Conditions for classifying an instrument as a fixed asset

Tools and inventory can be taken into account as inventories or fixed assets. An inventory item in accounting refers to fixed assets while the following conditions are met: (click to expand)

- Items are intended to be used in the activities of the enterprise to generate income;

- The object is not intended for subsequent resale;

- The service life of the objects is more than 12 months.

The absence of any of the conditions determines accounting as inventory and write-off of tool wear by transferring the cost to expenses when releasing accounting units into production. For tax purposes, classifying an instrument as a fixed asset is possible if the cost of acquisition costs exceeds 100,000 rubles. Accounting for inventory as a fixed asset is carried out using the OS-1 act and the C-6 card.

Instrument – fixed assets or turnover

An organization can register a purchased instrument in different ways. The order of its write-off depends on this.

Question: A manufacturing organization purchased drills, jigsaws and thermal blowers for use in its activities. How to take them into account: as part of fixed assets or assets in circulation? If we classify them as assets in circulation, then in what order should we write off when putting them into operation: as a special tool or in accordance with accounting policies?

Answer: In accounting, drills, jigsaws and thermal blowers can be accounted for both as fixed assets and as working capital. In the second case, when put into operation, they are written off in the manner established in the accounting policy, since this instrument is not a special one.

Rationale: If the purchased tool (drills, jigsaws, hot blowers) is planned to be used for less than a year, it is considered inventory. Such instruments are received as separate items as part of funds in circulation and are taken into account in subaccount 10-9 “Inventory and household supplies, tools” <1>.

If the useful life of an instrument exceeds a year, it can be accounted for both as fixed assets and as assets in circulation. This is explained by the fact that fixed assets are recognized as assets that meet certain conditions and are not classified as inventories. An instrument is considered an inventory only if, according to accounting policy, it does not belong to fixed assets <2>. This means that the accounting policy can provide for an additional criterion (for example, cost), subject to which the instrument will be accounted for as fixed assets. In addition, the organization has the right to establish a list of tools that will always be included in inventories <3>

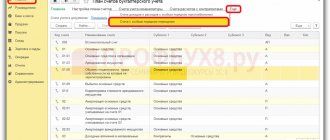

If a drill, a jigsaw and a thermal blower are classified as fixed assets, then in accounting before commissioning they are recorded in account 08 “Investments in long-term assets”, after entry - in account 01 “Fixed assets”. And as current assets they are accounted for in subaccount 10-9 <4>.

Having transferred the instrument, capitalized in subaccount 10-9, into operation, its cost is written off as expenses. The write-off procedure depends on the nature of the instrument’s use: universal or special <5>. But the accounting legislation does not explain what is considered a special tool.

In the situation under consideration, it can be assumed that the organization has acquired and is using a tool that does not have unique properties. In this case, the drill, jigsaw and blower are not considered special tools. This means that their cost is written off as expenses in accordance with accounting policies. For example: — 100% — upon commissioning; — 50% — upon transfer to operation and 50% — upon retirement;

— in a different order <6>.

Tool depreciation: procedure for determining depreciation rates

When registering equipment, tools, inventory, the period of use during which the inventory unit is capable of bringing economic benefits is determined. In accounting, the estimated useful period is determined by the enterprise. It is advisable to check the useful life with the Classifier of objects belonging to a depreciation group used in tax accounting.

Depending on the group, a period of use is established - the implementation of the assigned tasks by the tools. The length of the period affects the rate of deductions. Each of the Classifier groups provides the opportunity for enterprises to set the operating period within a period of several years. Enterprises independently choose the number of years of use within the allotted time period.

Duration of use in “Intended Use”

Men's YouDo overalls have a shelf life when issued:

- painter-plasterer Tikhomirov V.O. - 12 months;

- master Druzhnikov G.P. - 24 months.

If the same low-value object, depending on its purpose, has different useful life, in the Main - Functionality - Inventory section, check the Purpose of use of workwear . Despite the name, this setting applies not only to workwear, but also to special equipment.

After this, in the document Transfer of materials into operation, in the Warehouse Purpose of Use column will appear on the tabs:

- Workwear;

- Special equipment.

