Let me remind you that clause 27 of the Regulations on Accounting and Financial Reporting (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n) establishes that the preparation of annual financial statements must necessarily be preceded by an inventory of all assets and liabilities. At the same time, the rules for conducting such an audit are regulated by the Methodological Instructions for Inventory of Property and Financial Liabilities. Thus, according to paragraph 1.2 of the Methodological Instructions, accounts receivable refer to the organization’s property, and accounts payable and reserves refer to financial liabilities. The inventory itself is carried out by checking the amounts listed in the relevant accounting accounts at the end of the year, and also identifying receivables and payables with an expired statute of limitations.

To carry out the inventory, a permanent commission is created (clause 2.2 of the Guidelines). Upon completion, the results of the inspection are documented. Primary documents to reflect the results of the audit are developed by the company independently - as a rule, the document forms given in Appendices 1–18 of the Instructions, as well as those contained in albums of unified forms, are taken as a basis.

Please note that the results of the annual inventory must be reflected in the financial statements, which means that identified inconsistencies must be taken into account in a timely manner in the accounting accounts.

Inventory before drawing up final documents

Says Pavel Timokhin, head of the accounting consulting department: “Accountants have a lot of work to do before drawing up the annual report. One of the tasks is to conduct an inventory before drawing up final documents. Many accountants approach the inventory formally, filling out statements in which they enter the data of the balances listed in the accounting records, without checking this information with the actual presence of property and liabilities. But the purpose of conducting an inventory is to establish whether the accounting data corresponds to the actual presence of property and liabilities.”

An audit of settlements with suppliers, buyers, various debtors and creditors involves checking the validity of the amounts of receivables and payables listed on the balance sheet. Reconciliation of calculations helps to reliably assess the correctness of the amounts reflected. When taking inventory of settlements with buyers and customers, with suppliers and contractors, as well as with other debtors and creditors, companies carry out reconciliations of mutual settlements as of December 31 of the reporting year, audits are documented in the relevant acts.

The reconciliation report is drawn up separately for each debtor and creditor in two copies. This document allows you not only to identify errors in accounting, but also to avoid disagreements with counterparties. If the debtor of the organization signs the document, then he agrees with the state of the settlements and expresses his willingness to pay the debt. The act serves as the basis for writing off bad debts after the expiration of their statute of limitations. Paper is also necessary when an organization goes to court to collect a debt from a counterparty for goods supplied or services provided. Firms develop the form of the mutual settlement reconciliation act independently. The legislation does not provide for a unified format for this document (Letter of the Ministry of Finance of Russia dated February 18, 2005 No. 07-05-04/2).

note

The reconciliation report is drawn up separately for each debtor and creditor in two copies. This document allows you not only to identify errors in accounting, but also to avoid disagreements with counterparties. If the debtor of the organization signs the document, then he agrees with the state of the settlements and expresses his willingness to pay the debt.

When drawing up a reconciliation act, I recommend using the following provisions for filling it out: firstly, at the beginning of the document in the center you should write the title: “Reconciliation Act”, under it list the names of the parties. In addition, it is necessary to mention the contract or agreements between organizations for which the reconciliation report was drawn up. Claims can only be considered under existing contracts. Secondly, in the tabular part, each of the counterparties should have its own field for filling in data on general positions. Provide links to primary documents (invoices, acts of acceptance and transfer of results of work performed / services rendered, payment orders, cash orders, etc.).

At the end of the table, the data from each party is summarized to determine the presence or absence of debt.

And thirdly, at the end of the document the total amount of debt (final balance in monetary terms) is indicated based on the results of mutual settlements between organizations according to the data of each of the counterparties. A place is determined for the signature of the parties and the full names of authorized persons who signed the act. He can be endorsed as authorized persons by the sole executive body of the organization (general director, director, president, etc.) or by a representative acting on the basis of a power of attorney.

Read also “Inventory of assets and liabilities”

For the reconciliation act to become legal, it must be signed by both parties. The main part of the document, which contains information about business transactions carried out, is a table, which consists of two parts. The left side, as a rule, reflects the facts of the economic activities of the document compiler. It includes four columns. The first of them indicates the serial number of the entry, the second - a brief summary of the operation, the third and fourth - its monetary value by debit or credit.

