What types of powers of attorney are there?

A legal entity can issue:

- general trust document (or general);

- one-time document.

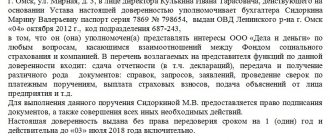

When issuing a general power of attorney, a legal entity transfers an unlimited range of powers to the representative. It is recommended that the list of transferred responsibilities be written down clearly so that the principal does not have any problems. For example, a document of trust was issued to an accountant to carry out transactions in a bank on behalf of the organization - withdrawing cash, transferring finances from one account to another.

A one-time power of attorney is issued for the execution of one-time orders. For example, a driver has been issued a power of attorney to receive fuel and lubricants from the warehouse of another organization on behalf of an enterprise.

Basic document forms

The trust document can be executed by hand or on a computer. There is no need to certify by a notary, except in cases prescribed in Art. 185.1 of the Civil Code of the Russian Federation. When drawing up on behalf of a legal entity, it is recommended to use company letterhead, but can be issued on a regular sheet of paper. Be sure to indicate:

- full and abbreviated name of the company;

- details – TIN, KPP, OKTMO, legal and postal address;

- date and place of compilation.

The power of attorney is signed by both parties - the principal (the head of the organization) and the representatives (an authorized employee). Issued in a single copy.

Free samples, recommendations

Find out which types of powers of attorney must be notarized and which are not.

Download free sample documents. Article navigation

- Sample power of attorney to represent the interests of an individual in court

- General power of attorney for representation of interests

- Sample power of attorney to represent an individual

- Sample power of attorney to represent the interests of a legal entity

- Sample power of attorney for the right to represent the interests of an organization during an inspection

- Sample power of attorney for the right to represent interests in an insurance company

- Sample power of attorney for the right to represent the interests of the traffic police

- Sample power of attorney for the right to represent the interests of a child

- Sample power of attorney to represent the interests of an LLC

- Sample power of attorney to represent interests in a bank

- Sample power of attorney to represent the interests of an individual entrepreneur (IP)

- Sample power of attorney for representation of interests in the tax office

- Sample power of attorney for representation of interests in the Federal Antimonopoly Service

- Sample power of attorney for representation of interests in the Pension Fund of Russia

- Sample power of attorney to represent interests at a meeting of SNT

- What we certify to a notary

A power of attorney is a transfer of your authority to another person or organization. Such a document can be received by both legal entities and individuals.

Such a document is drawn up in any form by hand or computer typed.

The document must contain points that fully disclose its purpose. Namely:

- Title. Typically, this is the name of the document itself.

- What and how the trustee should do. It is imperative to indicate the date the power of attorney was written, otherwise the document will not come into force.

- Details of the one who trusts and the one who is trusted. If this is an organization, you should indicate the company details. If an individual, passport data (usually the first, second pages and registration).

- What rights are you transferring to the trustee? That is, what exactly can a person to whom you have entrusted the solution of a particular issue do on your behalf.

- The period during which the document has legal force (not always).

- Signature of someone who trusts.

When to use

A power of attorney on behalf of a legal entity may be required to represent the interests of the organization:

- in a court;

- at the tax office;

- when purchasing goods, receiving inventory materials;

- when receiving funds from another company or bank;

- for driving a company car;

- in other cases.

A trust document is required to represent the interests of the organization in various instances, government bodies, and other legal entities, to resolve issues relating to the property of the legal entity. faces.

In a court

The responsible employee has the right to represent the interests of the organization in court and defend rights. But it is necessary to issue a power of attorney, which correctly states the powers. To speak in court on behalf of the company, you will need to present a document of trust.

It is recommended to submit it on the organization's letterhead. If this is not the case, then you should indicate:

- full and abbreviated name of the company;

- details – TIN, KPP, OKTMO, legal and actual addresses;

- information about the representative - full name, passport data, registration address and actual residence;

- a detailed list of delegated powers;

- date and place of execution of the document, time period of eligibility;

- signatures and transcripts of both parties - the head of the organization and the authorized representative;

- company seal, if used to certify documents.

The seal must be “live”, as well as the signatures of the parties. Facsimiles are not permitted.

For car

If the issue is only about driving a corporate vehicle, then there is no need to draw up a trust document. It is enough to enter information about the employee into the MTPL policy or make “open” insurance. But, if you need to perform any actions with the car, then a power of attorney is needed. For example, for sale or rent.

