Challenging the liquidation of a legal entity is not a simple matter; it is a headache for an entrepreneur or a creditor whose debtor was liquidated without repaying the debt. Termination of a company is a complex process, and in most cases it is a forced measure.

ATTENTION: our lawyer is ready to act in this process, to solve the problem: professionally, on favorable terms and on time.

Who and when starts challenging the exclusion from the Unified State Register of Legal Entities?

Mainly the reasons for appealing the liquidation process or appealing the actions of the liquidator are the very reasons for the liquidation. Here are a few main points on which you can begin the fight to restore the organization to the legal field:

- creditors who invested a certain amount of money or property into the liquidation of a legal entity did not receive the desired effect, go to court to challenge the liquidation process;

- an appeal from the founders - a statement of claim to invalidate an entry in the Unified State Register of Legal Entities can be considered upon an appeal from the founders of the organization, if the liquidation was initiated by the tax authorities;

- tax appeal.

Of course, any fact that the company is being liquidated not on completely legal grounds must be proven. Substantial evidence is provided:

- the law has been violated;

- the liquidation procedure was violated;

- absence of justified reasons for liquidation.

Useful : Find out how much the state duty for liquidating an individual entrepreneur is by following the link.

Procedure for canceling liquidation

IMPORTANT! The form of the Minutes of the extraordinary general meeting of shareholders of the joint-stock company on the cancellation of the previously adopted decision to liquidate the company from ConsultantPlus is available at the link

This procedure was developed by the Federal Tax Service of the Russian Federation and is contained in the regulatory documents of this structure. In particular, the procedure is discussed in detail in Letter of the Federal Tax Service No. CHD - 6-09/439 “On state registration in connection with the liquidation of legal entities.” The cancellation of liquidation has already been launched at the level of state bodies, but has not been completed by an entry in the Unified State Register of Legal Entities about liquidation and requires a certain sequence of mandatory actions:

Step 1. Organizing a general meeting at which a decision to cancel the liquidation is made by a majority vote on a voluntary basis. The specifics of this procedure depend on the form of ownership of the legal entity and the corresponding legal aspects in each specific case.

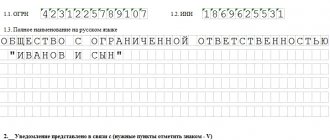

Step 2. Preparation of a package of documents to the Federal Tax Service, which includes:

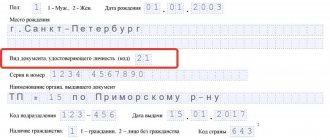

- application form P14001 containing information about the need for amendments in the Unified State Register;

- notification form P15001 with information about canceling the liquidation of a legal entity;

- minutes of the meeting in which the decision to cancel the liquidation was announced; by analogy - the decision of a single participant (for example, an LLC).

Documents must be notarized.

Step 3. Transfer of documents to the Federal Tax Service in person, through a representative or by mail. Transfer over the Internet using a digital signature is also possible. The applicant is given an acceptance receipt. You should contact the same inspectorate that deals with the liquidation of the legal entity.

By the way! Documents to the Federal Tax Service are prepared within three days. From the moment of their adoption, a decision will be made to cancel the liquidation within five days.

The fact of cancellation of liquidation is reflected in form P50007, which is transferred to the organization upon completion of the procedure for reviewing the package of documents submitted by the legal entity. The sheet is handed over in person or can be delivered by mail and other means provided by law.

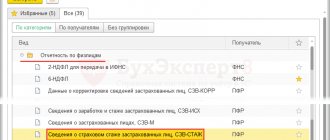

The tax service independently informs the statistical service of the Pension Fund of Russia, the Social Insurance Fund, that the liquidation of the legal entity has been cancelled.

Important! The applicant for cancellation of liquidation is the head of the legal entity. At this point, the liquidation commission and its responsible persons lose their powers.

Time limits for challenging liquidation

According to the law, the general period for appealing the liquidation of a legal entity is three months from the date of such decision on liquidation. However, our principals should remember that there is also a special period, which is one calendar year.

