Explanations and notes are not the same thing

The explanatory note does not replace the explanation of the balance sheet. PBU 4/99 “Accounting statements of an organization” states that:

Explanations are a decoding of balance sheet items, as well as clarification of individual reporting forms:

- statement of changes in capital;

- cash flow statement;

- other reporting forms and applications as part of the financial statements.

The answer to the question of what an explanatory note is is an arbitrary decoding of the entire financial situation in a business entity. It contains both general information and detailed explanations of the lines of the balance sheet and income statement.

Article 14 of the Federal Law dated December 6, 2011 No. 402 and clause 4 of the Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n states that this document is included in the annual financial statements. And clause 28 of PBU 4/99 provides that business entities are required to draw up explanations for the balance sheet and Form No. 2 in the form of separate reporting forms and a general note. It follows from this that all organizations must submit an explanatory note with a balance sheet.

An exception to the general rule are representatives of small businesses, who have the right to prepare and submit accounting reports in a simplified form. They must submit to the Federal Tax Service only two mandatory forms: a balance sheet and a statement of financial results. They do not have to decipher the meanings and describe their financial situation in an explanatory note. But if such a desire arises, it is not forbidden to write a separate note.

Use free instructions from ConsultantPlus experts to submit your annual reports for 2022 on time. In the guide you will find deadlines, forms and instructions for filling out.

Form 5 of financial statements: general information

Form 5 involves filling out the tabular elements of the balance sheet appendix for groups of assets that are classified according to the criterion of financial affiliation. The connection between the contents of the balance sheet and Form 5 is direct - the balance sheet acts as the main document, and the appendix to it performs the function of detailed transcripts of generalized indicators.

The peculiarity of filling out the tables in the appendix to the balance sheet by structures using a simplified accounting system is that they reflect the most significant indicators in Form 5. The main factor of significance for such a group of organizations is the possibility or impossibility of assessing the general financial condition. However, they do not have to fill out this form.

The amount of detailed information on the balance sheet in the tabular blocks of the application should correlate with the amount of information contained in the lines of the completed balance sheet. When creating a balance, links to explanatory documents for a specific position are provided. Form 5 does not provide an exhaustive list of indicators. Therefore, for example, when reflecting cash values in the balance sheet, a link to the cash flow statement is created in the explanation column, since Form 5 does not detail this position.

Who needs an explanatory note to the annual report for 2022 and why?

An explanatory note to the balance sheet is necessary for all users of financial statements to obtain more complete additional information about the financial and economic activities of a legal entity. Such information, as a rule, cannot be provided in other reporting forms, but it is important and is of interest both to the founders or creditors of the company, and to regulatory authorities. Data in this document is included based on specific wishes, for example, the board of directors, and on the characteristics of the current economic situation at the enterprise by the end of the year.

Appendixes to the balance sheet and income statement

Experts know that forms No. 3, 4 and 6 of the accounting report are part of the annual financial statements and at the same time appendices to the main forms (financial results and balance sheet):

- a report showing changes in capital or Form 3;

- a report showing cash flow or Form 4;

- a report showing the intended use of funds or form 6.

The forms of the main reporting forms and application forms are officially approved by order of the Ministry of Finance of Russia.

What information is indicated?

There are no legal requirements for the contents of this document. Each accountant independently determines what information the explanatory note should disclose and the completeness of the data in it, and in what form it is more convenient to provide it:

- plain text;

- diagrams;

- tables;

- schemes;

- graphs.

There is a general outline of this document. The most complete note usually contains:

- general data of the organization (address, average annual number of employees, types of economic activities, management personnel, etc.);

- general information about the applied accounting policies;

- analysis of the current financial performance of the organization;

- text and tabular explanations.

In order for inspectors to have fewer questions, the document must include at least brief information about accounting methods. This especially applies to the following areas:

- valuation of goods, inventories and finished products;

- assessment of work in progress;

- depreciation of fixed assets;

- recognition of sales revenue.

How to correctly write an explanatory note for annual reports

If changes have been made to the accounting policy, this must be indicated with justification of the reasons and the need for amendments. There must be an assessment of the result of changes in monetary terms - the amount by which the assessment of financial reporting items has changed due to a change in the accounting method. If the plans for the current year contain actions that affect the facts of economic activity or its continuity, for example, the upcoming liquidation of the organization, then the regulatory authorities must be informed about this.

