An auditor is coming to see you

According to the rules, the results of tax audits are documented in acts that record all violations found by tax officials. If you cheated, cheated, or simply made a mistake in the calculations, you will be asked to pay the additional amount of taxes, as well as penalties and fines.

But it happens that the taxpayer does not agree with the requirements of the tax office , and then the procedure for pre-trial (administrative) appeal of the tax audit report begins. The procedure is standard regardless of which tax audit report you were given: desk or field.

The desk tax audit report must be prepared within 10 days from the date of its completion. An act is drawn up only if violations of the legislation on taxes and fees are detected.

The on-site tax audit report is prepared within two months from the date of drawing up the certificate of its conduct.

If you have a question about bankruptcy, subsidiarity or protection of personal assets, subscribe to the newsletter on our website. Once a month we review one request, provide detailed advice and send action instructions by e-mail. Only for subscribers.

We submit an application to appeal the decision of the tax service to the court of first instance

In order to invalidate the decision of the tax authorities, you first need to contact the arbitration court at the location of the tax authority with an application (clause 4 of Article 138 of the Tax Code of the Russian Federation, subclause 2 of clause 1 of Article 29, Articles 34, 35 of the Arbitration Procedure Code of the Russian Federation).

Applications of taxpayers - individuals who do not have the status of an individual entrepreneur are considered in courts of general jurisdiction (clause 4 of article 138 of the Tax Code of the Russian Federation, article 24 of the Code of Civil Procedure of the Russian Federation, clause 2 of part 2 of article 1, article 19, part 1 Article 22, Parts 1, 5, Article 218, Part 3, Article 24 CAS RF).

According to paragraph 2 of Art. 138 of the Tax Code of the Russian Federation, before going to court, the taxpayer is obliged to go through the procedure of pre-trial dispute resolution.

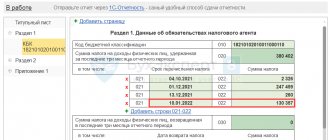

ConsultantPlus experts explained step by step how to properly fill out the documents and where to submit them. If you do not have access to the system, get a trial online access and upgrade to the ready-made solution for free.

Consideration of applications takes place in accordance with the rules of claim proceedings and the features established by Chapter. 24 Arbitration Procedure Code of the Russian Federation.

The judge alone considers the case for no more than 3 months, including the period for preparing for the trial and making a decision. This period may be extended if the case turns out to be quite complex or a large number of participants will be involved in the process (Clause 1 of Article 200 of the Arbitration Procedure Code of the Russian Federation).

If the decision of the arbitration court does not suit the taxpayer, then he can appeal it to higher courts.

It will no longer be possible to appeal to the arbitration court again based on the same decision of the tax authority, even if new arguments are later presented to substantiate the applicant’s position. When re-applying in the same case, the arbitration court must terminate the proceedings with reference to clause 2 of part 1 of Art. 150 Arbitration Procedure Code of the Russian Federation. The taxpayer will be denied the renewal of the same case (Part 3 of Article 151 of the Arbitration Procedure Code of the Russian Federation).

Example

The arbitration court received an application from the taxpayer to recognize the decision based on the results of the tax audit as illegal due to violations by the tax inspectorate committed during the audit. No other arguments were stated. The court did not satisfy the applicant's request.

Later, the taxpayer again applied to arbitration with an application to invalidate the same decision, in which he indicated that additional income tax assessments were made unlawfully. Although the application presented new arguments, the court is obliged to terminate the proceedings in this case.

See also “The procedure for appealing a tax authority’s decision in court.”

How long will it take to consider the complaint?

The time frame during which complaints are considered differs for complaints about decisions on desk and field inspections and for complaints about other decisions, as well as actions (inaction) of the inspectorate.

Complaints about decisions based on the results of on-site and desk inspections are considered by a higher authority within a month from the date of receipt.

This period may be extended for another month if the higher authority needs to obtain additional documents.

Complaints about other decisions and actions (inaction) of the inspectorate are considered within 15 working days from the date of receipt.

The decision on the complaint will be sent within 3 working days from the date of acceptance.

Section VII. APPEALING ACTS OF TAX AUTHORITIES AND ACTIONS OR INACTIONS OF THEIR OFFICIALS

Section VII. APPEALING ACTS OF TAX AUTHORITIES

AND THE ACTS OR INACTIONS OF THEIR OFFICERS

Chapter 19. PROCEDURE FOR APPEALING ACTS OF TAX AUTHORITIES

AND THE ACTS OR INACTIONS OF THEIR OFFICERS

Article 137. Right to appeal

Every person has the right to appeal against acts of tax authorities of a non-normative nature, actions or inactions of their officials, if, in the opinion of this person, such acts, actions or inactions violate his rights.

