When is it worth checking partners on the website of the Russian Tax Inspectorate?

The need to check counterparties is caused by various reasons. First of all, it is associated with the intention to reduce the risks of your own business:

- Avoid non-payments for goods supplied or services provided.

- Avoid non-receipt of paid goods.

- Do not incur losses due to late receipt of goods or their poor quality.

- Do not become a participant in fraudulent schemes.

- Avoid receiving dubious documents, which carries risks for income tax and VAT.

There is no legal obligation to verify the counterparty. And according to clause 3 of the new art. in force since August 19, 2017. 54.1 of the Tax Code of the Russian Federation, the mere signing of primary documents by an unidentified or unauthorized person, as well as tax violations of the counterparty, cannot be grounds for refusal to deduct VAT or accept expenses on profit.

But in fact, a taxpayer acting without due diligence may be held liable for unjustified receipt of a tax benefit (clause 10 of the resolution of the plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53). And most often it is the taxpayer who has to prove his/her good faith.

Important! ConsultantPlus explains At its core, assessing the circumstances of choosing a counterparty is an assessment of due diligence, i.e. how thoroughly the taxpayer checked it before the transaction (clause 13). We are talking about the history of doing business, credibility, experience, solvency, business reputation, etc. The inspection must, for example, evaluate (clause 15): - whether the taxpayer was aware of the actual location of the counterparty, its production and warehouse premises; For a complete list of circumstances that tax authorities check when assessing due diligence, see K+. Trial access to the system is free.

Therefore, most organizations and individual entrepreneurs, when entering into business relationships, especially with new partners, try to protect themselves as much as possible. Often, when concluding contracts, fairly voluminous sets of documents are mutually requested to confirm the reality of the existence of the counterparty:

- The fact of its registration in the Unified State Register of Legal Entities and the Federal Tax Service.

- His property and bank turnover.

- Powers of officials and samples of their signatures.

- No debts on taxes and reporting.

This information requires not only storage space, but also periodic updating. In addition, over time, even a completely conscientious counterparty may have problems, which are better to find out about in advance.

In this regard, Internet resources, which make it possible to obtain up-to-date information about a partner with minimal labor costs and do not require extensive paperwork, become of particular importance in terms of verification. One of such resources is the website of the Federal Tax Service - checking the counterparty is done here free of charge and allows you to find out not only information about the partner, but also information about your own organization or individual entrepreneur. The latter will also not be superfluous from the point of view of checking the reliability of information available for public viewing or looking at yourself from the outside.

Important! Recommendations from ConsultantPlus To confirm the exercise of due diligence, record all the results of the verification of the counterparty in a report that you can develop yourself. Attach to the report... More information on how to exercise due diligence and confirm the validity of the tax benefit is explained in detail in the Ready Solution. Get trial access to K+ for free and proceed to the material.

Find out tax debt by last name

What taxes do individuals pay?

Taxes paid by individuals can be divided into four groups:

- income taxes,

- property,

- land,

- transport.

We will analyze for each group what amount the tax is calculated from, how much you need to pay and whether there are benefits.

Income tax, or personal income tax.

The tax authorities consider material benefits to be income if a citizen:

- sold land, apartment, car, garage;

- received a salary, dividends, interest on the deposit;

- won the lottery;

- received a fee for a painted picture or song.

Income is the tax base.

Tax payers are divided into residents and non-residents. The difference is in the duration of actual stay on the territory of the Russian Federation: more than six months - a resident, less - a non-resident. For residents, the standard tax rate is 13%, for non-residents the rate is higher - 30%.

Those who have received an inheritance, alimony or sick leave are considered beneficiaries of this type of tax. Read about exceptions for non-residents, detailed calculations, all benefits and payment deadlines in the article on income tax.

Property.

This tax is paid by the owners of apartments, houses, garages and even parking spaces - all real estate.

The amount of tax depends on the cadastral value of the property and the interest rate. The cadastral value can be found on the Rosreestr website. For more information on how to do this and how to save on tax, read the article on selling a land plot.