It is advisable to provide the transcripts of the balance sheet lines and Form 2 in the form of tables, in particular:

- data on changes in the organization’s capital (authorized, reserve, additional, etc.);

- on the composition and movement of reserves for upcoming expenses and payments;

- estimated reserves of a legal entity;

- changes in the structure and volume of intangible assets and fixed assets;

- information about the leased property;

- information on financial investments, receivables and payables;

- composition of production costs and other expenses;

- volumes of sales of products, goods, works, services by type of activity of the organization and sales markets;

- data on securing the organization’s obligations;

- all extraordinary facts of the organization’s economic activity in the reporting period and their consequences.

In addition to dry facts and figures, the explanatory note welcomes an analysis of the organization’s financial indicators. Such information is primarily of interest to founders, shareholders and investors, but this data will also tell tax specialists a lot. In particular, information about the organization’s business activity and its position in the market will be useful when applying for VAT deductions or when opening foreign economic activity.

When drawing up a document with explanations, special attention should be paid to information about affiliated persons. It is advisable to document this data in a separate section, as required by paragraph 14 of PBU 11/2008. By law, it is necessary to disclose information not only about the founders of the organization itself, but also about persons associated with them, therefore, if the founders include a legal entity, its participants or shareholders must be indicated. In addition, they indicate information about transactions carried out with related parties during the reporting period, as well as, regardless of the transactions, for those legal entities and citizens that are recognized as affiliated.

Appendix 5 to the balance sheet: structure and filling procedure

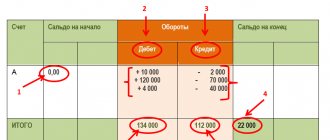

Let's take a closer look at the groups into which financial indicators are divided.

Section on intangible assets

The section “Intangible assets” is clarifying information on the balance sheet, recorded in line 110. Intangible assets are registered at their original cost. The data is reflected according to the principle:

Cost of intangible assets at the beginning of the reporting period + receipt - disposal = cost of intangible assets at the end of the reporting period

In Form 5, amounts reflecting retired intangible assets are written with parentheses. This block also describes the amounts for depreciation of intangible assets at the beginning and end of the reporting year. There are also lines for types of intangible assets:

Section "Fixed assets"

This section details all information relating to the movement of fixed assets and their availability, and deciphers line 120 of the balance sheet. The data presented in analytical accounting for accounts 01 and 02, where fixed assets and their depreciation are registered, are needed to reflect the indicators of this block. Indicators for fixed assets are filled in at cost, called initial or replacement.

The tables also reflect changes in the indicated value of fixed assets that were reconstructed, completed or liquidated. Figures for retired OS are written with parentheses. OS taking into account depreciation is also deciphered in a separate table in this section:

Section on financial investment amounts

This section details the amounts on lines 140 and 250 of Form No. 1. Indicators for investments of short-term and long-term funds are reflected here, their types are described and separated into groups. Also subject to submission are financial investments that have the status of “pledged” and for which there has been a transfer to other persons:

Conventionally, the following groups of financial investments can be distinguished:

- investing in funds that form the authorized capitals of other organizations;

- state and municipal securities;

- securities of other enterprises, which also includes debt securities (bonds, bills);

- loans issued;

- deposits and others.

Section “Securing Obligations”

This section details information regarding the information specified in the Certificate of Availability of Valuables that is presented on off-balance sheet accounts. Separately indicate information on collateral that was issued and received at the beginning and end of the reporting year:

Section "Production costs"

This block clarifies information on costs and expenses associated with the production process, as well as any changes in balances relating to work in progress, deferred costs and deferred inventories.

General information about the enterprise is indicated, but turnover within the enterprise is not taken into account. It may include expenses related to the transfer of goods, products or work and services that relate to the enterprise’s own goals:

Section "State aid"

This section applies to enterprises that received government assistance during the reporting period. These include subventions, subsidies, government loans, as well as other assets of the enterprise - land plots, natural resources, other real estate:

Debt section

This section provides clarification of lines 230 and 240 of the asset and lines 510, 520, 610, 620, 630 and 660 of the liability of the balance sheet, which include the amounts of the enterprise's debt to creditors and debt of debtors. All debt figures that have short-term and long-term status are recorded. They are divided by type at the beginning and end of the reporting year:

Sample explanatory note

Let's consider a sample explanatory note to the balance sheet in 2022 for a conditional company, which has been operating since 2005 and is engaged in the production and sale of dairy products. Its chief accountant compiled this document as follows:

Explanations to the balance sheet of PPT.ru LLC for 2022

1. General information

Limited Liability Company (LLC) "PPT.ru" was registered by the Federal Tax Service No. 1 for St. Petersburg on March 29, 2005. State registration certificate No. 000000000, INN 1111111111111111, checkpoint 22222222222, legal address: St. Petersburg, Wonderful Avenue, 1.

