Features of off-balance sheet accounting

Off-balance sheet accounts are a special section of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Off-balance sheet accounts were separated into a separate group of accounts due to their specifics: objects on them are reflected by a simple entry, that is, only by debit or credit of the account. In off-balance sheet property accounts, the accountant takes into account assets that are temporarily held by the organization and do not belong to it.

Some company obligations and documents accounted for in a special manner are also written off to off-balance sheet accounts - read the details in the article “Rules for maintaining accounting on off-balance sheet accounts.”

Why is off-balance account 02 needed?

The list of property subject to accounting on off-balance sheet account 02 is given in paragraph 335 of Instruction No. 157n. This:

- material assets of the institution that do not meet the criteria of assets;

- material assets accepted by the institution for storage and processing;

- material assets received (accepted for accounting) by an institution until they become the property of the state and (or) transfer of the specified property to the owner (property received as a gift, ownerless property, etc.);

- material assets seized to compensate for damage caused, with the exception of material assets that, according to the legislation of the Russian Federation, are material evidence and are accounted for separately;

- material assets seized (detained) by customs authorities and not placed in a temporary storage warehouse of the customs authority;

- property in respect of which a decision has been made to write off (cessation of operation), including due to physical or moral wear and tear and the impossibility (inexpediency) of its further use, until its dismantling (disposal, destruction).

As you can see, the latest changes do not exclude any types of property recorded in off-balance sheet account 02. On the contrary, this list has been supplemented with material assets that do not meet the criteria of assets.

Please note that the list of assets accounted for in off-balance sheet account 02, given in paragraph 335 of Instruction No. 157n, is open. For example, specialists from the financial department propose to attribute to it a spare part replaced as a result of modernization, transferred by the work contractor to the institution before a decision is made on its further functional purpose (use, sale, etc.) (Letter of the Ministry of Finance of Russia dated February 28, 2018 No. 02 -06-10/12969).

More on the topic: Transfer from off-balance sheet accounts 03 and 07: to reflect or not?

Accounting on off-balance sheet account 002

Account 002 is called “Inventory and materials accepted for safekeeping.” An organization transfers inventory assets to it if it:

- Ensures their safety on the basis of a property storage agreement (Chapter 47 of the Civil Code of the Russian Federation). When accepting valuables from a counterparty, an act is drawn up in form MX-1. The return of objects to the owner is documented by act MX-3; in addition, the owner records the absence of claims against the custodian organization in the MX-2 log. The custodian organization may not use the listed unified primary data in its work, but develop its own forms taking into account the requirements for mandatory details (clause 2 of article 9, clause 4 of article 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ ).

- She has received goods and materials, but due to circumstances she cannot capitalize them in the usual manner: the organization refuses to pay for the valuables due to violations by the other party of the terms of the supply agreement, or these are valuables that cannot be spent until the final settlement with the supplier. Or there was a re-grading - the buyer received goods and materials, but not the ones he ordered. The company cannot account for such materials on balance sheet accounts, therefore it is reflected in account 002. The basis for accepting such values into an off-balance sheet account and subsequent write-off is the primary document drawn up by the parties under the supply agreement (TORG-12, UPD or other documents agreed upon by the parties).

- I sold the valuables to the buyer, but he has not yet removed them. In this case, the transfer of inventory items to off-balance sheet account 002 is confirmed by safe receipts between the parties.

- Made valuables from customer-supplied raw materials - in this case, the customer-supplied raw materials received from the customer are first accounted for on off-balance sheet account 003, and the products made from these raw materials are transferred to account 002 until the final settlement with the customer on the basis of an invoice for internal movement between departments.

ConsultantPlus experts explained when and how to take into account materials on off-balance sheet accounts. If you do not have access to the K+ system, get a trial online access for free.

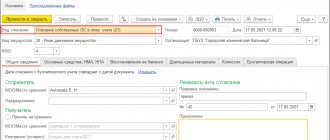

Accounting transactions for transferring inventory items to account 002 and writing them off from it are drawn up as follows:

| Debit | Credit | Contents of operation |

| 002 | Acceptance of inventory items for storage | |

| 002 | Disposal of inventory items accepted for storage |

Department of Finance of the Yamal-Nenets Autonomous Okrug

Question:

In accordance with the decision of the commission on receipt and disposal of assets, fixed assets that do not meet the asset criterion were transferred to off-balance sheet account 02 “Tangible assets in storage.” Subsequently, the accounting entity made a decision to transfer material assets to another institution of the same budget level (for the latter, this property has useful potential and meets the criterion of an asset).

How to reflect the transfer of the specified property in the accounting records of the transferring and receiving parties? At what cost should the property be transferred (accepted), if the transferring party had it accounted for on an off-balance sheet account in the conditional valuation of one object, one ruble (with a zero residual value)?

Are indicators for the transfer (acceptance) of property subject to reflection in the Certificate of Consolidated Settlements (f. 0503125)?