To convey authority on behalf of an organization, it is recommended to use letterhead. Information about the company must be provided in full. You also need to provide the correct information about the vehicle:

- the name of the vehicle – as it is stated in the PTS;

- state license plate;

- the year the car was produced;

- engine number;

- chassis;

- body number;

- VIN;

- details of the certificate of property rights;

- issued by whom and when;

- PTS details – series and number.

To the tax office

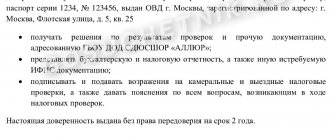

A power of attorney to the tax office is required to submit reports, return documents, and sign documents on behalf of the organization. If the authority to represent the interests of the company by a specific employee is not specified in the charter, a notarized power of attorney is required. It is drawn up on a unique form, certified by the seal and signature of a notary.

The employee of the notary office himself draws up the trust document, indicating the necessary information in it. The power of attorney to the Federal Tax Service must contain the following information:

- full name of the organization, full name and position of the head;

- if authority is transferred by an individual, then full name and data from the passport;

- name of the document, series and number, date and place of execution;

- full name and passport details of the authorized person;

- an exact list of delegated powers;

- validity period – it is recommended to issue for one financial year.

To receive goods or funds

Situations arise when the head of an organization trusts an employee to receive goods or funds. For example, a power of attorney may be issued to a forwarder to receive goods from another company or to an accountant to receive funds from a bank or cash desk of another organization.

The power of attorney to receive funds must indicate:

- the name of the credit institution or other organization from which the attorney must receive money for the principal;

- what exactly needs to be done - withdraw cash, withdraw money or transfer to another account;

- the amount that can be disposed of;

- a request to issue cash or make a transfer to a third party.

The details of the principal and the attorney must be indicated. The power of attorney is signed by both parties.

In order to receive goods on behalf of the company, the trust document indicates a list of goods and materials that the attorney must receive. It is necessary to indicate the data not only of the principal and the authorized representative, but also of the organization in which the transfer of goods and materials is to take place.

What actions can you take?

On behalf of a legal entity, an attorney can perform the following actions:

- represent interests in credit institutions, government, regulatory and supervisory authorities;

- resolve issues related to property owned by the company on the basis of legal property rights;

- receiving and sending inventory items;

- receiving funds, processing transfers to other accounts of your organization or to the account of another legal entity.

Depending on the powers being transferred, the power of attorney can be issued in simple written form or certified by a notary. Trust documents that transfer powers are subject to mandatory certification by a notary:

- for transactions that are initially subject to notarization.

- to carry out transactions that are initially subject to mandatory state registration by law. For example, a real estate lease agreement valid for more than one calendar year must be registered with Rosreestr. Consequently, the document on the transfer of authority to sign such an agreement must be certified by a notary.

- to carry out transactions to dispose of rights. For example, a trustee who has a power of attorney can sign an agreement for the transfer of property rights to real estate.

Documents for the transfer of powers are also subject to mandatory notarization:

- for maintaining cadastral registration of real estate, paperwork, for registering real estate with the cadastral register;

- to represent interests in courts of any jurisdiction and jurisdiction;

- representing the interests of a legal entity in interaction with tax authorities.

Sample power of attorney to represent the interests of an individual in court

A power of attorney to represent interests in an arbitration court (in administrative cases and not only) is issued to a lawyer or any other person.

The power of attorney lists the powers that the authorized person has to resolve a particular issue in all necessary government authorities. That is, a trusted person can use all the instruments of influence that the principal has given him. It is not necessary to have this document certified by a notary.

doc

Requirements for a power of attorney

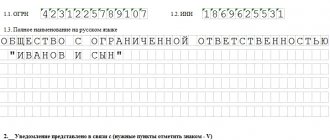

There are legal requirements for the execution of a power of attorney from a legal entity. The trust document must contain the following information:

- information about both parties to the relationship - full and abbreviated name of the principal, address details, full name of the authorized person, passport details, residential address;

- an exact list of powers that the principal transfers to the representative - the list must be complete, exhaustive, understandable, unambiguous;

- the exact calendar date of execution of the document – day, month, year;

- the name of the locality, subject of the federation in which the trust document is drawn up.

