The difference between an advance and a deposit

An advance is often confused with a deposit. Both the advance and the deposit have one function - advance payment for a product or service, partial or full. There is no clear definition in the legislation to separate these concepts, but according to established practice, an advance payment is considered to be the amount of prepayment for the transfer of which a separate agreement to the contract has not been drawn up:

Postings for advances issued in favor of the supplier

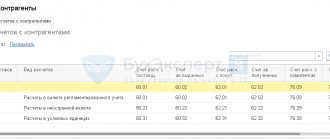

To account for advances transferred by the enterprise to pay for services, work and finished products, account 60 is used. The organization carries out settlements with accountable persons using account 71.

Reflection of the prepayment transferred to the seller for raw materials and materials

Let's consider an example: I ordered raw materials for the production of products from the Atlet enterprise and paid 48,000 rubles in advance on 04/2015. 06/01/2015 Atlet supplied raw materials to the Sigma warehouse.

The customer’s accounting must reflect the following accounting entries for the advance:

| Dt | CT | Description | Sum | Base |

| 60.02 | The advance payment issued to the Atlet enterprise was transferred | 48,000 rub. | invoice | |

| 10/1 | 60.01 | Atlet supplied raw materials and materials in full | RUB 39,360 | waybill |

| 19/3 | 60.01 | VAT (18% of the cost of the goods received) | RUB 8,640 | waybill |

| 60.01 | 60.02 | Crediting the supplier's advance upon delivery of goods | 48,000 rub. | waybill |

| 68.02 | 19.03 | VAT credit upon delivery of goods | RUB 8,640 | waybill |

How to reflect an advance to an employee for business needs

Inter LLC issued to its employee Sviridov V.P. advance payment in the amount of 5,200 rubles for the purchase of stationery. Sviridov purchased office supplies in the amount of 4,850 rubles, and returned the remaining unused funds of 350 rubles to the cash desk of Inter LLC.

| Dt | CT | Description | Sum | Base |

| 71 | Sviridov received an advance on his card account | 5,200 rub. | application for funds | |

| 10 | 71 | Reflection of purchased goods | 4,850 rub. | expense report |

| 50 | 71 | Sviridov returned unspent funds to the cash register | 350 rub. | expense report |

Advances issued

An advance payment is an advance payment to the supplier against future deliveries, work performed or services performed. Transferring an advance payment to a supplier does not mean receiving economic benefits, since the supplier may, for various reasons, fail to fulfill its obligations under the contract: fail to ship goods, fail to provide a service. In this case, the advance payment is returned to the buyer’s account if it was transferred through a bank, or to the cashier if received in cash.

In general, there is no obligation to return the deposit from the supplier.

To account for VAT on advances in the chart of accounts, there is a subaccount on account 76, most often its code is 76.AB.

The buyer can accept VAT as a deduction only if the following conditions are met:

- Presence of an advance payment clause in the contract;

- Documents confirming the transfer of prepayment;

- The supply of goods (services, etc.) is intended for use in activities subject to VAT;

- Availability of a supplier's SF with a dedicated tax.

The buyer does not have the right to accept VAT as a deduction if all of the above conditions are not met. Acceptance of VAT deduction is not an obligation, but a right of the purchasing organization.

If an organization decides to use VAT deduction from an advance issued, then after the provision of the service and the closing of this advance, it will be obliged to restore this VAT to the budget.

Example

Let's say Altavista LLC transfers an advance in the amount of 23,600 rubles. (including VAT). Then Altavista LLC receives goods worth RUB 23,600 from this supplier.

The rate and amount of incoming VAT are indicated in the supplier's invoice.

Advances issued - postings

| Dt | CT | Operation description | Sum | Document |

| 60.2 | 51 | Transfer of advance payment | 23 600 | Payment order ref. |

| 19 | 60.2 | VAT on advance | 3 600 | Advance invoice (received) |

| 68 | 76(advances) | VAT deduction from advance payment | 3 600 | Book of purchases |

| 10 | 60.1 | The received goods are registered | 20 000 | Invoice |

| 19 | 60.1 | Incoming VAT reflected | 3 600 | SF supplier |

| 60.1 | 60.2 | Advance offset | 23 600 | Accounting information |

| 60.2 | 68 | Recovered VAT from advance payment | 3 600 | Sales book |

Advance reports - accounting entries

In addition to settlements with counterparties - buyers and suppliers, the company regularly issues funds to its employees. How to correctly make accounting entries for expense reports? And is it true that the amount from the advance report is deducted from profit? Let's look at a specific example.

Example of settlements with accountable persons regarding advances issued:

The Pit Stop enterprise reported to employee E.I. Kovalev. for a business trip 8,000 rubles. Kovalev spent 5,400 rubles, and unused funds amounted to 2,600 rubles. returned to the cashier. The accountant will need to do the following:

- An advance was issued for travel expenses - posting D 71 K 50 for 8000.

- The balance of unspent money was returned - posting D 50 K 71 for 2600.

