Accusing the taxpayer of lack of due care and diligence when choosing a counterparty is one of the most common complaints made by tax authorities. To recognize your transaction expenses as undocumented, the tax authorities only need to suspect your partner of dishonesty. To avoid such problems, it is necessary to ensure the legal purity of the parties to the contract even before signing the documents.

A counterparty is your partner in transactions (from the Latin “contrahens”, i.e. negotiating). This is any organization or individual with whom you have entered into a contractual relationship. In the same way, you yourself will be the counterparty for your contract partner.

What is integrity

Informally, there are two concepts - conscientiousness and prudence. Despite the similarities, they are essentially different. There are no corresponding definitions in the Tax Code; references have to be found in the Civil Code.

For example, paragraph 3 of Article 307 mentions that the parties to the obligations must act taking into account legitimate interests and contribute to the achievement of a common goal (including providing the necessary information). Prudence is discussed in Article 401 (paragraph 1).

By the way! The Supreme Court gives some explanations to the Civil Code in Resolution No. 25 of June 23, 2015, for example, indicating that good faith is assessed by the behavior of each party to the transaction, and can also be considered by the court.

Still, there is no clear and precise definition of these two concepts in the law, so I will formulate them myself, based on their application specifically in relation to transactions and tax audits.

Good faith - organizing activities and concluding transactions solely on the basis of economic feasibility, without implying a cover for other activities or obligations (sham transactions), taking into account the goals established by the organization's charter (for commerce - making a profit as the main one). Moreover, all actions performed by the parties are transparent, documented, and each is ready to provide the necessary information not only to the counterparty, but also to the inspectors.

Prudence – when carrying out activities and selecting business partners (clients, suppliers, investors, contractors, etc.), collecting information and documents about counterparties confirming:

- Reality, period of existence, place of registration of a legal entity.

- The absence of outstanding, overdue obligations in a large amount (loans, salaries, taxes, contributions).

- The powers of the manager, representative, and other persons signing documents on behalf of the organization, the validity of the submitted powers of attorney.

- Absence of legal cases against the company itself, its manager, chief accountant, as well as disqualification of these persons.

- Experience in performing specific work, supplying goods, providing services, if required by business customs or legislation (for example, when purchasing by auction).

- Availability of licenses, certificates, exclusive rights, patents if necessary.

- Taxation system.

- Other information (in particular, recommendations, executed government contracts, registrations, various methods of communication, website, reporting).

Why are these two approaches important for the Federal Tax Service (conscientiousness, in terms of the work of the organization itself, and prudence in terms of choosing contractors)? Based on them, criteria are formed, lists of on-site inspections are compiled, declarations are processed, and requests are made.

Requirements for selecting counterparties

Tax officials do not at all seek to soften the requirements for administrative work when applying Art. 54.1 Tax Code . The larger the transaction and the higher the risks, the more extensive the set of control measures on the part of the taxpayer should be.

The stringency of requirements for selecting business partners can and should vary for different transactions. For a one-time transaction for an insignificant amount, the selection criteria will be completely different than when purchasing expensive property, especially large transaction amounts and unjustified risks, or in the case of engaging a contractor.

Criteria for Federal Tax Service inspections

It is not interesting to check all tax organizations. A complete audit will not benefit the budget - it is unprofitable to spend time and money on trustworthy taxpayers, and there will not be enough hands to deal with violators. Therefore, a system for planning on-site tax audits was developed (Order of the Federal Tax Service of Russia No. MM-3-06 / [email protected] dated May 30, 2007).

What is the department guided by when selecting:

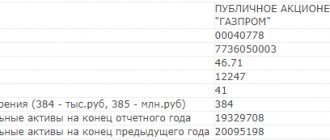

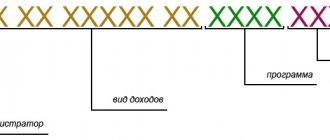

- Calculation of tax burden. You can do it yourself, using table appendix No. 7 to another letter from the Federal Tax Service dated 2022 (applicable to OSNO, simplified tax system, unified agricultural tax). We compare the data with Appendix No. 3 to the first letter for the corresponding year.

- Unprofitable reporting for more than two consecutive years. Even if the reasons are objective, such a trend may lead to a reduction in the value of net assets and liquidation or bankruptcy.

- High percentage of VAT deductions (from 89% in relation to tax).