For overalls with a useful life established in the item card (in our example - 12 months), the columns are:

- the purpose of use - the period indicated on the card will be used;

- the method for recording expenses manually.

For overalls with a useful life that differs from that specified in the nomenclature card (in our example - 24 months), in the form of the Purpose of use , indicate:

- Order of use - For a fixed period ;

- Useful life.

The column Method of reflecting expenses will be filled in automatically according to the intended use.

For inventory items reflected on tabs:

- Special equipment - the useful life is indicated in the same way as the Special clothing tab;

- Inventory and household supplies - the useful life from the item card is used.

The useful life of an item is counted from the date of the document Transfer of materials into operation.

Procedure for calculating instrument depreciation

The value of the instrument is transferred monthly until it is completely written off. The amount of annual deductions is determined by the product of the cost of the instrument and the annual depreciation rate. The amount included in the monthly cost is calculated by dividing the annual depreciation amount by 12 - the number of months.

| Basic concepts in accounting | Characteristics of concepts |

| Depreciation | Transferring the cost of the tool to cost throughout the entire period of use |

| Deduction rate | Set based on the type of tool (membership in the group), which determines the service life |

| Amount of deductions | Calculated depending on the calculation method, acquisition cost and annual rate |

The rate of depreciation is expressed as a percentage. Formula for calculating the norm: H = 1 / C x 100%, where C is the number of years of useful use of the tool. The rate of deductions is determined for the instrument for the entire period without changes, except in cases of modernization with an increase in the period of operation.

Useful life control

Control of inventory items issued to employees according to the terms of use is carried out using the Materials issued to employees in the Warehouse on the date specified in the report header.

The report is generated in the following sections:

- Employee;

- Nomenclatures;

- Issuing document.

The report is filled in:

- Issue date —date of issue document;

- Period of use from: nomenclature card;

- purpose of use;

Using the report, it is easy to identify materials that need to be decommissioned.

See also:

- Accounting for workwear from 2021

- Acquisition of low-value objects with a useful life of more than 12 months

- Accounting for non-essential assets in accounting and tax accounting

- Inventory of workwear and equipment from 2021

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Useful life You do not have access to view To gain access: Complete a commercial…

- Modernization of a fixed asset with an increase in useful life Let's consider how to reflect the modernization of an incompletely depreciated fixed asset...

- Acquisition of property with different useful lives in used and auxiliary units. Confession SHE...

- How to determine the remaining useful life of a fixed asset in 1C? ...

Methods used to calculate depreciation in accounting

At the legislative level in accounting, acceptable methods are enshrined in PBU 6/01. The choice of option is made by the enterprise depending on the economic efficiency of use.

| Usage options | Linear method | Reducing balance | Cumulative (number of years of use) | Production (proportional to production volume) |

| Characteristic | The cost is transferred evenly throughout the entire service life | Write-off at the initial stage of use is made in a larger amount | The transfer of value is carried out evenly, with a decrease in the amount | Write-off is used depending on the volume of production |

| Positive sides | Allows you to simplify cost planning | Allows for accelerated write-off | In the initial period of use, the maximum write-off is made | There is an opportunity to optimize costs |

| Preferred use | Used in activities with stable production of products and revenue generation | Used for the need for accelerated transfer of value | Used with high-tech tools | Used for seasonal use of equipment and tools |

Each option has its own calculation formula. The method chosen by the enterprise is fixed in internal documents.

Accounting, transfer, write-off and return of instruments

In practical activities, organizations engage a subcontractor to perform construction and installation work. The contract states that the subcontractor performs the work using the company’s materials, as well as its tools. Accounting for customer-supplied materials does not raise any questions. Let's look at how to correctly record the accounting, transfer, write-off and return of instruments if they cost up to 40,000 rubles. and are included in material and production costs (MPC).

In accordance with paragraph. 4 clause 5 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (hereinafter referred to as PBU 6/01), assets in respect of which the conditions provided for in clause 4 are met PBU 6/01, and cost within the limit established in the organization’s accounting policy, but not more than 40,000 rubles. per unit, can be reflected in accounting and financial statements as part of the inventory. To ensure the safety of these objects in production, proper control over their movement and operation must be organized. The task of accounting is to create a system for analytical accounting of these assets. Even if assets are written off in accounting, we must ensure off-balance sheet accounting of such inventories - clause 23 of the Guidelines for the accounting of special tools, special devices, special equipment and special clothing, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n (hereinafter referred to as the Guidelines instructions N 135n). To do this, it is necessary to reflect the cost of the instrument transferred for operation on the entered off-balance sheet account, for example 016 “Special equipment transferred for operation.”

