What is LLC liquidation

Liquidation is a procedure for closing a legal entity, in which an entry is made in the Unified State Register of Legal Entities that the LLC is ceasing to operate and is being liquidated. After the procedure is completed, the legal successors do not receive the company's assets and liabilities.

Liquidation is possible in two options - voluntary and forced. Compulsory is usually carried out by a court decision made at the initiative of one of the founders, tax or other government agency. It may be associated with violation of the law, registration errors, or bankruptcy. Also, the tax office can forcibly exclude an LLC from the Unified State Register of Legal Entities without a trial if the register contains false information or the company in fact does not conduct business.

The founders of the LLC carry out the voluntary process according to their decision - we will talk about this type of procedure in more detail.

To liquidate an LLC voluntarily, you need to:

- Hold a general meeting of founders and make a decision on liquidation.

- Appoint those responsible for the procedure - a liquidator or a commission.

- Report to Federal Resources, tax authorities and creditors.

- Prepare liquidation balance sheets.

- Submit information to the Pension Fund.

- Pay off the debts of the LLC.

- Distribute the remaining property among the LLC participants.

- Register the liquidation with the Federal Tax Service.

But in the process of fulfilling these points, the LLC should not forget about its standard responsibilities - pay salaries and taxes, pay off debts to counterparties, and also submit reports. Read more about reporting below.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Preparation of zero interim reporting

Zero interim reporting without indicators cannot be compiled. Even in the absence of activity, the authorized capital formed upon registration must be indicated in the balance sheet. If there is no cash or property, the loss is indicated at the same time. Zero reporting is prepared only at the final stage in the form of the final liquidation balance sheet.

Based on the interim balance, a decision is made to conduct an unscheduled on-site inspection. If there is no activity for 3 years and there are no assets, the inspection may not be scheduled or carried out in an expedited manner with the inspection being closed with a certificate.

Should I submit reports upon liquidation of an LLC in 2022?

All reports that the organization submitted while it was operating must continue to be submitted. While the liquidation process is underway, do everything as usual. But reporting for the last period in which the company operated is submitted within special deadlines and with changes in the filling procedure.

During the liquidation procedure of an LLC, it is necessary to submit reports to several regulatory authorities - the Federal Tax Service, the Social Insurance Fund and the Pension Fund of the Russian Federation. They will be waiting for accounting, as well as tax and employee reports.

Here is a complete list of reports that must be submitted:

- Declaration of profit, simplified tax system or unified agricultural tax.

- 6-NDFL.

- Declarations and calculations for other taxes and fees: property tax, mineral extraction tax, water tax, VAT, etc.

- RSV.

- Calculation of 4-FSS.

- Personal reporting for employees: SZV-M, SZV-STAZH, SZV-TD, DSV-3, information information.

- Liquidation balances.

- Reporting to Rosstat.

Fines for late submission of reports will not bypass liquidating legal entities. For example, for tax returns and the DAM, the amount of the fine will be 5% of the unpaid tax for each month of delay, but not less than 1,000 rubles and not more than 30%. Any fines received during the liquidation process will be added to the LLC's liabilities, which must be paid off before closure.

Next, we will analyze the procedure for preparing all reports and the rules for submitting liquidation reports in 2022.

Who signs the reports during the liquidation of an LLC?

When LLC participants decide to liquidate the company, they also decide who to entrust with the management of the procedure - they appoint a liquidator or a liquidation commission. From the moment of appointment, they receive all rights and obligations related to the activities of the LLC: they can represent in court, sign powers of attorney and perform other legally significant actions.

The liquidators will also sign the reports. Among the requirements for the balance sheet is the mandatory signature of the manager. Since from the moment the liquidator is appointed, he receives all the powers to manage the LLC, he must sign the balance sheet (Articles 62, 63 of the Civil Code of the Russian Federation).