- The growth of expenses outpaces the growth of income (tax and accounting reporting is considered).

- The salary is lower than the industry average established in the constituent entity of the Russian Federation (according to Rosstat, the Federal Tax Service, including those received upon written request), as well as information received when considering appeals (complaints). For example, an employee’s statement about not concluding a formal employment contract and paying wages “under the table.”

- The proximity of performance indicators in special modes to the maximum. Depending on the taxation system - revenue, number of employees, trading area, number of vehicles, share of participation of other companies. For Unified Agricultural Tax, the percentage of income from the sale of agricultural products. If less than 5% remains to the limit, then there is a high probability of increased attention from the Federal Tax Service.

- Multi-step and intermediary transactions that have no reasonable explanation. These are so-called dubious transactions, I wrote about them in the article about account blocking.

- Failure to respond to requests from the Federal Tax Service during a desk or counter tax audit, refusal or ignoring the requirement to submit supporting documents, eliminate contradictions and errors in reports.

- Re-registration of the company and change of its legal address. A change of location in itself does not cause interest, but repeated moves, entailing a change of the Federal Tax Service inspection, even within the boundaries of one city (typical of Moscow or St. Petersburg), are a reason to doubt the good intentions of the organization.

- Profitability level. This is an indicator that reflects the efficiency (if it is completely exaggerated - payback) of the use of assets and the sale of goods (works, services). The formula used for calculation is: financial result/cost (asset value)*100. Again you will have to compare the result with the table, this time look at Appendix No. 4 to the Order. A deviation of 10 percent or more requires verification.

- The last criterion is related to prudence. If an organization regularly takes risks by working with unreliable partners, or is simply in no hurry to conduct preliminary checks before transactions, then such activities are considered to require control by the tax service.

Important! For individual entrepreneurs on OSNO, increased expenses of 83% in relation to income are also considered a risk factor.

The loss of documents as a result of an emergency (for example, a fire) and their subsequent restoration, although an objective circumstance, is included in the list of criteria.

By the way! You can see if yours was included in 2020 on the website of the Prosecutor General's Office. For emergency services, inspections are suspended until December 31, 2022 due to the pandemic.

This is not a closed list, the Federal Tax Service has the right to be guided by established judicial practice, identified new schemes for tax evasion and concealment of income, considers other factors, for example, the presence of controlled transactions, foreign trade activities with countries that do not exchange information with Russian services, cooperation of the taxpayer with companies previously caught in illegal fraud, etc.

How to prove good faith

From the criteria, in principle, it is clear what needs to be done in order not to come under scrutiny: more income and taxes, high salaries, say “no” to dubious transactions. In practice, the most common operation can turn into unsafe. In part, in previous articles we have already examined complex situations:

- Controlled transactions - practice under 115-FZ

- Explanations for low average wages – application of the minimum wage

I would like to note that careful selection of suppliers when working with VAT is relevant not only for large organizations, because a small company using the simplified tax system is sometimes required to pay tax (when importing).

As for other ways to ensure confirmation of your own integrity, you will need:

- When creating a company, check the participants and the manager for the presence of disqualification, unfinished court cases, large debts, in order to avoid refusal of registration and unnecessary attention at the initial stage.

- Somehow it is not customary (and the law does not require) when registering to be interested in the origin of the property contributed as a contribution to the authorized capital, but it should be. Spouses, for example, have joint property (including money); if the other spouse did not know about its use to create a company, he has the right to go to court, demand its return, and include it in the share, which, of course, will not benefit the organization. The easiest way is to obtain a notarized consent.

- Conduct the most open dialogue in transactions, guided, however, by the principle of reasonableness, while maintaining commercial secrets.

- Avoid too favorable terms in contracts, unless this is one of the customs of business or does not provide the company with additional benefits. For example, a long-term, unreasonable deferment of payment for a large contract for a new client will be suspicious from a tax point of view, but installment plans with monthly payments and interest are normal.

- Don’t leave accounts receivable to chance. This means: writing letters of claim if sanctions are provided (fines, penalties), calculating them and demanding payment, going to court, joining the ranks of creditors in bankruptcy.

- Pay attention to the execution of transactions and promptly (without delay!) resolve issues with errors, inaccuracies and incomplete completion in documents confirming expenses and invoices.