If there is a need for notarization of a trust document, it must contain the seal of the notary office and the signature of the notary. It is issued on a unique form with a series and number.

Contents of the power of attorney

A document confirming the transfer of authority to represent the interests of the taxpayer to the Federal Tax Service must contain the following information:

- name of the document and internal registration number;

- date of issue (required) and expiration date;

- full name of the organization or individual entrepreneur;

- full name of the principal (manager of the LLC or entrepreneur);

- full name and passport details of the representative;

- a detailed description of the delegated powers.

Next, the principal confirms with his signature the sample signature of the authorized representative; of course, the representative himself also signs. In addition, prepare a copy of the passport of the person who represents your interests. A copy can be made on the back of the power of attorney.

Important: If the expiration date is not specified, the document is valid for one year from the date of issue.

Below we provide a sample power of attorney to the tax office to represent interests from a legal entity, developed by the Federal Tax Service. It is not officially approved, so you can adjust it to suit your needs.

Rules for issuing a power of attorney from a legal entity in 2022

Since September 2013, the procedure for issuing a power of attorney from a legal entity has been somewhat simplified. The innovations are as follows:

- An employee has the right to issue a document of trust on behalf of a legal entity, even if this is not stated in the constituent documents;

- no need to stamp;

- Only the manager must sign; the obligation for the chief accountant to sign is cancelled;

- the “body” does not indicate the period of validity - the power of attorney can be issued for any time period.

Who writes

Any employee authorized to write a document of trust by order of management. The function of registration and issuance can be specified in the job description.

Design features

It is not necessary to put a stamp, it is not necessary to certify with the signature of the chief accountant. Mandatory written form, oral form is not established by law.

List of documents

For registration, the principal's constituent documents and the attorney's passport are required. The data in the “body” of the power of attorney is transferred exactly as written in official documents.

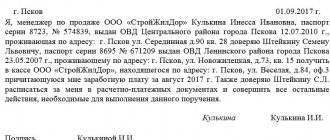

Sample

How long does it last?

The validity period of the document can be any - established by agreement of the parties or determined by the principal. The obligation to indicate the time period for the transfer of powers has been abolished since September 2013.

Cost of power of attorney

If the power of attorney is in simple written form, it will be free. If there is a need for certification by a notary, the cost will depend on the number of powers transferred. The fee for issuing a trust document ranges from 1 to 5 thousand rubles.

Sample power of attorney to represent the interests of an individual entrepreneur (IP)

Prepared to transfer authority to an accountant. Or an employee authorized to conduct accounting. It is necessary for a business owner to relieve himself of obligations to the Federal Tax Service. But not only. It all depends on the actions prescribed in the power of attorney, entrusted to the shoulders of the one who is trusted. A document requires notarization in two cases:

- if there is no IP seal on it;

- if it is issued to represent interests in the tax office.

doc

The right of subrogation: what is it?

The right of delegation - the attorney has the right to delegate the duties previously assigned to him to a third party. The possibility of registering a sub-power of attorney should not be prohibited by the primary power of attorney.

For example, the director trusts the chief accountant with the right to receive cash from the bank from the company’s account. A copy of the power of attorney is available at the credit institution. But the chief accountant ends up in the hospital for a long time.

There is no one to receive money from the account; the general director is away. The chief accountant issues a “secondary” power of attorney in the name of the cashier. There is no prohibition on sub-reliance in the “primary” document.

It is recommended to specify the right of subrogation in the primary trust document. Otherwise, the secondary attorney may have difficulty performing his assigned duties.

The execution of the transfer of trust is regulated by Art. 187 Civil Code of the Russian Federation. It says here that a secondary power of attorney must be certified by a notary. The rule applies even if the original trust document was not notarized.

Is it possible to revoke a document?

The law provides for the possibility of revoking a power of attorney at any time. This must be done by the principal. The reasons don't matter. There is no additional need to fill out a cancellation document. But the head of the organization or other employee who issued the trust document must take several actions:

- notify the attorney in writing about the cancellation of the power of attorney;

- notify in writing the organization in which the authorized person represented the interests of the organization.

If the power of attorney was certified by a notary, then you need to visit the notary’s office and issue a review. The notary will make a special note in the journal.

