General information about the pilot project

A pilot project is a procedure for paying benefits, determined by government decree No. 294 of 04/21/2011. In accordance with this document, for the pilot project, 3 days of sick leave are paid by the employer, the remaining amount is subject to calculation by the Fund’s specialists and transfer to the details of the individual.

The procedure for direct payments is as follows:

- The employee submits to the accounting department a certificate of incapacity for work closed by the medical institution, to which is attached an application for the transfer of funds.

- If there is no data on income for the two previous years, other documents must be attached: a certificate of earnings from the previous place of work, an application to change the period for calculating benefits, etc.

- The accountant calculates the average earnings and the amount due for the first three days of illness.

- Within five days from the date of receipt of documents from the employee, information on sick leave with an electronic registry attached is submitted to the Social Insurance Fund.

- The fund calculates the benefit and transfers money to the employee using the details specified in the application. The established deadline for transferring sick leave to the Social Insurance Fund during the pilot project is 10 days from the date of receipt of the package of documents from the employer.

- The procedure for paying for the first three days of incapacity for work remains the same: money is transferred on the next payday (Part 1, Article 15 of Law No. 255-FZ of December 29, 2006).

The Direct Payments project has been applied in all constituent entities of the Russian Federation since January 1, 2022.

ConsultantPlus experts sorted out what an accountant should do when switching to a pilot project on sick leave. Use these instructions for free.

to read.

Step-by-step instruction

Deadlines for submitting documents

Do I need to send a package of papers to the Social Insurance Fund in order to receive benefits not only from the employer for 3 days, but also the rest of the amount for sick leave? Yes, and the employer is required to submit documents for payment of benefits to the territorial body of the Social Insurance Fund . To do this, you must submit to your employer a certificate of incapacity for work and an application for benefits within 6 months. The organization prepares a certificate calculating benefits for the Social Insurance Fund and, together with a sick leave certificate and an application, submits it to the Fund within 5 days.

Who fills out the form and how?

The first part of the sick leave form is filled out by the doctor. The information in the second part is entered by the employer. According to Order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n, when filling out the following basic rules should be followed:

- Do not use a ballpoint pen.

- If you need to make corrections, you should cross out the erroneous information and indicate the correct information on the back of the form.

Since the Social Insurance Fund calculates the amount of compensation, the fields “At the expense of the Social Insurance Fund of the Russian Federation” and “Total accrued” must be filled in by a Fund employee.

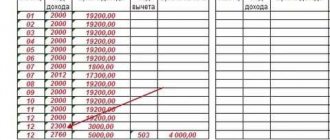

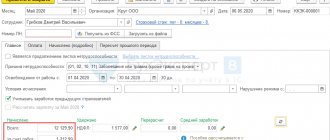

The photo shows a sample of filling out a sick leave certificate by an employer under the Social Insurance Fund pilot project

Filling out an application

The application form for payment of benefits is established by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 N 578. This application must be filled out by the employee, but as a rule, the employer does this independently in order to reduce the number of errors. The employee only has to check whether the bank details are correct and sign.

Minimum and maximum period

After you have provided your employer with your sick leave, he has 10 days to accrue sick leave for the first 3 days. And he is obliged to make the payment on the next day of salary transfer.

After receiving a certificate of incapacity for work from you, the employer is obliged to submit a package of documents to the Social Insurance Fund within 5 days. Over the next 10 days, the Social Insurance Fund is obliged to check all the information and pay you benefits.

Thus, the maximum period during which an employee will receive payment of disability benefits is 15 days from the moment he provides sick leave to the employer. The minimum payment period is not established by law.

How is personal income tax collected?

The employer withholds tax from the amount of compensation he makes. That is, during the first three days of illness. Personal income tax on the remaining amount is withheld by the Fund, because it is the Fund that pays this part of the benefit.

How to check traffic on a website?

An employee can find out the status of his sick leave on the Social Insurance Fund website. The Fund launched the “Insured Person’s Account” service, where the employee logs in through his account on the State Services Portal.

The account must be verified. When an employee logs into his account on the FSS website, he will be able to track his benefits.

Can they refuse and why?

The Social Insurance Fund may refuse to pay benefits in the following cases:

- The documents necessary for calculating compensation were not provided . In this case, the FSS sends the employer a notice of the need to transfer data within 5 working days from the date of receipt of the letter.