The rate can be found in the Federal Tax Service directory. To do this, open the tax website and select “Services and government services” in the top menu.

Scroll down to the “Reference Information” section.

Next, select the type of tax and your region - rates differ in different regions of the country. Click the “Find” button, and then click “Details”.

Land.

The amount of this tax also depends on the cadastral value and rates in the regions. You can also check the rates on the tax service website.

As in the case of property tax, you need to select the type of tax - land, select your region, click "Find", then - "Details".

Transport.

Here, too, the final amount of deductions and benefits depends on the region. Owners of cars, motorcycles, buses, motor boats and snowmobiles must pay this tax. The full list of taxable equipment is described in the relevant article of the Tax Code.

To calculate the tax yourself, you need to know the power of the car, its price, region of registration, time of ownership and year of manufacture. The exact amount can again be found in the Federal Tax Service reference book.

How to find out about debts by last name

At Autotaxes.

On the main page of the site you have the choice to find out taxes by TIN or by passport. Choose the second one.

Fill out all the windows in the form and the site will display the result - information about your taxes.

It’s convenient if you don’t have a TIN at hand, but you have a passport on the FSSP website.

Through a special service on the bailiffs website, you can see the debt, but only when the payer missed the payment deadline. Let's look at how this happens using the example of unpaid transport tax.

For example, for a year of owning a Skoda Rapid in Moscow you will have to pay 2,750 rubles. Taxes for 2022 are due by December 1, 2022. If you are late by at least a day, the service will charge 20% on top and another 1/300 of the Central Bank rate for each day of delay. Let’s calculate the month of delay, taking into account the Central Bank rate of 4.25%:

2,750 × 0.2=550 rubles

Penalties: 2,750 × 30 × 4.25% × 1/300 = 11.3 rubles

2,750 + 550 + 11.3 = 3,311.3 rubles

After the tax office discovers the arrears, the inspector will send the payer a payment notice indicating the date of payment. If you do not pay within 8 days from the date on the document, the case will be transferred to the bailiffs. Then the information will appear on the FSSP website.

To avoid confusion due to full namesake, please enter your date of birth

For other services - by TIN.

Before the bailiffs find out about your taxes, you can check the amount of deductions on Autotaxes or the Federal Tax Service website. But you need to know the TIN number.

How to find out your TIN

Find evidence.

The certificate is issued upon application. The application form, an example of filling it out and the service for submitting it to the tax office are available on the Federal Tax Service website. By the age of 18, almost all Russian citizens receive a Taxpayer Identification Number (TIN) - without this document you cannot receive a payment or open a bank account.

Foreigners and stateless persons can also obtain a TIN. In addition to the application, you will need any identification or residence permit. The service will issue the document within 5 working days. So far only on paper - electronic certificates have not yet been introduced.

This is a sample. Usually, instead of zeros, a set of special numbers. The first four are the code of the tax department that assigned the TIN, the next six are the entry number in the Unified State Register of Taxpayers, and the last two are check digits to check the correctness of the entire number

Request on the tax website.

You will need your passport and a few minutes. Go to the service website and enter your passport information.

Items with a red asterisk must be filled out, otherwise the system will not issue a TIN number

This is a drop-down list of documents that can be used when requesting a TIN

If you don’t have a TIN, you’ll have to get one. To do this, use the service from the tax office.

Through State Services.

It’s even easier and faster to find out your TIN at State Services. This option is suitable for those who are registered on the portal. Go to the page.

As a result, a page with your TIN number will appear

If you did not receive a certificate of TIN assignment before the State Services check, the service will not give you anything. First, get your Taxpayer Identification Number (TIN).

Where to look up taxes by TIN

At Autotaxes.

Go to the website, enter your TIN in 12 digits and add your email so as not to miss messages from tax authorities.

An account on State Services, a passport or other documents are not needed

On the Federal Tax Service website.