The Ministry of Finance of Russia in Letter dated May 30, 2006 N 03-03-04/4/98 explained that if an organization decides to take into account objects as part of the inventory, it must maintain the appropriate primary documents (receipt order in form N M-4, demand invoice in form N M-11, materials accounting card in form N M-17, etc.). These forms were approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction” (hereinafter referred to as Resolution N 71a).

Since these objects meet the characteristics of fixed assets, it is advisable to indicate the expected period of use of such assets. The procedure for determining the period of use of such objects must be prescribed in the accounting policy. However, the organization should not set this period by order, since such assets are not subject to the rules for accounting for fixed assets. To indicate the expiration date, you can use the “Expiration date” column in the material accounting card M-17. In addition to maintaining primary documents, it is necessary to conduct an inventory of such objects. By means of an inventory, the compliance of accounting data with the actual availability of property and liabilities is verified.

There are no special instructions in accounting legislation regarding the inventory of assets that have already been written off from balance sheet accounts, but are actually used in production, but since the institution will use these objects for several years, it is necessary to have information about their availability. This will make it possible not to consider such objects as surpluses identified during the general inventory. The results of the inventory of inventories are documented in a separate inventory. The need for an inventory is also indicated by the fact that if shortages of such property are discovered, damages can be recovered from the guilty parties. The unified form of inventory inventory of goods and materials (INV-3) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 N 88 “On approval of unified forms of primary accounting documentation for recording cash transactions, for recording inventory results” (hereinafter referred to as Resolution N 88). If during the inventory process unusable material assets are discovered, the commission draws up acts for their write-off. There is no unified form of such an act, therefore, in the accounting policy of the organization, it is necessary to approve its form of the act, and it must contain all the mandatory details listed in paragraph 2 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”.

The cost of special tools, special devices and replacement equipment is repaid only by writing off the cost in proportion to the volume of products (works, services). The cost of special tools and special devices intended for individual orders or used in mass production is allowed to be fully repaid at the time the corresponding tools and devices are transferred to production. (Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 N 34n “On approval of the Regulations on accounting and financial reporting in the Russian Federation”, paragraph 50).

Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n “On approval of the Guidelines for accounting of special tools, special devices, special equipment and special clothing” paragraph 56.

DOWNLOAD LINK:

Accounting, transfer, write-off and return of instruments.docx

RECORDING OF INSTRUMENTS pr. dated December 26, 2002 N 135n.docx

https://cons-systems.ru/

Formulas used for various accrual options in accounting

When calculating annual deductions in accounting, the following formulas are used: (click to expand)

- The linear method is based on the initial cost: A = Sp x N / 100%, where Sp is the cost of registration, N is the depreciation rate;

- To calculate the method of reducing the balance, the basis is the residual value and the coefficients accelerating write-off: A = Co x N x K / 100%, where Co is the residual value, N is the norm, K is the acceleration factor;

- To apply the cumulative method, the initial cost and the number of years of use are taken: A = Sp x Chki / Chpi, where Chki is the number of years until the end of use of the tool, Chpi is the total number of years of operation.

- When using the production method, the initial cost and indicators of the volume of the plan and the actual production of products are taken into account: A = Of x Sp / Opl, where Of is the actual output of products, Opl is the planned output.

The option chosen by the enterprise is applied to the entire group of homogeneous tools. The disadvantage of using non-linear methods of writing off depreciation is the lack of accounting by company code. The acceleration factors selected in accounting are also applied to the entire tool group.

Use of increasing factors in calculating depreciation

The opportunity to speed up the process of attributing the cost of a tool to expenses is provided to enterprises by using acceleration factors. In accounting, the use of the coefficient is possible when the enterprise chooses the accrual method using the reducing balance method.

