To resolve financial issues, many companies attract internal and third-party sources of financing. In the second case, at a certain stage the company may have so-called long-term and short-term obligations. If they exist, one of the main tasks of a company or enterprise is timely repayment of debts, while the funds received are not the property of the company, it simply uses them until the time for their repayment comes.

How are assets and liabilities divided into short-term and long-term according to International Financial Reporting Standards?

Signs of short-term liabilities

This type of loan has the following features:

- The total amount of borrowed funds largely determines the duration of the enterprise's production cycle. The more significant the short-term obligations of a business entity, the smaller amounts it will attract to use to pay current expenses in the course of the company's operation.

- The company's short-term liabilities replace a free source of borrowed capital.

- The total amount of debt is often determined by how successfully the company sells its products. An actively operating enterprise is forced to constantly spend money, so it often requires borrowed funds.

- When preparing the financial statements of a company, it is worth remembering that short-term liabilities on the balance sheet are “Liabilities”.

- In some cases, debts that are less than 12 months old can be paid off using current assets. These financial resources are used in the planned activities of a business entity, and in order to use them to pay off debts, they must be credited no later than 12 months from the date the debt was created.

- The amount of this type of debt depends on the frequency of payments on it, which makes it possible to quickly work with sources of funds when carrying out production activities.

- The size of short-term liabilities is difficult to estimate in the future; this situation arises from the impossibility of accurately calculating the amount of amounts that form the basis of debt obligations.

How are short-term liabilities reflected in the balance sheet ?

Key purpose

A detailed and detailed analysis of financial statements can reveal almost the entire picture of the life of an economic entity.

However, there is not always enough time to conduct a thorough analysis. To obtain reliable but timely data, special calculation indicators are used - coefficients. The debt-to-equity ratio is one such benchmark. By calculating this indicator, you can assess how stable the financial position of the controlled organization is. If your own funds dominate in the ratio, then you can confidently say that the enterprise’s activities are profitable. That is, the company is able to independently pay off its obligations.

If most of the finances at the disposal of the company are credit money, then you should be wary. It is likely that the company is suffering losses and that there is not enough of its own money to pay the bills. True, the predominance of credit finance is not always negative. After all, a company can receive investments and loans to expand production, open a branch network, develop new products, etc. Thus, when assessing the situation, you need to take into account the circumstances.

The value of the ratio of equity capital (EC) and debt capital (DC) should be of interest to business partners of an economic entity (suppliers, buyers, intermediaries), as well as creditors and investors. The owners of the enterprise should also pay close attention to the indicator in order to realistically assess the state of affairs in the company, and, if necessary, promptly change financial and management policies.

Calculation of the coefficient and its meaning

Described debt is expressed using a ratio that shows the proportion of liabilities in relation to total debt. To calculate this coefficient, use the following formula:

Kkz = Ko: (Ko + Do)

Where

- Kkz is the coefficient that needs to be calculated,

- Ko – short-term,

- Until – long-term.

obligations used:

The indicator that will be obtained after the operations performed shows how dependent the business entity is on borrowed financial injections over a 12-month period. If the short-term liabilities ratio is high, this indicates that the company is solvent, respectable and reliable.

Accounting for interest-free loans issued

Let's consider the conditions from example 2, and assume that the agreement provided for the issuance of an interest-free loan.

Then the lender’s postings will look like this:

Dt 76 Kt 51 - issuance of an interest-free loan of 3,000,000 rubles.

The next and last entry in the lender's accounting will be entry Dt 51 Kt 76 (it will appear on the day the loan is repaid).

IMPORTANT! Loans issued on interest-free terms are not financial investments for the lending company (clause 2 of PBU 19/02), since the essential condition for recognizing assets as such is not met: their ability to generate income. At the same time, a loan issued that includes interest will be considered as such (clause 3 of PBU 19/02).

In the lender's reporting, the loan issued will be reflected in line 1230 “Receivables”. In this case, the organization can detail the type of receivables in the balance sheet: short-term debt with a maturity of 12 months or less and long-term debt with a maturity of more than 12 months.

Read how to account for an interest-free loan issued to an employee here.

Short-term liabilities and their components

When recording debt obligations, all borrowed funds of the company must be taken into account. The company's current liabilities consist of the following components:

- Conditional payment.

