non-commercial activities can be in the form of donations, membership fees or other payments for statutory activities; they are reflected in the following entries:

| Dt | CT | Description |

| 76 | 86 | the receivable for the receipt of a charitable contribution is reflected |

| 51, 50, 52 | 76 | money was received for the non-profit statutory activities of the fund |

By account 86, subaccounts are opened depending on the type of income. If the receipt is not money, but fixed assets that will be used in statutory activities:

| Dt | CT | Description |

| 08 | 76 | OS received free of charge (at market value) |

| 01 | 08 | OS put into operation |

| 86 | 83 | targeted funding used |

| 010 | depreciation accrued on an asset |

When receiving materials for conducting statutory activities, the following entries are made:

| Dt | CT | Description |

| 76 | 86 | the receivable for the receipt of a charitable contribution is reflected |

| 10 | 76 | materials received |

The use of received funds is shown in the debit of account 20, and if the funds are directed to the maintenance of a charitable foundation, then in the debit of account 26:

| Dt | CT | Description |

| 20 (26) | 10, 60, 70, 69… | expenses for non-commercial statutory activities of the fund are reflected |

| 86 | 20 (26) | costs covered by targeted funding |

If a charitable foundation conducts business activities, then the profit from it is attributed to the conduct of charitable activities by posting Dt 84 Kt 86.

If you have access to ConsultantPlus, check whether your accounting records are recorded correctly when receiving a donation free of charge. If you don't have access, get a free trial of online legal access.

How to reflect the provision of charitable assistance in transactions?

How to reflect charitable donations in accounting? Charitable expenses in a regular business organization are miscellaneous. In addition, they are not taken into account when taxing profits (clause 16 of Article 270 of the Tax Code of the Russian Federation), therefore PNO appears in accounting. The accountant must make the following entries:

- Dt 91.1 Kt 76 - expenses for charity are shown;

- Dt 76 Kt 51 - money was transferred to charity;

- Dt 99 Kt 68 subaccount “Income Tax” - PNO is shown.

In the following example, we will consider the situation of transferring a fixed asset within the framework of charity.

Example

Pervotsvet LLC in March 20XX purchased a copying machine worth 75,000 rubles, including VAT 12,500 rubles. In June, the device was transferred to a charitable foundation for the implementation of a specific program. Depreciation charges for the period of operation are equal to 10,593 rubles. In March 20XX, the following entries were made in accounting:

| Dt | CT | Amount, rub. | Description |

| 08 | 60 | 62 500 | purchased a copy machine |

| 19 | 60 | 12 500 | reflected incoming VAT |

| 68 | 19 | 12 500 | VAT is accepted for deduction |

| 01 | 08 | 62 500 | the device is put into operation |

In June 20XX the following entries were made in the accounting records:

| Dt | CT | Amount, rub. | Description |

| 01 subaccount “Disposal of fixed assets” | 01 | 62 500 | the initial cost of the retiring device is reflected |

| 02 | 01 subaccount “Disposal of fixed assets” | 10 593 | depreciation of the retiring equipment is reflected |

| 91.2 | 01 subaccount “Disposal of fixed assets” | 51 907 | the residual value of the device has been written off |

| 19 | 68 | 10 381 | VAT has been restored from the residual value of the device (RUB 52,966 × 20%) |

| 91.2 | 19 | 10 381 | recovered VAT is charged to other expenses |

| 99 | 68 | 10 381 | reflected PNO RUB 52,966. × 20% |

Look for clarification on VAT accounting in the next section.

Tax reporting of NPO expenses for charity

As you may have already understood, a non-profit organization can act not only as a recipient of donations, but also as a donor. The question becomes relevant: can a non-profit organization using a simplified taxation system take into account the amounts transferred for charitable purposes in its expenses?

The answer to this question is no , since due to the direct instructions of the Tax Code of the Russian Federation, when calculating the single tax, the taxpayer has the right to take into account only those expenses that are contained in the closed list given in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Since such expenses are not mentioned in this article, the organization does not have the right to include them in the calculation of the tax base for the single tax. However, at the same time, when it comes to the tax base when calculating income tax, expenses in the form of the value of property donated as charitable assistance are not taken into account when taxing profits (clause 16 of Article 270 of the Tax Code of the Russian Federation).

VAT on disposal of fixed assets as charitable donation

According to sub. 2 p. 3 art. 170 of the Tax Code of the Russian Federation, the tax must be restored if the fixed asset will be used in transactions that are not subject to VAT. Charity is considered to be such an operation according to subparagraph. 12 clause 3 art. 149 of the Tax Code of the Russian Federation - the main thing is that charity activities comply with the law 135-FZ and the asset is not excisable.

To calculate the amount of VAT related to retired fixed assets or intangible assets that must be restored, you need to calculate the residual value of the object and take the corresponding VAT percentage from it. The proportional calculation applies only to the indicated two types of assets; for other assets, the tax is fully restored. The restored VAT is charged to other expenses (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation).

You can learn about various situations for VAT recovery from our section “Procedure for VAT recovery (postings)”.

All typical risks that a charitable foundation may encounter in its activities are collected in a single review material in ConsultantPlus. Learn the information by getting free trial access to the system.

Results

Charitable assistance can be provided through a charitable foundation or independently by legal entities and citizens. In our article we looked at accounting in a charitable foundation, reporting of charitable foundations, as well as accounting in charitable organizations. A special feature is that in foundations, charitable transactions do not affect the financial results accounts; in a regular organization, charitable expenses are other.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.