During a special period, persons whose rights and interests were infringed by the liquidation of a given legal entity have the right to appeal this decision on liquidation. Special periods will be calculated from the moment when these persons learned about the violation of their rights, and general terms from the date of publication of information about liquidation in the unified state register of legal entities.

Can liquidation always be reversed?

There are two types of liquidation, depending on the reasons that caused it:

- Liquidation by decision of the Federal Tax Service or court. It is appointed from the outside due to detected abuses, violations of legislation, registration violations, and bankruptcy proceedings. The reversal of such liquidation is very problematic. However, it is possible to challenge the decision on forced liquidation in court.

- Liquidation by decision of the governing body of the organization and its founders. In such a case, the procedure can be reversed according to the recommendations of the Federal Tax Service. This must be done before making an entry in the Unified State Register of Legal Entities about liquidation. If the deadline is missed, you will have to register a new legal entity.

What are the grounds for refusing state registration of liquidation (cancellation) of a limited liability company?

When carrying out voluntary liquidation before making an entry in the Register, two scenarios are possible:

- Before the start of official liquidation activities. The Federal Tax Service and other official bodies are not yet aware of the intention to liquidate an LLC, JSC, or other legal entity. The decision on liquidation in this case is canceled by another relevant internal decision, and the organization continues its work.

- After the official authorities have been notified, and an entry has been made in the Register that the organization is in the process of liquidation. To cancel the procedure, you must contact the tax service with a package of relevant documents.

By the way! There is no state duty charged for canceling liquidation. The need to pay it arises only when changes are made to the constituent documents of a legal entity.

Regulatory justification for challenging liquidation

As practice shows, one of the main reasons for the liquidation of a company is its bankruptcy. Below you will find out what laws govern the right to challenge liquidation:

- Legislation on state registration of legal entities and individual entrepreneurs

- Bankruptcy legislation

- Civil legislation

- Arbitration procedural legislation

A complete list of grounds for challenging the liquidation of legal entities, as well as the closure of a non-profit organization by court decision, can be found in these regulations.

ATTENTION : everything is not so simple with the liquidation of an organization, watch the details in the video, listen to the advice of a lawyer, subscribe to our YuoTube channel right now. By the way, in the comments to the video you can ask your question and receive a free answer from a lawyer: professionally and on time.

Documents for challenging the liquidation of a legal entity

If everything is more or less clear with the deadlines, then with documents the situation is a little more complicated; for collecting documents, the initiator of the dispute is important, since this or that set of documents will depend on this. For example, for the founders of a legal entity, it is necessary to collect the following documents:

- Constituent documents

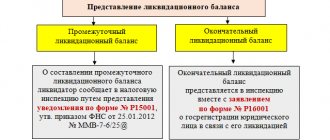

- Liquidation balance

- Documents confirming settlements with creditors

If you challenge liquidation by a creditor, you must:

- Documents confirming the existence of receivables

- Evidence of outstanding financial obligations

To find out how the liquidation of an LLC with one founder proceeds, follow the link

Sample application to the court to cancel a decision to exclude from the Unified State Register of Legal Entities

To the Arbitration Court of the Sverdlovsk Region, the Claimant:

AND.

Respondent:

Inspectorate of the Federal Tax Service

in the Kirovsky district of Ekaterinburg address: 620062 Ekaterinburg, st. Timiryazeva, 11

State duty – 200 rubles.

Statement of claim

on the cancellation of the decision to exclude a legal entity from the Unified State Register of Legal Entities

The limited liability company, by decision of the Inspectorate of the Federal Tax Service for the Kirov District of Yekaterinburg, was excluded from the Unified State Register of Legal Entities as having actually ceased its activities on the basis of Article 21.1 of Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, activities The LLC was terminated by the tax authority.