The accountable person is obliged to report on the expenditure of funds within 3 days after the end of the issuance period, and in the case of being on a business trip - after the employee returns. Specific deadlines are set by the head of the organization. If an employee, without good reason, has spent more than the allocated funds and is unable to account for them, the excess is withheld from his income. Buh. The entries for expense reports in this situation look like this:

- The amount not returned on time is reflected - D 94 K 71.

- The shortfall from the employee’s earnings is withheld - D 70 K 94, but not more than 20% monthly.

Advances received

When an organization sells goods, works or services, the buyer can make an advance payment before the moment of sale.

According to the requirements of the Tax Code, the seller is obliged to charge VAT on the advance received. VAT is calculated using the formula:

VAT on the advance received = Sales amount *18/100

Example

Let's consider the previous example from the point of view of the selling organization, that is. VAT is charged on the advance payment at the time of its receipt; the amount of such VAT is reimbursed to the budget at the end of the tax period - quarter.

VAT on sales is accrued at the time of shipment, that is, at the time the sales transaction is created Dt 62 - Kt 90.1 .

Advances received - postings

When receiving an advance from a buyer, the accountant makes the following entries:

| Dt | CT | Operation description | Sum | Document |

| 51 | 62.2 | Advance received from buyer (including VAT) | 23 600 | Payment order in. |

| 76(advances) | 68 | VAT accrual on advance payment | 3 600 | Invoice issued, accounting certificate |

| 62.1 | 90.1 | Sales revenue accrued | 23 600 | Sales certificate, invoice |

| 90(VAT) | 68 | VAT on sales | 3 600 | SF issued, accounting certificate |

| 68 | 76(advances) | Accepted for deduction of VAT on advances (after sale) | 3 600 | Book of purchases |

VAT on advances from buyers in 1C: Enterprise Accounting 8

Published 05/30/2016 09:02 Calculation of VAT on advances received from buyers for upcoming deliveries very often raises questions among novice accountants and others. In this article, I would like to break down this process (and write down the transactions) using one specific example in the 1C program: Enterprise Accounting 8. Consider an option in which an organization receives an advance from the buyer, calculates VAT on this advance, and then makes the shipment goods against the received advance payment.

The fact of receiving an advance is reflected in the document “Receipt to the current account”, located in the menu “Bank and cash desk” - “Bank statements”. We make sure to check that the VAT rate is indicated correctly in the document, especially if bank statements are loaded into 1C from third-party programs.

When posting a document, movements are generated on accounts 51 and 62.02.

Based on the document “Receipt to current account” we can create an invoice for the advance payment. To do this, use the corresponding button on the top panel of the document.

The document is filled in automatically; we only need to check the correctness of the data.

Then we carry out the document and look at the movements on the accounts. In this case, wiring Dt 76.AV Kt 68.02 is generated, i.e. the amount of VAT on the advance received is calculated for payment. The document also makes movements in other registers of the VAT accounting subsystem in 1C: Accounting, which are necessary for correctly filling out the declaration.

Since issuing invoices for each advance manually is very labor-intensive, the program provides a mechanism for group registration of invoices for advance payments. I talked about how to work with it, as well as the necessary accounting policy settings, in my video Registration of invoices for advance payments in 1C: Accounting 8 - VIDEO

Then we reflect the fact of shipment of the goods, which in our case occurs a week later than payment. To do this, go to the “Sales” section and create the “Sales (acts, invoices)” document.

We make sure to check the correctness of the settlement accounts (in our case, these are accounts 62.01 and 62.02, as in the document “Receipt to the current account”) and the VAT rate. Then click on the “Write an invoice” button at the bottom of the document.

When posting the document, the advance payment is offset (Dt 62.02 Kt 62.01) and VAT is charged on the shipment (Dt 90.03 K 68.02). Movements in the “VAT sales” register are also generated.

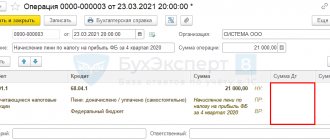

As we can see, VAT in the amount of RUB 15,254.24. was accrued in our case twice (entries were made to account credit 68.02):

1. when registering an invoice for an advance payment - posting Dt 76.AV Kt 68.02

2. upon shipment of goods - posting Dt 90.03 Kt 68.02

Accordingly, so that the amount of tax payable is not overestimated, we need to do one more operation - deduct the amount of VAT from the offset advance. This operation is performed during regulatory procedures for VAT at the end of the tax period; the document “Creating purchase ledger entries” is used. You can find it in the “Operations” menu, the “VAT Accounting Assistant” or “VAT Regular Operations” items. I talked in detail about how to work with this document in my video tutorial Document “Creating purchase book entries” in the 1C program: Enterprise Accounting 8 - VIDEO We create a new document, click the “Fill out the document” button and go to the “Advances received” tab.

The required entry is included in the document automatically with the “Advance payment” event. We post the document and see that our VAT amount goes to the debit of account 68.02, reducing the total amount of VAT payable, and to credit 76.AB, closing settlements for this counterparty. Movements are also generated in the “Purchase VAT” register, due to which this amount is included in the VAT return.

