Calculating the average salary is usually a simple operation, but it is complicated by the need to take into account bonuses. Bonuses given to employees can be very diverse: one-time, quarterly, annual. They all need proper accounting. Its absence will lead to biased salary calculation results. Accounting for bonuses requires a certain procedure.

Question: LNA has the right to pay special bonuses to employees. The organization provided bonuses to employees in connection with their participation in city holiday events (celebratory procession) on a non-working day. Is the specified bonus taken into account in calculating average earnings for calculating vacation pay? View answer

In what cases is the calculation carried out?

Indicators of average earnings are required to determine the amount of vacation, maternity and other payments. To find out the required indicator, you need to know the amount of the employee’s annual salary. An employee's earnings include not only salaries, but also other accruals, in particular bonuses. That's why it's so important to keep records of them.

Question: On the basis of a collective agreement, the company pays monthly bonuses, including to an elected employee of the primary trade union organization of the company - the chairman of the primary trade union organization (exempt trade union worker). Is the specified bonus amount taken into account when calculating average earnings by the trade union organization for calculating vacation pay? View answer

Results

Bonuses accrued in the 12-month period preceding the month of calculation of vacation pay must be taken into account when determining the income involved in calculating average earnings, if these bonuses are provided for by the current remuneration system. However, the process of including the entire bonus amount or a certain part of it in the calculation requires compliance with a number of rules, depending on the full (incomplete) working out of the calculation period, the coincidence (non-coincidence) of the bonus accrual period with the calculated one, and the accounting (non-accounting) of time worked when calculating the bonus.

Read the latest news about personal income tax on bonuses in the articles:

- “The Ministry of Finance has returned to the issue of personal income tax on bonuses”;

- “How to correctly reflect a one-time bonus in 6-NDFL (nuances).”

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation of December 24, 2007 N 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basic Rules

The procedure for calculating wages is established by Article 139 of the Labor Code of the Russian Federation. The nuances of carrying out calculations are established by the Regulations of the Russian Federation of January 24, 2007 No. 922. Clause 2 of the Regulations establishes the inclusion of all additional payments in the average salary when calculating it. Additional payments include bonuses. When carrying out work, it is necessary to take into account the actual wages, as well as the actual time during which the employee worked.

Typically, the average salary is calculated annually. This is a standard reporting period. However, it can be different, depending on the needs of the enterprise: quarter, week. The period must be specified in the accounting policies of the organization. The selected period of time should not violate the rights of employees.

bonus based on the results of work over three years taken into account when calculating average earnings for the payment of vacation ?

The bonus is included in the remuneration only when it is specified in the Regulations on remuneration of the enterprise. Only bonuses given for work in the organization are taken into account.

IMPORTANT! “Anniversary” payments (for example, paid for a decade of service in the company) are not taken into account when performing work. They are not directly related to the employee's merits.

Tax accounting of annual bonus

The annual bonus is included in income tax expenses, in expenses under the simplified tax system “income - expenses” or the special tax system for individual entrepreneurs only if a number of conditions are met:

- the bonus is provided for in the company’s labor documents (paragraph 1 of article 255, paragraph 21 of article 270, subparagraph 6 of paragraph 1 and paragraph 2 of article 346.16 of the Tax Code of the Russian Federation);

- the bonus was paid for labor performance (clause 2 of article 255 of the Tax Code of the Russian Federation).

An annual bonus is considered provided for by labor documentation if any of the following conditions are met:

- the employment contract contains the amount of the annual bonus and the conditions for its accrual (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation);

- the employment contract contains a reference to the company’s local regulations governing the procedure for calculating and paying bonuses.

Such an act may be a provision on remuneration. You can find a sample of it at the link.

Premiums are most often classified as indirect expenses (Article 318, paragraph 3 of Article 320 of the Tax Code of the Russian Federation). They can be included in direct expenses if this is an incentive for employees involved in the production of products or performance of work (paragraph 7, paragraph 1, article 318 of the Tax Code of the Russian Federation).

The procedure for accounting for bonuses

The accounting procedure is specified in paragraph 15 of Regulation No. 922. The following forms of remuneration will be taken into account:

- Monthly . No more than one payment is taken per 30 days.

- Bonuses for a period of more than a month . For example, they can be quarterly.

- Annual.

- For length of service . Available with extensive work experience.

How to take into account bonuses when calculating average earnings for unemployment benefits ?

ATTENTION! If the employee did not work the entire pay period, then the actual remuneration received is taken into account. This point is specified in the letter of the Ministry of Health and Social Development of the Russian Federation dated March 5, 2008.

IMPORTANT! When calculating, working dates are taken into account, not calendar dates.