The right side of the table remains blank; The data is recorded there by the counterparty when he performs reconciliation. Thus, records are entered into the act in chronological order about all operations carried out by the organization with the participation of a specific counterparty for a certain period. After that, debit and credit turnovers are calculated and the ending balance is determined for the required date. If there are no problems or errors, then the amounts received after filling out the first and second tabs will look mirrored. One copy of the act remains in the organization’s accounting department, the second is sent to the company with which the reconciliation is carried out. The counterparty who received this act must check all the data contained in it and enter his own. He must also record any discrepancies identified in the document. After reflecting all the necessary information, the counterparty returns the act to the organization.

Inventory of settlements with buyers and customers

Before drawing up annual financial statements, it is necessary to carry out an inventory of calculations. Carrying out an inventory is one of the components that guarantees the reliability of accounting and reporting. Therefore, if the untimely inventory led to distortion of reporting data, liability is provided.

It is worth understanding that violation of deadlines for conducting an inventory is not a reason why an organization can be held accountable. However, this may lead to violations of the rules for accounting for expenses and income, and reporting requirements. Thus, the tax inspectorate can fine a company up to 30 thousand rubles, or 20% of the amount of tax that was not paid, but not less than 40 thousand rubles. For violation of accounting requirements, the head of the organization (or other officials) may be fined by the court in the amount of 5 to 10 thousand rubles. If the inventory was not carried out on time due to the fault of the employee who is responsible for its implementation, disciplinary action may be applied to him.

Please note that the need to conduct an inventory does not depend on the tax system that the organization uses. Inventory must be carried out by all enterprises that maintain accounting. So, this obligation also applies to organizations that work on the simplified tax system, and to companies that apply the special UTII regime, since these companies are not exempt from accounting.

During the inventory of settlements with suppliers and contractors, the following information is checked:

- Settlements with regulatory agencies (tax office, Pension Fund, Social Insurance Fund);

- Settlements with suppliers, contractors, buyers, customers;

- Claim settlements;

- Settlements with company employees regarding wages;

- Other calculations of the organization.

Before starting an inventory of payments to suppliers and contractors, it is worth preparing the following documents:

- A document on conducting an inventory - this can be an order, instruction, resolution;

- Primary accounting documents, contracts concluded with counterparties, etc.

An inventory order can be developed and approved by the company independently. As a sample for filling out an order, an organization can take the unified form No. INV-22. The main condition that must be met is the presence of all the mandatory details listed in Federal Law No. 402-FZ of December 6, 2011. The order must be signed by the head, registered in the accounting journal (for example, according to the INV-23 form) and transferred to the chairman of the commission.

Error correction

If inconsistencies resulting from erroneous actions of an accountant are identified, adjustment entries must be made in accounting in the manner prescribed by paragraph 5 of PBU 22/2010 “Correcting errors in accounting and reporting,” approved by Order of the Ministry of Finance dated June 28, 2010 No. 63n.

So, for example, an error in the reporting year identified before the end of the year is corrected by entries in the corresponding accounting accounts in the month of the reporting year in which the inaccuracy was identified. Inventory differences discovered during the inventory can be reflected as follows:

Debit 41 Credit 60

— an error identified as a result of the inventory of settlements with suppliers, which resulted in incomplete reflection in the accounting of the cost of purchased goods, has been corrected;

Debit 60 (62, 76) Credit 91-1

— accounts payable to the supplier (buyer) for which the statute of limitations has expired has been written off;

Debit 91-2 Credit 60 (62, 76)

— accounts receivable to the supplier (buyer) for which the statute of limitations has expired has been written off;

Debit 007

— the amount of written off receivables is included in the balance sheet.

Purpose of the INV-17 form

Before preparing financial statements, organizations need to take an inventory of their assets and liabilities.

This facilitates not only the correct completion of the balance sheet, but also the timely identification of inconsistencies between accounting data and information available to counterparties. Test yourself: how to take an inventory. Completion time: about 5 minutes. Take the test

To learn about what accounting data needs to be inventoried before starting to compile annual reporting, read the material “How to conduct an inventory before annual reporting.”