- The deadline for applying for benefits has been missed . If you do not have documents confirming that this deadline was missed for a good reason, the Fund will not transfer the money to you. To avoid these situations, the employer should submit a full package of documents on time, and the employee should not delay in applying for payment.

If you believe that the Social Insurance Fund illegally refused to pay you benefits, you need to go to court.

Positive and negative sides

The Social Insurance Fund project has certain advantages for both the employer and the employee. First of all, the responsibility for calculating the insurance payment lies with the Social Insurance Fund. The employer can transmit information about the insured person to the Social Insurance Fund in electronic form , which is more convenient.

Employees receive protection: they are spared from delayed payment of benefits or complete non-payment, as well as from controversial situations with the employer. However, the employer must now be more responsible about the deadlines for submitting the package of documents, as well as the correctness of filling out sick leave.

How sick leave is filled during a pilot project

Paper certificates of incapacity for work are filled out in accordance with the order of the Ministry of Health No. 925n dated 09/01/2020. The form was approved by order of the Ministry of Social Development No. 347n dated April 26, 2011.

It is recommended to issue a memo for employees on how to submit sick leave to the Social Insurance Fund in 2022 on paper for direct payments:

- attach a statement to the certificate of incapacity for work in the form approved by Appendix No. 1 to the order of the Social Insurance Fund No. 578 dated November 24, 2017;

- check the filling out of the details by the medical institution: name of the organization that issued the sheet, disease code, period of illness, date of return to work, doctor’s name and presence of a seal.

The rules for filling out a paper sick leave certificate for direct payments by the employer have one difference from the credit system: the columns “At the expense of the Social Insurance Fund of the Russian Federation” and “Total accrued” remain empty. These data are filled in by the Foundation.

The employer should fill out the lines:

- Name of the organization or full name of the individual entrepreneur.

- Place of work (check the box “Primary” or “Part-time”).

- Employee Taxpayer Identification Number.

- SNILS.

- Insurance experience.

- Period of illness.

- The amount of earnings for the billing period.

- Average daily earnings.

- The amount of benefit is at the expense of the employer.

- Full name of the manager and chief accountant, their signatures and seal of the organization.

FSS pilot project - working with sick leave in 1C: ZUP and 1C: ZGU

Published 11/25/2018 11:43 Author: Administrator The FSS pilot project is confidently moving across the country, affecting more and more regions. The author of this article, Madina Tlisova, lives in the republic, which is one of the pioneers of the pilot project for direct payments from the Social Insurance Fund. We asked Madina to share with our readers her experience of working with sick leave using practical examples in 1C programs.

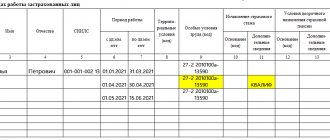

To work within the framework of a pilot project in PP 1C: ZUP and 1C: ZGU, you need to go to the “Settings” - “Organization details” section on the “Accounting policies and other payments” tab, click on the “Accounting policies” link, check the boxes as shown in the figure , and fill in the transition date for your region.

But even if you forgot to make these settings, when calculating salaries or benefits according to the BL, the program will display a message that you still need to indicate the date of entry into the project (the check is carried out according to the checkpoint of your organization).

Next, for ease of use and registration of all interrelated documents along the chain, you can set up the “Benefits at the expense of the Social Insurance Fund” workplace.

Go to the “Main” menu - “Benefits from the Social Insurance Fund”

or in the section “Reporting, certificates” - “Benefits at the expense of the Social Insurance Fund”.

In our example, we will work in the “Direct Payments” tab, and the “Reimbursement of Organization Expenses” tab is used to register applications for funeral benefits and payment for additional days off for caring for disabled children, when the organization pays for them from its own funds, and the Social Insurance Fund then reimburses these amounts.

So, the sequence of actions will be as follows:

1. To begin with, the employee must provide the organization with a sick leave certificate in paper form or an electronic certificate of incapacity for work, which is registered in the program.

Let’s register the BC using the “Create sick leave” button. Further filling out the document is described in the article Calculation of payment for sick leave in the 1C program: Salary and personnel management 8.