Possible methods for calculating quarterly bonuses

The procedure for calculating the quarterly bonus, as well as the incentive system itself, is developed by the employer independently. The following options for determining the specific amount of the bonus may be considered:

- by calculation according to the formula established in the bonus regulations, summing up the bonus indicators assessed in monetary terms, which serve to assess the employee’s participation in the labor process;

- as a percentage of actually accrued earnings for the period;

- in a fixed amount that serves as a salary supplement;

- as a percentage of salary.

The first of the listed options most fully reflects the employee’s participation in the labor process. But it also turns out to be the most labor-intensive. Therefore, most employers prefer not to use it and resort to the remaining methods that are quite simple from a mathematical point of view.

But even these seemingly simple methods have their pitfalls.

Monthly Rewards

With an annual billing period, 12 premiums are taken, according to the number of months in the year. Even if employees were paid 2 bonuses per month, only one of them is taken into account. However, there are exceptions. In particular, if several remunerations were accrued on different grounds, all of them will appear when determining the average salary. It is important to consider remuneration according to the time actually worked. For example, an employee was on vacation. For a given month, his premium will be reduced.

Examples

It is easier to consider the nuances of calculating the average salary using examples.

Example No. 1 . The accountant calculates vacation pay for the period from January 1 to December 31. Each month, one bonus was accrued to the employee. However, in August, two bonuses were awarded for different positions (a salary increase and a reward for good work). 13 awards will be taken into account per year. This is quite legitimate, since 2 bonuses per month are allowed to be taken into account for various reasons.

Example No. 2 . The company awarded one bonus per month with the exception of two months. In June, no bonuses were given to the employee; in July, 2 bonuses were awarded. In this case, all 12 premiums are taken into account. The only limitation specified in the law is a maximum of 12 bonuses per year (meaning rewards accrued on the same basis). Therefore, all rewards can be taken into account.

We establish rules for calculating bonuses for the quarter

Bonuses paid quarterly are characterized by the following points:

- inclusion in the wage system used by the employer, i.e., thereby equating quarterly bonuses to wages (Article 129 of the Labor Code of the Russian Federation);

- the presence of an undoubted connection with the results of labor activity of each individual employee during the bonus period;

- systematic (regular) accrual;

- attitude towards all members of the workforce or the vast majority of them;

- dependence of the possibility of accrual on the overall results of the employer’s financial and economic activities for the bonus period;

- compulsory accrual to the employee if all the conditions that give him the right to receive bonuses are met.

The inclusion of bonuses in the wage system and the need to develop bonus rules common to the entire team require the employer to create internal regulations (Article 135 of the Labor Code of the Russian Federation) establishing:

- the structure of the wage system, for which documents such as wage regulations or a collective agreement are created;

- employee incentive system, which can be covered both in documents devoted to the remuneration system and in a separate document called the provision on incentive payments (on incentives, on bonuses).

The regulations on incentives in relation to bonuses should reflect:

- a list of all types of bonuses used by the employer;

- frequency of payment of bonuses of each type;

- the range of employees entitled to receive each type of bonus;

- conditions under which the accrual of bonuses becomes possible;

- a system for assessing the labor participation of each employee in the general labor process and translating it into specific bonus amounts;

- description of the procedure for reviewing the results of assessing the labor participation of each employee;

- criteria under which an employee is deprived of a bonus (deprivation of bonuses);

- a procedure that allows an employee to challenge the evaluation of his work performance.

The employer can establish the possibility of simultaneous accrual of several types of quarterly bonuses. But they must differ in the reason (ground) for the bonus. Moreover, each type of bonus may have its own circle of rewarded employees, its own conditions for accrual, its own evaluation system and its own grounds for depreciation.

To learn how you can draw up a document combining a description of the wage system and the incentive system, read the material “Regulations on the remuneration of employees - sample 2021”.

Annual awards

Annual benefits must be taken into account in any case, regardless of when they are accrued. It is important to follow the main rule - accounting for remuneration for the year that preceded the billing period. In particular, there is a letter from Rostrud dated February 13, 2007, which explains the calculation procedure. If accounting is performed for vacation pay in 2006, you need to calculate the average salary for 2005. Indicators for 2004 cannot be taken.

When accounting for annual remunerations, you must use the following rules:

- If an employee has not fully worked the pay period, but the remuneration payment period coincides with the reporting period, the entire bonus must be taken into account.

- If the employee has not worked the entire period and the accrual time does not coincide with the reporting period, then bonuses are accounted for in accordance with the time actually worked.

The accounting rules are also set out in a letter from Rostrud dated May 3, 2007. It states that if the average salary is taken into account without taking into account the annual bonus, then a recalculation is carried out.

Example

Vacation pay must be accrued in January 2022. The calculation period is the time from the beginning to the end of 2022. This year the employee received annual benefits:

- In March 2022 - 5,000 rubles for 2016.