The need for an inventory also arises in the following cases:

- when changing materially responsible persons;

- theft at an enterprise and other unusual situations;

- liquidation of the organization.

The unified form INV-17 is used to document the results of the inventory of receivables and payables. It was put into effect by Decree of the State Statistics Committee of Russia “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88. But it is not mandatory for use since 2013. It is possible to use a self-developed form of similar content instead. However, the INV-17 form contains fields for filling in all the information that must be reflected in such a form, and therefore continues to be actively used.

Find out how to properly conduct an inventory of settlements with debtors and creditors in the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Inventory of reserves

The organization is obliged to create reserves for doubtful debts for all “receivables”, including the debt of suppliers and contractors for advances issued to them, the debt of employees and third parties for loans provided to them. A reserve is created if a debt is recognized as doubtful. The criteria upon the occurrence of which a debt is considered doubtful are established by the enterprise independently (reflected in the accounting policies). The accountant who maintains settlement accounts must clearly know these criteria and create reserves in a timely manner.

Read also “Formation of a reserve for doubtful debts in 2017”

If the receivables meet the concept of “doubtful”, the accounting specialist must assess the probability of repayment of the debt and, in accordance with the assessment, determine the amount of the reserve - the higher it is, the smaller the amount of the reserve for doubtful debt, and vice versa - the lower the probability that the debtor will repay the debt, the larger the reserve. Thus, during the inventory of reserves for doubtful debts, the commission analyzes each amount reflected in account 63 for compliance with the approved criteria and for its proportionality. I note that the amount of the reserve for doubtful debts at the end of the reporting year (based on inventory results) is taken into account in the manner accepted in the organization.

In the first method, accounting is carried out with the addition of unspent amounts of the reserve (created a year earlier) to the financial results and the simultaneous creation of a new reserve (this method of accounting is expressly provided for in clause 70 of the Regulations on accounting and financial reporting in the Russian Federation).

The second option is associated with revising the amount of the reserve, that is, with checking the validity of the amounts that are listed on account 63, and, if necessary, with making appropriate adjustments (this method is dictated by the norms of PBU 21/2008 “Changes in estimated values”, approved by Order of the Ministry of Finance of Russia dated 6 October 2008 No. 106n).

EXAMPLE.

WE REFLECT THE PROBABILITY OF DEBT REPAYMENT At the end of the year, the organization’s records included an unspent amount of the reserve for doubtful debt - 500,000 rubles.

During the inventory, it was found that the likelihood of repaying the debt had decreased, so it was decided to increase the specified reserve to 700,000 rubles. The first way to reflect the inventory results: Debit 63 Credit 91-1

- 500,000 rubles.

– the reserve for doubtful debts was restored; Debit 91-2 Credit 63

- 700,000 rub.

- a new reserve for doubtful debts has been formed. The second way to reflect inventory results: Debit 91-2 Credit 63

- 200,000 rubles. – the amount of the provision for doubtful debts has been revised (re-estimated).

Registration of results

“It should be taken into account that all companies must conduct an inventory, regardless of the tax regime applied, that is, even those belonging to small enterprises. Thus, for a manager, conducting an inventory is an important factor. It should be noted that if you do not carry out an inventory, then no one will punish the company for refusal. But management that knows how to count money and wants to know the real picture of what is happening at the enterprise will fulfill the requirements of the law and conduct an inventory of property and liabilities,” says Pavel Timokhin, head of the accounting consulting department.

The results of the inventory of calculations are presented as follows. First, the results of the verification of each debtor and creditor are entered into a certificate, which is an appendix to the act in form No. INV-17. The certificate indicates the details of each debtor and creditor of the organization, the date and reason for the debt, as well as its amount. Then, on the basis of the certificate, an inventory report of settlements with buyers, suppliers and other debtors and creditors is drawn up in form No. INV-17 in two copies, which is signed by the commission. One copy of the act is transferred to the accounting department, the second remains with the commission.

The act specifies:

- name of the company conducting the inventory;

- the department in which the audit is carried out;

- reference to the order in accordance with which the inventory is carried out;

- serial number and date of document preparation;

- date of verification of the status of receivables and payables;

- names of debtor organizations;

- accounting account number on which accounts receivable are recorded;

- the full amount of debt for each counterparty;

- the amount of debt that the debtor has not confirmed and for which the statute of limitations has expired;

- names of creditor organizations;

- number of the accounting account in which accounts payable is recorded;

- the full amount of accounts payable for each counterparty;

- the amount of debt that the creditor has not confirmed and for which the statute of limitations has expired;

- the total amount for each type of debt.