To enter your personal account you will need a TIN and you will have to come up with a password. If you have an account with State Services, you can use it - click “Login through State Services (ESIA)”.

Who can find out about my taxes?

Only a Federal Tax Service employee or someone who knows your Taxpayer Identification Number (TIN) can check your taxes. But even if a fraudster finds out your TIN, this number alone will not be enough to harm you. To process financial transactions, you also need a passport, and sometimes SNILS.

All information on our website is stored in encrypted form

How to receive notifications on time

To avoid problems at the border, seizure of accounts or unpleasant contacts with bailiffs, follow the notifications. The easiest way is to subscribe to Autotax notifications.

Turn on email notifications so you won't miss important information about your taxes. Tax officials send warnings by mail - payment notifications if the payer has forgotten to pay the tax.

Remember

- Individuals pay taxes on income, as well as property, land and transport taxes.

- You can find out about tax debt by TIN and surname on Autotaxes or on the FSSP website if the payer missed the payment deadline.

- Other services, including the Federal Tax Service website, require an INN to check taxes.

- The TIN can be found on the pink certificate from the tax office. If you don’t have it on hand, check through the websites of the Federal Tax Service or State Services.

- Subscribe to notifications on Autotaxes so as not to miss messages from the Federal Tax Service.

What information about the organization and individual entrepreneur does the Federal Tax Service provide?

The Federal Tax Service is entrusted with not only fiscal functions, but also the obligation to register taxpayers, therefore it has the maximum possible volume of reliable, up-to-date data on all persons included in the state registration register.

Based on this information, on the Federal Tax Service website in relation to the counterparty, you can check:

- Facts of its inclusion in the Unified State Register of Legal Entities and registration with the Federal Tax Service.

- Have there been such events as reorganization, liquidation, exclusion from the state register, reduction of the capital.

- Legal address for the mass registration and the actual presence of the counterparty on it.

- The presence of disqualified persons among the founders, owners or managers of the partner.

- Founder, owner or manager on the fact of participation in related organizations.

- Availability of tax and reporting debts.

Visit to the Federal Tax Service inspection

You can access your personal account on the Federal Tax Service website in three ways:

1) using the login and password specified in the registration card . You can get such a card if you visit any Federal Tax Service inspection, no matter what city or town in the Russian Federation you are in (with a few exceptions: if the tax office that suits you does not work with individuals, they will not help you there);

2) using an account on the State Services website (number 4 in Fig. 1). More precisely, you can use the same login and password to enter the Federal Tax Service website that you use to enter the State Services website. However, such authorization will be possible only for those users who applied to receive access details in person at one of the places of presence of Unified Identification and Logistics operators (branches of the Russian Post, MFC, etc.);

3) using an electronic signature (number 3 in Fig. 1). The electronic signature verification key certificate is issued by a Certification Center accredited by the Russian Ministry of Telecom and Mass Communications. It can be stored on any medium: hard drive, USB key or smart card. To use an electronic signature, you will need to install special software on your computer. To access your personal account on the Federal Tax Service website using an authorized electronic signature, you must first obtain it.

I will tell you about the first method, that is, how to get a registration card. You need to take your passport to the Federal Tax Service inspection office of your choice. If the inspection is not located at the place of registration (for example, in another district or in another city), then you will also need an original or a copy of the TIN Assignment Certificate.

A security guard at the tax office told me that to apply for a personal account on the nalog.ru website, you need to use the window labeled “Personal Account.” In other tax offices this may be done in other “windows”, which can be clarified at the beginning of the visit. Having handed over to the employee at this “window” a passport with a TIN certificate, I received from him a printout sheet “Registration card for the provision of services of the Internet service of the Federal Tax Service of Russia “Taxpayer’s Personal Account for Individuals.” It contained a login (this is my Taxpayer Identification Number) and the user’s primary password for logging into my personal account. You must activate your login and password within a month, otherwise you will have to contact the inspectorate again. Having received a printout from the tax office with instructions and a password, you can log into the taxpayer’s personal account on your computer.