There are circumstances under which the validity of a trust document is automatically terminated:

- death of one of the parties - principal or attorney;

- loss of working capacity or capacity of one of the parties;

- voluntary refusal of the attorney to perform the duties assigned to him;

- carrying out the reorganization procedure of a legal entity, when the powers of one company are transferred to another;

- the responsible employee receives a new position;

- incorrect registration – lack of a calendar date for registration;

- abuse by a responsible employee of his duties within the framework of a power of attorney - the perpetrator may be punished within the framework of current legislation.

Sample power of attorney to represent the interests of an LLC

Here all the data of the two parties is indicated: the one who trusts and the one who is trusted, and also all the actions and powers of the trusted person are prescribed. This document is certified by a notary in two cases:

- if the power of attorney was issued by way of subpoena;

- if the power of attorney was issued to represent interests in the tax office.

doc

When do you need to notarize?

The Civil Code of the Russian Federation specifies situations when mandatory certification of a power of attorney by a notary is required. These include:

- Transactions with the organization's property - leasing, selling, purchasing, registration of property rights. Rosreestr will not be able to accept documents signed by a third party if he does not present the original power of attorney. A copy, even certified by a notary, is not suitable. When registering a transaction, a copy will be made of the trust paper, which will be certified by an MFC employee with a signature and seal.

- Transactions on debt obligations - processing a loan, transferring a debt to a third party, assignment of rights. Only the original trust document is suitable.

- Representing the interests of a legal entity in courts of any jurisdiction and jurisdiction. The court will accept documents from a representative only if there is an original power of attorney. Representation of interests and protection of rights will be carried out after studying the original by the judge.

- Representing the interests of the organization in the tax service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and other regulatory and supervisory authorities. With a power of attorney, reporting documentation is signed, reports are submitted on behalf of the organization, documents are received, and overpaid amounts are returned.

It is mandatory to have trust papers certified by a notary, which stipulate the right to delegate authority to a third party. A “secondary” power of attorney is also certified in case of reassignment.

In other cases, there is no need to visit a notary’s office to issue a power of attorney. But, if the parties want to further insure themselves, then any trust document can be certified by a notary.

General power of attorney for representation of interests

The maximum validity period of such a power of attorney is three years. There is no approved form of power of attorney for representation of interests; it is drawn up in any form.

For example, let's take a form for receiving documents. It is not necessary to have this document certified by a notary.

doc

Termination of the document and its consequences

The legal consequences of revoking a power of attorney occur the moment the attorney learns of the accomplished fact. Therefore, it is in the interests of the principal to notify the authorized person of his decision as soon as possible. In Art. 189m of the Civil Code of the Russian Federation spells out the legal consequences of termination of the competence of a trust document:

- mandatory notification of the attorney about the termination of the validity of the trust document - it is not necessary to notify the reasons;

- mandatory notification of those persons and organizations for whose representation the trust document was issued;

- if the document was executed by a notary, a mandatory visit to the notary’s office in order to enter the cancellation into the register;

- the attorney is obliged to return the power of attorney immediately after learning of the revocation;

- powers previously transferred under the document are terminated.

If a sub-power of attorney was issued on the basis of the primary trust document, it immediately ceases to be valid after the cancellation of the primary power of attorney.

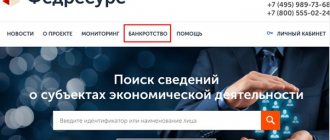

If third parties have not previously been notified of the cancellation of the notarized power of attorney, they are considered to be “automatically” notified on the next day after the calendar date on which the information was entered into the register. It is recommended to check the eligibility of the document in advance before exercising the delegated authority. But you can only check the validity of the notarized trust document. The check can be carried out through the official website of the FNR https://www.reestr-dover.ru/.

The principal has the right to decide to revoke the power of attorney at any time. Even if the “body” indicates the period of eligibility, the principal may not wait for the expiration date. There is no need to explain the reasons for cancellation.

The attorney cannot exercise the powers previously assigned to him from the moment he learns about the cancellation of the trust document or from the moment he should have learned about this fact.

Downloads

– Form of power of attorney by mail from a legal entity to an individual – Form of power of attorney to represent the interests of a legal entity in court – Form of power of attorney to represent the interests of a legal entity in the Federal Tax Service – Sample of a power of attorney to represent the interests of a legal entity – Form of power of attorney from a legal entity to an individual – Form of power of attorney from a legal entity person to a legal entity - Sample power of attorney from a legal entity to an individual