Why monitor your net worth ratio?

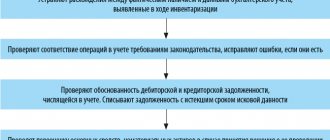

The volume of net assets needs to be monitored due to the following circumstances:

- The volume of net assets is equal to the company's equity capital. Moreover, it is the equity capital that is an indicator of the company’s sustainability for regulatory authorities, credit institutions, as well as persons who plan to invest money in the company.

- Constant assessment of net assets allows you to reduce the risk of their size falling to a level less than the authorized capital. If this happens, the company may be forced to close. Moreover, the requirement that the value of the company’s net assets must not be lower than the amount of the authorized capital is established for companies of almost all organizational and legal forms. Even companies using a simplified taxation system are not exempt from this requirement.

Thus, for many companies, increasing net assets is a necessary operation (

Ways to increase a company's net assets

The value of net asset indicators allows you to assess the real state of affairs in the company. In accordance with Law No. 14-FZ of 02/08/1998, the company’s annual report must include information on net asset indicators. The information should contain the following:

- how the value of the indicator of interest changed over three years (the period could be shorter if the organization was registered less than three years ago);

- the reasons why there was a decrease in net assets to an amount less than the authorized capital;

- plans to correct the situation with net assets.

Important! Law 14-FZ obliges all companies to ensure that the company’s net assets are greater than the authorized capital. Otherwise, the company is obliged to increase them to the specified value. If a company neglects to do this, the company may face forced liquidation.

You can return this ratio when net assets exceed the amount of the authorized capital in one of the following ways:

- revaluation of assets (it is recommended to involve an independent valuation);

- reduction of the authorized capital (but to an amount not lower than the minimum - 10,000 rubles);

- increase in assets at the expense of the company’s founders.

The procedure for determining the value of net assets

The net assets of an LLC characterize the financial state of affairs of the company. This indicator is necessary when increasing or decreasing the authorized capital, when paying the actual value of shares to participants upon leaving or expulsion from the LLC.

In November last year, the Russian Ministry of Finance approved a new Procedure for determining the value of net assets (order No. 84n dated August 28, 2014, registered with the Russian Ministry of Justice on October 14, 2014 under number 34299). At the same time, we would like to note that this document was adopted in accordance with the amendments made to paragraph 3 of Art. 35 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” and in paragraph 2 of Art. 30 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”, which stipulates that the value of the net assets of organizations of all forms of ownership (except for credit) is determined according to accounting data.

Before talking about the new Procedure for determining the value of net assets, we will give a definition of this concept.

Net assets are a calculated value determined by subtracting the amount of its liabilities from the total assets of an organization. In other words, net assets are assets secured by equity. Simply put, this is the book value of all of the organization's assets, adjusted downward by the amount of its liabilities.

GOOD TO KNOW

Net assets are one of the most important indicators of the financial and economic condition of an enterprise.

Let us say right away that before the above order came into force, the procedure for calculating the value of net assets for some organizations was not determined. In particular, this applies to limited liability companies. In judicial practice, a unified position on this issue has also not been developed, although most courts were inclined to believe that limited liability companies should be guided by the rules developed for joint-stock companies. In particular, the question of determining the actual value of an LLC participant’s share was controversial: at market value or according to accounting data.

In the new Procedure, the Ministry of Finance of Russia not only clearly outlined the list of organizations that are subject to this document, but also specifically prescribed accounting items accepted for calculating the value of net assets, which is important both for the annual determination of the financial independence of the company and for calculating the amount of dividends, paid to the participants of the company based on the results of work for the corresponding period or upon their withdrawal from the company. This document also indicates the frequency of determining the value of net assets.

Thus, the new Procedure for calculating the value of net assets must be applied by organizations of all forms of ownership, regardless of the taxation system used. The only exceptions are credit organizations and joint-stock investment funds.

According to clause 4 of the Procedure, the value of net assets is determined as the difference between the amount of the organization's assets accepted for calculation and the amount of the organization's liabilities accepted for calculation. At the same time, we pay attention to several very important aspects.