How the official website of the Federal Tax Service can help

Verification of the counterparty by TIN or other data is available on the tax office website https://egrul.nalog.ru/.

The site allows you not only to see the above information about the partner, but also to print it, and also makes it possible to obtain an extract from the Unified State Register of Legal Entities, signed electronically by the Federal Tax Service.

In relation to debtors for paying taxes and submitting reports, the Federal Tax Service website now refers to the FSSP database of enforcement proceedings, which is also worth checking the counterparty.

You can also use the websites of other authorities for verification. For example, on the website of the Notary Chamber you can check the notarized powers of attorney of the counterparty - see “Now the powers of attorney of the counterparty can be checked on the Internet” .

Registration of a personal account on the Federal Tax Service website

Login to your personal account on the official website of the Federal Tax Service (Federal Tax Service) https://lkfl2.nalog.ru/lkfl/login

Rice.

1 (click to enlarge). Login to your personal account on the official website of the Federal Tax Service - nalog.ru In line 1 in Fig. 1 you will need to enter your TIN, and in line 2 - the password that was issued by the Federal Tax Service inspection in the “Registration Card” printout.

After entering your login and password, the following message will appear:

“The Federal Tax Service welcomes you to your “Personal Account” and thanks you for connecting! For security reasons, you need to change your primary password."

And immediately, “without leaving the cash register,” you will be given the opportunity (by the way, mandatory) to change the primary password (Fig. 2):

Rice. 2 Change the primary password on the Nalog.ru website and confirm your e-mail

Required fields are marked with a red asterisk. As shown in Fig. 2, you need to enter your new password twice (fields 2 and 3), then your E-mail (field 5 in Fig. 2). It is not necessary to enter a telephone number (field 4 in Fig. 2).

By filling out the fields marked 1, 2, 3 and 5 in Fig. 2, click on the only active button “Send a letter to this e-mail to confirm it” (number 6 in Fig. 2).

We read the message that appears: “A letter with instructions for confirming the e-mail was sent to the address ...”, which we personally entered in the previous step (number 5 in Fig. 2).

To save the new password for your personal account, you need to click on the “Save” button (number 7 in Fig. 2).

Email confirmation is necessary to prove that the email belongs to you and you have access to your email. Such confirmation may come in handy later, for example, if you need to send a message (appeal) to the tax assessment office. The response from the tax office will be sent to your email.

The confirmation email does not arrive immediately; you need to wait 10-15 minutes. However, here it is not necessary to do it once at a time and therefore different options are possible. On the other hand, you shouldn’t put off confirming your e-mail: then it will fly out of your head and the question of registering your personal account will remain “hanging in the air.” It also makes sense to check the Spam folder in your mail, because the letter could have ended up there by mistake.

In our mail we find an e-mail confirmation letter with the following heading (click on Fig. 3 to enlarge it):

Rice. 3. A letter with a link to confirm your e-mail.

You need to open the letter from the tax office in your mail (Fig. 3) and click on the longest link. This is a simple check that the e-mail was entered correctly, without errors, and that this is your e-mail, that is, you have access to this mail.

That's it, we are registered in your personal account and can start working in it.

Search data: OGRN, INN, KPP, company name, full name of individual entrepreneur, region

To obtain information about a counterparty, in the search criteria window on one of the tabs (for an organization or individual entrepreneur), simply enter the following information:

- For legal entities - OGRN or TIN, which are unique for each company. You can also search by organization name. Since company names can be duplicated several times, it is advisable to indicate the region of its location.

- For individual entrepreneurs - OGRNIP or TIN, which are also inherent to each individual person. You can search for individual entrepreneurs by full name. However, to simplify the search among full namesakes, it is advisable to indicate the region of residence of the individual entrepreneur.

Knowing the organization's checkpoint is not important for searching for information about it. Moreover, one organization may have several checkpoints.

On the Federal Tax Service website, the checkpoint is involved in searching for counterparties to confirm the issuance of documents reflected in the purchase book submitted to the Federal Tax Service as part of VAT reporting. However, here it is not a mandatory requirement. Most often, a counterparty is searched by TIN.