In accordance with paragraph 8 of Art. 22 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”, the exclusion of an inactive legal entity from the Unified State Register of Legal Entities can be appealed by creditors or other persons whose rights and legitimate interests are affected in connection with the exclusion of an inactive legal entity from the Unified State Register of Legal Entities , within a year from the day they learned or should have learned about the violation of their rights. Clause 1 of Art. 21.1 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” provides that: “a legal entity that, during the last twelve months preceding the moment the registration authority made the relevant decision, did not submit reporting documents required by the legislation of the Russian Federation on taxes and fees, and did not carry out transactions on at least one bank account, is recognized as having actually ceased its activities (hereinafter referred to as an inactive legal entity). Such a legal entity may be excluded from the unified state register of legal entities in the manner prescribed by this Federal Law.” I am the founder of an LLC. In the period from 2008 to 2012, the LLC did not submit tax reports due to the difficult financial situation associated with the crisis. However, the activities of the LLC actually continued during this period and did not stop. These circumstances are confirmed by the following evidence:

- A limited liability company owns real estate in the form of a bathhouse - boiler room, located at the address: Yekaterinburg. Currently, the LLC is renovating this property. The activities of the LLC were actually carried out.

- A message with the following content was posted in the State Registration Bulletin under number 5660: “Decision No. 1811 was adopted on the upcoming exclusion of the Limited Liability Company.” This publication in the State Registration Bulletin does not contain information about the procedure and deadlines for sending applications by the inactive legal entity itself, its creditors and other persons whose rights and legitimate interests are affected in connection with exclusion from the Unified State Register of Legal Entities, as well as the address to which such statements can be sent. statements, which indicates a violation by the Inspectorate of the Federal Tax Service for the Kirov District of Yekaterinburg, clause 3, article 21.1 of Federal Law No. 129 “On state registration of legal entities and individual entrepreneurs.”

In view of the above, the plaintiff was deprived of the opportunity to exercise the right to raise objections to the liquidation of the company in an administrative manner, even if the plaintiff had become aware in a timely manner that the contested decision had been made.

Since the actions of the Inspectorate of the Federal Tax Service for the Kirovsky District of Yekaterinburg do not comply with the above requirements of the Law on State Registration and violate the rights and legally protected interests of the plaintiff, who is the founder of the LLC, in the field of business and other economic activities, we ask you to recognize them as illegal and in order to restore the violated rights and legitimate interests of the applicant to impose on the inspectorate the obligation to cancel the entry on the termination of the LLC’s activities. Based on the above, guided by art. 29, 35, 125, 126, part 1 of Art. 198 of the Arbitration Procedural Code of the Russian Federation, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 20, 2006 No. 67 “On some issues of practice in applying the provisions of the law on bankruptcy of absent debtors and termination of inactive legal entities”, clauses 1, 2, 3 of Art. 21.1, clause 8, 9 art. 22 Federal Law “On state registration of legal entities and individual entrepreneurs”,

ASK:

- Declare illegal the actions and decision of the Federal Tax Service Inspectorate for the Kirov District of Yekaterinburg to exclude the Limited Liability Company from the Unified State Register of Legal Entities on the basis of Art. 21.1 of the Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”

- Oblige the Inspectorate of the Federal Tax Service for the Kirov District of Yekaterinburg to exclude the entry on the termination of the activities of the Limited Liability Company due to exclusion from the Unified State Register of Legal Entities.

Date, signature

USEFUL: watch the video and find out why it is better to draw up any sample claim or complaint with our lawyer, write a question in the comments of the video, subscribe to the YouTube channel

Procedure for appealing a liquidation decision

The legislative framework clearly defines the procedure and procedure for challenging an entry in the Unified State Register of Legal Entities on the liquidation of an organization and restoring the right to exist of a legal entity.

Mainly these are:

- contacting the service responsible for registration and liquidation of legal entities with a claim. The purpose of such an appeal is to invalidate the entry in the Unified State Register of Legal Entities;

- appealing to the liquidation commission with a claim - such an appeal will allow not only to carry out the action - canceling the entry in the Unified State Register of Legal Entities, but also to prove the existing shortcomings. For example, failure to provide information to all creditors, deliberate underestimation of the price of an asset.

The period given for appealing an entry in the Unified State Register of Legal Entities is 1 year from the date of submission of information about liquidation to the media. However, it is possible to extend this period. But this is only in certain cases, when the participants in the process can prove that they had no idea about the situation with the company for completely valid reasons.