In taxation, there are several reasons for using accelerated depreciation.

| Operating Condition | Coefficient | Limitation |

| Using a tool under the influence of factors that accelerate the aging of objects or operation with increased shifts | 2 | Not used for 1-3 depreciation groups |

| Application of high energy output tools | 2 | According to the list approved by the Government |

| Produced under an investment contract | 2 | Applicable for instruments included in groups 1-7 |

| Purchased under a leasing agreement when recorded on the lessor’s balance sheet | 3 | Does not apply to instruments of groups 1-3 |

| Used for the extraction of marine hydrocarbons | 3 | In case of termination of use, deductions are subject to recalculation |

Each of the conditions allowing the application of an increasing factor requires mandatory documentary confirmation. Read also the article: → “Depreciation under the simplified tax system. Examples, answers to questions”

Tax accounting for tool depreciation

In taxation, 2 calculation methods are used: linear and non-linear. Enterprises calculate depreciation separately for each inventory item using the linear method and entirely for a homogeneous group when using the non-linear method.

An example of writing off depreciation in taxation

Perekrestok LLC acquired ownership of a tool worth 125,000 rubles, used for operation in aggressive environments. Service life – 8 years. In the accounting of the enterprise, a write-off acceleration factor of 2 was applied. The enterprise:

- Determines the rate of deductions: N = 1/8 x 100% = 12.5%;

- Calculates the norm taking into account the coefficient: Well = 12.5 x 2 = 25%;

- Determines the amount of annual deduction: Ar = 125,000 x 25% = 31,250 rubles;

- Sets the amount of monthly deduction: Am = 31,250 / 12 = 2,604.17 rubles.

Conclusion: The company takes into account monthly expenses in the amount of 2,604.17 rubles for tax purposes.

The procedure for reflecting depreciation of tools and equipment in accounting

The amounts of accrued depreciation are reflected in account 02 in correspondence with the production cost accounts: Dt 20, 44, 26 Kt 02. Deductions are made monthly from the month following registration.

An example of calculating depreciation using the accelerated method

Avtodrom LLC uses tools for repairing transport equipment in its activities. After purchasing a lift worth 250,000 rubles, the company decided to accelerate depreciation with a coefficient of 2. The service life is 10 years. In enterprise accounting:

- The depreciation rate is determined: N = 1 / 10 x 100% = 10%;

- The write-off amount for the first year is calculated: A1 = 250,000 x 10% x 2 / 100% = 50,000 rubles;

- The write-off amount for the second year is determined: A2 = 200,000 x 10% x 2 / 100% = 40,000 rubles;

- For the third year: A3 = 160,000 x 10% x 2 / 100% = 32,000 rubles;

- For the fourth year: A4 = 128,000 x 10% x 2 / 100% = 25,600 rubles;

- For the fifth year: A 5 = 102,400 x 10% x 2 / 100% = 20,480 rubles;

- Further according to a similar scheme.

Enterprises that use a simplified accounting procedure have the right to expense the cost of instruments at a time when registering a fixed asset.

Accounting for tools and equipment as fixed assets

Let us recall that the main difference between fixed assets and inventories is that the costs of their acquisition cannot be taken into account immediately when putting the facility into operation. Their cost is repaid gradually through depreciation.

Accounting.

The main criterion for property to belong to the category of fixed assets in accounting is its useful life. If this period exceeds 12 months, the property can be classified as fixed assets.

In addition to the period of inclusion of property in fixed assets, it also depends on the nature of its use. Fixed assets can be recognized as property that:

- intended for use in the production (managerial) activities of the organization or for rental;

- not intended for resale;

- capable of generating income in the future.

If the purchased equipment meets these conditions and its cost is higher than the limit established in the organization’s accounting policy for accounting for assets as part of inventories (or over 40,000 rubles), then it should be accounted for in account 01 “Fixed Assets”.

Depreciation is calculated in one of the following ways: straight-line; reducing balance method; the method of writing off the cost by the sum of the numbers of years of useful life; by writing off the cost in proportion to the volume of products (works).

When deciding whether to classify certain objects as fixed assets and choosing a method for calculating depreciation, it is necessary to take into account that in some cases you will have to pay property tax on the cost of fixed assets.