Thus, in accordance with clause 5 of the Procedure, it is necessary to exclude from the assets accepted for calculation the receivables of the founders (participants, shareholders, owners, members) for contributions (contributions) to the authorized capital (authorized fund, mutual fund, pooled capital), as well as the debt of shareholders to pay for shares, if there is such debt. And according to clause 6 of the Procedure, when calculating the amount of net assets, all liabilities of the organization are taken into account, with the exception of deferred income. At the same time, the document specifically identifies those of them that organizations are required to exclude from the calculation. This is government assistance received, for example, in the form of targeted financing of capital investments aimed at the acquisition or construction of fixed assets, as well as property received free of charge.

Note that in accounting, such targeted cash receipts are usually reflected in the credit of account 98 “Deferred income”, subaccount “Gratuitous receipts” in correspondence with account 86 “Targeted financing”. And gratuitously received assets in accounting are usually reflected in the credit of account 98 “Deferred income”, subaccount “Gratuitous receipts” in correspondence with property accounting accounts (07, 08, 10, 41).

AUTHOR'S ADVICE

We recommend that designated future income be reflected separately in the balance sheet.

We focus on the fact that both assets and liabilities are taken into account in a net valuation, i.e., minus regulatory values in accordance with clause 35 of PBU 4/99. Such control quantities, in particular, may be:

- the amount of accrued depreciation of fixed assets and intangible assets;

- the amount of reserve for the reduction in the value of material assets that, for example, are obsolete, have either completely or partially lost their original qualities, or their selling price has decreased;

- the amount of reserve for depreciation of financial investments.

The new document has another significant aspect. According to clause 7 of the Procedure, the amount of net assets of both LLC and JSC is calculated exclusively according to financial statements. Therefore, to determine the amount of net assets, it is necessary to have a balance sheet of the organization compiled as of a certain date. As a result, in relation to the balance sheet and on the basis of paragraphs. 4–6 The following formulas can be derived to calculate the value of net assets.

Option 1.

| Assets accepted for calculation | = | Balance sheet asset (balance sheet line 1600) | — | Debt on contributions to the authorized capital (debit balance of account 75 “Settlements with founders”*) | — | Own shares purchased from shareholders (debit balance of account 81 “Own shares/shares”) |

| Obligations accepted for settlement | = | Long-term liabilities (line 1400 of the balance sheet) | + | Current liabilities (line 1500 of the balance sheet) | — | Deferred income (credit balance of account 98 “Deferred expenses”**) |

| Net assets | = | Assets accepted for calculation | — | Obligations accepted for settlement |

Option 2. To calculate the value of net assets, you can apply the following formula:

| Net assets | = | Capital and reserves (line 1300 of the balance sheet) | — | Debit balance on account 75 “Settlements with founders”* | — | Debit balance of account 81 “Own shares purchased from shareholders” | + | Credit balance on account 98 “Deferred income”** |

* Sub-account “Calculations for contributions to the authorized (share) capital”. ** Sub-accounts “Gratuitous receipts” and “State. help". The presented formulas clearly confirm the fact that net assets are assets secured by the organization’s own capital.

Example 1.

Vostok LLC applies the simplified tax system and carries out trade and procurement activities for 5 years. The authorized capital of the organization is fully paid by its founders. Throughout the entire activity of the organization, there were no gratuitous receipts. The organization also did not receive government assistance.

As of December 31, 2014, the organization has the following balance sheet indicators (conditional figures):

- asset (line 1600) – RUB 1,850,000;

- capital and reserves (line 1300) – 450,000 rubles;

- long-term liabilities (line 1400) – 850,000 rubles;

- short-term liabilities (line 1500) – 550,000 rubles.

Let's calculate net assets.

Since in the reporting period the organization has no debt from the founders for contributions to the authorized capital, then only the values of long-term and short-term liabilities are subtracted from the value of the balance sheet asset (line 1600 of the balance sheet).

In digital terms we have: the value of the organization’s net assets as of December 31, 2014 is 450,000 rubles. (RUB 1,850,000 – RUB 850,000 – RUB 550,000).

As we can see, this value is provided by the organization’s own capital and represents the real value of the organization’s property. In other words, this is the value of all property that remains at the disposal of the organization after all of the company's obligations have been repaid.

For what purposes does a simplifier need to determine the value of net assets?