- Funds that were borrowed for a long period of time, but part of them must be returned within a period not exceeding a 12-month period.

- Accounts payable.

- Income that the company did not earn.

- Debt obligations on demand.

- Deposits placed for a 12-month period and which will be returned.

- Tax deductions.

- Dividends to be paid to shareholders.

- Loans on bills of exchange with maturities of less than 12 months.

- Debts requiring repayment no later than 12 months.

Question: How to reflect in the accounting of an organization (debtor) the fulfillment of its obligations under a short-term interest-bearing loan agreement by a guarantor (legal entity) and the further repayment of debt by the organization to it, if in addition to the amount paid by the guarantor to the creditor, the organization pays to the guarantor the interest accrued on this amount, the amount of which Is the guarantee agreement not established? View answer

Types of short-term liabilities

Short-term liabilities can be divided into several subtypes:

- Operating rooms. This type of debt includes: rent payments, advance payments received by a business entity, taxes, current payments to the budget. The group of operational obligations includes the company's debts for materials received that will be used in production, as well as accrued but not yet paid salaries to the company's employees.

- Debts subject to repayment no later than 12 months from the date of reporting.

- Funds required to pay off debts within a 12-month period. This category includes bonus payments, deductions to employees of the company for vacations, bonuses and other short-term obligations.

Conditions for incurring debt

This type of debt can arise due to the fact that it is impossible to predict the income that the company will receive or the amount of losses it will incur. For example, in the area where a company produces its products, there is always the possibility of natural disasters or man-made disasters. This threat can significantly disrupt a company's production cycle. It is believed that the probability that a disaster will occur can be large, small or medium.

Current liabilities are divided into two categories:

- Calculated.

- Precisely definable.

The specific amount of settlement obligations cannot be determined before the settlement date. Since the settlement date is sure to arrive, the accountant’s task is to accurately calculate the amount that the borrowing company must submit for repayment. Examples of this type of obligation may include taxes on property or profits, as well as paid vacations for company employees or fulfillment of warranty claims.

Precisely determinable short-term liabilities are future payments that have been specified in the contract or specified in legislation and can be accurately calculated. When accounting for such obligations, it is necessary to determine the availability of the required amount to pay each obligation and monitor that payment of the debt is correctly recorded. Examples of precisely determinable liabilities include: bank loans, bills of exchange, dividends, bills. It also includes income that was not earned, excise taxes, and sales taxes.

Bills of exchange as a debt instrument

Such securities have the same meaning as the concept of “accounts payable”. The company uses bills of exchange to obtain products and financing that will not be used in the main activities of this business entity.

Short-term securities are conventionally divided into secured and unsecured. This classification is largely determined by the conditions that were agreed upon when concluding the agreement. Mortgages on the property of the debtor company or rights to seize property can be considered as security.

If a company has short-term debts secured by such bills, then the assets with the help of which these obligations will be repaid are indicated in the statements.

Today, companies operate with both interest-bearing and non-interest-bearing promissory notes. Interest-bearing securities are characterized by a clearly stated rate. Non-interest bearing bills do not have a note indicating the interest charged, but additional interest must still be paid after you use them.

Advances and other types of obligations

Advance payments are associated with the fact that business risks often arise when carrying out transactions. If a company requests an advance, but the counterparty does not fulfill the terms of the contract, then with the help of this payment it will be possible to at least partially repay the losses.

If we talk about other types of obligations, they may include payment of salaries to staff, as well as interest on the loan.

A special expense item is taxes. It is always included in the structure of short-term debt. Taxes consist of all funds that will be sent to the budgets of various departments.

After the company’s performance has been assessed and all reporting documentation has been submitted, dividends are calculated and paid to shareholders. The liabilities of the enterprise's balance sheet also include transfers on creditors' claims. Another type of short-term debt obligations may arise at an enterprise - wage arrears. If the company has not paid the staff, then the funds that have not yet been paid are classified as short-term liabilities.

Short-term assets are parts of the company's capital that are used to pay short-term obligations, the payment period of which should not exceed 12 months. These assets are formed at the moment when the enterprise is created. These include:

- Sponsorship funds.