Final liquidation balance sheet: deadline for drawing up and execution of the interim balance sheet

The interim form is drawn up 2 months after the official publication of the beginning of the liquidation of the company. The preparation of an interim balance sheet is carried out after notification of creditors about the upcoming liquidation of the company and the expiration of the period for filing financial claims against the organization. The closing date for accepting claims is indicated in the publication.

The interim balance is compiled by the liquidation commission, whose responsibilities include conducting an inventory, preparing documents and generating reporting data. Employees who are not members of the liquidation commission may be involved in the verification procedure.

An enterprise may prepare interim balance sheets as of the reporting date or any other date. An organization can draw up several balance sheets. The frequency is determined by the needs of the liquidated organization.

Interim liquidation balance sheet

The PLB is drawn up after the commission has determined the composition of the LLC’s property and the deadline for presenting creditors’ claims has expired. There is no special form for the PLB; it is drawn up according to the standard or simplified form of the balance sheet, but with the appropriate note “Interim liquidation balance sheet” (Letter of the Federal Tax Service of Russia dated 08/07/2012 No. SA-4-7/13101). The recommended forms are given in the Letter of the Federal Tax Service of Russia dated November 25, 2019 No. VD-4-1/ [email protected]

The appendices to the PLB must disclose information about the organization’s property, creditors’ claims, the results of the consideration and the list of claims that were satisfied by a court decision.

The liquidation commission submits the PLB for approval to the founders of the LLC, and then sends a notification to the registration authority in the form P15016. There is no need to submit your balance sheet anywhere.

On what date is the liquidation balance sheet compiled?

Specific dates for drawing up the liquidation balance sheet are not regulated by law. But taking into account the procedure for liquidating a company provided for in the Civil Code of the Russian Federation, we will name the following deadlines:

- for the interim liquidation balance sheet - the end date of the deadlines for identifying creditors and completing procedures to establish the actual condition of the property based on the results of the inventory;

- for the final liquidation balance sheet - the nearest date after the creditors' claims are satisfied.

In any case, the date of compilation of the liquidation balance sheet precedes the date of formation of the final (last) statements class=”aligncenter” width=”675″ height=”342″[/img]

Final liquidation balance

After settlements with creditors, the liquidation commission draws up the final liquidation balance sheet (FLB). In general, the procedure for its preparation is similar to the preparation of the PLB, but it reflects the property that remains after satisfaction of the creditors’ claims.

After approval, send the OBL to the tax authority along with an application for liquidation, a document confirming payment of the duty and a document confirming the submission of information to the Pension Fund (subparagraph b, paragraph 1, article 21 of the Law on State Registration of Legal Entities and Individual Entrepreneurs).

How to submit a liquidation balance sheet to the tax office

The fact that the liquidator has drawn up a liquidation balance sheet must be reported to the tax authority by submitting a special notification. Moreover, the form of notification differs depending on the type of liquidation balance sheet:

Documents related to the liquidation of a company are submitted to the tax office in the following ways:

When submitting electronically, sample documents must be scanned (subject to certain technical requirements) and certified with a digital signature of the liquidator or notary.

How to submit tax reports upon liquidation of an LLC

A company in liquidation must submit all tax reporting forms that it submitted during its normal operation. Only the rules for filling out some fields, the reporting period and the submission date change.

The last day for submitting declarations is the day preceding the entry into the register of the termination of the company's work. You can begin preparing it when all taxable transactions have been completed. The tax period depends on the frequency of filing the declaration. Thus, a declaration under the simplified tax system must be drawn up for the period from January 1 to the day of liquidation. If the liquidation entry is added to the register on November 26, then the reporting period will be January 1 - November 25. For quarterly and monthly reports, the procedure for determining the reporting period is almost the same - from the beginning of the quarter or month until the day of liquidation (clauses 2–3.4 of Art. Tax Code of the Russian Federation).

If an organization is liquidated at the beginning of the year, then some reports for the current year must be submitted along with reports for previous years.

Income tax declaration (USN, UTII, etc.) upon liquidation

Income declarations during liquidation are filled out almost in a standard manner. Among the features, one can highlight the “Tax period” field, in which the code “50” is indicated, and the “Reporting year” field, in which the year of liquidation is indicated. The reorganization (liquidation) form code is “0”.