(as amended by Federal Laws dated 07/09/1999 N 154-FZ, dated 07/27/2006 N 137-FZ)

Regulatory legal acts of tax authorities can be appealed in the manner prescribed by federal legislation.

Article 138. Appeal procedure

1. Acts of tax authorities, actions or inactions of their officials may be appealed to a higher tax authority (higher official) or to court.

Filing a complaint to a higher tax authority (superior official) does not exclude the right to simultaneous or subsequent filing of a similar complaint with the court, unless otherwise provided by Article 101.2 of this Code.

(as amended by Federal Law dated July 27, 2006 N 137-FZ)

2. Judicial appeal of acts (including regulations) of tax authorities, actions or inactions of their officials by organizations and individual entrepreneurs is carried out by filing a statement of claim with the arbitration court in accordance with arbitration procedural legislation.

Judicial appeal of acts (including regulations) of tax authorities, actions or inactions of their officials by individuals who are not individual entrepreneurs is carried out by filing a statement of claim in a court of general jurisdiction in accordance with the legislation on appealing to court unlawful actions of state bodies and officials .

3. In the event of appealing acts of tax authorities, actions of their officials to the court at the request of the taxpayer (payer of fees, tax agent), the execution of the appealed acts, the commission of the appealed actions may be suspended by the court in the manner established by the relevant procedural legislation of the Russian Federation.

In the event of an appeal against acts of tax authorities, actions of their officials to a higher tax authority at the request of the taxpayer (payer of fees, tax agent), the execution of the appealed acts, the commission of the appealed actions may be suspended by decision of the higher tax authority.

(Clause 3 introduced by Federal Law dated July 27, 2006 N 137-FZ)

Article 139. Procedure and deadlines for filing a complaint with a higher tax authority or a higher official

1. A complaint against an act of a tax authority, actions or inaction of its official is submitted, respectively, to a higher tax authority or to a higher official of this body.

2. A complaint to a higher tax authority (superior official) is filed, unless otherwise provided by this Code, within three months from the day the person learned or should have learned about the violation of his rights. Supporting documents may be attached to the complaint.

(as amended by Federal Laws dated 07/09/1999 N 154-FZ, dated 07/27/2006 N 137-FZ)

If the deadline for filing a complaint is missed for a good reason, this deadline, at the request of the person filing the complaint, can be restored by a higher official of the tax authority or a higher tax authority, respectively.

An appeal against a tax authority’s decision to prosecute for committing a tax offense or a decision to refuse to prosecute for committing a tax offense is filed before the decision being appealed comes into force.

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ)

A complaint against a decision of a tax authority that has entered into legal force to hold accountable for committing a tax offense or a decision to refuse to hold accountable for committing a tax offense that has not been appealed is filed within one year from the date of the appealed decision.

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ)

3. The complaint is submitted in writing to the relevant tax authority or official, unless otherwise provided by this paragraph.

(as amended by Federal Law dated July 27, 2006 N 137-FZ)

An appeal against the relevant decision of the tax authority is submitted to the tax authority that made this decision, which is obliged to send it with all materials to a higher tax authority within three days from the date of receipt of the said complaint.

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ)

4. A person who filed a complaint with a higher tax authority or a higher official, before a decision is made on this complaint, may withdraw it on the basis of a written application.

Withdrawal of a complaint deprives the person who filed it of the right to file a second complaint on the same grounds to the same tax authority or to the same official.

Repeated filing of a complaint with a higher tax authority or a higher official is carried out within the time limits provided for in paragraph 2 of this article.

Chapter 20. CONSIDERATION OF A COMPLAINT AND MAKING A DECISION ON IT

Article 140. Consideration of a complaint by a higher tax authority or a higher official

1. The complaint is considered by a higher tax authority (higher official).

(as amended by Federal Laws dated 07/09/1999 N 154-FZ, dated 07/27/2006 N 137-FZ)

2. Based on the results of consideration of a complaint against a tax authority’s act, a higher tax authority (superior official) has the right to:

1) leave the complaint without satisfaction;

2) cancel the tax authority’s act;

(as amended by Federal Law dated July 27, 2006 N 137-FZ)

3) cancel the decision and terminate the proceedings on the tax offense;

4) change the decision or make a new decision.