- Payments from the budget.

- Share contributions.

- Contributions from company shareholders.

Replenishment of short-term assets is also possible from such sources as:

- Accounts payable.

- Deposit funds placed in banks and the storage period of which does not exceed a 12-month period.

- Redistributed capital, which is created from profits from accumulation and consumption funds.

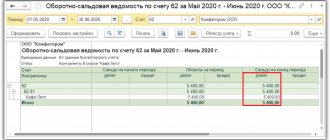

How to take into account other people's funds

Funds received, regardless of the type and source of financing, are accounted for by enterprises in accordance with the Chart of Accounts approved by the legislator:

- Account 66 “Settlements for short-term loans and borrowings”;

- Account 67 “Settlements for long-term loans and borrowings.”

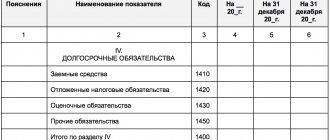

Sharing of debt capital

As the name suggests, loans can be divided according to repayment periods:

- for long-term, that is, over 12 months;

- and short-term, that is, up to 12 months.

Loans, in addition to cash, can be received as debt securities:

- bonds;

- bills.

In this case, the company pays the lender not interest, but a discount, that is, the difference between the nominal and real value of the security.

The liability on accounts 66 and 67 is accounted for in two ways:

- Based on actual loan amount plus interest.

- At par value of debt securities.

In this case, the valid entry is the one generated at the time the borrowed funds are received into the organization’s current account:

- Debit 51 of the “Current account” account Credit 66, 67 – a loan or credit was received.

What to do with interest on loans

In addition to the main body of the loan, interest on the loan, which is the income of the lender, is taken into account in separate subaccounts 66 and 67 of the account. Accrued interest is reflected on account 91 “Other income and expenses” as expenses, or on account 08 “Investments in non-current assets” as an increase in the cost of fixed assets:

- Debit 91.02 Credit 66, 67 – monthly interest accrued.

- Debit 08 Credit 66, 67 – the cost of the object under construction has been increased by the amount of interest.

Note from the author! Before putting an object into operation, all costs during construction are accumulated on capital investments, that is, on account 08. After completion of construction or additional equipment, the objects are entered into account 01 “Fixed Assets”.

For example, a company took out a loan for the construction of a bridge in the amount of 1,000,000 rubles for one year. The bank's annual interest rate is 18%. You need to calculate how much deductions to take into account each month:

- 1,000,000 * 18% = 180,000 rubles per annum;

- 180,000 / 12 months = 15,000 rubles – monthly interest accrual.

Since the loan term is one year, it is considered short-term, which means it will be displayed on account 66:

- Debit 51 Credit 66.01 – a loan was received in the amount of 1,000,000 rubles.

- Debit 08 Credit 66.02 – interest was accrued on the increase in the cost of the bridge in the amount of 15,000 rubles.

- Credit 66.02 Debit 51 – monthly payment to the bank of 15,000 rubles is transferred.

What are the features of tax accounting for loans and borrowings?

Received credit or borrowed funds are not income for the purpose of calculating income tax for their recipient due to the provisions of sub. 10 p. 1 art. 251 Tax Code of the Russian Federation. Also, the funds issued are not an expense, taking into account the provisions of clause 12 of Art. 270 Tax Code of the Russian Federation. Likewise, funds received and paid to repay a loan or loan are not considered income or expenses.

In this case, the amounts of accrued and paid interest are fully recognized as non-operating expenses in accordance with subparagraph. 2 p. 1 art. 265 Tax Code of the Russian Federation. The moment of reflection of interest amounts in expenses is determined in accordance with clause 8 of Art. 272 Tax Code of the Russian Federation:

- at the end of each month,

- on the date of repayment of the loan or loan (if they are fully repaid).

The amount of interest in the presence of controlled debt is included in non-operating expenses in the amount provided for in Art. 269 of the Tax Code of the Russian Federation.

Interest received under agreements on the issuance of loans and borrowings relates to non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

It should be noted that differences in accounting and tax recognition of accrued interest expenses for an investment loan or in the presence of controlled debt give rise to temporary differences accounted for in accordance with PBU 18/02 “Accounting for corporate income tax calculations.”