This question is quite reasonable. Indeed, in most cases, “simplified” refer to small businesses, and Form No. 3, which reflects this value, is not included in the accounting statements under the simplified tax system (Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n). At the same time, the legislation of the Russian Federation defines a number of situations in which it is important for a “simplified” organization to know the amount of net assets. So in what situations should this indicator be determined?

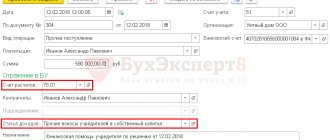

Firstly, such a situation may occur when dividends are paid.

The fact is that if the value of net assets turns out to be less than the authorized capital or becomes such after the payment of dividends, then in accordance with paragraph 1 of Art. 29 of Law No. 14-FZ, it is impossible to make a decision on their payment. Therefore, each time, before paying dividends to the founders, the value of the net asset value should be determined.

Secondly, determining the value of net assets may be necessary in the event of a participant leaving the company, because in this situation it will be necessary to calculate the actual value of his share, and for this calculation information on the value of net assets will be required. This is due to the fact that the actual value of the share corresponds to part of the value of net assets and is determined in proportion to the size of the founder’s share in the LLC in accordance with clause 2 of Art. 14 of Law No. 14-FZ.

Thirdly, monitoring the financial condition of the company is important for the “simplified” people. To do this, it is necessary to determine the control ratio of the value of net assets to the amount of authorized capital, which cannot be greater than the value of net assets for more than two years (clause 4 of article 90 of the Civil Code of the Russian Federation, clause 4 of article 30 of Law No. 14-FZ) . Therefore, all organizations using the simplified tax system need to independently make calculations at the end of each year and determine the value of net assets in order to track this point.

In this case, the net asset value indicator must be at least positive. A negative indicator means that the company is completely dependent on creditors and does not have its own funds sufficient to conduct its activities. In this case, the size of the authorized capital should be reduced to an amount not exceeding the value of net assets. If the authorized capital is initially minimal and cannot be reduced, then the company is subject to liquidation in accordance with clause 4 of Art. 90 Civil Code of the Russian Federation.

At the same time, it is not at all easy to make changes to the authorized capital of a company. It is much easier to draw up the relevant documents to increase the value of net assets. And recent changes to the Civil Code of the Russian Federation have provided organizations with such an opportunity.

How to increase assets

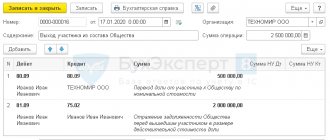

To increase assets, the founders can provide their company with financial assistance, the direction of which will indicate the increase in assets. In addition, the founder can contribute additional property to the company.

Such methods will be most effective when the size of the authorized capital can no longer be reduced to the amount of net assets. That is, it is already minimal and it is no longer possible to reduce it any more.

If the founders decide to increase assets by contributing financial assistance, then they must correctly indicate the purpose for which these funds are contributed. For example, the purpose of the payment may indicate “increase in net assets by the founders.” Such an indication will allow you to judge the purpose of this operation, and will also help to avoid additional questions from regulatory authorities.

When increasing assets by adding property, the purpose of net assets is the ability to generate profit. In other words, net assets must be profitable. Despite the fact that this condition is not mandatory, the founder should evaluate all factors that influence this indicator. Of course, generating income is always accompanied by some costs, so any investment must be smart and justified. If you make mistakes in this area, this can lead to negative consequences, including losses for the company (

Start managing your family budget

Until we see a complete picture of income and expenses for the year, we will move towards the goal like blind kittens. That’s how we humans are designed, that we don’t want to do what we don’t understand. A budget allows you to see real expenses, see the full picture in terms of a year, not a month, understand where you can save and where you don’t need it, how much money can be used to increase assets and pay off liabilities. Keeping all these hundreds and thousands of numbers in your head is unrealistic. You can download the family budget here.

Consequences of replenishing the authorized capital

An increase in the authorized capital for a company can be carried out by making contributions by participants . If we are talking about a joint stock company, then they issue an additional block of shares.