Based on the results of consideration of a complaint against the actions or inaction of tax authorities, a higher tax authority (superior official) has the right to make a decision on the merits.

Based on the results of consideration of the appeal against the decision, a higher tax authority has the right to:

(paragraph introduced by Federal Law dated July 27, 2006 N 137-FZ)

1) leave the decision of the tax authority unchanged and the complaint without satisfaction;

(Clause 1 introduced by Federal Law dated July 27, 2006 N 137-FZ)

2) cancel or change the decision of the tax authority in whole or in part and make a new decision on the case;

(Clause 2 introduced by Federal Law dated July 27, 2006 N 137-FZ)

3) cancel the decision of the tax authority and terminate the proceedings.

(Clause 3 introduced by Federal Law dated July 27, 2006 N 137-FZ)

3. The decision of the tax authority (official) on the complaint is made within one month from the date of its receipt. The specified period may be extended by the head (deputy head) of the tax authority to obtain documents (information) necessary for consideration of the complaint from lower tax authorities, but not more than for 15 days. The decision made is notified in writing to the person who filed the complaint within three days from the date of its adoption.

(clause 3 as amended by Federal Law dated July 27, 2006 N 137-FZ)

Article 141. Consequences of filing a complaint

1. Filing a complaint to a higher tax authority (superior official) does not suspend the execution of the act or action being appealed, except for the cases provided for by this Code.

2. If the tax authority (official) considering the complaint has sufficient grounds to believe that the act or action being appealed does not comply with the legislation of the Russian Federation, the said tax authority has the right to fully or partially suspend the execution of the act or action being appealed. The decision to suspend the execution of an act (action) is made by the head of the tax authority that adopted such an act, or by a higher tax authority. The decision made is notified in writing to the person who filed the complaint within three days from the date of its adoption.

(as amended by Federal Law dated July 27, 2010 N 229-FZ)

Article 142. Consideration of complaints filed with the court

Complaints (statements of claim) against acts of tax authorities, actions or inactions of their officials, filed in court, are considered and resolved in the manner established by civil procedural, arbitration procedural legislation and other federal laws.

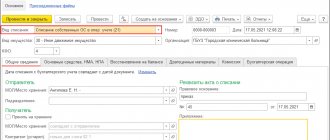

Complaint (appeal)

When filling out a complaint, please provide the following information:

- outgoing number (if available) assigned by the person filing this complaint;

- type: ordinary or appeal.

An appeal is filed against decisions of the tax authority that have not entered into force on bringing or refusing to hold accountable for a tax offense, and a regular complaint is filed against acts of tax authorities of a non-regulatory nature that have entered into force.

The corresponding field reflects the name and code of the higher tax authority in relation to the tax authority, non-normative acts, actions (inaction) of whose officials are being appealed.

A complaint must always be addressed to a higher tax authority, but it must be submitted not directly, but through the inspectorate, whose decision (action or inaction) is being appealed. Having received the complaint, the Federal Tax Service will forward it to a higher tax authority within 3 working days.

The following is information about the person whose rights violation is being appealed:

- name of the organization or full name of the individual entrepreneur (an individual who is not an individual entrepreneur);

- address of the location of the organization or place of residence of an individual.

In the “Subject of appeal” , select the corresponding code of the document being appealed, and then indicate its details: number and date.

In the field “Tax Inspectorate, decisions or actions (inactions) of which are being appealed,” the name and code of the Federal Tax Service Inspectorate, about whose actions the person filing the complaint is complaining, is indicated.

In the field “Grounds on which the applicant believes that his rights have been violated:” the reasons for the complaint are indicated in detail and arguments are given that confirm the illegality of the decision of the Federal Tax Service and other important circumstances.

In the field “Applicant's requirements:” the requirements for the higher tax authority are indicated. For example, to partially or fully recognize the decision of the Federal Tax Service as invalid.

Fields that provide grounds for appeal and requirements are limited to 2000 characters. If the text in the specified fields exceeds this limit, brief information is displayed, and a full description of the circumstances (requirements) is uploaded to the complaint as a separate file in the form of a scanned document.

In the section “Who signs:” it is indicated:

- “Manager” - if the complaint is filed by the taxpayer,

- “Authorized representative” - if the document is presented by a legal or authorized representative of the taxpayer. In this case, the name of the representative and details of the document confirming his authority are indicated.

To send documents confirming the circumstances of the complaint, you must select “Attach” .