Paying taxes online

Paying taxes online, that is, via the Internet, means that you can pay taxes either using a bank card or through Internet banking, where you will need to pay the invoice.

Internet banking in Sberbank is called Sberbank Online.

In Alfa Bank, a similar service was called Alfa Click.

On the Yandex.Taxes website, payment can be made using a bank card, without resorting to Internet banking. True, you will have to independently enter all the details from the tax notice that came by mail or was received through your personal account on the Federal Tax Service website, and only then pay the tax by bank card.

Let's return to the “Taxpayer Personal Account” service on the Federal Tax Service website. There are three options for paying taxes (Fig. 5):

- bank card,

- you can generate a receipt,

- through the credit institution’s website (via Internet banking).

Rice. 5 (click to enlarge). Selecting a tax payment method on the Federal Tax Service website.

In Fig. 5 you can see that there is a “Generate receipt” button. After clicking on it, you will be able to receive and print a receipt for subsequent payment in the usual way, through an operator at Sberbank. This may be necessary if you are used to paying by receipt, but for some reason you have not received a “chain letter” with taxes from the Federal Tax Service in the mail.

But we, active Internet users, are not looking for easy ways, so we will pay taxes via the Internet. First of all, we need to understand whether there are payment options that suit us: after all, no one forces us to pay for something right away.

You can pay taxes using a bank card (number 1 in Fig. 5). Next you can read “Consent to the processing of personal data”. You should definitely check the box next to the sentence “I have read and agree to the processing of my personal data” (3 in Fig. 5). Only after this checkbox appears will the “Pay” button become clickable (4 in Fig. 5). Next, you will need to enter your bank card information to pay taxes. You may have to confirm payment using a code received via SMS to your mobile phone.

In addition to a bank card, online banking . Sberbank is there (Fig. 6):

Rice. 6 (click to enlarge). A list of banks available for paying taxes is on the official website of Tax ru.

If in Fig. 6 there is a bank that suits you for payment, click on the icon of this bank. If not, then for online payment you can use, for example, the Yandex.Taxes service.

If you click on the “Alfa-Bank” icon (Fig. 6), the “Invoice Confirmation” window will appear.

Rice. 7 (click to enlarge). Payment of taxes by confirming the invoice through Alfa-Click Internet Banking.

Here you need to enter your Alfa-Click online banking login (number 1 in Fig. 7). You can study the information via the “Help” link (Fig. 7), where the screenshots show how to pay an invoice in the selected online bank.

If at the last minute you change your mind about paying taxes via online banking, then you need to click on the “Cancel payment” button (Fig. 7).

After clicking on the “Confirm” button (number 1 in Fig. 7), the message “Thank you. The invoice has been issued. To pay, go to the new version of Alfa-Click online banking.” At the same time, SMS messages about invoices will be sent to your mobile phone.

You can then pay only by logging into your online bank using your login and password. In Fig. Figure 8 shows where the issued invoices are located in the new version of Alfa-Click - this is “Payment of issued invoices” in the top menu “Payment for services” (black number 1 in Fig. 8):

Rice. 8. Search for tax invoices in Alfa-Click.

By clicking on the “Payment of invoices” option (Fig. 8), we get a window of the same name (Fig. 9) with a button (more precisely, an inscription that appears only if you move the mouse cursor to this place) “Pay”:

Rice. 9. Payment of tax in Alfa-Click.

Information about paying a bill (tax) in your personal account on the Federal Tax Service website will not appear immediately, because:

"Attention! The formation of a “Taxpayer Personal Account for individuals” may take up to three working days!”

Thus, instead of waiting for a receipt by mail, you have the opportunity to directly find out about your debts and taxes on the official website of the Federal Tax Service in your personal account. And pay for them, for example, via the Internet.

Why did they stop sending paper receipts?