Note! In the provision on personal data, provide for cases of transfer of information to third parties. An example is passes to the closed territory of the supplier. Because they are manufactured by another party, it is necessary to obtain the consent of employees in advance. It is not necessary, but it is advisable to request written guarantees from the counterparty that the data will be used exclusively for the specified purposes.

Example: the supplier indicated the old legal address on the invoice, the manager immediately noticed the error, but did not send it for correction, the document was submitted for verification. The tax income will not be deducted for the supplier, the maximum that awaits him is a reprimand, but for the buyer, a refusal to deduct VAT is a real possibility.

The more careful you are in dealing with transaction security, the more reliably you are protected from tax claims. Now let’s look at what to demand from the counterparty and what signs should ring a bell.

On the calculation of arrears during crushing

It is necessary to determine the actual tax obligations of the taxpayer on the basis of circumstances that are subject to establishment by the tax authority, taking into account the information and documents available to it and with the assistance of the taxpayer in establishing them, taking into account both imputed income and corresponding expenses, tax deductions for value added tax, taxes paid under special tax regimes.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Trust, but verify: counterparty dossier

Above, when describing the concept of diligence, I indicated the basic information about counterparties necessary for work. What should be on your guard when searching for information (inspectors will probably ask related questions):

- The organization has existed for a long time, but there is almost no data on the Internet - reviews, mentions, and the website was created this year. Fraudulent companies are not phantoms, they are actually registered companies, but have never conducted business before, so there is nothing to learn about them.

- Communication takes place exclusively by phone, via instant messenger or email, visiting the warehouse, communicating in person with the manager, etc. attempts are stopped, vague explanations are given as to why this cannot be done. Large swindlers may be more advanced, but direct contact is still undesirable for them.

- The counterparty cannot send copies or scans of the main registration documents: certificate of inclusion in the Unified State Register of Legal Entities, TIN, order for director, charter, etc. A manager or supervisor usually has such a package ready, because... often required.

- The supplier offers delivery conditions that differ sharply from generally accepted ones. For example, you want to purchase a trial batch of goods for a small amount, but they offer a large one at a reduced price (possibly below the market average), motivating you to pay more.

- The contractor or performer does not provide evidence of the availability of the necessary resources (employees, materials, equipment), although the contract provides for such a mandatory condition.

- The counterparty requests unnecessary information and documents: SNILS of the manager, SZV-M reports and others containing personal data, including information on earnings, telephone numbers, email (not corporate), copies of employee passports.

- Discrepancy between the declared and real scales of the business. “We have been selling online all over Russia for 5 years now, working with leading delivery companies” - delivery people have never heard of such an organization, and there are only a few products on the website, no reviews.

When compiling dossiers of counterparties, try to maintain a white list. Black is usually useless - fly-by-nighters and other adventurers change companies and managers like gloves. Now let’s imagine that you are unlucky with the Federal Tax Service or you have met a scammer – what should you do?

What to look for when checking a counterparty

There are a lot of red flags when checking a counterparty; it all depends on the type of activity and the selection criteria. The main risk factors may be:

- mass address;

- combination of different types of OKVED;

- short period of work of the counterparty;

- the coincidence of the founder and the manager in one person;

- “vicious” connections with previously liquidated companies;

- being on the “black” list of the Bank of Russia;

- lack of staff and resources to perform the proposed contract;

- low tax burden;

- negative financial indicators;

- increasing inspections of government agencies and identifying violations;

- invalid passport of the founder or manager;

- being in the liquidation stage;

- many unfulfilled enforcement proceedings;

- facts of blocking of accounts by the Federal Tax Service.

This is not a complete list of risk factors that may affect the assessment of the possibility of working with a counterparty. Each indicator has its own weight, and many of them individually are not an obstacle to cooperation, but if there are several factors, then it’s worth thinking about. For example, if you are only interested in the issue of reducing tax risks, then factors such as being on the “black” list of the Bank of Russia, negative financial indicators or increasing inspections by government agencies may not have any significance at all in assessing the counterparty. A properly conducted verification of the counterparty allows you to properly structure your work, set yourself up for possible communication with the bank regarding transactions carried out under the concluded agreement, and also prevent potential losses.

And setting up a business process for verifying a counterparty allows you to prepare for changes to the “anti-money laundering” law 115-FZ, which establishes a number of responsibilities for all legal entities without exception. Failure to comply with procedures aimed at establishing the integrity of counterparties leads to fines of 1 million rubles.

Subscribe to our channel in Yandex Zen.