Author of the article Alena Donmezova: Specialist in RKO

Publication date: 06/12/2019

Current for March 2022

In this article, we will look at what rules need to be taken into account when filling out this column, and what can be indicated in the purpose of payment when transferring between your own accounts.

There is no special procedure for filling out the “Payment purpose” field when transferring funds between your current accounts. Therefore, entrepreneurs often wonder what to write in the payment instructions.

What to indicate to the organization when transferring from one account to another

Legal entities, when transferring money between accounts, can indicate in the payment slip one of the wordings below:

- transfer of funds to replenish your own account for further settlements is not subject to VAT;

- internal movement of own funds, excluding VAT;

- transfer of funds within the organization to replenish working capital in the current account, excluding VAT.

There are no strict requirements, so the organization has the right to fill out the purpose of payment at its discretion.

Individual entrepreneurs transfer their money to a plastic card

It is convenient for an entrepreneur to transfer his profits to a bank card. It is necessary to take into account the correct filling of the payment purpose column in the payment order on paper or in the client bank. If an entrepreneur indicates “payment of wages,” then by law he is obliged to pay taxes and contributions to funds on this amount, since wages are profit. And any profit is subject to tax by law. To avoid possible claims from the tax office, you must indicate the correct purpose:

- transfer of own funds

- income from the activities of individual entrepreneurs

- funds for personal needs

Be sure to write that the payment is not subject to VAT. If the fact of taxation is incorrectly stated, for example, VAT 10%, 18%, 20%, you must write a clarifying letter to the bank, indicating the correct purpose of the payment in full, taking into account the absence of VAT.

An individual entrepreneur can open a card in any bank and transfer his business profits to it.

If an individual entrepreneur transfers money to a third party, then this is considered income. The entrepreneur is obliged to pay taxes on the income of this person and make the necessary deductions. There is no difference here - it is a payment to a third party for goods/services or a transfer to a relative.

How to correctly fill out the payment instructions as an individual entrepreneur

An individual entrepreneur does not have to open a bank account, but without it, a businessman will greatly limit his options. Why it is needed and how to open a current account we wrote here. Transfers from an individual entrepreneur to a personal account are controlled by tax authorities and banks. To get rid of unnecessary questions, it is especially important to fill out the “Purpose of payment” field correctly. Here are some examples:

- transfer of own funds to current account No.... is not subject to VAT;

- transfer of proceeds to a personal account, excluding VAT;

- replenishment of a personal account is not subject to VAT.

Cash deposit to the bank

Example:

On August 28, 2012, cash in the amount of 10,000 rubles was deposited from the cash desk of the Confetprom organization to the bank account of this organization.

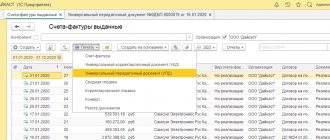

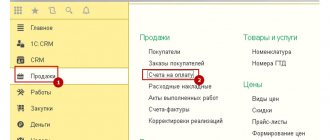

To reflect this operation, you need to create a document “Cash expenditure order” (menu or “Cash” tab) with the type of operation “Cash deposit to the bank”. When posting, the document generates the posting Dt 51 Kt 50:

Movements in the current account are reflected in the Bank Statements journal. However, if we open this journal (menu or “Bank” tab) and indicate the date 08/28/2012, we will see that there are no transactions for that day in it. However, at the bottom of the journal the receipt amount of RUB 10,000 is displayed. To see the document used to formalize the cash payment to the bank, you must click the “Including transfers” link. The list of movements displays the cash receipt order:

Transfer money between organization accounts

When downloading a bank statement containing transactions for transferring funds from one organization account to another account, the following documents are automatically created:

- Debiting from a current account with the transaction type Transfer to another account of the organization;

- Receipt to the current account with the transaction type Transfer from another account.

The transactions generated by these documents depend on the accounting policy settings. If the Use account 57 “Transfers in transit” flag is checked, the transactions will look like this:

Debit 57 Credit 51 - for the amount written off from the current account; Debit 51 Credit 57 - for the amount credited to the current account.

If the flag is disabled, then when posting the document Write-off from the current account, the following transaction is generated:

Debit 51 Credit 51 - for the amount debited from the current account.

In this case, the document Receipt to current account does not generate transactions.

Transfer of funds to another organization's own account

Example:

The Confetprom organization transferred funds in the amount of 100,000 rubles on August 30, 2012. from the main current account in the bank JSCB "AVT-Bank" to another own account in the bank JSCB "Torbank".