Having received the inventory results, the company's management approves them and makes decisions on creating reserves for doubtful debts, writing off bad debts or debts with an expired statute of limitations.

It should be noted that conducting inventories of various accounting areas is not only a necessity, but also the responsibility of entrepreneurs. And if the legislation approves annual audits, then it would be correct to organize such events more often: once a quarter or even a month. This will not only allow you to put things in order in the company’s accounting system, but also to efficiently and quickly inventory the company’s accounting records within the time limits established by law. If the company’s management is not ready to spend its resources on unscheduled audits, then you need to be prepared that if you take inventory once a year, the company will incur significant losses. And a lot of time will be spent on such checks. And you should not hope that the results of the audits will show complete order in the accounting. In the activities of any organization, a competent accounting and taxation specialist, and after him an inspector, will find errors and inaccuracies. That is why taking inventory is one of the most important stages of doing business not only in Russia, but also in the West. And by checking each area of accounting, an entrepreneur can see his weaknesses and take the necessary measures in a timely manner that will allow him to restore order in the “right places.”

Inventory act of settlements with buyers and suppliers

The inventory results are documented in a form that is approved for these purposes in the company’s accounting policy. An organization can develop a document independently, not forgetting to include all the required details, or use the unified form INV-17, approved. Resolution of the State Statistics Committee of Russia No. 88 of August 18, 1998, which is called the act of inventory of settlements with buyers, suppliers and other debtors and creditors. This form can also be used as a template for developing your own form: you can add necessary or, conversely, remove unnecessary details. This act is drawn up in two copies - one each for the accounting department and the commission.

The main part of the document contains data on receivables and payables, presented in the form of tables. For each accounting account, the total amount of the balance sheet and debts are indicated: those that are confirmed and not confirmed by debtors (creditors), as well as debts for which the statute of limitations has already expired. First, data on accounts receivable is indicated, and then – on accounts payable.

It is mandatory to fill out a certificate-attachment to the act in form INV-17, which is the basis for drawing up the act. It consists of a table and contains information about creditors and debtors: location and contact information, amount of debt, date, reason for the debt, etc. After completing the certificate, you should begin filling out the act itself.

A sample act of inventory of settlements with buyers and suppliers is presented below.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Objects to check

According to paragraph 3.44 of the Methodological Instructions, the inventory of calculations consists of checking the validity of the amounts listed in the accounting accounts. So, the following accounts must be subject to inventory:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 63 “Provisions for doubtful debts”;

- 66 “Settlements for short-term loans and borrowings”;

- 67 “Settlements for long-term loans and borrowings”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors”;

- 79 “Intra-economic calculations”.

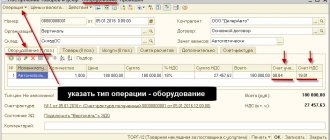

Settlements with suppliers, postings

Analytical accounting must be organized for each supplier (contractor, performer) if the calculations are planned (contractual). If the relationship is one-time, analytics is organized for each invoice.

In addition, two sub-accounts are definitely opened for the account:

- 60-r - settlements, the loan of which reflects the debt to suppliers (contractors) for purchased goods, works and services in an amount that includes VAT. The debit of this account reflects the repayment of debt by payment or other means;

- 60-va - payment to the supplier (posting) in advance, the debit of which reflects the amounts transferred to prepayment suppliers.

Accounting for settlements with suppliers and contractors, postings:

| Dt 60-va Kt 51, 52 | Prepayment for delivery has been transferred |

| D 08, 10, 41, 20, 26, 44 Kt 60-r | Goods, works, services, materials, etc. received from the supplier are reflected. |

| Dt 60-r Kt 60-va | The prepayment amount is offset against payment for goods supplied, work performed, services rendered |

| D 19 Kt 60-r | VAT included in the cost of delivery |

| D 60-r Kt 51, 52 | The debt to the supplier has been repaid |