Information in the declaration is indicated for those periods that ended before the date of liquidation, and for the tax period as a whole.

It is recommended to hand it over after all taxable transactions are completed: sale of property, settlements with creditors, etc. We remind you that this must be done before entering information about the liquidation into the Unified State Register of Legal Entities (clause 1, article 346.19 of the Tax Code of the Russian Federation, clause 9, article of the Civil Code RF, Letter of the Federal Tax Service of Russia dated August 3, 2006 No. 02-6-10/ [email protected] ).

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Calculation of 6-NDFL and certificates of income and tax amounts

Calculation of 6-NDFL together with certificates of income must be submitted after final settlements with employees, founders and other individuals, but not later than the end of liquidation (Clause 3.5 of Article of the Tax Code of the Russian Federation, Clause 9 of Article of the Civil Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated 30.03. 2016 No. BS-3-11/ [email protected] ). They contain information from the beginning of the year until the moment of termination of activity.

When liquidating, 6-NDFL indicates the code of the period in which the procedure was completed - “51” for the first quarter, “52” for the first half of the year, “53” for 9 months and “90” for the year. For individual entrepreneurs and heads of peasant farms from 2022, codes “83” for the first quarter, “84” for the first half of the year, “85” for 9 months and “86” for the year should be indicated. In the “Form of reorganization (liquidation)” field, enter the code “0”.

Declaration of property tax and other taxes

They submit the declaration after all taxable transactions or taxable objects have been completed. For example, when preparing a property tax return, it is better to wait until the taxable property is sold or transferred to the participants.

When liquidated, the tax period code “50” is indicated in the annual declaration. In other declarations, the codes may differ depending on the frequency of delivery.

Reporting on insurance premiums

RSV and 4-FSS also need to be submitted upon liquidation. They are compiled after the final settlement with employees, but the end date of the reporting period is different.

Calculation of insurance premiums

The DAM must be prepared and submitted before the interim balance sheet is drawn up. The calculation is drawn up for the period from the beginning of the year to the filing date (clause 3.5 of Article 55, clause 1 of Article 423, clause 15 of Article 431 of the Tax Code of the Russian Federation).

During liquidation, the reporting period code is indicated in the DAM - “51” for the first quarter, “52” for the first half of the year, “53” for 9 months and “90” for the year. In the field with the reorganization (liquidation) form code, enter “0”.

The difference between the amount of insurance premiums payable in accordance with the DAM and the amount of contributions paid from the beginning of the billing period is due within 15 days from the date of submission of the calculation.

From 2022, information on the average number of employees is also indicated as part of the DAM, so they will be reflected in the latest calculation of contributions (Clause 2, Article 1, Part 2, 3, Article 2 of the Federal Law of January 28, 2020 No. 5-FZ) .

4-FSS

4-FSS must be submitted to the fund before the day of filing the tax application for state registration of the liquidation of the LLC (clauses 1, 4, 15 of Article 22.1 of Law No. 125-FZ). The calculation is prepared for the period from the beginning of the billing period to the day the calculation is submitted.

Fill out 4-FSS in the usual manner. In this case, put “L” in the “Cessation of activity” field on the title page.

The LLC must pay the calculated amount of injury contributions within 15 calendar days from the date of submission of the form.

Where is the liquidation balance presented?

The head of the liquidation commission (liquidator) must notify the tax authority about the preparation of the interim liquidation balance sheet using form No. P15001, in section 2 of which it is necessary to put about (clause 3 of Article 20 of Law No. 129-FZ, Letter of the Ministry of Finance of the Russian Federation dated 04.03.2015 No. 03-02-07/1/11378). There is no legal obligation to submit the interim liquidation balance sheet to the tax inspectorate (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of the Russian Federation dated March 4, 2015 No. 03-02-07/1/11378, dated December 17, 2014 No. 03-02-07/1/65223).