It is necessary to create a bank statement “Debit from current account” with the transaction type “Transfer to another account of the organization”. In the “Recipient Account” field, you need to select the bank account of our organization to which the funds are transferred. In this case, the “Debit account” detail must be filled in - the account for recording the recipient’s funds. The default score is 51:

When posted, the document generates posting Dt 51 Kt 51, with different sub-accounts “Bank accounts”:

Let's see how this operation is displayed in the Bank Statements journal. Let's open the journal and indicate in the quick selection field the date 08/30/2012, the organization "Confetprom" and its main bank account from which the funds were transferred. The debit from the current account is reflected:

Now let’s set the selection for the current account in JSCB “Torbank”, to which the funds were transferred. The document is not visible in the journal itself, but at the bottom of the journal the receipt of funds into the account is reflected as a transfer. Clicking on the “Including movements” link opens a list of movement documents; it contains “Write-offs from a current account”:

Receiving cash from the bank

Receipt of cash from the bank is reflected in the document “Cash receipt order” with the transaction type “Receipt of cash from the bank”.

Example:

We will reflect the receipt of funds from the current account of the organization “Confetprom” to the cash desk of this organization in the amount of 5,000 rubles. 08/29/2012.

Receipt cash order" generates the posting Dt 51 Kt 50:

In the Bank Statements journal, the operation of receiving cash from the bank is reflected as a movement:

What do individual entrepreneurs want and what do they risk?

Entrepreneurs are interested in the opportunity to perform the following types of operations:

- payment to a personal bank card by clients;

- withdrawing money from your current account to your bank card;

- transferring money from your account to bank cards of third parties.

Let's take a closer look at the possibilities and risks of each of them.

Crediting other people's funds to an individual entrepreneur's personal card

Is it possible to receive payments from clients into your current account, especially regularly? In other words, this will be the use of a personal card for business purposes. Based on the positions of the tax office and the bank, the answers will be different: the tax office does not directly object, the bank prohibits it, but cannot always control it.

Possible risks from the tax authorities

The inspectorate may consider all receipts on the card taxable, and not just those made “for business”. As a result, tax authorities have the right to assess additional tax, issue a fine for arrears and a penalty for late payment. The individual entrepreneur will have to prove which part of the income is income and which is not, and document this. If this cannot be proven, they may be charged with “systematic tax evasion,” which is fraught with serious sanctions.

Possible risks from the bank

If an entrepreneur violates the terms of use of a bank service, and transferring business money through a personal card is a violation, the bank has the right to stop providing the service, that is, to block the card, not only this one, but also others belonging to this person. In addition, as part of the fight against money laundering, regulated by Federal Law No. 115, banks are required to report suspicious movements of funds to the tax and law enforcement agencies. Regular receipts on an individual’s card, especially in large amounts, may well be considered such. The individual entrepreneur will have to resolve the issue not only with the bank - explain and confirm the sources of funds.

Withdrawing your funds from your current account to your card

From the point of view of the law, an individual entrepreneur keeps his own funds in both a current and personal account. He has the right to dispose of them at his own discretion. Income from business activities can be used by an entrepreneur as he pleases, without restrictions, including withdrawn to a personal card for any needs. The purpose of the transfer should indicate “Income from business activities, excluding VAT” or simply “Financial assistance” (to avoid a possible conflict with the bank).

Possible risks

As stated above, banks do not encourage the “mixing” of personal and business funds. It is not uncommon for them to send such clients a warning and recommendation. However, this is precisely a recommendation, and not a ban, to which they do not have a legislative right. In response to such a requirement, one can point out its illegality and fallacy, because the property of an individual entrepreneur and an individual is one and the same. If there is no response from the bank, you can appeal its actions to the Central Bank of the Russian Federation, as well as to the Antimonopoly Committee.

If large amounts of money are regularly passed through this operation, you will have to explain their origin and purpose to the tax office in order to avoid charges of tax evasion.

FOR YOUR INFORMATION! You can replenish your own account from your card without risks and restrictions.

RESULT: this operation is allowed, but it should not be abused. If it is proven that you use the transferred funds for business, you will have to pay tax on them. For personal purposes – translate to health.

Personal account instead of current account - why?

An entrepreneur who wonders whether it is possible to make payments not through a bank account, but through a personal card of an individual, wants to provide himself with some benefits:

- no need to go through the procedure of opening a current account;

- some clients prefer to make payments from card to card;

- more economically profitable: servicing a bank card is much cheaper than a cash account.