If a taxpayer is registered on the Federal Tax Service website and has a personal account there, then since June 2016, tax notices are sent to him only electronically, through his personal account. Such a taxpayer will not receive notifications in a regular mailbox.

Here is the official information on this matter:

What are the prospects for paper notices? In the near future, individuals will no longer receive paper receipts from the Federal Tax Service for the payment of property taxes. How does a person find out about his taxes? The notification will be sent exclusively to your Personal Account on the Federal Tax Service website. Don't have an office yet? So, it's time to connect to this service.

An example of searching for information about an LLC using TIN

As a rule, to search for information about a counterparty, the necessary unique information (OGRN, OGRNIP or TIN) is available. Most often, counterparties are checked on the Federal Tax Service website using their Taxpayer Identification Number (TIN).

If you enter the TIN for a specific LLC in the search criteria window and, having entered the proposed digital code in the line for the cipher, click the “Find” function, then information about the person of interest to us will appear on the screen in tabular form:

- full name;

- legal address;

- OGRN;

- TIN;

- checkpoint;

- date of assignment of OGRN;

- date of entering information about termination of activity - if available.

The generated table, like an extract from the Unified State Register of Legal Entities, can be saved as a file or printed.

On the same page of the Federal Tax Service website there are separate sections in which in a similar way you can find information of interest about a specific organization or individual entrepreneur on the following issues:

- On changes made to the constituent documents.

- About the processes of liquidation, reorganization, reduction of capital assets, acquisition of shares.

- On exclusion from the Unified State Register of Legal Entities.

- About mass registration addresses.

- About legal entities whose actual location does not correspond to their legal addresses.

- About the existing tax debts of legal entities and submitted reports.

- About disqualified individuals.

- About legal entities whose management includes disqualified persons.

- About individuals who cannot manage organizations by court decision.

- About individuals participating in the creation of several organizations or in the management of them.

What services of the Federal Tax Service can be used to find out the data of a legal entity by TIN, was explained in detail by the adviser to the State Civil Service of the Russian Federation, 3rd class, A.Yu. Vasiliev. The official's response is available in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Registration in the personal account of a taxpayer of a legal entity

Going through the stage of registering a new user of a legal entity’s account differs from similar actions for individuals. persons in the direction of complication. Two options are identified, one of which will need to be completed at the start of commercial activity.

Design of a legal entity's office for a management company

To register, you need to sign an agreement to provide the organization with an electronic signature key - EDS. Either the manager or a person authorized by a power of attorney must submit documents containing information about the company for which the personal account is being created.

Then do the following:

- Open the registration page https://lkul.nalog.ru/check.php and sign the User Agreement with an electronic signature.

- Next, enter the email address and captcha verification characters.

- They recheck the data and continue registration.

- If the application does not contain errors, a letter with an activation code will be sent to your e-mail.

- From the letter follow the link to complete registration.

Initially, management of your personal account is given to one user - the manager. If you need to increase the number of employees who are allowed to log into your account, this is done in the “Administration” section.

Registration of an organization’s personal account by proxy

In situations where the owner of the company entrusts the registration of the account to an authorized person, registration of the personal account is carried out by power of attorney. When filling out the data, you will need to indicate how to enter the power of attorney. The rest of the registration process does not differ from the standard one.

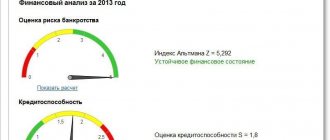

A legal entity has reporting and tax debts - what does this mean?

For the purposes of auditing a counterparty, its failure to pay taxes is a characteristic indicator of existing problems. A company that doesn't pay taxes probably isn't doing very well.

If a company has tax debts or does not submit reports (or the individual entrepreneur does not pay taxes), then information about this can be transferred to the FSSP to collect tax payments or penalties (if they exceed a certain amount).

It should be noted that on the issue of counterparty non-payments, information about cases considered by the arbitration court may also be of interest.

To find out whether information about non-payment of taxes can be publicly available, read the material “What information constitutes a tax secret?”