The organization's balance sheet is formed in accordance with the rules and requirements of accounting and reporting in force in the Russian Federation:

- Authorized capital of the organization: 5,000,000 (five million) rubles, fully paid.

- Number of founders: two individuals O. M. Kurochkin and P. P. Petrov and one legal entity "Moloko" LLC.

- Main activity: milk processing OKVED 15.51.

- The number of employees as of 31.123.2020 was 165 people.

- There are no branches, representative offices or separate divisions.

2. Basic accounting policies

The accounting policy of PPT.ru LLC was approved by order of director P.P. Petrov. dated December 25, 2019 No. 289. The straight-line depreciation method is used. Valuation of inventories and finished products is carried out at actual cost. The financial result from the sale of products, works, services, goods is determined by shipment.

3. Information about affiliates

Porfiry Petrovich Petrov is the founder, 50% of the ownership share in the management company, holds the position of general director.

Kurochkin Oleg Mikhailovich - founder, 30% share of ownership in the management company.

LLC "Moloko" is the founder, 20% of the ownership share in the management company, Russian organization (founders V.P. Petrov and Yu.K. Sidorov).

During the reporting period, the following financial transactions were carried out with related parties:

- On March 12, 2021, the general meeting of the founders of PPT.ru LLC reviewed and approved the financial statements of the organization for 2020. The meeting decided to pay a profit in the amount of 3,252,000 rubles to the founders at the end of 2022, based on their share in the authorized capital. The payment (including personal income tax withholding for two individuals) was made on 04/01/2021;

- 05/25/2021 PPT.ru LLC entered into a contract with the founder of Moloko LLC, Yu.K. Sidorov, an agreement for the purchase of non-residential premises worth 5,102,000 rubles. The cost of the transaction is determined by an independent assessment of the value of the property. Payments under the agreement were made in full on 06/06/2021, and the real estate acceptance certificate was signed.

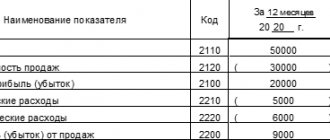

4. Key performance indicators of the organization

In the reporting year, revenue amounted to:

- for the main type of activity “production and sale of dairy products” - 385,420,020 rubles;

- for other types of activities - 650,580 rubles;

- other income - 170,800 rubles (sale of fixed assets).

Costs of production and sales of products:

- acquisition of fixed assets - 1,410,500 rubles;

- depreciation of fixed assets - 45,230 rubles;

- purchase of raw materials - 110,452,880 rubles;

- wage fund - 137,580,040 rubles;

- travel expenses - 238,300 rubles;

- rental of premises - 8,478,190 rubles;

- other expenses - 532,458 rubles.

5. Explanation of balance sheet items as of December 31, 2021 (using the example of accounts payable)

Availability and movement of accounts receivable

| Index | Period | For the beginning of the year | Changes over the period | At the end of the year | ||||||||||||

| Accounted for under contracts | Provision for doubtful debts | Received | Dropped out | Remainder | ||||||||||||

| In thousands of rubles with decimal places | Under contracts (transactions) | Fines, penalties, penalties | Redeemed | Written off in Finnish result | Written off to reserve for doubtful debts | Current | Overdue | |||||||||

| Total short-term accounts receivable, including: | 2021 | 25 489,3 | (200,0) | 15 632,7 | 300,4 | (25 023,2) | (102,1) | (48,9) | 15 726,1 | 522,1 | ||||||

| buyers | 20 409,0 | (200,0) | 10 015,5 | 300,4 | (17 315,3) | (87,7) | (48,9) | 12 750,9 | 522,1 | |||||||

| suppliers | 5080,3 | — | 5617,1 | — | (7707,9) | (14,4) | — | 2975,2 | — | |||||||

| Total long-term accounts receivable, including: | 2021 | 50 000,0 | — | — | — | — | — | — | 50 000,0 | — | ||||||

| for interest-free loans | 40 000,0 | — | — | — | — | — | — | 40 000,0 | — | |||||||

| TOTAL accounts receivable | 30 489,3 | (200,0) | 15 632,7 | 300,4 | (25 023,2) | (102,1) | (48,9) | 65 726,1 | 522,1 | |||||||

6. Estimated liabilities and provisions

As of 12/31/2021, an estimated liability was formed to pay for regular vacations of employees in the amount of 7,458,000 rubles, the number of unpaid vacation days is 67, the deadline is 2022.