Answer:

In accordance with paragraph 8 of the order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 257n “On approval of the federal accounting standard for public sector organizations “Fixed Assets” (hereinafter referred to as the GHS “Fixed Assets”), fixed assets that do not bring value to the accounting entity economic benefits that do not have useful potential and in respect of which the receipt of economic benefits are not envisaged in the future are taken into account in the off-balance sheet accounts of the Working Chart of Accounts of the accounting entity, approved by the accounting entity within the framework of its accounting policies (hereinafter referred to as off-balance sheet accounts).

At the same time, according to paragraph 45 of the GHS “Fixed Assets”, recognition of an object of fixed assets in accounting as an asset ceases in the event of disposal of the property:

a) on the grounds providing for a decision to write off state (municipal) property;

b) upon termination, by decision of the accounting entity, of the use of an item of fixed assets for the purposes provided for when recognizing the item of fixed assets, and the termination of the accounting entity’s receipt of economic benefits or useful potential from the further use of the item of fixed assets by the accounting entity;

c) upon transfer in accordance with a lease agreement (property lease) or an agreement for gratuitous use, if the recipient of such property has an accounting item as part of fixed assets;

d) upon transfer to another public sector organization;

e) upon transfer as a result of sale (donation);

f) on other grounds providing, in accordance with the legislation of the Russian Federation, for the termination of the right to operational management of property (the right to own and (or) use property received under a lease agreement (property lease) or an agreement for gratuitous use).

In the event that the institution’s commission for the receipt and disposal of assets determines that a fixed asset does not meet the criteria for recognition of an asset (it is not possible to use the fixed asset for the purposes envisaged upon its recognition, and the institution has ceased to receive economic benefits or useful potential from the further use of the object institution (operation of the facility), such property is subject to reflection by the institution on off-balance sheet account 02 “Material assets in storage.”

The rules for making a decision on the write-off of property established by the owner may provide for the institution’s obligation to coordinate with the authorized state body the decisions of the institution’s commission on the receipt and disposal of assets (similar to the provisions of Decree of the Government of the Russian Federation dated October 14, 2010 No. 834 “On the specifics of writing off federal property” ).

In the case when, when considering the decision of the institution’s commission on the receipt and disposal of assets on the write-off of property in relation to an object that is not an asset for the institution, the owner (the state body authorized by him) made a decision determining the further functional purpose of such an object as an asset (a decision was made on the transfer object for the purpose of operation by another institution), such an object is subject to restoration on the balance sheet.

Taking into account the information specified in the request about the determination by the owner of the target function of an object of fixed assets, providing for its transfer to another institution of the same budget level for the purpose of further operation as part of fixed assets, the specified object is recognized by the decision of the owner as an asset and is subject to restoration on the balance sheet as part of fixed assets .

In accordance with paragraph 24 of the GHS “Fixed Assets”, fixed assets received by the accounting entity from the owner (founder), another public sector organization are subject to recognition in accounting at the valuation determined by the transferring party (owner (founder) - at the cost reflected in the transfer documents

According to paragraph 25 of the GHS “Fixed Assets,” after an asset is recognized in the accounting records as an item of fixed assets, it is accounted for at its book value, and the amounts of accumulated depreciation and accumulated losses from impairment of fixed assets are reflected in accounting separately.

In accordance with the provisions of the Instructions for the application of a unified chart of accounts for state authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved by order of the Ministry of Finance of the Russian Federation dated December 1 2010 No. 157n, analytical accounting of fixed assets is carried out on inventory cards for accounting for non-financial assets (form 0504031), opened and filled out for the corresponding fixed assets on the basis of primary accounting documents.

According to the order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state (municipal) institutions , and Methodological guidelines for their application”, the Inventory Card for Accounting for Non-financial Assets (f. 0504031) reflects information on the book value and information on accrued depreciation of fixed assets.

At the same time, the Inventory card for accounting for non-financial assets (f. 0504031) is closed when an item of fixed assets is disposed of from the balance sheet.

As of the date of disposal of an item of fixed assets, the Inventory Card for Non-Financial Assets (form 0504031) reflects the book value and information on accrued depreciation.

Primary accounting documents, accounting registers, accounting (financial) statements, audit reports on them are subject to storage by an economic entity for periods established in accordance with the rules for organizing state archival affairs, but not less than five years after the reporting year (Article 29 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”).

Taking into account the provisions of paragraphs 24 and 25 of the GHS “Fixed assets”, the restoration in the accounting of a property should be reflected at the book value and the amount of accrued depreciation of such an object on the date of its disposal from the balance sheet, indicated in the Inventory card for accounting for non-financial assets (f. 0504031) of this object.

Additionally, please note that additional depreciation is not charged for the period the object is on an off-balance sheet account.

Results

On off-balance sheet account 002, buyers and suppliers reflect inventory items that do not belong to them and are with them temporarily. Receipts of inventory items on account 002 are reflected as a debit, and write-offs are reflected as a credit to this account.

For more information about off-balance sheet accounting of inventory items, read the material “How to put materials into an off-balance sheet account - postings.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.