But in practice, companies submit an interim balance sheet along with a notice of liquidation of a legal entity. And the final liquidation balance sheet of the company must be submitted to the tax office as part of the package of documents for state registration of liquidation (Letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1/65223 dated December 17, 2014).

Reporting on personalized accounting

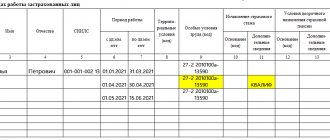

After the dismissal of all employees and final settlement with them, you need to submit the latest personalized reporting for them. A month is allotted for its preparation from the date of approval of the PLB, but you need to have time before submitting documents for state registration of liquidation.

Prepare the following documents for the Pension Fund:

- SZV-M - from the beginning of the month of submission until the day of compilation.

- SZV-STAZH - from the beginning of the year until the day of compilation.

- DSV-Z - for the period from the beginning of the quarter in which it is submitted until the date of compilation, if in this quarter you made additional contributions to the funded pension of employees.

- SZV-TD - submit for the last month, if necessary, as well as for all dismissed employees no later than the working day following the day the dismissal order was issued.

- Individual information about employees - for each employee you need to transfer the data specified in paragraphs. 1-8 tbsp. 6 of the Law on Persuancet. They can be submitted using the ADV-1 form, supplemented with SNILS and the last name from the birth certificate.

The reporting for employees includes the liquidator and all members of the commission, since they are also among the insured.

If you do not submit to the Federal Tax Service the documents confirming the sending of the above information to the Pension Fund, then registration of the liquidation will not be refused. But in this case, the tax office will request this information from the fund independently, in the manner of interdepartmental interaction.

Differences between interim and final liquidation reporting

The information presented in the interim and final balance sheets differs.

| Condition | Interim balance | Final balance |

| Lack of data in reporting | Zero reporting is not submitted | Zero reporting |

| Quantity | Can be more than one form | Submitted once |

| Dependence of indicators | Do not depend on final reporting | To reflect the opening balances, the closing balances of interim reporting are used |

| Obligation to submit to the Federal Tax Service | May not be visible to external users | Must be submitted |

| Date of reporting | Any of the dates, for example, the day of the end of the period for presenting claims of creditors before settlements with the founders | Date preceding the exclusion of the enterprise from the register |

Statistical reporting

Reports to Rosstat are submitted until the organization ceases to exist in the standard manner. The law does not provide for any special forms or features of reporting during the liquidation process and after its completion.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

How to submit reports during liquidation through Extern

Extern is a service for submitting reports via the Internet. Through it you can report to the Federal Tax Service, Pension Fund, Social Insurance Fund, Rosstat, RPN and FSRAR. In addition, sending electronic applications and letters is available.

Organizations in the process of liquidation can submit all necessary reports and applications through Extern. The service allows you to send a notice of liquidation of a legal entity and an application for state registration of a legal entity in connection with its liquidation. You can also prepare and send a balance sheet, tax and personalized reporting. The service has tips to help you at every step of filling out, and if difficulties arise, specialist consultants will help you figure it out.

To get started, all you need is registration in the service and an issued electronic signature. All new users can use Extern for free for three months as part of the “Test Drive” promotion. This will help you get acquainted with all the capabilities of the service:

- automatic and timely updating of all forms of reports, declarations, calculations and statements;

- uploading reports from 1C;

- automatic verification of reports before sending according to approved control ratios;

- unlimited number of extracts from the Unified State Register of Individual Entrepreneurs and the Unified State Register of Legal Entities;

- correspondence and reconciliation with regulatory authorities;

- detailed individual reporting schedule;

- automatic generation of payment invoices based on tax declarations and requirements.

Externa provides a special function - “Business registration with the Federal Tax Service”. With its help, you can send all applications to the tax office without paying state duty. To send an application, it must be signed with an electronic signature issued in the name of the head of the legal entity.

Response documents from the Federal Tax Service will come directly to the system; you won’t have to go to the tax office to get them. Download the files on the document flow page and print.