For the convenience of working with the document, you can apply some of the settings described by me in the article “Secret” document capabilities in 1C: ZUP and 1C: ZGU edition 3

With the advent of the electronic certificate of incapacity for work, the ability to auto-fill this document was added. All you need to do is enter the employee’s full name, personal identification number, and when you click on the “Receive from FSS” or “Load from file” button, the information that the previous medical institution that issued the individual identification document transferred to the FSS will be filled in.

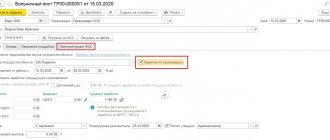

We see that an additional tab “FSS Pilot Project” appears in the window for entering the information required to be sent to the FSS. On the “Main” tab, the “at the expense of the Social Insurance Fund” field will be zero, since the amounts of payments are calculated only at the expense of the employer - the first 3 days.

You can view the accrued amounts in detail by opening the “Accrued (details)” tab.

If an employee was sick for only 3 days, then all of them are paid by the employer. In this case, we simply post the document and close it.

2. The need to transfer data to the Social Insurance Fund arises when the employee’s illness lasts more than three days. In this case, you need to create an “Employee Application for Payment of Benefits” (hereinafter referred to as the Application). To do this immediately when entering sick leave, go to the “FSS pilot project” tab and use the link “Enter an employee’s application for payment of benefits” to register it.

If we fill out the application later, we have the opportunity to choose one of three options:

a) through the “Benefits from the Social Insurance Fund” workplace, which we opened above,

b) through the section “Reporting, certificates”.

Useful setting: if you do not find some sections in the list in the information database, you can independently adjust their visibility.

For example, initially the list does not contain a section for filling out an application (highlighted in black). Click on the “Settings” button (gears at the top right) to the “Navigation settings” line. Select the element “Application for payment of benefits” in the left part of the window that opens, use the “Add” command to move it to the right side, click “OK”, and the document section appears in the list.

You can also add this section to your Favorites and easily find it using the method described under point 6 in the article Useful settings for ease of work in the programs 1C: ZUP and 1C: ZGU edition 3.1

c) “Reporting, certificates” - “Transfer of information about benefits to the Social Insurance Fund” - click on the “Create” button.

We fill in all the fields of the document, moving along the bookmarks. After selecting an employee, information about him that is present in our database is automatically pulled up.

If changes are made to the employee’s personal data after filling out the Application, a message appears in the document that the data has been updated automatically.

When working with the “Payment Method” tab, you can select one of the modes, and the program will fill the corresponding windows with data from the employee’s card. When choosing the “On a MIR card” option, you only need to enter the card number once, then the system will remember it.

When filling out other bookmarks, information from the sick leave sheet is pulled up. If it is necessary to correct any data, changes must be made in the primary document.

3. The next thing you need to create when you exchange information electronically with the FSS is the Register of information necessary for the assignment and payment of benefits (hereinafter referred to as the Register). Data for it can be entered in the “Sick Leave” document on the “FSS Pilot Project” tab. Again, when using ENL, this information is filled in automatically.

The registry is written through:

a) “Benefits at the expense of the Social Insurance Fund”,

b) “Reporting, certificates”,

c) “Reporting, certificates” - “Transfer of information about benefits to the Social Insurance Fund” - click on the “Create” button.

Fill in the fields.

We enter the date, select the type of register, click “Fill” - completed Applications that were entered earlier, but not included in the Register or not sent, immediately appear. If desired, you can create it manually by clicking the “Add” button and selecting the required Application document.

Again, if any data changes, adjustments must be made to the original BL and Application documents, and in the Register this information will be updated automatically (if this does not happen, you can use the “Update secondary data” command).

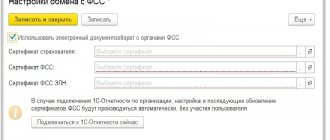

Then the register can be downloaded or sent directly from the program when using the 1C-Reporting service.

4. When documents are submitted to the Social Insurance Fund in printed form, an “Inventory of employee applications for payment of benefits” is compiled.

or “Reporting, certificates” - “Transfer of information about benefits to the Social Insurance Fund” - click on the “Create” button.

By clicking the “Fill” button, all Applications appear in the document, and using the “Add” command it is possible to selectively enter the necessary documents.

The inventory can be printed using the “Print” button.