Be sure to take into account the information we provide. If problems arise, you should enlist the support of specialists who have proven themselves to be the best. Then you will have every chance of a positive outcome. You can be one hundred percent sure of this.

Algorithm of actions when challenging liquidation

There are two procedures for challenging liquidation:

- Administrative

- Judicial

To do this, the interested person needs to file a complaint with the registering authority about making an entry in the Unified State Register of Legal Entities about the liquidation of a particular legal entity to a higher authority. After this, the body that accepted the complaint will forward it to a higher authority, which will consider it.

If the registration authority refuses to satisfy the requirements. Then you need to go to court.

The statement of claim must indicate:

- Name of the court

- Applicant details

- Data about the interested party

- Result of the complaint consideration

- Information about violation of the applicant's rights

Recognition of the liquidation of a legal entity as illegal, or “The Rising of the Phoenix from the Ashes”

It should be noted that declaring the liquidation of a legal entity illegal in court is very difficult, as evidenced by judicial practice. I believe that one of the explanations for this is the active resistance in court on the part of the Federal Tax Service inspection, which is trying in every possible way to prove the legality of the actions to register the termination of the activities of a legal entity in connection with its liquidation, which is quite understandable.

However, judicial practice recognizing the liquidation of a legal entity as illegal and recognizing the actions of the Federal Tax Service inspectorate to register the termination of the activities of a legal entity in connection with its liquidation as illegal still takes place.

Thus, the decision of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 15, 2013 in case No. A55-15285/2011 is of particular interest, which overturned the decision of the Arbitration Court of the Samara Region dated December 29, 2011 in case No. A55-15285/2011, the decision of the Eleventh Arbitration Court of Appeal dated 16.03 .2012 and the decision of the Federal Arbitration Court of the Volga District dated June 15, 2012 on the same case.

The Presidium of the Supreme Arbitration Court of the Russian Federation established the following: “The courts of three instances considered that the procedure for liquidation of legal entities was followed and refused to satisfy part of the requirements to the registration authority. Meanwhile, the courts' conclusions are erroneous. In accordance with the provisions of Articles 61-64 of the Civil Code, the liquidation of a legal entity by decision of the founders (participants) means the voluntary termination of the activities of such a legal entity. At the same time, termination of the activities of one person should not be aimed at causing harm to another person (Articles 1, 10 of the Code).

The procedure for liquidating a legal entity provided for by these norms involves the actions of the liquidation commission (liquidator) to identify its creditors and provide creditors with the opportunity to present their claims; drawing up a liquidation balance sheet reflecting the actual property status of the liquidated legal entity and its settlements with creditors; determining the procedure for liquidation (including by declaring a legal entity insolvent (bankrupt) - paragraph 4 of Article 61, Article 65 of the Civil Code). At the same time, the liquidation commission (liquidator) is obliged to act in good faith and reasonably in the interests of both the liquidated legal entity and its creditors.” In addition, attention should be paid to the clarification of the Presidium of the Supreme Arbitration Court of the Russian Federation regarding the application of procedural law rules governing the jurisdiction of arbitration courts in corporate disputes related to the creation, reorganization and liquidation of a legal entity (clause 2 of part 1 of Article 33 of the Arbitration Procedure Code of the Russian Federation and Article 225.1 of the Arbitration Procedure Code of the Russian Federation ).

The resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation discussed in this article has precedent significance for arbitration courts, since it has a reservation on application in cases with similar factual circumstances (clause 5, part 3, article 311 of the Arbitration Procedure Code of the Russian Federation).

I believe that the importance of this resolution of the Supreme Arbitration Court of the Russian Federation may lie in the following:

Firstly , if a legal entity being illegally liquidated has outstanding accounts payable, creditors are thereby harmed.

Secondly , if an illegally liquidated legal entity has outstanding receivables, the legal entity itself is thereby harmed.

Thirdly , if, at the initiative of the counterparty of the legal entity (or the legal entity itself), it is necessary to challenge transactions previously concluded with a liquidated legal entity on the basis of their invalidity; transactions on the basis of their non-conclusion or terminate previously concluded valid transactions.

Fourthly , based on other considerations.