When replenishing the authorized capital of a subsidiary by transferring property to the co-founder organization, the consequences may be as follows:

- there is no VAT on the value of property transferred to replenish the authorized capital;

- VAT, which was accepted for deduction upon the initial purchase of property, will have to be restored;

- There is no need to issue an invoice when adding property to the authorized capital, and the invoice that was received when purchasing the transferred property is recorded in the sales book;

- restored VAT is also not taken into account;

- it is impossible to reduce the tax base of the founder due to the value of the property transferred to the authorized capital.

A legal entity that receives property as a contribution to the authorized capital must also assess the impact of this operation:

- the restored VAT on the transferred asset can be deducted in full;

- the document on the basis of which input VAT is taken into account - this is the act of acceptance and transfer of property indicated in the purchase book;

- if the company is on the simplified tax system, then it does not have the right to increase the value of property by the amount of VAT, and also to take it into account as expenses for tax accounting;

- the value of the property received will not increase the tax base, as will the restored VAT.

It should also be remembered that similar consequences may arise if other methods of increasing net assets are used.

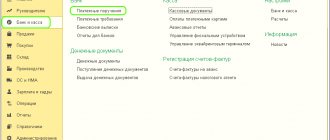

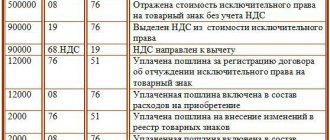

Increase in net assets by founders: postings

Important! An increase in net assets by the founders will not in any way affect the size of the authorized capital.

The increase in assets at the expense of the founders is included in additional capital and is reflected in account 83 “Additional capital”. For this account, the source of the transfer of funds, as well as the purpose of this transfer, are taken into account. The posting when receiving funds from the founder will be as follows:

D 51 (08, 10) K 83

This posting is generated on the date the founders contribute funds.

What are net assets and how to calculate them

Let's consider this theoretical situation. The owner of the company decided to stop his business. He fired the workers, paid them the settlement, sold the buildings and equipment, sold the remaining raw materials and products (goods), received all accounts receivable, and also fully paid off with suppliers and the budget.

The money that will remain at the disposal of the business owner after all these operations is the net assets (NA) of the company.

The procedure for calculating net assets was approved by order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n.

NA = (A – DZU) – (O – DBP)

A – company assets (line 1600 of the balance sheet)

DZU – receivables of the founders for contributions to the authorized capital;

О – company liabilities (sum of lines 1400 and 1500 of the balance sheet);

DBP – separate income of future periods.

In practice, situations when it is necessary to use the corrective indicators DZU and DBP are rare. Therefore, in most cases the formula looks like

HA = A - O = page 1600 – page 1400 – page 1500 = page 1300

Those. In general, the company’s net assets are the result of Section III of the balance sheet, “Capital and Reserves.” It consists of:

- Authorized capital (AC).

- Retained earnings (RE).

- Reserve and other similar funds (RF).

- Additional capital

- Amounts of revaluation of non-current assets.

- The value of shares in the management company owned by the company itself.

Most small LLCs usually only use the first three positions, because... They rarely use other types of sources of funds.

CHA = UK + NP + RF = line 1310 + line 1370 + line 1360

Features of replenishing additional capital

Important! A donation between organizations cannot be formalized. The transfer of property may be recognized as a gift if there is no justification for such a transfer for the business. If organizations enter into an agreement on financial assistance, then it should clearly state what exactly the goals are pursued by both parties when making such a transaction.

All changes in the authorized capital of the company lead to the need to adjust the charter and record this in the Unified State Register of Legal Entities. And one of the advantages of replenishing additional capital is the absence of the need to make changes to the constituent documents. This method will also not affect the size of the founder’s contribution to the authorized capital. If we consider replenishing the additional capital of an LLC, then this is possible only at the expense of the founders, and for a JSC only direct financial support can be considered, and shareholders cannot contribute property.

The features of replenishing additional capital include the following:

- The amount of the contribution does not increase the taxable base for income tax if the founder who makes the contribution has a share in the authorized capital of 50% or more. Such property cannot be transferred to third parties for 1 year (251 Tax Code of the Russian Federation). If this requirement is violated, the value of the property will be recognized as income, which is subject to tax.

- In accordance with Article 251 of the Tax Code of the Russian Federation, property and funds contributed to increase net assets are not subject to taxation. If this is recorded in writing, then these assets should not be transferred to third parties for 1 year.

- The founder's contribution will be considered as a gratuitous transfer of property.