Author of the article: Madina Tlisova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Tasya 02/13/2021 04:08 But what about those who, out of memory, sent the allowance for January 6752 themselves (you still have to pay January and February)

Quote

Update list of comments

JComments

How to clarify information on sick leave

The adjustment procedure is regulated by clause 63 of Section IX of Order No. 925n of the Ministry of Health.

If an error was made by a medical institution and discovered by the employer before submission to the Social Insurance Fund, then the document should be replaced with a duplicate.

If an error is made by the employer, corrections are allowed. The erroneous entry is crossed out, and a correct entry is made on the back of the document with the note “Believe the corrected one,” certified by the seal and signature of the responsible person.

The use of correction fluid and eraser is prohibited.

If errors are detected in the amount of electronic sheets, the accountant sends an adjustment. If the benefit has already been paid by the Fund, a recalculation is made.

The organization has the right to view and edit sent sick leave certificates on the Social Insurance Fund portal in the “Certificates of Incapacity for Work” section of your personal account.

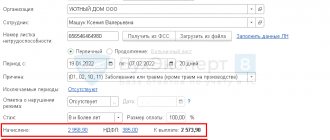

Setting up 1C ZUP 3 for benefits of the FSS pilot project

Accounting for benefits from the Social Insurance Fund pilot project is reflected in the Accounting Policy (Settings - Organizations - Accounting Policies and other settings) on the Social Insurance Fund Benefits by checking the box and filling in the date from which the Benefit Payment was transferred to the Social Insurance Fund .

Accounting Policy settings affect the presence of the following objects in the program:

- tab FSS Pilot Project in the documents Sick Leave (Salary - Sick Leave) and Parental Leave (Salary - Parental Leave and Returns from Leave);

- specialized documents intended for transfer to the Social Insurance Fund. These documents are contained in the document journal Transfer of benefits information to the Social Insurance Fund (section Reporting, certificates );

- workplace Benefits at the expense of the Social Insurance Fund (section Reporting, certificates ). This tool improves the convenience of users in preparing documents to be sent to the Social Insurance Fund.

Accounting of transfers

In 2022, the amount paid to an employee from the Fund is not reflected in the employer’s accounting records. The postings should reflect only the accrual of benefits for the first three days of illness. The accounting entries for sick leave in 2022 during the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit accrued for 3 days of incapacity for work | 20 (25, 26, 44) | 70 | 2054,79 |

| Personal income tax withheld | 70 | 68.01 | 267,00 |

The accounting entries for sick leave payments during the pilot project are as follows:

| Contents of operation | Debit | Credit | Sum |

| Benefit paid from the cash register | 70 | 50 | 1787,79 |

| Benefit paid to bank details | 70 | 51 | 1787,79 |

Direct benefit payments

The system of paying benefits to employees directly from the Social Insurance Fund of the Russian Federation was launched back in 2011. The features of direct payments of benefits for compulsory social insurance in case of temporary disability and in connection with maternity in the constituent entities of the Russian Federation are approved by Decree of the Government of the Russian Federation of April 21, 2011 No. 294.

The Nizhny Novgorod region and the Karachay-Cherkess Republic joined the FSS pilot project in 2011. As of the end of 2019, the direct procedure for paying benefits from the Social Insurance Fund is already successfully working in more than 50 constituent entities of the Russian Federation.

Since 01/01/2020, the Komi Republic, the Sakha (Yakutia) Republic, the Udmurt Republic, the Kirov, Kemerovo, Orenburg, Saratov and Tver regions, and the Yamalo-Nenets Autonomous Okrug have been participating in the project.

The Irkutsk region was supposed to join the project from 07/01/2020, but the deadline was postponed to 01/01/2020 (Resolution of the Government of the Russian Federation of November 13, 2019 No. 1444).

From July 1, 2020, the project will expand to other regions: the Republic of Bashkortostan, the Republic of Dagestan, the Krasnoyarsk and Stavropol Territories, the Volgograd, Leningrad, Tyumen and Yaroslavl regions. It is planned that in 2022 the whole country will join the direct payments project.

The direct payments project implies that amounts from the Social Insurance Fund are transferred directly to employees for the following types of benefits:

- temporary disability benefits due to illness;

- temporary disability benefits due to an accident at work or occupational disease;

- maternity benefits;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years;

- payment for additional leave for the entire period of treatment and travel to and from the place of treatment.