Is such a desire legal from the point of view of tax legislation and the rules of credit organizations?

Question: Can an individual entrepreneur challenge the restrictions imposed on him on the use of the “client-bank” system and the failure to execute payment documents if his transactions are classified by the bank as dubious? Does the bank have the right to charge a commission for transferring funds from the account of an individual entrepreneur to his personal account opened for him as an individual? View the court decision

Tax office's opinion

Having analyzed the Tax Code of the Russian Federation, we can draw conclusions regarding the position of the fiscal authorities regarding the use of a personal bank card for the entrepreneurial activities of an individual:

- there is no legal requirement for individual entrepreneurs to open a current account;

- the law does not separate the personal property and funds of the individual entrepreneur and his business;

- The Tax Code does not directly prohibit the use of personal accounts in the business activities of individuals;

- it does not matter what type of account is used for crediting or transferring funds (clause 2 of article 11 of the Tax Code of the Russian Federation);

- An entrepreneur is not required to inform the tax authorities about the opening of an account, although it is recommended to do so.

CONCLUSION: it is not directly prohibited - that means it is allowed. Tax legislation does not formally object to the use of a personal card for business purposes, of course, taking into account the risks that we will consider below.

Bank's opinion

Receiving a personal bank card is also an agreement with the bank, and you should study its provisions so as not to violate them, although they are not by-laws.

If the tax office does not separate current and current accounts, then the bank does this quite clearly - Instruction of the Central Bank of the Russian Federation No. 153-I dated May 30, 2014 allows individuals to open current accounts for transactions not aimed at entrepreneurship, and for this activity an individual entrepreneur or legal entity must to open a current account (this is stipulated in clause 2 of these Instructions).

The agreement may directly state a prohibition on using a current account for business, or such a prohibition may be included in the bank regulations, which you automatically agree to when concluding an agreement.

CONCLUSION: the bank, as a credit institution, is against the use of personal cards for business purposes, since opening and servicing an account is more expensive, and therefore more profitable for the bank.

Collection

If we want the cash deposit to the bank to be made through account 57 “Transfers in transit” and reflected in the program using a bank statement, we need to issue a collection operation.

Example: From the cash desk of the organization “Confetprom”, on August 28, 2012, the cashier was given cash in the amount of 20,000 rubles. for the purpose of depositing them into the bank account of the organization. A statement was received from the bank confirming the receipt of this amount into the current account.

First, you need to create a “Cash expenditure order” with the “Collection” operation type. When posted, the document will generate posting Dt 57.01 Kt 50.

Now, in order to reflect the receipt of money to the organization’s current account, it is necessary to create a bank statement “Receipt to the current account” with the transaction type “Collection”. You can create it manually (menu or “Bank” tab) or based on a previously entered “Cash outgoing order”. When conducting “Receipt to current account” it will generate posting Dt 51 Kt 57.01.

Let's open the bank statement journal. A document of receipt to the current account with the type “Collection” appeared in the journal. We indicate the date 08/28/2012. At the bottom of the journal, the total amount of receipts for that day is displayed, as well as the amount of movements (in our case, this is a cash deposit to the bank, which is described in the previous paragraph):

Let’s generate the “Account Card” report for account 57.01 (menu: “Reports”). Collection operations are reflected: issuance of money from the cash register and receipt of money to the current account:

Let's generate the "Account Analysis" report for account 51 "Current accounts". The correspondence of this account with accounts 50 and 57 is visible:

Depositing money into a current account

Access to the list of all cash documents in the program is carried out using the Cash documents hyperlink from the Bank and cash department section.

The issue of cash from the enterprise's cash desk is registered using the accounting system document Cash Withdrawal with the transaction type Cash Deposit to the Bank. When loading a bank statement into the program that contains a transaction for a cash deposit to a current account, a document Receipt to a current account with the transaction type Cash Deposit is automatically created. Postings generated by the documents Receipt to current account and Cash withdrawal depend on the accounting policy settings. When the Use account 57 “Transfers in transit” flag is checked, the postings will be as follows (Fig. 2):

Debit 57 Credit 50 - for the amount issued from the cash register; Debit 51 Credit 57 - for the amount credited to the current account.

Rice. 2. Depositing cash into a current account using account 57 “Transfers in transit”

If the flag is disabled, then when posting the Cash Withdrawal document the following transaction is generated:

Debit 51 Credit 50 - for the amount of money issued from the cash register.

In this case, the document Receipt to current account does not generate transactions.