- In November 2022 - 10,000 rubles based on the results of 2022.

Only the premium for 2022, amounting to 10,000 rubles, will be used for calculations. Remuneration for 2016, regardless of its actual payment, will not be taken into account.

Is vacation pay included in the average salary?

Employers often reward employees with bonuses for special achievements - fulfilling or exceeding plans, successfully completing important tasks. Such payments may be systematic or one-time in nature.

Bonuses can be paid monthly, quarterly, annually, or one-time when a certain indicator is achieved or on the occasion of a holiday or important event.

All types of bonuses can be taken into account differently by the employer when calculating average earnings for vacation pay.

To include a one-time bonus in the calculation of the average amount of earnings received when determining the amount of vacation pay, the following requirements must be met:

- This incentive payment was made to the employee during a specific billing period taken into account for calculating vacation pay.

- The one-time bonus assigned to a working citizen is provided for by the local regulations (regulatory act) of the employer. It is important not to confuse this payment with financial assistance, which is calculated differently.

If a one-time cash incentive is paid to an employee for a certain period, vacation pay in this case is calculated taking into account the following circumstances:

- It is necessary to clarify which period of time is longer – bonus or settlement.

- It is necessary to find out whether the bonused employee has fully worked the period for which the incentive payment was transferred to him.

Accounting for bonus payments in full

It should be noted that one-time bonuses can be taken into account in different ways when determining the amount of vacation payments.

One-time cash incentives are included in the calculation in whole or in part - it depends on the circumstances mentioned above.

Typical situations that arise during such calculations should be considered in detail.

The amount of the one-time bonus will be fully included in the amount of vacation payments due if the following requirements are simultaneously met:

- A working citizen who takes paid leave has worked the entire pay period.

- The period of time for which the company’s management assigned a one-time bonus to the employee is entirely included in this billing period.

The situation when a one-time incentive payment in full is taken into account when calculating the average amount of earnings for vacation pay should be considered with an example.

Calculation example

Initial data:

The employee intends to take annual paid leave from 09/01/2019 to 09/14/2019.

His monthly salary (salary) is 20,000 rubles.

For vacation pay, the calculation period is taken, which begins on 09/01/2018 and ends on 08/31/2019.

As stipulated by the collective agreement with the employer, this employee was paid a one-time cash incentive on November 1, 2018 for the construction of the facility, which was carried out from October 1, 2018 to October 31, 2018.

Let's summarize the initial data in a table:

| Vacation dates | 01.09.2019 — 14.09.2019 (14 cal days) |

| Billing period | 01.09.2018 — 31.08.2019 |

| Monthly salary | 20,000 rub. |

| One-time bonus | 10,000 rub. (for the period from 10/01/2018 to 10/31/2018) |

Calculation:

Since the time from 10/01/2018 to 10/31/2018 is fully included in the period for calculating vacation, the amount of the one-time bonus paid - 10,000 rubles - will be fully taken into account when calculating average earnings, since the citizen worked the entire calculation period.

| Total income | 20000*12 months. + 10000 = 250000 |

| Days worked | 29.3 * 12 months = 351.6 days. |

| Average daily earnings | 250000 / 351,6 = 711 |

| Vacation pay | 711 * 14 = 9954 |

Personal income tax must be withheld from the accrued amount of vacation pay and insurance premiums must be calculated.

Partial inclusion of a one-time bonus in vacation pay

A special case is if the employee did not work the entire pay period. In other words, if he has unworked days within the time interval taken into account for calculating vacation pay.

If, under such circumstances, the bonus period is included in the calculated time interval, and a one-time incentive was paid to the employee for the days actually worked, this bonus will also be fully taken into account for vacation pay.

A common situation is when an employee has not worked all the days of the annual calculation period taken into account for determining vacation pay. Moreover, the time interval for which he was accrued a one-time bonus turned out to be longer than the calculated period in duration.

In this case, to calculate the average amount of earnings received, you have to take a specific share of the one-time bonus attributable to the billing period.

The resulting value will require recalculation, since the employee has not fully worked out the calculation interval.

Example

Initial data:

From 03/22/2019 to 04/04/2019 inclusive, the employee was allocated annual paid leave (its duration is 14 days).

The period for determining vacation pay due began on 03/01/2018 and ended on 02/28/2019.

This citizen earns a monthly salary (20,000 rubles) and a bonus (10,000 rubles).

For the successful completion of the construction of a real estate project in the billing period, he was assigned a one-time cash incentive amounting to 60,000 rubles (according to the norms of the collective agreement). The bonus period is 18 months.

It is known that from October 15, 2018 to October 23, 2018, this employee took sick leave for 10 calendar days (7 working days). How does sick leave affect the calculation of vacation pay?