A number of types of benefits are still paid by the employer, and then reimbursed upon application from the funds of the Social Insurance Fund of the Russian Federation:

- social benefit for funeral;

- payment of four additional days off to one of the parents (guardian, trustee) to care for disabled children;

- expenses for preventive measures to reduce industrial injuries and occupational diseases of workers.

Advantages of the direct payment mechanism

By participating in the FSS project “Direct Payments”, from the point of view of calculating benefits, the policyholder still:

- calculates average earnings;

- pays the employee part of the benefit - payment for the first three days of illness;

- provides the necessary data for calculating the portion from the Social Insurance Fund.

Advantages of the Social Insurance Fund project “Direct Payments”:

- improving the situation of insured citizens when receiving benefits under compulsory social insurance;

- benefits at the expense of the Social Insurance Fund are paid within the strictly established deadlines;

- payment of benefits does not depend on the financial situation of the employer;

- improving the position of policyholders when paying benefits under compulsory social insurance;

- transfer of obligations to pay part of the benefit directly to the Social Insurance Fund.

Simplifying the work of an accountant is not so obvious: storage, preparation and responsibility for identifying falsification of certificates of incapacity for work do not reduce the workload.

Additional responsibilities for accountants when making direct payments include preparing and sending to the Social Insurance Fund:

- a register containing complete information about the organization that issued the certificate of incapacity for work to verify its accuracy;

- data on the employee’s average earnings to enable the fund to calculate amounts to be paid;

- applications containing the employee’s bank details to provide the Social Insurance Fund with the opportunity to transfer benefits to the insured.

Interaction scheme for the project of direct payments of benefits from the Social Insurance Fund

The interaction between the employee of the insured person, the employer - the policyholder, the Social Insurance Fund - the insurer and the medical institution in the Social Insurance Fund project “Direct Payments” is as follows (Fig. 3):

- The employee goes to a medical facility.

- The employee receives a document “certificate of incapacity for work” at the medical institution.

- Upon completion of the illness, the employee submits to the accounting department of the organization in which he works a “closed” and partially completed “certificate of incapacity for work.” In this case, the employee fills out an application to the Social Insurance Fund with a request to pay the benefit, indicating the details for transferring funds. The employer fills out his part of the “sick leave certificate” with information about the employee’s insurance record and data on average earnings and makes a calculation.

- The employer pays the employee (if necessary) for the first 3 days of illness.

- The employer submits to the Social Insurance Fund a register of information for calculating benefits and an application for the transfer of funds to the account of the insured person within no more than 5 days.

- The FSS checks the information received and informs the employer of either an error log or confirmation of receipt of the register and application.

- Having confirmed receipt of the register and application, the Social Insurance Fund calculates the amount to be paid from the fund and makes the transfer to the employee in accordance with the application.

Rice. 3. Scheme of interaction on the project of direct payments of benefits from the Social Insurance Fund

Direct payments in “1C: Salary and HR Management 8” (rev. 3)

To confirm the region’s participation in the direct payments project in “1C: Salaries and Personnel Management 8” edition 3, in setting up the organization’s Accounting Policy on the FSS Benefits tab, you should set the flag I confirm that the organization is registered in the region with direct payment of benefits through the FSS

and in the field Payment of benefits transferred to the Social Insurance Fund from: indicate the date of entry into the pilot project (Fig. 4).

Rice. 4. Setting up accounting policies

As a result of setting up the Accounting Policy in the Sick Leave document, the FSS Pilot Project tab becomes available (Fig. 5).

Rice. 5. Document “Sick leave”

Clicking the link Fill in the data for the register of information transmitted to the Social Insurance Fund opens a form for filling out data about the medical organization and the doctor who issued the certificate of incapacity for work. The employee’s application for payment of benefits must be submitted to the Social Insurance Fund office. It can be generated right there using the link Enter an employee’s application for payment of benefits. Data that is already in the program is inserted into the application automatically.

In the Reporting, certificates menu, there is a specialized workplace Benefits at the expense of the Social Insurance Fund, where you can create documents for payment of benefits, and then, using the 1C-Reporting service, immediately send the necessary information in the required format via electronic communication channels to the Social Insurance Fund.

| 1C:ITS For more information on preparing in 1C and sending to the FSS a register of information for direct payments, see the section “Instructions for accounting in 1C programs.” |