The reserve for doubtful debts was formed in the amount of RUB 600,000. due to the presence of overdue and unsecured debt of Girya LLC in the amount of 522,000 rubles.

The organization did not create a reserve for reducing the value of inventories in 2022, since inventories do not show signs of depreciation.

7. Salary

Payables for wages as of December 31, 2021 amounted to RUB 3,876,400. (payment for December 2022, due date: 01/10/2022). Staff turnover in the reporting period was 14.88%. The number of employees as of December 31, 2020 is 165 people. The average monthly salary is 25,675 rubles.

Director of PPT.ru LLC /signature/ Petrov P.P. 03/12/2022.

Form 5 (attachment to the balance sheet): example of completion

The nuances of filling out Form 5 can be seen using an example. The company Globus LLC has the following completed balance sheet lines:

- cost indicators for fixed assets minus depreciation, consisting of production and office equipment, the cost of which changed during the year);

- the amount of reserves (in the presented value of the indicator there are no assets pledged);

- the volume of accounts receivable, which is represented only by short-term loans, the company did not create a reserve for doubtful debts;

- available financial investments;

- monetary resources;

- authorized capital;

- the value of the organization's retained earnings indicator;

- the total amount of outstanding accounts payable formed under agreements with counterparties; there are no long-term liabilities in the total amount.

The appendix to the balance sheet will disclose details on those lines that contain links to the corresponding tabular parts of Form 5:

- 2.1;

- 3.1;

- 4.1;

- 5.1;

- 5.3.

To detail the values of amounts for fixed assets, section 2 of the application is used, consisting of 4 blocks. The fact that the balance sheet contains a reference only to Table 2.1 indicates that during the reporting period the enterprise did not have cases of additional equipment, liquidation, or completion of fixed assets, and there are no assets in the form of unfinished capital construction.

Appendix Table 3.1 details the indicator of financial investments. The amount is reflected at historical cost, taking into account all types of receipts, accrued interest and disposals. Long-term assets are shown separately from short-term ones.

Block 4.1 contains information about the available volume of inventories and their reserve; all unpaid groups of inventories, including collateral items, are entered in table 4.2.

Section 5 is devoted to the enterprise’s debts – accounts payable and accounts receivable. The latter indicator should take into account the reserve for doubtful debts created in the institution.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features for budget organizations

Budgetary (autonomous) institutions submit their balance sheets in form 0503730, and government institutions (recipients of budget funds) - in form 0503130. For them, explanations are not only mandatory, but are also submitted in the approved form. In 2022, the requirements for filling out tables No. 1 and No. 4, provided as part of the explanatory note, have changed. Table No. 1 indicates only those types of activities that the institution began to engage in or that it ceased to conduct in the reporting year.

Table 4 in the new edition is called “Information on the main provisions of accounting policies”.

This is what a sample explanatory note to the balance sheet of a budgetary institution for 2022 looks like (table columns):

They indicate data only on those accounting policy provisions that are listed in the new appendices No. 2 to instructions No. 191n and No. 33n, according to the rules:

- in column 1 - the name of the accounting object in respect of which the features of reflecting transactions in accounting (budget) accounting are applied;

- in column 2 - the code of the balance sheet account (off-balance sheet account) in which accounting objects are reflected;

- in column 3 - the method of maintaining accounting (budget) records in relation to the designated objects;

- in column 4 - a description of the method of accounting used, based on the structural, sectoral and other features of the institution’s activities.

Here is a sample of filling out Table 4 to explanatory note 0503760 for 2022 for a budget institution according to the new rules for fixed assets:

Obviously, competent drafting of the document will save the manager and accountant from additional communication with regulatory authorities. It is important to remember that the detail of the information in this document depends only on its compiler - on the intention of the organization itself to disclose or not certain indicators for the year. The main and only requirement that the legislator makes for this document is that the information contained in the explanations must be reliable. The person who signed the document is responsible for its correctness.