Olga Sergeeva answers,

Editor-in-Chief Aktion Accounting

In accounting, depreciation must be calculated starting from the month following the month in which the property was accepted for accounting as a fixed asset. Subsequently, depreciation is accrued monthly regardless of the organization’s performance. It is necessary to stop accruing depreciation starting from the month following the one in which the fixed asset was retired or completely paid off its value. For more information about the rules for depreciation of fixed assets, see the recommendations of the Glavbukh System, which is part of Aktion Accounting.

Tax accounting.

In tax accounting, the following criteria are established for classifying assets as depreciable property:

- they must be owned by the organization;

- used to generate income;

- the useful life must be more than 12 months;

- the cost must exceed 100,000 rubles.

The cost of depreciable property is repaid through depreciation.

The useful life of acquired objects for tax accounting purposes is determined by the organization in accordance with the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1.

Depreciation is calculated using the linear or non-linear method (clause 1 of Article 259 of the Tax Code of the Russian Federation).

Before starting to depreciate property, the very possibility of its use is assessed. In addition, the initial cost and useful life of the property are determined. The object begins to be depreciated after it is put into operation. In the recommendations, see what is considered the date of commissioning and what documents need to be drawn up.

Write-off of depreciation costs upon disposal of tools and inventory

The reasons for the disposal of tools or inventory are write-off due to loss of useful properties or sale to third parties. To write off inventory, a commission is created that evaluates the condition of the object and issues a conclusion in the form of a report. Non-operating expenses include disposal costs and the amount of underaccrued depreciation.

Depreciation stops accruing from the month following the sale of the instrument. When selling, account 02 for the object is closed by transferring the amount to the “disposal” subaccount, opened separately to account 01. The following entries are made in accounting:

- Dt 01 (disposal) Kt 01 – the residual value has been written off;

- Dt 02 Kt 01 (disposal) – depreciation is written off;

- Dt 91 Kt 01 (disposal) - residual value is reflected in expenses.

When selling inventory, it is necessary to reconcile the data of NU and BU if they differ.

Rules for document design and preparation

The legislation does not provide for a special form for drawing up an Act on the write-off of an unusable instrument. Therefore, an enterprise can independently develop a form, taking into account the legal requirements for the details of primary documents (Accounting Law No. 402-FZ, Art. 9).

In our case, the following will be required:

- Name of company

- Date of preparation

- Title of the document

- A descriptive part, with reasons, number of written-off instruments.

- Positions, full names and signatures of the participants in the process.

Sample (step-by-step completion of document items)

Okay, let's fill out the write-off form together.

| n/n | Description |

| 1. | At the top of the document we indicate the name of the enterprise and the details of the manager, who will have to confirm his agreement with the conclusions set out in the act |

| 2. | Title of the document. In our case - Write-off act |

| 3. | Place and date of drawing up the act |

| 3. | Descriptive part. Here we indicate the name of the manual or automated tool, the quantity and reasons for exclusion from the list of existing ones, as well as its total cost. If there are documents that confirm the reason for writing off mechanisms that have fallen into disrepair, then a link should be made to them. |

| 4. | Final part. Positions, details and signatures of commission members |

The act of writing off an unusable instrument is drawn up in two copies, one for the financially responsible person, and the second is transferred to the accounting department of the enterprise to reflect the operation in tax accounting.

TRUDKO, INFO

Accounting for instrument depreciation in different taxation systems

Enterprises that apply the simplified tax system with the object “income minus expenses” and have the right to pay the unified agricultural tax take into account the amount of the cost of the instrument as part of expenses when determining the tax base. Depreciation is not charged, but the cost of acquisition or creation costs is written off. Features of attributing deductions to expenses under the simplified tax system and unified agricultural tax:

- Instruments subject to depreciation with a useful life of up to 3 years are written off during the first year of application of the regime;

- Inventory units with a useful life of 3 to 15 years are written off during the first year in the amount of 50%, the second - 30%, the third - 20%;

- Tools must be used in the activity.

Write-offs are made in equal parts during the accounting period. Objects taken into account under the simplified taxation system and unified agricultural tax must be paid to the supplier. Taxpayers using UTII or simplified tax system with the object “income” do not keep track of expenses, including the cost of the instrument.