In the calculated annual interval there are 249 working days, of which the citizen worked 242 days. It turns out that in October 2018 the employee earned 20,000 rubles (a 10,000 bonus is added to the 20,000 salary, and then the resulting value is multiplied by 14 days and divided by 21 days).

Accordingly, for all other months of the calculated annual interval, he earned 330,000 rubles (30,000 multiplied by 11 months).

| Vacation dates | 22.03.2019 — 04.04.2019 (14 cal days) |

| Billing period | 01.03.2018 — 28.02.2019 |

| Monthly salary + monthly bonus | 20000 + 10000 = 30000 |

| One-time bonus | 60,000 rub. (for 18 months) |

| Sick leave | 15.10.2018 — 23.10.2018 (9 cal days) |

| Salary for October 2018 | 20000 |

Calculation:

To determine the amount of vacation pay, the amount of one-time bonus is partially taken into account, since the duration of the bonus interval turned out to be longer than the duration of the billing period.

This means that when calculating vacation pay, only that portion of the one-time bonus that falls within 12 months of the calculation interval will be taken into account. 60000*12 months. / 18 months = 40000.

It should also be taken into account that the calculated interval (12 months) was worked by the individual partly due to sick leave. This means that you also need to recalculate the amount of the bonus in proportion to the time worked. 40000 * 242 working days / 249 working days = 38875.

| Premium taken into account | 38 875 |

| Total income | 30000 * 11 months. + 20000 + 38875 = 388875 |

| Days worked in October 2018 | 29.3 * 14 / 31 = 13 days. |

| Days worked in the billing period | 29.3 * 11 months + 13 = 335 days. |

| Average daily earnings | 388875 / 335 = 1161 |

| Vacation pay | 1161 * 14 = 16254 |

conclusions

- Calculation of the average salary is necessary to determine the amount of vacation and maternity pay.

- Not only salaries are taken into account, but also rewards.

- Annual, quarterly, monthly and one-time payments are taken into account.

- Only the remunerations stipulated by the accounting policy of the enterprise are important. If they are accrued unofficially, then they are not recorded.

- When accounting for amounts, you must be guided by the rules established by the relevant regulations.

- It is important to remember some features. For example, only 12 monthly bonuses accrued according to one indicator are taken into account.

- If there are several bases for accrual, then several remunerations can be taken into account.

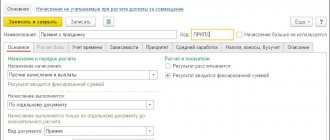

Calculation of a premium set at a fixed amount

The accrual of a bonus in a fixed amount may also have options depending on what conditions are specified in the bonus regulations regarding this bonus. It is possible to establish such calculation conditions when the fixed amount is:

- accrued in full regardless of the time the employee is actually present at work during the bonus period;

- paid in proportion to actually worked for the period of time in question;

- is not paid for a month not fully worked.

In the first version of the calculation, in fact, no calculation is required. The bonus is simply awarded in the agreed amount.

For the second option, it will be necessary to determine what proportion of the time actually worked by the employee in the total working time attributable to the bonus quarter. And then multiply the resulting ratio by the total amount of the fixed premium.

According to the third option, to calculate the amount of the bonus for the quarter, the total amount of the fixed bonus must be divided by 3 and multiplied by 2.

How to calculate quarterly bonus from salary

A quarterly bonus calculated from salary is defined as a percentage of the employee’s salary and, at first glance, is not much different from a bonus set at a fixed amount. However, it has its own characteristics:

- the accrual base (salary) may change;

- for regions where a regional salary coefficient applies, this coefficient will have to be applied to the amount of the bonus calculated from the salary.

Just like a bonus accrued in a fixed amount, a bonus calculated from a salary, according to the conditions included in the incentive provision, may be linked to the actual time worked or not accrued for an incompletely worked month and in these cases will be calculated accordingly:

- taking into account the share of time actually worked by the employee in the total working time attributable to the bonus quarter;

- by dividing the total calculated premium amount by 3 and multiplying by 2.

Taxation of quarterly bonus

The inclusion of a quarterly bonus in the wage system clearly requires that its amount be subject to all salary taxes: personal income tax and insurance contributions. But these payments will also have to be calculated even in cases where the quarterly bonus:

- not included in the wage system;

- accrued on grounds not related to the employee’s work activity.

In terms of personal income tax, this requires clause 1 of Art. 210 of the Tax Code of the Russian Federation, and in relation to insurance premiums - clause 1 of Art. 420 Tax Code of the Russian Federation IP. 1 tbsp. 20.1 of the Law “On Compulsory Social Insurance against Accidents...” dated July 24, 1998 No. 125-FZ.

Insurance premiums accrued for premiums not related to work activities can be included in expenses taken into account when calculating the profit base (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06 /1/220), despite the fact that such a bonus itself is not included in expenses for calculating the profit base.