Of course, it is impossible to talk about all the nuances of calculating VAT on advances in one article, so if you want to fully master this and other topics related to VAT calculation, I recommend you our video course “VAT: from concept to declaration”! We share practical experience and help bring order to your database. The course is structured according to the “theory + practice in 1C” scheme. Detailed information about the course is available at the link VAT: from concept to declaration.

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga Shulova 10/22/2019 10:32 I quote Alexander:

Good afternoon Olga. Please tell me what to do: When trying to generate a VAT return and perform routine operations, account 62 was not checked for correct offset of advances and the program registered 2 c/f for the advance, in addition to the c/f for sales to the counterparty. An analysis of the subconto was carried out, errors were corrected, and there were no advances in fact. All d/s receipts were credited to sales. Advance tax payments are reversed, but VAT on these reversed amounts in the declaration is not reduced for payment. All transactions were in one quarter. What was done wrong and what needs to be done to reduce the tax payable by the amount of sorted income tax? Thank you in advance.

Good afternoon

If advance invoices were issued in the same period, then they can simply be deleted rather than reversed. After this, perform the routine operations again. Quote 0 Alexander 10/19/2019 10:08 Good afternoon Olga. Please tell me what to do: When trying to generate a VAT return and perform routine operations, account 62 was not checked for correct offset of advances and the program registered 2 c/f for the advance, in addition to the c/f for sales to the counterparty. An analysis of the subconto was carried out, errors were corrected, and there were no advances in fact. All d/s receipts were credited to sales. Advance tax payments are reversed, but VAT on these reversed amounts in the declaration is not reduced for payment. All transactions were in one quarter. What was done wrong and what needs to be done to reduce the tax payable by the amount of sorted income tax? Thank you in advance.

Quote

0 Olga Shulova 08/13/2019 18:42 I quote Maria:

Good afternoon. What to do when the sales amount is greater than the advance received and in the document Formation of purchase ledger entries, the amount of VAT is placed greater than in the advance receipt document.

Good afternoon

An amount not exceeding the calculated VAT on advances under the document can be deducted. 1C programs work exactly this way. In your case, there was probably an error in record keeping. If documents are entered correctly, this situation is impossible. Try to re-post the documents and repeat the routine operations. Quote 0 Maria 08/13/2019 12:55 Good afternoon. What to do when the sales amount is greater than the advance received and in the document Formation of purchase ledger entries, the amount of VAT is placed greater than in the advance receipt document.

Quote

Update list of comments

JComments

Advance as part of salary: postings

The requirement to pay wages twice a month applies to everyone in the organization. Moreover, this resolution is mandatory and has no exceptions even in the following cases:

- the employee wrote a statement in which he voluntarily refused to pay advance wages;

- payment once a month is approved by internal regulations;

- an employee who performs his duties as a part-time worker;

- the approved payment system does not provide for payment several times a month;

- The salary amount is too low.

Personal income tax is paid only once a month, so the amount of personal income tax is not withheld from the advance payment. According to the procedure approved by the Ministry of Finance, personal income tax is withheld from wages on the last working day of the month for which income was accrued.

Typical entries for recording accrual and payment of wages:

| Debit | Credit | Description |

| 70 | 51, 50 | Advance paid to employee |

| 20 (23, 25,…) | 70 | Salary accrued |

| 70 | 68 | Personal income tax accrued |

| 20 (23, 25,…) | 69 | Insurance premiums have been calculated (each fund has its own sub-account) |

| 70 | 51, 50 | Salary transferred |

It is worth noting that we are only talking about paying wages several times a month, while wages are calculated only once, as well as withholding personal income tax and calculating insurance premiums.

Creating a document debiting from a current account

Creating a document through the menu: Bank – Bank statements – “Add” – transaction type Payment to supplier

Filling out the document header (Fig. 382):

- In the From – the date of the bank statement;

- In the Bank account – the current account from which funds were written off;

- In the Amount – the amount of the transaction;

- In the line Accounting account – one of the cash accounting accounts, on the credit of which an entry will be made to write off funds;

- In the lines Input number and Input date - the number and date of the payment order on the basis of which the transfer was made.

| Attention | |

| Correctly fill in the fields Input number and Input date , because this information will be useful when checking the correctness of the Invoice issued by the supplier, in particular filling out the details for payment and settlement document No. dated . |

- ke Recipient, indicate the supplier to whom the funds were transferred;

- In the Recipient's account , indicate the current account of the recipient of the funds;

Filling out the tabular part of the document (Fig. 382):

- In the Contract , indicate the agreement with the supplier;

| Attention | |

| In the contract selection form, only those contracts that have the type of contract With supplier are displayed. |

- In the line VAT rate VAT field , it must be checked and adjusted if necessary;

- In the line Settlement account, account 60.01 “Settlements with suppliers and contractors” must be indicated;

- In the Advance Account , account 60.02 “Settlements for advances issued” must be indicated.

| Attention | |

| The fields Settlement account and Advance account must be filled out correctly. Otherwise, the advance payment will not be offset automatically, which will lead to incorrect posting. |

- In the line Cash Flow Item, the cash flow item is indicated; analytical accounting will be kept for it in cash accounts;

- In the line Purpose of payment - the purpose of payment, which was in the payment order.

Rice. 382

| STEP 2 |